Accounting for finished products

To summarize information about the availability and movement of finished products, account 43 “Finished products” is intended.

This account is used by organizations carrying out production activities.

Finished goods can be accounted for in one of three ways:

- at actual production cost;

- at accounting prices (standard (planned) cost) - using account 40 “Output of products (works, services)” or without its use;

- for direct cost items.

Accounting for products at actual cost

If an organization decides to account for finished products at actual cost, then in this case they will be accounted for only using account 43 “Finished products”.

In this case, the receipt of finished products at the warehouse is reflected by the following posting:

Debit 43 Credit 20 - finished products are accepted for accounting.

Accounting for products at accounting prices (planned cost)

There are two ways to account for such products:

- without using account 40 “Output of products (works, services)”;

- using account 40 “Output of products (works, services)”.

If the first method is used, then when transferring finished products to the warehouse, reflected at accounting prices (planned cost), the following entry is made:

Debit 43 Credit 20 (23, 29) - finished products were capitalized at accounting prices (planned cost).

If the second method is used, then the finished products are reflected in correspondence with account 40 “Output of products (works, services)” at standard or planned cost.

After the products are manufactured and transferred to the warehouse, a record is made:

Debit 43 Credit 40 - finished products were capitalized at standard (planned) cost.

The cost of products manufactured by the main production is reflected by posting:

Debit 40 Credit 20 - reflects the actual cost of products produced by the main production.

As a rule, the accounting standard (planned) cost of finished products does not coincide with its actual cost.

As a result, account 40 has a balance - debit or credit.

At the end of the month it is written off, and as a result account 40 will have no balance.

The debit balance on account 40 is the excess of the actual cost over the standard or planned cost (overexpenditure), the credit balance is the excess of the standard or planned cost over the actual cost (savings).

The debit balance of account 40 is written off monthly by posting:

Debit 90-2 Credit 40 - the excess of the actual cost of manufactured products over its standard (planned) cost is written off.

The credit balance on account 40 is written off monthly with a reversal entry:

Debit 90-2 Credit 40 - the excess of the standard (planned) cost of manufactured products over its actual cost is reversed.

Accounting for revenue from the sale of finished products

Transactions related to the sale of finished products are reflected in accounting using the following accounting entries:

Debit 62 Credit 90-1 - revenue from the sale of finished products is reflected.

When revenue from the sale of finished products is recognized in accounting, its value is written off from account 43 “Finished Products” to the debit of account 90 “Sales”.

What to check for technical clarifications in accounting rules

Asset Eligibility

Reflect inventories on balance sheet accounts only when they are recognized as assets. If the reserves do not have useful potential and cannot bring economic benefits, the commission for the receipt and disposal of assets decides to stop using them. Based on this, the accountant writes off the object from the balance sheet.

The rules providing for the recording of only inventory assets on the balance sheet, the write-off of objects from the balance sheet upon termination of their use, as well as the reflection of such objects on the off-balance sheet account 02, have already been enshrined in Instruction No. 157n.

Term of use

If inventories will be in use for more than 12 months, the asset receipt and disposal committee must determine a specific useful life.

A similar obligation was already provided for by Instruction No. 157n. However, previously there was no single guideline for materials with exactly what duration of use it is necessary to establish a specific service life.

Accounting units

Inventories should be recorded individually or as a group.

An accounting group can be created if the inventories are homogeneous, that is, similar in characteristics that are minimally necessary for their identification in accounting. Determine how detailed the similarities should be based on the institution’s needs for controlling the safety and movement of inventory, as well as the needs of reporting users.

You can create inventory groups by the batches in which they were received, or regardless of the date of their receipt. The right to develop additional grouping methods no longer applies.

Initial cost

Check whether the procedure you use for determining the initial cost of inventory complies with the rules of the standard.

If you purchase several items of inventory, distribute in proportion to their cost any costs associated with such a purchase. Previously, such a procedure was provided only for procurement and delivery costs.

Advances in foreign currency are included in the initial cost of inventories at the exchange rate on the date of payment. This procedure has already been applied to fixed assets.

If you received inventory through a non-exchange transaction and you cannot estimate its market price, record it at the cost indicated by the transferring party. And if she does not provide this information, use the general rule for accounting for inventories in the conditional valuation.

