Accounting

According to clause 6 of PBU 14/2007, intangible assets are accepted for accounting at the actual (initial) cost determined as of the date of its acceptance for accounting.

By virtue of clause 16 of PBU 14/2007, the actual (initial) cost of intangible assets at which it is accepted for accounting is, as a general rule, not subject to change. A change in the actual (initial) value of an intangible asset at which it is accepted for accounting is allowed in cases of revaluation and impairment of intangible assets.

PBU 14/2007 does not provide for other grounds, for example, modernization of an intangible asset to change its actual (initial) cost.

From the above it follows that the costs incurred by the organization and associated with further improvement of intangible assets do not increase the initial cost of intangible assets.

Such expenses can be included by the organization as part of expenses for ordinary activities (clause 5 of PBU 10/99 “Expenses of the organization”, hereinafter referred to as PBU 10/99). They are recognized in the reporting period in which they occurred, regardless of the time of actual payment of funds and other form of implementation (assuming the temporary certainty of the facts of economic activity) (clause 18 of PBU 10/99). Expenses are recognized in the income statement through their reasonable distribution between reporting periods if they lead to the receipt of income over several reporting periods (clause 19 of PBU 10/99).

In accordance with clause 65 of the Regulations on maintaining accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 N 34n, expenses incurred by the organization in the reporting period, but relating to the following reporting periods, are reflected in the balance sheet in accordance with conditions for recognition of assets established by regulatory legal acts on accounting, and are subject to write-off in the manner established for writing off the value of assets of this type.

To summarize information about expenses incurred in a given reporting period, but relating to future reporting periods, the Chart of Accounts uses account 97 “Expenditures of future periods.” The list of deferred expenses is open, that is, the organization has the right to reflect as deferred expenses any expenses related to several reporting periods and meeting the expense criteria established by clause 16 of PBU 10/99.

Taking into account the above, we believe that the costs of upgrading the software can be taken into account either at a time on cost accounts, or on account 97 “Deferred expenses”, followed by an even write-off to the debit of cost accounts over the expected period of use of the modified version of the program.

Taxation

A closed list of expenses that organizations using the simplified tax system can recognize for tax purposes is enshrined in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation. So, the expenses take into account:

- expenses for the acquisition, construction and production of fixed assets, as well as for completion, additional equipment, reconstruction, modernization and technical re-equipment of fixed assets (clause 1, clause 1, article 346.16 of the Tax Code of the Russian Federation);

- expenses for the acquisition of intangible assets, as well as the creation of intangible assets by the taxpayer himself (clause 2, clause 1, article 346.16 of the Tax Code of the Russian Federation).

From a literal reading of the above standards, it follows that they do not apply to cases of modernization of intangible assets. At the same time, paragraph 1 of Art. 346.16 of the Tax Code of the Russian Federation does not contain provisions directly indicating the possibility of recognizing such expenses.

In relation to the procedure for calculating income tax, representatives of the financial department explain that, according to the provisions of Chapter 25 of the Tax Code of the Russian Federation, intangible assets are depreciated, but an increase in their original cost as a result of additional equipment, modernization, reconstruction, etc. is not provided for by the provisions of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated September 27, 2011 N 03-03-06/1/595). It is also clarified that the costs of finalizing intangible assets are taken into account on the basis of paragraphs. 26 clause 1 art. 264 of the Tax Code of the Russian Federation, i.e. as expenses associated with the acquisition of the right to use computer programs and databases under agreements with the copyright holder (license and sublicense agreements) (see letters of the Ministry of Finance of Russia dated May 17, 2018 N 03-03-06/1/33132, dated January 30, 2017 N 03-03-06/1/4386, dated 09/29/2011 N 03-03-06/1/601).

Subclause 19, clause 1, art. 346.16 of the Tax Code of the Russian Federation makes it possible to take into account the costs associated with the acquisition of the right to use computer programs and databases under agreements with the copyright holder (licensing agreements). These costs also include costs for updating computer programs and databases.

Then, if we consider the expenses incurred by the organization as a software update, then they can be taken into account for tax purposes under paragraphs. 19 clause 1 art. 346.16 Tax Code of the Russian Federation. See also letters of the Ministry of Finance of Russia dated July 15, 2019 N 03-11-11/52099, dated July 15, 2019 N 03-11-11/52121, dated June 19, 2019 N 03-11-11/44650.

