Accounting

In accounting, reflect settlements under civil contracts on account 76 “Settlements with various debtors and creditors”, even if the contract was concluded with an employee (Instructions for the chart of accounts). In this case, account 70 “Settlements with personnel for wages” cannot be used. It is intended only for conducting settlements with employees regarding wages; in this case, the performer cannot be recognized as an employee.

Determine the corresponding account based on the nature of the work (service):

Debit 20 (23, 29) Credit 76

– remuneration was accrued under a civil contract for work performed (services provided) for the needs of the main (auxiliary, servicing) production;

Debit 25 (26) Credit 76

– remuneration was accrued under a civil contract for work performed (services provided) for general production (general economic) needs;

Debit 44 Credit 76

– remuneration has been accrued under a civil contract for work performed (services provided) related to the sale of products, goods, works and services. In trade organizations, the debit of account 44 can reflect the accrual of all remunerations under civil contracts for work performed (services rendered);

Debit 08 Credit 76

– remuneration was accrued under a civil contract for work performed (services provided) for the construction (installation, reconstruction) of fixed assets;

Debit 91-2 Credit 76

– remuneration has been accrued under a civil contract for work performed (services provided) not related to production and sales (for example, services for organizing recreation and entertainment);

Debit 91-2 Credit 76

– remuneration was accrued under a civil contract for work performed (services provided) to eliminate the consequences of emergency events;

Debit 91-2 Credit 76

– remuneration was accrued under a civil contract for work performed (services provided) at the expense of net profit with the consent of the owners of the organization.

Reflect the payment of remuneration by posting:

Debit 76 Credit 50 (51, 52…)

– remuneration was paid under a civil contract.

This procedure follows from the Instructions for the chart of accounts.

Posting in accounting for payment of accrued remuneration

Each of the entries indicated in the previous section forms in the accounting the customer’s obligation to the contractor to pay remuneration for work performed under the GPC agreement (services provided). It arises after the customer accepts the work (service) from the contractor and signs the acceptance certificate. The act will serve as the basis for accounting entries. Then the customer needs to pay the contractor and also reflect this operation in accounting.

To reflect settlements under GPC agreements, the following posting is used:

The basis for such an entry in accounting (in addition to the agreement and act) will be a bank statement if the money is transferred in non-cash form, or a cash order when paying the contractor money from the cash register.

This material will introduce you to the postings for accounting cash transactions.

You can find out how a customer can calculate income tax, pay personal income tax and insurance premiums when paying for services to an individual in ConsultantPlus by getting trial access to the system for free.

Personal income tax

Withhold personal income tax from payments to citizens under civil contracts for the performance of work (rendering services), since in this case the organization is recognized as a tax agent (subclause 6, clause 1, article 208 of the Tax Code of the Russian Federation, article 226 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated 13 January 2014 No. 03-04-06/360 and November 7, 2011 No. 03-04-06/3-298).

And even if the civil contract stipulates that the personal income tax must be paid by the citizen himself, the organization will not be relieved of the duties of a tax agent, since such terms of the contract will be void (Article 168 of the Civil Code of the Russian Federation, letters of the Ministry of Finance of Russia dated December 28 2012 No. 03-04-05/10-1452 and dated April 25, 2011 No. 03-04-05/3-292).

Withhold tax on payments to both residents and non-residents. At the same time, withhold personal income tax from payments under a civil contract to a resident contractor if he received income both from sources in the Russian Federation and from sources outside of Russia. Personal income tax on payments to non-residents for performing work (rendering services) must be withheld only if the citizen received income from sources in the Russian Federation. If income is received by a non-resident from sources outside of Russia, do not withhold personal income tax. Such rules are established by Article 209 of the Tax Code of the Russian Federation.

Also, do not withhold tax if the agreement is concluded with an entrepreneur, notary or lawyer. Entrepreneurs and notaries pay personal income tax on their own (clause 2 of article 227 of the Tax Code of the Russian Federation). Lawyers who have established a law office also pay personal income tax on their own (clause 2 of article 227 of the Tax Code of the Russian Federation). In other cases, tax is withheld from the income of lawyers by bar associations, law offices or legal consultations (clause 1 of Article 226 of the Tax Code of the Russian Federation).

In accounting, reflect the deduction and transfer of personal income tax to the budget with the following entries:

Debit 76 Credit 68 subaccount “Personal Income Tax Payments”

– personal income tax is withheld from remuneration;

Debit 68 subaccount “Personal Income Tax Payments” Credit 51

– transferred to the personal income tax budget.

Personal income tax must be transferred to the budget at the place where the organization is registered.

What if we are talking about income from civil contracts entered into by a separate division? Then the personal income tax must be transferred according to the details of the tax office in which this unit is registered.

This procedure is provided for in paragraph 7 of Article 226 of the Tax Code of the Russian Federation.

For payments to residents for performing work (providing services), calculate the tax at a rate of 13 percent (clause 1 of Article 224 of the Tax Code of the Russian Federation).

Withhold personal income tax from payments to non-residents at a rate of 30 percent. The exception is non-residents who are recognized as highly qualified specialists. Regardless of their tax status, their income will be taxed at a rate of 13 percent. This is stated in paragraph 3 of Article 224 of the Tax Code of the Russian Federation. When calculating personal income tax for residents, take into account the professional tax deduction (clause 3 of Article 210 of the Tax Code of the Russian Federation). Do not provide a deduction to non-residents (clause 4 of article 210, clause 3 of article 224 of the Tax Code of the Russian Federation).

Situation: is it possible to provide standard tax deductions for personal income tax to residents working under civil contracts?

Yes, you can.

When providing a standard tax deduction, restrictions on the type of contract (labor or civil) are not provided for in Article 218 of the Tax Code of the Russian Federation.

A person has the right to receive a standard tax deduction for himself and (or) his child. A deduction for yourself in the amount of 3000 or 500 rubles. provide to special categories of citizens. Deductions for a child are provided for in subparagraph 4 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation.

To provide a standard deduction to an employee engaged under a civil contract, an organization must fulfill the following conditions:

- obtain from the employee all the necessary documents (clause 3 of Article 218 of the Tax Code of the Russian Federation);

- determine the size of the standard tax deduction that can be provided (clause 1 of article 218 of the Tax Code of the Russian Federation).