When exchanging inventories on non-commercial terms (except for payment in cash or cash equivalents), reflect the inventories according to the accounting data on the value of the assets transferred in exchange. A similar procedure has already been applied to fixed assets.

In the initial cost of products and other inventories that the institution has manufactured, do not include excess losses and storage costs outside the production process.

Change in value and reclassification

When alienating inventories (except for goods and finished products) in favor of a non-budgetary organization, revaluate them to fair value. This rule is already provided for in Instruction No. 157n.

When transferring inventories to another group or category of accounting objects, do not change their value, but reflect the postings for disposal and receipt simultaneously.

Documentation of the movement of finished products

The transfer of finished products to the warehouse is formalized by a requirement-invoice (form N M-11 “Requirement-invoice”) (approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a).

When finished products arrive at the warehouse, materials accounting cards are opened according to Form N M-17 “Material Accounting Card” (approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a), which are issued against receipt to the financially responsible person.

The operation of selling finished products is documented with a consignment note (standard form TORG-12).

Reflection of finished products in the balance sheet of the enterprise

Finished products are reflected in the balance sheet at the actual or standard (planned) production cost (clause 59 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n).

In the balance sheet, the value of balances of finished products not sold and not shipped to customers as of the reporting date is indicated on line 1210 “Inventories”.

Organizations independently determine the details of this indicator.

For example, the balance sheet may separately contain information on the cost of materials, finished products and goods, costs in work in progress, if such information is recognized by the organization as significant.

If in current accounting finished products are reflected at actual production cost, then in the balance sheet they are reflected at actual production cost (debit balance of account 43).

When recording the production of finished products at standard (planned) production cost using account 40, the balance sheet shows the standard (planned) production cost of finished products.

Line 1210 of the balance sheet: explanation

Raw materials, main and auxiliary materials, fuel, purchased semi-finished products and components, spare parts, containers and other material assets are reflected in the balance sheet at their actual cost, which includes all costs for the acquisition, procurement and delivery of material assets to warehouses.

Raw materials transferred for processing are reflected in the balance sheet of customers as part of production inventories, also at actual cost.

Raw materials supplied by customers are reflected on the balance sheet at the prices stipulated in the contract.

The cost of inventory items accepted for safekeeping due to refusal to accept payment requests and other reasons is reflected on the balance sheet in the amount of payment documents presented by the supplier for payment.

18. Finished products are reflected in the balance sheet at the actual production cost, which includes costs associated with the use of fixed assets, raw materials, materials, fuel, energy, labor, and other costs of production in the production process.

Seeds and feed of own production and young animals transferred to the next year on state farms and other state agricultural enterprises are assessed in the manner established by the Council of Ministers of the USSR.

19. Goods at retail trade enterprises are reflected in the balance sheet at retail prices, and at wholesale warehouses and bases of trading and supply and distribution organizations - at retail prices or purchase cost. The difference between the cost of goods at purchase and retail prices is highlighted in the balance sheet as a special item.

20. Shipped goods, completed works and rendered services are reflected in the balance sheet at the full actual cost, including sales expenses subject to reimbursement by buyers in excess of the wholesale price. If these goods, works and services are allowed to be reflected in the established order as sold before payment, they are accounted for at their selling or estimated cost.

21. Work in progress is reflected in the balance sheet at actual cost.

In industries with large-scale and mass production, it is allowed to evaluate work in progress at the current standard cost.

Work-in-progress construction and installation work at facilities for which interim payments are made for work performed is reflected in the balance sheet at the estimated cost minus planned savings.

22. Unfinished capital repair work is reflected in the balance sheet under a special item in the amount of actual costs.

Raw materials, materials, finished products and goods

58. Raw materials, main and auxiliary materials, fuel, purchased semi-finished products and components, spare parts, containers used for packaging and transportation of products (goods), and other material resources are reflected in the balance sheet at their actual cost.

The actual cost of material resources is determined based on the actual costs incurred for their acquisition and production.

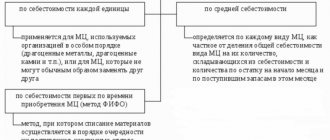

Determining the actual cost of material resources written off for production is permitted using one of the following inventory valuation methods:

at the cost of a unit of inventory;

at average cost;

at the cost of the first acquisitions (FIFO);

paragraph deleted as of January 1, 2008. — Order of the Ministry of Finance of Russia dated March 26, 2007 N 26n.

