How to reflect a loss in 1C 8.3? Before the release of “1C:ERP Enterprise Management” version 2.4.2, in which the developer introduced automation of the procedure to reflect last year’s losses, users had to resort to accounting for them and reflecting operations in the operational management loop to items in the directory of deferred expenses (abbreviated as RBP) . Even with the release of update 2.2, where the possibility of independently entering accounting, management, and tax accounting amounts debuted in the distribution documentation of the BPR, the ability to specify a distribution item for the BPR with the posting of account 99 and calculating the offset amounts from the proceeds in automatic mode remained unrealized.

Because of this, up to version 2.4.2, in order to reflect losses in regulated accounting for enterprises maintaining registration records in the general taxation system, the “Operations” document was used, where users had to manually fill in the distribution amount for VR and NU.

Reflection of losses in 1C:ERP

The main innovation of update 2.4.2 is the ability to maintain records within tax accounting, as well as reflect losses when preparing an income tax return, without the need to carry out manual operations.

For these tasks, the following were introduced into the system: account 97.11 and a directory with the same name. At the same time, the added directory is the only subaccount available for the added account.

As a rule, filling out the directory of past losses is carried out automatically: when closing the calendar year and before the balance sheet is reformed, the system checks for the presence in the directory of an entry with a year that would correspond to the period being closed. If there is no date, a new element for the current year will be added automatically.

To account for time differences in financial losses, in accordance with the requirements of the accounting standard of the Russian Federation 18/02, an asset of the same name is added to the list of types of tax liabilities/assets (ONO/ONA).

Closing the month for enterprises on the OSN (general taxation system) in terms of calculation and accounting of losses is carried out as follows:

- According to account 99.01.1 (Losses and income from activities with special tax purposes), the balance in tax accounting is calculated.

- If the balance presented in the paragraph above corresponds to financial losses, the amount of the latter is written off from this account, transferred to account 97.11 (Dt 97.11 - Kt 99.01.1), at the same time filling in the NU amount in the account assignment. Already on this account, in the account assignment of the analytical account of past losses, the element of the directory of the same name is filled in in accordance with the year being closed. If such an element does not exist, the system will create it automatically.

- If at the enterprise for which the year is closed, a flag appears in the accounting policy, accounting provision 18/02 is required, and the amount of the transferred loss is entered into the “Amount Kt BP” and “Amount Dt BP” with a negative value. The balance in the debit of account 09 “Deferred tax assets” at the time of closing the calendar year in the analytical account “Loss of the current period” is transferred to the debit of account 09 to the analytical account “Losses of previous years” (account assignment creation is required Dt 09 “Losses of previous years” - Kt 09 "Loss of the current period"). The existing balance on the above account 09 according to the analytical account “Loss of the current period” at the end of the last year and at the beginning of the current year is taken as an error that must be corrected, followed by repeating the registration procedure for closing it.

Accounting for losses of previous years in “1C: Accounting 8” (rev. 3.0)

The procedure for accounting for losses from previous years in the 1C: Accounting 8 program, edition 3.0, is carried out in two stages:

1. Transfer of losses of the current period to expenses of future periods. 2. Write-off of losses from previous years.

The operation of transferring a loss of the current period to future expenses (FPO) is performed manually using the Operation document (section Operations - Operations entered manually). The purpose of this operation is to ensure automatic write-off of the loss in the future. For this purpose, the mechanism of deferred expenses is used, which is well known to users of the program. The tax loss of the current year, accounted for in the debit of account 99.01.1 “Profits and losses from activities with the main taxation system” must be transferred to the debit of account 97.21 “Future expenses” with the expense type Losses of previous years. For taxpayers applying the provisions of PBU 18/02, it is additionally necessary to adjust the analytics of deferred tax assets accounted for in account 09.

