- Initiation of proceedings

- How to find out about arrest and write-off of funds

- When are bailiffs required to lift an arrest?

Home/Articles on bankruptcy of individuals

Author of the article: Konstantin Milantiev

Last revised January 21, 2021

Reading time 13 minutes

The seizure of a bank account by bailiffs is imposed for the sole purpose of writing off money to pay off debts. The FSSP initiates proceedings, issues a resolution and sends it to the bank. If there is money in the account, it will be written off immediately. If there are no funds on the balance, the block will remain until the next deposits, until the debts are fully paid.

When and why can an account be frozen?

A bank account is opened for financial transactions in non-cash form. A person stores money on it, receives a salary, pension or other income, and makes payments. For payments a bank card is issued:

- debit - that is, the client credited his money to it;

- credit - that is, it is the bank’s money, and the client takes out loans by paying with a card.

The card is always linked to a specific account.

Seizure of property is one of the interim measures in enforcement proceedings. Since money is considered property, bank accounts and deposits can also be seized. This measure will allow:

- write off the entire amount at once, or a certain percentage (for example, when crediting salaries, the withholding does not exceed 50%, for alimony up to 70%);

- block transactions so that the defaulter cannot spend money, transfer it to other persons or withdraw it;

- collect money as it is credited.

When an arrest is imposed without bailiffs:

- The court issued a ruling to secure the claim - only the amount of the debt is frozen. The debtor will not be able to spend or withdraw the money until the trial is completed.

- The bank will seize the account if the writ of execution comes from the creditor. Yes, if you know which bank the debtor has the money in, it is not necessary to involve bailiffs - you can submit an application and execute it. sheet directly to the bank.

A citizen may have many accounts opened in different banks. Anyone can be arrested for debt. After the opening of proceedings, the bailiff requests data from the Federal Tax Service through the banking monitoring system. The FSSP will see which credit institutions have accounts and will send orders on arrest and write-off to all banks.

What are the consequences of arrest?

If the seizure of funds is imposed by the court as a measure to secure a claim, they will not be written off, but blocked. If the plaintiff wins, the seized money will be retained. If the defendant wins the case, the blocking of funds is lifted, after which they can be disposed of without restrictions.

When a bailiff seizes a bank account, the following consequences occur:

- suspension of account transactions, i.e. the debtor will not be able to withdraw, spend or transfer funds to others;

- writing off the debt amount immediately in full or in parts. As received;

- The credit institution notifies the bailiff and the debtor of each write-off.

Seizure of the debtor's accounts is not the only power of the bailiff. At the same time, it is allowed to send documents to the employer to deduct wages, seize real estate and transport, and movable property. Also, the FSSP, according to Law No. 229-FZ, can prohibit the debtor from traveling abroad and take away his driver’s license.

How not to pay bailiffs by court decisionRelated article

If money is debited from your salary, the bailiff determines the withholding percentage. For example, if a salary is credited to a card, 50 or 70% will be withheld from it (depending on the subject of the requirements). The remaining funds will be available for withdrawal, transfers, and other operations.

How are arrest and write-off related?

If there is money in the account, it will be written off to pay off the debt:

- if there was enough money to close the debt, the bank returns the documents with a note of full execution;

- if the money is written off, but the entire debt is not closed, the bank reports partial fulfillment and retains the arrest for subsequent write-offs;

- if the account is empty, the credit institution will make a note of arrest and write off funds as they are credited.

The debtor may close the seized account. To do this, just submit an application to the bank. After closure, the arrest is automatically lifted, which the credit institution will report to the FSSP.

What is the reason for the arrest?

Blocking an organization's account or a personal account of an individual by the Federal Tax Service is a radical measure applied by a government agency that pursues certain goals.

Among them are the following reasons for account blocking:

- Forced collection of debt to the Tax Service. The account owner refuses or for other reasons does not pay taxes (fines and penalties) or makes payments with long delays. Then the organization applies a forced measure and seizes the debtor’s bank account, from which the unpaid amount is debited.

- Compulsory fulfillment of the obligation to provide reporting documents to the tax service . Here we are talking about informative tax reporting documents that are of particular importance. These are tax returns. If it is not provided or the deadline established for provision is exceeded, the Federal Tax Service applies penalties to the taxpayer. Also in the future, he will seize bank accounts belonging to him (according to the principle of action discussed in the first paragraph).