(see text in previous)

59. Finished products are reflected in the balance sheet at actual or standard (planned) production costs, including costs associated with the use of fixed assets, raw materials, materials, fuel, energy, labor resources, and other costs for production of products or direct cost items.

60. Goods in organizations engaged in trading activities are reflected in the balance sheet at the cost of their acquisition.

When selling (dispensing) goods, their value may be written off using the valuation methods set out in paragraph 58 of these Regulations.

When an organization engaged in retail trade accounts for goods at sales prices, the difference between the acquisition cost and the cost at sales prices (discounts, markups) is reflected in the financial statements as a value that adjusts the cost of goods.

(edited)

What does line 1210 of the balance sheet consist of?

Line 1210 of the balance sheet is called “Inventories”. As the name suggests, this line needs to be shown (clause 20 of PBU 4/99):

- raw materials, materials and other similar values;

- costs in work in progress (distribution costs);

- finished goods, goods for resale and goods shipped;

- Future expenses.

This means that to fill out line 1210 of the balance sheet as of the reporting date, you need to add up the debit balance of the following accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n):

- 10 “Materials;

- 11 “Animals in cultivation and fattening”;

- 15 “Procurement and acquisition of material assets”;

- 16 “Deviation in the cost of material assets”;

- 20 “Main production”;

- 21 “Semi-finished products of own production”;

- 23 “Auxiliary production”;

- 28 “Defects in production”;

- 29 “Service industries and farms”;

- 41 "Products";

- 43 “Finished products”;

- 44 “Sales expenses”;

- 45 “Goods shipped”;

- 97 “Deferred expenses”.

We remind you that in financial statements, indicators must be presented in a net assessment, i.e., minus regulatory values (clause 35 of PBU 4/99). This means that if an organization has an amount of reserve for depreciation related to inventories (credit balance of account 14 “Reserves for depreciation of material assets”) or a trade margin (credit balance of the same name account 42), the debit balance of the above accounts should be equal to their amount decrease. And the already “cleared” balance of inventories should be reflected on line 1210. And information about regulatory values that are not given separately in the balance sheet must be disclosed in the explanations to it.

Please also note that if the organization’s reserves include, for example, raw materials or materials used to create non-current assets, then these amounts are not reflected on line 1210 as current assets (Letter of the Ministry of Finance dated January 29, 2014 No. 07-04-18 /01). The amount of such inventories will need to be shown in line 1190 “Other non-current assets”. Similarly, the balance of accounts 15 and 16 related to the acquisition of non-current assets will also not be shown on line 1210. It is quite natural that the balance of account 97 is reflected on line 1210 only in that part that relates to expenses with a write-off period not exceeding 12 months after the reporting date. The remaining deferred expenses are included in non-current assets.

Valuation of materials in current accounting and balance sheet.

Home Favorites Random article Educational New additions Feedback FAQAccording to PBU, materials, as part of inventories, are accepted for accounting at actual cost.

The actual cost of materials purchased for a fee is the amount of the organization's actual costs for the acquisition, with the exception of value added tax and other refundable taxes.

The actual costs of purchasing materials include:

— amounts paid in accordance with the contract to the supplier;

- amounts paid to organizations for information and consulting services related to the purchase of materials;

- customs duties;

- non-refundable taxes paid in connection with the purchase of a unit of materials;

— transportation and procurement costs;

- costs of bringing materials to a state in which they are suitable for use for the intended purposes;

— other costs directly related to the purchase of materials.

This list of actual costs for purchasing materials is open. General and other similar expenses are not included in the actual costs of purchasing materials, except when they are directly related to the purchase of materials.

Transportation and procurement costs (TPC) are the costs of an organization directly related to the process of procurement and delivery of materials to the organization.

The actual cost of inventories, in which they are accepted for accounting, is not subject to change, except in cases established by the legislation of the Russian Federation.

The actual cost of materials in their manufacture is determined by the organization itself based on the actual costs associated with the production of these materials. Accounting and formation of costs for the production of materials is carried out by the organization in the manner established for determining the cost of relevant types of products.

