What should be included in the advance report?

Is it generally necessary to accompany the expense report with any documents?

Clause 6.3 of the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U states that the corresponding report must be presented to an accountant or manager, but it does not specify which ones. Clause 26 of the regulations on business trips, approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749, states that upon returning from a business trip, a company employee must submit an advance report to the employer and attach to it documents confirming the rental of housing, travel expenses and other items.

It is necessary to attach documents to the advance report that confirm that the employee spent the funds issued correctly. Apart from the specified requirement of the legislator, there are other reasons for this. In particular, amounts issued to an employee on account and used by him for the purposes agreed upon at the time of issuance can be accepted by the employing company to reduce the tax base (if they are available in the completeness required by law, papers are needed confirming both the fact of payment for goods or services and their receipt).

CLARIFICATIONS from ConsultantPlus: Is it possible to take into account an advance report with a sales receipt, but without a cash receipt? Study the material by getting trial access to the K+ system for free.

The main regulations establishing the need to generate advance reports do not say anything about the fact that cash receipts must be attached to the relevant document. At the same time, it should be noted that in the structure of the AO-1 form, proposed by Decree of the State Statistics Committee of the Russian Federation dated 01.08.2001 No. 55 as a unified form for drawing up an advance report (as well as in its analogue used for budgetary institutions - form 0504505, approved by order Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n), there are columns where you need to enter information about documents confirming expenses. In form AO-1 it is necessary to record the name of these documents, their numbers and dates, in form 0504505 - numbers, dates, as well as the content of expenses.

Read more about filling out the AO-1 form in the article .

NOTE! Currently, most sellers must use online cash register systems and issue buyers a cash register receipt that meets all the requirements of the Law “On Cash Register Systems” dated May 22, 2003 No. 54-FZ. Only persons exempt from the use of cash register systems can work without a cash register and issue other payment documents. If the seller ignores his cash obligation, he breaks the law, not the buyer. Therefore, the buyer should not bear the negative consequences of not having a cash register receipt, and is also not obliged (and does not have the opportunity) to check whether the seller does not use the cash register lawfully and issues him another document. Therefore, you can now attach any of the following documents confirming payment to the advance report. But it should be remembered that this is associated with certain risks. Mainly in terms of confirming expenses for tax purposes.

So, the documents that contain the necessary primary details (number, date, content of expenses), in addition to the cash receipt, include:

- strict reporting form (including, for example, an air ticket);

- PKO receipt;

- sales receipt.

Let's consider what the requirements for the execution of each of the mentioned documents are.

VAT deduction on a cash receipt: is it possible without an invoice?

From July 1, 2021, the rules for accepting documents from accountable persons have changed significantly. If innovations in work are not taken into account, then the company’s expenses cannot be taken into account for tax purposes. Let's figure out how to work with accountable documents according to the new rules.

Checks for advance report

This means that the absence of a readable cash register receipt, if there is a copy made from it in advance, is not an obstacle to the recognition in tax accounting of expenses for the purchase of goods, works, services paid for with this check.

As we know, from July 1, 2021, changes came into effect in the procedure for issuing cash register checks, and these changes affected the procedure for issuing accountable documents. What should you tell your employees before giving them money?

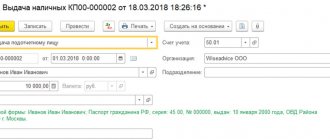

Advance report without cash receipt: attach PKO receipt

An advance report without a cash receipt can also be supplemented with receipts for cash receipt orders.

The PKO, like the BSO, consists of 2 elements - the main part and the tear-off receipt. The employee who paid for goods or services with accountable funds is given the second element. This is what needs to be attached to the expense report.

It is important that the PKO receipt meets the following basic requirements:

- the supplier's seal (if any) must be affixed simultaneously on both elements of the PQS - thus, approximately half of it will be visible on the receipt;

- in the “Amount” column of the PKO receipt, the amount of funds should be recorded in numbers, in the column below - in words.

One more nuance: PKOs must be drawn up exclusively according to the KO-1 form, which was put into circulation by the State Statistics Committee by Resolution No. 88 dated August 18, 1998. Therefore, before taking the PKO receipt, it is advisable for the employee to make sure that the original order contains a mark indicating that the document complies with the form KO-1.

