How assets and liabilities are formed

In the course of the company's business activities, personal property and liabilities are formed. These concepts have a polar accounting structure and are reflected in the balance sheet in different sections.

In essence, they are the same financial resources, divided according to the principle of use. Current liabilities on the balance sheet are sources of assets, so they should always be equal. A violation of the balance sheet indicates that the acquired property is not backed by cash. The main working capital management strategy is aimed at maintaining the solvency of the company and maintaining a certain level of assets.

Cost of fixed assets on the balance sheet: line 1150

In accounting, fixed assets include assets worth more than 40,000 rubles. with a service life of more than a year. In the balance sheet, fixed assets are reflected in the amount of their value reduced by the amount of depreciation (i.e., at the residual value).

To learn how the residual value of fixed assets is determined, read the material “How to determine the residual value of fixed assets.”

The cost of fixed assets on the balance sheet - line 1150 - is taken as the difference between the balance existing at the end of the reporting period on the debit of account 01 and the balance on the credit of account 02.

In the case of additional equipment (reconstruction, partial write-off) of fixed assets, leading to a change in the initial cost, this information is reflected in the appendices to the balance sheet. The same applies to the case of revaluation of property, carried out by indexing the replacement cost of assets or by direct recalculation to the actual market value. Any differences that arise are credited to additional capital.

Read more about accounting for revaluation in the material “Revaluation of non-current assets on the balance sheet is...”.

What are current assets

Funds that can be converted into money during one production cycle are called current (current) assets. These include all material assets, inventories, components, accounts receivable, finished products and, of course, cash. Current assets are in constant motion, ensuring continuity of the production process.

Depending on how quickly property assets are converted into money, they are assigned a degree of liquidity. Current balance sheet items are placed as this indicator decreases from higher to lower values.

Composition of the enterprise's property

The basis of any balance sheet is the current and non-current assets of the enterprise, then it is necessary to figure out which pieces of property can be taken into account as the property of the organization. Experts identify several types of property included in the balance sheet. Thus, the company’s property can be taken into account in the balance sheet in:

- Monetary form;

- Natural form.

Therefore, it is necessary to consider a more detailed classification:

- Production assets. These include the company's property, which allows it to form its economic potential. It also allows you to determine the size of the organization, the direction of its work, which contributes to making a profit. These include: intangible assets, fixed assets, and inventories;

- Commodity. This property is intended to receive financial resources and create a product of labor. Experts classify this type as: finished products and goods and services;

- Settlement and monetary assets include property that ensures the company's expenses for its needs, namely: accounts receivable, financial assets.

In order to understand each of the types of enterprise ownership, it is necessary to consider each of them separately:

- Intangible assets. This is property that has no material structure. It is most often isolated and applied for a certain time. It must exceed the business cycle of creating a product and the timing of its implementation;

- Fixed assets of the enterprise. These include tangible non-current assets that can be used for more than 12 months to produce goods and services;

- Financial resources. They refer to the cash of an enterprise, as well as the finances that enterprises have in bank accounts. This number also includes demand deposits;

- Long-term financial investments of the enterprise. These are the rights of an enterprise that are entitled to its share of property in other organizations;

- Productive reserves. This is all the property of the enterprise, which is the basis of all material objects for carrying out economic activities;

- Goods and services. This is the tangible property of an enterprise that was acquired or produced by it for its subsequent sale;

- Finished product of labor. This property of the enterprise, which was produced by him, has passed all the necessary tests for compliance with norms and quality standards, and is also equipped for subsequent sale on the market;

- Accounts receivable. This is the total amount paid to the business from other sources. They may be intermediary organizations.

There is also such a type of assets as biological ones. These are animals and plants that are owned by the company and bring benefit to it.

The nature of liabilities

The totality of all the obligations of the company, which occupies the opposite side of the balance sheet, is usually called liabilities. Such funds include short-term loans, accounts payable, authorized capital, accumulated profit.

Depending on the nature of their occurrence, such funds can be divided into own and borrowed funds. In turn, own funds paired with long-term loans form permanent liabilities, and short-term liabilities and accounts payable form current short-term liabilities.

Placement of passive liabilities by balance sheet items

Financial management of working capital is a thorough analysis of the movement of current liabilities and assets. This policy is aimed at solving such problems as accelerating turnover in order to increase liquidity, optimizing the formation of assets, and identifying shortages or surpluses of funds.

