Explanations to the Balance Sheet and Statement of Financial Results

If annual dividends for the reporting year are declared before the financial statements are signed, this is an event after the reporting date and is subject to reflection in the notes to the Balance Sheet and the Statement of Financial Results. In accounting, this operation is carried out during the dividend accrual period.

If declared but unclaimed dividends were restored during the reporting period, this must also be described in an explanation. This way you will reveal the reasons for the discrepancy between the net profit of the Income Statement and the Balance Sheet data.

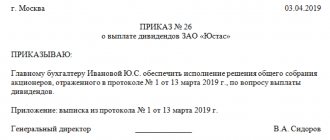

How to cancel a decision to pay dividends

In Art. 43 of the Tax Code of the Russian Federation does not define the period for receiving net profit from which dividends are paid. The company can distribute, based on the results of the current reporting period, both the profit received in the past quarter (six months, nine months) and the retained profits of previous years. In paragraph 1 of Art. 28, pp. 7 paragraph 2 art. 33 of the Law on LLC and paragraph 2 of Art. 42 of the Law on JSC, the source of dividends is not limited only to the net profit of the reporting year.

In a number of explanations, this position is also supported by regulatory authorities (see, for example, Letters of the Ministry of Finance of Russia dated March 20, 2012 N 03-03-06/1/133, Federal Tax Service of Russia dated October 5, 2011 N ED-4-3/ [email protected] ). It is noted that such a procedure for distributing net profit should be reflected in the organization’s charter. And the financial department in Letter N 03-03-06/1/133 named one more condition: the distributed net profit of previous years should not have previously been directed to the formation of a reserve fund and (or) an employee corporatization fund (clauses 1, 2 of Art. 35 of the Law on JSC).

However, when deciding to reclassify the source of dividend payment, it is necessary to take into account the timing of the meeting on the distribution of profits.

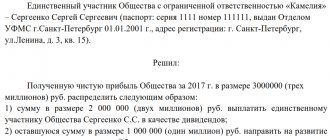

1.1. Adoption by the authorized body of the LLC of a decision to hold a general meeting of participants on the issue of distribution of net profit

According to paragraph 1 of Art. 28 of the LLC Law, the company has the right to decide on the distribution of net profit between participants quarterly, once every six months or once a year.

The issue of distribution of net profit has the right to be considered only by the general meeting of LLC participants (clause 1, article 28 and subclause 7, clause 2, article 33 of the LLC Law).

By unanimous decision of the participants (founders), the charter may include a provision on transferring issues within the competence of the general meeting to the consideration of the supervisory board or collegial executive body.

Thus, by decision of the participants (founders), adopted unanimously, the charter may include a provision on transferring the issue of distribution of net profit to the supervisory board or collegial executive body (clause 1, clause 3, article 66.3 of the Civil Code of the Russian Federation).

If the issue of profit distribution is not submitted to the board of directors (supervisory board) or the collegial executive body, then a general meeting of participants must be held on this issue. The authorized body may initiate consideration of this issue in the following ways:

1) include in the agenda of the planned regular or extraordinary general meeting of participants the issue of distribution of net profit;

2) decide to hold an extraordinary general meeting on this issue.

Bodies authorized to prepare, convene and hold a general meeting of participants

1. Executive body (paragraph 1, paragraph 2, article 35 of the LLC Law).

The LLC Law does not define the competence of which executive body - sole or collegial - has the authority to prepare, convene and hold a general meeting of participants. Therefore, in the case of the formation of an LLC, simultaneously with a sole and collegial executive body, this issue must be provided for in the LLC charter.

2. Board of directors (supervisory board), if the charter of the LLC includes within the competence of this body the resolution of issues related to the preparation, convening and holding of a general meeting of participants (clause 10, clause 2.1, article 32 of the LLC Law).

The procedure for authorized bodies to make a decision on holding a general meeting of LLC participants on the issue of distribution of net profit

Similar to the procedure for making a decision on holding both regular and extraordinary general meetings of LLC participants

Contents of the decision to hold a general meeting of LLC participants

1. Date, place and time of the meeting (if the meeting is held in the form of absentee voting, only the date is indicated).

2. Form of the meeting (joint presence or absentee voting (by poll)).

In accordance with paragraph. 4 p. 2 tbsp. 12 of the Law on LLC, the charter of the company must also contain information on the procedure for making decisions by the company’s bodies. In this regard, the possibility of holding an extraordinary meeting of LLC participants in the form of absentee voting should be provided for in the charter.

In addition, according to paragraph 3 of Art. 38 of the LLC Law, an internal document of the company must regulate the procedure for conducting absentee voting. This procedure should provide for the mandatory notification of the proposed agenda to all members of the company, the possibility of familiarizing all participants of the company with the necessary information and materials before voting, the possibility of making a proposal to include additional issues on the agenda, the mandatory notification of all participants of the company before the voting of the amended agenda, as well as the deadline for the voting procedure.

3. Agenda.

Question 1. On the distribution of part of the net profit of LLC “__________” for _____ (indicate the period: quarter, half-year, year for which the profit (part of the profit) is distributed).

4. Procedure for notifying participants about the meeting.

As a general rule, notice of convening a general meeting is sent by registered mail to the addresses indicated in the list of company participants (Article 36 of the LLC Law). The company's charter may provide for a different procedure.