Provide deductions to an employee hired under a civil contract only for those months during which the contract is valid. When deciding whether to provide a standard deduction for children, the income received by the employee from the beginning of the tax period (year) is taken into account.

Similar conclusions follow from letters of the Ministry of Finance of Russia dated April 7, 2011 No. 03-04-06/10-81, the Federal Tax Service of Russia dated March 4, 2009 No. 3-5-03/233 and the Federal Tax Service for Moscow dated June 1, 2010 No. 20-15/3/057717.

If the contract is valid for several months, and the remuneration is not paid monthly (for example, in a lump sum upon expiration of the contract), then provide standard tax deductions for each month of the contract, including those months in which the remuneration was not paid. This conclusion follows from letters of the Ministry of Finance of Russia dated January 13, 2012 No. 03-04-05/8-10, dated July 21, 2011 No. 03-04-06/8-175, Federal Tax Service of Russia dated October 9, 2007 No. 04-1-02/002656. This approach is confirmed by the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 14, 2009 No. 4431/09.

An example of providing a standard tax deduction under a civil contract concluded with a citizen who is not an employee of the organization

On April 1, Torgovaya LLC concluded with A.I. Ivanov contract for the current renovation of office premises. Ivanov is not an employee of the organization, and is also not registered as an entrepreneur.

The contract was concluded for a period of three months. The amount of Ivanov’s remuneration under the contract is 30,000 rubles. and is paid in a lump sum upon completion of the work.

On June 30, Ivanov handed over the completed work. The organization accepted them according to the acceptance certificate.

The Hermes accountant awarded Ivanov a remuneration of 30,000 rubles. and included its amount in the personal income tax base for June.

Ivanov has one child under the age of 18. According to Ivanov’s statement, this year, before the conclusion of the contract, he did not work anywhere and did not receive any income. Thus, in June, its tax base since the beginning of the year did not exceed 350,000 rubles. Standard deductions were provided to Ivanov in the following amounts:

- 1400 rub. – for April;

- 1400 rub. – for May;

- 1400 rub. - for June.

Personal income tax on Ivanov’s remuneration amounted to 3,354 rubles. ((RUB 30,000 – (RUB 1,400 × 3 months)) × 13%).

In June, Hermes paid Ivanov a reward in the amount of 26,646 rubles from the cash register. (30,000 rubles – 3354 rubles).

An example of how to reflect in accounting remuneration under a civil contract for the performance of work concluded with a citizen who is not an employee of the organization

On March 1, Torgovaya LLC concluded with A.S. Kondratyev contract agreement for routine repairs of office space. Kondratyev is not an employee of the organization, and is also not registered as an entrepreneur.

The cost of work is 41,000 rubles. When performing repairs, Kondratiev uses materials from the organization.

In March, Kondratiev renovated the office space. The Hermes accountant, on the basis of the acceptance certificate for the work performed, accrued remuneration to Kondratiev in the amount of 41,000 rubles.

The amount of the remuneration was included in Kondratiev’s personal income tax base for March. Kondratiev has one child under the age of 18. According to Kondratyev’s statement, this year before the conclusion of the contract, he did not work anywhere and did not receive any income. Thus, in March, its tax base since the beginning of the year did not exceed 350,000 rubles. Therefore, he is provided with a standard tax deduction for a child in the amount of 1,400 rubles. Personal income tax amounted to 5148 rubles. ((RUB 41,000 – RUB 1,400) × 13%).

In March, Hermes paid Kondratiev from the cash register in the amount of 35,852 rubles. (RUB 41,000 – RUB 5,148).

The accountant made the following entries in the accounting:

Debit 44 Credit 76 – 41,000 rub. – repair work performed by Kondratyev under a contract was accepted;

Debit 76 Credit 50 – 35,852 rub. – remuneration was paid to Kondratiev under the contract;

Debit 76 Credit 68 subaccount “Personal Income Tax Payments” – 5148 rubles. – personal income tax was withheld from remuneration accrued in favor of Kondratiev;

Debit 68 subaccount “Personal Income Tax Payments” Credit 51 – 5148 rub. – transferred to the personal income tax budget, withheld from Kondratiev’s income.

To learn whether it is necessary to withhold personal income tax from the cost of materials, transportation or other expenses that the organization compensates to the contractor under a civil contract in addition to remuneration, see On what income to withhold personal income tax.

Include remuneration (advance) under a civil contract for the performance of work or provision of services in the tax base for personal income tax on the day of payment of the remuneration (advance) in cash or in kind (clause 1 of Article 223 of the Tax Code of the Russian Federation). In this case, it does not matter in which tax period the work will be performed (services provided). That is, the tax must be withheld on the day of actual payment of income, regardless of whether this payment is an advance payment or final payment under the contract. Similar conclusions follow from the letter of the Ministry of Finance of Russia dated January 13, 2014 No. 03-04-06/360.

If a person receives remuneration in cash, transfer the calculated personal income tax to the budget no later than the day following the day the income was paid. This is provided for in paragraph 6 of Article 226 of the Tax Code of the Russian Federation.

If a citizen receives remuneration in kind, withhold the calculated tax from any monetary rewards paid to him (Clause 4 of Article 226 of the Tax Code of the Russian Federation). If personal income tax cannot be withheld, notify the tax office at the place of registration of the organization, as well as the citizen to whom the income was paid (clause 5 of Article 226 of the Tax Code of the Russian Federation).

Situation: is it necessary to withhold personal income tax from the income of a non-resident from whom an organization leases equipment used in Russia? The lessor is registered in the Republic of Belarus as an individual entrepreneur.

Yes need.

Income from the rental of equipment located on the territory of Russia is recognized as income from sources in Russia (subclause 4, clause 1, article 208 of the Tax Code of the Russian Federation). As a general rule, such income for a non-resident is subject to personal income tax at a rate of 30 percent (clause 1 of Article 207, clause 3 of Article 224 of the Tax Code of the Russian Federation). In this case, the amount of personal income tax must be withheld from the income of a non-resident and transferred to the budget by the Russian organization that pays income to a citizen of the Republic of Belarus, since in this case it is a tax agent (clause 1 of Article 226 of the Tax Code of the Russian Federation). The fact that a citizen of the Republic of Belarus is registered in this country as an individual entrepreneur does not matter in the situation under consideration. The fact is that a foreign citizen registered as an entrepreneur in another state in accordance with its national legislation, for the purpose of calculating personal income tax in Russia, has the status of an individual.