The actual cost of materials contributed to the contribution to the authorized capital of the organization is determined based on their monetary value, agreed upon by the founders of the organization. If delivery costs are borne by the receiving party, the actual cost of materials increases by the amount of expenses incurred.

The actual cost of materials received by an organization under a gift agreement or free of charge, as well as those remaining from the disposal of fixed assets and other property, is determined based on their current market value as of the date of acceptance for accounting.

In this case, the current market value is understood as the amount of funds that can be received as a result of the sale of these assets.

Materials that do not belong to the organization, but are in its use or disposal in accordance with the terms of the contract, are taken into account in the assessment provided for in the contract.

The assessment of materials, the cost of which is determined in foreign currency upon acquisition, is made in rubles by recalculating the amount in foreign currency at the exchange rate of the Central Bank of the Russian Federation effective on the date of acceptance of inventories for accounting.

With a large range of materials used, it is impossible to keep current records at actual cost. Therefore, it is allowed to use conditional discount prices.

It is allowed to use the following as accounting prices for materials:

— negotiated prices;

— actual cost of materials according to the previous month or reporting period (reporting year);

— planned prices;

— average price of the group.

A specific option must be recorded in the accounting policy of the enterprise.

An important aspect of materials accounting is determining the actual cost of writing off materials for production.

The actual cost of materials consumed can be calculated in one of the following ways:

- at the cost of each unit;

- at average cost;

- at the cost of the first acquisition of inventories.

Unit accounting is an absolutely accurate method of recording the movement of materials. The accounting price in this case is the actual purchase price. For each batch of material arriving at the enterprise, an inventory card is created. An inventory number is attached to each unit, which serves to uniquely identify this material. At the time the material is released, the accountant makes a note in a special accounting register about which inventory number and from which department it was released into production. At the same time, the cost of the material that transfers its cost to the finished product is precisely known. In the absence of automated accounting systems and the continuous increase in inventory cards, this method is very labor-intensive.

When evaluating materials at average cost, it is determined for each group of materials as the quotient of dividing the total cost of the group of materials by their quantity. The specified quantity and cost are added up, respectively, from the cost and quantity for the balance at the beginning of the month and for materials received during the month.

Method 3. involves writing off materials in an assessment corresponding to the order in which they were received.

In the balance sheet, materials are reflected at cost determined based on the valuation methods used. Inventories that are obsolete, have completely or partially lost their original qualities, or the current market value of which has decreased, are reflected in the balance sheet at the end of the reporting period minus a reserve for a decrease in the value of material assets. A reserve for reducing the value of material assets is formed at the expense of the organization’s financial results by the amount of the difference between the current market value and the actual cost of inventories, if the latter is higher than the current market value.

Accounting for the procurement process.

The supply process is a set of business operations that are associated with providing the organization with objects of labor and real estate necessary for carrying out economic activities.

The main objectives of the procurement process are:

identification of all costs associated with the procurement and acquisition of labor items;

calculation of the actual cost of harvested property;

identifying the results of supply activities.

Material assets necessary for the organization’s activities are purchased mainly from counterparties, which are suppliers. The enterprise enters into a supply agreement with each supplier, which stipulates: the object and volume of supply, terms of payment, wholesale price, ex-prices associated with the moment of transfer of ownership from the supplier to the buyer for this property, etc.

Wholesale prices are the prices at which one organization sells products to another or to the state.

The enterprise also bears costs associated with transportation, loading and unloading, etc., which are carried out by the organization’s own resources, as well as by third-party enterprises. These costs are called transportation and procurement costs.

Wholesale prices, together with transportation and procurement costs, form the actual cost of labor items.

In accounting, items of labor are recorded in accounts: 10 “Material”, 15 “Procurement and acquisition of materials”, 16 “Deviation in the cost of materials”. Subaccounts have been opened for account 10 “Materials”: 1 “Raw materials and materials”, 2 “Purchased semi-finished products”, “Fuel”, etc.

Analytical accounting of materials is carried out in accordance with their nomenclature. The nomenclature of materials is a list of individual types, names, grades of materials used by the enterprise. Each individual name of materials is assigned a permanent number, which is called a nomenclature number. All documents used to document the movement of materials indicate not only their name, but also this number. The range of materials consumed in production is very diverse and reaches a huge number of items.