As soon as the seizure is imposed, the client will receive a call on his phone from an employee of the financial institution (bank) and will inform him about the measure taken.

At the time of this action, the taxpayer must be aware of the reason for what is happening. Before blocking, the Federal Tax Service notifies the client about the precarious position of his account and explains what to do to avoid unpleasant consequences.

Most often, the reason for the arrest is the irresponsibility of the client himself, who does not pay attention to warnings from the tax service.

There are also frequent cases when documents from the Federal Tax Service simply do not reach the taxpayer. In such a situation, the debt will only be known from an employee of the bank in which the open account that has been seized is opened.

Useful material : applying for a loan secured by real estate at Vostochny Bank.

How a bank account is seized

The bailiff does not go to banks to manually enter a lien. In 2021, everything is done remotely, through electronic services. Banks operating in Russia are required to post information about their clients in the monitoring system of the Central Bank of the Russian Federation and report client accounts to the Federal Tax Service.

Therefore, it will not be possible to hide accounts in Russian banks; it is a myth that there are banks that do not cooperate with bailiffs. There are simply bailiffs who did not look at the extract properly.

Initiation of proceedings

The claimant submits documents and an application to the FSSP unit at the place of registration of the defendant. The claimant has the right to indicate the institutions where the debtor stores or receives money. The bailiff is obliged to check this data plus send his requests to the monitoring system.

Assets and money can be seized immediately after opening a case.

But until the 5-day deadline has expired, write-off is prohibited. In practice, this rule is often violated. The period for execution begins from the date on which the debtor received the orders. But many bailiffs transfer documents for retention without waiting for notification from the post office. Such actions can be appealed; this is a violation.

Resolution to the bank

The FSSP specialist cannot himself manage the bank accounts of the defaulter. But he has the right to give such instructions to the bank. For this purpose, an arrest order is issued. It states:

- production details;

- information about the debtor so that the bank identifies the owner of the accounts;

- the nature of the requirements (this is important for the amount of deductions);

- details for transferring funds (usually a FSSP deposit);

- other information that is important for debiting funds and blocking transactions.

From 2021, credit institutions are required to calculate the amount of withholding themselves, taking into account the nature of the requirements and the type of income. If the resolution contains incomplete or inaccurate information, the bank is obliged to request clarification from the FSSP.

How does the bank operate?

If the bailiffs have seized the accounts, the bank is obliged to comply with the order no later than 1 day. The responsibilities of the credit institution include:

- control of all credits in favor of the debtor;

- determining the amount of withholding;

- notification of the account owner about arrest, write-offs;

- informing the FSSP about full or partial write-offs, about the closure of accounts.

If the bank has information that the debtor receives income that is prohibited from foreclosure, it notifies the FSSP about this. The full list is specified in Art. 101 of Law No. 229-FZ. Employers, the Pension Fund of the Russian Federation, social security authorities and other departments are required to indicate the income code in the payment order. Using it, the credit institution will check whether the money can be written off.

Blocking operations

Account collection and seizure

If the account is seized, transactions are blocked until the debt is repaid. However, when crediting salaries, pensions or other income, bailiffs and credit organizations are required to comply with restrictions on the percentage of withholding. For example, for alimony they take up to 70%, for other debts - up to 50%. The remaining funds after deduction can be spent at your discretion.

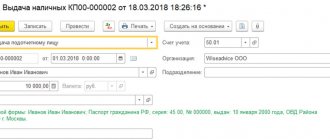

Write-off of funds

If there is money in the account, the bank will transfer it to the FSSP deposit. The amount of debt decreases when property is sold, deductions at the place of work, and write-offs from other banks. The FSSP employee is obliged to inform the bank to avoid double collection. The debtor can also take the initiative and demand from the FSSP to transfer data on the current status of the debt.

Can the tax office seize an account?

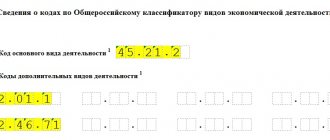

In order to seize an account, tax authorities must decide to block the taxpayer's current account. There may be several reasons for such a decision:

- Tax authorities want to ensure the collection of arrears, penalties, fines, interest accrued in accordance with Chapter. 9 of the Tax Code of the Russian Federation, through money held in bank accounts (clauses 8–10 of article 46, clause 10 of article 68, clause 2 of article 76, subclause 2 of clause 10 of article 101 of the Tax Code of the Russian Federation);

You can find out in detail how the inspectorate acts when identifying tax arrears in the Ready-made solution from ConsultantPlus, having received free access to the system.

