Very often, accountants in their work are faced with accounts payable and receivable. They can be both from the organization and from the counterparty. There can be many reasons for their occurrence. This includes incorrect data entry into the program, repayment of debt with another equivalent, etc. Debt, as a rule, is revealed in reconciliation reports.

There are two ways to make mutual settlements and adjustments to debt in 1C 8.3: partial repayment of the debt and full repayment (the debt will be fully repaid). Let's look at the step-by-step instructions.

Debt adjustment

Select the “Debt Adjustment” item in the 1C 8.3 “Purchases” or “Sales” menu.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

Create a new document from the list form that opens and fill out the header. The most important field is “Type of operation”. Depending on it, the composition of the fields changes. Let's look at these types in more detail:

- Settlement of advances. This type is selected if it is necessary to take into account advances in mutual settlements.

- Debt offset. Selected if it is necessary to change mutual settlements against the debt of the counterparty to us, or a third party.

- Transfer of debt. This type is necessary for transferring debts, advances between counterparties or contracts.

- Debt write-off. This implies complete write-off of the debt.

- Other adjustments.

When does a debt adjustment need to be made?

It is almost impossible to imagine the economic activity of any organization without debt. The volume and nature of the debt subject to adjustment can be determined when compiling the turnover (turnover balance sheet). If you work with turnover, you can get a pretty good look at accounts receivable and payable. This allows you to know exactly how the debt adjustment will be made. The intermediate balance indicator in this case can be either positive or negative. In addition, to adjust the debt, you must study the following documents:

- letters from counterparties that are for informational purposes only;

- reconciliation acts;

- content of contracts with counterparties, as well as additional agreements with them.

Automation of accounting significantly simplifies the adjustment process. As a rule, most companies today use 1C programs; it makes adjustments quite simple.

Important! If debt adjustment is not made in a timely manner, this can contribute to the formation of a large volume of receivables, as well as creditors. The latter is more dangerous for the company. All this can lead to taxes being calculated incorrectly. In addition, other consequences may arise that will ultimately lead to bankruptcy of the company.

To carry out a debt adjustment, an important condition is the consent of the parties. This is due to the fact that transactions can be carried out on a net basis, or debt can be written off.

An example of writing off accounts payable in 1C 8.3

In our example, it is necessary to write off a debt of 3,000 rubles, which is owed to the supplier. There may be many reasons, but in this situation they are not particularly interesting to us.

Let's move on to filling out the main part of the document. This can be done automatically using the button of the same name, but keep in mind that there are two of them on the form. In this case, there is no difference, just as with the selected type of operation “Debt transfer”. In other cases, the “Fill” button, which is located at the top of the form, will fill in both accounts payable and accounts receivable.

Manual input is also available here. It is convenient in cases where adjustments are made based on one or two documents.

Everything was filled in correctly automatically. Our receipt of 11 chairs in the amount of 33,000 rubles appeared in the tabular section.

Now we will correct 33,000 rubles to the amount of our debt.

Next, fill out the “Write-off account” tab. In our example, we specified the account as 91.01. In the case where the debt is not with us, but with the counterparty to us, it is necessary to indicate account 91.02.

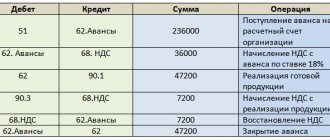

Adjustment of debt according to the reconciliation report: postings

The accountant, based on the results of a reconciliation carried out with the counterparty after the approval of the annual statements, discovered that, according to the act with the counterparty for August last year, they capitalized the work performed instead of the 8,500 rubles indicated in the act. for 10,000 rubles. wiring:

- Dt 20 Kt 60 (reflected in work costs). This error did not affect any balance sheet or financial statement indicator;

- Dt 91 Kt 20 (work costs are recognized as expenses). The error affected the indicators “Retained earnings” (uncovered loss) of the balance sheet and “Net profit” (loss) of the financial results report.

Correcting:

- Dt 20 Kt 60 in the amount of 10,000 rubles. - reversal;

- Dt 20 Kt 60 in the amount of 8500 rubles. — reflected the correct amount in the reconciliation report;

- Dt 20 Kt 91 in the amount of 10,000 rubles. — the erroneous amount for work was restored from expenses;

- Dt 91 Kt 20 in the amount of 8500 rubles. — reflected the correct amount of costs according to the reconciliation report with the counterparty.

How to correct a significant error identified after approval of the reporting by the manager depends on whether it was identified before the approval of the reporting by the organization’s participants or after (clause 3 of PBU 22/2010).