Due to the fact that current liabilities have different sources of origin, their distribution in the balance sheet is strictly structured. The third section of the balance sheet is entirely devoted to all types of capital (authorized, reserve, additional). Also in this section you can find retained earnings, which remain at the disposal of the company after taxation.

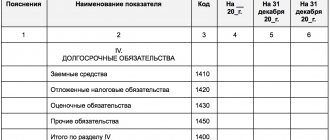

The balance sheet items of the fourth section consist of long-term credit and deferred liabilities. The fifth section of the balance sheet is devoted to accounts payable, which includes tax obligations, accrued wages to employees, debt to suppliers and founders, as well as short-term loans.

Liability balance

Dividing accounting indicators into two categories – assets and liabilities – helps to systematize data on the company’s activities and form a complete economic picture of the current state of the enterprise.

The main reporting of organizations - the balance sheet (Order of the Ministry of Finance dated July 2, 2021 No. 66n) is based on the equality of liabilities and assets. For Passive, the report has the right tabular part.

To allocate data to balance sheet items, use the amounts of account balances as of the reporting date.

Balance sheet liability: definition and rules for filling

Liability is a set of systematized final indicators about the sources of profit creation. In the report they are divided into groups with further detail. The criterion for dividing into categories is the origin of capital. Balance sheet items are regulated by PBU 4/99. The liabilities of the balance sheet are grouped:

- Capital.

- Liabilities of an enterprise of a long-term nature.

- Liabilities that must be repaid in the short term.

Liabilities consist of sections that are formed by groups of balance sheet items. Balance sheet items are represented by report lines intended for individual indicators. They are needed to reflect the values at the reporting dates of the enterprise’s property, its sources of origin and the company’s outstanding obligations.

Balance sheet liability structure

Each of the three sections of liabilities reflects the sources of formation of the organization’s assets and shows what basis the enterprise has for extracting material benefits.

Section 1 shows the institution’s own resources, represented by capital and created reserves. These resources are divided into permanent and temporary categories. The permanent part includes the authorized capital, which is formed when the organization is opened.

Variable indicators of the company's own resource base are formed through created reserves and revaluation.

The remaining sections of the balance sheet liabilities are reserved for recording obligations to counterparties.

Section 2 is devoted to the organization’s debt, which remained outstanding at the reporting date, and the final settlement date for the formed loans should occur no earlier than 12 months later.

Section 3 includes short-term liabilities, which are characterized by a high intensity of change in the overall debt indicator of the enterprise. These debts must be repaid by the company in full within the next 12 months.

The balance sheet liabilities reflect detailed values of indicators for each section thanks to the report items. The level of detail depends on the form of the balance sheet:

- in the full form of the report (Appendix 1 of Order No. 66n), item-by-item transcripts provide a detailed understanding of each indicator;

- in the abbreviated version of the balance sheet (Appendix 5 of Order No. 66n), items are combined into subgroups and show aggregated indicators, this is necessary to simplify the procedure for drawing up a report by persons using the simplified tax system.

Balance sheet liability items

The balance of the accounting accounts and the balance sheet lines are related as follows:

- for article 1310 of the liability, called “Authorized capital”, the value of the indicator is taken from the balance of account 80;

- line 1320 reflects the value of account balance 81;

- line 1340 is intended to detail the balance of account 83 as it relates to non-current assets;

- the remaining amounts for account 83 are displayed in balance line 1350;

- line 1360 corresponds to account balance 82;

- line 1370 accumulates the value of 84 accounts.

The liability accounts of the balance sheet must be expressed in positive numerical terms. An exception is made for line 1370, which can be in negative form. The sign in front of the amount depends on what the result of the financial activity of the enterprise was - profit or loss.

The section with long-term liabilities may be left blank if the organization does not have this type of debt. The indicator of long-term liabilities is taken from account 67. The peculiarity of loans with a long repayment period is that interest on them is reflected in the section of short-term liabilities in the balance sheet. Line 1420 corresponds to account 77, line 1430 shows the balance of account 96.

Conservative working capital management

The capital management policy is based on maintaining a sufficient level of current assets by attracting financial sources. Depending on what goals are pursued when running a particular business, three main models for managing current assets and liabilities can be identified.