It is almost impossible to determine the actual cost of each item of labor. Therefore, current accounting of materials is carried out at fixed accounting prices: supplier wholesale prices or planned cost.

Free prices, state regulated prices are established when concluding contracts for the supply of labor items. On their basis, settlements with suppliers are carried out, they are indicated in the primary documents.

Registration prices are contained in the price list. Such prices can be the planned cost, average purchase prices. Their calculation is based on the contract price and the planned amount of transportation and procurement costs.

Inventory is accepted for accounting purposes at actual cost.

The actual cost of items of labor released into production in accordance with the Accounting Regulations is determined by the following methods: at average cost; at the cost of the first acquisition of inventories (FIFO method); at the cost of the most recent acquisition of inventories (LIFO). The procedure for their calculation is considered when taking into account the production process.

In accounting accounts, the process of procuring items of labor can be carried out in one of two ways.

In the first method, account 10 “Materials” reflects the wholesale cost of purchased materials. To account for transport and procurement expenses (TZR), a special sub-account “Transportation and procurement expenses” is opened to account 10 “Materials”. The actual cost of labor items is the sum of the turnover in the debit of account 10 “Materials” and the subaccount “Transportation and procurement expenses”.

To determine the actual cost of materials released into production, it is necessary to calculate the absolute (in rubles) and relative (in %) values of labor and production requirements. Transportation and procurement costs are calculated monthly. In general, for the “Materials” account, for subaccounts, accounting groups of materials or for individual item numbers.

,

where TZRo – transport and procurement costs in solda as of 01.08.2019;

TZRP – transport and procurement costs incurred in the reporting month;

Mo – balance of materials at wholesale cost on 08/01/2010;

MP is the wholesale cost of materials received in the current month.

Encyclopedia of solutions. Inventories (line 1210)

Inventories (line 1210)

Line 1210 reflects data on the total cost of the organization's inventories listed as of December 31 of the reporting year.

The cost of inventories to be reflected in the balance sheet is determined based on the valuation methods used (clause 24 of PBU 5/01 “Accounting for inventories”, hereinafter referred to as PBU 5/01). The organization establishes the choice of a specific method in its accounting policies.

The actual cost of inventories is not subject to change, except in cases established by the legislation of the Russian Federation (clause 12 of PBU 5/01).

Paragraph 35 of PBU 4/99 “Accounting statements of an organization” establishes the requirement to fill out the balance sheet in a net assessment, i.e. excluding regulatory values, which are disclosed in the notes to the balance sheet. Such a regulating value when reflecting the cost of inventories is the amount of the reserve for reducing the cost of material assets (clause 25 of PBU 5/01). The reserve is not formed for all inventories, but only for those that:

— morally outdated;

— completely or partially lost their original quality;

— the current market value of the sale of which has decreased.

For example, in the Recommendations to auditors for 2013 (attachment to the letter of the Ministry of Finance of Russia dated January 29, 2014 N 07-04-18/01), the Ministry of Finance of Russia draws attention to the fact that if an organization has entered into an agreement for the sale of finished products at a price lower than its cost, then at the end of the reporting year in the balance sheet the specified finished products are reflected minus the reserve for a decrease in the value of material assets.

To account for the reserve, account 14 “Reserves for reducing the value of material assets” is intended.

Attention

Reservations are not made for goods listed as shipped goods at the end of the reporting year (letter of the Ministry of Finance of Russia dated January 29, 2008 N 07-05-06/18).

Information about reserves is provided in the balance sheet without being broken down by type. Data on the movement of inventories by type and group are reflected in the notes to the balance sheet, in table 4.1 “Availability and movement of inventories” and in table 4.2 “Inventory pledged”.

When filling out line 1210, the following data will be required:

- about the cost of raw materials and materials, purchased semi-finished products and components, containers, spare parts, and other material assets that are used to produce products, perform work, provide services not written off in production, recorded in the debit of accounts 10 “Materials”, 11 “ Animals for growing and fattening", 15 "Procurement and acquisition of material assets", debit or credit account 16 "Deviation in the cost of material assets";

- about the cost of goods intended for resale, recorded in the debit of account 41 “Goods”. Organizations engaged in retail trade, when accounting for goods at sales prices, use account 42 “Trade margin”.