Debt write-off operations

In order to write off debt, appropriate grounds are required. These include:

- expiration of the statute of limitations;

- impossibility of fulfilling the obligation (liquidation of the company);

- unreality of recovery.

Example No. 1: Write-off of accounts receivable

15..2013 carried out an inventory of settlements with customers, during which a reserve was created - 80,000 rubles.

08..2014 the debt to was recognized as unrealistic for collection (the debtor company was liquidated). The amount of bad debt amounted to 120,000 rubles. (including VAT - 20,000 rubles).

| date | DT account | Kt account | Sum | Contents of operation | Document |

| 15..2013 | 91-2 | 80000 | A reserve for doubtful debts has been formed | Accounting policy | |

| 08..2014 | 80000 | Part of the bad debt was written off using the reserve created | Accounting certificate-calculation | ||

| 08..2014 | 91-2 | 40000 | The balance of accounts receivable not covered by the reserve amount is written off | Accounting certificate-calculation | |

| 08..2014 | 76/Deferred VAT settlements | 68/VAT calculations | 20000 | VAT is charged on the amount of written off receivables | Accounting certificate-calculation |

Example No. 2: Write-off of accounts payable

On 31..2014, during an inventory check of settlements with suppliers, overdue accounts payable in the amount of 20,000 rubles were identified, with the statute of limitations expired in June 2014.

| date | Account Dt | Kt account | Sum | Contents of operation | Document |

| 31..2014 | 91/Other income | 20 000 | Expired accounts payable written off | Leader's order. |

In what situations is adjustment carried out?

It is impossible to imagine the economic activity of an enterprise without such a pattern as debts to creditors and debtors. If the debt needs adjustments, the data on it can be viewed in the balance sheet type. It is possible to save both positive and negative values for the intermediate balance.

The adjustment is necessary so that the information about debts from the documents corresponds to what is happening in reality. And exclude the presence of unclear amounts in the corresponding columns.

Creation of adjustments by 1C program

To carry out an operation, the program creates a document that has the same name. It belongs to the sections on purchases and sales, to the group of Settlements with counterparties. First you need to go to this section, and then click on the Create button.

When the form for the documentation to be created appears, enter information on:

- The counterparty with whom mutual settlements require adjustment.

- Writing off debts in relations with suppliers

- The type of operation, which is debt write-off itself.

- Information about the enterprise.

When working with this document, the results are largely determined by the types of operations used.

Dear readers! Our articles talk about typical ways to resolve legal issues with debts, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call . It's fast and free!

- Debt write-off. Usually occurs on the account of income and expenses.

- When debts are transferred. One participant transfers them to a supplier or buyer of another group.

- Debt settlement. Provides the opportunity to adjust mutual settlements on account of a third party or supplier in relation to the enterprise.

- Accounting for advances.

Click on the Fill button in the tabular part of the calculations. The program will perform most actions automatically. You must exclude everything from the list except the document that comes last. We are only interested in him.

All corrections of incorrect amounts are carried out manually.

How to offset advances

Mutual settlement of advances with counterparties is carried out in the following ways:

- When a third party owes a debt to the originating organization.

- Settlement of specific buyers with sellers.

Creating a document for offsetting advances.

Advances intended for counterparties are also processed according to these rules. Mutual settlements are carried out between them and the enterprise, or with the participation of a third party. The organization we are interested in is selected in the field indicating the Buyer. Adjustments cannot be made without advance payments.

It is possible to carry out offsets if the amounts in the calculation results do not coincide with each other. In the tabular part, the larger indicator then changes to a smaller one. Or the choice is made in favor of a specific amount that is already present in the documents.

The document is posted only after the specialist is convinced that there are zero balances.

What will the wiring be like?

Typically, account 60 and credit from account 91 are used for this. Accounts receivable are classified as expenses. And the payable is counted as income. In some cases, a count can be used, which is indicated by the number 19.

Debt transfer operations

Debt transfer is the transfer of receivables or payables from counterparty “A” and its contracts to counterparty “B” and its contracts.

So, let's assume that the debt is 3,000,000 rubles. At the same time, I owe 4,000,000 rubles. , “B” and “C” entered into a tripartite agreement on 04/03/2015, according to which they transferred their debt to . On April 10, 2015, she repaid the transferred debt. 04/12/2015 also paid off the balance of the debt to - 1,000,000 rubles.