- the taxpayer missed the deadline for submitting a tax return (clause 3 of Article 76 of the Tax Code of the Russian Federation);

- the taxpayer did not provide a receipt for the documents submitted by the tax authority within the established time frame;

- the tax agent did not submit the 6-NDFL calculation (clause 3.2 of Article 76 of the Tax Code of the Russian Federation);

- the employer did not submit a calculation of insurance premiums (clause 3.2 of Article 76 of the Tax Code of the Russian Federation) - from 08/30/2018.

However, not all taxpayer accounts can be blocked, but only those opened under a bank account agreement, which is also concluded when opening a foreign currency account. Consequently, the tax inspectorate has the right to block both ruble and foreign currency current accounts (clause 2 of article 11, paragraph 5 of clause 2 of article 76 of the Tax Code of the Russian Federation). It is also possible to suspend operations on accounts opened in precious metals (from 06/01/2018 - see the law on amendments to the Tax Code of the Russian Federation dated November 27, 2017 No. 343-FZ).

Whether tax authorities can block a collateral account, see this publication.

With regard to interest accrued on the basis of Sec. 9 of the Tax Code of the Russian Federation, it should be noted that Art. 46, 76 do not contain a direct reference to the right to suspend transactions on current accounts. However, it follows from the fact that interest is collected in the same manner and within the same time frame as arrears, while the suspension of transactions on accounts is an interim measure for the collection of arrears.

The time period for tax authorities to make a decision to block an account varies depending on the basis on which this measure is applied. You don’t have to bother yourself with calculations, but get free access to ConsultantPlus and see these deadlines there. K+ experts have already calculated everything.

New law - how the bailiff writes off money in 2021

In 2021, all banks apply the following procedure:

- a system of codes has been introduced for different incomes of the debtor: there are separate codes for wages, for different types of pensions, for alimony, for unemployment benefits, etc.;

- the employer or other person (government agency) transferring the income is required to indicate the code on the payment slip;

- when money arrives, the bank looks at the income code;

- if the code allows collection, the bank determines the amount of withholding and transfers the funds to the FSSP;

- no later than 3 days, the credit institution notifies the bailiff and the client about the write-off.

All deposits to which codes are assigned are reflected in the monitoring system of the Central Bank of the Russian Federation. A special algorithm for coloring income has been introduced, where each code is assigned its own color. Upon a complaint from the debtor or on his own initiative, the bailiff can check whether the amount of deductions is calculated correctly.

If an error is made due to the fault of the bank, an administrative case is initiated. If an error is made when processing a payment by an employer or other person, they will also be held accountable.

Administrative liability has been introduced for violations under Art. 17.14 Code of Administrative Offenses of the Russian Federation.

How to get rid of arrest

The work of the state apparatus is bureaucratic. As stated above, restrictions are lifted provided that they are illegal or the circumstances that caused them are eliminated.

Illegal actions can be appealed within 15 days if we are talking about a court ruling in a civil or administrative case.

If officials send the person to court, not wanting to lift the arrest themselves for internal departmental reasons, the statute of limitations does not actually apply. The violation is considered ongoing, and the citizen has reason not to worry about the timing.

First, an application is submitted to the state body with a request to remove the seizure from bank accounts. Documents are attached, information from which proves the groundlessness of the arrest or the absence of grounds for further continuation of restrictions.

What to do if your bank account is seized

To check the legality of the arrest and write-off of funds, the debtor needs:

- find out whether enforcement proceedings have been initiated, why the arrest was imposed, i.e. check the FSSP resolution;

- check that the bailiff and the credit institution have correctly determined the intended purpose of the moves and funds credited to the account.

Law No. 229-FZ and other regulations do not prohibit the seizure of accounts. Even if you have a MIR payment system card issued for social benefits or pensions: you can use it to receive income from commercial activities, transfers from individuals and legal entities. Therefore, any account opened in the name of the debtor can be seized.

How to find out about arrest and write-off of funds

According to the law, the bailiff sends a resolution to the debtor to initiate a case, to impose arrests and prohibitions. Therefore, the easiest way to find out information is to receive letters on time. BUT the rules are not always followed:

- an FSSP employee may take a formal approach to meeting the deadline for voluntary execution and immediately send the documents to the bank for retention;

- an unscrupulous bailiff may delay sending a copy of the resolution to the debtor or not send him documents at all, or make a mistake in the address;

- letters from the FSSP may not arrive due to the fault of the post office.