And most importantly: the receipt for the PKO only confirms the fact of payment. Using it to confirm the type of expenses, for example, the name of purchased goods and materials or services, is problematic. Therefore, in addition to the receipt to the recipient, a document indicating the type of expenses incurred must be attached to the advance report: invoice, act, etc.

For an example of form KO-1, see the material “Cash receipt order - form and sample”.

Do I need to run a cash receipt at the online checkout when making an advance payment (advance payment) for goods?

First of all, Article 487 of the Civil Code of the Russian Federation provides for the possibility of making an advance payment under any purchase and sale agreement. Thus, an advance payment (or advance payment) can be made, including for the purposes of a retail purchase and sale agreement.

- on the basis of clause 1 of Article 1.2 of the new edition of No. 54-FZ, cash register equipment must be used throughout the entire territory of the Russian Federation. This requirement applies to any organizations and entrepreneurs, except in cases where No. 54-FZ itself provides for exceptions (in accordance with its Article 2);

- The obligation to use cash register systems applies only to cash payments and (or) payments using electronic means of payment. Moreover, the calculations themselves must be made only in the currency of the Russian Federation - in rubles. As for payments in foreign currency, based on Article 14 of the Federal Law of the Russian Federation No. 173-FZ of December 10, 2003. “On Currency Regulation and Currency Control”, currency transactions are carried out only in non-cash form, with some exceptions, which are also specified in Article 14 of the same law;

- the new edition of No. 54-FZ (Article 1.1) clarifies what kind of calculations cash register equipment should always be used for, in particular, for goods sold, work performed and services provided. Except for certain cases in which the use of CCT is not required;

- In addition, the new edition of No. 54-FZ clearly indicates the presence of exceptions for which the right not to apply CCP is provided - through Article 2 of the law. And this article does not mention the possibility of not punching a cash receipt in case of making an advance payment (advance payment).

More to read: Payments and allowances for Labor Veterans in 2021 in the Sverdlovsk Region

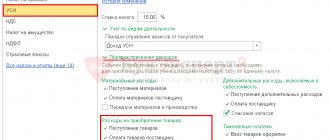

We supplement the advance report with a sales receipt

Another possible scenario for justifying expenses for reporting funds is the use of a sales receipt as a document supplementing the expense report. A sales receipt can be made an attachment to the JSC if it confirms the fact of concluding an agreement and the fact of payment (Article 493 of the Civil Code of the Russian Federation, letters of the Ministry of Finance dated 08/16/2017 No. 03-01-15/52653, dated 05/06/2015 No. 03-11-06 /2/26028).

There is no legislatively approved form for a sales receipt, but there are requirements for details. It should contain:

- serial number, date of compilation;

- name of the company or full name of an individual entrepreneur - supplier of goods or services;

- supplier's tax identification number;

- a list of goods and services paid for by the employee with accountable funds, their quantity;

- the amount that the employee deposited into the supplier’s cash desk in rubles;

- position, full name, initials of the employee who issued the sales receipt, his signature.

As a rule, a sales receipt contains a complete statement of paid goods and materials, which means that it is not required to supplement it with an invoice.

Is it possible to take into account the costs of purchasing goods for income tax if the sales receipt attached to the advance report has defects, for example, it is missing a number? You will find the answer to this question from expert practitioners in ConsultantPlus. Get trial access to the system for free and proceed to the material.

Sales receipt without cash receipt for 2021

A sales receipt is a non-state document , which is generated by the seller for a cash register receipt. The current legislation of the Russian Federation provides for exceptions when a non-fiscal document is issued instead of a fiscal check.

- Name of the act of mutual settlement . In the upper part of the document, in the center, the “SALES RECEIPT” must be written.

- Check number . Even if the form does not provide a “No.” icon, each tear-off document must have its own individual number. Since the consumer, when drawing up an advance report, must refer to the serial number of the accounting act according to which the goods were purchased. Document numbering can begin from the beginning of the reporting period, or from the beginning of each day, month, quarter, year.

- Formation date . The day of mutual settlement for sold products or services is indicated. It is advisable to write the month in letters.

