Accounting for depreciation (depreciation) of fixed assets

The straight-line method of calculating depreciation involves writing off the cost of an object in equal amounts over its service life.

For example, if the initial cost of the object is 10,000 rubles. if its service life is 5 years, then the annual depreciation amount is equal to: 10,000: 5 = 2,000 rubles. The depreciation rate is constant. The accrual of depreciation is suspended for objects that, by decision of the head of the organization, are under reconstruction and modernization for more than 12 months or are transferred to conservation for a period of more than three months.

- straight-line method - depreciation is calculated based on the original cost of the property, which is calculated based on the useful life of the property

- reducing balance method - depreciation is calculated based on the residual value of the object at the beginning of the reporting period and the depreciation rate, which is calculated based on the useful life of the fixed asset and a coefficient of no more than 3, which is established by the organization itself

- a method of writing off value based on the sum of the numbers of years of the useful life of a fixed asset - depreciation is calculated based on the original cost and the ratio, the numerator of which is the number of years remaining until the end of the useful life of the property, and the denominator is the sum of the numbers of years of the useful life

https://www.youtube.com/watch{q}v=habR0zvpILI

Resolution of the State Statistics Committee of Russia dated January 21, 2003 N 7 (clause Selections from journals for an accountant If a plot is purchased for a fee, its initial cost includes: amounts paid in accordance with the agreement to the seller; registration fees, state duties and other similar payments made in connection with acquisition and registration of land rights;

expenses for paying for the services of organizations producing cadastral registration documents; expenses for land surveying; remuneration of the intermediary organization through which the land plot was acquired; payments for providing information about registered rights; expenses for payment of services of authorized bodies for the assessment of land plots, production of cadastral and technical registration (inventory) documents of real estate objects and other costs directly related to the acquisition and registration of the object.

First Capital Legal Center Telephone, 7 (985) 776 13 39 Is the land plot an object of fixed assets{q} First of all, let’s find out whether the land plot is an object of fixed assets for profit tax purposes. According to para. 1 clause 1 art. 257 of the Tax Code of the Russian Federation, fixed assets are understood as part of the property used as means of labor for the production and sale of goods (performance of work, provision of services) or for the management of an organization, with an initial cost of more than 40,000 rubles. Moreover, from the title of this article it follows that it establishes the procedure for determining the value of depreciable property.

From this we can conclude that fixed assets are depreciable property. But does this apply to all fixed assets{q} The concept of depreciable property is given in paragraph 1 of Art. 256 Tax Code of the Russian Federation.

Accounting provisions “Accounting for fixed assets” PBU 6/01″, approved. LAND ACCOUNTING, revaluation, taxation, how to draw up {q} 5 PBU 6/01). In accordance with paragraphs. 7 and 8 PBU 6/01, fixed assets are accepted for accounting at historical cost, which recognizes the amount of the organization's actual costs for the acquisition of fixed assets, excluding VAT and other refundable taxes, including state duty paid in connection with the acquisition of fixed assets.

The actual costs of purchasing fixed assets are, in particular, the amounts paid in accordance with the contract to the supplier (seller). Since the consumer properties of a land plot do not change over time, in accounting based on clause Accounting for fixed assets (FA), such property is intended for resale, therefore it cannot be regarded as fixed assets.

We suggest you read: Is it possible to return perfume to the store{q} Rules for returning perfume.

In this article we will look at: depreciation of land in accounting and tax accounting. Let's find out whether it is possible to calculate depreciation of the asphalt pavement. We will answer your questions. Companies acquiring land on a property basis are required to reflect the land on their balance sheet in accordance with the procedure for accounting for fixed assets.

The objects of land relations, as we have already noted, are, in particular, land plots. According to Art. 11.1 of the Land Code of the Russian Federation, a land plot is a part of the earth’s surface, the boundaries of which are determined in accordance with federal laws. Land plots are formed when dividing, merging, redistributing land plots or separating them from land plots, as well as from lands in state or municipal ownership, as established by Art. 11.2 Land Code of the Russian Federation.

Depreciation is not accrued on fixed assets received under a gift agreement or free of charge during the privatization process, on housing stock, external improvement facilities and other similar forestry and road facilities, specialized shipping facilities and other facilities, productive livestock, buffaloes, oxen and deer, perennial plantings that have not reached operational age, as well as purchased publications (books, brochures, etc.).

