Objects and procedure of taxation

From the name it is clear that this fee is established for land owners. Since local authorities have a greater understanding of the land plots in their area of responsibility, this tax is local. The funds go to the budget of the corresponding municipality and local authorities are vested with great powers in regulating it: they set tax rates and payment deadlines; at the federal level, only their maximum and minimum limits are indicated.

In accordance with Art. 389 of the Tax Code of the Russian Federation, the objects of taxation are land plots. The following areas are not recognized as such:

- withdrawn from circulation or limited in circulation due to the location within their boundaries of water bodies of federal significance or particularly valuable objects of cultural heritage;

- members of the forest fund;

- located under apartment buildings.

Maximum bet:

- 0.3% - for agricultural land occupied by housing stock or its infrastructure, acquired for the purposes of horticulture and livestock farming;

- 1.5% - for all other areas.

This percentage is calculated from the cadastral value, which is the tax base in this case.

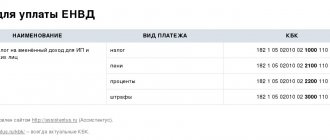

Kbk land tax in 2020

To pay land tax in a bank payment order, you must correctly indicate the mandatory details - KBK (budget classification code), in the digital blocks of which the basic data of the payment to the state treasury is encrypted.

We will tell you in this review how to decipher the composition of the Kbk land tax in 2021, what identifiers legal entities and individuals should use when paying this type of tax, the penalties and fines due for it.

Who is the payer of land tax

The obligation to pay land tax applies to all citizens of the Russian Federation and organizations that own land plots used for both commercial and domestic needs.

For individuals (including individual entrepreneurs), the settlement transaction for the amount of tax is carried out by specialists of the local branch of the Federal Tax Service, after which a notification about the amount of tax and the timing of its payment is sent to the taxpayer.

Business entities independently calculate the tax and advance payments for it, paying it at the location of the site. For 2021, legal entities will prepare a land tax return for the last time.

KBK land tax: composition of the code and decoding of identifying blocks

When filling out a payment to the bank, the KBK land tax is indicated in field 104. The identifier contains 20 characters, divided into four blocks. Their decoding allows you to determine the purpose and subsequent distribution of the payment, to identify the payer and recipient of the tax.

- The first block consists of 3 characters (from 1st to 3rd). Indicates the payee. The combination “182” means the recipient is the Federal Tax Service (indicates a tax payment);

- The second consists of 10 characters (from 4th to 13th). Contains information about the financial classification of the payment

- char. 4 identifies the type of income (“1” – tax payment),

- char. 5-6 is the purpose of payment (“06” – property tax),

- char. 7-8 deciphers income items,

- char. 9-11 clarify sub-items of income according to the Russian Book Code,

- char. 12-13 identifies the status of the budget (federal, regional, municipal);

- The third block consists of 4 characters (from 14th to 17th). Possible combinations in the land tax code: “1000” – taxes and fees, “2100” – penalties, “3000” – fines;

- The fourth block consists of 3 characters (from 18th to 20th). Corresponds to the type of receipt. Combination for land tax – “110” (tax revenues)

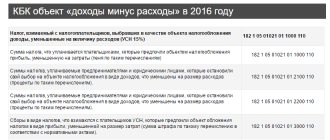

KBK: land tax 2021 for organizations

When filling out a payment document, you must accurately indicate the KBK, since an error in even one of the 20 characters of the code can lead to the fact that the payment will be credited as payment not for land tax, but for some other tax, or returned by the bank as an unclear payment, which is fraught with consequences, especially if the payment is made in the last days of the due date.

The main factor on which the composition of the BCC for land tax 2021 for legal entities depends is the administrative sign of the location of the plot owned by the legal entity (along the boundaries of municipalities).

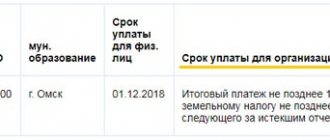

Payment of land tax is made in accordance with Art. 397 of the Tax Code of the Russian Federation. The exact deadlines are established by regional regulations. From 2021, the tax payment deadline will be the same for all regions – March 1 of the following reporting year.

KBK: land tax 2021 for individuals and individual entrepreneurs

As for legal entities, the composition of the BCC for physicists and individual entrepreneurs depends on the type of municipality within which the site owned by the payer is located.

Individuals pay land tax no later than December 1 of the year following the reporting year. For late payment, the owner of the land plot will have to pay penalties.