This manual operation is recorded on the last day of the year before the balance sheet reformation. If the accounting system does not reflect the transfer of losses to the RBP, the program will detect this situation and remind the user about it. In January of the next year, when performing the routine operation Calculation of income tax, which is included in the Closing of the month processing, a message will be displayed on the screen that the loss of the previous year has not been carried forward. Processing is interrupted, and until the user creates an operation to transfer the loss, he will not be able to move forward.

Meanwhile, the transfer of losses to the future is a taxpayer’s right, and not an obligation (clause 1 of Article 283 of the Tax Code of the Russian Federation). What to do if for some reason the taxpayer does not want to exercise this right?

In this case, you will still have to create a manual operation, but in the form of the reference book item Deferred expenses, you simply do not need to indicate the start date for writing off the loss. In the future, at any time you can open the desired record (section Directories - Deferred expenses) and fill in the Write-off period from: field, if the user changes his mind and wants to reduce the profit received by losses of previous years, starting from the specified date.

Losses from previous years are automatically included in expenses that reduce the income tax base when performing the regulatory operation Write-off of losses from previous years. The amount of write-off of losses is calculated only if at the time of performing a regulatory operation, according to tax accounting data, there is a debit balance in account 97.21 “Deferred expenses” with the expense type Loss of previous years. The write-off is made to the debit of account 99.01.1 in accordance with the data specified in the directory Deferred Expenses.

Starting from 2021, losses incurred in 2007 and later can be carried forward to an unlimited number of subsequent tax periods, and profits for the reporting (tax) periods 2017-2020. can be reduced by the amount of losses of previous tax periods by no more than 50%. This change is supported in the 1C: Accounting 8 program starting from version 3.0.45.20.

To remove the ten-year limit established in the program for “old” losses (received from 2007 to 2015), just open the corresponding entries in the Deferred Expenses directory and clear the Write-off period field by:.

As for participants in regional investment projects, SEZ participants, etc., for such organizations that apply reduced tax rates, automatic write-off of losses according to the rules of Article 283 of the Tax Code of the Russian Federation in “1C: Accounting 8” is not supported.

Let's look at how the program "1C: Accounting 8" (rev. 3.0) carries out the transfer of losses to the future, taking into account the latest changes in tax legislation.

Example 1

CJSC "TF Mega" applies OSNO, the provisions of PBU 18/02, calculates and pays monthly advance payments during the reporting period. At the end of 2021, the organization received a loss, which, according to tax accounting data, amounted to 5 million rubles. In 2021, the organization operated with a profit, which cumulatively from the beginning of the year amounted to:

When calculating the tax base in each reporting and tax period, the organization exercised its right and transferred part of the loss to the future. |

Reflection of the amount of loss in accounting and reporting

To determine the amount of the 2021 tax loss that the taxpayer has the right to carry forward to the future, you must first complete all regulatory operations for December 2021 included in the Month Closing processing.

The amount of the loss will be reflected, for example, in the Income Tax Calculation Certificate if you set tax accounting data as indicators in the report settings.

You can analyze tax accounting data for account 99 for 2016 using one of the standard reports from the Reports section, for example Account Analysis. If you cancel the routine operation Balance Reformation, then the Account Analysis report for account 99 will be more clear: a debit balance in the amount of 5 million rubles. indicates a loss (Fig. 1).

In the tax return for corporate income tax for 2016 (approved by Order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected] , hereinafter referred to as the Order of the Federal Tax Service), this amount of loss is reflected:

- with a minus sign in Sheet 02 on line 100 “Tax base”;

- in Appendix No. 4 to Sheet 02 with a minus sign on line 140 “Tax base for the reporting (tax) period” and with a plus sign on line 160 “Balance of uncarried loss at the end of the tax period - total.”

Since the organization applies the provisions of PBU 18/02, when performing the regulatory operation Calculation of income tax for December 2021, a deferred tax asset (DTA) is recognized and an accounting entry is generated:

Debit 09 for the type of asset “Loss of the current period” Credit 68.04.2 - for the amount of IT (RUB 1,000,000.00 = 5,000,000.00 x 20%).