First of all, we will find out whether the land plot is an object of fixed assets for profit tax purposes. According to para. 1 clause 1 art. 257 of the Tax Code of the Russian Federation, fixed assets are understood as part of the property used as means of labor for the production and sale of goods (performance of work, provision of services) or for the management of an organization, with an initial cost of more than 40,000 rubles.

What applies to fixed assets

In the future, when accepting the purchased formwork for accounting, the manager’s order can indicate that the useful life of the formwork is determined based on the manufacturer’s recommendations, taking into account the needs of creating a specific structure at a specific facility.

Cost limit for accounting as part of OS

If the cost of non-production objects does not exceed 40,000 rubles. (or another limit approved by the organization), they can be reflected as part of the inventory (clause 5 of PBU 6/01). In this case, the organization will not have to charge depreciation on such objects. The cost of non-production objects does not apply to the cost of production, so write it off on account 91 “Other income and expenses.”

Consequently, the initial cost of the building includes RUB 75,000,000. (RUB 120,000,000 x 62.5%), and the initial cost of the land plot is RUB 45,000,000. (RUB 120,000,000 x 37.5%) or (RUB 120,000,000 - RUB 5,600,000).

The cost of the building is repaid through depreciation (clause 17 of PBU 6/01). Depreciation charges under the linear method of calculating depreciation are calculated monthly based on the original cost of the building and the depreciation rate calculated on the basis of the useful life of the building, which is established by the organization when accepting the building for accounting. This follows from clause 18, paragraph. 2, 5 clause 19, clause 20 PBU 6/01.

We recommend reading: Federal Law Providing Land to Large Families

Accounting

The initial cost of an OS is defined as the sum of expenses for its acquisition, construction, manufacturing, delivery and bringing it to a state in which it is suitable for use (paragraph 2, paragraph 1, article 257 of the Tax Code of the Russian Federation).

Tax accounting involves the formation of depreciation deductions linked to depreciation groups. The list of such groups and their features are established by Art. 258 Tax Code of the Russian Federation. A breakdown of classification characteristics and exact service life for each category of fixed assets are given in government decree No. 1 dated January 1, 2002.

Land – depreciation group 7, if the territory belongs to landfill sites. This conclusion can be drawn according to international standards for conducting accounting operations. The areas located under buildings are not included in the depreciation group of assets. The cost of such plots does not affect the amount of depreciation charges for structures located on their surface. The accountant must organize separate accounting of the land and other fixed assets located on it.

Is depreciation charged on a land plot: accounting rules

Which depreciation group does the land plot belong to? This type of asset is not indicated in the classification scheme. Tax accounting rules in relation to land plots coincide with accounting provisions. In paragraph 2 of Art. 256 of the Tax Code of the Russian Federation specifies the list of objects that are considered non-depreciable. These include land resources, subsoil, and water sources.

Resolution No. 7 of the State Statistics Committee

of the Russian Federation

[3] does not contain a special form of the primary document for processing the operation of registering a land plot.

Consequently, organizations have the right to use form No. OS-1 “Act of acceptance and transfer of fixed assets (except for buildings, structures)”

.

At the same time, for organizations of the agro-industrial complex, Order of the Ministry of Agriculture of the Russian Federation No. 750

[4] approved a specialized form

No. 401-APK “ Act for the registration of land”

.

The act reflects the following information: quantity, type of land, quality of land, book value of the object being registered.

Which depreciation group does the land belong to?

- is recognized as expenses of the reporting (tax) period in an amount not exceeding 30 percent calculated in accordance with Art.

274 of the Tax Code of the Russian Federation of the tax base of the previous tax period, until the full amount of these expenses is fully recognized, unless otherwise provided by Art. 264.1 Tax Code of the Russian Federation.

In this case, to calculate the maximum amount of expenses, the tax base of the previous tax period is determined without taking into account the amount of expenses of the specified tax period for the acquisition of rights to land plots.

Simplified tax system: are land plots subject to depreciation?

In accounting, acquired land plots are classified as fixed assets and are taken into account at their original cost. The initial cost includes the amount of actual costs for the purchase of the site, including the state fee for registering the transfer of ownership of land (paragraph 2, paragraph 5, paragraphs 7, 8 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/ 01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n).

A land plot can be taken into account as an object of fixed assets from the moment of its use and the drawing up of an act of acceptance and transfer of an object of fixed assets in form N OS-1, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 N 7 (clause 52 of the Guidelines for accounting of fixed assets approved by Order of the Ministry of Finance of Russia dated October 13, 2003 N 91n).

