Home / Labor Law / Payment and benefits / Wages

Back

Published: March 16, 2016

Reading time: 8 min

0

5459

The wage fund includes all types of payments made to employees of the enterprise for a certain period of time from the enterprise budget. These are wages, bonuses, allowances, compensation.

Correct fund calculation is necessary at all stages - both in the process of planning investments and profits, and subsequently for basic financial forecasts and reporting. For this, there is a special formula into which the relevant data is substituted; the efficiency of the enterprise depends on the correct calculation.

- What does the fund consist of?

- Fund structure

- What data will be required for the calculation?

- Calculation procedure Annual

- Monthly

- Day

- Essential workers

What it is

Payroll – Payroll Fund, it represents all the amounts that employees of an enterprise receive in the course of their activities. With the help of payroll, expenses are kept track of for a certain time period. It includes expenses for staff salaries, as well as allowances, vacation pay and all types of social benefits.

Payroll calculation is carried out taking into account a certain time period, for example, a month or a quarter. At the legislative level, a minimum level of payment is established, and the maximum is not limited and depends only on the employee himself.

The payroll changes depending on the situation in the services market, the level of inflation, labor costs and other factors. At the same time, the wage fund is the main part of the final cost of the organization.

How to calculate payroll: formula for calculating the balance

What does the wage fund include and how to calculate it correctly? This question is relevant for all businessmen - the salary component of the cost of goods or services often constitutes a significant share of it and affects the final financial result of the company.

Excessive savings on the payroll amount are fraught - meager salaries, lack of incentives and compensation payments do not contribute to high production indicators and obtaining decent profits. The result of such tight-fistedness of a businessman can be staff turnover, low labor productivity, the desire of individual team members to make up for the amount of remuneration received for work at the expense of the company’s property, etc.

The formula for calculating payroll is the sum of its various components. The number of elements of such a formula depends on the content of internal local acts. For example, if these documents provide for monthly payment to employees of wages (W), bonuses (PR), as well as financial assistance (MA) in addition to vacation pay (WTP), then the formula for calculating the payroll will look like this:

PHOT = Salary + PR + OTP + MP.

The algorithm for calculating the wage fund, the formula of which is presented above, is schematic, and the calculation of the payroll (as well as the calculation of the wage fund) in various companies can be carried out according to a more detailed or abbreviated version of the formula, depending on the composition of the payroll and the wages.

When accounting registers are used as a source of information for the formula, the wage fund for a certain period is calculated as follows. The data on the credit of the 70th account (“Settlements with personnel for wages”) is added from the debit of the accounts:

- the 20th, which reflects operations characteristic of “Main production”;

- 25th, where “General production expenses” are reflected;

- the 26th, reserved for “General business expenses”;

- 08th, where “Investments in non-current assets” are recorded;

- 91st, intended for “Other income and expenses”, etc.

The labor inspector of the State Labor Inspectorate of the Nizhny Novgorod Region, V. I. Neklyudov, explained how to conduct an analysis of the wage fund. Get trial access to ConsultantPlus and find out the official’s point of view for free.

What does it include

Payroll is a wage fund and every employer should know what it includes, since incorrect calculation of indicators can lead to liability when inspected by regulatory authorities. Payroll includes:

- the amount of accrued wages;

- the final cost of products when labor is paid in kind;

- additional pay for additional work, including overtime or night shifts, as well as days off on holidays;

- all types of bonuses, including for long and continuous work experience;

- all types of payments for carrying out activities in hazardous conditions;

- payments for unworked time;

- expenses of funds to provide employees with free products, services, food, and accommodation;

- costs for the purchase of products issued to the employee free of charge, for example, uniforms. This type of expense can be replaced by the provision of cash or other benefits for the employee to independently purchase the necessary uniform;

- cash payments provided to an employee in connection with going on vacation, both main and additional or maternity leave. This also includes the amount of compensation for vacation that the employee has not previously used;

- payments in the form of remuneration for labor of minors;

- all expenses for medical and other types of examinations, as well as the performance of duties established at the state level;

- all types of compensation that are due to employees during the liquidation or reorganization procedure of an enterprise;

- payments for forced absence, transfer to a job with a lower level of pay, or for temporary disability, for example, due to illness;

- travel expenses. This also includes payments when working on a rotational basis and all delays that arose for reasons beyond the control of the employee;

- expenses for payment of certain types of pensions.

