What is accounts receivable

The work of any organization is associated with the occurrence of debt. It comes in two types:

Take our proprietary course on choosing stocks on the stock market → training course

– accounts receivable

– accounts payable

Usually there are no difficulties in understanding what accounts payable is. If we explain it in terms familiar to the average person, then accounts payable are all the amounts that a company owes to its counterparties, the budget (in the form of taxes) or other creditors.

The opposite situation occurs when accounts receivable are formed. All amounts that the company expects to receive will be the amount of accounts receivable.

For example, a company overpaid VAT to the budget. The amount of tax that is transferred in excess of the accrued amount will be a receivable. The same situation arises if an organization transfers money to a counterparty on account of a future delivery. With regard to funds paid to employees: the “accounts receivable” includes wage debts to employees, as well as funds issued on account.

The amount of such debt is formed throughout the year and is reflected in the balance sheet in line 1230, in accordance with Order of the Ministry of Finance No. 66n dated July 2, 2010.

| IMPORTANT! In the vast majority of cases, the debt of counterparties to the organization is reflected in the balance sheet asset in the section reflecting the value of current assets |

Types of receivables in a company

All receivables are divided into two large groups:

- Long-term

- Short term

Both varieties fall into balance after a year.

All debts that are repaid within 12 months constitute short-term “receivables”. As a rule, such debt includes overpayment of taxes, shipments to counterparties “on credit,” or prepayment for goods or services.

Long-term debt appears when the debt is not paid off within a year. As for settlements with counterparties, the possibility of this type of debt arising should be specified in the agreement with the partner. However, if the counterparty simply does not pay its obligations for a long time, then such debt also belongs to the category of long-term.

Of course, it is in the interests of each organization to have a significant share of short-term debt out of the total amount of “receivables”.

It must be taken into account that no matter what type of debt, after missing the repayment deadline, it becomes overdue. It is not in the best interests of the company to have overdue accounts receivable .

There is often great doubt that the debt will ever be repaid. Often such overdue debts are never closed, that is, they become hopeless. A debt can be doubtful for three years, and then becomes uncollectible. Ultimately, such debt must be written off as a loss.

Details

Formation of accounts receivable

Accounts receivable are formed from the terms of the transaction under which they arose. In this case, the amount of debt corresponds to the price of the product sold, which was initially agreed upon. There are exceptions in which its formation will occur differently.

Based on this, it should be understood that the amount of debt may increase or decrease, this is the case if the company is ready to offer the buyer a commercial loan, if the debt is expressed in another currency or conventional units, if the debt was incurred during the transfer of an advance payment and under other circumstances .

In addition, a special procedure is also present in the debt between transactions for the exchange of goods.

What does accounts receivable mean on the balance sheet?

In simple terms, this is the debt of counterparties incurred for the provision of goods or services, which must be closed. The company plans to get the entire amount back in the short term. This also includes advances that suppliers were able to issue. Amounts are recorded based on accounting notes.

Reference. Accounts receivable in the accountant's balance sheet are reflected as the organization's obligations at the time the document is drawn up.

Every operating enterprise has debts; this is considered normal practice. Accounts receivable are considered part of the company's working capital.

Data retention periods

Accounts receivable data is stored for three years. The countdown date starts from the time the funds were last moved. After three years, the amount must be written off from the balance. In order to do this, the counterparty must be warned about the existing debt; the next step is to justify it in writing and issue a special order that corresponds to this topic.

After this, the debt is written off at a loss to the enterprise. In the event that the counterparty is not able to pay the entire amount of the debt, then it also automatically becomes a loss for the enterprise. At the same time, debt liquidation does not occur in full. For five years, such debt is recorded in off-balance sheet accounts. Once the debtor becomes solvent, it is possible to write off the debt in full.

Which accounts make up the amount of accounts receivable?

When determining the amount of accounts receivable, it should be remembered that its amount is not formed on any one account, but consists of a set of values that are reflected in the debit balances of many accounts. This is enshrined in the order of the Ministry of Finance No. 94n dated October 31, 2000.

The calculation uses balances on the following accounts:

- If the company has a work in progress, then the turnover on account 46 will show the volume of work already completed

- Account 60. Shows the status of settlements with various suppliers

- Account 62 reflects the status of settlements for transactions with customers

- Accounts 68, 69. Show balances for settlements with the budget and extra-budgetary funds

- Accounts 70, 71, 73. They show the status of settlements with employees of the organization

- Account 75. This is the debt incurred in relation to the founders

- Account 76. Reflects settlements with other counterparties

Who uses accounts receivable and payable and when?

