When purchasing a computer program, you can acquire exclusive or non-exclusive rights to it - the accounting and tax accounting scheme used directly depends on this. In this article we will look at the option of purchasing non-exclusive rights and learn how to reflect the purchase of a program in 1C.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

How to capitalize a 1C program in 1C 8.3

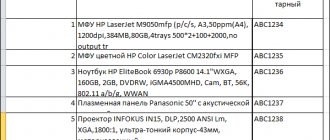

Let's look at how to reflect the purchase of a 1C program in 1C 8.3 using the following example.

On July 24, the Organization, in accordance with the license agreement, received, under an acceptance certificate from FIRST BIT LLC, non-exclusive rights to use the 1C:ERP Enterprise Management 2 program worth 360,000 rubles. The period of use of the program specified in the contract is 2 years.

Accounting for the costs of acquiring the 1C program (non-exclusive right) is reflected in the document Receipt (act, invoice) transaction type Services (act) in the section Purchases - Purchases - Receipts (acts, invoices).

The document states:

- Nomenclature is a software product from the Nomenclature directory, Type of nomenclature - Services .

Follow the Accounts :

- Cost account - 97.21 “Other deferred expenses”;

- Deferred expenses (FPR) - parameters for automatic uniform recognition of costs for the purchase of the 1C program (software).

According to the recommendations of the Ministry of Finance for auditors (Appendix to the Letter of the Ministry of Finance of the Russian Federation dated January 29, 2014 N 07-04-18/01), the RBP is reflected:

- in the balance sheet in Section I “Non-current assets” on line 1190 “Other non-current assets” - if the period for writing off the RBP is more than 12 months;

- in Section II “Current assets” on line 1210 “Inventories” - if the write-off period is less than 12 months.

Study the regulatory regulation of cost accounting for the acquisition of software (non-exclusive right)

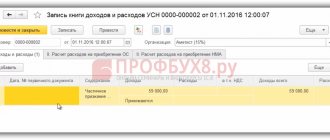

Postings according to the document

The document generates transactions:

- Dt 97.21 Kt 60.01 - reflection of the costs of the non-exclusive right in the expenses of the future period.

Find out more about how to reflect deferred expenses in 1C 8.3 Accounting

How to reflect the purchase of 1C in accounting and tax accounting

Expenses for the purchase of 1C programs are considered expenses for ordinary activities and cannot be classified as intangible assets. The accounting automation system 1C: Accounting is no exception.

Accounting

Since 1C software products are often used by organizations for more than one month, and their payment is made in the form of a one-time fixed payment, in accounting it is reflected as deferred expenses with subsequent write-off as expenses during the period of use of the program. If the contract does not specify the period of use of the program, it should be set independently, based on the useful life of the program on the 1C:Enterprise platform or based on a letter from 1C, where the recommended service life of the program is 24 months. In this case, the maximum period during which the company can write off expenses is 5 years.

During this period, the amount of the one-time payment is evenly included in the expenses of the current period in account 26 “General business expenses”, because Software "1C:Enterprise 8" was purchased for the needs of accounting (clause 18, paragraph 3, clause 19 of PBU 10/99, Instructions for using the Chart of Accounts).

The following entries must be made in accounting:

- Debit account 60.01 – Credit account 51

- Debit account 97.21 – Credit account 60.01

- Debit account 26 – Credit account 97.21

If recording expenses for programs using 1C causes you difficulties, contact our 1C support specialists. We will be happy to help you!

In the 1C: Accounting program (rev. 3.0), the transaction of acquiring a non-exclusive right to use the software is reflected in the document “Receipt (act, invoice)”, as a service, because a software product cannot be entered into a warehouse as a product or material.

Fig. 1 The software is reflected in the document “Receipt (act, invoice)”

Fig.2 Accounts

Fig. 3 Deferred expenses

To view transactions, you must click the “Show transactions and other document movements” button (Dt/Kt)

Fig.4 Result of posting the document “Receipt (act, invoice)”

Result of posting the document “Receipt (act, invoice)”

To perform the operation of including part of the expenses in the current month, you need to create a “Regular operation” document with the operation type “Write off deferred expenses”. As a result of posting the document, the corresponding postings will be generated.