The conservative management method assumes the presence of a fairly low number of current assets. At the same time, the turnover period of funds is also reduced to a minimum. This policy is convenient for companies that clearly know the time frame of the production cycle. Products are manufactured for a specific consumer, so the volume of reserves is strictly limited. The manufacturer has no doubts about the timing of receipt of payments, and therefore there is no need to purchase materials for future use.

In conditions of extreme savings, a sufficiently high indicator of asset liquidity is achieved, and, as a result, an increase in production profitability. But with such business tactics, there is a high risk of unforeseen situations when payments are not received on time and the material base is at zero.

The main distinguishing feature of conservative management is that current liabilities in the form of short-term loans have a very low share in the mass of all liabilities. All activities of the enterprise are carried out at the expense of its own working capital.

Total current liabilities 2752 2821 2659 [p.63]

It is often advisable to correlate financial indicators with each other by building equations or constructing indices that reflect one or another significant ratio and are more useful for work than the raw numbers themselves. For example, comparing the amount of current assets on a balance sheet to the amount of current liabilities provides greater insight than simply examining each amount without comparing it to the other. The fact is that current assets are often considered the most important source of material funds to meet current obligations, especially when the future of the company is at risk. [p.65]

Significance. This equation produces one of the most widely used indices of financial strength, although it is a fairly crude measure. The main question that the equation must answer is the ability of the enterprise to fulfill its current obligations with a margin of safety that allows for possible depreciation in the value of various current assets, such as inventory and accounts receivable. This ratio is applied at a specific point in time and is based on the assumption that the business is being liquidated, and not on the going concern principle, since it does not take into account the turnover of current assets and current liabilities. [p.67]

Current liabilities $37,500 [p.68]

BOB and liabilities involved in the calculation according to time parameters. In this regard, for a comprehensive assessment of balance sheet liquidity, in addition to the net assets indicator, the absolute value of net working capital is determined, which represents the excess of current assets over current liabilities and is used to ensure the security of loans and as a reserve for financing unforeseen expenses. The net working capital indicator is calculated as the difference between current current assets and current liabilities. In turn, current current assets are calculated as the difference between the total of section II of the balance sheet, Current assets (line 290) and [p.324]

Any company is usually financed from several sources simultaneously. From a strategic perspective, optimizing the structure of sources is a manifestation of a reasonable and conscious financial policy from the perspective of current financing - the emergence of certain sources, changes in the structure of current liabilities are carried out not only in a planned manner, but also often spontaneously (in particular, the expansion of activity volumes is usually accompanied by an increase in accounts payable debt). In terms of costs, all sources can be divided into two groups [p.402]

Current liquidity ratio (debt coverage ratio) is the ratio of the total amount of current assets, including inventories and work in progress, to the total amount of short-term liabilities (III section of liabilities). It shows the extent to which current assets cover current liabilities. [p.639]

The excess of current assets over current liabilities provides a buffer to compensate for losses that a business may incur when disposing of and liquidating all current assets other than cash. The larger the value of this reserve, the greater the confidence of creditors that debts will be repaid. In other words, the coverage ratio defines the margin of safety for any possible decline in the market value of current assets caused by unforeseen circumstances that could suspend or reduce cash flows. Usually a coefficient > 2 is satisfactory. In our example, its value at the beginning of the year is 1.78 (28,000/15,700), at the end - 1.73 (38,000/22,000). [p.639]

However, it is almost impossible to justify the general value of this indicator for all enterprises, since it depends on the field of activity, the structure and quality of assets, the duration of the production and commercial cycle, the speed of repayment of accounts payable, etc. In this regard, it is impossible to compare enterprises by the level of this indicator. It is advisable to use it only when studying the dynamics at a given enterprise, which will make it possible to draw preliminary conclusions about the improvement or deterioration of the situation, which should be clarified in the course of further research into the individual components of current assets and current liabilities. [p.640]

A change in the level of the current liquidity ratio can occur due to an increase or decrease in the amount for each item of current assets and current liabilities (Fig. 24.6). [p.640]

Then, using the method of proportional division, these increases can be decomposed into second-order factors. To do this, the share of each item of current assets in the total change in their amount must be multiplied by the increase in the current liquidity ratio due to this factor. The influence of second-order factors on changes in the liquidity ratio for current liabilities is calculated similarly (Table 24.14). [p.641]

Change in current liabilities +6300 100 1.73-2.42 -0.69 [p.641]

Current liabilities, to measure the possibility of repayment of which liquidity ratios are intended, are also determined by the volume of production and sales of products. As long as sales volume remains constant or increases, debt repayment is essentially a reinvestment operation. [p.645]