Accounts for settlements with debtors and creditors are an integral set of accounts for any company, since its functioning is impossible without:

- accrual and payment of wages and other payments to their employees (the appearance of debit and credit turnover on account 70);

- fulfillment of tax obligations (the emergence of a debit and credit balance on accounts 68 and 69);

- carrying out settlements with their counterparties (turnovers and balances on settlement accounts: 60,62,76);

It is impossible to organize full-fledged accounting without these accounts. Accounting for them must be maintained continuously in chronological order throughout the entire period of the company’s activities.

Which accounting accounts are used by budgetary organizations for settlements with debtors and creditors, see the material “Creating a chart of accounts for budgetary accounting - sample 2016”.

Doubtful debts and receivables

Currently, it is established at the legislative level that each organization, subject to certain conditions, must create a reserve for doubtful debts.

Such a reserve is created when there is debt from counterparties. In this case, one of the following conditions must be met:

- The debt must be overdue

- The company has information about serious problems in the financial sector of the counterparty

However, even if there are accounts receivable, a reserve may not be created if the company knows for certain that the debt will be repaid by the counterparty.

Accounting for created reserves is kept on account 63. In order to create a reserve, it is necessary to make accounting entry D91.2 K63. The same posting is used if the reserve needs to be increased (added).

The restoration of the reserve is reflected by posting D63 K91.1. But if the debt is hopeless and needs to be written off, an entry is made D63 K62 (or another accounting account for the counterparty).

Instructions for creating a reserve are contained in paragraph 7 of PBU 1/2008.

It is very important to remember that the provision for such debt is directly related to accounts receivable and its reflection in the company’s annual reports. When drawing up a balance sheet, the amount of the reserve reduces the amount of accounts receivable, the net amount is reflected in line 1230 of the balance sheet asset .

Purchase of receivables: conditions and postings (to which account to attribute)

Accounts receivable may appear on the company's accounts as a result of assignment - transfer of the right to claim the debt.

Any business entity has the right to acquire the debt of a third party. The main purpose of such a purchase is to benefit from the transaction (buy cheaper and collect (or offset) the face value of the debt).

The purchase process occurs under the following conditions:

- an assignment agreement is concluded between the parties to the agreement;

- the contract requires notarization if the debt arose from a transaction completed in notarial form;

- the transfer of rights to property subject to mandatory state registration to a new creditor is subject to state registration;

- the debtor must be informed about the transfer of the right to claim the debt - this responsibility lies with the original creditor;

- After completing a debt purchase transaction, it is better to receive all documents confirming the debt from the original creditor using the transfer and acceptance certificate.

For situations that require the execution of a transfer and acceptance certificate, please use the materials posted on our website:

- “Act of acceptance and transfer of documents upon change of director”;

- “Act of acceptance and transfer of affairs of the chief accountant - sample”.

Accounting entry for accounting for receivables purchased from the original creditor (clause 3 of PBU 19/02 “Accounting for financial investments”, approved by order of the Ministry of Finance of the Russian Federation dated December 10, 2002 No. 126n):

Dt 58 “Financial investments” Kt 76 “Settlements with various debtors and creditors”

When reflecting acquired debt as part of financial investments, a number of conditions must be met - learn about this in the next section.

The procedure for calculating the amount of receivables in the balance sheet

In order to calculate the amount of “receivables” to be reflected in the balance sheet, data from 10 accounting accounts is used.

To identify the correct debt balance for counterparties, it is necessary to generate settlement reconciliation acts and display the correct debt balance. This is necessary both for the organization itself and for the counterparty to correctly account for all obligations. After determining the amount of debt, its value can be transferred to the appropriate line of the balance sheet.

Let's give an example of filling out line 1230. At Romashka LLC, the account balances at the end of the year are as follows:

| Check | Debit balance | Credit balance |

| 60 | 10000 | 5000 |

| 62 | 25000 | 17000 |

| 63 | 8000 | |

| 76 | 3000 | 1000 |

Based on the given data, line 1230 will have the following meaning:

Page 1230 = 10000 + 25000 – 8000 + 3000 = 30000

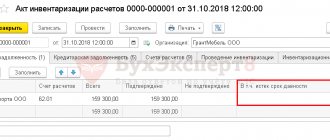

Brief instructions for analyzing receivables

Analysis of debt in a company is important. During its implementation, many indicators are assessed, but even based on the dynamics of changes in debt indicators, some conclusions can already be drawn.

| Index | 2017 | 2018 | Height, % | Deviation, thousand rubles | ||

| Sum | Percent | Sum | Percent | |||

| Total | 233810 | 100 | 324306 | 100 | 138,7 | 90496 |

| Suppliers | 227 | 0,1 | 601 | 0,2 | 264,8 | 374 |

| Buyers | 233353 | 99,7 | 316614 | 97,5 | 2721,1 | 83261 |

| Taxes | 228 | 0,1 | 6204 | 1,9 | 44350 | 5976 |

| Other counterparties | 2 | 887 | 0,3 | 885 | ||

In accordance with the data presented in the table, we can conclude that the largest weight of debt falls on buyer debts. In addition, compared to 2021, in 2018 there was a general increase in receivables for all counterparties.