The income statement in line 2300 reflects the amount of loss according to accounting data: 5,000 thousand rubles. with a minus sign (a negative value is indicated in parentheses). Please note that this amount may not be the same as your tax loss. The amount of recognized deferred tax asset in the amount of RUB 1,000 thousand. is reflected in line 2450 “Change in deferred tax assets” and reduces the amount of loss. Thus, indicator 2400 “Net profit (loss)” reflects the amount of the adjusted loss in the amount of 4,000 thousand rubles. with a minus sign. The recorded deferred tax asset will further reduce the income tax base.

In the first section of the balance sheet asset “Non-current assets” the amount of deferred tax asset is in the amount of 1,000 thousand rubles. reflected in line 1180 “Deferred tax assets”.

In the third section of the liability “Capital and reserves”, the amount of the uncovered loss for 2021 is reflected in the total amount on line 1370 “Retained earnings (uncovered loss)”. If the organization at the beginning of the year had no retained earnings (uncovered loss) from previous years, and no dividends were distributed during the year, then the value of line 1370 should be equal to the value of line 2400 of the financial results statement (see Instructions for using the Chart of Accounts).

Carrying forward losses from the current period to the future

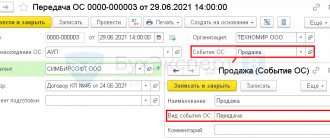

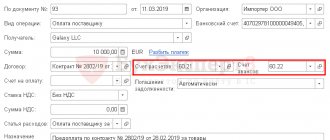

In order for a loss received in 2021 to be taken into account automatically in the 1C: Accounting 8 program (rev. 3.0), it must be transferred to future expenses. Let's create the document Operation 12/31/2016 (Fig. 2).

In the document form, to create a new posting, you need to click the Add button and enter correspondence for the debit of account 97.21 “Deferred expenses” and the credit of account 99.01.1 “Profits and losses for activities with the main tax system.” Since in accounting a loss is not carried forward into the future, we leave the Amount field empty, while filling in special resources for tax accounting purposes:

Amount of NU Dt 97.21 and Amount of NU Kt 99.01.1 - for the amount of loss (RUB 5,000,000.00); Amount VR Dt 97.21 and Amount VR Kt 99.01.1 - for taxable temporary difference (-5,000,000.00 rub.).

In the form of the directory element Deferred expenses, you must indicate the following information:

- name of the expense for future periods, for example, Loss 2016;

- type of RBP for tax accounting purposes - Losses of previous years (selected from the predefined directory Types of expenses (NU));

- the amount of loss (RUB 5,000,000.00) is indicated as a guide, since the amount of the balance according to accounting and tax accounting data is used to write off the RBP;

- method of recognition of expenses - In a special order;

- the start date of loss transfer is the first day of the year following the year in which the loss was received, that is, 01/01/2017;

- We do not indicate the end date, since the restriction on the period for carrying forward losses has now been lifted;

- The write-off account and analytics are not required.

Carrying forward a loss means that the tax base is planned to be reduced in the future. In accounting, such a reduction in the tax base will occur due to the write-off of a deferred tax asset. Since at the time of loss transfer in a manual transaction temporary differences in the valuation of the Deferred Expenses asset are reflected, then for this type of asset in accounting it is necessary to reflect the occurrence of IT using the posting:

Debit 09 for the type of asset “Future expenses” Credit 09 for the type of asset “Loss of the current period” - in the amount of IT (RUB 1,000,000.00).

Please note that the operation to transfer losses to the RBP should be entered after the final completion of the Closing of the month for December processing.

After saving the manual operation, you should re-enter the Month Closing form and perform the following sequence of actions for operations:

- Re-posting documents for the month - select the Skip operation command;

- Balance reform - select the Perform operation command.

If there is a need to close the month again, the manual operation to carry forward the loss should be canceled (marked for deletion). After the final closure of the month, you need to uncheck the deletion of the manual operation (record it in the accounting) and perform the balance sheet reformation again without re-posting the documents.