In this case, expenses are recognized in the generally established manner, i.e. after their actual payment (clause 2 of article 346.17 of the Tax Code of the Russian Federation).

If the modernization of intangible assets is carried out on our own, then the corresponding costs, in our opinion, can be taken into account, for example, as part of material costs, labor costs, costs for all types of compulsory insurance of employees (subparagraphs 5, 6, 7 p. 1 Article 346.16 of the Tax Code of the Russian Federation). So, according to paragraph 4 of Art. 252 of the Tax Code of the Russian Federation, if some costs with equal grounds can be attributed simultaneously to several groups of expenses, the taxpayer has the right to independently determine which group he will attribute such costs to (in paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation a reference is made to the provisions of Article 252 of the Tax Code RF).

We do not have any explanations from the authorized bodies in relation to the situation under consideration. The absence of direct rules related to the modernization of intangible assets in Chapter 26.2 of the Tax Code of the Russian Federation does not exclude tax risks.

Answer prepared by: Expert of the Legal Consulting Service GARANT auditor, member of the RSA Kirill Zavyalov

Response quality control: Reviewer of the Legal Consulting Service GARANT auditor, member of the RSA Elena Melnikova

Acceptance of VAT for deduction on intangible assets

VAT is accepted for deduction on purchased intangible assets if the following conditions are met (clause 2 of Article 171 of the Tax Code of the Russian Federation):

- Intangible assets must be used in activities subject to VAT;

- a correctly executed SF (UPD) is available;

- Intangible assets were accepted for accounting on account 08.05 “Acquisition of intangible assets” (paragraph 3 of clause 1 of Article 172 of the Tax Code of the Russian Federation, Resolution of the Federal Antimonopoly Service of the Ural District dated December 25, 2013 N F09-13315/13 in case N A76-25197/2012).

VAT can be deducted within 3 years after it is registered in account 08.05 “Acquisition of intangible assets”. In this case, VAT must be deducted on intangible assets in the full amount of tax indicated in the invoice (clause 1, 1.1 of Article 172 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated December 19, 2017 N 03-07-11/84699).

At the moment, in 1C, accepting VAT for deduction is possible only after reflecting intangible assets on account 04.01 “Intangible assets of the organization”, i.e. after posting the document Acceptance for accounting of intangible assets . Unlike OS, this may pose a tax risk.

Due to the fact that the Tax Code of the Russian Federation, in order to accept VAT for deduction, does not indicate in which accounting account the object of intangible assets should be accounted for, disagreements between tax authorities and taxpayers cannot be ruled out regarding the issue of counting the 3-year period for claiming this deduction - by analogy with the deduction VAT on fixed assets (Definition of the Armed Forces of the Russian Federation dated September 21, 2015 N 309-KG15-11146). Regarding intangible assets, such judicial practice is not enough to draw any conclusions.

Acceptance of VAT for deduction on intangible assets is formalized by the document Generation of purchase ledger entries in the Operations section - Closing the period - Regular VAT operations. To automatically fill out the Purchased Assets , you must use the Fill .

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt 19.02 - VAT accepted for deduction.

Purchase Book report can be generated from the Reports - VAT - Purchase Book section. PDF

VAT declaration

The deduction amount is reflected in the VAT return:

In Section 3 page 120 “Amount of VAT to be deducted”: PDF

- the amount of VAT accepted for deduction.

In Section 8 “Information from the purchase book”:

- invoice received, transaction type code "".

Accounting for software product modernization (intangible assets)

