When starting a business, every businessman must choose a taxation scheme. At the moment, both a general regime with payment of a standard tax and special regimes that provide preferential tax payments are available. One of these regimes involves obtaining a patent. But before choosing this form, you should find out whether the patent tax system for individual entrepreneurs in 2021 allows the types of activities (PSN) that the merchant plans to engage in.

The essence of the patent tax system

A patent is a special document that is issued for a specific type of activity and for a specific period. This tax scheme is available exclusively to individual entrepreneurs. You can purchase a permit for a period of one month to a year.

The conditions for obtaining a patent and switching to the appropriate taxation system are:

- Permission to use this scheme in the region where the entrepreneur operates.

- Compliance of the selected activities with the provisions of the Tax Code and regional legislation.

- Permissible number of employees.

- Receiving annual income from activities on the PSN within the limit.

- The area of the sales area or catering facility is up to 50 m2.

The types of activities that fall under the PSN may vary depending on the region. Accordingly, a patent can be obtained only for those of them that are permitted by the Tax Code of the Russian Federation and local regulations.

As for the number of employees, there are some nuances. To apply the patent regime, there is a limitation on the average number of employees hired. At the same time, the number of employees is not counted as a whole for the entrepreneur, but only in terms of doing business under a given tax regime. For example, if an individual entrepreneur combines PSN with UTII, only those employees who are engaged in patent activities are considered.

Important! The average number of employees is determined over the period of validity of the patent.

It is allowed to switch to a patent if the businessman’s income since the beginning of the year is below 60 million rubles. Income for each type of activity carried out under the patent system is taken into account.

Individual entrepreneurs are prohibited from using a patent when working under simple partnership agreements, as well as when concluding an agreement for trust management of property.

In case of violation of the listed conditions, the entrepreneur is obliged to switch to another regime before the expiration of the patent: simplified tax system, UTII, unified agricultural tax or general regime. This applies to exceeding the limit on income or number of employees. The form of settlements with consumers and the source of payment do not in any way affect the application of the special regime. On a patent, you can receive revenue in cash or non-cash form, including budget funds.

Types of activities for PSN

One of the key conditions for the use of PSN is the compliance of the types of activities of the patent for individual entrepreneurs for 2021. Their list is in the Tax Code in paragraph 2 of Article 346.43. The list includes:

- repair of haberdashery and its tailoring (fur, sewing, textile and leather products, hats, knitwear, knitting);

- sewing, repairing, cleaning or painting shoes;

- cosmetic and hairdressing services;

- dry cleaning and laundry services;

- production or repair of metal products (keys, haberdashery, signs);

- repair work to restore the functionality of household appliances, radio electronics, watches;

- furniture repair;

- photo and film services;

- service and repair of motorcycles, vehicles;

- transportation of goods or passengers by motor transport;

- working with glass and mirrors (cutting, artistic processing, glazing);

- repair of buildings and residential premises;

- electrical installation, plumbing, welding work;

- tutoring, educational activities;

- looking after sick people and children;

- acceptance of glass containers and recyclables;

- veterinary services;

- construction activities.

This also includes the creation of handicrafts, as well as the leasing of land or buildings owned by the entrepreneur. There are quite a lot of such types of activities, and regional authorities are allowed to add to the list at their discretion.

Patent types of activities, complete list

- repair and sewing of clothing, fur and leather products, hats and textile haberdashery products, repair, sewing and knitting of knitwear;

- shoe repair, cleaning, painting and sewing;

- hairdressing and beauty services;

- dry cleaning, dyeing and laundry services;

- production and repair of metal haberdashery, keys, license plates, street signs;

- repair and maintenance of household radio-electronic equipment, household machines and household appliances, watches, repair and manufacture of metal products;

- furniture repair;

- services of photo studios, photo and film laboratories;

- maintenance and repair of motor vehicles and motor vehicles, machinery and equipment;

- provision of motor transport services for the transportation of goods by road;

- provision of motor transport services for the transportation of passengers by road;

- renovation of housing and other buildings;

- services for installation, electrical, sanitary and welding works;

- services for glazing balconies and loggias, cutting glass and mirrors, artistic glass processing;

- services for training the population in courses and tutoring;

- services for supervision and care of children and the sick;

