At any manufacturing enterprise there are products that have not completely gone through the manufacturing cycle and are not ready, and therefore they are in the work-in-progress stage. However, such goods are the property of the enterprise, and therefore must be subject to inventory, like any other material assets. In the article we will look at how the inventory of work in progress (WIP) takes place in construction and production and how accounting (postings) is carried out.

The essence of work in progress inventory

Inventory of work in progress involves determining the volume of such products at the enterprise and its actual cost, as well as the correspondence of this information to accounting data. At the same time, objects of work in progress are understood as goods that are only partially finished, that is, they have not gone through the entire manufacturing cycle, and therefore cannot be considered finished products and, accordingly, cannot be sold to consumers.

Work in progress items should include:

- products sent into the production process;

- defective items of goods;

- manufactured goods that have not passed tests (if this item is mandatory);

- incomplete products;

- work or services performed that were not accepted by the customer;

- semi-finished products of own production, not considered finished products.

Determining the actual cost of work in progress items can be carried out using several methods, namely:

| Method | Cost calculation |

| Simple (process-based) | Used for homogeneous products and involves the summation of all costs incurred divided by the number of units produced |

| Custom | Cost is determined in terms of costs incurred for each specific order |

| Lateral non-semi-finished | It is used in production, where products go through several stages of processing and are not sold until they are ready. Cost is calculated as the sum of all costs incurred at each stage of processing |

| Lateral semi-finished | It is used in production, where products undergo several stages of processing and can be sold at any of them. Cost is defined as the amount of costs incurred at past stages |

| Normative | The method is based on the use of standard cost, adjusted by indexes of changes in standards depending on deviations recorded at the final stage of production |

Rules for filling out the WIP verification report form

The act form is developed at the enterprise and approved by order of the manager, with subsequent consolidation in the accounting policy. It can be based on the forms given in appendices Nos. 6–15 to the guidelines, approved. by order of the Ministry of Finance No. 49.

The act must indicate:

- Title of the document,

- link to administrative document,

- inventory start and end date.

It is recommended to summarize the results of the check in a table for the convenience of recording work in progress by quantity and cost. At the end of the act there must be signatures of all members of the inventory commission.

IMPORTANT! The absence of the signature of at least one member of the commission makes the act invalid. Acts are filled out separately for each separate division of the enterprise

The acts are filled out separately for each separate division of the enterprise.

WIP inventory report can be found here:

The purpose and objectives of inventory of work in progress

The main purpose of the inventory of work in progress is considered to be to determine the actual presence of objects of work in progress, identifying unaccounted for defects, determining the completeness of products, determining the balances of canceled or suspended orders and calculating the cost of products that are in the stage of work in progress. In addition, the purpose of the inventory is to compare actual data with accounting indicators and identify factors influencing discrepancies in information.

In accordance with the goal, the following tasks should be solved during the inventory of work in progress:

- determination of the composition, structure and quantity of work in progress;

- drawing up inventory lists that will contain all the necessary information, including the name of the object or product, its quantity, degree of readiness and completeness, stage of production;

- identifying unaccounted for defects in production and determining its percentage of manufactured products;

- study and analysis of maps for the release of materials into production in order to identify the irrational use of the enterprise’s material resources;

- calculation of the cost of work in progress according to the method specified in the accounting policy and used in the organization.

Does a company have to work with INV-4?

Form INV-4 unified, primary document. The form was introduced by Resolution of the State Statistics Committee of August 18, 1998 No. 88. INV-4 was mandatory until 2013, and then the mandatory unified forms became recommended. To take inventory of shipped goods and materials, organizations have the right to draw up their own form, supplementing the existing one. Mandatory details cannot be removed from the form; without them, the document will not be considered legally significant.

The convenience of INV-4 is undeniable: some companies still use it. In addition, inspection authorities also prefer to work with unified papers.

Attention! The company's management must decide in favor of its own developed or unified forms and record it in the accounting policies

Preparatory activities

Before carrying out an inventory of work in progress, it is necessary to carry out a number of preparatory procedures in order for the process to produce effective results. Storekeepers need to sort work-in-process items according to their nomenclature, as well as separate defective items to make it more convenient to carry out direct counting.

Accounting employees should post all available documents on the movement of materials and work-in-progress items into synthetic and analytical accounting accounts. In addition, you need to prepare a scheme according to which the cost will be calculated, as well as identify orders that were canceled or suspended for some reason.

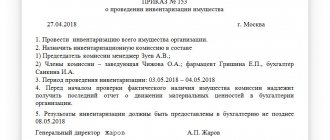

The director of the organization is obliged to issue an inventory order, which will specify the timing of the event and the composition of the working audit commission. In addition, the document indicates the reason for which the inventory is carried out and the list of property being inspected. As for the reasons, there may be several of them, for example, the dismissal of a storekeeper or other financially responsible person, the preparation of annual reports, suspicion of embezzlement or theft.

The main preparatory activities can be presented in the following table:

| Event | Description |

| Issuance of an order | The order is issued by the director of the organization. It indicates all the essential aspects of the inventory, including the period of conduct, objects of inspection, the reason for the audit and the composition of the working commission |

| Delivery and preparation of documentation | Materially responsible persons are obliged to submit to the accounting department all documentation on the movement of work in progress objects, and the accountant is obliged to enter documents into the program and process them in accordance with all established rules |

| Identifying groups of objects or individual units | The audit commission, together with accounting and economists, must develop a nomenclature according to which the inventory will be carried out. In addition, a scheme should be prepared according to which the cost of work in progress items will be assessed |

When the act of inventory results is applied f. 0504835

Conventionally, the inventory process can be divided into several stages:

- First, the head of the company issues an order in which he appoints and approves members of the inspection team.