At the same time, Article 7 of the Tax Code of the Russian Federation establishes the priority of the norms of international treaties of Russia over the norms of the Tax Code of the Russian Federation. Currently, there is an agreement between the Government of the Russian Federation and the Government of the Republic of Belarus dated April 21, 1995 “On the avoidance of double taxation and the prevention of tax evasion in relation to taxes on income and property.” In accordance with parts 1, 2 and 3 of Article 11 of this agreement, payments in the form of remuneration for the use (granting the right to use) industrial, commercial or scientific equipment, the source of payment of which is the territory of Russia, may be subject to personal income tax both in Russia and in the Republic of Belarus . However, the tax rate in Russia cannot exceed 10 percent.

These payments include, in particular, remuneration for rental (leasing) of equipment. But provided that the equipment is industrial, commercial or scientific. That is, the leased property must meet the following criteria:

- be considered equipment according to the All-Russian Classification of Fixed Assets, approved by Decree of the State Standard of Russia dated December 26, 1994 No. 359 (i.e., included in the “Machinery and Equipment” group, OKOF - 14 0000000);

- be designated in the contract between the Russian tenant organization and a citizen of the Republic of Belarus specifically as industrial, commercial or scientific equipment.

Similar conclusions follow from letters of the Ministry of Finance of Russia dated September 10, 2012 No. 03-08-06/Belarus, dated January 24, 2011 No. 03-08-05. Despite the fact that these explanations are devoted to the relationship between organizations of Russia and the Republic of Belarus, they can be extended to the situation under consideration. Since the provisions of Article 11 of the agreement apply to the taxation of income of both organizations and individuals.

Thus, if an organization leases industrial, commercial or scientific equipment from a citizen of the Republic of Belarus, personal income tax will be withheld at a rate of 10 percent. To confirm the right to apply the 10 percent rate, provide the inspection with confirmation that the non-resident is a tax resident of the Republic of Belarus.

If the leased property used on the territory of Russia is not recognized as industrial (commercial, scientific) equipment, withhold personal income tax at a rate of 30 percent.

Advice: there are factors that make it possible not to withhold personal income tax from the income of a resident of the Republic of Belarus if he is registered in this country as an individual entrepreneur. They are as follows.

As a general rule, when paying income to an individual entrepreneur, the organization is not recognized as a tax agent. An entrepreneur registered in accordance with the legislative procedure must independently calculate and pay tax on income received to the budget. This procedure is established by paragraphs 1 and 2 of Article 227 of the Tax Code of the Russian Federation.

From the provisions of Part 2 of Article 8 of the Treaty of December 8, 1999 “On the Creation of a Union State” it follows that an entrepreneur registered in the Republic of Belarus has the same rights, obligations and guarantees on the territory of Russia as a Russian entrepreneur. Therefore, a Belarusian entrepreneur must independently calculate and pay tax on income paid to him by a Russian organization. Accordingly, the Russian organization is not recognized as a tax agent in relation to him and should not withhold personal income tax from his income.

This approach is confirmed by arbitration practice (see resolution of the FAS of the North-Western District dated September 9, 2008 No. A56-1937/2008).

If an organization does not withhold personal income tax when paying income to an entrepreneur who is a resident of the Republic of Belarus, this may cause claims from inspectors. And then the organization will have to defend the legality of its actions in court.

Calculation of remuneration under a contract in 1C ZUP 3.1: step-by-step instructions

Step 1: Setup

The 1C:ZUP 3.1 program provides functionality for calculating remuneration under contract agreements. To enable it, you can use the program’s initial setup assistant and check the “Use GPC agreements” checkbox.

If you have been working in the program for a long time and cannot enter the initial setup assistant, do not worry, you can open the “Settings” menu, go to “Payroll calculation” and check the box “Payments under GPC agreements are registered”.

Step 2. Fill out personnel information

Next, we need to go to the “Personnel” section, the “Employees” directory and create a new one. We fill in the last name, first name and patronymic, INN, SNILS, date of birth, gender. The program will automatically check by last name, first name and patronymic whether such an individual is in the directory, offer to use it or create a new one. At this point, it is very important not to miss if such an individual is already in the database in order to avoid duplication of data. We save the entered data.

The program will highlight in color and display a message if the entered TIN or SNILS is incorrect. Using the “Insurance” hyperlink we will indicate the insurance status of an individual, and using the “Income Tax” hyperlink we will establish the “resident” status and the right to apply deductions if necessary. After this, click the “Complete Agreement” hyperlink.

Step 3. Create an agreement

We fill out the contract period. Enter the contract amount and select the payment method. There are three options: a lump sum at the end of the contract, according to certificates of completion and at the end of the contract with advance payments every month.

It is possible to indicate the need to calculate insurance premiums against accidents. It is also possible to indicate to which account the posting for uploading to 1C:BP 3.0 will be generated.

Conduct and close the contract.

It is also worth noting that the number of executed contracts with the same individual in the 1C: ZUP 3 program is not limited.

Although contracts are concluded with individuals who may not be employees of the enterprise, accounting for contracts is not automated and is not provided for in the 1C:BP 3.0 program; the 1C:ZUP program is also intended for these purposes, since the organization will act as a tax agent for income tax individuals not only for their employees, but also for individuals with whom contracts have been concluded.

Based on the contract, we can create a certificate of completion of work. Let's file two acts. The first act dated February 12, 2021 in the amount of 20,000 rubles. Payment date is February 12. Accrual month February 2019.

The program provides printed forms of the contract and the acceptance certificate for completed work. You can also edit these forms and add your own.

Step 4. Calculation

Let’s create an accrual of remuneration under a contract; to do this, go to the “Salary” section – “Accruals under contracts” and create a document. We select the accrual month February 2021, date 02/12/2019. On the “Agreements” tab, click “Fill out”. The program calculated the accrual result using information from work completion certificates. Please note that this document does not calculate insurance premiums for compulsory pension and health insurance.