The manager must take into account all the expenses of the enterprise, which primarily go towards paying employees or creating conditions for their implementation, for example, payments for travel.

Taxes

The payroll does not have taxes as such, but for various items, including the income of individuals, the tax is removed. The fund also includes permanent social payments.

Taxes and their size depend on whether the enterprise or organization has benefits. At the same time, payments will definitely be made in any case.

Contributions

All social contributions, including insurance and pensions, are paid to the fund. Each type of contribution has its own rate. All fees are required to be paid. For this reason, they are included in the fund, as well as in calculating the cost of products or services.

Sick leave

Sick leave is included in the payment fund there and is taken into account when calculating costs. At the same time, insurance payments for sick leave are no longer included in the organization’s payroll.

Benefit

Benefits, including child care, are not included in the payroll. This applies to all types of benefits.

Personal income tax

Personal income tax is included in the fund without fail. The payroll must take into account all personal income taxes during the billing period.

Vacation pay

Each employee's vacation pay, like all other regular payments due, is paid into the wage fund.

Payroll structure: what does it consist of?

The fund includes amounts to be paid to the employee in cash or in kind:

- Payroll fund (WF): accrued salary;

- the cost of products issued as wages;

- additional pay for days off on holidays, paid time off, bonuses for overtime and night work;

- regular bonuses in any form, including rewards for long continuous work experience;

- hazard pay;

- payment to non-registered employees, part-time employees, contracted persons, including fees for one-time services, consultations, etc.

- the period of performing public duties, agricultural work;

- the cost of company shares issued to employees, benefits for their purchase;

- travel expenses;

This does not include:

- annual one-time bonuses;

- payment of dividends to employees;

- any financial assistance;

- awards from special funds of the organization;

- loans provided to personnel, benefits, reimbursement of travel costs, vouchers, etc.

What does not apply

It is worth noting that income coming from third party sources should not be taken into account in the calculation. So the payroll does not include:

- one-time bonuses accrued every year;

- expenses for sick leave payments arising after the third day of illness of the employee;

- payments transferred monthly to women who give birth until the child reaches the age of 1.6 years;

- all expenses incurred during the sending of an employee for training or retraining and transferred by bank transfer;

- all funds received or spent from third-party sources of income;

- financial assistance, which is provided after a written request from the employee;

- payment of dividends to employees.

When calculating payroll, you need to be guided by the data recorded in the time sheet, salary slips and staffing schedule of each employee. With their help, you can calculate payroll for any period, including an hour, which is especially necessary if you have a large staff of workers.

What does the payroll include?

To calculate the total cost of paying staff wages, a wage fund is calculated, the structure of which includes the following data:

- wages accrued to employees, regardless of their job responsibilities;

- if payment for work to employees is accrued in the form of manufactured products, then the cost of these products is included in the calculation;

- all incentives accrued to employees in the form of monetary remuneration;

- if free meals are organized for the company’s employees, then the fund will include the funds allocated for it;

- bonuses for performing work without interruption, for length of service;

- funds accrued for compensation for sick leave or absenteeism through no fault of the employees;

- allowances for payment to employees transferred to lower positions;

- funds allocated for travel and accommodation for workers working on a rotational basis;

- funds for salaries of employees of third-party organizations or individual entrepreneurs providing various services;

- funds for payment of pensions if the employee had to retire due to the occurrence of a special situation (for example, an industrial injury was received that caused disability before the employee reached the retirement age provided for by law).

The following amounts are excluded from the calculation:

- dividends;

- loans issued to employees without accruing interest for the use of funds;

- social benefits accrued and paid from the state budget;

- bonuses given to staff for quality work throughout the year;

- any types of financial assistance;

- compensation caused by rising prices.