Quote (AlexandraVV): An intangible asset (software product) is reflected in the accounting records of an organization. The object was created by a third-party organization, relates to intellectual property and meets the conditions for acceptance for accounting as an intangible asset, set out in PBU 14/2007 “Accounting for intangible assets”. The initial cost of intangible assets was formed in accordance with PBU 14/2007 from a set of costs. Later, a third-party organization developed new modules for this intangible asset. How should an organization account for rework costs? Is it possible to increase the initial cost of an existing intangible asset by the amount of rework? Good afternoon! I don’t quite understand—the question concerns tax or accounting? Since it is asked in the tax section of the forum, I will answer from a tax point of view with a link to the letter from the tax authorities posted below. Question: In 2011, the organization paid for services for the development and creation of an Internet site. Under the agreement, the organization received exclusive rights to use the website. The cost of the website exceeds 40,000 rubles, its useful life is more than 12 calendar months. The organization took the site into account for the purpose of calculating income tax as part of intangible assets and calculated depreciation. The useful life of the site has not yet expired. In 2012, the organization paid for services to update the site (developing a new design, updating sections of the site, setting up a feedback system, etc.). From the clarifications of the Ministry of Finance of Russia it follows that the organization has the right to write off the costs of updating the website as part of other expenses associated with production and sales (Letter of the Ministry of Finance of Russia dated July 19, 2012 N 03-03-06/1/346). For the purpose of calculating income tax, does an organization have the right to take into account the costs of updating a website included in the intangible assets at a time or do these costs need to be distributed? If expenses need to be allocated, in what order? Answer: MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION LETTER dated November 6, 2012 N 03-03-06/1/572 The Department of Tax and Customs Tariff Policy reviewed the letter and reports the following on the issue of accounting for the costs of updating computer programs. In accordance with paragraph 1 of Art. 256 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), depreciable property for profit tax purposes is property, results of intellectual activity and other objects of intellectual property that are owned by the taxpayer, used by him to generate income and the cost of which is repaid by calculating depreciation. Depreciable property is property with a useful life of more than 12 months and an original cost of more than 40,000 rubles. Clause 3 of Art. 257 of the Code establishes that for profit tax purposes, intangible assets are the results of intellectual activity acquired and (or) created by the taxpayer and other objects of intellectual property (exclusive rights to them) used in the production of products (performance of work, provision of services) or for the management needs of the organization for a long time (lasting over 12 months). Thus, the above-mentioned property with a useful life of more than 12 months and an initial cost of more than 40,000 rubles is recognized as intangible assets. According to the provisions of Ch. 25 of the Code, intangible assets are depreciated, but an increase in their initial value as a result of additional equipment, modernization, reconstruction, etc. not provided for by the provisions of the Code. Subclause 26, clause 1, art. 264 of the Code establishes that costs associated with the acquisition of the right to use computer programs and databases under agreements with the copyright holder (under license and sublicense agreements) are included in other costs associated with production and sales. These expenses also include expenses for the acquisition of exclusive rights to computer programs worth less than the amount of the cost of depreciable property, defined in paragraph 1 of Art. 256 of the Code. Thus, the costs of updating a computer program, the exclusive right to use of which belongs to an organization, can be taken into account as expenses for the purposes of taxing the profits of organizations on the basis of paragraphs. 26 clause 1 art. 264 Code. The costs of purchasing updates for such programs are allocated taking into account the principle of even recognition of income and expenses. In this case, the taxpayer in tax accounting has the right to independently determine the period during which these expenses are subject to accounting for profit tax purposes. Deputy Director of the Department of Tax and Customs Tariff Policy S.V. RAZGULIN 11/06/2012

Practical situations

Let's look at specific examples of how the acquisition of various intangible assets is reflected in accounting and tax accounting.

Practical situation 1: a patent for a selection achievement has been acquired

On December 10, 2021, LLC "X" acquired from CJSC "U" under an agreement on the alienation of exclusive rights, a patent for a selection achievement for 2,360,000 rubles, including VAT - 360,000 rubles.

When purchasing an intangible asset, the company paid a patent fee in the amount of 660 rubles. for registration of an agreement on the alienation of the exclusive right to a selection achievement.

The selection achievement is supposed to be used for the production of products subject to VAT;

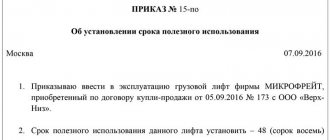

Reference data: By order of the manager, the useful life of an intangible asset is set at 20 years (seventh depreciation group).

According to the accounting policy, depreciation is calculated using the linear method in accounting and tax accounting.

Please note that the transfer of the exclusive right to a selection achievement is subject to VAT (clause 1 of Article 146 of the Tax Code of the Russian Federation, subclause 26 of clause 2 of Article 149 of the Tax Code of the Russian Federation).

The following entries are made in accounting.

