Are you switching from UTII? Connect Kontur.Accounting

45% discount in November: RUR 7,590 instead of 13,800 rub. per year of work

Easy bookkeeping

The system itself will calculate taxes and remind you of the deadlines for payments and submission of reports.

Automatic calculation of salaries, vacation pay and sick leave

Technical support 24/7, tips inside the service, reference and legal database

Sending reports via the Internet

Reports and KUDiR are generated automatically based on accounting data

Electronic document management and quick verification of counterparties

Documents, transactions, analytical reports, VAT reconciliation

UTII for transport services is paid to the budget quarterly - four times a year. When calculating the imputation for the type of activity “transport services”, it is necessary to take into account a number of different indicators - from the type of activity to the region in which this activity is carried out. We will tell you more about how to calculate taxes for transportation in our article.

Taxi tax according to OSNO

If, when answering the question: “Which taxation should I choose for an individual taxi?”, an entrepreneur leans towards the basic system, then he will have to pay VAT, personal property tax and personal income tax. This system is complex and expensive; it requires a complete accounting workflow. It is necessary to correctly process all financial transactions and observe all the nuances when submitting reports. Therefore, there is a need to hire an accountant and oblige drivers to fill out primary cash documents every time.

What you need to know to calculate tax

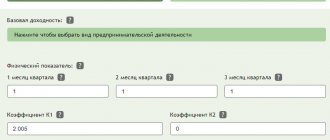

To start calculating tax, determine the main indicators. Let's look at them in more detail:

1. Physical indicator - for cargo transportation, this is the number of vehicles involved in making a profit when transporting goods. And in the case of passenger transportation - the number of seats for passengers in vehicles;

Important! Only organizations and individual entrepreneurs who own, rent or lease no more than 20 vehicles used to provide transportation services can apply UTII (subclause 5, clause 2, article 346.26 of the Tax Code of the Russian Federation).

2. Basic profitability is imputed income per unit of physical indicator, which is the object of taxation:

- for cargo transportation - 6,000 rubles per vehicle,

- for the transportation of passengers - 1,500 rubles per seat;

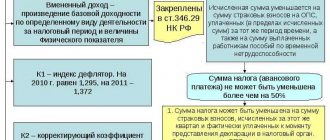

3. Correction coefficients K1 and K2, which do not depend on the type of activity (according to the Ministry of Economic Development of the Russian Federation in 2021, the coefficient K1 is 2.005. The value of the coefficient K2 varies depending on the region from 0.1 to 1, but in most regions the maximum value is used);

4. UTII tax rate (has different values depending on the region, can be from 5 to 15%, almost all regions use the maximum tax rate).

Some regions reduce the tax rate down to the minimum for a certain group of people: start-up entrepreneurs or entrepreneurs with disabilities.

From January 1, 2021, imputation will be cancelled. It's time to choose a new tax regime for transport services. Choose a favorable tax system for yourself using our online calculator. Kontur experts explained how to transfer transport services and other areas to the new regime. We have collected the most frequently asked questions and answers to them in this article. If you haven’t found the answer to your question, ask it in the comments, we will definitely answer.

business -

Attention

The transition to the new system will occur gradually, which is regulated by the Federal Law on the Application of CCP in the new edition. Common questions and answers to them Question No. 1. Should an organization take into account leased cars to calculate UTII? In a situation where an organization specializes in providing transportation services using vehicles from third-party companies under a lease agreement, when calculating UTII, it must also include leased vehicles in the calculation. If the number of cars of an organization, including leased ones, exceeds 20, then the organization violates the law regarding the application of a special tax regime.

Question No. 2. Does the actual occupancy of places affect the calculation of the single tax? In accordance with the resolution of the Ministry of Finance, the occupancy rate of seats in transport is in no way related to the calculation of UTII.

Calculation of UTII for transport services

Keep records and submit all reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat through Kontur.Accounting. >> Try it now! It's free! <

In general, the formula that will allow you to calculate the amount of tax for the reporting period (i.e. for the quarter) is as follows: UTII for the quarter = (Tax base for the reporting period × Tax rate) × 3 , in this case:

- tax base = basic profitability × number of cars or seats × K1 × K2;

- K1 - deflator coefficient = 2.005;

- K2 - correction factor = from 0.1 to 1;

- Tax rate = from 5 to 15%.

