Receiving fixed assets free of charge

Example

Astra LLC received a machine worth 500,000 rubles under a donation agreement. Such inventory items cannot be included in income immediately; income is recognized as they are used.

The useful life of the machine is set at 50 months.

Postings

| Dt | CT | Operation description | Sum | Document |

| 08 | 98 | Received a machine free of charge | 500000 | Transfer certificate |

| 01 | 08 | The machine is registered as OS | 500000 | Act OS-1 |

| 20 | 02 | Depreciation calculated for the month | 10000 | Accounting information |

| 98 | 91.1 | Income is recognized in the amount of monthly depreciation | 10000 | Accounting information |

Marketstek

In the balance sheet, the credit balance of account 98 as of the reporting date is reflected in line 1530 “Deferred income” (Order of the Ministry of Finance dated July 2, 2010 No. 66n).

Account 98 of accounting is a passive account “Deferred income”, it belongs to section Ⅷ “Financial results” of the chart of accounts. Using standard postings and practical examples, we will study the specifics of using account 98 and the features of reflecting transactions for accounting for future income.

https://www.youtube.com/watch?v=Ng4Ifp0Mgog

This account is intended to accumulate information about:

- Income received that relates to future reporting periods;

- The debt for the shortfall for previous years, which is to be collected;

- The difference in case of shortages and damage between the amount of recovery and the value of the property.

The amounts of income for future periods are reflected on the credit of account 98, and on the debit - the amount of income transferred to the corresponding accounts upon the arrival of the expected date.

The subaccounts of account 98 “Deferred income” are presented below in the figure:

Analytical accounting of account 98 “Deferred income” is carried out for each:

- Type of income;

- Free receipt of valuables.

Example 1. Renting property

On February 1, 2021, a lease agreement for office space was concluded between Spide LLC and Left LLC and payment was made for 6 months in advance. On February 3, 2021, funds in the amount of 354,000 rubles were received into the account of Spide LLC, incl. VAT — 54,000 rub. According to the lease agreement, payment for the premises is made monthly, or for several months at once - the amount is reflected immediately, but is written off monthly.

Table of entries for account 98 - Accounting for future income from rental:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 51 | 98.01 | 354 000 | Reflects the actual receipt of rent (six months) - advance | Bank statement |

| 98 | 90.01 | 59 000 | Monthly rent reflected (February) | Lease agreement, accounting certificate |

| 90.03 | 68 | 9 000 | VAT has been charged on rent for February 2021. | Invoice, lease agreement |

| 76.AB | 68 | 54 000 | VAT charged on advance payment | Invoice, sales book, payment order |

| 68 | 76.AB | 9 000 | VAT deducted from rent (February) | Invoice, sales book |

Receiving free materials

Example

Alina LLC, a confectionery factory, received 800 kg of granulated sugar free of charge. The goods are capitalized at a cost of 20 rubles/kg, the total amount is 16,000 rubles. The next month, 400 kg of granulated sugar were written off for production, and in the next two months - 200 kg per month.

Assets received free of charge are included in non-operating income. In accounting they are reflected at market value determined as of the date of acceptance for accounting. Market value is determined on the basis of prices prevailing for a given type of asset as of the current date, or on the basis of an examination.

Postings

| Dt | CT | Operation description | Sum | Document |

| 10 | 98 | Sugar is capitalized at market value | 16000 | Transfer and acceptance certificate, Receipt order |

| 20 | 10 | 400 kg of sugar written off for production | 8000 | Withdrawal slip |

| 98 | 91.1 | Used sugar is written off as income for the current period | 8000 | Accounting information |

Correspondent accounts of subaccounts of account 98

Since shortages, subscription fees and gratuitous transfer of materials are radically different sources of finance in the accounting sense, then the correspondence of subaccounts will differ significantly.

Postings to subaccount 98.1

Subaccount 98.1 reflects the receipt of funds in the current period, but relating to future months or quarters. This is the receipt of utility bills, payment of monthly travel tickets, subscription fees for telephone services, rental payments, etc. The credit part of subaccount 98.1 corresponds with accounts reflecting the route of receipt of this income:

- 50 – cash acceptance;

- 51 – non-cash payment;

- 52 – use of currency units, etc.

Accordingly, upon the arrival of the period for which income was received, posting Dt98.1 will be used in correspondence with the account reflecting the use of these funds.

Analytical accounting for this sub-account is carried out for each type of income.

Postings to subaccount 98.2

Assets donated to the organization are reflected in subaccount 98.2. The credit part of the subaccount corresponds with accounts reflecting the purpose of the asset receipt:

- 08 – when investing in non-current assets;

- 86 – upon receipt of targeted funding for the implementation of the project.

The debiting of funds from this subaccount is reflected by posting Dt98.2 - Kt91:

- when calculating depreciation on donated fixed assets;

- when writing off production costs based on donated materials.

Analytical accounting for this subaccount is carried out for each gratuitous receipt.

Postings to subaccount 98.3

Subaccount 98.3 takes into account upcoming receipts from the guilty parties to cover the shortfall. This can be either a voluntary admission of guilt and agreement to compensation, or by a court decision. The most commonly used wiring is:

- Dt94 – Kt98.3 – reflection of the amount of shortage identified in the previous reporting period;

- Dt73 – Kt94 – reflection of upcoming receipts from the guilty parties;

- Dt50 (51.52) – Kt73 – upon receipt of compensation;

- Dt98.3 - Kt91 - reflection of actual funds received to repay the previously identified shortage.