- Accounting balances and primary documents that will be needed for verification are drawn up. Other similar work related to preparation for inventory is being carried out.

- Financially responsible employees properly draw up a receipt. Thus, they confirm the actual existence of the property for which they are responsible.

- A direct inspection is carried out, in which each member of the commission must take part.

- Entering the results obtained into the relevant act.

If a mistake was made when drawing up the act, it is easier to start filling out a new document. Although the law allows corrections to be made in this case. But they need to be done correctly. So, incorrect information needs to be crossed out with one line. The information above is correct. After this, all members of the review team must sign their autographs next to the correction. The financially responsible employee must also confirm with his signature that the correction took place in his presence. You should not leave empty columns. If for some reason there is nothing to write in them, it is necessary to put dashes.

(Video: “Procedure for carrying out inventory, accounting for surpluses and shortages”)

Condition for taking inventory

Important conditions for conducting an inventory include the presence of all members of the inspection team. In the absence of anyone, the act is considered invalid; accordingly, the results of the inspection cannot be called correct. All information is entered into the act, which must have at least two copies. In some cases, the number of copies may be increased.

As a rule, the basis for filling out the act is an inventory of property, which is drawn up for individual areas and responsible persons. You can often encounter a situation where actual property differs from accounting information. In this case, the act is still drawn up. However, as a supplement to it, a special statement is drawn up, which is intended to display the existing discrepancies. Together with the corresponding inventory, these documents officially record the discrepancies found. Here you can clearly see for which position shortages or surpluses have been identified. There can be quite a few reasons, from basic mistakes to theft.

(Video: “How to reflect inventory results in 1C?”)

Inventory procedure

At the time of the inventory of work in progress, the audit commission receives documents that serve as the basis for the movement of material assets and checks that they are filled out correctly. Then a direct complete census of work-in-progress items is carried out into the inventory list. A separate inventory is drawn up for rejected products, since such items cannot be included in the general inventory list for work in progress. It is necessary to take into account that the absence of a financially responsible person or one of the commission members during the audit is considered unlawful, and therefore the results of the audit are considered invalid.

Upon completion of the inventory, all compiled documents are signed by members of the inspection commission and transferred to the accounting department for processing. In this case, the discrepancy between the actual and accounting indicators must be documented using a reconciliation sheet, and the results - surplus or shortage - are attributed to the appropriate accounts of synthetic and analytical accounting.

What other documents are there:

- All documents from the “Act” section

- Categories of all standard samples and document forms

What else to download on the topic “Act”:

- Samples and standard forms of documents generated as a result of the execution of the state function of monitoring and coordinating the activities of state budgetary institutions of the Moscow region. Inspection report form

- Act of reconciliation of calculations between the budgets of the budgetary system of the Russian Federation for interbudgetary transfers provided in the form of subsidies, subventions and other interbudgetary transfers with a designated purpose from the federal budget under Chapter 092 “Ministry of Finance of the Russian Federation”

- Act on the compliance of the parameters of the constructed, reconstructed capital construction facility in the Pavlovo-Posad municipal district of the Moscow region with design documentation

- Act of inventory of financial investments (except for securities stored in the organization's cash desk) (form developed by the organization independently). Form N INV-1-FV (filling sample)

- Certificate of inspection of an educational institution of the Federal Penitentiary Service of Russia (recommended sample)

- Important nuances when buying a company

- The process of transferring an apartment to another person

- US Visa Process

- Car selling process

- Garage construction process (from a bureaucratic point of view)

- Construction of a private house in the city

How is WIP inventory carried out in production?

At industrial enterprises, inventory of work in progress can be carried out both for individual objects and for their totality. The main points to pay attention to when taking inventory are the following:

- it is necessary to determine the actual quantity of all items in the nomenclature;

- it is necessary to establish the completeness of all work in progress items;

- you need to determine the balance of work in progress that relates to canceled or suspended orders.

The production process in a large enterprise involves a variety of operations, for which different areas of work can be organized. Accordingly, an inventory of work in progress should be carried out in the context of these areas, and for each of them a corresponding inventory list should be compiled, and then all the data obtained should be compiled into a general inventory sheet.

How is the inventory of work in progress carried out in construction?

If the inventory is carried out on unfinished construction projects, then the inventory list indicates the buildings, the stage of their production, as well as the volume of certain work on them or individual structural elements. Objects that are currently under conservation are also subject to inventory, and the inventory list must indicate the reasons for their conservation.

It must be taken into account that buildings that are completely constructed, but not put into operation and do not have the appropriate documentation, are also considered work in progress, and therefore they must be recorded in a separate statement. This document reflects the reasons why the buildings were not put into operation and the delivery documents were not properly completed.

Typical entries for inventory of work in progress

When conducting an inventory, the commission can receive several results, and for each of them the corresponding entries are generated. The most common ones are:

- if a surplus of work in progress items is identified

Debit 20 Credit 91/1 market value of surplus accepted for accounting

- if a shortage is identified

Debit 94 Credit 20 reflects the cost of the shortage

- shortages according to the norm and in excess of it are allocated to different accounts

Debit 20 Credit 94 shortage within normal limits attributed to production

Debit 73 Credit 94 shortage in excess of the norm is attributed to the culprit, if he is identified

Debit 91/2 Credit 94 shortfall in excess of the norm is charged to other expenses if the culprit is not identified