Also, the calculation does not take into account one-time or non-permanent payments, funds that workers receive from insurance funds.

How is it different from the Payroll Fund?

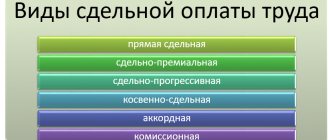

The wage is the amount that an employee receives for work performed or time worked. It is calculated using the tariff rates established at the enterprise.

In this case, the FZP includes:

- labor costs in any form;

- additional payments, including bonuses and allowances;

- compensations due to employees working in difficult or harmful conditions.

At the same time, the federal wage does not take into account the costs of social benefits. The wage fund includes a larger list of expenses, including the wage fund itself.

Are social benefits included in the wage fund?

No!

SOCIAL PAYMENTS ARE NOT INCLUDED IN THE WAGE FUND.

The structure of social payments in Russia includes: ************************************************* ***************************************** 1. Supplements to pensions for those working at the enterprise, one-time benefits for those leaving for pensions for labor veterans, paid at the expense of the enterprise. 2. Insurance payments (contributions) paid by an enterprise under personal, property and other insurance contracts in favor of its employees at the expense of the enterprise.

3. Contributions for voluntary medical insurance of employees at the expense of the enterprise. 4. Expenses for payment to healthcare institutions and organizations for services provided to workers at the expense of the enterprise.

How to calculate

When calculating payroll, you need to select one of the periods for calculation:

- annual;

- monthly;

- day;

- hourly.

The most popular period is the annual period. To calculate payroll, there is no single, mandatory formula, but most often the following is used for calculation:

FOT=NW×SCH×12

Where:

| NW | average salary per month |

| midrange | average number of employees |

SP can be obtained if the final amount of all payments and accruals that are part of the payroll is divided by 12. SP is calculated by adding the number of all employees for each day of the month and dividing the number of calendar days.

To calculate the annual value, you need to repeat the steps for the period from January to December, then add the resulting numbers and divide by 12.

For example:

If SZ = 350 thousand rubles. taking into account allowances and additional payments, and SCH = 20, then payroll = 350 × 20 × 12 = 84,000 thousand rubles.

Payment procedure

Depending on the period for which the calculation needs to be made, there are annual, monthly, daily and hourly types of fund. The data is taken from statements, work report cards, and staffing schedules. For each such period there is its own formula.

Annual

Annual figure = average salary * number of employees * 12 (months)

In this case, indicators are taken for each group of workers separately (management, ordinary employees), multiplied by the number of workers in these groups, then the results are added up.

To determine a resource, most often they take a calculation period equal to the calendar year (the last one), and based on its data, calculations are made.

All amounts that were paid to employees of the enterprise for twelve months,

fold up. In this case, only regular payments are taken into account, one-time (social) payments are not taken into account.

It is necessary to sum up the number of hours worked by all employees for. Data is taken from time sheets.

The average number of employees in the timesheet is determined. The number of personnel for each working day is added up and the result is divided by 30 (average number of days). The results obtained for each month of the year are added up, then the sum is divided by 12 (months).

Monthly

To calculate the monthly fund, it is necessary to add up all the amounts that were accrued to employees during a given period, divide the amount by 12. Also divide the number of all days worked during the year by 12. Divide the average monthly salary for all employees by 30. The resulting result is divided by the number employees working in a given month.

Day

The daily payroll is calculated in the same way as the monthly payroll, taking into account that you need to divide by 30.

The total annual payroll includes salary funds:

- essential workers;

- auxiliary;

- management;

- engineers;

- Employees;

- MOP.

Estimate

Payroll estimates are most often used as a planning element in large organizations that employ workers with the appropriate level of qualifications and maintain an approach to planning characteristic of the times of a planned economy.

In most modern enterprises, this document is practically not used or is used under a different name.

Typically, the payroll estimate is used to identify all areas in which the enterprise's funds are spent, as well as the exact amount of all components of the payroll. The estimate is most often drawn up taking into account not only the main elements of the wage fund, but also including all payments and benefits of a social nature.

Most often, estimates are calculated for one year, including a breakdown by months and quarters.

