Ways to check reports

Law No. 125-FZ dated July 24, 1998 established that filing and checking Form 4-FSS is the responsibility of all types of employers. They prepare the document on a quarterly basis. The form has a unified template, which is fixed by Order No. 381 dated September 26, 2016. Also see “Form 4-FSS in 2021.”

The calculation according to the approved form can be submitted in paper form or electronically. Depending on the method used to prepare the finished form, the deadlines for its submission to the regulatory authority differ:

- when submitting a document on paper, verification of 4-FSS in 2018 and the fact of acceptance of the form by the responsible person in the government agency must be carried out by the 20th day of the month following the reporting quarterly interval;

- when submitting the form via TKS electronically, time restrictions are fixed within 25 days after the end of the reporting quarter.

Also see “Deadlines for submitting 4-FSS in 2021“.

In the latter case, the 4-FSS can be checked online. This is done using special services of the Social Insurance Fund on the official website of the government agency. Preliminary verification of control ratios, accounting data and numerical values reflected in the reporting form are mandatory stages in preparing a document for submission to government agencies. Options for implementing verification activities:

- checking 4-FSS on the FSS website online - carried out by policyholders independently;

- employers perform reconciliation manually without the use of software;

- a desk audit, which is initiated and carried out by the regulatory authority without the involvement of the policyholder to confirm the correctness of the information contained in the form;

- on-site inspection format.

Is it possible to check the report?

The completed report on electronic media must be sent to the fund via telecommunication channels. If the report is prepared in paper form, then the document must be delivered directly to the territorial division of the FSS. But before you submit the completed form, you should check it. The verification procedure is carried out on several resources.

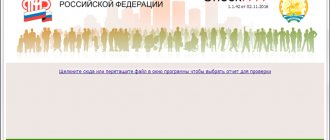

A free online 4-FSS check is possible on the FSS website. To start checking, go to portal.fss.ru. Next you need to complete the following steps:

- create a file for verification in a program for accountants (such programs, for example, include 1C);

- upload the document to a folder on your personal computer;

- go to the fund’s website and open the “Form 4-FSS” section;

- after clicking on the “Download XML” button, you need to select the document you want to check from the computer folder;

- click on the “Download” button;

- after the report file is uploaded to the fund’s website, you need to click on the “Check” button;

- When the verification procedure is completed, review the verification protocol.

Checking on this resource does not take much time and does not require special knowledge from the user.

In addition, you can check 4-FSS online on the buhsoft website. The verification procedure includes the following steps:

- We upload the report file from the program for accountants to a computer folder;

- go to the website online.buhsoft.ru, where we complete the registration procedure;

- on the main web page you need to click on the “Start” button, and then select the “Reporting Testing” section;

- after clicking on the “Select files” button, you need to download the previously uploaded report file;

- when the form file is completely loaded, a corresponding entry will appear on the monitor;

- at the next stage you need to click on the “Check” button;

- When the report on insurance premiums is fully verified, a report of the results can be downloaded next to the downloaded file.

The verification procedure on this resource is intuitive even for those policyholders who are submitting a report on insurance premiums for the first time.

By checking the report, company managers can avoid receiving the report back, which could expose policyholders to late submission and penalties.

GU - Kirov RO Social Insurance Fund of the Russian FederationAnnouncements

Do-it-yourself check

Using electronic services on the official website of the Social Insurance Fund, the 4-FSS report is checked online by the employer independently and free of charge. The sequence of actions is as follows:

- Log in to the social insurance website https://portal.fss.ru and go to the menu item https://portal.fss.ru/fss/services/f4input.

- On the portal, an electronic document template is filled out or an already generated report is uploaded.

- The 4-FSS report is checked on the FSS website, and the result produced by the program is analyzed.

Desk type of verification activities

On-site data reconciliation is carried out by employees of the regulatory body without the participation of the policyholder. The documentary basis for verification is the fact of receipt of the report. According to its content, the correctness of calculations for insurance premiums, the completeness of their transfer, and compliance with the deadlines for repayment of obligations are analyzed. A 4-FSS check (online for free or carried out by specialists as part of a mandatory desk reconciliation) is necessary to assess the legality of the costs incurred for the payment of social benefits.

Up to 3 months are allotted for non-travelling analytical reconciliations. The countdown starts from the moment the document is actually submitted to the controlling structure. If inaccuracies or gross errors are identified, the policyholder is notified in writing. In this situation, the policyholder is given the opportunity to justify his actions to reflect conflicting data by providing explanations. Each detected offense is recorded in an act.