The receipt of goods and containers can be reflected using account 15 “Procurement and acquisition of material assets” or without using it in a manner similar to the procedure for accounting for relevant transactions with materials;

— about the cost of finished products, recorded in the debit of account 43 “Finished products”;

— about the cost of finished products and goods shipped to customers, recorded as the debit of account 45 “Goods shipped”;

A property transferred to a buyer, the transfer of ownership of which has not yet been registered as of the reporting date, is reflected in the balance sheet as part of current assets. To reflect a disposed fixed asset item until the recognition of income and expenses from its disposal, account 45 “Goods shipped” (a separate sub-account) can be used (letter of the Ministry of Finance of Russia dated January 27, 2012 N 07-02-18/01).

- on the amount of costs in work in progress, recorded in the debit of accounts 20 “Main production”, 21 “Semi-finished products of own production”, 23 “Auxiliary production”, 29 “Service production and facilities”;

- about the amount of the amount of circulation costs not written off to the accounts for accounting for sales revenue, recorded in the debit of account 44 “Costs of circulation”;

- on the amount of amounts of deferred expenses recorded in the debit of account 97 “Deferred Expenses”, provided that these expenses comply with the conditions for asset recognition.

Thus, the procedure for generating the final value for line 1210 will look like this:

Line 1210 “Inventories”: how to fill out correctly

Order of the Ministry of Finance of Russia dated December 24, 2010 N 186n)

(see text in previous)

61. Goods shipped, work delivered and services provided, for which revenue is not recognized, are reflected in the balance sheet at the actual (or standard (planned)) full cost, which includes, along with production cost, costs associated with the sale (sale) of products, work, services reimbursed by a negotiated (contract) price.

(as amended by Order of the Ministry of Finance of Russia dated December 24, 2010 N 186n)

(see text in previous)

62. The values provided for in paragraphs 58 - 60 of this Regulation, for which the price has decreased during the reporting year or which have become obsolete or partially lost their original quality, are reflected in the balance sheet at the end of the reporting year at the price of possible sale, if it is lower than the original cost of procurement (acquisitions), with the difference in prices attributed to the financial results of a commercial organization or an increase in expenses for a non-profit organization.

What reserves are included in the balance sheet?

To begin with, it is worth saying that the resources themselves for the production of products are only part of what is recognized as reserves, and what line 1210 of the balance sheet consists of. They are divided into several categories:

- Materials and raw materials used for the manufacture of goods or work.

- Financial costs for materials and raw materials. Materials for production also include fuel, repair tools, clothing and waste generated at the enterprise.

- Money for employee salaries, as well as social benefits.

- The number of products that are not yet completed in production.

- Finished products for sale, as well as services, works, animals. Before shipment they undergo mandatory quality checks.

- Expenses for new production equipment and its modernization.

- Depreciation expenses.

- Cost of gross output.

- Costs for customs duties.

- Taxes belonging to the non-refundable category.

- Funds paid by an enterprise to the seller of products for his services.

- Consulting services if the company's activities related to the sale and purchase of inventories.

- Transportation of goods, storage services in warehouses.

- Costs related to advertising.

The balance sheet reflects only general information about all these categories, without decoding. And all purchases, payments and sales of shipped goods must have documentary evidence. Inventory analysis is needed in order to optimize them, because a shortage is just as bad as an excess. The consequence of the first scenario is a delay in the production of goods, and the second is the withdrawal of money from the company’s turnover, which will be spent on the purchase of goods that were not included in production.

Balance sheet

The balance sheet is one of the basic forms of accounting for commercial enterprises, thanks to which you can obtain information about:

- Property status of the company.

- Her financial stability.

- Liquidity.

- Solvency, etc.

The balance sheet consists of two parts - assets and liabilities, equal to each other in amounts. Inventories and expenses in the balance sheet are indicated in line 1210, and relate to the Assets part, subsection “Current assets”. There you can also find information about VAT on purchased assets, financial investments and receivables. But here it is worth recalling that all inventories are reflected in account 002, which is classified as off-balance sheet.

