A universal adjustment document includes an adjustment invoice and a notice of changes in the price of goods, services, etc. The document is important for companies that pay VAT, so you need to take it seriously so that the tax office does not have any complaints. Let us tell you in more detail what this paper is and how to correctly enter all the information into it.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

General information

The tax office, in its letter dated October 17, 2014 No. ММВ-20-15/ [email protected], recommended a new document to firms - a universal adjustment document. The form itself is published in Appendix No. 1 to the letter; the rest tell us in what situations it needs to be filled out, how to do it correctly, etc.

The nature of this form is advisory, so organizations decide for themselves whether they will use this paper or not.

The document is formed on the basis of Federal Law No. 402 of December 6, 2011 (“Accounting Law”), since a change in the price of a product after it has been sent is a fact of the organization’s economic life and must be confirmed by a primary accounting document.

In addition, paragraph 3 of Art. 168 of the Tax Code of the Russian Federation states that if the value of goods sent or transferred, etc. changes. The selling organization must issue an adjustment invoice (hereinafter referred to as CFI) 5 working days in advance. The CSF form itself is already included in the UKD - it is placed in a black frame.

Changes after adjustment

If the price, quantity or volume of goods, works, services or property rights are changed again, the seller must issue a new adjustment invoice. And do not make corrections to the previous one.

When filling out a new adjustment invoice in such a situation, consider the following features. In the “Before change” line, transfer the data from the previous adjustment invoice. This procedure is established in paragraphs 2 and 4 of Appendix 2 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Do the same when filling out line 1b. It must indicate the number and date of the previously issued adjustment invoice. Although, even if the details of the original (not adjustment) invoice are provided in this line, this cannot serve as a basis for refusing the buyer a VAT deduction. After all, such an error does not interfere with identifying the seller, buyer, name of goods, works, services or property rights, their cost, rate and amount of tax. This is indicated in paragraph 2 of clause 2 of Article 169 of the Tax Code of the Russian Federation. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated May 26, 2015 No. 03-07-09/30177 and the Federal Tax Service of Russia dated December 10, 2012 No. ED-4-3/20872.

When companies fill out the UCD

The document is used:

- If the cost of a previously completed delivery has changed due to a change in price and/or clarification of the number of goods shipped, etc. and the proposal for change comes from the seller, whether the buyer's consent is required or not (if agreements were previously established).

- If the seller needs to document agreement with the buyer company’s claim in case of detection of shortcomings in the quantity and quality of goods, etc. upon their acceptance and the document on the discrepancy was not signed by the seller’s authorized representative.

The document does not need to be used:

- If the price has changed due to the seller making any errors in the documents.

- If there is a situation for which it is necessary to use a special procedure for processing paperwork (return of goods, for example).

Universal adjustment document: what does a “simplified” person need to know?

The practice of using a universal transfer document has shown that a special form is needed to correct it. The Federal Tax Service of the Russian Federation has approved such a form - a universal adjustment document. However, its use is not possible in all cases when it is necessary to change the data in the universal transfer document.

In 2013, the Federal Tax Service of Russia developed the form of a new primary document designed to combine the functions of an invoice and a primary accounting document called the “Universal Transfer Document” (UDD), and issued official clarifications on its use (letter dated October 21, 2013 No. ММВ-20- 3/ [email protected] ). This was a completely logical decision, because now the “primary” contained in the albums of unified forms is not mandatory for use (Part 4 of Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”), but -invoice, you can enter additional details, since neither ch. 21 of the Tax Code of the Russian Federation, nor the Decree of the Government of the Russian Federation No. 1137 contain such restrictions. A similar position is set out in the letter of the Ministry of Finance of the Russian Federation dated 02/09/2012 No. 03-07-15/17.

Last year, the tax service continued to work on introducing complex documents into the workflow of taxpayers. And in mid-October, a universal adjustment document (UCD) was approved (letter of the Federal Tax Service of the Russian Federation dated October 17, 2014 No. ММВ-20-15 / [email protected] ).

In other words, a universal adjustment document is a document developed and recommended by the Federal Tax Service for use, consisting of an adjustment invoice and a primary accounting document that allows you to formalize a change in the status of settlements of counterparties for a previously performed transaction of acceptance and transfer of goods (work, services, property rights).

The use of such documents, on the one hand, allows business entities to reduce the costs of processing the “primary tax return”; on the other hand, it facilitates the work of the tax authorities themselves, because the volume of documentation requiring verification will also be reduced.

When can you apply for a UKD?