Formula for calculating monthly payroll

To determine the monthly fund, use a modified formula for finding the annual indicator:

FOT m = Szp * H , where

Payroll m – monthly wage fund;

Сзп – average monthly salary;

H – average number.

A conscious and balanced approach when planning the activities of any enterprise is the key to stability and successful development in the future. Payroll is one of the most important financial indicators, the correct calculation of which will become a fundamental factor in forecasting work activity and developing a set of measures aimed at stabilizing the company’s balance sheet.

Since the fund is formed by enterprises that independently engage in their own financing, when planning and calculating this indicator, it is necessary to separately allocate funds for the formation of reserve funds. Such measures will help not only to repay debts to staff, but also to reserve the remaining excess funds.

Planning procedure

Planning is an important task for every enterprise, since payroll takes into account the bulk of the organization’s expenses.

The planning itself can be carried out using the following algorithm:

- collect information about the structure of the organization, the number of employees and their movement, the average wage and planned production indicators;

- carry out a study of the staffing table and internal local acts that are related to the payroll;

- forecast the average number of employees for the planning period;

- select a planning structure and draw up an estimate;

- calculate payroll.

During the planning procedure, it is necessary to take into account current indicators, as well as the future direction of the organization’s development, including possible changes in wages or the number of employees.

Timely planning will allow you to have full control over your payroll and conduct timely analysis.

Usage Analysis

The analysis is directly related to the planning procedure. It is necessary to fully identify how much the planned indicators diverged from the actual ones.

If a discrepancy was identified in favor of the enterprise itself, then the size of the payroll can be reduced next year, otherwise it is necessary to find out all the reasons for the discrepancy.

This procedure is especially necessary in large enterprises, in which, due to a crisis or other unforeseen circumstances, the discrepancy between the planned and actual indicators can amount to several million.

The analysis allows the company to provide stable payment of wages to employees, regardless of force majeure.

Instructions on the composition of the wage fund and social payments

This instruction is also used when filling out section I of federal state statistical observation forms No. 1-t (monthly), 1-t (quarterly), approved by Resolution of the State Statistics Committee of the Russian Federation dated August 21, 1996 No. 104 According to the Explanation approved by the Resolution of the Pension Fund Board dated 6 March 1996

We recommend reading: Checking a car by engine number

No. 226, this Instruction applies to the extent that does not contradict the List of payments for which insurance contributions are not charged to the Pension Fund of the Russian Federation, approved by Decree of the Government of the Russian Federation of February 19, 1996 No. 153. The List of payments for which insurance contributions are not charged is currently in effect to the Pension Fund of the Russian Federation, approved by Decree of the Government of the Russian Federation of May 7, 1997.

No. 546 This Instruction is applied to conduct federal state statistical observation on labor. 1. Included in the wage fund

Certificate of monthly

A certificate of monthly payroll may be needed if:

- the loan is being processed;

- the bank requested data to confirm the legality of the company’s actions, that is, to confirm that all funds withdrawn are credited to the employees’ account;

- inspection is carried out by employees of the Federal Tax Service or insurance funds.

This certificate may reflect payroll data not only for a specific month, but also for other periods. In addition, it may reflect planned indicators. However, there is no single form for this document, which allows the organization to use a company letterhead.

Sample form.

Regardless of the type of activity of the company, it is obliged to pay workers involved in production.

Payroll allows you to reflect all the company’s expenses for its employees, including wages and social benefits. With the help of payroll, the manager will be able to competently formulate the company's budget, which will prevent the possibility of bankruptcy.

Payroll optimization

There are legal methods for reducing tax deductions from the payroll fund - when transferring wages to other less taxable forms:

- Registration of an employee as an individual entrepreneur with a simplified tax system with a tax rate of 6%, by concluding an agreement for the provision of services;

- Concentrating the bulk of the payroll on one employee, for example, a director, which makes it possible to reduce the rate to 10%.

You can learn how to correctly calculate salary taxes in this video tutorial:

https://www.youtube.com/watch?v=FFU5tJ4EtDY