KBK table for land tax for legal entities and individuals

The proposed table will help you correctly indicate the land tax identifier codes in your bank payment, which shows the BCC taking into account the territorial affiliation of the land plot to various types of municipalities.

| Location of the land plot in | KBK for | KBK for |

| borders of municipalities (municipalities) | individuals | legal entities |

| Urban districts | 182 1 0600 110 | 182 1 0600 110 |

| City districts with intracity division | 182 1 0600 110 | 182 1 0600 110 |

| Intracity areas | 182 1 0600 110 | 182 1 0600 110 |

| Urban settlements | 182 1 0600 110 | 182 1 0600 110 |

| Rural settlements | 182 1 0600 110 | 182 1 0600 110 |

| Intersettlement territories | 182 1 0600 110 | 182 1 0600 110 |

Fines and penalties - land tax: KBK in 2021

To pay penalties and fines for late or unpaid payments, the Ministry of Finance of the Russian Federation has approved separate identifier codes for land tax.

The BCC for land tax penalties for individuals and legal entities differs. In the summary table below you can find a specific BCC for payment of penalties or fines for land tax, corresponding to the required type of municipality.

| Location of the land plot within the boundaries of the municipalities (municipalities) | Payer category | KBK penalties | KBK fines |

| Urban districts | legal entity | 182 1 0600 110 | 182 1 0600 110 |

| individual | 182 1 0600 110 | 182 1 0600 110 | |

| City districts with intracity division | legal entity | 182 1 0600 110 | 182 1 0600 110 |

| individual | 182 1 0600 110 | 182 1 0600 110 | |

| Intracity areas | legal entity | 182 1 0600 110 | 182 1 0600 110 |

| individual | 182 1 0600 110 | 182 1 0600 110 | |

| Urban settlements | legal entity | 182 1 0600 110 | 182 1 0600 110 |

| individual | 182 1 0600 110 | 182 1 0600 110 | |

| Rural settlements | legal entity | 182 1 0600 110 | 182 1 0600 110 |

| individual | 182 1 0600 110 | 182 1 0600 110 | |

| Intersettlement territories | legal entity | 182 1 0600 110 | 182 1 0600 110 |

| individual | 182 1 0600 110 | 182 1 0600 110 |

Source: https://regioncentr73.ru/press/2020/02/05/kbk-zemelnogo-naloga-v-2020-godu/

Code meaning table

BCCs for land tax in 2021 are presented in the table.

| Payment (location of land) | KBK Primary Obligation | KBK Peni | KBK Fine | KBK Interest |

| Within the boundaries of municipal districts of federal cities | 1821 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within urban districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of urban settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within urban districts with intracity division | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of intracity districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within inter-settlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within rural settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

Thus, the BCC of land tax depends on the location of the object of taxation. There are also special BCCs “Penalties for land tax 2020”; separate values are provided for the payment of fines and interest.

Kbk on land tax for legal entities and individuals for 2021

- For organizations

- For individuals

Land tax from organizations owning a land plot located within the boundaries of intra-city municipalities of federal cities

KBK Name of payment

| 182 1 0600 110 | payment amount (recalculations, arrears and payment arrears, including canceled ones) |

| 182 1 0600 110 | penalty on payment |

| 182 1 0600 110 | interest on payment |

| 182 1 0600 110 | amounts of monetary penalties (fines) for payment |

Land tax on organizations owning a land plot located within the boundaries of urban districts

KBK Name of payment

| 182 1 0600 110 | payment amount (recalculations, arrears and payment arrears, including canceled ones) |

| 182 1 0600 110 | penalty on payment |

| 182 1 0600 110 | interest on payment |

| 182 1 0600 110 | amounts of monetary penalties (fines) for payment |

Land tax on organizations owning a land plot located within the boundaries of urban districts with intra-city division

KBK Name of payment

| 182 1 0600 110 | payment amount (recalculations, arrears and payment arrears, including canceled ones) |

| 182 1 0600 110 | penalty on payment |

| 182 1 0600 110 | interest on payment |

| 182 1 0600 110 | amounts of monetary penalties (fines) for payment |

Land tax on organizations owning a land plot located within the boundaries of intracity districts

KBK Name of payment

| 182 1 0600 110 | payment amount (recalculations, arrears and payment arrears, including canceled ones) |

| 182 1 0600 110 | penalty on payment |

| 182 1 0600 110 | interest on payment |

| 182 1 0600 110 | amounts of monetary penalties (fines) for payment |

Land tax on organizations owning a land plot located within the boundaries of inter-settlement territories