Current assets - Deferred expenses Current liabilities - Deferred income [p.664]

In the Russian Federation, consumption funds and reserves for future expenses and payments are also deducted from current liabilities. [p.664]

Current assets-Deferred expenses-] Current liabilities-Deferred income-Z-T/ [p.666]

Most enterprises have operating cycles of less than one year, which complicates the analyst's work, since the current state is analyzed from the point of view of the ratio of current assets and current liabilities. The difference between them forms net working capital. [p.156]

It is easy to see from the balance sheet that current assets are quite heterogeneous in terms of their role in the circulation of funds; in particular, a quantitative assessment of liquidity can be carried out using various types of assets that differ in turnover, i.e. the time required to convert them into cash. Therefore, depending on what types of current assets are taken into account, liquidity is assessed using different ratios. The general idea of such an assessment remains unchanged and consists in comparing short-term (sometimes called current) liabilities and assets used to repay them. Current assets include assets and/or liabilities to creditors with a circulation time and/or maturity of up to one year. [p.309]

The solvency of an enterprise refers to its ability to make timely payments on its urgent obligations. The analysis process examines current and future solvency. The current solvency for the reporting period can be determined from the balance sheet by comparing the amount of its means of payment with current liabilities. There are different points of view on the issue of determining the amount of means of payment. The most acceptable means of payment include cash, short-term securities, since they can be quickly sold and converted into money, part of the receivables for which there is confidence in its receipt. Current liabilities include current liabilities, i.e. obligations and debts, short-term bank loans subject to repayment, accounts payable for goods, works and services, to the budget and other legal entities and individuals. Excess of means of payment over urgent obligations of the witness [p.50]

One of the characteristics of liquidity is working capital (current assets). It is used to calculate several liquidity ratios. This is primarily net working capital, which represents the excess of current assets over current liabilities. A working capital deficit will occur when current liabilities exceed current assets. [p.53]

Current assets 2. Current liabilities 3. Net working capital (page 1-page 2) 600000 200000 400000 2400000 2000000 400000 [p.53]

The current ratio is the ratio of current assets (total amount or part thereof) to current liabilities. In the example given (Table 1.13), for enterprise 1 it will be equal to 3 1 (600000 200000), for enterprise 2 - 1.2 1 (2400000 2000000). In countries with developed market economies, this indicator is given special importance when assessing the current liquidity of an enterprise. The main reasons for its widespread use are the following: firstly, the current ratio reflects the degree to which current assets cover current liabilities; the greater this value, the greater the confidence in paying short-term obligations (therefore, this indicator can be called the general coverage ratio) [p.54]

Current liabilities (total X 35202 X 1561482 +1526280 [p.56]

The calculation of factors 1, 2 can be made by sequentially isolating factors 1.1-1.3 and 2.1-2.3 using the equity method according to the information in Table. 1.14. In addition to it, the current liquidity ratio is calculated subject to the presence of current assets at the beginning and current liabilities at the end of the year (1556941 - 1202775) 1561482 = ODZ equity participation ratios for factor 1 (1.27 1545968) = 0.0000008, for factor 2 (9 .82 1526280) = 0.0000064. The calculation of factors is given in table. 1.15. [p.57]

Change in current liabilities 0.23-10.05 [p.57]

Borrowed funds in this case represent the sum of current liabilities, long-term liabilities, and other liabilities that represent the obligations of the enterprise (i.e., the total of sections II and III of the balance sheet liabilities). [p.74]

IAS 13 Presentation of current assets and current liabilities, [p.34]

Current assets Residual value of fixed assets 1,125 1836 Current liabilities Long-term loans Share capital Retained earnings 972 450 100 1,439 [p.216]

Cash Accounts receivable Inventory (FIFO) Current assets Book value of property, plant and equipment Total Current liabilities Long-term liabilities Common stock Retained earnings Cumulative translation adjustment Total 600 2000 4000 1000 2600 4500 75 250 500 100 260 45 0 100 260 500 [p.735 ]

Current assets-Current liabilities oss Current assets [p.664]

General assets 1. Inventories short-term capital and other liabilities (current liabilities) [p.8]