Why is 4-FSS filled out and checked online?

Employers with 25 or more people on staff are required to submit the form in question to the Social Insurance Fund in electronic form (Clause 1, Article 24 of the Law “On Social Insurance” dated July 24, 1998 No. 125-FZ). For details, see the material “Who is required to submit insurance premium calculations and in what form.” This document format can be completed (and checked for errors) in two popular ways:

- using a special program (for example, “1C”), that is, offline;

- through the FSS website online.

Both methods involve the generation of a 4-FSS file in XML format, which is subsequently signed using an electronic digital signature and sent to the department (also in different ways). Therefore, it does not matter which of the specified file formation options is preferable for the user. The main thing is that the XML file is correct - both from the point of view of authenticity and from the point of view of the completeness of the reporting data reflected in it.

If the user does not have a special program, then using the resources of the 4-FSS website will be one of the most convenient options for fulfilling the obligation to submit an electronic payment to the department. Online tools from the FSS allow you to generate an XML report file, fully prepared for signing and sending to the fund.

Let's study in more detail how 4-FSS is filled out and checked online through the department's website.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Monitoring as part of an on-site inspection

Checking the submission of the 4-FSS report online is available for registered users on the FSS website. The completed stages of automatic monitoring of information from the reporting form and the completion of a desk audit do not guarantee that fund specialists will not conduct on-site monitoring activities. The following features are typical for on-site inspections:

- the entire list of operations performed is included in the inspection plan;

- information for the reporting period and the three years preceding it will be verified;

- there can be no more than 2 months between the start date of the inspection and its end date;

- The frequency of implementation of this form of monitoring is limited to once every three years.

Control can affect not only reporting forms, but also contractual documentation, primary documents, and acts. Recommendations for checking Form 4-FSS and documents related to the report establish that if, as a result of analysis of the submitted forms, cases of understatement of obligations for insurance premiums or facts of unreasonable expenditure of funds on insurance coverage are identified, these amounts must be additionally accrued and shown in the report for the corresponding period. Such information is reflected in Table 2.

Read also

31.08.2018

Errors about failure to comply with control ratios

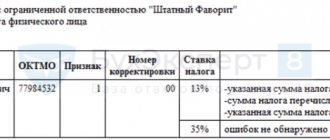

The Kontur.Extern service implements the same checks that the report goes through on the FSS portal. These controls were proposed by the Social Insurance Fund of the Russian Federation and approved by:

- FSS Order No. 19 - on approval of the 4-FSS format and verification ratios;

- FSS Order No. 381 - on approval of the 4-FSS printed template and the procedure for filling out the form.

Error correction depends on how the file was generated:

- the report was created in a third-party program and uploaded to Kontur.Extern without editing;

- the report was completed in Kontur.Extern.

Examples of common errors:

- Table 2. The indicator “Table 2 line 10 column 3” should be equal to 0 if the indicators “Table 2 line 13 column 3” and “Table 2 line 15 column 3” are equal to 0;

- The indicator “Table 2 line 10 column 3” should be equal to 0 if the indicators “Table 2 line 13 column 3” and “Table 2 line 15 column 3”;

- Table 2. The indicator “Table 2 line 2 column 3” ('0') should be equal to ", calculated using the formula (Table 1 line 3 column 3 - Table 1 line 4 column 3 + 0.6 * Table 1 line 4 column 3 )* (Table 1 line 9 / 100) +/- 1 ruble, if the SKE/IF section and table 1.1 are missing and the “60% Benefit” flag is not set..

Important: the error text on the control may be different from the example.

Errors in the received file

To correct errors, accept the file via “Upload for Editing”.

After this, some of the indicators are recalculated automatically.

Then click on the “Check and Submit” link.

Select the certificate to sign and click on the “Check report” button.

If there are no errors, we recommend returning to the filling and checking the correctness of the data. To do this, click on the “Edit report” button.

If everything is correct, you can proceed to sending: “Go to sending” > “Sign and send”.

Errors in the filled file

Check the completion of the report according to the text of the error. Compare the amounts, make corrections if necessary, and resubmit the report for review.

If you cannot fix the error yourself, contact the technical support service at the following address. In the letter, you must indicate the following information:

- verification protocol and screenshots of filling out the lines indicated in the error;

- report file if you filled it out in a third-party program.

Kontur.Extern implements the same checks that the report will undergo on the FSS portal. It is technically impossible to send a file with errors. If you do not agree with the controls, we recommend that you contact the FSS for clarification. You can find inspection contacts here. The special operator is not responsible for the relevance of contacts.