Our company is on a simplified taxation system. In 2005, acquired a plot of land. Should we increase fixed assets by the cost of land, given that land is not subject to depreciation, and fixed assets are only subject to depreciable property{q}

Accounting and taxation of transactions with land plots

The first option seems to be the riskiest. The costs of acquiring land ownership in full are included in material costs on the basis of paragraphs. 3 p. 1 art. 254 Tax Code of the Russian Federation

:

“Material expenses, in particular, include the following taxpayer costs...

We recommend reading: For Which Year is the Car Tax Paid in 2020

Contents of operation

To accept for accounting of land, land shares, including for temporary use, specialized forms of primary accounting documentation for organizations of the agro-industrial complex No. 401 APK, No. 402 APK, No. 403 APK, approved by order of the Ministry of Agriculture of the Russian Federation dated May 16,

2003, .

No. 750" .

If this type of property assets directly affects the process of producing products, providing services, performing work, determining the result in terms of quantity and quality, then it is classified as active .

IMPORTANT ! In each economic sector, these groups have their own specifications: for example, in agriculture, the composition of fixed assets for the same groups may differ significantly from industrial.

Active and passive fixed assets

- industry of application – means for the production of goods, provision of services or performance of work;

- property – property assets can be divided according to their forms of ownership into public, private, etc.;

- involvement - according to the degree of involvement in the activities of the enterprise, one can distinguish directly used operating systems, backup, spare, repaired, reconstructed, mothballed, etc.;

- source – own property, rented, leased, etc.;

- territory - fixed assets on the balance sheet of a particular enterprise, industry, district, republic, territory, region, city or any other structural territorial unit;

- age – a certain depreciation group, that is, division depending on the maximum useful life;

- form of existence – tangible and intangible funds (according to the all-Russian classifier).

State measures such as recording all land plots, dividing them into categories, establishing restrictions on use, etc., pursue an important goal - the protection of a valuable natural resource , the quantity of which is limited for objective reasons.

- agricultural;

- settlements;

- industrial and other special purposes (transport, various types of communications, defense and security, etc.);

- specially protected natural, historical and cultural sites and territories;

- forest fund;

- water fund;

- reserve lands.

Useful video

- farming itself, all its types;

- personal subsidiary farming of citizens;

- gardening and gardening;

- country house construction (seasonal);

- organization of farming;

- construction of the necessary infrastructure to serve agricultural producers.

Non-agricultural land is occupied by various auxiliary structures. These may include: roads, communications, protective forest belts, reservoirs, buildings that support agricultural production.

Is depreciation charged on land in tax accounting{q}

However, this period cannot be less than 5 years. Or include in the tax base a share of the costs of purchasing a plot in the amount of 30% of the entire base for the previous period and thus act until the costs are fully paid off. This assumption in tax legislation leads to discrepancies between accounting and tax accounting and, accordingly, permanent tax differences.

- The land is used as a quarry for mining. If a site is acquired for the purpose of mining, its cost must be depreciated in the general manner. The quarries belong to the 7th OS group with a useful life of 15 to 20 years.

- The site is used to accommodate a waste dump. If land is acquired for use as a municipal waste dump, the site has a limited useful life and is therefore subject to depreciation as required.

According to clause 41 of the Methodological Instructions, the revaluation of fixed assets is carried out in order to determine the real value of fixed assets by bringing the original cost of fixed assets in line with their market prices and reproduction conditions on the date of revaluation.

You can take into account the costs of purchasing a land plot only when selling it later. Then, on the date of transfer of the plot to the buyer, the seller of the land reflects the income from the transaction, reduced by the cost of acquiring the plot and expenses for its sale (Articles 271, 268 of the Tax Code of the Russian Federation).

We suggest you read: How to get the cadastral number of a land plot

Instructions for the application of the Chart of Accounts for the accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n “On approval of the Chart of Accounts for the accounting of financial and economic activities of organizations and instructions for its application”, to summarize information about the costs of the organization for objects that will subsequently be accepted for accounting as fixed assets, account 08 “Investments in non-current assets” is assigned, subaccount 08-1 “Acquisition of land plots” until the organization registers ownership of the land plot in the Unified State registry

With the Unified Agricultural Tax for tax purposes, only those expenses that are listed in paragraph 2 of Article 346.5 of the Tax Code of the Russian Federation can be taken into account. This also includes the costs of acquiring property rights to land plots, including the costs of acquiring the right to conclude a land lease agreement.

