What is return on equity?

The most indicative economic coefficient of an enterprise’s activity is return on equity (ROC), which shows the size of the return on invested capital.

For business owners, the IC profitability ratio is very useful, since it characterizes the usefulness of the investment of the participants’ funds, and not the attracted capital.

- The SC profitability formula is the ratio of profit to SC.

- To calculate as a percentage, the result is multiplied by one hundred.

- For a more accurate calculation, use the arithmetic average of equity for the analyzed period.

Based on financial statements, profitability can be determined:

Line 190 (at the beginning of the period): 0.5 (line 490 (at the beginning of the period) + line 490 (at the end of the period).

When determining the profitability of an insurance company, the Dupont formula is also used:

SK profitability = (Net profit : Revenue) x (Revenue : Assets) x (Assets : SK) = Net profit margin x Asset turnover x Financial leverage.

The normal value of this indicator for developed economies ranges from 10-12%

But for the Russian economy with an inflationary component, this figure should be higher.

When analyzing the profitability of an insurance company, the resulting indicator is compared with the value of the alternative return that the owners could receive when investing their funds in another enterprise.

7.Profitability threshold formula.

The profitability threshold is revealed by such concepts as the number of products sold in physical terms and the profit of the enterprise. They are the guarantors of covering both semi-fixed and variable expenses with revenue equal to zero.

The profitability threshold is represented by sales volume. Under it, the company, without achieving income, covers all essential costs itself.

This is the level of sales of products when the company, without receiving a loss, was unable to achieve profit in its activities.

Profitability threshold formula in rubles:

- 1. subtract variable expenses from income;

- 2. multiply revenue by fixed costs;

- 3. Divide the resulting product by the difference.

Each company has its own rate of return, a formula for success. But, in general, profitability is a relative indicator. It can be expressed as income per unit of investment funds, or more often as a percentage.

Return on total capital

Another feature that determines economic stability and constitutes the enterprise profitability index is the return on total capital.

Total capital is the sum of current and non-current assets.

The return on total capital formula is characterized by the ratio of profit to the average annual value of invested capital (total assets of the company).

According to the financial statements, this indicator can be calculated as the ratio of the value of line 2300 of the profit and loss statement to line 1700 of the balance sheet.

Primary accounting documents - rules for their preparation. PBOYUL - decoding and is there a difference with individual entrepreneurs?

8.Formula for profitability of core activities.

The key indicator of the success of the enterprise was the profitability of its core activities. Like other economic assessment ratios, including return on capital, a formula on the company’s balance sheet, profitability expresses the efficiency of any production process.

To determine the profitability of the company’s core activities, it is enough:

- — report in form number two on losses and income;

- - balance sheet in form number one.

To find out the profitability ratio of the main activity, it is necessary to divide sales income by production costs. This coefficient indicates the amount of net revenue from one ruble, which is spent on the manufacture of products.

The established profitability and the formula for its derivation characterize the company as a whole and each area of work separately.

Return on working capital

When determining the economic efficiency of a company's activities, they also use the return on working capital (or current assets).

Working capital is funds allocated to current activities to ensure the production cycle.

Working capital can be divided into constant or variable:

- Constant working capital is the funds that provide the minimum acceptable economic results of activity.

- Variable capital is the attraction of additional funds to expand production tasks.

How to correctly register entries for profit and tax on it? How are fixed assets written off in accounting, how are postings made? Read the rules for writing a single settlement document for the Pension Fund here:

Return on working capital is calculated as the ratio of profit to the average annual (or average for the period under review) value of current assets.

You can calculate profitability using accounting data as follows:

Line 2400 of the income statement: Line 1200 of the balance sheet.

Formula and example

The formula expresses the amount of funds raised by the company to generate a ruble of profit:

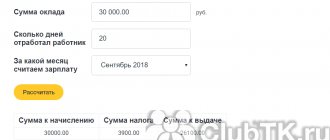

RSK = PE / STKo * 100 , where:

- RSC – return on total capital;

- PE – net profit;

- STCo is the total cost of capital.

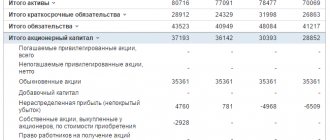

The material for calculations is taken from the financial statements. Net profit is line 2400 of the financial report. results, and the total cost of capital is line 1600 of the balance sheet, i.e. total assets.

The total cost of capital, or assets, as already mentioned, can be calculated using the average value for the period: RSK = PE / (STKoNP + STKoKP) * 1/2, where STKoNP and STKoKP, respectively, assets at the beginning and end of the period on page 1600 Profitability is traditionally expressed as a percentage (the result is multiplied by 100).

Example (conditional data). Let's calculate the return on total capital based on the average value of total capital for the period. Let the profit minus taxes (net profit) be equal to 55,000 rubles. At the beginning of the period, the amount of assets is 390,000 rubles, at the end of the period - 380,000 rubles. Average total capital: (390,000 + 380,000) * 1/2 = 385,000 rub. RSC = 55000 / 385000 * 100 = 14.29%.

This data can be used both for internal analysis and for external analysis: take for comparison data for another period of the company’s operation or compare them with those calculated for another company in the same market segment.

The concept of “normal indicator value” is not used. First of all, changes in value and trends identified through calculations are taken into account. An increase in the indicator is usually associated with an increase in the efficiency of the company, an increase in sales, and a decrease indicates inefficient use of assets.