The personal income tax tab calculates the amount of personal income tax. Under a work contract, professional deductions are provided in the event that expenses associated with the execution of the contract, for materials, for example, are not compensated. The standard deduction is available for the executor and/or his children. Deductions apply throughout the duration of the contract. If remuneration is not paid every month under the agreement, then deductions are still applied for each month of the agreement. Personal income tax is not withheld from the cost of materials, transportation or other expenses that the organization compensates to the contractor under the contract.

After that, in this document, click on the button “Pay”, “Post and close”. The program will create a statement for the cash register.

The statement will be in the form of “accruals under contracts”.

At the end of the month, we will reflect the certificate of completion of work for the remaining amount of remuneration. The accrual month is February 2021, the act date is 02/28/2019, the accrual will be calculated during the final payroll calculation.

In the act, the “account as” field can be of two types: payroll settlements and settlements with counterparties. The first type corresponds to accounting account 70, the second – to account 76. Postings with such correspondence will be generated in 1C: Enterprise Accounting 3.0 after exchanging data with 1C: Salary and Personnel Management 3.0.

For the final payroll calculation, we will create a “Payroll” document. In addition to information about the calculated salary, personal income tax and insurance premiums for employees of the enterprise, in this document, on the “Contracts” tab, accruals under work contracts will be filled in, and the income tax on individuals executing the contract will be calculated.

If the contract includes accident insurance, insurance premiums will be calculated at the end of the month using the “Payroll” document.

In this case, income under a contract is subject to insurance contributions for compulsory pension and health insurance. Insurance premiums for non-resident performers will be calculated based on their status: permanent resident, temporary resident, temporarily staying in the Russian Federation.

After that, by clicking the “Pay” button, we will create a statement to the cashier for payment.

A statement will be created for the cash register with the “salary accrual” type.

In order to reflect accounting entries, after calculating wages for the entire month, create and fill out the document “Reflection of wages in accounting.” After synchronization, this document will be loaded into the 1C: Enterprise Accounting 3.0 program and, when posted, will generate the necessary transactions.

Insurance premiums

Regardless of what taxation system the organization uses, contributions to compulsory pension (medical) insurance must be calculated from remuneration to people under certain civil contracts (Article 7 of Law No. 212-FZ of July 24, 2009). Such agreements include civil contracts for the performance of work (provision of services), the execution of an author's order, the transfer of copyright, and the granting of rights to use works. Under other civil contracts (for example, under a lease agreement), insurance premiums are not required. For more information about this, see How to calculate contributions for compulsory pension (social, medical) insurance under civil contracts. Do not charge contributions for compulsory social insurance (Clause 2, Part 3, Article 9 of Law No. 212-FZ of July 24, 2009).

But compensation for actual expenses of an individual related to the performance of work or the provision of services under civil contracts is not subject to insurance premiums at all. This is stated in subparagraph “g” of paragraph 2 of part 1 of article 9 of the Law of July 24, 2009 No. 212-FZ. Naturally, reimbursed expenses must be documented. Such clarifications are given in the letter of the Ministry of Labor of Russia dated January 22, 2015 No. 17-4 / OOG-63.

Contributions for insurance against accidents and occupational diseases must be accrued only if the organization’s obligation to pay them is provided for by a civil contract (paragraph 4 of article 5, paragraph 1 of article 20.1 of the Law of July 24, 1998 No. 125-FZ).

The procedure for calculating other taxes depends on what taxation system the organization uses.

How to report on personal income tax?

For tax accounting in terms of filling out the regulated 6-NDFL report, line 100 will reflect the date of actual receipt of income under the contract, that is, the date of payment from the statement. The date of tax withholding is line 110, also the date of payment of income according to the statement. Line 120 will indicate the deadline for transferring the tax - no later than the day following the day the income is paid. This date is automatically determined by the program.

To always fill out reports without errors and in an up-to-date form, enter into a support agreement with the First BIT company. Our specialists will help you update the program and draw up a report. They will also answer all your questions.

Income tax

Please take into account remuneration for the performance of work (services) under civil contracts when calculating income tax as part of:

- labor costs if the contract is concluded with a citizen who is not on the staff of the organization (clause 21 of article 255 of the Tax Code of the Russian Federation);

- other expenses, if the agreement is concluded with an entrepreneur who is not on the staff of the organization (subclause 41, clause 1, article 264 of the Tax Code of the Russian Federation);

- non-operating expenses - when paying for the services of lawyers, advocates and other people providing legal assistance (representatives). Costs can be taken into account regardless of the outcome of the trial (subclause 10, clause 1, article 265 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated July 10, 2015 No. 03-03-06/39817).

An example of how to take into account remuneration under a civil contract for the performance of work concluded with a citizen who is not an employee of the organization. Organization on a general basis (accrual method)

On March 1, Torgovaya LLC concluded with A.S. Kondratyev contract agreement for routine repairs of office space. Kondratyev is not an employee of the organization, and is also not registered as an entrepreneur.

The cost of work is 41,000 rubles. When performing repairs, Kondratiev uses materials from the organization.

In March, Kondratiev renovated the office space. The Hermes accountant, on the basis of the acceptance certificate for the work performed, accrued remuneration to Kondratiev in the amount of 41,000 rubles.

The amount of the remuneration was included in Kondratiev’s personal income tax base for March. Kondratiev has one child under the age of 18. According to Kondratyev’s statement, this year before the conclusion of the contract, he did not work anywhere and did not receive any income. Thus, in March, its tax base since the beginning of the year did not exceed 350,000 rubles. Therefore, he is provided with a standard tax deduction for a child in the amount of 1,400 rubles. Personal income tax amounted to 5148 rubles. ((RUB 41,000 – RUB 1,400) × 13%).

Hermes pays insurance premiums for pension and health insurance at the general rate. The obligation to pay contributions for insurance against accidents and occupational diseases is not provided for in the concluded contract.

In March, Hermes paid Kondratiev from the cash register in the amount of 35,852 rubles. (RUB 41,000 – RUB 5,148). Insurance premiums and personal income tax were transferred to the budget in the same month.