What does this mean? A person will suddenly be debited a certain amount. Then everything depends on the speed of reaction - you need to appeal the actions of the bailiff. If the money has already left the FSSP for the claimant, it will be even more difficult to return it.

To avoid problems and find out about the seizure of a bank account in time:

- receive mail, especially registered letters;

- check the online Data Bank on the FSSP portal - you can search for information by last name;

- read SMS, notifications about account status in online banking, in your personal account. In Sberbank, the seized account is marked in red, and the notes contain a link to the bailiff’s document;

- Call the bailiff if a court judgment has been made against you.

Seizure of the debtor's property by bailiffsRelated article

Having lost the trial, get ready to initiate proceedings at the FSSP. Do not keep large sums in the bank so that they are not immediately written off as debts. If you receive your salary on a card, make sure that your accountant is aware of the new codes. You can also submit documents to the FSSP that show the intended purpose of the income.

How to check the legality of a write-off

To check on what basis money was written off, you can:

- request a statement of accounts and deposits in the bank, which indicates the basis for each write-off (for example, the statement will indicate the FSSP production number);

- contact the FSSP and personally receive documents about the initiated proceedings and the amount of debt;

- send a request to the FSSP by mail or through State Services.

You can act personally or through a representative. For example, you can contact a lawyer, describe the situation to him, and issue a power of attorney to represent your interests. When defending in enforcement proceedings, a lawyer can prepare complaints, challenge arrests and write-offs. Sometimes it is more profitable to immediately write off debts through bankruptcy than to pay bailiffs and banks or borrow from microfinance organizations.

Can money be debited from a salary card?

Seizure of a salary account is not a violation of the debtor’s rights. Salary does not qualify as income that cannot be levied.

However, Law No. 229-FZ has rules for deductions from wages:

- no more than 50% is withheld from earnings monthly (for alimony - up to 70%);

- the balance goes to the card, and the debtor can withdraw money or spend it;

- If the balance is not withdrawn, then next month it will be written off - the debtor cannot save money.

In simple words, the restriction applies to each salary transfer. Anything in your account on payday is automatically considered savings. The bank will withhold 50% of the received salary + money on the balance.

Double debiting at the same time at your place of work and at the bank is not allowed - this is a mistake, contact the bailiff immediately. But if other income is received on the card, the withholding will be completely legal.

Seizure of credit card or account

With credit cards, it can be difficult to keep track of debts. It all depends on how the loan is structured:

- if the bank approved the loan and transferred the money to the borrower, it can be written off without restrictions;

- if it is a credit card with a limit, deduction is not allowed, since the money belongs to the bank;

- Seizure of a credit account by bailiffs is allowed, and they will take the money that you make as a regular payment.

If the borrower deposited money as a loan payment, the bank is obliged to write it off and transfer it to the FSSP. To prevent bailiffs from writing off money, deposit it into the bank's cash register or terminal indicating the details of the loan agreement - the funds will go to the bank's account, not yours.

If the payment is credited to a card with an open overdraft credit line, the money becomes the property of the bank and will not be written off by the bailiffs. This is convenient for the borrower and the bank. Tinkoff credit cards provide direct credit to the bank, i.e. You don’t have to worry about unexpected write-offs.

Can pensions, benefits, social benefits and alimony be withheld?

Any account can be seized. What income cannot be written off:

- survivor's pension (although seizure of a pension account is not a violation - other income can be credited to it);

- alimony, child benefits, maternity capital;

- Deductions from compensation for damage to health upon the death of the breadwinner are not allowed.

The full list of income for which debts cannot be withheld is indicated in Art. 101 of Law No. 229-FZ. If the bailiff or bank violates this norm, the withholding can be appealed through the court or the head of the FSSP. We described how to file a complaint against the bailiff here.

Actions of the bailiff

He either works with existing accounts that were seized by the court before the start of enforcement proceedings. Or if no one has seized the accounts before, then the bailiff can find them by submitting requests to different banks.

Having an official job or other income (pension) makes the search easier. The seizure of a bank account by bailiffs is carried out as one of the first actions in enforcement proceedings.