Firstly, the UCD can be used to formalize a change in the total cost of a previously made (properly documented) delivery due to a change in price (tariff) or change in the quantity (volume) of goods shipped (work performed, services rendered), transferred property rights, including the case when the proposal for such a change comes from the seller and requires the buyer’s consent to such a change or does not require it.

Secondly, the UCD can also be used for the purpose of documenting the seller’s agreement with the buyer’s claim when the latter identifies a discrepancy in the quantity and quality of goods (work, services, property rights) upon their acceptance (without registration) if the document on discrepancies is submitted by a representative the seller did not sign (unilateral statement of discrepancies).

The UCD cannot be applied in all cases of return (movement from buyer to seller) of goods accepted by the buyer for registration (letter of the Ministry of Finance of Russia dated May 16, 2012 No. 03-07-09/56), for which a special deduction procedure is established in clause 5 of Art. 171 of the Tax Code of the Russian Federation (decision of the Supreme Arbitration Court of the Russian Federation dated May 19, 2011 No. 3943/11). The UCD is not used when changing the total cost of shipment due to an error made by the seller in the initial set of documents accompanying the shipment (UCD, other primary accounting document for shipment and invoices). Correction of such errors in the previously applied UPD form can be carried out in the manner specified in Appendix No. 7 to the letter of the Federal Tax Service of the Russian Federation dated October 17, 2014 No. MMV-20-15 / [email protected]

Can “simplified people” use the UKD?

The UCD can be used by absolutely all taxpayers, regardless of the chosen tax regime, and “simplified” ones are no exception. Indirect confirmation of the possibility of using the UKD by special regime officers is the letter of the Federal Tax Service dated 03/05/2014 No. GD-4-3 / [email protected] : “In accordance with the provisions of clause 3 of Art. 346.5 and paragraph 2 of Art. 346.16 of the Tax Code of the Russian Federation, expenses taken into account for taxation purposes with the unified agricultural tax and the tax paid when applying the simplified taxation system are accepted subject to their compliance with the criteria specified in paragraph 1 of Art. 252 of the Tax Code of the Russian Federation. Thus, expenses confirmed by the UPD are taken into account when forming the tax base for the purpose of calculating the above taxes in the generally established manner.”

How can a “simplified” person fill out the UCD?

When organizations or entrepreneurs use the simplified tax system, “2” should be reflected in the “Status” field of the UCD. This status indicates that the UCD is used as a primary document confirming changes in the value of previously shipped goods (work, services, property rights). In this case, the indicators established as mandatory exclusively for the adjustment invoice are not filled in (or dashes are placed in the corresponding fields):

- “to invoice (invoices) No. _ from _, taking into account correction No. _ from _” (line 1b);

- “including the amount of excise tax” (column 6);

- “tax rate” (column 7).

In the field of line 1, the date and serial number of the adjustment are entered, and the date and number of the UPD or other primary accounting document, the indicators of which are being adjusted, are indicated in line 5.

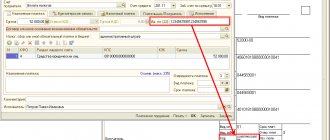

Filling example

Universal adjustment document

Will there be an obligation to pay VAT?

Issuing a UCD with status 2 and dashes to the buyer in the section of the document duplicating the adjustment invoice will not lead to the emergence of an obligation to calculate and pay VAT.

It is necessary to take into account that the “status” indicator in the UKD is of an informational nature. The actual status of this document is determined by the presence (absence) of all mandatory indicators established by the Accounting Law in relation to primary accounting documents and (or) clauses. 5.2 and 6 art. 169 of the Tax Code of the Russian Federation in relation to adjustment invoices (paragraph 5, 6 of Appendix 4 to letter No. ММВ-20-15/ [email protected] ).

How to fill out the UCD

There are many details in the form, let’s look at each of them.

What is UCD status and what to note

This information is for informational purposes only. Select code “1” if the document acts as a CSF + primary document, that is, an agreement or notification of a price change. In this case, the paper will be the basis for deducting VAT.

The number “2” is written if the document is used only as a primary accounting document, that is, it is simply an agreement or notification of a price change. Simplified business entities can use a document with status “2”; there will be no obligation to transfer VAT.

UKD hat

Here you need to indicate the following information (they are similar to what is written in the CSF form):

- Number of the document to be filled out, date.

- Which CSF is corrected (number and date). Fill in if necessary.

- Which invoice is generated for (also paper number and date). This item is not filled out if the document has status “2”.

- Number subject to adjustment.

