What is account 19 used for in accounting?

In accordance with the Tax Code of the Russian Federation, business entities in the general regime must include VAT in the cost of products produced, services provided and work performed. It is called output tax.

On the other hand, a business entity is a consumer of products, works and services, in the cost of which their suppliers also included these amounts of mandatory collection. This tax is called input VAT.

Input VAT is subject to exclusion from the cost of purchased material assets, works and services. An organization or individual entrepreneur has the right, when paying its outgoing VAT to the budget, to offset the incoming VAT on received goods, works, and services.

Therefore, incoming VAT is subject to separate reflection in accordance with the Chart of Accounts on account 19. The information collected on this account is of great importance in determining the VAT payable, therefore the indicators reflected on the account are under close attention when carrying out tax audits.

The amounts reflected in account 19 must be included in the tax register, which is called the purchase book. Information is entered into it based on invoices received from suppliers.

This account is also used by entities under the simplified tax system. This is due to the fact that they can also purchase goods, works, and services, the price of which includes input VAT. Since these entities cannot offset the output VAT due to its absence, the accumulated amounts are written off as a separate item in the company’s expenses.

Attention! Business entities in special regimes have the right not to use account 19. However, it must be remembered that there is a possibility for them of violating the conditions for using the special regime and losing the right to use it.

After such an event, it is necessary to recalculate all taxes, including VAT. Failure to use account 19 in such a situation will lead to the re-posting of all received documents with the allocation of tax.

When determining what is reflected in the debit and credit of this account, you need to remember that VAT may be reflected here on advance amounts listed to suppliers.

If an organization or individual entrepreneur simultaneously applies several taxation systems, for example OSNO and UTII, then it must organize separate accounting of VAT amounts on purchased goods, works and services that belong to different regimes on account 19.

Attention! Thus, activities that fall under VAT and without VAT can be carried out at the same time. Tax on non-taxable transactions cannot be claimed as a deduction, but must be included in the cost of the acquired assets.

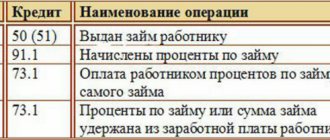

Typical accounting entries for VAT: tax accounting

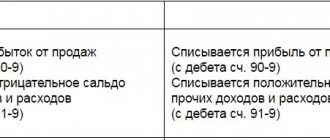

Construction materials previously purchased from Rubin LLC were transferred to pay off the debt on the contribution to the authorized capital of Amethyst JSC. These transactions were reflected in the accounting of Yantar JSC with the following entries: Debit Credit Description Amount Document 10 60 Received construction materials purchased from Rubin LLC (48,350 rubles - 7,375 rubles) 40,975 rubles. Consignment note 19 60 The amount of VAT on purchased building materials is reflected: RUB 7,375. Invoice 68 VAT 19 VAT on the cost of building materials is accepted for deduction of 7,375 rubles. Invoice 58 76 Accounted for the acquisition of a share in JSC Amethyst RUB 54,280. Purchase and sale agreement 76 10 Reflected the transfer of construction materials to pay off the debt on the contribution to the authorized capital of Amethyst JSC 40.975 rubles. Acceptance and transfer certificate 19 68 VAT The amount of VAT on purchased building materials, previously accepted for deduction, was restored 7.375 rubles. As a rule, in account 68, enterprises post the amounts of obligations for value added tax (VAT), income tax (INP), property tax, etc. The accrual of tax amounts is reflected in K68; when transferring funds to the budget and when accepting tax for deduction, D68 is used. Let's consider typical transactions: Debit Credit Description Document 68 19 Tax amount written off as offset (for the purchase of goods, services, works) Invoice, act 68 50, 51, 55 Tax amount transferred to the budget Payment order, cash receipt order 10, 15 68 Inclusion in the cost of materials (stocks) the amount of non-refundable tax Bill of lading 20, 23, 29 68 The amount of accrued tax is taken into account in production expenses Acts, invoices, limit-fence cards 44 68 Accrued tax is taken into account as part of sales expenses Acts, invoices, expense reports Video Lesson: Accounting 68 in Accounting. If the purchased goods were used by the organization for production purposes, the amount of “input” VAT is subject to reimbursement based on a correctly executed invoice received from the supplier. The accountant, reflecting the fact of accepting VAT for accounting and presenting it for deduction, makes the following entries: Dt Kt Description Document 19 60 The amount of VAT paid to the supplier of the goods is taken into account Invoice 68 VAT 19 VAT accepted for deduction Invoice Sub-accounts on account 19 When reflected amounts of VAT on account 19, an organization can open sub-accounts by type of goods purchased: Typical entries on account 19 Account 19 is widely used when reflecting VAT on mutual settlements with suppliers and contractors. In addition, the amount of VAT may be deducted from the cost of goods (services) received from third parties.