As for buyers, each of them needs to be considered more carefully, in terms of contracts. It is necessary to determine the dynamics of debt and its change in accordance with the level of revenue. Only after conducting a full analysis can we say what condition the receivables are in and what risks exist for the company.

Reflection of accounts receivable in the notes to the balance sheet

It is extremely rare that by the end of the year, based on the results of the analysis of the balance sheet, no debts are identified. Usually these indicators are present.

When preparing the annual report, debt amounts are reflected in the corresponding line of the balance sheet, and must also be reflected in Form No. 5, which is an appendix and is an integral part of the annual reporting. To reflect receivables and payables, there is a special table that details what type of debt is present in the company and what specific indicators it consists of. Moreover, in the explanations the amount of “receivables” is indicated regardless of whether a reserve for doubtful debts has been created or not.

When drawing up the application form, it is necessary to take into account that long-term receivables are reflected in the section with non-current assets.

Experienced accounting specialists do not recommend reflecting the presence of overdue accounts receivable in the explanations; accordingly, do not fill out the table in this part. Such advice is given so that there are no questions from regulatory authorities.

Accounting data is used to fill out information in Form No. 5. You need to know that when filling out the tabular lines, data on the balances and turnover of accounts 62, 60, 68, 69, 70, 71, 73, 75, 76 are used. Everything related to reserves for doubtful debts is reflected in account 63. Data is collected in the context analysts.

Options for reflection in the balance sheet

The required detail is shown in lines 12301 to 12305 of the transcript for Form-1.

In these lines you must indicate the debit balance of the following accounting accounts:

- account No. 60 “Settlements with suppliers and contractors” in connection with prepayments made for the upcoming execution of work, provision of services, delivery of goods or materials;

- account No. 62 “Settlements with buyers and customers” in connection with the shipment of goods, performance of services and work overdue for payment by customers and customers;

- account No. 68 “Calculations for taxes and fees”, where there is a surplus of the amount transferred to the tax authority from the calculation of taxes and fees;

- account No. 69 “Calculations for social insurance and security” in connection with the surplus paid to the Social Insurance Fund;

- account No. 70 “Settlements with personnel for wages” in terms of overpaid wages;

- account No. 71 “Settlements with accountable persons” in connection with funds paid to employees of the organization;

- account No. 73 “Settlements with personnel for other transactions” in connection with credits, borrowings and advances issued to the organization’s personnel, or for compensation of material damage to the company;

- account No. 75 “Settlements with founders” in connection with the debt of the founders for contributions to the authorized capital of the organization;

- account No. 76 “Settlements with various debtors and creditors” in connection with accrued income from joint activities, sanctions recognized by debtors for failure to fulfill contractual terms, debts of other persons on transactions, dividends that must be paid by other companies.

It is necessary to make a reserve for outstanding overdue payments in terms of receivables - it is best to register it on account 63.

It is necessary to provide for a reserve for outstanding payments in terms of receivables for services provided, work, goods or materials that most likely will not meet the deadlines, specified in the contract, or not having guarantees that payment will be made on time.

It is most reasonable to make a reserve on account No. 63 “Provisions for doubtful debts”, in correspondence with account No. 91 “Other income and expenses”, subaccount 2 “Other expenses”.

Accounts receivable are entered into the balance sheet minus this reserve, if one has been created.

The reserve is reflected by posting:

D 91-2 K 63 – a provision was made for doubtful debt.

How to find the accounts receivable turnover ratio? What is the capital intensity of production, its calculation. A sample of filling out an invoice can be found here:

The write-off of a debt that is impossible to repay, for which a provision has been made, is recorded as follows:

D 63 K 62 - uncollectible debt for which a reserve was created has been written off.

The amount written off under this posting must be reflected in off-balance sheet account 007 “Debt of insolvent debtors written off at a loss”:

D 007 – doubtful debts are taken into account.

The amount of such a reserve is calculated for each specific debtor depending on its solvency and the share of risk for full and partial repayment.