Line "Inventories" in the balance sheet

Now the balance sheet for accounting has a new form to fill out, which, according to accountants, has become simpler than the previous one. Now there is no need to detail the data, highlighting only the main thing. But they need to be filled out correctly, and for this you need to know the decoding of line 1210 of the balance sheet. Thus, to reflect information, the following manipulations are carried out with debit and credit account balances:

- 10, containing data on raw materials and supplies in the balance line, is added to 11 - it contains information about fattening animals. This category includes not only artiodactyls, but also birds, rabbits, bees, etc.

- The credit balance 14 is subtracted from the addition result.

- Add 15 – purchase of material assets.

- 16 is either added or subtracted, depending on the circumstances. Data on 15 and 16 should be entered only for stocks of raw materials and materials.

- The balances from 20, 21, 23, as well as 28 and 29 accounts are added to the result obtained.

- Then you need to find the balance of 41 and also add it.

- The credit balance of account 42 is deducted.

- The last steps are to add balance 43 - “Finished products”, as well as 44, 45 and 97. The latter includes only those expenses that were written off within one year.

After the calculations, an assessment is made. There are several methods available to an accountant to carry it out, for example:

- Calculate the average commodity cost.

- Accounting at cost of all production goods, etc.

The most commonly used method is one associated with recording the time of purchase of goods, since it is recognized as more convenient than others.

Composition of material current assets

The balance sheet is divided into two parts: assets and liabilities. In assets you can see the property owned by the organization. Passives will show from what sources it was formed. Each part is divided into several sections consisting of lines. The numbers in the line are the account balances at the end of the period, that is, the year.

In order for users of this report to evaluate the dynamics of the movement of the enterprise’s operating results, the balance sheet shows information for three years. The property part is divided:

- Fixed assets.

- Current assets.

Attention! The difference that separates property for accounting is the period during which it can be sold, used or completed. Property to be included in current assets must be sold within one year.

In turn, current assets are tangible and intangible. Intangible current assets are the capital of the company, which are placed in different sources:

Raw materials

- accounts receivable

- short-term financial investments

- current account, deposits, cash desk

- VAT etc.

In accounting, tangible current assets on the balance sheet are everything that is used by an organization for production, resale or its own needs within one year. The composition includes what is reflected in line 1210:

- materials, raw materials (MPZ)

- unfinished production

- finished products

- Future expenses

- goods for resale

The materials include all kinds of stationery and household goods used for office needs. This includes supplies involved in the manufacture, repair and maintenance of equipment. For example:

- Construction Materials

- tools

- pieces of furniture

- spare parts for various types of equipment

- details

- fuel

- workwear

- container

Materials that are sent for processing are also counted as inventories. Any thing, plant or fattening animal can be used as a raw material, depending on the nature of the production process. The main condition for recognizing it as a raw material is the manufacture of a final product based on it.

Work in progress is not included in the structure of materials, but remains part of working capital, since its final goal is transformation into products. Accordingly, the finished product is made from materials that have undergone processing, and therefore can be recognized as a material item.

Deferred expenses do not relate to the production process, but belong to related costs, such as insurance, purchase of software, and real estate registration.

Notes on future expenses

In order for the documents to reflect costs in subsequent periods, they must be described according to all the rules. This can be done on the balance sheet line, but this accounting procedure must be noted in the company’s accounting policy. For example, account 97 will allow you to create additional subaccounts in line 1210, which will contain information about expenses in the following purchasing periods.

All resources used for production are accounted for in the debit balance of account 10. For this, the initial price of those goods that will be written off before the end of the next reporting period is used. To simplify this process, accounts 15 and 16 are usually taken. The first reflects information about acquired and procured assets, the cost of material assets, the second - about deviations in their cost. This allows you to describe materials and raw materials, as well as reflect their accounting price in as much detail as possible.

Information about manufactured products is included in line 1210.

Here it is important to mention account 14. It will come in handy if production decides to create a reserve fund, with the help of which it will be possible to depreciate the total amount of inventory. Depreciation here is a decrease in the value of inventories.

So, in account 14, raw materials and supplies are recorded, minus the reserve for their depreciation. Subsequently, their cost should be several times lower than the initial one by the date of the report. To determine whether these conditions are met, an impairment test is performed:

- It is determined which assets are involved in testing.

- The value of the asset to be recovered is calculated.

- Impairment losses are determined.

- The loss is recognized as a gain or loss from impairment over a specified period of time.

- An analysis of the resulting calculations is being prepared.

- All data is documented.

- Reporting is completed.

