How to keep records of goods exports

Export in economics refers to the export of goods abroad for sale or processing. Goods exported outside the state are recorded by the customs service and drawn up with the relevant documents. Documents accounting for and accompanying the export of goods abroad of the Russian Federation must be drawn up in accordance with the current laws of Russia.

The main laws regulating foreign trade activities are the Federal Law “On Currency Regulation and Currency Control” No. 173-FZ dated December 10 and the Law “On the Fundamentals of State Regulation of Foreign Trade Activity” dated December 8, 2003 No. 164-FZ.

Law No. 173-FZ defines:

- rights and obligations of persons participating in foreign economic transactions;

- currency regulation authorities and foreign exchange control authorities;

- rights and obligations of currency control authorities and agents.

In accordance with Federal Law No. 164-FZ, goods fall under the customs export procedure if the following conditions are met:

- for transactions that are not subject to statutory benefits, all export customs duties have been paid;

- all restrictions and prohibitions are observed;

- For goods included in the consolidated list, a certificate of origin is presented.

Read the article: Modern structure of Russian exports

Accounting for primary documents

During export and import operations, new forms of primary documents arise that you have not previously used. All documents are drawn up in two languages - Russian and the language of the counterparty. If your partner sent you a copy in only one language, you will have to make a translation. Typically, requests for translation come from the Federal Tax Service. The documents will be partially prepared by you, and partially by the foreign partner. The following primary will appear:

Contract. Directly the contract itself with the foreign counterparty. It reflects all the terms of the transaction and the rules of Incoterms 2021. This is a set of rules that defines the basic terms and provisions for foreign trade. In particular, it regulates issues related to the payment of expenses by the parties and the transfer of risks of loss.

An invoice is a document that the seller creates for the buyer. It reflects all information about the product: quantity, price, color, size and other quality characteristics. It also reflects the terms of delivery and details of the parties. An invoice is needed for customs and currency control. In domestic accounting, there is no full-fledged analogue to an invoice, but an invoice is in many ways similar to an invoice, although an invoice is more of a tax document, while an invoice is still an accounting document.

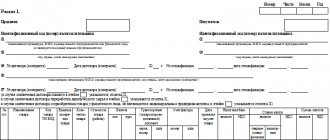

Customs declaration. Issued when importing and exporting goods. The cargo manager fills out a declaration form for each shipment of goods, and the customs inspector approves it. It contains all the information about the cargo, the sender, the recipient and the transport on which you are moving the goods.

Remember! The goods declaration confirms the legality of the transaction. If it is filled out with errors or is missing, customs officers will not allow the cargo to pass through.

Changes in documents will also affect VAT. In the standard VAT return you will have to fill in new lines. When importing goods from the countries of the Customs Union, fill out an application for the import of goods and payment of indirect taxes.

Transaction passport. Previously, this was a required document for exchange control, but from March 1, 2021, passports were canceled and new rules were introduced. Import contracts over 3 million rubles and export contracts over 6 million rubles are registered with the bank. To do this, provide the bank with information about the agreement and details of the other party. Be prepared for the bank to ask you for information on any foreign currency payment if it exceeds 200 thousand rubles, regardless of its registration.

Documents confirming the registration of the counterparty in another country . They will contain the details of your partner and confirm the fact that he is conducting legal activities.

Payment documents.

Other documents. The list is huge and depends on the specific operation. This includes licenses, certificates and insurance policies.

Accounting for goods export operations: required documents

When exported from Russia, the goods are taken outside the Russian Federation for subsequent processing or sale, that is, without the right of return. Export is subject to the payment of duties. Their size depends on various reasons and, in particular, is determined by the value of the exported goods, which is declared in the customs declaration. When carrying out export operations, there is a certain procedure.

Accounting for the shipment and sale of goods for export is carried out separately from accounting for the activities of the enterprise in the Russian Federation. The document flow uses primary documents confirming the shipment of goods, their payment, and the services of intermediaries.

All goods transported abroad of the Russian Federation are subject to mandatory customs clearance, which can be carried out:

- by the exporter himself,

- his customs representative,

- by another person on the basis of a power of attorney.

A package of supporting documents is attached to the declaration presented to the customs authority. It is allowed to provide documents in copies, and the customs authority has the right to check any of them for compliance with the original.

Read the article: Customs transit of goods

Export operations

Export operations are the opposite of import operations. Now you are exporting goods from your country. Similar to imports, all export transactions go through customs and are subject to duties.

Maintain export accounting separately from trade within your country.