Expenses for the acquisition of a land plot are recognized evenly over a period determined by the organization, but not less than seven years. Amounts of expenses are reflected on the last day of the reporting (tax) period (subclause 31, clause 2, clause 4.1, article 346.5 of the Tax Code of the Russian Federation). The same explanations are given in the letter of the Ministry of Finance of Russia dated July 16, 2008 No. 03-11-04/1/14.

- book value of the plot – 1,050,704 rubles;

- the cost of the right to conclude an agreement with the municipality is 3,990,407 rubles. (paid in April 2020);

- The amount of state duty for registering a land lease agreement is 14,000 rubles. (paid in April 2020);

- start of construction of the warehouse - May 2021, commissioning of the facility - February 2020;

- useful life of the warehouse is 25 years;

- the period for writing off expenses for concluding an agreement with the municipality is 4 years;

- State registration documents are dated 05/18/2020.

- The construction of a road is inextricably linked with the creation of a fixed asset. The most common situation is that the contractor, as part of the contract for the construction of a building, has undertaken obligations to develop the adjacent territory (in this case, paving the road). Another example is that asphalt pavement is an integral part of the overall design of a construction site.

- The asphalt pavement was created without attracting targeted funding; its creation complies with legal requirements. For example, according to technical safety requirements, an asphalt site is required on the production site of an enterprise. In this case, the asphalt pavement is recognized as an asset and is depreciated in the general manner.

Question No. 1: Can an organization use the simplified tax system to calculate depreciation on a land plot{q}

Answer: The procedure for calculating depreciation on land does not depend on the taxation regime chosen by the company. Land is not subject to depreciation for both “general regime” and “simplified” enterprises.

Question No. 2: The store paved the road around its own territory and equipped sidewalk areas. Is this type of asphalt pavement recognized as depreciable property{q}

Answer: The position of the Ministry of Finance clearly denies the possibility of accruing wear and tear on store improvement facilities, including asphalt paths and sidewalks.

Question No. 3: The asphalt surface of the parking lot is recognized as depreciable property (due to the fact that the creation of an improvement facility is directly related to production activities). Which fixed assets should cover be classified as?{q}

We invite you to read: Dismissal of a disabled child, working off

Answer: For depreciation purposes, the asset should be classified as a separate structure with a specified useful life. If the covering is installed on a leased land plot, then the improvement object must be classified as a capital investment.

Repayment of the valuation of fixed assets through depreciation is regulated by the norms of PBU 6/01. The document provides a list of assets that are not subject to depreciation. These include objects for which:

- there is no provision for changes in quality characteristics in the short and long term;

- consumer properties are not influenced by external factors; objects can continue to be used for their intended purpose indefinitely.

This category of assets also includes environmental management facilities with museum exhibits. The fact that the life of a land allotment is reflected in the accounting policy cannot become a basis for violating the rules of PBU.

Tax accounting involves the formation of depreciation deductions linked to depreciation groups. The list of such groups and their features are established by Art. 258 Tax Code of the Russian Federation. A breakdown of classification characteristics and exact service life for each category of fixed assets are given in government decree No. 1 dated January 1, 2002.

Documentation procedure

The legislation does not provide for any special documents intended for recording land plots. The main document is the contract. In this case, you will need to prepare it in 3 copies, one of which is transferred to Rosreestr.

The transfer of land can also be carried out under an agreement, but in this case it must indicate that it is also an act of acceptance and transfer. You can choose the form for reflecting transactions with fixed assets in the company yourself, but such unified documents as OS-1, OS-6 and OS-6b can also be used.

Sometimes a company does not purchase a plot, but receives it as a contribution from the founder as a gift or in exchange for other property. In this case, an objective assessment of the land plot will be required, as well as its acceptance for registration at cadastral value . If a company leases a site, a lease agreement must be drawn up. For a long lease period, such an agreement must be registered with Rosreestr.

Is depreciation charged on land plots purchased for the construction of residential buildings{q} (D

The database contains cases:

- — civil proceedings

- - administrative proceedings

- — criminal cases of open court proceedings

Simple and convenient search for documents:

- - by territory

- - by court

- - by date

- - type

- - by case number

- - on both sides

- - according to the judge

We have developed a special type of search - SEARCH BY CONTEXT, which is used to search the text of court documents using specified words. All documents are grouped into individual cases, which saves time when studying a specific court case. Each case is attached with an information card that contains brief information on the case – number, date, court, judge, type of case, parties, history of the process indicating the date and action taken.