If the industry or enterprise has established indicator standards, enshrined in local, industry documents, compare actual indicators with these standards. It should also be noted such a factor as comparison with return on equity (line 2400 of the report corresponds to the data on page 1300 of the balance sheet). Close values for total and equity capital indicate the ability to get by with a minimum of borrowed money when acquiring assets.

Average statistical values by year for Russian enterprises

The current market is developing dynamically, and some trends are rapidly being replaced by others, so every company whose management is focused on stable growth must monitor the economic indicators of the organization. The data obtained as a result of such analysis will allow you to competently plan production operations, which, in turn, will lead to maximum profit growth.

In turn, the degree of efficiency of an enterprise can only be assessed by determining such a general indicator as the level of profitability. By calculating the profitability of an enterprise, it is possible to give an accurate assessment of its financial results and level of development as a whole. Profitability involves calculating the profitability of an enterprise from various positions, which allows you to display the work of all components of the company.

R = P / X * 100%,

R - profitability;

P - profit;

X is the indicator whose profitability we consider.

These indicators will be discussed further.

Profitability is expressed as a percentage, so the division result must be multiplied by 100.

We know that in order to calculate the profitability of an activity, the formula must contain information about the profit, revenue, assets, capital and borrowings of the enterprise. All this information can be gleaned from financial statements: the balance sheet and income statement.

For more information about the balance sheet, see the article “Filling out Form 1 of the Balance Sheet (sample)”, and for Form 2 - in the article “Filling out Form 2 of the Balance Sheet (sample)”.

But on their basis, only fairly aggregated, general indicators can be calculated. A more detailed and in-depth analysis requires more detailed information. For example, to calculate the profitability of a particular type of product, we need figures for the profit and cost of a specific product; the profitability of sales can be calculated not for the organization as a whole, but for the type of activity, and for this we need to know the amount of revenue and profit specifically for the line of business that interests us.

Purpose

Historically, the beginning of the use of the WACC concept dates back to 1958 and is associated with the names of such scientists as Modigliani and Miller. They argued that the concept of weighted average cost of capital can be defined as the sum of the company's shares of funds. In this case, each share of the source must be discounted.

They associated this indicator with the minimum threshold of profitability for the investor, which he receives as a result of investing his funds.

The indicator under study reflects the following points:

- a negative WACC value means that the company's management is working effectively, which indicates that the company is making economic profit;

- if the value under study is within the dynamics of return on assets between the value of “0” and the industry average, then this situation indicates that the company’s business is profitable, but not competitive;

- if the indicator under study is higher than the industry average return on assets, we can safely say that the company’s business is unprofitable.

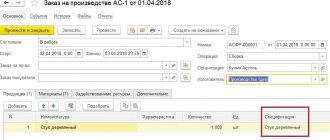

The main components of its capital (MC, RK, DC and NP) in accounting. balance sheet

Own capital, or more precisely, all its components (MC, RK, DC and NP), are fully represented in the accounting. balance sheet No. 1. The current balance sheet form, corresponding to OKUD 0710001, was introduced by Order of the Ministry of Finance of the Russian Federation No. 66n dated 07/02/2010. The latest changes to the wording of this order are dated April 19, 2019. The named components of the insurance company correspond to balance sheet lines 1310-1370. The insurance amount itself is written down on page 1300.

| Line by line distribution by book. balance | ||||

| UK | Revaluation of VA | DK | RK | NP |

| 1310 | 1340 | 1350 | 1360 | 1370 |

It should be noted that this balance sheet interpretation of the SC concept is traditional and most widespread. Moreover, this approach is used not only in domestic practice, but also abroad. In this regard, it is advisable to separately consider each component (MC, RK, DC and NP) of equity capital.

Authorized capital (AC) according to accounting. the balance sheet consists, literally, of “shared capital, authorized capital and contributions of partners.” In other words, this is the totality of all funds brought by the founders of an enterprise or organization into the property directly upon its formation. The sizes of these deposits, shares (other) are determined, as established, by the constituent documentation. Its corresponding value is subject to recording during state registration.

Reserve capital (RC) is a certain part of your capital. It is usually allocated from profit for the purpose of covering potential, expected losses. The size of the Republic of Kazakhstan and its features, the formation procedure are established by the legislation of the Russian Federation and the organization’s charter itself.

Additional capital (AC) is the price of property that was brought in by the founders of the organization after state registration of the size of the capital. These are already excess amounts generated from other cash receipts in the insurance company. Such an amount, for example, may arise as a result of a property revaluation, which revealed changes in the price of property.

Another important component of an enterprise’s capital is its retained earnings (RE). It is considered an absolute indicator of the effective performance of enterprises, reflecting retained earnings received for a specific period of operation. This part of the VP is after taxes are deducted and funds are transferred to other purposes.

The insurance company also includes investment and accumulated capital. The first includes the investments of the founders themselves, and the second, accumulated, includes that part of the capital that is formed and brought in above the first. The composition of SC can be shown schematically in the following way.

It is important to know and distinguish the terms listed above and their definitions, since they are involved in the formation and calculation of the insurance system.

Features of the indicator

Let us highlight the main features of the formula for calculating the indicator:

- The purpose of the formula for calculating the indicator is that it allows you to evaluate not the value of the indicator itself. The meaning of the indicator is to apply the calculated value in the form of a discount factor when investing in a project;

- The weighted average cost of capital is a fairly stable value and reflects the optimal existing capital structure of the company;

- The correctness of the WACC calculation is associated with the inclusion of comparable indicators in the formula.