The procedure for notifying a general meeting must provide participants with the opportunity to properly

According to the requirements of the legislation on limited liability companies, notification of the convening of a general meeting is carried out (Clause 1, Article 36 of the LLC Law):

a) in the manner established by the charter of the company;

b) if the charter of the company does not define the procedure for notification, the notification of convening a general meeting is sent by registered mail to the addresses specified in the list of participants of the company.

Violation of the procedure for notifying a participant about a general meeting may be considered a significant violation, entailing invalidation of the decision of such a meeting.

In addition, the following additional methods of notifying participants may be provided:

- by email;

- in the printed edition.

If the charter does not specify the media in which a message about a general meeting of LLC participants can be posted, and the target audience of the media in which the message is posted does not provide real notification to the participants, the latter are not considered to have been properly notified of the meeting.

5. The postal address to which completed ballots should be sent and the closing date for their acceptance (in the case of a meeting held in the form of absentee voting).

6. Information (materials) provided to company participants in preparation for the meeting, and the procedure for its provision:

— information on the amount of net profit;

— financial statements confirming the amount of net profit for the period for which the profit is subject to distribution;

— information about the presence or absence of grounds preventing the distribution of profits (Clause 1, Article 29 of the LLC Law);

— other information (materials) provided for by the company’s charter.

Information and materials within 30 days before the general meeting of the company’s participants (unless a shorter period is established by the company’s charter) must be provided to all participants for review in the premises of the executive body of the company (clauses 3, 4 of Article 36 of the LLC Law) . At the request of a participant, the company is obliged to provide copies of these documents. The fee charged for providing copies cannot exceed the costs of their production (paragraph 3, paragraph 3, article 36 of the LLC Law).

If the procedure and methods for obtaining information are not determined by the charter, it must be sent along with the notice of convening the general meeting (paragraph 2, paragraph 3, article 36 of the LLC Law).

Determining the amount of net profit to be distributed among the LLC participants

clause 2 art. 42 of the Federal Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies” (hereinafter referred to as the Law on JSC);

- clause 1 art. 6 Civil Code of the Russian Federation;

— Chart of accounts for accounting financial and economic activities of organizations and Instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94 n (hereinafter referred to as the Chart of Accounts).

The procedure for determining the amount of net profit of an LLC

The LLC Law does not contain provisions on the procedure for determining the amount of net profit that can be distributed among the participants of the LLC.

The corresponding provisions on the procedure for determining the amount of profit of joint-stock companies are provided for in paragraph 2 of Art. 42 of the Law on JSC. This procedure, in accordance with paragraph 1 of Art. 6 of the Civil Code of the Russian Federation can be applied to the procedure for determining the net profit of an LLC. According to this norm, the source of payment of dividends is the company’s profit after taxation (the company’s net profit), which is determined according to the company’s financial statements.

When determining net profit based on financial statements, you must be guided by the Chart of Accounts.

Other forms of financial statements

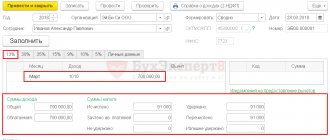

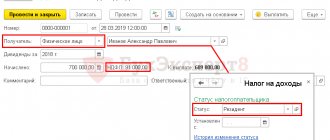

Accrued dividends are also reflected in the Statement of Changes in Capital. For this purpose, line 3327 “Reduction of capital - dividends” is intended here. There are no special features when filling out this indicator.

And reflect the amount of dividends paid on line 4322 “Payments for the payment of dividends and other payments for the distribution of profits in favor of owners (participants)” of the Cash Flow Statement.

When filling out this report, remember that we are talking about cash flow here. Therefore, you need to show the payment of dividends only in cash. If dividends are issued by property, they are not shown in the Cash Flow Statement.

Read in the berator “Practical Encyclopedia of an Accountant”

How to fill out a capital flow statement

How to fill out a cash flow statement

Dividends have been accrued but not paid, what to do?

The company can enter into a loan agreement with any of the founders: those who are on staff (for example, a director), and those who are not. There are no legal restrictions on the amount and term of the loan yet. Therefore, the loan can be issued immediately after signing the agreement by transferring it to a personal card or issuing it from the cash register. If the founder and the director are the same person, he has the right to sign a loan agreement on both sides: both as a borrower and as a lender, the law does not prohibit this, although the courts are suspicious of such agreements: they check everything thoroughly. It is better when the borrower and the lender are different persons, for example, to register another person as acting director at the time of signing the agreement as a director.

Founder of UYUT CJSC Krivtsov P.K. is also a director in this company. On August 23, 2011, he took out an interest-free loan from his organization in the amount of 40,000 rubles. A year later, the loan amount was officially forgiven by signing an agreement on August 23, 2012. The founder used the loan for a year and received material benefits as a result of savings on interest. Personal income tax was withheld from material benefits at a rate of 35%. The amount of material benefit is calculated based on the refinancing rate at the time of debt forgiveness. In our example it turns out to be 8%.

26 Jun 2021 glavurist 1300

Share this post

- Related Posts

- Series and number of the certificate of ownership

- According to a civil contract, what taxes to pay?

- How much does one cube of hot water cost according to the meter 2020

- Car tax calculation 2019