Fig.5 Creating and filling out the “Routine Operation” document

Fig.6 Closing the month

Creating and filling out the “Routine operation” document

Fig. 7 Result of carrying out the “Routine operation” document

The result of the “Routine operation” document

Amount of expenses written off:

- 10800/2/12 = 450 rub. per month

- 450 rubles / 31 = 14.52 rubles. in a day

- 14.52 * (31-5) = 377.42 rub. for December

Costs associated with the acquisition of the right to use computer programs under license and sublicense agreements are included in other costs associated with production and sales (clause 26, clause 1, article 264 of the Tax Code of the Russian Federation).

If the terms of the license agreement establish a period for using computer programs, expenses are taken into account evenly over this period. If the license period is not established, then the organization can independently set the period for writing off expenses for the program (paragraph 2, paragraph 1, article 272 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated 08/31/2012 No. 03-03-06/2/95, dated 18.03. 2014 No. 03-03-06/1/11743) or take it equal to 5 years (letter of the Ministry of Finance of the Russian Federation dated 04/23/2013 No. 03-03-06/1/14039).

As a rule, the useful life of RBP for software in BU and NU is set the same so that the cost is repaid in equal shares:

Fig.8 NU

VAT deductions on future expenses (for the purchase of 1C programs) are carried out in the generally established manner if the following conditions are met:

- The goods have been accepted for accounting;

- VAT amounts have been paid to the supplier;

- The purchased goods are intended for use in activities subject to VAT;

- Availability of a supplier invoice with a allocated VAT amount.

If a taxpayer has received a program of the 1C:Enterprise family, then he has the right to deduct the entire amount of “input” VAT relating to them, regardless of when their cost is charged to costs. Those. the amount of VAT can be deducted in full in the period when the program was purchased and accepted for accounting on account 97.21.

Application of standards PBU 18/02

In accounting, the costs of acquiring 1C:Enterprise programs will be written off as expenses during the established period of use of the program, and in tax accounting - at a time during the acquisition period. Such a difference is reflected according to the rules regulated by PBU 18/02.

In accounting (for the period in which the programs were acquired), it is necessary to reflect a taxable temporary difference in an amount equal to the difference between the entire amount of expenses for the acquisition of programs and the amount that participates in the formation of accounting profit for the reporting period. The identified taxable temporary difference will be repaid gradually as expenses for the acquisition of programs are written off from account 97.21 (during the established period of use of the program).

Accounting for non-exclusive rights

Intangible assets received for use must be accounted for in an off-balance sheet account (clause 39 of PBU 14/2007):

- Dt 012 “Non-exclusive rights to software” - for the cost of the non-exclusive right received for use.

In 1C there is no special off-balance sheet account for accounting for non-exclusive rights, so you need to create it yourself, for example, 012 “Non-exclusive rights to software”.

Acceptance of a non-exclusive right for off-balance sheet accounting is documented in the document Transaction entered manually, type of operation Transaction in the section Transactions – Accounting – Transactions entered manually.

Write-off of deferred expenses

This operation is a regulatory one. That is, it will be carried out automatically by the system based on the initially specified calculation parameters in the “Month Closing” document. In this case, 1C takes care of all the calculations of the amount of funds written off and the write-off itself.

After the document is posted, a posting is generated with expenses assigned to account 26, as was originally established. The write-off amount was calculated by the system based on the established start and end dates of the period of use.

By going to the document movement through the “Calculation of write-off of deferred expenses” tab, you can always see the main write-off parameters for the category being carried out.

The program will automatically write off monthly expenses until the expiration date for the write-off is set in the program. The user can view automatically created operations in the journal of routine operations, where they are stored. To do this, you need to go through the section “Operations” - “Closing the period” - “Routine operations”.

It is worth noting that in 1C this operation is open for creation in manual mode, and the use of the “Month Closing” document is not required.

Reflection in accounting of costs for the purchase of 1C software

To automatically account for the monthly costs of purchasing a 1C program, you need to run the procedure Closing the month, a routine operation Write-off of deferred expenses in the section Operations - Closing the period - Closing the month.