1. Responses of government bodies to specific questions from citizens and organizations in various sectors of activity. 2. Your practical source for applying the law. 3. The official position of government bodies in specific legal situations requiring decisions.

Question: The land was registered as the property of the organization

The land was registered as the property of the organization. The organization's repair workshops are located on this site. The land plot should be accounted for as a fixed asset{q} Is depreciation charged on land{q}

Land plots are also taken into account as part of the OS (clause 5 of PBU 6/01). According to clause 17 of PBU 6/01, fixed assets whose consumer properties do not change over time (land plots and environmental management facilities) are not subject to depreciation.

Calculation of depreciation on a land plot

a) use in the production of products or for the management needs of the organization; b) use for a long time (useful life over 12 months); c) the organization does not intend to subsequently resell these assets; d) the ability to bring economic benefits (income) to the organization in the future.

Therefore, if any expenses associated with the acquisition of an object are incurred by the organization after its inclusion in fixed assets, do not change the original cost. And take into account the costs as part of expenses for ordinary activities.

- the cost of purchasing the property;

- the costs of delivering the object and bringing it into a condition suitable for use. For example, the cost of services of a transport organization or the salary of employees who assembled and installed the object;

- submitted VAT. True, they do this only if they plan to use the fixed asset in activities that are not subject to this tax. In other cases, VAT and excise taxes are not taken into account in the initial cost.

Land plot useful life

Due to the fact that a land plot is not recognized as depreciable property, its value is not taken into account when calculating the residual value of fixed assets for the transition to the simplified tax system.

Rationale:

In accordance with paragraph 16, paragraph 3, Article 346.12 of the Tax Code of the Russian Federation, organizations whose residual value of fixed assets, determined in accordance with the legislation of the Russian Federation on accounting, exceeds 100 million.

rubles, is not entitled to apply the simplified taxation system. For the purposes of this subclause, fixed assets that are subject to depreciation and are recognized as depreciable property are taken into account in accordance with Chapter 25 of the Tax Code of the Russian Federation.

In addition, according to clause 4 of Article 346.16 of the Tax Code of the Russian Federation, for the purposes of Chapter 26.2 “Simplified Taxation System”, fixed assets are included in fixed assets that are recognized as depreciable property in accordance with Chapter 25 of the Tax Code of the Russian Federation.

Clause 1 of Article 256 of Chapter.

25 of the Tax Code of the Russian Federation establishes that depreciable property is property, results of intellectual activity and other objects of intellectual property that are owned by the taxpayer (unless otherwise provided by this chapter), are used by him to generate income and the cost of which is repaid by calculating depreciation. Depreciable property is property with a useful life of more than 12 months and an original cost of more than 40,000 rubles.

Based on the provisions of paragraph 2 of Article 256 of the Tax Code of the Russian Federation, land and other environmental management facilities are not subject to depreciation.

Based on the above, the land plot is not recognized as depreciable property, therefore, its value is not taken into account when calculating the residual value of fixed assets for the transition to the simplified tax system. Therefore, the organization has the right to switch to the simplified tax system from 01/01/2016. subject to other restrictions for the transition.

Razumova I.V. LLC "IK U-Soft" Regional center of the ConsultantPlus Network

Please note that legislation may have changed. The expert's opinion is based on the provisions of the legislation in force on the date of preparation of the consultation

If you have not found the answer to your question, please contact us for advice. We will be happy to answer your question based on verified documents included in the Consultant Plus System

Ask a Question

Which depreciation group does the land belong to?

It turns out that in this case the land does not “wear out”, and its book value changes over time only due to improvements and revaluations. As for accounting, in this case the provisions of PBU completely coincide with tax legislation.

The position on non-accrual of depreciation on land in accounting is confirmed by PBU 6/01. Leased land: postings If a company leases a plot, then there is no need to charge depreciation on it either. The value of land received for temporary use should be reflected on the balance sheet.

Depreciation must be charged only on fixed assets located on the leased site.

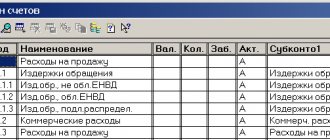

Example. Then all the entered depreciation settings will not matter. But you will have to fill them out, since they are required. Do not forget to indicate the account of the fixed asset itself.

This field is hidden after all the shock absorption settings and is easy to miss. If you maintain management accounting for fixed assets, then the tab for this type of accounting is filled out in the same way. But in tax accounting you need to set the value Cost is not included in expenses.