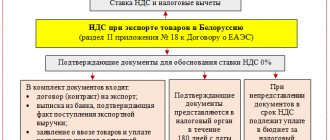

Export VAT

In terms of exports, the VAT rate is more lenient than for imports and is equal to 0%. The right to apply such a rate must be confirmed. To do this, within 180 calendar days from the moment the cargo is declared at customs, provide the following documents to the tax office:

- foreign trade contract with a foreign buyer;

- bank statement confirming receipt of proceeds from the counterparty;

- a copy of the customs declaration with customs marks;

- copies of documents confirming the export of goods abroad.

For a complete list of documents, see Article 165 of the Tax Code of the Russian Federation. All these documents are submitted simultaneously with the declaration at a 0% rate.

If you received an advance payment for products, pay VAT on it. Once title to the item has passed to the buyer, you can request a refund of the amount paid. To do this, submit a separate tax return with the documents listed in Art. 165 Tax Code of the Russian Federation.

Don't forget about tax deductions. Art. 172 of the Tax Code of the Russian Federation regulates which amounts are subject to deduction:

- amounts of VAT on advances from foreign buyers that can be deducted after sale;

- VAT amounts paid to contractors for materials, works and services for the production of export goods.

Important! To deduct, you must keep separate records of “input” VAT on internal and external transactions. The following options can be offered for tax distribution:

- according to the amount of actual costs;

- by the share of shipped export products in the total production volume;

- in proportion to the cost of exported goods to the total cost of shipped products.

Income tax

The purpose of export is to generate revenue, which means it occupies an important place in the calculation of income tax. In practice, it has developed that export operations fall into the category of the main activity. Therefore, consider income and expenses in terms of two categories:

- for production and sales of products;

- non-operating (Chapter 25 of the Tax Code of the Russian Federation).

Income will be the proceeds from the sale of products. Despite the fact that your products will be paid for in foreign currency, recalculate the proceeds at the Central Bank exchange rate on the date of sale.

Exchange differences

The exchange rate of the ruble against other currencies changes daily. This can affect you both for the better and for the worse, so there are positive and negative exchange rate differences. Let's look at examples (the rates of the Central Bank of the Russian Federation are conditional!)

Example . Equator LLC plans to purchase a batch of tomatoes from a foreign partner. However, the company does not hold foreign currency. To remedy this, it was decided to purchase $5,000 from the bank. May 31 - a purchase order was sent to the bank, which reserved 355,000 rubles for the purchase. The currency itself was purchased on June 3 at the rate of 69.9925 rubles. The exchange rate of the Central Bank of the Russian Federation as of June 3 is 68.9831 rubles.

| date | Debit | Credit | Sum | Description |

| 31.05.2020 | 57 | 51 | 355 000 | Funds for the purchase of currency were reserved by the bank |

| 03.06.2020 | 52 | 57 | 5 000 × 68,9831 = 344 915,5 | Foreign currency has been deposited into the foreign exchange account |

| 03.06.2020 | 51 | 57 | 355 000 — 5 000 × 69,9925 = 5037,50 | Excessively reserved funds were returned to the account |

| 03.06.2020 | 91.2 | 57 | (69,9925 — 68,9831) × 5 000 = 5 047 | The negative exchange rate difference between the purchase rate and the Central Bank rate is reflected |

Example 2. Pyramid LLC bought laser engraving equipment for $3,000 on June 4 (Central Bank of the Russian Federation exchange rate - 68.3413 rubles). The debt to pay for the equipment is subject to revaluation. The exchange rate of the Central Bank of the Russian Federation dropped to 68.0313 rubles on June 30. This created a positive exchange rate difference, since the amount of our liabilities decreased.

| date | Debit | Credit | Sum | Description |

| 04.06.2020 | 08 | 60 | 3 000 × 68,3413 = 205 023,9 | Purchased equipment for laser engraving |

| 30.06.2020 | 60 | 91.1 | 3 000 × (65,5547 — 64,5) = 930 | A positive exchange rate difference is reflected, as the amount of debt has decreased |

Accounting for export of goods

To obtain reliable information, accounting for the export of goods is carried out in separate sub-accounts, which makes it possible to separate ordinary and foreign economic activities in accounting. Features of accounting and tax accounting for the export of goods include:

1. Settlements under an export contract are most often carried out in foreign currency. To do this you need:

- open foreign currency accounts for each currency separately, and use account 52 in accounting for settlements with the counterparty: Dt 52 Kt 62;

- master currency purchase and sale transactions and reflect them in the report, using account 57 for this purpose (or account 91 depending on the adopted accounting policy):

Dt 57 Kt 52;

Dt 51 Kt 57;

Dt 91 Kt 57 or Dt 57 Kt 91;

- keep records of settlements for each transaction simultaneously in two currencies: foreign and Russian;

- carry out a revaluation of currency balances and debts of counterparties (in currency terms) both on the date of the transaction and on the reporting date, using for this account 91: Dt 91 Kt 52, 62 or Dt 52, 62 Kt 91.