An ordinary bailiff has the right to block an account, but he no longer has the right to remove the blocking; lifting restrictions is the authority of the head of the department. If the actions are illegal, in particular, the account for receiving child benefits is seized (the law prohibits collection from them), 10 days are given to file a complaint.

It is submitted either to the senior bailiff or to the court. If you first go to the prosecutor's office, the documents will be forwarded to the bailiff from there. Prosecutors have the right to intervene when a higher-ranking official of the body to which the complaint was received takes action.

An application to the court to remove the seizure from a bank account by bailiffs is allowed to be sent within a 10-day period.

Unfortunately, practice shows that higher-ranking bailiffs do not remove the arrest from accounts if the blocking is illegal or the grounds no longer exist, and citizens often have to go to court.

How to cancel account seizure

How to remove a seizure from an account if your rights have been violated.

When are bailiffs required to lift an arrest?

All restrictions will be lifted as soon as the debtor pays off the debtor. A resolution on this is issued and sent to the bank. Also, the lifting of prohibitions and restrictions occurs in the following cases:

- if a judicial act or executive document is canceled;

- if, based on the debtor’s complaint, the arrest order is cancelled;

- if the bailiff has completed or ceased production.

All prohibitions and restrictions can be lifted if you go through bankruptcy. You can learn more about all the nuances of this procedure from our lawyers.

Civil and other cases

The judge does not make his own decision regarding arrest. It is imposed at the initiative of the plaintiff or the prosecutor or other body protecting the interests of the plaintiff.

An application to seize a bank account is sent to the court at any time after the claim is submitted to the court. You can combine statements, but it is better not to do this: the defendant, having learned about the attempt to arrest, may take measures to withdraw funds from the accounts.

In addition, the judicial act is not automatically transmitted to the bank or other organization maintaining the account. The funds in the bank account are seized by the FSSP. For this purpose, the applicant submits a copy of the decision to the service, attaching it to the application for the commencement of enforcement proceedings.

The restrictions are lifted either if the plaintiff loses the case, or after the defendant hands over the agreed amount of money.

In practice, judges rarely issue decisions to freeze accounts. Bailiffs deal with all this already at the execution stage.

How to find out the exact reason and duration of blocking

You can find out whether your current account is blocked on the website of the Federal Tax Service of the Russian Federation. It is advisable to carry out such a check before concluding an agreement with a new partner.

You can find out about the status of your bank account without the Federal Tax Service - the operator will notify you about this. If he does not have the information or is not authorized to answer such questions, submit a written request to the manager. An alert is also enabled in the client bank service. Usually the notification indicates not only the fact, but also the reason for the blocking.

The period for lifting the seizure of an account depends on the reason and the authority that authorized it.

- Federal Tax Service. The blocking is lifted the next day after submitting the missed declaration or calculation, or within 3-4 days after the debt is repaid.

- Bank. He has his own rules. To lift the arrest for reasons independent of the Federal Tax Service, you will have to document or refute all suspicions of Financial Monitoring. It may take up to 2 months to review documents and make a decision.

- FSSP. Unfreezing of the account is carried out only after the obligations under the writ of execution have been repaid. But paying the debt does not automatically remove the arrest. You will have to write an application to the FSSP to lift the block and attach a document confirming the repayment of obligations. You need to get a decree from the bailiff to end the enforcement proceedings and provide a copy of it to the bank. If you do all this personally, without waiting for the bailiffs to do everything themselves, then it will take several days to unblock. According to the law, FSSP employees must complete this entire procedure independently, without reminders. But in practice, everything is different - only up to 10 days are allotted for consideration of the application.

How can I find out if my account is unblocked? Try making an online payment or just call your operator. Another way is to check on the Federal Tax Service website.

What should a debtor do if he has his account seized and his money written off?

In conclusion, we will give some recommendations and advice on how to eliminate violations during arrests and withholdings, and where to complain about banks and bailiffs.

How to check if an arrest has been made

We noted above that the debtor can find out about the arrest after debiting from an SMS, statement, or through online banking. But if you lost the case and know in advance that the bailiffs will soon begin collection, you can be proactive.

Here are some tips:

- you can check online whether proceedings have been initiated by the FSSP (this can be done through the service on the bailiffs website);

- at a personal meeting with the bailiffs, you can also get information about the opening of the case, the arrests and restrictions imposed;

- suspension of account transactions may also indicate a seizure has been imposed, so we recommend that you check with the bank about the reason for the suspension.