The accountant made the following entries in the accounting:

Debit 44 Credit 76 – 41,000 rub. – repair work has been accepted;

Debit 76 Credit 68 subaccount “Personal Income Tax Payments” – 5148 rubles. – personal income tax withheld;

Debit 76 Credit 69 subaccount “Settlements with Pension Fund”

– 9020 rub. (RUB 41,000 × 22%) – pension contributions accrued;

Debit 76 Credit 69 subaccount “Settlements with FFOMS”

– 2091 rub. (RUB 41,000 × 5.1%) – health insurance premiums have been charged;

Debit 76 Credit 50 – 35,852 rub. – remuneration was paid to Kondratiev under the contract;

Debit 68 subaccount “Personal Income Tax Payments” Credit 51 – 5148 rub. – transferred to the personal income tax budget;

Debit 69 subaccount “Settlements with the Pension Fund of the Russian Federation” Credit 51 – 9020 rub. – pension contributions are transferred;

Debit 69 subaccount “Settlements with FFOMS” Credit 51 – 2091 rub. – health insurance premiums are listed.

When calculating income tax in March, the accountant took into account Kondratiev’s accrued remuneration and insurance premiums in the total amount of 91,408 rubles as expenses. (RUB 41,000 + RUB 9,020 + RUB 2,091).

Situation: is it possible to take into account, when calculating income tax, remuneration for the performance of work (provision of services) under a civil contract concluded with a person on the staff of the organization?

Yes, you can. Moreover, such payments must be economically justified and documented (clause 1 of Article 252 of the Tax Code of the Russian Federation).

The procedure for accounting for remuneration paid to full-time employees under civil contracts depends on whether an employee of the organization is registered as an entrepreneur or not.

If the employee is not an entrepreneur, remuneration paid to him under civil contracts can be taken into account when calculating income tax as part of other expenses on the basis of subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. This point of view is confirmed by the Ministry of Finance of Russia in letters dated September 21, 2012 No. 03-03-06/1/495, dated March 27, 2008 No. 03-03-06/3/7 and the Federal Tax Service of Russia in a letter dated October 20, 2006 No. 02-1-08/222.

If a full-time employee has the status of an entrepreneur, the cost of paying remuneration can also be included in expenses when calculating income tax. At the same time, the procedure for accounting for these payments depends on the nature of the work (services) performed under a civil contract.

If the work (services) is of a production nature, then take into account the remuneration paid to the entrepreneur on staff as part of material expenses (subclause 6, clause 1, article 254 of the Tax Code of the Russian Federation). If he performs work (services) of a non-productive nature, then take into account the costs of paying remuneration as part of other expenses (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation).

Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated July 13, 2010 No. ШС-37-3/6521.

Attention: do not enter into civil contracts with full-time employees for the performance of those works (services) that they perform as part of their job duties. Otherwise, payments under such agreements may be considered economically unjustified. And then the costs of paying remuneration cannot be included in tax expenses (clause 1 of Article 252 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated January 26, 2007 No. 03-04-06-02/11 and the Federal Tax Service of Russia dated July 13, 2010 No. ШС-37-3/6521, dated October 20, 2006 No. 02-1-08/222).

Situation: is it possible to take into account payments under civil contracts when calculating income tax if the organization has employees performing similar functions?

No you can not.

Expenses for payments under civil contracts are economically justified only if the third-party contractor working under such a contract does not duplicate the functions of full-time employees. This position is reflected in letters of the Ministry of Finance of Russia dated December 6, 2006 No. 03-03-04/2/257, dated September 4, 2006 No. 03-03-04/2/200, dated May 31, 2004 No. 04- 02-05/3/42 and the Federal Tax Service of Russia dated October 20, 2006 No. 02-1-08/222.

Advice: there are arguments that allow an organization to take into account payments under civil contracts when calculating income tax, even if it has employees performing similar functions. They are as follows.

Tax legislation does not make the economic justification of expenses for payments under civil contracts dependent on whether the organization has full-time employees performing similar functions.

Thus, the presence of employees with similar responsibilities on the organization’s staff is not a basis for recognizing such costs as economically unjustified. This conclusion is confirmed by paragraph 3 of the ruling of the Constitutional Court of the Russian Federation dated June 4, 2007 No. 320-O-P.

Similar conclusions are contained in the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 18, 2008 No. 14616/07, resolutions of the Federal Antimonopoly Service of the West Siberian District dated January 21, 2008 No. F04-231/2008(681-A27-40), and the Northwestern District dated January 21, 2008 No. F04-231/2008(681-A27-40), dated December 1, 2008 No. A05-586/2008, Moscow District dated August 19, 2009 No. KA-A40/7963-09, dated May 5, 2009 No. KA-A40/3335-09, Ural District dated May 18, 2009 No. Ф09-3078/09-С3, Volga District dated January 26, 2009 No. A55-9610/2008, Central District dated 26 June 2009 No. A35-991/08-C21.

At the same time, in some court decisions, courts place special emphasis on the fact that an organization can take into account payments under civil contracts when calculating income tax if the employee’s duties in the job description do not coincide with the list of services provided. That is, if the services of third-party contractors and full-time employees are not duplicated (see, for example, the determination of the Supreme Arbitration Court of the Russian Federation dated April 14, 2009 No. VAS-3597/09, resolution of the Federal Antimonopoly Service of the Moscow District dated January 18, 2013 No. A40-32442/12- 129-151, dated April 13, 2009 No. KA-A40/2899-09, Volga District dated October 22, 2009 No. A49-1429/2009).

Reflection of accruals under GPC agreements in regulated reports

Many organizations are faced with the need to hire individuals for a short period of time to perform a specific function.

Registration of such services most often occurs using a civil law agreement or, as it is otherwise called, a work contract. In this article, we will consider some legal aspects of this issue, as well as the procedure for reflecting accruals under GPC agreements in 1C: Accounting and regulated reports. Let us turn to the legal regulation of this issue. The principles regulating the relationship between an organization and an individual in this situation are set out in Chapters 37 and 39 of the Civil Code of the Russian Federation. The main difference between a contract and an employment contract is that the employer is the customer, and the employee is the contractor. In this case, labor legislation does not affect the rights and obligations of the parties.

The contractor under the GPC agreement does not have the right to vacation and sick leave, and the company does not pay contributions to the Social Insurance Fund on the amounts of his remuneration. The remaining contributions, the basis of which is wages, are paid in the standard manner.