KBK Name of payment

| 182 1 0600 110 | payment amount (recalculations, arrears and payment arrears, including canceled ones) |

| 182 1 0600 110 | penalty on payment |

| 182 1 0600 110 | interest on payment |

| 182 1 0600 110 | amounts of monetary penalties (fines) for payment |

Land tax on organizations owning a land plot located within the boundaries of rural settlements

KBK Name of payment

| 182 1 0600 110 | payment amount (recalculations, arrears and payment arrears, including canceled ones) |

| 182 1 0600 110 | penalty on payment |

| 182 1 0600 110 | interest on payment |

| 182 1 0600 110 | amounts of monetary penalties (fines) for payment |

Land tax on organizations owning a land plot located within the boundaries of urban settlements

KBK Name of payment

| 182 1 0600 110 | payment amount (recalculations, arrears and payment arrears, including canceled ones) |

| 182 1 0600 110 | penalty on payment |

| 182 1 0600 110 | interest on payment |

| 182 1 0600 110 | amounts of monetary penalties (fines) for payment |

Land tax for individuals

Land tax from individuals who own a land plot located within the boundaries of intra-city municipalities of federal cities

KBK Name of payment

| 182 1 0600 110 | payment amount (recalculations, arrears and payment arrears, including canceled ones) |

| 182 1 0600 110 | penalty on payment |

| 182 1 0600 110 | interest on payment |

| 182 1 0600 110 | amounts of monetary penalties (fines) for payment |

Land tax for individuals who own a land plot located within the boundaries of urban districts

KBK Name of payment

| 182 1 0600 110 | payment amount (recalculations, arrears and payment arrears, including canceled ones) |

| 182 1 0600 110 | penalty on payment |

| 182 1 0600 110 | interest on payment |

| 182 1 0600 110 | amounts of monetary penalties (fines) for payment |

Land tax from individuals who own a land plot located within the boundaries of urban districts with intra-city division

KBK Name of payment

| 182 1 0600 110 | payment amount (recalculations, arrears and payment arrears, including canceled ones) |

| 182 1 0600 110 | penalty on payment |

| 182 1 0600 110 | interest on payment |

| 182 1 0600 110 | amounts of monetary penalties (fines) for payment |

Land tax from individuals owning a land plot located within the boundaries of intracity districts

KBK Name of payment

| 182 1 0600 110 | payment amount (recalculations, arrears and payment arrears, including canceled ones) |

| 182 1 0600 110 | penalty on payment |

| 182 1 0600 110 | interest on payment |

| 182 1 0600 110 | amounts of monetary penalties (fines) for payment |

Land tax from individuals who own a land plot located within the boundaries of inter-settlement territories

KBK Name of payment

| 182 1 0600 110 | payment amount (recalculations, arrears and payment arrears, including canceled ones) |

| 182 1 0600 110 | penalty on payment |

| 182 1 0600 110 | interest on payment |

| 182 1 0600 110 | amounts of monetary penalties (fines) for payment |

Land tax from individuals owning a land plot located within the boundaries of rural settlements

KBK Name of payment

| 182 1 0600 110 | payment amount (recalculations, arrears and payment arrears, including canceled ones) |

| 182 1 0600 110 | penalty on payment |

| 182 1 0600 110 | interest on payment |

| 182 1 0600 110 | amounts of monetary penalties (fines) for payment |

Land tax for individuals owning a land plot located within the boundaries of urban settlements

KBK Name of payment

| 182 1 0600 110 | payment amount (recalculations, arrears and payment arrears, including canceled ones) |

| 182 1 0600 110 | penalty on payment |

| 182 1 0600 110 | interest on payment |

| 182 1 0600 110 | amounts of monetary penalties (fines) for payment |

Source: https://www.kontur-extern.ru/info/kbk_zemelnyj_nalog

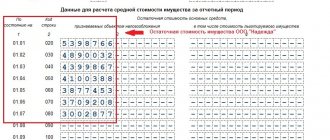

Specifics for legal entities

Legal entities, like ordinary citizens, are taxpayers for this fee in favor of the state. The tax system does not matter in this case; simplified regimes do not exempt organizations from fulfilling the obligation to transfer a fee for land ownership. But unlike citizens who receive notifications from the tax office indicating the amount of tax and attaching a document for payment (or in their personal account on the government services portal), companies are required to independently draw up and submit a declaration to the regulatory authority at the place of their registration. Local authorities may provide tax benefits for certain categories of persons. These norms must be sought in the land tax laws of individual municipal districts.