Tax accounting in the document Acceptance of fixed assets for accounting in 1C UPP and Complex 1.1 That's it - now the document can be posted. Check that the postings for accounting for the construction project have been successfully generated.

Answer Land plots are not subject to depreciation, therefore they do not belong to depreciation groups. Rationale The peculiarity of land plots is that their consumer properties do not change over time.

In this regard, the law establishes that land plots are not subject to depreciation.

This rule is established both for corporate income tax and in accounting (in Russian accounting standards and in IFRS): Corporate income tax: “Land and other natural resources (water, subsoil and other natural resources) are not subject to depreciation... "(Clause 2 of Art.

In this article we will look at: depreciation of land in accounting and tax accounting. Let's find out whether it is possible to calculate depreciation of the asphalt pavement. We will answer your questions. Companies acquiring land on a property basis are required to reflect the land on their balance sheet in accordance with the procedure for accounting for fixed assets.

However, among owners who have purchased land, the question often arises: is it necessary to depreciate the cost of land and whether it is possible to reduce the taxable profit of the company in this way.

You will find answers to these and many other questions regarding land depreciation in our article.

Land as an object of fixed assets In accordance with the provisions of the Tax Code, land plots are recognized as objects of fixed assets.

The basis for reflecting land in the balance sheet can be contracts of purchase and sale, exchange, or gratuitous use.

>Standard service life of trees

Service life of a wooden house

The shelf life of a wooden house also very much depends on the completeness of the research work carried out before the actual construction.

If all the properties of soil and ground, groundwater flow, temperature, climate and flora of the land plot are studied in detail, then with a high degree of probability we can say that the service life of a wooden residential building will be long thanks to a high-quality foundation that can withstand heavy weight for a long time. And the foundation, as you know, is the basis of everything.

The predicted service life of a wooden house is the duration of use of housing until the physical wear and tear of the building reaches 40-60%. Subject to maintenance and timely repairs.

It is calculated based on the minimum service life of individual non-replaceable (capital) structures. Here and further we consider capital class VI - load-bearing walls made of solid wood.

Conventionally, wooden frame “cottages” of economy class and the other extreme - timber made from boards with glue, are not considered in principle.

Standard service life of trees

The criterion for assessing the technical condition of the building as a whole and its structural elements and engineering equipment is physical wear and tear.

During many years of operation, structural elements and engineering equipment constantly wear out under the influence of physical, mechanical and chemical factors; Their mechanical and operational qualities decrease, and various malfunctions appear. All this leads to a loss of their original value.

Physical wear and tear is the partial or complete loss of building elements of their original technical and operational qualities. Many factors influence the time it takes for a building to reach the maximum permissible physical wear and tear, at which further operation of the building is practically impossible.

The maximum physical wear and tear of a building according to the “Regulations on the procedure for resolving issues regarding the demolition of residential buildings during the reconstruction and development of cities,” approved by the USSR State Construction Committee, is 70%. Such buildings are subject to demolition due to dilapidation.

The main factors influencing the time it takes for a building to reach the maximum permissible physical wear and tear are: the quality of the building materials used; frequency and quality of repair work; quality of technical operation; quality of design solutions during major repairs; period of non-use of the building; population density.

BP 2.0 acceptance for registration of fixed assets (land plot)

Good afternoon. Please tell me. There was 1 large plot of land (accepted for registration, write-off of fixed assets was introduced (according to the inventory, this plot was written off).

Next, this plot was divided into 5 plots, the Registration of the land plot was entered (all data was filled out), then it is necessary to Accept these land plots for accounting (we create the document Acceptance for accounting of OS for inventory, select the desired land plot, on the BU tab indicate the accounting procedure - Cost not repaid, method of receipt Other, accounting account 01.01, on the Tax Accounting (STS) tab The procedure for including the cost in expenses (STS) - indicate Not to include in expenses. But when posting the document, it displays a message In the field “Procedure for including the cost in expenses: "on the "Tax Accounting" tab the value is set to "Cost is not included in expenses" Posting the document: Acceptance for accounting of OS 00000000002 dated 10/29/2014 12:00:01 (Based on inventory results) The value of the detail "Cost (amount of expenses of the simplified tax system)" is not filled in ! The value of the attribute "Useful life (USN), months" is not filled in!" The document is not processed. Please tell me who knows what I'm missing, it seems like I checked all the settings, everything is filled out correctly.

Thank you in advance.