Personal income tax is withheld at a rate of 13%, an individual has the right to take advantage of standard tax deductions.

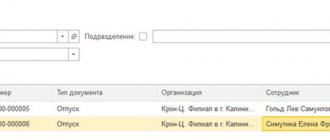

This was a brief description of the theoretical foundations of contracting services. Now let’s look at how to reflect this in the software product 1C: Enterprise Accounting 8 edition 3. Unfortunately, this program does not have automated accounting of contract agreements, so entering such accruals is not very convenient. To begin with, you need to select the “Individuals” directory in the “Salaries and Personnel” section panel:

Fill in the fields with data as shown in the figure below:

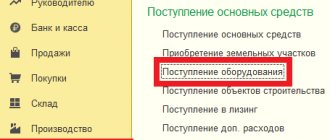

The result of work with the contractor is documented in a Certificate of Work Completed/Services Rendered. After it is received and signed by the parties, we proceed to the formation of entries for accrual of remuneration. To do this, click on the “Operations” section and select “Operations entered manually.” Click on the “Create” button and select “Operation” from the drop-down menu:

Next, you need to create accounting entries for the calculation of remuneration and insurance premiums, as well as for the withholding of income tax. Filling out a manually entered operation is shown in the figure below:

It is important that when entering this operation, tax register records are not generated, which are so important when filling out regulated reporting. Therefore, we go to the section “Salaries and Personnel” – “Personal Income Tax” – “All Documents on Personal Income Tax” and create the document “Personal Income Tax Accounting Operation”.

It is necessary to fill out the tabs of this document, indicating information about the amount of income, tax deductions and the date of tax withholding. The income code is usually selected as 2010 – “Payments under GPC agreements”. The date of personal income tax withholding is the day of payment of remuneration. The deadline for tax remittance is the day following the day the individual receives income.

We fill out the insurance premium registers in the same way. Section “Salaries and Personnel” – “Insurance Contributions” – “Contribution Accounting Operations”. In the created document, you must enter information on the “Contributions Accrued” and “Income Information” tabs.

Payments of remuneration, income tax and insurance premiums are processed using standard payment documents that form the following transactions:

Dt 76.10 Kt 51 for the amount of remuneration, minus personal income tax

Dt 68.01 Kt 51 for the amount of personal income tax

Dt 69.02.7 Kt 51 for the amount of insurance premiums for pension insurance

Dt 69.03.1 Kt 51 for the amount of insurance premiums for health insurance

After the operations are completed, the data on the contract will be included in the reporting on personal income tax and insurance premiums. Let's consider it sequentially. To do this, let’s go to the “Reports” – “Regulated reporting” section and one by one we will generate the necessary declarations.

The figure below shows the SZV-M report form. This form usually does not cause any difficulties. It is enough to indicate the insured person in the months in which he performed the work. When sending a report, if the mercenary is not an employee of the organization, a warning message may appear stating that the report contains an unhired person. This warning should not confuse you; contractors working under GPC contracts must be indicated in the SZV-M report to reflect their length of service.

Let's move on to the SZV-STAZH report: in addition to filling out the standard data of an individual, you also need to fill out column 11 “Additional information”. It indicates the code: “AGREEMENT”. Section 3 of this report is presented in the figure:

Next, we will check the completion of the Calculation of Insurance Premiums. Let's start with the third section - personalized accounting: lines 160 and 170 should contain “1”, and 180 – “2”. In subsection 3.2.1, the amount of remuneration must be indicated in columns 210, 220 and 230.

Section 1 of the report must contain the amounts payable for insurance premiums for compulsory pension insurance and compulsory health insurance. Social insurance contributions are not filled in because they were not calculated.

Subsections 1.1 and 1.2 are presented in the figure:

It remains to consider personal income tax reporting. We will generate 2-NDFL for transfer to the Federal Tax Service for 2021. Let's check the filling according to the picture:

Let's move on to quarterly income tax reporting - form 6-NDFL. Section 1 indicates the amounts of accrued income and the amount of calculated and withheld personal income tax.

Section 2 reflects the deadline for transferring tax, based on the date of actual receipt of income and withholding of personal income tax.

I hope this article will help you correctly reflect in accounting and regulated reporting mutual settlements with the contractor under the contract.

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Procedure for recognizing expenses

The procedure for reducing the tax base by the amount of remuneration under a civil contract depends on the method of calculating income tax used by the organization.

If the organization uses the cash method, then take into account the accrued remuneration as an expense only after it is actually paid to the person (clause 3 of Article 273 of the Tax Code of the Russian Federation).

If the organization uses the accrual method, then include the accrued amount of remuneration under a civil contract as part of direct or indirect expenses (clause 1 of Article 318 of the Tax Code of the Russian Federation). The fact of payment does not matter here (subclause 3, clause 7, article 272 of the Tax Code of the Russian Federation). The moment when the amount of remuneration is included in the tax base depends on what expenses the paid remuneration relates to - direct or indirect.

Organizations can independently determine in their accounting policies a list of direct costs associated with the production and sale of goods, performance of work or provision of services (clause 1 of Article 318 of the Tax Code of the Russian Federation).

Attention: when approving the list of direct expenses in the accounting policy, keep in mind that the division of expenses into direct and indirect must be economically justified (letter of the Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3/2952). Otherwise, the tax office may recalculate the income tax.

Thus, consider remuneration under a civil contract for the performance of work (rendering services) directly related to production and sales as part of direct expenses. Refer to other fees as indirect expenses.

Remunerations for the performance of work (provision of services) under civil contracts, which relate to direct expenses, should be included in the tax base as products are sold in the cost of which they are taken into account (paragraph 2, clause 2, article 318 of the Tax Code of the Russian Federation). Take into account remunerations that relate to indirect expenses when calculating profit tax at the time of accrual (clause 2 of Article 318, clause 1 of Article 272 of the Tax Code of the Russian Federation).

If an organization provides services, then direct costs can be taken into account, as well as indirect ones, at the time of their accrual (paragraph 3, paragraph 2, article 318 of the Tax Code of the Russian Federation).

In trade organizations, remunerations paid under civil contracts are recognized as indirect expenses (paragraph 3 of Article 320 of the Tax Code of the Russian Federation). Therefore, take them into account when calculating income tax at the time of accrual.