Postings according to the document

Accounting for software costs for July

The document generates the posting:

- Dt Kt 97.21 - accounting for software costs as part of general business expenses for July.

Accounting for software costs for August

The document generates the posting:

- Dt Kt 97.21 - accounting for software costs as part of general business expenses for August.

Similarly, the cost of purchasing the 1C program is recorded for the following months before the expiration of the non-exclusive right.

To access the section, log in to the site.

Purchasing software

The fact of purchasing the software is reflected in the 1C program with the document “Receipt of goods and services”, and a note is made that the purchase belongs to the category of services. The corresponding item must be entered in the nomenclature directory, in this case “Purchase of the 1C program: Accounting version PROF”. The nomenclature should be based on service category.

In the “Accounts” column, you need to enter data on account 97.21 “Other deferred expenses”.

In the process of filling out the details “Deferred expenses”, you need to create a new expense item, specifying not only the acquisition cost, but also the period during which the write-off will be carried out (indicate the start and end dates, analytics parameters, and so on).

After this, the specified cost is immediately included in deferred expenses for the specified amount. After posting the “Receipt of goods and services” document, the system will generate the following transaction:

Debit 97.21 Credit 60.01

Taking into account the fact that the company in question is a VAT payer, the amount of tax on the purchase is entered as a separate entry Debit 19.04 Credit 60.01

Accounting for software and license costs. How to do everything in 1C

Any purchase must be reflected in accounting, since all expenses must be documented and justified. With non-exclusive rights to software, the following questions arise: when do payments occur, on what basis are they made and how to do this in 1C?

Accounting expenses

Accounting for the cost of purchasing a license or software may differ depending on the payment method:

1. The license was purchased at a time for a certain period established by the contract.

2. Payment occurs on the specified dates.

After we have decided on the payment method, we make the purchase:

In case of a one-time transaction, you need to distribute the amount over the entire period of use. Write-offs occur gradually until your contract expires. Payments will correspond to a specific tax period.

In the second option, you pay every month, quarter or year and carry out all transactions.

Tax accounting

Despite the fact that everything is simple in accounting, the question arises when posting expenses. Should I do it gradually or all at once?

It all depends on the deal. There are general rules according to which expenses are posted in the period in which they were incurred. If this is not discussed and fixed in the contract, spread the expenses over the entire period of use. If it is not specified, then it is set by default - 5 years (letters of the Ministry of Finance of the Russian Federation dated 04/23/2013 No. 03-03-06/1/14039, dated 02/02/2011 No. 03-03-06/1/52). The Treasury also recommends spreading out payments if you modify the software.

If the product is provided at a time and payment has been made in full, then you can write off the expenses in the current tax period.

What does the purchase of a license include?

The purchase of a license is classified as other expenses (Article 264 of the Tax Code of the Russian Federation). Its purchase along with a computer or ATM automatically turns other costs into bringing the fixed asset to a state suitable for use. Equipment without software will not be able to work, so expenses move into another category.

We make a purchase in 1C

Now, having familiarized ourselves with the main subtleties, let’s try to make a purchase using an example. We will be purchasing a license for 1C: Accounting. Payment is debited from us gradually in accordance with the agreement.

First you need to complete the deal. Go to the “Purchases” section, select “Receipts (acts, invoices)”.

In the window that opens, click “Receipt”, then “Services (act)”.

Pay attention to the column “Accounts”. Indicate expense account 97.21 (Other deferred expenses).

We remain in the “Accounts” menu. Now we need to create a new document in the “Deferred expenses” column. You can fill it out using the example screenshot:

Indicate the name of the program and the amount of payment. In the write-off period, enter the dates from your contract. The cost account will be 26. After entering the data, go back to the “Receipt of goods and .

We succeeded. All that remains is to write off by period. Go to the “Month Closing” menu and click “Write off deferred expenses”.

After the transaction, the partial amount from account 97.21 will be transferred to account 26. You can see the details of the operation in the “Calculation of write-off of deferred expenses” section. Purchasing software is a simple process that you can understand. The main thing to consider is under what circumstances a license is purchased for correct tax accounting.