2. Accounting for the export of goods is maintained by the enterprise separately from other accounting, which is due, on the one hand, to the requirements of the law, and on the other hand, to the need to achieve the following goals, which include:

- separation of data on accounting for the export of goods from information on activities subject to VAT at other rates or exempt from this tax (clause 4 of Article 149 and clause 1 of Article 153 of the Tax Code of the Russian Federation);

- control over the completeness of receipt of payment from foreign counterparties (clause 1 of Article 19 of the Federal Law “On Currency Regulation...” dated December 10, 2003 No. 173-FZ);

- taking advantage of the opportunity not to charge VAT on advances received from foreign buyers (clause 1 of Article 154 of the Tax Code of the Russian Federation);

- monitoring compliance with the deadlines required to confirm the right to use the zero rate (clause 9 of Article 165 of the Tax Code of the Russian Federation);

- tracking the moment of transfer of ownership of the goods if, according to the international rules for the interpretation of trade terms "Incoterms", it does not coincide with the moment of shipment;

- correct correlation of shipment volumes, which is necessary when calculating VAT.

3. Additional operations arise to account for the export of goods:

- calculation of customs duties and fees (account 76):

Dt 76 Kt 51 (52);

Dt 44 Kt 76;

- in case of a discrepancy between the moments of transfer of ownership of the goods and the moment of shipment, account 45 is used to account for it:

Dt 45 Kt 41 (43);

Dt 90 Kt 45;

- restoration of VAT accepted for deduction and then attributed to export operations (clause 6 of Article 166 of the Tax Code of the Russian Federation);

- penalties and fines for VAT on exports not confirmed on time are charged on Dt 91 Kt 68;

- for unconfirmed exports, VAT is written off as other expenses (Dt 91 Kt 19), three years from the end of the tax period in which the corresponding shipment was made.

The most time-consuming part in accounting for the export of goods is VAT postings. Correct VAT accounting makes it possible to obtain a tax deduction if the right to apply the zero VAT rate is confirmed. In this regard, special attention should be paid to:

- accounting for taxes related to direct export costs;

- distribution of VAT on indirect costs to determine its part attributable to exports;

- correct execution of documents relating to VAT;

- compliance with deadlines for preparing documents confirming the right to tax deductions;

- restoration of VAT accepted for deduction and then attributed to export transactions;

- compliance with the established deadlines for tax accounting when exporting goods for unconfirmed, as well as for later confirmed deliveries;

- a high probability of discrepancy between the accounting periods for export shipments for profit tax purposes and confirmation of the right to deduct VAT on it, which leads to a discrepancy between the tax bases for profit and VAT in the same tax period.

VAT on export costs is accumulated on account 19 with its allocation to a special sub-account: Dt 19 Kt 60.

The tax previously accepted for deduction, when accounting for the export of goods, is restored at the time of their shipment by posting: Dt 19 Kt 68.

The tax on indirect costs is redistributed on account 19 with the transfer of the export part of the tax to the subaccount: Dt 19 Kt 19.

If documents appear confirming the possibility of applying a deduction, then tax is written off from account 19 in the amount corresponding to the documents: Dt 68 Kt 19.

Tax on exports not confirmed on time is charged to the subaccount of account 19: Dt 19 Kt 68.

In this case, the tax on expenses related to it is taken for deduction: Dt 68 Kt 19.

Penalties and VAT fines for exports not confirmed on time are charged on Dt 91 Kt 68.

If the export is subsequently confirmed, then this part of the tax is accepted for deduction (clause 10 of article 171, clause 3 of article 172 of the Tax Code of the Russian Federation): Dt 68 Kt 19.

For unconfirmed exports, VAT is written off as other expenses - Dt 91 Kt 19 - three years from the end of the tax period in which the corresponding shipment was made.

Read the article: Analysis of Russian exports

VAT reflection

The accountant must pay attention to accounting for VAT transactions. This need is due to the fact that the company can use a 0% rate. The accountant needs to develop a procedure for distributing VAT on indirect expenses and prepare all important tax documents. VAT on export expenses is summed up on account 19. In this case, separate accounts are allocated.

Let's look at the wiring used:

- DT19 KT60. VAT on export expenses.

- DT19 KT68. Restoration of tax that was previously accepted for deduction. The entry is made on the date of shipment of the product.

- DT19 CT19. Tax on indirect expenses.

- DT68 KT19. Tax write-off on confirmed transactions.

- DT19 KT68. Taxes on unconfirmed exports.

- DT68 KT19. Deduction of tax previously assessed on unconfirmed exports.

- DT91 KT68. Calculation of VAT fines.