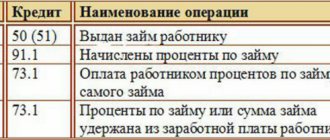

How much will the fine be?

Article 122 of the Tax Code of the Russian Federation specifies the procedure for calculating fines and penalties in case of late payment of taxes, including land tax.

According to this provision, tax is paid as follows:

- 20% of the total amount of unpaid tax, this fine is imposed on those citizens who paid incompletely or unintentionally;

- 40% of the total amount of unpaid tax, such a fine is imposed on citizens who knew about the need to pay tax and deliberately did not do so.

Calculation

For example, if the tax amount is 9 thousand rubles, then you will have to pay:

- 1,800 - if unintentionally;

- 3,600 - if intentional.

Kbk for payment of land tax

Land tax is local, as it is a type of fiscal burden that is regulated by the authorities of municipalities and cities of federal significance.

Municipal authorities have the right to regulate tax rates, approve benefits or even exemptions from paying obligations to the state budget.

However, it should be remembered that the basic norms and rules of taxation are enshrined in the Tax Code of the Russian Federation, and local norms cannot contradict current federal provisions.

So, land is recognized as the object of taxation. Consequently, the owners of land plots are recognized as taxpayers of land tax. Moreover, the right of ownership can arise not only under a purchase and sale agreement, but also on other grounds. For example, receiving land for indefinite and/or free use, inheritance, and others.

Please note that not all plots of land may be considered taxable. So, for example, areas that are part of water bodies or forests are excluded from taxation.

In addition, cultural heritage sites, special-purpose lands, areas for apartment buildings and many others are completely excluded.

An exhaustive list of exceptions is assigned to each municipality separately.

Users of lands transferred for free, fixed-term use, as well as under lease agreements, are not recognized as taxpayers (clause 2 of Article 388 of the Tax Code of the Russian Federation).

Please note that not only the encumbrance rate and benefits, but also the BCC for land tax in 2020 depend on the category and location of the land.

Kbk table for paying land tax

Payment Description

KBK for transferring basic payments

KBK for transferring penalties

KBC for transferring the fine

KBK for transferring interest

| Land tax on land plots located within the boundaries of intra-city municipalities of federal cities (Moscow, St. Petersburg, Sevastopol) | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| From lands located within the boundaries of urban districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| From areas located within the boundaries of urban settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| From areas located within the boundaries of urban districts with intracity division | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| From sites located within the boundaries of intracity districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| From areas located within the boundaries of inter-settlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| From plots of land located within the boundaries of rural settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

As you can see, the KBK land tax for 2021 directly depends on the location of the site recognized as the object of taxation. Therefore, it is important to correctly indicate the BCC. But this is not the only feature of the fiscal payment. Let's understand the key aspects of land taxation.

Conditions for legal entities

Not only ordinary citizens - land owners, but also legal entities are recognized as payers. Thus, an organization that owns a plot or a share in it is obliged to bear similar fiscal burdens as an individual.

Please note that the tax treatment applied by the company does not matter as far as the application of the rules is concerned. In simple words, if a company has switched to a simplified or special taxation system, it will still have to pay land tax. According to the provisions of the Tax Code of the Russian Federation, none of the special regimes provide for exemption from land tax.

Let us repeat once again that organizations are obliged to pay in accordance with the general procedure. However, local authorities have the right to provide exemptions and benefits for certain categories of taxpayers.

For example, a municipality may exempt a city-forming enterprise and budgetary institutions from paying. Beneficiaries can be absolutely any economic entity, as well as ordinary citizens.

The main thing is that this kind of decision is enshrined in the relevant regulatory legal act. If there is a decision on exemption, then the land tax code will not be useful.

When to pay

Since land tax is a local tax, the frequency of payment, as well as the number of reporting periods, is established by the municipal authorities. You can check if advance payments are available in your municipality online.

To do this, just go to the official website of the Federal Tax Service and select the municipality or city of federal significance you are interested in. It is also necessary to determine the tax period - the year for which information is required.

And, of course, a type of fiscal obligation is land tax.

https://www.youtube.com/watch?v=b8oAsN9sc8w

The system stores all legal acts establishing general and exclusive taxation rules.

Payment Features

To credit funds to pay land tax, you will have to fill out a payment order. To do this, use the unified form OKUD 0401060. Please note that the payment form can be filled out online in a special service from the Federal Tax Service.

Enter the budget classification code (BCC) in field 104 of the payment document. When filling out a payment form online on the Federal Tax Service website, it is not necessary to indicate the KBK. The code will be filled in automatically after filling in the individual payment details.