Depending on the specifics of the activity and the applied tax regime, additional sub-accounts may be opened, for example: 68.11 - UTII 68.12 - STS The debit of account 68 is intended to record the paid amounts of taxes and fees transferred to the budget. The debit also indicates the VAT presented by suppliers and sent for deduction (reimbursement from the budget). The debit of account 68 corresponds with the credit of accounts, which reflect the movement of funds (cash, non-cash), as well as with the credit of account 19 “VAT on purchased assets.” The credit of account 68 is intended to reflect the amounts of accrued taxes that are subject to payment to the budget. The credit to account 68 corresponds with the debit of various accounts, the choice of which depends on the type of tax. Typical entries for subaccounts of account 68 Debit entries: D68 K50 - the amount of tax or fee was paid to the budget in cash from the cash register. Account 19 in accounting is intended to reflect generalized information about the amounts of VAT paid by the purchasing organization when purchasing goods from the supplier. The article describes the basic rules for using account 19, and also discusses transactions and examples of typical operations in the form of tables. Content

- 1 Accounting for “incoming” VAT on account 19

- 2 Sub-accounts on account 19

- 3 Typical account entries 19 3.1 Example of reflecting account transactions 19

Accounting for “input” VAT on account 19 An organization, when purchasing goods (work, services) from a supplier (contractor), pays the amount of VAT included in the cost of the goods and indicated in the invoice. The amount of tax that is subject to accounting on the basis of received invoices is called “input” VAT and is taken into account on account 19. Example of VAT accounting with postings An organization bought goods from a supplier for 14,750 rubles. (including VAT). After which I sold it completely for 23,600 rubles. (VAT included). A rate of 18% applies to this product. How is accounting carried out in this case, what accounting entries for VAT need to be made (accrual and refund)? Accounting for VAT refunds submitted by the supplier when purchasing goods: The purchased goods are recorded on the account. 41.

When purchasing goods from a supplier, the organization receives documents, including an invoice, which indicates the amount of value added tax. If an organization is not exempt from paying VAT, then it has the right to separate it from the amount and send it for deduction; in this case, goods are included in the receipt at cost without taking into account tax.

Account characteristics

To answer the question which account 19 is active or passive, you need to know where it is reflected in the balance sheet.

You might be interested in:

Write-off of receivables in an organization with an expired statute of limitations: procedure

Since the account reflects the amount of VAT paid upon acquisition, it is reflected in the balance sheet as part of inventories and costs, which are reflected in the active part of the above report. Therefore, according to the Chart of Accounts, account 19 is active, which has a balance reflected in the debit of the account.

Let's take a closer look at what is accounted for in this account. The debit of the account reflects the amount of VAT paid on purchased goods, works, and services. For the credit of account 19, it is necessary to take into account the write-off of previously recorded VAT either on account of the output tax, or in special modes its inclusion in expenses.

The balance at the end of the month is determined based on the following rule. The turnover on the debit of the account should be added to the initial balance and the amount of VAT passed on the credit of account 19 should be subtracted.

Attention! As a rule, account 19 is closed at the time of writing off material assets in production, transferring them into operation, etc.

The account balance at the end of the year is to be reflected in the balance sheet. For this, line 1220 is used. If the requirements of tax legislation are met, this amount can be included in the VAT deduction in the next period.

What subaccounts are used?

The chart of accounts recommends opening the following subaccounts for account 19:

- 19 subaccount 1 - VAT on acquired fixed assets;

- 19 subaccount 2 – VAT on acquired intangible assets;

- 19 subaccount 3 – VAT on purchased inventories.

By analogy, if necessary, an accountant can also open additional sub-accounts:

- 19 subaccount 4 – VAT on services received;

- 19 subaccount 5 - VAT transferred when importing goods into the territory of the Russian Federation from abroad;

- 19 subaccount 6 – VAT on goods at a rate of 0%;

- 19 subaccount 7 – VAT on the construction of non-current assets;

- 19 subaccount 8 - VAT on a decrease in sales value;

- 19 subaccount 9 – VAT on imports of goods from the countries of the Customs Union

- and many others.

Attention! All additional sub-accounts used by the organization must be assigned to the working Chart of Accounts.

Account correspondence

Account 19 can participate in transactions with the following accounts.

Based on the debit of account 19, entries can be made to the credit of accounts:

- Account 60 - when accepting incoming VAT from a supplier for accounting;

- Account 76 - when accepting input VAT on other transactions that are not reflected in account 60.