The formula involves multiplying the result by 3, since UTII is paid quarterly - immediately for 3 months. The received amount to be paid can be reduced by the amount of the imputed insurance premiums to various funds or the amount of expenses for the purchase and installation of an online cash register, which we will discuss later. For now, let’s look at the calculation of this tax using an example.

UTII passenger transportation 2018

The code for the type of business activity UTII-2017 cargo transportation according to the Federal Tax Service is 05. It is this value that should be indicated in the application for the transition to a single tax, as well as in reporting. At the same time, OKVED-2017 (transport services, cargo transportation) of an individual entrepreneur UTII or a legal entity must also correspond to this value.

In order to be able to apply imputed taxation for cargo transportation, the taxpayer must meet a number of criteria:

- not have more than 100 employees (average number for the reporting period);

- if this is an organization, then not have a share of participation in the authorized capital of other organizations of more than 25%;

- not to work under a simple partnership agreement or a property trust agreement;

- not to be the largest taxpayer.

All this applies equally to cargo transportation.

An example of calculating UTII for transportation

The entrepreneur is engaged in the transportation of passengers in St. Petersburg and has 1 car at his disposal. The transportation is carried out by himself, there are no hired workers. The number of seats is 3. We use the formula:

UTII for the quarter = (DB × FP × K1 × K2 × Tax rate) × 3

Tax base = 1500 (basic profitability for passenger transportation) × 3 (number of seats) × 2.005 (K1) × 0.25 (K2) = 1500 × 3 × 2.005 × 0.25 = 2,255.63 rubles;

tax rate = 15%;

UTII for the month = 2,255.63 × 15% = 338.34 rubles;

UTII for the quarter = 338.34 × 3 = 1015.02 rubles.

When calculating the tax for cargo transportation, we will use a base profitability of 6,000 rubles, and the physical indicator will not be the number of seats for passengers, but the number of cars that are involved in generating profit. Cars that are under repair or in stock are not taken into account when calculating the tax.

UTII and cargo transportation 2021: calculation

Calculation of UTII for the quarter is carried out according to the following formula (clause 1, clause 2, clause 4 of Article 346.29 of the Tax Code of the Russian Federation, clause 1 of Article 346.31 of the Tax Code of the Russian Federation):

Amount of UTII = Basic profitability for the month * (Value of the physical indicator for the first month of the quarter + Value of the physical indicator for the second month of the quarter + Value of the physical indicator for the third month of the quarter) * K1 * K2* Tax rate

The basic profitability per month for cargo transportation is 6,000 rubles. The physical indicator will be equal to the number of vehicles transporting goods (clause 3 of Article 346.29 of the Tax Code of the Russian Federation).

You can read about coefficients K1 and K2 in a separate consultation.

You can read about the UTII rate, as well as tax deductions that reduce the single tax, in a separate consultation.

How to reduce UTII by the amount of insurance premiums

According to Art. 346.32 of the Tax Code of the Russian Federation, organizations and individual entrepreneurs can reduce the amount of quarterly imputation payments by the amount of insurance premiums. Let's consider cases when this is possible:

- if an individual entrepreneur works without hiring employees, you can reduce the amount of tax paid by the full amount of contributions for yourself - to the Pension Fund, as well as to the health insurance fund;

- if an individual entrepreneur or organization uses the labor of hired workers, you can reduce the amount of imputation tax by the amount of contributions for individual entrepreneurs and for employees, but the amount thus reduced should not exceed 50% of the total UTII for the quarter.

Thus, to calculate the actual amount payable to the budget, it is necessary to subtract the amount of insurance premiums for yourself or employees from the UTII for the quarter, calculated using the formula presented above. An important condition: contributions must not only be accrued, but also already paid in the reporting quarter.

Author of the article: Arina Gyulmetova

Easily calculate UTII tax in the Kontur.Accounting web service. The service is suitable for small businesses: simple accounting, payroll, reporting via the Internet. The first 14 days of work are free.

Keep records and submit all reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat through Kontur.Accounting. >> Try it now! It's free! <

Taxi: payment of tax 2021 according to UTII

Quarterly, before the 20th day of the next month, a tax return is submitted to the regional department of the Federal Tax Service. Payment is due by the 25th of the same month.