Upon learning that proceedings have been initiated, immediately submit to the FSSP documents on the intended purpose of payments, if you have them. For example, by submitting a salary payment certificate on time, you can avoid illegal write-off of the entire amount. If possible, pay off the debt immediately or withdraw money from the card.

The situation will be even worse when the bailiff simultaneously sends documents for retention at the place of work and imposes an arrest. The following may happen: the employer will withhold 50% and transfer the second part of the salary to the bank.

Bank employees do not know about the withholding at the place of work and will once again write off the money to the FSSP deposit. To avoid such problems, immediately provide the bailiff with a certificate from work and from the bank to avoid double debiting.

How to cancel account seizure

Knowing why the arrest was imposed, you can try to lift it. The easiest way to do this is to pay off the debt in full and close production. Here are a few more reasons for removing the arrest from your account and stopping write-offs:

- appeal and cancel the judicial act based on which the collection is being carried out (in this case, you are required to return all the money withheld);

- appeal and cancel the bailiff’s decision if he violated the law (for example, if the withholding began before the expiration of 5 days given by law for voluntary payment of the debt);

- submit a certificate from your place of work, from the Pension Fund or social service about the strictly intended purpose of the account or card.

How quickly do bailiffs remove the seizure from an account?

Law No. 229-FZ states that the bailiff is obliged to send the resolution to the bank no later than 1 business day. Another day is given to bank employees to remove information from databases, remove blocking and restrictions on transactions.

Is it possible to get my money back?

If the illegally withheld money has already been transferred to the claimant, it is almost impossible to return it. The only option is to cancel the judicial act. In this case, the claimant is obliged to return all money received under the canceled proceedings.

If the money is on deposit with the FSSP, it will be returned at the request of the debtor. Refunds will take up to 30 days. The money will be transferred to the debtor’s account using the same details from which the deduction was made.

How to unblock an account?

Before lifting restrictions from the tax service on conducting monetary transactions, it is necessary to clarify their reason.

- Contact the Federal Tax Service where the current account is opened and find out under what resolution the money was frozen.

- Pay off your debt if your tax payments are overdue.

- Fulfill obligations to submit a declaration or other types of documents in electronic form.

- Notify the Federal Tax Service about the elimination of previously identified violations.

In cases where the bank has blocked the current account of an individual entrepreneur or legal entity due to suspicions of criminal actions, the sequence will be as follows:

- visit a credit institution in person, where you should be given a document confirming the grounds for freezing monetary transactions;

- if refused, send a complaint to the Central Bank or call the bank’s hotline;

- determine why the bank blocked the current account. In some cases, returning a monetary transaction allows you to remove the established restrictions;

- prepare documents confirming the need to make transfers and payments.

The Tax Code provides for deadlines for lifting restrictions in cases where a current account has been blocked. The decision must be made within one business day after confirmation is provided to the Federal Tax Service. In practice, this process is delayed.

Minus a few days: try to unblock some of the seized accounts

Often, fiscal officials suspend transactions on all accounts known to them, although the total balance of funds on them may be greater than the total amount of the company's tax debt. Then you can submit to the inspectorate an application to cancel the seizure of some of the accounts, indicating the details of the accounts that have enough money to fulfill the decision of the inspectors. In this case, account balances are confirmed by bank statements. No later than on the second working day after receiving the documents, tax officials must make a decision on unblocking (Clause 9, Article 76 of the Tax Code of the Russian Federation).

How to reduce the risk of blocking your current account

To minimize the likelihood of cases where the tax authorities will seize monetary transactions, an entrepreneur needs to follow five simple tips:

- submit reports and pay taxes on time;

- use remote banking services;

- open several current accounts in different banks;

- regularly check the conditions for imposing restrictions from the Federal Tax Service;

- request a bank guarantee or surety in a difficult situation.

In practice, there are many reasons why the tax service will block the financial transactions of an enterprise. As a result, the entrepreneur will not be able to conduct normal activities, fulfill obligations and make a profit from transactions. But given the existing problems, you can always find the best solution to them. Everyone chooses exactly the one that will best meet the assigned tasks.

Reasons and consequences of legal blocking of current accounts

In accordance with the law, the Federal Tax Service and its divisions have the right to block a settlement account only if:

- The taxpayer has an outstanding tax debt to the state budget (unpaid taxes and fees).