Using the credit of the account, he can generate transactions with the debit of the following accounts:

- Account 08 - when writing off the amount of VAT that is not reimbursed from the budget for the costs of preparing a non-current asset for operation;

- Account 20 - when writing off the amount of VAT that is not reimbursed from the budget for the costs of main production;

- Account 23 - when writing off the amount of VAT that is not reimbursed from the budget for the costs of auxiliary production;

- Account 25 - when writing off the amount of VAT that is not reimbursed from the budget, general production costs;

- Account 26 – when writing off the amount of VAT that is not reimbursed from the budget for administrative (general business) costs;

- Account 29 – when writing off the amount of VAT that is not reimbursed from the budget for the costs of service and subsidiary farms;

- Account 44 – when writing off the amount of VAT that is not reimbursed from the budget for the costs of preparing goods for sale;

- Account 68 - when carrying out an offset with the output VAT tax;

- Account 91 - when writing off the amount of VAT that is not reimbursed from the budget, other expenses of the organization;

- Account 94 - when writing off the amount of VAT related to inventories that were recognized as a shortage, damaged, etc.;

- Account 99 - when writing off the amount of VAT related to inventories that were lost due to emergency events.

You might be interested in:

Account 60 “Settlements with suppliers and contractors” in accounting: what it is intended for, characteristics, postings

Application of Dt 19 Kt 60 in case of non-compliance with the seller’s documents

When the goods arrive, the buyer accepts them in terms of quality and quantity. If the actual quantity of goods is less than indicated in the documents, the buyer draws up an act where he records the actual quantity (form TORG-2, TORG-3, M-7). If a shortage is detected during acceptance of the goods, the buyer records the quantity, amount and VAT in the amount in which the goods were actually delivered. If for some reason the shortage is discovered later, the postings will need to be adjusted.

Example

Personnel Solutions Agency LLC purchased 10 boxes of paper for accounting with a total cost of 10,000 rubles. (incl. VAT RUB 1,525.42) The seller delivered the goods to the buyer’s warehouse, but upon acceptance, the buyer did not immediately count the number of boxes, reflecting the purchase of the entire batch in accounting:

- Dt 10 Kt 60 - 8,474.58 (received MPZ from the supplier);

- Dt 19 Kt 60 - 1,525.42 (VAT allocated);

- Dt 68 Kt 19 - 1,525.42 (VAT accepted for deduction).

The next day, the warehouse worker discovered that not 10 boxes were received, but 9. The accounting department makes corrective entries:

- Dt 10 Kt 60 - 847.46 (reversal for the amount of shortfall: goods received from the supplier);

- Dt 19 Kt 60 - 152.54 (reversal: VAT allocated);

- Dt 68 Kt 19 - 1,525.42 (reversal: VAT accepted for deduction).

- Dt 76.2 Kt 60 - 1,000.00 (a claim was made for the amount of shortfall);

- Dt 51 Kt 76.2 - 1,000.00 (the supplier transferred the amount of shortfall to the buyer’s bank account).

If surpluses are identified, then the same accounting records are created, however, the surplus amounts are not reversed, but are taken into account as the main supply. Next, you can draw up an additional agreement with the seller establishing new delivery conditions.

Posting examples

Let's look at typical situations using count 19.

VAT deduction

| Debit | Credit | Description |

| 41 | 60 | Purchased goods for resale |

| 19 | 60 | Input VAT taken into account |

| 60 | 51 | Payment for goods has been made to the supplier |

| 68/VAT | 19 | The amount of input tax is presented as a deduction |

Write off VAT on the cost of goods

| Debit | Credit | Description |

| 10 | 60 | Materials for production were purchased |

| 19 | 60 | Input VAT taken into account |

| 10 | 19 | The amount of VAT is included in the cost of materials |

Write off VAT on expenses

| Debit | Credit | Description |

| 41 | 60 | Purchased goods from a supplier |

| 19 | 60 | Input VAT taken into account |

| 91 | 19 | The tax amount is written off as other expenses |

Reflection of VAT when adjusting an invoice

| Debit | Credit | Description |

| 41 | 62 | The buyer returned the goods |

| 19 | 62 | Input VAT on returned goods has been taken into account |

| 68/VAT | 19 | Tax amount accepted for deduction |

What documents accompany VAT accounting?

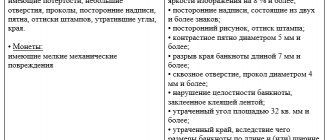

VAT is charged by the supplier on the basis of Art. 168 of the Tax Code of the Russian Federation in the invoice, which he is obliged to provide within 5 days from the date of shipment.

ATTENTION! If the required invoice details are filled in with errors or are missing, the tax amounts are incorrectly calculated, etc., the organization will not be able to reimburse the tax on such a purchase in the future.

If the seller is not a VAT payer, he may not provide an invoice, but then the buyer will not be able to accept the amounts for deduction.

It happens that the parties to a transaction are located in different cities, the flow of documents between them is difficult, and the package of documents for shipment was not provided in full or significant errors were found in them. In such a situation, the buyer is given 3 years to put the documents in order and refund the tax.

In addition, tax cannot be reimbursed in cases where the acquired assets are not accepted for accounting or are not intended for the area of activity of the enterprise that is not subject to VAT.