- Full name of the organization or enterprise . Which should include an identification number, complete information about the owner or founder, actual and legal address, and contact information (email, telephone). If the full name of the individual entrepreneur does not fit into the purchased form, then you must independently or with the help of a printing house develop and print suitable document forms.

- Quantity and name of goods sold or services/work provided . In this case, it is necessary to decipher each product separately, and indicate its quantity in numbers.

- Product/service unit cost . Displayed in numbers opposite each product name. This number must be separated by a comma, where the first numbers denote rubles, and the subsequent kopecks. If there are no kopecks in the price, then two zeros are placed after the decimal point.

- The total cost of the settlement made . The amount is calculated by multiplying the quantity of goods sold by the price of one unit of product.

- Information about the seller or other person who accepted money for the goods sold and issued a sales receipt . In this case, it is necessary to indicate the position or profession of the person signing the check.

More to read: Ministry of Emergency Situations of Russia News Payments to Large Families in 2020 of One Hundred Thousand Rubles

Results

The preparation of an advance report must be accompanied by the attachment of documents confirming the expenses incurred. Such documents can be not only cash receipts, but also BSO, receipt for PKO and sales receipts. The registration of the PKO takes place on an approved form, and there are certain requirements for the details of the BSO and sales receipts that do not have such forms.

Sources:

- Federal Law of May 22, 2003 No. 54-FZ

- Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

***

To summarize, let's say that a cash receipt is not the only document that an employee can attach to an expense report in order to report on funds issued for business expenses. The function of a cash receipt can also be performed by a sales receipt, a receipt stub of a cash receipt order or a BSO stub.

Similar articles

- Do I need a cash receipt for the tax office?

- Fine for failure to issue a cash receipt in 2017

- Where is the cash receipt number?

- Cashier's check when paying by credit card

- How to check the authenticity of a cash receipt?

Filling rules

Regardless of the reason for which a sales receipt is issued, it must comply with the requirements established by the regulations. Any deviation from the norm entails the invalidity of the document, which can lead to administrative, tax, and sometimes criminal liability.

Template registration of a sales receipt is not established by law.

The following details must be present:

- Title of the document.

- Serial number.

- Date and time in hours, minutes and seconds of receipt of the product or service.

- Name of the enterprise (can be abbreviated).

- TIN.

- List of goods and services purchased by the buyer.

- Number of units purchased.

- Total purchase amount.

- Full name of the seller or cashier.

- Seller's signature.

A sample of a 2021 receipt without cash register is presented below:

In turn, the cash receipt has a prescribed form and is produced using an appropriate machine on special paper, which guarantees a long shelf life.

Among the required details are:

- Name of the organization (can be abbreviated).

- The actual address of the purchase, that is, the address of the organization.

- TIN.

- Number order of CCP.

- Serial number of the check.

- The date and time the product or service was purchased.

- Number of units purchased.

- Price per unit of goods.

- Total purchase amount.

- If available, quantity and amount of discount.

- Amount received for payment.

- PCC or check authentication code.

- Information about VAT payment, which distinguishes it from the previous type of check.

It is also suggested to look at a sample:

The required elements of a cash and sales receipt were described above, without which these documents may be considered invalid.

In terms of registration, it is necessary to establish exactly what color of ink should be used to write down the data: this requirement is not established at the legislative level, however, it is worth adhering to the standard rules for preparing documentation - using black or blue ballpoint pens.

The most important elements when manually filling out a sales receipt:

- provide accurate, reliable information about the purchased product: name of purchase, its price, number of units purchased and total payment amount. In case of an error, it is recommended to take another form;

- The date and time of purchase must be indicated. This will have a positive effect when the buyer re-applies with possible claims, as well as for submitting daily reports;

- Separately, it is worth paying attention to the organization’s seal on the sales receipt: according to the law, this is not a mandatory element in this documentation, however, it is recommended to affix the company’s seal on each receipt, because this will help in further verification of the authenticity of the received document.

Thus, a cash receipt and a sales receipt are independent documents in the process of entrepreneurial activity.

A priori, these types of checks implement different functions, KCH - for tax reporting, TC - to confirm a purchase, so they can be used independently.