Thanks to this process, it is possible to reduce the price of consumed resources several times, thereby stopping overconsumption in further periods.

The company's reserves noted in the documentation allow us to assess its material security. The availability of resources must be maintained at a certain level so that there is no shortage or overexpenditure in the reserve. The balance sheet stability of an organization's inventory indicates its competent management policy and good marketing, since the income of the entire enterprise depends on the speed of inventory turnover.

When preparing financial statements, a special form approved by law is used. All reports must be submitted in this form and filled out according to certain rules so that the documentation is without violations. The tax authorities are provided with statistics on certain data indicated in the appropriate lines. Each line has its own code, which is deciphered in a certain way. There is also a transcript to line 1210 of the balance sheet. To correctly fill out this column, you need to understand what exactly is included in it and enter all the necessary information.

What does column 1210 consist of?

In reporting, balance sheet line 1210 is called “Inventories”; it usually reflects the following items that relate to any material assets of the organization, raw materials, related costs and expenses, as well as goods received during the production process:

- Raw materials used in production, as well as other valuables that have a similar purpose.

- Costs with distribution costs.

- Products received or goods used for resale.

- Possible future expenses.

Given this information, it is necessary to add up the debit balance of certain accounts for the required period of time for which the report is required. This list includes the following items:

- Materials that are used in production to obtain finished products, all kinds of raw materials used.

- Animals raised and fattened by the organization.

- Procurement or purchase of various valuables necessary for the functioning of production.

- Permitted deviations in the cost of acquired assets.

- The main operating production.

- The resulting semi-finished products are made in-house.

- Operating auxiliary production facilities.

- Manufacturing defects and related costs.

- Maintenance of the farm and the costs of this work.

- Received goods in production.

- Finished products.

- Sale of created products.

- Shipment of goods produced by the company.

- Future costs and potential costs.

All these points allow you to understand what balance line 1210 is made up of. Also, when preparing reports, it is worth remembering that the indicators in the documentation are given in a net assessment, that is, the data when compiling a summary should be indicated after the deduction of regulated quantities.

If a company has a reserve amount in its account for a possible reduction in cost or trade margin, then the debit balance must be reduced by this amount. After this, the information should be reflected in the completed line. As for regulated quantities that are not themselves included in the balance sheet, information about them is reflected in the explanations.

In cases where the organization’s balance sheet contains raw materials or materials used for use in non-current assets, then these amounts are not reflected as current assets when filling out line 1210. The amount of these inventories is reflected in the line used for other non-current assets, its number – 1190. Also, balances related to the acquisition of non-current assets will not be reflected in 1210. As for expenses for future expenses, only those whose write-off dates do not exceed exactly one year from the date of filing the report are mentioned. The remaining expenses are classified as non-current assets and must be recorded accordingly, in the appropriate line.

If you find an error, please select a piece of text and press Ctrl+Enter.

Fixed assets on the balance sheet and their valuation

Since fixed assets are a long-term asset (with a service life of more than a year) and tend to gradually wear out during operation, its value changes at each reporting date, that is, the assessment of the recorded fixed assets changes depending on revaluations or due to depreciation charges, unless, of course, it relates to depreciable property. Depreciation is a regulatory indicator that affects the value of fixed assets.

Fixed assets are reflected in the balance sheet at cost reduced by the amount of accrued depreciation (clause PBU 4/99), i.e. at residual value. In the company's balance sheet, the valuation of fixed assets is indicated at the residual value: the original value minus depreciation.

In accounting, the initial (or replacement after revaluation) cost of fixed assets is taken into account as the debit of account 01 “Fixed assets”, and the amount of accrued depreciation is recorded as a credit of account 02 “Depreciation of fixed assets”. Accordingly, the residual value is calculated as the difference between the amounts of initial cost and depreciation (D/t 01 minus K/t 02).

In the form of the balance sheet, a separate line 1150 “Fixed assets” is provided to reflect the amount of fixed assets valuation as of the reporting date.

Leased fixed assets are subject to separate accounting in account 03 “Income-generating investments in tangible assets”. Depreciation on them is calculated in the same way as on all fixed assets on the account. 02, recorded in the analytical accounting registers, and the residual value of such property occupies line 1160 “Profitable investments in materiel” in the balance sheet.