In December 2021

Debit 08-5 Credit 60

— 2,000,000 rub. — the purchase price of the patent is reflected in the amount excluding VAT;

Debit 19-2 Credit 60

— 360,000 rub. — the amount of “input” VAT is reflected according to the seller’s invoice;

Debit 60 Credit 51

— 2,360,000 rub. — funds were transferred to the seller of the patent;

Debit 08-5 Credit 76, subaccount “Calculations for patent fees”

— 660 rub. — a fee has been charged for the state registration of an agreement on the alienation of the exclusive right to a selection achievement;

Debit 76, subaccount “Calculations for patent fees” Credit 51

— 660 rub. — the fee for state registration of an agreement on the alienation of the exclusive right to a selection achievement is transferred;

Debit 04 Credit 08-5

— 2000 660 rub. (2,000,000 rubles + 660 rubles) - registration of intangible assets is reflected at the actual (original) cost;

Debit 68, subaccount “Accounting for VAT calculations” Credit 19-2

— 360,000 rub. — the amount of “input” VAT on the intangible asset accepted for accounting is presented for deduction.

In this situation, the initial cost of the intangible asset for tax accounting purposes will differ from the initial cost formed according to the accounting rules for the cost of paying the fee for the state registration of the agreement on the alienation of the exclusive right to a selection achievement.

According to the Determination of the Constitutional Court of the Russian Federation dated December 10, 2002 No. 283-O, patent duties, although they do not have a number of essential features of a tax payment, inherently fall under the concept of a fee established by clause 2 of Art. 8 of the Tax Code of the Russian Federation (see also decisions of the Supreme Arbitration Court of the Russian Federation dated August 28, 2012 No. VAS-5123/12, dated April 11, 2012 No. VAS-308/12).

In tax accounting, this expense is recognized as part of other expenses associated with production and sales, according to clause. 1 clause 1 art. 264 Tax Code of the Russian Federation.

At the same time, it should be noted that the Russian Ministry of Finance expressed a different point of view regarding patent duties. Thus, in letter dated February 6, 2006 No. 03-03-04/1/88, the Ministry of Finance of Russia Fr.

In any case, the right to choose remains with the organization. If patent duties are taken into account for profit tax purposes as part of other expenses associated with production and sales, it will be necessary to draw up a tax register calculating the formation of the initial cost of an intangible asset and make an entry in the register for accounting for other expenses associated with production and sales (see table . 1).

Table 1. Register-calculation of the formation of the initial cost of an intangible asset

| Object name | Patent for selection achievement |

| Patent number | 658453 |

| Date of acceptance for accounting | 10.12.2017 |

| Date of acceptance for tax registration | 10.12.2017 |

| Depreciation group number | 7 |

| No. | Indicators | A source of information | Amount of expense for accounting purposes | Amount of expense for tax accounting purposes |

| 1 | Contractual value of the intangible asset | Agreement on alienation of exclusive rights | 2101694,91 | 2101694,91 |

| 2 | Patent fee | Receipt | 660 | —* |

| Total | 2102354,91 |

*This example considers a situation where an organization has decided to include the cost of paying duties as part of other costs associated with production and sales.

In this situation, the patent duty when taxing profits is taken into account as part of other expenses associated with production and (or) sales (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation). In this regard, at the time of registration of an intangible asset, the specified expense is recognized only for tax accounting purposes (Table 2).

Table 2. Tax register “Other expenses related to production and sales” for December 2021

| No. | Type of consumption | Base | Amount, rub. |

| 1 | Patent fee | Receipt | 660 |

| 2 | And etc. | ||

| Total | 660 |

In accounting, this expense will be recognized as a current expense as depreciation is calculated, that is, from the first day of the month following the month the facility was put into operation. Thus, a taxable temporary difference arises, which will lead to the formation of a deferred tax liability (DTL).

IT for patent duty = 660 rubles. x 20% = 132 rub.

Debit 68 “Accounting for income tax calculations” Credit 77 “IT for patent duties”

— 132 rub. — accrual of deferred tax liability is reflected.

The amount of depreciation for a month in accounting is determined by multiplying the initial cost of an intangible asset by the depreciation rate (Na), calculated based on the useful life of the object:

Na = 100%: 240 months. = 0.42%.

Ames. =2,000,660 x 0.42% = 8,402.77 rubles.

The following entries must be made in January 2021:

Debit 25 (26) Credit 05

— 8402.77 rub. — depreciation of the intangible asset was accrued for the month.