Documentation of acceptance and transfer of work

Acceptance and transfer of work under a construction contract is formalized by an act signed by the customer and the contractor.

This procedure applies regardless of the duration of the work under the contract. This follows from the provisions of paragraph 4 of Article 753 of the Civil Code of the Russian Federation. To formalize the acceptance and transfer of work, an organization can use unified document forms approved by Decree of the State Statistics Committee of Russia dated November 11, 1999 No. 100. These include:

- act of acceptance of work performed (form No. KS-2) (drawn up on the basis of data from the log book of work performed according to form No. KS-6a);

- certificate of the cost of work performed and expenses (form No. KS-3);

https://www.youtube.com/watch?v=7F4AOdR9oVA&list=PLWTTVWuqx8_fVArUVPDLeliMmRTspR1ah

Moreover, such documents must contain the mandatory details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. In addition, they must be approved by the head of the organization (Part 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

In the act of acceptance of completed work (for example, according to form No. KS-2), provide a list of work performed by the contractor during the reporting period, indicating their cost. An act of acceptance of completed work (for example, in form No. KS-2) can be drawn up in two cases:

- upon acceptance by the customer of a stage of work, if stage-by-stage acceptance is provided for by the terms of the contract;

- to determine the cost of work performed by the contractor for a certain period of time for the purpose of making interim payments, if such payments are provided for by the terms of the contract.

In the first case, signing an act of acceptance of completed work (for example, in form No. KS-2) indicates acceptance of the completed stage of work in accordance with the contract. The risk of accidental death or damage to the result of the work passes to the customer (clause 3 of Article 753 of the Civil Code of the Russian Federation).

In the second case, the agreement of the parties should provide that the drawing up of an acceptance certificate for the work performed (for example, in form No. KS-2) does not indicate the customer’s acceptance of the results of the work performed with the transfer to him of the risks of accidental loss or damage to the results of the work. And also that acts are drawn up only for settlements between the parties.

In this case, such documents are of an interim nature (clause 18 of the information letter of the Supreme Arbitration Court of the Russian Federation dated January 24, 2000 No. 51). The acts serve as the basis for determining the amount of the next advance payment and filling out a certificate of the cost of work performed (for example, according to form No. KS-3), which is presented to the customer for payment.

When filling out these forms, follow the recommendations contained in Resolution of the State Statistics Committee of Russia dated November 11, 1999 No. 100.

The cost indicated in the certificate of acceptance of work performed (for example, in form No. KS-2) may differ from the cost indicated in the certificate of cost of work performed (for example, in form No. KS-3). In particular, in the certificate, in addition to the cost of the work performed, reflected in the act, data on the cost of equipment payable by the customer, data about which is not included in the act, can be entered.

Document the acceptance by the customer of the completed construction facility with an acceptance certificate for the completed construction facility (for example, according to form No. KS-11).

simplified tax system

The tax base of simplified organizations that pay a single tax on income is not reduced by remunerations paid under civil contracts. Such organizations do not take into account any expenses (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

If an organization pays a single tax on the difference between income and expenses, then remuneration under a civil contract paid to a person who is not on the organization’s staff will reduce the tax base (subclause 6, clause 1, paragraph 2, clause 2, article 346.16, clause 21 of article 255 of the Tax Code of the Russian Federation). When calculating the single tax, take into account accrued remunerations only after they are actually paid to the person (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

Situation: is it possible for an organization to use a simplified method to take into account remuneration under a civil contract concluded with an employee who is on the organization’s staff?

No you can not.

The list of expenses that can be taken into account when calculating the single tax is closed (clause 1 of Article 346.16 of the Tax Code of the Russian Federation). Remuneration under a civil contract concluded with a full-time employee cannot be taken into account as labor costs. Organizations that apply the general taxation system can take it into account as part of other expenses on the basis of subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated March 27, 2008 No. 03-03-06/3/7, dated January 26 2007 No. 03-04-06-02/11 and the Federal Tax Service of Russia dated October 20, 2006 No. 02-1-08/222).

This is possible if, under a civil contract, an employee performs work that is not related to his job duties. In the list of expenses established in Article 346.16 of the Tax Code of the Russian Federation, there are no expenses for civil contracts concluded with employees, nor other expenses related to production and sales. Consequently, a simplified organization cannot take these expenses into account when calculating the single tax.

In what account should personal income tax be reflected on payments to the contractor?

When paying remuneration, the source of payments is obliged to withhold personal income tax from the amount accrued to the individual (subclause 6, clause 1, article 208 of the Tax Code of the Russian Federation). The customer does not have to perform the duties of a tax agent for personal income tax only if the GPC agreement is concluded with an individual entrepreneur, a private notary or a lawyer. These categories of performers pay the tax themselves (clause 2 of Article 227 of the Tax Code of the Russian Federation).

Operations for calculating tax and transferring it to the budget are carried out according to the following scheme:

The responsibilities of the tax agent when making payments under the GPC agreement are not limited to withholding tax, transferring it and reflecting payments in Form 6-NDFL. At the end of the year, you need to issue a 2-NDFL certificate or inform the tax authorities and the recipient of the income about the impossibility of withholding tax if the remuneration is issued in kind (clause 5 of Article 226 of the Tax Code of the Russian Federation).

Long-term construction work

Debit 62 Credit 90-1 – revenue from the implementation of work is reflected (based on the acceptance certificate).

Debit 90-2 Credit 20 – the cost of work performed is taken into account as expenses.

For more information on the formation of the cost of contract work, see How to reflect the contractor's expenses under a construction contract in accounting.

Debit 90-3 Credit 68 subaccount “Calculations for VAT” – VAT is charged on the cost of contract work.

The customer can pay the contractor for the work in advance - in advance.

Debit 51 Credit 62 subaccount “Settlements for advances received” – an advance was received from the customer.

Debit 62 Credit 90-1 – revenue from the implementation of work is reflected (based on the acceptance certificate);

Debit 90-2 Credit 20 – the cost of work performed is taken into account as expenses;

Debit 62 subaccount “Calculations for advances received” Credit 62 – the advance (part of the advance) received from the customer is credited.

This accounting procedure is based on the provisions of paragraph 3 of PBU 9/99 and the Instructions for the chart of accounts.