- services for receiving glassware and secondary raw materials, with the exception of scrap metal;

- veterinary services;

- leasing (hiring) of residential and non-residential premises, dachas, land plots owned by an individual entrepreneur by right of ownership;

- production of folk arts and crafts;

- other production services (services for processing agricultural products and forest products, including grain grinding, peeling cereals, processing oil seeds, making and smoking sausages, processing potatoes, processing customer-supplied washed wool into knitted yarn, dressing animal skins, combing wool, grooming of domestic animals, repair and production of cooper's dishes and pottery, protection of gardens, vegetable gardens and green spaces from pests and diseases; production of felted shoes; production of agricultural implements from customer's material; engraving work on metal, glass, porcelain, wood, ceramics; production and repair of wooden boats; repair of toys; repair of tourist equipment and inventory; services for plowing vegetable gardens and sawing firewood; services for the repair and production of eyeglasses; production and printing of business cards and invitation cards for family celebrations; bookbinding, stitching, edging, cardboard work ; charging gas cartridges for siphons, replacing batteries in electronic watches and other devices);

- production and restoration of carpets and rugs;

- repair of jewelry, costume jewelry;

- embossing and engraving of jewelry;

- monophonic and stereophonic recording of speech, singing, instrumental performance of the customer on magnetic tape, CD, re-recording of musical and literary works on magnetic tape, CD;

- residential cleaning and housekeeping services;

- residential interior design and decoration services;

- conducting physical education and sports classes;

- porter services at railway stations, bus stations, air terminals, airports, sea and river ports;

- paid toilet services;

- services of chefs for preparing dishes at home;

- provision of services for the transportation of passengers by water transport;

- provision of services for the transportation of goods by water transport;

- services related to the marketing of agricultural products (storage, sorting, drying, washing, packaging, packing and transportation);

- services related to the maintenance of agricultural production (mechanized, agrochemical, land reclamation, transport work);

- green farming and decorative floriculture services;

- management of hunting and hunting;

- engaging in medical or pharmaceutical activities by a person licensed for these types of activities;

- carrying out private detective activities by a licensed person;

- rental services;

- excursion services;

- ritual services;

- funeral services;

- services of street patrols, security guards, watchmen and watchmen;

- retail trade carried out through stationary retail chain facilities with a sales floor area of no more than 50 square meters for each trade facility;

- retail trade carried out through stationary retail chain facilities that do not have sales floors, as well as through non-stationary retail chain facilities;

- public catering services provided through public catering facilities with an area of the customer service area of no more than 50 square meters for each public catering facility;

- public catering services provided through public catering facilities that do not have a customer service area;

- provision of services for slaughter, transportation, distillation, grazing of livestock;

- production of leather and leather products;

- collection and procurement of food forest resources, non-timber forest resources and medicinal plants;

- drying, processing and canning of fruits and vegetables;

- production of dairy products;

- production of fruit and berry planting materials, growing vegetable seedlings and grass seeds;

- production of bakery and flour confectionery products;

- commercial and sport fishing and fish farming;

- forestry and other forestry activities;

- translation and interpretation activities;

- activities for caring for the elderly and disabled;

- collection, processing and disposal of waste, as well as processing of secondary raw materials;

- cutting, processing and finishing of stone for monuments;

- provision of services (performance of work) for the development of computer programs and databases (software and information products of computer technology), their adaptation and modification;

- repair of computers and communication equipment.

For more information about the patent, see the link: Patent taxation system .

Will prepare reports, calculate taxes, help with issuing invoices and other documents. Together with Kontur Elba you will cope with accounting and any routine in a few clicks. More than 600,000 entrepreneurs already use this service.

Download the Classifier of types of entrepreneurial activities (KVPDA) , in respect of which the law of the constituent entity of the Russian Federation provides for the use of a patent taxation system.

Codes and classifier

To determine the possibility of using PSN in relation to a certain area of work, you should study the list of identification codes for types of business activity of a patent, presented in a special classifier. The corresponding codes are indicated in the application for the use of a special regime by analogy with OKVED.

The type of business activity code for patent 2021 consists of 6 digits:

- The first ones indicate the type of activity according to the Tax Code.

- The following numbers are the code of the subject of the Russian Federation.

- Then comes the number assigned in a specific region to a specific type of activity.