Write-off of losses from previous years

From January 2021, the Month Closing processing includes the regulatory operation Write-off of losses from previous years, during which the program reduces the profit of the current month by the amount of losses of previous tax periods according to the updated norms of Article 283 of the Tax Code of the Russian Federation, that is, by no more than 50%.

The result of a decrease in profit is reflected in special resources of the accounting register:

Amount of NU Dt 99.01.1 and Amount of NU Kt 97.21 - for the amount of write-off of the loss; Amount VR Dt 99.01.1 and Amount VR Kt 97.21 - for taxable temporary differences.

If there is no profit in the current month, then the document will still be created, but will not have any movements in the registers. If a loss is incurred in the current month, the amount written off is restored, and in the specified resources the amount written off of the loss is reversed.

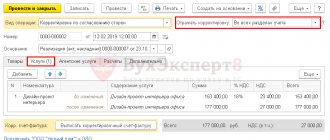

According to the conditions of Example 1, the organization “TF Mega” in the first quarter of 2017 received a profit of 1,000,000.00 rubles.

Half of this amount can be reduced by the amount of losses from previous tax periods.

We will close the month for March 2021 and generate a certificate calculating the write-off of losses from previous years (the certificate is generated on an accrual basis from the beginning of the year). In column 4 of the Certificate of calculation of write-off of losses of previous years for March 2021, the amount of 500,000 rubles will be indicated as the amount of loss taken into account in the reduction of profit. (Fig. 3).

When carrying out the routine operation Calculation of income tax, the amount of income tax will be reduced by writing off the deferred tax asset, which is reflected by the posting:

Debit 68.04.2 Credit 09 by type of asset “Deferred expenses”

In total, for this type of asset for the first quarter, IT was written off in the amount of RUB 100,000.00. (500,000.00 x 20%).

Let's look at how the income tax return for the first quarter of 2021 is filled out. Appendix No. 4 to Sheet 02 automatically reflects the following indicators (Fig. 4):

| Line of Appendix No. 4 to Sheet 02 of the income tax return for the first quarter of 2021 | Data |

| 130 | Uncarried loss for 2021 (RUB 5,000,000), the same amount is reflected on line 010 in the total balance of uncarried loss at the beginning of the tax period |

| 140 | Tax base for the reporting period (RUB 1,000,000) |

| 150 | The amount of the portion of the loss that reduces the tax base. This includes the credit turnover of account 97.21 with the type “Losses of previous years” (RUB 500,000) |

| 160 | Balance of uncarried loss at the end of the tax period (RUB 4,500,000) |

From line 150 of Appendix No. 4 to Sheet 02 of the declaration, the amount of the part of the loss that reduces the tax base is transferred to line 110 of Sheet 02 of the report. The tax base for calculating tax will be reduced by this amount (p. 120), which will be 500,000 rubles. (1,000,000 - 500,000).

Filling out profit declarations for interim reporting periods

Despite the fact that the taxpayer has the right to carry forward a loss to the future in any reporting period (clause 1 of Article 283 of the Tax Code of the Russian Federation), Appendix No. 4 to Sheet 02 is included in the declaration only for the first quarter and tax period (clause 1.1 of the Order of the Federal Tax Service ). Accordingly, Appendix No. 4 to Sheet 02, as well as line 110 of Sheet 02 of the half-year and 9-month declarations are not filled out in the program. At the same time, the algorithm for writing off losses does not change. How, in this case, should you fill out a declaration under the conditions of Example 1?

The answer to this question is provided by paragraph 5.5 of the Order of the Federal Tax Service, according to which in income tax returns for interim reporting periods, line 110 of Sheet 02 is determined based on the data:

- line 160 of Appendix No. 4 of the declaration for the previous tax period;

- line 010 of Appendix No. 4 of the declaration for the first quarter of the current tax period;

- line 100 of Sheet 02 for the reporting period for which the declaration is drawn up.