Debit 76 subaccount “Calculations for VAT on advances received” Credit 68 subaccount “Calculations for VAT” – VAT is charged on the advance received for the completion of upcoming work.

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT on advances received” – VAT previously accrued on the advance received is accepted for deduction.

Situation: how can a contractor reflect in accounting and taxation the proceeds from the implementation of work under a construction contract if the customer refuses to sign the acceptance certificate? The work is short-term in nature. The Contractor applies the general taxation system and uses the accrual method when calculating income tax.

The basis for reflecting in the contractor’s accounting the proceeds from the implementation of work under a construction contract is a document (act) confirming the acceptance and transfer of work, signed by the contractor and the customer (subclause “d”, clause 12 and clause 13 of PBU 9/99 , part 1 of article 9 of the Law of December 6, 2011 No. 402-FZ, paragraph 4 of article 753 of the Civil Code of the Russian Federation).

Upon completion of the work, the contractor must inform the customer that he is ready to deliver the result of the work (stage of work). A standard sample of such a message is not approved by law, so the contractor has the right to draw it up in any form. Having received such a message, the customer is obliged to immediately begin accepting the work performed (Clause 1 of Article 753 of the Civil Code of the Russian Federation).

If the customer refuses to sign the act, the contractor must make an appropriate note about this in the act and sign it unilaterally (clause 4 of article 753 of the Civil Code of the Russian Federation). According to civil law, such an act is considered valid, which means it can serve as the basis for reflecting proceeds from sales in accounting and tax accounting (clauses 12, 13 PBU 9/99, clause 3 of Article 271, clause 1 of Article 39 of the Tax Code RF).

The moment of determining the tax base for VAT (in the absence of prepayment) is the day of transfer of the results of the work performed (subclause 1, clause 1, article 167 of the Tax Code of the Russian Federation). The fact of such transfer is confirmed by an acceptance certificate (including one signed unilaterally with a note indicating the other party’s refusal to sign) (Clause 4 of Article 753 of the Civil Code of the Russian Federation).

If the debt is collected in court, do this. The day the work was completed will be the date of entry into force of the court decision, according to which the court recognized that the contractor had fulfilled all the terms of the contract. Therefore, accrue VAT on this date, and not on the date of signing the act unilaterally (clause 1 of Article 167 of the Tax Code of the Russian Federation).

If construction work is long-term in nature or a transitional period (the start and end dates of the contract fall on different reporting years), when reflecting operations under a construction contract in accounting, follow the rules of PBU 2/2008 (clause 1 of PBU 2/2008). According to this document, accounting for income, expenses and financial results is carried out separately for each executed contract (accounting object).

In accordance with PBU 2/2008, revenue from the implementation of contract work is recognized in the “as ready” method, taking into account the features provided for in paragraph 23 of PBU 2/2008.

The “as ready” method is applied if the financial result (profit or loss) of the execution of the contract as of the reporting date can be reliably determined. In this case, the contractor’s revenue is determined on an accrual basis, regardless of the cost of work performed in each reporting period being presented to the customer for payment.

We suggest you read: How to divorce your husband if his whereabouts are unknown

The “as ready” method provides that revenue and expenses are determined based on the degree of completion of work confirmed by the organization as of the reporting date. In turn, the degree of completion of work can be determined by one of two options specified in paragraph 20 of PBU 2/2008. The selected option must be fixed in the accounting policy for accounting purposes (clause 7 of PBU 1/2008).

| Degree of completion of work | = | The volume of work actually performed as of the reporting date in physical terms | : | Total volume of work under the contract in kind | × | 100 |

In addition, the degree of completion can be determined by the share of the volume of work completed using expert assessment. Such an expert assessment may be the data of Form No. KS-3, signed by the parties for the reporting period.

An example of determining revenue under a long-term construction contract. Revenue is recognized on an “as-available” basis. The contractor determines the degree of completion of work by the share of completed work in the total amount of work under the contract (the expert assessment method is used)

LLC "Alfa" (contractor), on the basis of a construction contract, performs work on the construction of a facility for the developer - LLC "Proizvodstvennaya". The contract was concluded for a period from January 20, 2015 to March 20, 2021.

The cost of work under the contract is 1,400,000 rubles. (without VAT). Actual expenses incurred - 900,000 rubles. In accordance with Alpha's accounting policy, for accounting purposes, the degree of completion of work is determined by the share of completed work in the total volume of work under the contract.

According to Alpha's engineering service, as of December 31, 2015, the volume of work performed at the site amounted to 80 percent of the total volume of work under the contract.

Based on this, in 2015, under the agreement with “Master”, the following indicators are reflected in Alpha’s accounting:

- revenue from the sale of contract work in the amount of RUB 1,120,000. (RUB 1,400,000 × 80%);

- expenses associated with the performance of contract work in the amount of RUB 900,000.

The work was fully completed and handed over to the developer on time - March 2016. The revenue reflected in Alpha's accounting records in the first quarter of 2021 is: RUB 1,400,000. – 1,120,000 rub. = 280,000 rub.

| Degree of completion of work | = | Costs actually incurred as of the reporting date for work performed | : | Total costs under the contract (calculated amount) | × | 100 |

Expenses incurred at the reporting date are determined only for work performed. The cost of materials transferred to perform work, but not yet used to fulfill the contract, is not included in the amount of expenses (clause 21 of PBU 2/2008).

In accounting, reflect income and expenses under construction contracts separately for each concluded contract (in the context of analytical accounting). However, some agreements have a number of specific features. This is stated in section II of PBU 2/2008.

With the “as ready” method, until the work is completely completed, revenue is accounted for as a separate asset - “accrued revenue not presented for payment” (clauses 25, 26 of PBU 2/2008). If the contractor does not have, in accordance with the terms of the contract, the right to present the cost of work performed for payment, it is impossible to reflect the revenue on account 62 (Instructions for the chart of accounts).

Therefore, the organization reflects it on account 46 “Completed stages of work in progress” (paragraph 9 of the Instructions to the chart of accounts). It is this account that is used, if necessary, by organizations performing long-term work (Instructions for the chart of accounts). After the contractor has received the right to present the cost of work performed to the customer for payment, account 46 is closed as a debit to account 62.