At the same time, the part of the IT related to the reporting month is written off (IT month for patent duty = 132 rubles: 240 months = 0.55 rubles):

Debit 77 “IT for patent duties” Credit 68 “Accounting for income tax calculations”

— 0.55 rub. — reflects the write-off of part of the deferred tax liability relating to the reporting month.

This entry is made throughout the useful life.

Announcement

RUSAUDIT Group of Companies 129085, Russia, Moscow, Mira Ave., 95, tel. (095)217-23-29, web: https://www.russaudit.ru Criteria and composition of intangible assets Currently, the accounting of intangible assets is regulated Regulations on accounting and financial reporting in the Russian Federation, which contains general requirements for intangible assets, as well as PBU 14/2000 “Accounting for Intangible Assets” adopted at the end of last year, which largely specifies the norms of the Regulations on accounting. Due to the relative novelty of PBU 14/2000, a number of requirements contained in it require closer consideration. 1. First of all, it is necessary to note a fundamentally new approach to the question of what rights can be taken into account by an enterprise as intangible assets. Thus, clause 4 of PBU 14/2000 determines that intangible assets do not include any rights to intellectual property objects, but only exclusive rights to these objects. An exclusive right implies that the copyright holder has the entire range of rights to an object of intellectual property. The owner of exclusive rights, without any restrictions from third parties, can use and dispose of the intellectual property at his own discretion (modify, reproduce, copy, distribute, alienate, provide temporary use to third parties, etc.). In contrast, non-exclusive, that is, limited rights allow their owner to use the intellectual property for strictly defined purposes. Thus, when acquiring the right to use a computer program in one’s business activities (for example, for accounting purposes), the owner of such a program cannot modify, copy, or distribute it. Such rights, due to their non-exclusive nature, are not considered by law as an intangible asset. 2. The criteria (requirements) that intellectual property objects must meet in order for exclusive rights to them to be recognized as intangible assets are set out in paragraph 3 of PBU 14/2000. There are seven such criteria in total, among which there are both well-known and new ones. The already known ones include, firstly, the requirement that an intangible asset must be used in the production activities of the enterprise. Moreover, an intangible asset can be used both in the production of goods, works, services, and for the management needs of the organization. The second well-known criterion is the period of intended use of the asset - it must exceed 12 months. The third criterion is the ability of an intangible asset to generate income in the future. We emphasize that, unlike the Accounting Regulations, this refers to the theoretical possibility of receiving income, and not the very fact of receiving it. This formulation, in our opinion, is more correct. Based on this, it is possible that the use of an intangible asset may ultimately be unprofitable for the organization. And finally, fourthly, the enterprise must have documents that confirm the existence of the asset itself (patents, certificates, agreements for the transfer of exclusive rights, etc.). Among the new requirements is the absence of a tangible form for the asset. This rule is formal and just reminds us that it is not the material object (floppy disk, manuscript, documentation) that embodies the intangible asset that is subject to accounting, but the rights to the intellectual property itself (the exclusive right to a program, trademark, utility model and etc.). Another new criterion is that an enterprise, at the time of acquisition (emergence) of exclusive rights to an object of intellectual property, should not assume its subsequent alienation (resale). Otherwise, such an object should be accounted for by the enterprise not as an intangible asset, but by analogy with goods or products. 3. Types of intellectual property objects, the rights to which can be classified as intangible assets, are listed in clause 4 of PBU 14/2000. Among them are inventions, industrial designs, utility models, computer programs and databases, trademarks and service marks. In addition, business reputation is taken into account as part of intangible assets (which is understood as the difference between the purchase price of an organization and the book value of its assets), as well as organizational expenses associated with the formation of a legal entity and recognized as the founder’s contribution to the authorized capital. The above list does not include such widespread objects of intellectual property as works of science, literature and art, as well as “know-how”. However, this does not mean that such objects cannot be considered as intangible assets - these objects are listed in the Accounting Regulations, which have a higher status. It should be taken into account that rights to intellectual property may arise, inter alia, from contracts for the performance of research, development and technological work. This is due to the fact that as a result of performing the specified work, the enterprise may have exclusive rights to such objects of intellectual property as objects of copyright (for example, a work of science) or “know-how” contained in the completed technical documentation. The exception established by clause 2 of PBU 14/2000 in relation to work that was not completed or did not produce a positive result is due to the fact that intellectual property objects arising as a result of work that was not completed or did not produce a positive result do not meet such a necessary criterion of an intangible asset as ability to generate income. Oleg Kornyshev, head of the Department of Taxes and Law IMHO: PBU-14 is complete nonsense, it contains a clause not for credit institutions, the Central Bank for such creativity of the Ministry of Finance (in particular, the criterion for classifying it as fixed assets) says until we say how to take it into account as before. I don’t understand how to take into account according to PBU-14, and until there are precedents, I won’t.