The following transactions were made in the accounting department:

| date | Account Dt | Kt account | Sum | Contents of operation | Document |

| 03.04.2015 | 58.03 | 3000000 | Repayment of accounts payable to Company B | Agreement dated 04/03/2015 | |

| 12.04.2015 | 58.03 | 1000000 | Write-off of accounts receivable | Payment order dated 04/12/2015 |

The following transactions were made in the accounting department:

| date | Account Dt | Kt account | Sum | Contents of operation | Document |

| 03.04.2015 | / | / | 3000000 | Transfer of accounts receivable | Agreement dated 04/03/2015 |

| 10.04.2015 | / | 3000000 | Repayment of accounts receivable | Payment order dated 04/10/2015 |

Conducting a debt analysis

It is necessary to generate a report on “Mutual settlements”. This document will allow you to understand the state of relationships with suppliers.

The main thing is to specify in advance and accurately the period for which the report is generated. Filters exist in several varieties, and concern:

- Deals.

- Agreements on mutual settlements.

- Counterparties.

- Company divisions.

- Organizations.

It is acceptable to group using the same parameters.

About other features of the program

Adjusting debt has long ceased to be a simple accounting operation. Now this is a type of document created in special software. You can describe in more detail the order in which the document is created or adjusted.

- First, a new type of reporting is created.

- We select the required adjustment option using the tabs with operations.

- We identify creditors and debtors if necessary to adjust mutual settlements.

- Let's move on to filling out the table section.

- We select accounts payable, which will be repaid at the expense of accounts receivable.

- We use auxiliary accounts if necessary.

Debt write-off is also possible through items with other expenses and income. It is acceptable to use reserves for doubtful debts. The transfer of debts and a number of other, less important operations are also carried out by making adjustments to the corresponding lines.

Rules for settlement and transfer

There are two options for mutual settlement.

- Partially carried out.

- In full.

It is necessary to make data adjustments in the program if serious discrepancies are identified. For example, when performing the following actions:

- Making changes without agreement with the parties.

- Presence of erroneous data in the documentation.

- Providing false information during calculations.

For mutual settlements in the 1C program, a document of the same name is used. Necessary postings must be carried out taking into account his information.

This operation may involve not two, but three parties. This point is also provided in the program. If there are amounts that do not match each other, the transaction becomes invalid. First, they are adjusted.

The essence of mutual settlements is that debts between partners are mutually repaid on the basis of concluded agreements. Mandatory - within the amounts indicated in the documents. Once mutual agreement is reached, the remaining balances can be written off in the future.

The main thing is to provide accounting documents to prove the legality and justification of each action during the transfer.

If the terms of the deal simply change

It often happens that the terms of transactions that have already been completed in practice change and are revised.

Entering additional information to the contract in the 1C program.

Because of this, the cost of goods previously shipped to the buyer is adjusted. The cost changes because:

- Number of valuables shipped.

- The price of the specific objects themselves.

The adjustment in this case is made by agreement between the parties. Which also requires the execution of an additional agreement to the contract. Both parties must notify each other that the price changes. An invoice is issued as a separate document by the seller.

You can use the official printed form to generate a separate document in connection with the changed cost. The program itself offers them when you click on the Print command. It is mandatory to indicate the date of adjustments along with the number. And data on the original document on the basis of which services were provided.

All necessary movements pass through VAT accounting registers. Thanks to the “debt adjustment” function, any accountant can easily choose the method for completing the transaction that seems most convenient to him. It all depends on how economic activities are conducted at a particular enterprise.

The 1C program, when used correctly, will save time and money. After all, many values are calculated automatically. It will not even be difficult to transfer data between several versions of contracts and individual documents when the need arises.

You can see an example of a debt adjustment program in 1C in this video:

Documents confirming the existence of debt

The main condition for accounting for debt for income tax purposes is the ability to document it. There are no documents certified by the buyer, and there is no debt.

What must we have in order to confirm the reality of the debt? These are invoices, acts of work performed, services rendered, acts of transfer of rights, payment orders, extract from the Unified State Register of Legal Entities confirming the exclusion of the organization. A settlement reconciliation act signed by the counterparty to confirm the debt will not be suitable, since this requires only primary documents (clause 1 of Article 525 of the Tax Code of the Russian Federation, Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n, Letter of the Federal Tax Service of the Russian Federation dated December 6, 2010 No. ШС-37-3/16955). If you do not have a primary document, but have a receipt from the debtor confirming the existence of a debt, and competent explanations of why there are no primary documents, then you can try to go to court with these papers.