- A legal entity or an individual as an individual entrepreneur did not submit the necessary financial declarations to the local tax authorities within the specified time frame. According to the law, a taxpayer can submit reports to the regulatory (tax) authorities no later than the expiration of ten days after the date determined as the day of submission of the reporting documentation.

To avoid problems, all business entities are advised to adhere to established norms and rules and not become participants in the situations mentioned above.

Can the Federal Tax Service use illegal grounds to seize a subject’s account?

If the tax authorities seized the current account due to the fact that the entity did not submit financial statements on time, then such actions may be regarded as illegal. This rule of law is contained in Article 76 of the Tax Code of the Russian Federation. It also states that the Federal Tax Service has the right to seize the current accounts of debtors only if they are late in filing tax returns.

In addition, it is impossible to block the bank accounts of a business entity if it made a mistake in the reporting papers or indicated incorrect details when transferring tax payments to budget accounts.

Taxpayers cannot be limited in their legal rights to instruct banks to make payments, which in a particular situation have certain advantages of priority for the payment of funds to the state treasury. Such payments are:

- payment of funds to a bank client based on a submitted check;

- issuing wages to employees of the organization who have entered into an employment contract with it.

Also, if for some reason you did not manage to submit calculations for tax advance payments on time, for example, you did not calculate the tax on existing property within six months, then this is also not a legal basis for the seizure of your bank accounts.

Minus a few days: replace the arrest of the account with other interim measures

If current accounts are blocked as an interim measure in pursuance of an inspection decision (see sub-set on page 38), then the company can offer controllers other options instead of blocking (clause 11 of Article 101 of the Tax Code of the Russian Federation). A bank guarantee, a pledge of marketable securities or other property, as well as a third party guarantee are suitable for this.

If the amount of funds in the arrested accounts exceeds the difference between the arrears and the value of the property (according to accounting data) prohibited from alienation, then the company has the right to demand that the arrest be lifted from such a difference. This conclusion follows from subparagraph 2 of paragraph 10 of Article 101 of the Tax Code of the Russian Federation. If the tax authorities did not impose a ban on the alienation of property at all and did not determine its value based on accounting data, then the blocking is considered unlawful (resolution of the Seventh AAS dated August 14, 2014 No. A27-4159/2014). Even if the company does not have any property (resolution of the Seventeenth AAS dated September 27, 2013 No. 17AP-10785/2013-AK). On this basis, the company can apply to cancel the seizure of the account.

However, all these possibilities relate only to blocking in execution of a verification decision. These rules do not apply to the seizure of accounts for the collection of arrears in accordance with Article 76 of the Tax Code of the Russian Federation (clause 30 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57).

Tax authorities did not cancel the seizure of accounts, even when the obligation to pay the remaining penalties disappeared

Inspectors blocked the company's accounts because it failed to pay taxes and penalties. The organization transferred part of the arrears to the budget, and also submitted updated declarations for previous periods. In them, she reduced the amount of tax payable; accordingly, the grounds for charging part of the penalties disappeared. Taking into account this reduction, the amount of debt to the budget specified in the blocking decision was repaid.

However, the controllers, without arguing with the reduction of the tax payable and with the recalculation of penalties, did not cancel the seizure of the accounts. They indicated that the submission of clarifications only entails a change in the amounts of tax payable to the budget for a specific period, which, in the opinion of the tax authority, does not correspond to the concept of “change in tax liabilities.” Therefore, it is not a basis for terminating the undisputed collection procedure. But the court did not agree with this logic and declared the inaction of the tax authorities unlawful (resolution of the Federal Antimonopoly Service of the Central District dated November 15, 2012 No. A68-3136/2012).

However, the company proved the illegality of the tax authorities’ actions. According to data from the Unified State Register of Legal Entities, at the time of filing the declaration, this particular general director was registered as a person authorized to act without a power of attorney on behalf of the company. At the same time, the Tax Code does not regulate the actions of the tax inspectorate if the head of the organization denies signing the reports.

However, the taxpayer has the right to submit an updated declaration in order to report his actual tax obligations (Article 81 of the Tax Code of the Russian Federation). The inspectorate, in turn, has the right to check the correctness of tax calculations. On these grounds, the court came to the conclusion that the inaction of the controllers was unlawful, and collected interest from them for untimely unblocking of the current account in accordance with paragraph 9.2 of Article 76 of the Tax Code of the Russian Federation (Resolution of the Federal Antimonopoly Service of the Ural District dated March 21, 2014 No. F09-1036/14).