For differentiated activities, several numbers are indicated, in other cases the numbering is 01. The classifier for each code contains a link to a regulatory act that allows the conduct of a particular activity in the selected region. Entrepreneurs on PSN who provide services to the public choose code 94.

Classifier of the Federal Tax Service by type of patent activity

To carry out work on a patent, a special identification code for the type of business activity is used. The document on this was approved by the Federal Tax Service of the Russian Federation in 2013. in order No. ММВ-7-3/9. It is part of a whole system of codes provided for taxation of citizens engaged in entrepreneurial activities.

Attention! As of 01/01/2020, some changes to the list of classifiers regarding the conditions for obtaining them came into force. Before filling out the application, you should carefully read the innovations.

The document contains a detailed list of classification objects - activity codes that can be used in the patent taxation regime. Each number consists of three parts:

- ordinal part;

- number of the region of the Russian Federation where the patent is issued (approved by order of the Tax Service of the Russian Federation No. BG-3-13/149);

- code for a specific business activity (assigned on the basis of Article 346.43 of the Tax Code of the Russian Federation).

A separate block contains the names of the codes, which consist of a direct designation of the activity, links to legislation (regulatory acts of the Russian Federation and regions), and an indication of the expiration of the certificate for a specific industry.

The procedure for obtaining a patent and its cost

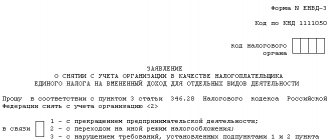

To obtain a patent, you need to submit an application and go through the registration procedure. The transition to this regime is carried out voluntarily. The application should be submitted to the tax authority at the place of registration of the individual entrepreneur at least 10 days before the start of work under the new regime. In addition to personal submission of the document, it is allowed to transfer it through a representative, by e-mail or by a valuable letter containing an inventory of the attachment.

PDF file

Tax officials review applications for no more than five days. The validity period of a patent cannot exceed a calendar year, and transfer to the next year is prohibited. This means that you can obtain a patent in August for a maximum of 4 months. If an individual entrepreneur ceases its activities before the expiration of the PSN, the time of actual work in this mode is considered as the tax period.

The tax rate on PSN is 6%, but regional authorities have the right to adjust the figure downwards. Patent calculation for 2021 is made according to the formula:

Tax = (Base / 12 months × term) × 6%

- The base represents the potential income of a businessman. Its size is determined by the type of activity and the place where it is carried out.

- The term is the period of validity of the patent chosen by the entrepreneur.

When purchasing a trade patent for an individual entrepreneur for 2021 for a period of up to 6 months, the individual entrepreneur pays the entire amount one time until the patent expires. When purchasing for 6-12 months, a third of the amount is paid within 90 days from the date of receipt of the document, another two-thirds - before the expiration of its validity period. The actual income received does not affect the value of the patent.

The patent term is easy to extend. To do this, it is enough to submit an application to the tax authorities before December 20. In some regions, tax holidays are provided for beginning businessmen - the opportunity to work with a zero interest rate for a specified period. This benefit applies to certain types of activities.

Important! To calculate the cost of a patent, you can use an online calculator.

How much does a patent cost for an individual entrepreneur?

Before purchasing a permit, it is important to calculate its exact cost. Based on the data obtained, you can compare whether it is profitable to work under the PSN or whether it is easier to use another tax regime. One of the features of the patent system is the upfront payment of the cost of permission. The contribution amount is calculated not based on the actual income received, but on the potential income. The amount of expected revenue is determined by local legislation for each specific type of activity.

In addition to the expected income, other indicators influence the cost of the permit:

- validity period of the document;

- number of employees;

- number of vehicles;

- presence of several retail outlets.

Tax calculation procedure

The cost of a certain type of patent for an individual entrepreneur for 2021 depends on the basic income, the amount of which is calculated individually for each type of business in a particular region, as well as the calendar period for which the permit is issued. The annual tax rate is fixed at 6%. Based on this, the calculation formula will look like this:

- SP = BD x 6%, where;

- SP – patent cost;

- DB – basic profitability.

Provided that the individual entrepreneur acquires a permit for a period of less than one year, the result obtained is divided by 12 (the number of months in the year), and then multiplied by the required number of periods:

- SP = BD x 6% / 12 x KM, where;

- SP – patent cost;

- BD – basic profitability;

- KM – number of months.