Postings to subaccount 98.4

Subaccount 98.4 is used to reflect the difference between the amount recovered from the guilty parties and the book value of the missing valuables. The movement is described by wiring:

- Dt73 – Kt98.4 – the difference between the amount recovered and the book value of lost assets;

- Dt98.4 - Kt91 - writing off the difference after the actual receipt of funds from the person responsible for the shortage.

>Account 98.02 - Free receipts

Account 98.02 – “Gratuitous receipts” is subordinated to the account “Deferred income” (98).

Deferred income from the lessor

Example

According to the terms of the agreement, rent can be paid monthly, or several months in advance. In this case, the payment is reflected as income for the current period - in parts, a multiple of the number of months paid.

Initially, the received amount is reflected in credit 98 of the account, then written off monthly.

On April 14, 2015, Bastion LLC leased vacant premises to Karina LLC. According to the agreement, Karina LLC transfers rent for 6 months at once.

On April 18, 2015, 708,000 rubles were received into the account of the lessor Bastion LLC, including 18% VAT - 108,000 rubles.

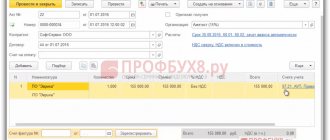

Postings

| Dt | CT | Operation description | Sum | Document |

| 98 | Receipt of rent is reflected | 708000 | Payment order | |

| 98 | 90.1 | Monthly rent included in monthly expenses | 118000 | Accounting information |

| 90.3 | 68 | VAT charged on monthly rent | 18000 | Invoice issued |

| 76(advances) | 68 | VAT is charged on the advance received | 108000 | Invoice issued |

| 68 | 76(advances) | Submitted for deduction of VAT on the amount related to the monthly part | 18000 | Book of purchases |

Account 98 in accounting

To reflect the movement of future financial income in accounting, account 98 “Deferred income” is used in the chart of accounts.

In the economic life of a company, it happens when in the current month you receive income that you should receive in the next month/quarter:

- payment for renting premises several months in advance (if the contract provides for payments for several periods at once);

- Payment of utility services;

- for telecommunications and communication services (subscription payments);

- income from cargo transportation by all modes of transport (road, rail and air);

- receipt of money from the state budget (targeted funding) for commissioning of facilities (money has been received, and commissioning is expected in the future);

- in the current month, shortfalls related to the reporting year and to previous quarters/years were discovered, and the receipt of income for them is expected in the next month/quarter/year;

- receiving free fixed assets (fixed assets), materials, etc.;

- if the company is engaged in leasing sales, leasing income (amounts “above” the cost of the goods).

Account correspondence 98

Refers to passive accounts. Interacts (corresponds) with accounts:

On loan: with accounts 94,08,86,50,55,52,51,58,91,73,76

By debit: with accounts 68,90,91

Subaccounts 98 accounts

- 98-1 “Income received for future periods.” On this sub-account, records are kept of the rent received, subscriber fees for communication and telecommunications services, utility services, passenger transport for subscriptions and travel documents (not one-time, but for a month, half a year, year, etc.).

Example.

Vostok LLC received rental payments several months in advance in the amount of 480,000 rubles.

The rental price per month is 120,000 rubles, including VAT 18%.

Postings:

Dt 51 Kt 98 The rental amount of 480,000 rubles was credited to the current account;

Dt 98 Kt 90.1 Revenue from receipt of rental payments for the month is reflected at 120,000 rubles;

Dt 90.3 Kt 68 VAT (value added tax) on the monthly rental amount is charged to the budget. 18,305 rubles.

Dt 76.AV Kt 68 VAT on the remaining amount of the rent, which acts as an advance, is accrued for payment to the budget. 54,915 rubles.

- 98-2 “Gratuitous receipts.” Movement, receipt, disposal of gratuitous fixed assets/funds, donated materials, etc. assets, as well as operations on budget financing from the budget for strictly defined purposes.

Regulatory documents - Order of the Ministry of Finance 91n dated October 13, 2003, 94n dated October 31, 2000, letter 07-02-06/223 dated September 19, 2012, Instructions PBU13/2000

Example 1.

Recipient LLC received free equipment worth 600,000 rubles (market value). The equipment has a useful life of 60 months. It is necessary to indicate income according to depreciation charges as other income (account 91.1).

Dt 08 Kt 98 Equipment was received that does not require installation. 600,000 rub.

Dt 01 Kt 08 The equipment was put into operation. 600,000 rub.

Value of assets received free of charge

Subaccount 98-2 “Gratuitous receipts” takes into account the value of assets received by the organization free of charge. In the credit of account 98 “Deferred income”, in correspondence with account 08 “Investments in non-current assets” and other accounts, the market value of assets received free of charge is reflected, and in correspondence with account 86 “Targeted financing” - the amount of budget funds allocated by a commercial organization for financing expenses. Amounts recorded on account 98 “Deferred income” are written off from this account to the credit of account 91 “Other income and expenses”: - for fixed assets received free of charge - as depreciation is calculated; - for other material assets received free of charge - as production costs (sales expenses) are written off to the accounts. The theory and practice of accounting is based on the principle of correspondence, the essence of which is that income must correspond to the expenses through which they (income) were received. Meanwhile, Professor Ya.V. Sokolov notes that from time immemorial, gratuitous receipts have been attributed to the profit of the reporting period when this gift was received and, naturally, this was considered the profit of that reporting period. True, there were accountants who said that the balance sheet asset reflected the actually invested capital, and the funds received “for free”, they came in a pro memoria assessment - for memory and valued them at 1 ruble. But recently, notes Ya.V.