The critical liquidity ratio is calculated as the ratio of cash, marketable securities and receivables (the total of subsection 2 of section III of the balance sheet asset minus line 390) to the amount of current liabilities. Theoretically, its value is considered sufficient at a level of 0.7-0.8. This ratio can also be calculated as the ratio of current assets, minus inventories and costs, to current liabilities. In this case, liquids include both finished products and shipped goods. [p.55]

The absolute liquidity ratio is calculated as the ratio of cash and marketable securities to current liabilities. Theoretically, this indicator is considered sufficient if its value is greater than 0.2-0.25. [p.55]

Data tables 1.15 show that the absolute increase in assets had a positive impact on the growth of the current liquidity ratio, due to which it increased by 1.27 times. The change in the ratio under consideration was negatively affected by the increase in current liabilities, which led to its decrease by 9.82 times. The most significant positive and negative changes occurred in connection with the growth of receivables and payables due to mutual non-payments. [p.58]

Aggressive model for increasing assets and liabilities

With a significant amount of cash, the company continuously increases the volume of inventories and finished products. In addition, due to the increase in current assets, a direct relationship appears in the form of an increase in liabilities. In turn, the production process itself is quite lengthy, and the turnover of material assets is slow.

By choosing such a management policy, we can say with confidence that the risk of technical failure of the production process will be minimal in this case, as well as economic profitability.

An aggressive management model increases current liabilities through short-term borrowings that ensure sufficient levels of inventory and cash flow. In turn, a large amount of accrued interest acts as a financial lever, which increases costs and reduces profitability. The risk of loss of asset liquidity is also high.

Moderate working capital management policy

If you analyze moderate business tactics, you will notice that this model occupies an intermediate place among the above. Half of all assets under this policy are occupied by current working capital, which has a moderate period of liquidity. Current liabilities, current liabilities and borrowings are also average.

This model is the safest and most calculated. The likelihood of a risk of decreasing asset liquidity is minimal. The formation of current assets occurs in most cases at the expense of own funds.

The impact of current assets on financial stability

The solvency and economic stability of a company are determined by the ratio of the efficiency of asset use and the level of financial risk. Based on such concepts, a business model and working capital management policy are built.

If current liabilities in the form of short-term liabilities remain unchanged against the backdrop of growing assets, this means that the company has acquired financial stability and is able to break-even increase working capital at the expense of its own income.

At the same time, if current liabilities (balance sheet line 610 “Short-term liabilities”) grow against the background of equity and long-term liabilities, then in such a situation one can observe an increase in the liquidity of working capital, but at the same time financial stability and solvency will be reduced.

Adequacy of cash in relation to current liabilities

In order to find out how much cash is required to pay current obligations, it is necessary to calculate the adequacy ratio. When determining it, an economic concept such as the degree of coverage is used. In other words, you need to determine the ratio of the amounts of current liabilities and assets.

If, as a result of calculations, it turns out that current assets have a fairly significant weight in balance sheet items, then there is confidence that current liabilities will be paid from own funds. This dominance allows the company to create a reserve stock in case of unexpected losses. The amount of reserve stock is an important indicator for lenders. If the resulting coverage ratio is greater than 2, then this value is a guarantee of the safety of current assets in the event of a decline in market prices.

The company's commercial cycle also plays an important role in the formation of current assets and liabilities. The enterprise's need for working capital directly depends on the timing of accounts payable and receivable. The longer the term of the supplier's credit obligations, the more confident the company feels in the event of delays in payments from customers.

The relationship between current liabilities and assets in the commercial activities of an enterprise is obvious. These concepts are the fundamental constants of the balance sheet. The size of working capital and liabilities characterizes the economic condition of the company and its financial stability.

Assets and liabilities of the balance sheet

The balance sheet is the main document within the framework of financial statements. It allows you to recreate an accurate picture of the company's financial condition. The balance sheet has a special structure, the purpose of which is impossible to understand without an idea of what the essence of the assets and liabilities of the balance sheet is.

Components of a balance sheet

The balance sheet is a table with a special structure, where all amounts are grouped in a special order, forming sections of the balance sheet.

Assets

The first and main part of the balance sheet is its Asset. This is where everything that belongs to the company or enterprise is indicated. This includes all property, as well as materials and goods for carrying out activities. The equipment that became the property of the company upon purchase is also displayed here.

The balance sheet asset reflects what the enterprise owns at the reporting date. The asset has two sections in its structure, which are compiled on the basis of different articles.

These sections are worth considering in more detail, since the correctness of their completion plays a key role in drawing up a high-quality balance sheet.