Note! If the document acts as a CSF, then the number is assigned according to the general chronology of invoice numbering. You should take into account the special order of numbering of adjustment documents by separate divisions. When the UCD has status “2”, the number is designated according to the general order of numbers of adjustment documents. Such details as a number are not included in the list of mandatory ones in Art. 9 Federal Law No. 402-FZ.

- Name of the selling company, its address, INN, checkpoint.

- Name of the second party to the transaction, address, TIN, checkpoint.

- Name of the currency and its code.

What is important to know about dates! The paper indicates 2 dates: the date of compilation (line (1)) and the date when the buyer agreed to change the price of the goods (or the date of receipt of notification about the change in price) - this is line [13]. The first date is set by the seller, and the second by the buying company.

If the status is “1”, then the real date of execution of the primary document and the CSF is entered in line (1). The day of compilation is a mandatory requisite. According to the law, this document must be presented no later than 5 calendar days from the date of formation of the papers on the basis of which the cost of goods is changed.

If the contract with the client does not indicate that when the price changes, his consent is required, then the UCD is issued only to notify the buyer, and the date of issuing the UCD will be the same as indicated in line (1). If consent is required, then the date indicated in line [13] will be considered such a date.

If the status is “2”, then the date of the transaction must be indicated (Article 9 of Federal Law No. 402-FZ).

The dates in lines (1) and [13] may be the same or different: in line [13] a later date is noted than in (1).

Main part

Here you need to fill out the table. It is similar to that presented in the adjustment document.

What needs to be entered:

- Serial number of the record. These are additional details to fill out. It is indicated at will.

- Product/service/work code. It is also not considered mandatory for inclusion in the document.

- Name of the product or description of the work performed, services provided, etc.

- Indicators in connection with changes in the cost of goods.

- Unit of measurement and its code according to OKEI.

- Quantitative indicators.

- Cost indicators.

- Excise tax amount. There is no need to write anything if the document has status “2”.

- Tax rate. There is no need to write anything if the document has status “2”.

- Tax amount.

- Total cost.

At the end of the table you need to summarize the results - indicate the resulting cost.

Next, you need to indicate the details of the transfer/shipping papers, the basis document for the cost adjustment and any other data.

Features of signing

The UKD form contains 6 lines for signing the document. Signatures under the table are always affixed when the paper status is “1”. The head of the company or authorized representative and the chief accountant sign there. If the UCD status is “2”, such signatures are not required.

In the signature lines [8] and [9], it is necessary to note the employee who has the right to offer the buyer to change the price of goods or notify about such a fact. You need to write the employee's position and full name. If he has the right to sign this paper, then he does not need to sign it again. You can only indicate your position and full name.

In line [10] it is necessary to note information about the employee who is responsible for documenting the fact of the company’s economic life. This person may coincide with what is indicated above (lines [8] and [9]): similarly, only the position and full name are indicated without a signature.

In line [12] enter data about the employee who has the right to agree on changes in the cost of goods, etc. on behalf of the buyer, if this action is required. In line [14] the employee who is responsible for registering the fact of the economic life of the organization signs. If this is the same employee as in line [12], then indicate the full name and position, and there is no need to sign a second time.

Important! You can read about filling out an invoice and CSF in our article.

Form and filling procedure

The form of the adjustment invoice and the Rules for filling it out are given in Appendix 2 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. Use it. However, you have the right to add additional information to the document. The main thing is to save the lines, columns, values and details of the approved form.

Adjustment invoices can be generated on paper or electronically. The electronic format of the document was approved by order of the Federal Tax Service of Russia dated March 4, 2015 No. ММВ-7-6/93.

The adjustment invoice reflects only those items of the original document that were affected by the changes. This procedure is established in paragraph 2 of Appendix 2 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

If changes affect several deliveries to one counterparty, then it is not necessary to prepare a separate adjustment invoice for each primary document. Instead, issue a single adjustment invoice. It will reflect all changes. Just keep in mind that in the original invoices the name, price, tax rate of goods, works, services, property rights must match.

This procedure is provided for in paragraph 2 of subclause 13 of clause 5.2 of Article 169 of the Tax Code of the Russian Federation and is confirmed by letters of the Ministry of Finance of Russia dated September 8, 2014 No. 03-07-15/44970 (brought to the tax inspectorates by letter of the Federal Tax Service of Russia dated September 17, 2014 No. GD- 4-3/18758), dated September 5, 2014 No. 03-07-09/44607.

If the seller or buyer's details have changed, please indicate the new details in the adjustment invoice. In this case, as additional information, you can indicate the previous details that were reflected in the original invoice. This was stated in the letter of the Ministry of Finance of Russia dated September 4, 2012 No. 03-07-08/264.