In practice, this means the following: line 110 must be filled out manually based on tax accounting data, while the remaining indicators on Sheet 02 are filled in automatically.

Thus, for the first half of 2021, the credit turnover of account 97.21 with the type Losses of previous years according to tax accounting data is 1,000,000 rubles. The same amount is reflected in column 4 of the Certificate of calculation of write-off of losses of previous years for June 2021 as the amount of loss included in the reduction of profit. Thus, in line 110 of Sheet 02 of the half-year declaration, you need to enter the value: 1,000,000. The tax base indicator for calculating the tax (page 120) will be reduced by this amount, which will be 1,000,000 rubles. (2,000,000 - 1,000,000).

For 9 months of 2021, the credit turnover of account 97.21 with the type Losses of previous years according to tax accounting data is 1,500,000 rubles. The same amount is reflected in column 4 of the Certificate of calculation of write-off of losses of previous years for September 2021. In line 110 of Sheet 02 of the declaration for 9 months, the value is manually entered: 1,500,000.

The tax base indicator for calculating income tax (p. 120) will be 1,500,000 rubles. (3,000,000 - 1,500,000).

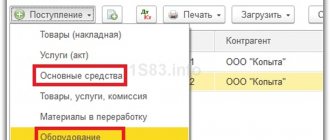

Closing last year's losses in 1C 8.3

Closing of recorded losses from last year is carried out by performing the regulatory process of closing the month, if there is a profit for the current period. For these purposes, in the program updated to version 2.4.2, the list of month-closing procedures includes the “Write-off of losses from previous years” procedure, carried out automatically if there is a balance on the debit of account 97.11. When performing this step, the system calculates the amount of losses for previous years (up to ten years) and, if there is a profit for the current period, writes off the loss to the amount of previously recorded profit, as a result of which account assignments Dt 99.01.1 - Kt 97.11 of the amount according to NU are formed .

If a flag is set in the enterprise’s accounting policy indicating that the organization maintains accounting in accordance with accounting regulations 18/02, then the amount of financial losses written off from account 97.11 is expressed in the amount of time differences with a negative value.

The write-off is carried out before the calculation of the direct state tax, which comes from the profit of the enterprise. The result of the procedure is taken into account in the process of calculating income tax at the subsequent stage of closing the month.

Reflection of profit in the current period

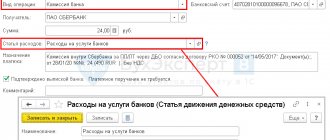

Let me remind you that in January 2021 the organization made a profit of 211,864.41 rubles.

We will carry out the operation of closing the month for January 2021 in 1C 8.3. At the end of January, in 1C 8.3 we will generate a report on document postings. Write-off of losses from previous years:

And Calculation of income tax:

Transfer of last year's losses when updating 1C ERP settings to the latest version

All of the above applies to new systems that do not provide information on losses for previous years, which remain after the system is updated from previous versions. But what to do if the system has already accounted for account 97.21 and the losses were closed manually?

In this case, after updating the settings, the balance will need to be manually assigned to the beginning of the current year from account 97.21 to account 97.11, using the “Operation (reg.)” document. Since after updating the settings, the directory of last year’s losses will be empty, you will need to manually prepare elements for those years for which there are unclosed losses, and when transferring from the account, fill out analytical account 97 yourself and correctly.

It is important not to forget the fact that the write-off of last year's losses (up to ten years) is not carried out automatically. In this case, a notification will appear about the presence of such amounts when closing regulated accounting for the last month of the year.

In order to write off last year's losses for a period of ten years or more from the current moment, you will need to use the document “Operation (reg.)”, starting from the decision made and filling out the following entries:

- Dt 91.02 PR – Kt 97.11 NU for a loss that is subject to write-off;

- Dt 91.02 VR – Kt 97.11 VR for a loss with a negative value that is subject to write-off.