Example:

A businessman from Moscow plans to repair shoes in 2021. The basic profitability according to the law is 660 thousand rubles. The cost of a permit for a year will be:

- 660,000 x 6% = 39,600 rub.

If the activity falling under the patent, the individual entrepreneur will be carried out for only 6 months, the result obtained must be divided by 12 and multiplied by 6:

- 39,600 / 12 x 6 = 19,800 rub.

If it is difficult to make the calculation yourself, you can use the online calculator located on the official portal of the Federal Tax Service. It can be used by any citizen who wants to obtain information about the cost of a patent, regardless of whether it is registered or not. The scheme of working with the calculator does not cause any particular difficulties and consists of filling out the following fields:

- Period. The calendar year in which the business is expected to be conducted is selected.

- Period of use. Here you enter the number of months per year during which the entrepreneur will work.

- Federal Tax Service. You must select the name of the tax office, for example, 77 - Moscow city.

- Municipality. The specific area in which the business will be conducted is determined.

- Kind of activity. From the list you must select the direction in which the merchant will work.

- Meaning. Filled in when selecting certain types of activities, for example, to indicate the number of trade objects, etc.

- Calculate. After filling out all the fields, you need to click the “Calculate” button, after which the program will issue the amount required for payment.

Example:

- Khachapuri with cheese: recipes with photos

- How to get rid of papilloma at home

- Measles in adults - signs and symptoms of the disease, photo

An entrepreneur from Moscow plans to engage in rental services in 2018 for 7 months. Enter data:

- period – 2018;

- period of use – 07;

- Federal Tax Service - 77 - Moscow city;

- municipal formation - for example, Administration of the municipal formation of Tverskoy;

- type – rental services.

After clicking the “Calculate” button, information will appear on the screen that the cost of the patent for this period is 34,650 rubles, and the tax is paid in two parts:

- RUB 11,550 – within 90 calendar days from the date of issue of the patent;

- RUR 23,100 - until the permit expires.

Tax holidays

Russian legislation may establish a zero tax rate – tax holidays. A free patent is issued for a period of 2 years from the date of opening your own business, provided that:

- a citizen is registered as an individual entrepreneur for the first time;

- activities are carried out in the social, scientific and production spheres, including the provision of consumer services to the population.

Tax holidays are in effect until 2021. In addition, for merchants engaged in business in the Republic of Crimea and the city of Sevastopol, until 2021, the tax contribution rate for all types of commercial activities or individual positions can be reduced to 4% (instead of the legally established figure of 6%). Such a relaxation for individual entrepreneurs is recorded in the Tax Code of the Russian Federation - clause 2 of Art. 346.5.

Advantages and disadvantages of PSN

PSN gives an entrepreneur a number of advantages when working with both citizens and legal entities. One of the main advantages is the exemption from most taxes: on property used within this regime, personal income tax on income received under a patent, VAT on transactions related to this regime.

If a businessman combines PSN with another taxation scheme, activities under these regimes are subject to different taxes. When a patent is combined with the simplified tax system, compliance with the income limit is assessed based on all profits received under both special regimes.

The advantages also include:

- Relatively low patent cost.

- Possibility to choose the validity period.

- Possibility of acquiring several patents to work in different areas in selected regions.

- No tax reporting - only a declaration is submitted, which significantly saves time and nerves.

- Extensive list of activities.

Among the disadvantages of PSN are strict restrictions on the number of employees and the size of the sales floor. The patent has to be paid not based on the results of the activity, but during the period of its implementation. The cost of a patent cannot be reduced by paying insurance premiums.

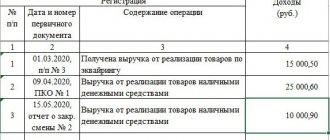

Patent reporting

If an entrepreneur works under several patents, he has to keep a book of income. This is necessary to calculate total earnings, which should not exceed 60 million rubles.

Businessmen on PSN who have entered into contracts with employees must provide reporting for calculating salaries and paying taxes on them. For this purpose, SZV-M is compiled monthly, and calculations of insurance premiums are made quarterly. You will also have to submit information on forms 6-NDFL, SZV-STOAZH and 2-NDFL.