Receipt of intangible assets into the company

Intangible assets can be received by an organization by purchasing it for money, creating it in the organization, or as a contribution to the authorized (share) capital; free of charge, under barter agreements, etc.

When receiving intangible assets, organizations usually enter into the following types of contracts:

— agreement on the alienation of a patent (when acquiring exclusive rights to an invention, utility model or industrial design);

— an agreement on the alienation of the exclusive right to a work (for the acquisition of works of science, art, computer programs and databases);

- work agreement;

— contract for R&D (a type of contract);

— constituent agreement (in case of contribution of intangible assets to the contribution to the authorized capital), etc.

According to Art. 1365 of the Civil Code of the Russian Federation, under an agreement on the alienation of the exclusive right to an invention, utility model or industrial design (agreement on the alienation of a patent), one party (patent holder) transfers or undertakes to transfer its exclusive right to the corresponding result of intellectual activity in full to the other party - the acquirer of the exclusive right (to the purchaser of the patent).

When filing an application for a patent for an invention, the author may attach to the application documents a statement that if the patent is issued, he undertakes to enter into an agreement on the alienation of the patent with any citizen of the Russian Federation or Russian legal entity who is the first to express such a desire and notify the patent holder and federal executive body for intellectual property (clause 1 of article 1366 of the Civil Code of the Russian Federation).

Rospatent publishes information about this application in the official bulletin. The nomenclature of official publications of Rospatent was approved by order of this department dated February 26, 2009 No. 32.

A person who has concluded an agreement with the patent holder on the alienation of a patent for an invention is obliged to pay all patent fees from which the applicant (patent holder) was exempted. In the future, patent fees are paid in accordance with the established procedure.

Under an agreement on the alienation of the exclusive right to a work, the author or other copyright holder transfers or undertakes to transfer the exclusive right to the work belonging to him in full to the acquirer of such right (Article 285 of the Civil Code of the Russian Federation).

An agreement on the alienation of the exclusive right to a work is not subject to state registration, since the emergence, implementation and protection of copyrights does not require registration of a work or compliance with any other formalities (clause 2 of Article 1232, clause 4 of Article 1259 of the Civil Code of the Russian Federation) .

Under a contract for the performance of scientific research work, the contractor undertakes to carry out scientific research stipulated by the technical specifications of the customer, and under a contract for the performance of development and technological work - to develop a sample of a new product, design documentation for it or a new technology, and the customer undertakes to accept the work and pay her. Unless otherwise provided by law or contract, the risk of accidental impossibility of fulfilling contracts for the performance of research, development and technological work is borne by the customer (Article 769 of the Civil Code of the Russian Federation).

When performing R&D, the contractor has the right, unless otherwise provided by the contract, to involve third parties in its execution. The rules on the general contractor and subcontractor (Article 706 of the Civil Code of the Russian Federation) apply to the relations of the contractor with third parties.

The parties to contracts for the performance of research, development and technological work have the right to use the results of the work within the limits and on the conditions stipulated by the contract.

The source of the acquisition and creation of intangible assets is capital investments, which represent the totality of costs for making long-term investments of an organization associated with the acquisition and creation of fixed assets and intangible assets.

Information about the receipt of intangible assets into the organization is first reflected in account 08 “Investments in non-current assets”. A special sub-account 08-5 “Acquisition of intangible assets” is opened for it;

Account 08 - active, debit balance, shows the amount of unfinished investments in intangible assets.

The debit of subaccount 08-5 reflects the amount of actual costs for the acquisition of an intangible asset, included in its actual (initial) cost.

The generated actual (initial) cost of intangible assets accepted for operation and registered in the prescribed manner is written off from the credit of subaccount 08-5 to the debit of account 04:

Debit 04 Credit 08-5

— registration of an intangible asset at its actual (initial) cost and its commissioning are reflected.