UTII for taxis: tax reduction

For individual entrepreneurs with a taxi fleet, it is possible to reduce the amount of tax on the amount of sick leave payments, insurance premiums, and benefits to their employees. The maximum reduction amount is 50%. If an individual entrepreneur works alone, without hired workers, then 100% of the contributions to compulsory medical insurance and the Pension Fund of the Russian Federation.

When is the declaration submitted and tax paid?

For UTII, as for all other taxes, tax legislation has established its own deadlines for payment to the budget.

The tax amount should be deposited into the treasury at the end of the quarter, which is the tax period for imputation. This must be done before the 25th day of the month following the quarter.

The tax return must be submitted 5 days earlier - before the 20th.

IT SHOULD BE NOTED! When the specified deadlines fall on holidays or weekends, you can submit a report or pay taxes on the first working day after your vacation.

***

When carrying passengers, you can use UTII if the conditions stipulated by the Tax Code are met. The fact that vehicles are used or idle does not affect the calculation of tax.

The remaining conditions - registration with the Federal Tax Service, submission of a declaration and transfer of tax to the budget - are the same as for other types of activities subject to imputation.

Similar articles

- Latest changes in the Tax Code of the Russian Federation on UTII

- How to switch to UTII in 2021

- Procedure and deadlines for registration with UTII

- How to calculate property tax for UTII?

- UTII: deadlines for submission and payment in 2016-2017

Conditions of use

The provisions of tax legislation allow the payment of the Unified Imputed Tax when providing transport services to the population, such as cargo transportation, passenger transportation, as well as the provision of vehicle repair services.

For companies engaged in the transportation of both goods and passengers, imputed tax can only be paid if the number of vehicles is no more than twenty. Moreover, it absolutely does not matter whether the vehicles are owned or whether the company disposes of them as leased property.

The use of the imputed tax payment regime for the provision of transport services is permitted only if it is established by legislative acts of regional authorities.

Due to the fact that the state at the federal level establishes general cases of application of this regime, the authorities of the constituent entities have the right to make their own adjustments to this list, supplementing it.

A company providing transport services is required to register at the place of business (if we are talking about an entrepreneur, then at the place of registration).

How to calculate UTII for passenger and cargo transportation services

Physical indicators

When calculating UTII for transportation, use the following physical indicators:

- for passenger transportation - the number of seats. The basic profitability of one place is 1,500 rubles;

- when transporting goods - the number of vehicles (cars). The basic profitability of one car is 6,000 rubles.

Such rules are established by paragraph 3 of Article 346.29 of the Tax Code of the Russian Federation.

Determine the physical indicator “number of seats” on the basis of the technical equipment passport (PTS) without taking into account the driver’s and controller’s seats. If the number of seats in the PTS is not indicated, contact the state technical supervision authorities or the territorial division of the traffic police for this information. This procedure is established by paragraph 10 of Article 346.27 of the Tax Code of the Russian Federation and letters of the Ministry of Finance of Russia dated June 16, 2009 No. 03-11-11/112, dated March 16, 2009 No. 03-11-06/3/61.

The actual occupancy of seats in a vehicle does not affect the calculation of UTII (letter of the Ministry of Finance of Russia dated October 20, 2010 No. 03-11-11/272).

When determining the physical indicator “number of vehicles,” take into account all cars that are on the organization’s balance sheet or that it manages on lease. That is, this indicator includes both vehicles that are actually used for transportation, and vehicles that are on the balance sheet, but are temporarily not in use (for example, they are undergoing technical inspection, conservation, repair, downtime, etc.) . In this case, the nature of the use of vehicles also does not matter. That is, it is necessary to take into account both vehicles that are directly used to provide services, and service (auxiliary) vehicles. This position is reflected in letters of the Ministry of Finance of Russia dated July 27, 2015 No. 03-11-09/43179, dated November 18, 2013 No. 03-11-11/49499, dated June 3, 2013 No. 03-11-11/ 20192, dated December 28, 2011 No. 03-11-11/329.

Physical indicators

The imputed tax for each specific type of business is calculated differently, despite the uniform rate in the region. When calculating imputed tax, one of the important indicators used for calculation is physical.

For different categories of transport services, different physical indicators are provided that characterize a specific type of commercial activity.

For the group of transport services, tax legislation provides the following data.

| Type of commercial activity | Physical indicator |

| Freight transportation services | Number of freight vehicles |

| Passenger transportation services | Number of passenger seats in the vehicle |

| Vehicle repair services | Number of employees in the car service center |