- DT91 KT19. Writing off tax as other expenses when the transaction remains unconfirmed.

IMPORTANT! The peculiarities of export accounting are determined by the special taxation procedure and the risk that export accounts may be unclaimed.

Features of tax registration

When goods cross the border, the exporter charges and pays VAT at the usual rate. The basis for calculating VAT is the amount consisting of the value of the goods according to the declaration, as well as duties and excise taxes. If VAT is not paid, the goods will not be able to leave the temporary storage area at customs. If payment is late, a penalty will be charged on the unpaid amount. Upon subsequent confirmation of export, the exporter has the right to deduct the amount of paid “unconfirmed” VAT if the following conditions are met:

- The goods have been registered.

- Revenue from transactions with goods is subject to VAT.

- All primary documents for the goods and their transportation have been collected.

- Customs VAT has been paid in full.

If a simplified taxation scheme is used, then when accounting for the export of goods, VAT is not applied to the deduction. In this case, actions with VAT depend on what object of taxation is used. If “income” is used as the object of taxation, then VAT is included in the cost of the goods or fixed assets. When applying the “income minus expenses” scheme, the tax amount is included in the costs that reduce the taxable base.

Import operations

When you import, you bring a product from a foreign country for further use or sale in your country. In any case, import goods only through customs.

In import accounting, a difficult point is the formation of cost. Do not forget to include customs duties, fees, and delivery costs into the cost price. If you hired a person who represented your interests during the transportation and declaration of cargo, then also include the cost of paying for his labor in the cost price.

To account for the movement of imported goods and the formation of cost, you can use accounts 15 or 41.3 by opening subaccounts for them.

Due to constant changes in the exchange rate, the question arises: at what rate should goods be accepted for accounting? In total you have two options. The first is to take into account at the rate on the date of advance payment, if it was made. The second is at the rate at the moment of transfer of rights. The moment of transfer of rights is determined by the Incoterms rules.

Incoterms 2020

Since 2021, a new set of international rules, Incoterms 2020, has appeared. It can be applied from January 1, 2021, but you can continue to use the rules of Incoterms 2010, Incoterms 2000 and even earlier versions.

Incoterms 2021 identifies 7 rules for any transport and 4 for sea vessels. For example, in a contract involving delivery by truck, you can specify the following rules:

- EXW - ex-warehouse, delivery costs are transferred to the buyer at the moment when he picks up the goods from the recipient's warehouse.

- FCA is a free carrier. The supplier delivers the goods to the customer's carrier and pays all export payments, after which all risks and costs of delivery and import customs clearance are borne by the buyer. The FCA delivery basis provides two shipping options:

- A place that belongs to the seller (his warehouse, store, factory). Delivery is considered complete when the goods are loaded onto the vehicle designated by the buyer.

- A place that does not belong to the seller (port, terminal). In this case, it is considered that the shipment is made after the goods are loaded onto the carrier’s vehicle, paid for by the seller.

- According to the new rules of Incoterms 202, as part of an FCA delivery, it is possible to indicate in the sales contract that the buyer obliges the carrier to issue a bill of lading with an on-board entry. This will help avoid conflicts between the seller, buyer and carrier, which often arose when delivering by water.

- CPT - the supplier performs export customs clearance, delivers the goods to its carrier and pays the cost of its services. The buyer unloads the goods and performs import customs clearance. Risk passes to the customer upon delivery to the carrier.

- CIP - Similar to CPT, but insurance costs are borne by the seller. The seller is obliged to insure the goods against all risks (at least 110% of the cost of the goods). The parties may agree to a lower level of coverage.

- DPU - delivery to unloading place. The seller delivers the goods to the terminal, unloads them and pays export payments. And the import duty and delivery from customs are paid by the buyer himself. The transfer of risks to the buyer occurs after the seller unloads the vehicle at the terminal.

- DAP - delivery at point. The supplier delivers the goods to the agreed location, which is usually in the buyer's country, and pays export customs duties. Customer pays for unloading, import duties and taxes. The moment of risk transfer is unloading from the seller’s vehicle.

- DDP - full delivery to the client, that is, the seller pays all costs (export and import duties, clearance, loading, delivery, etc.) and bears the risks until the goods are delivered to the client.

For maritime transport, you can specify the following rules:

- FAS - free along the side of the ship. The costs of delivery to the agreed port are paid by the supplier. He also pays the export duty. The costs of loading on board the vessel, vessel freight (freight charges), duties and taxes are the responsibility of the buyer. Transfer of risks is the moment the seller transfers the goods to the carrier.

- FOB - free on board. In addition to FAS, the seller is responsible for the costs of loading the goods on board the vessel. The buyer delivers the goods to the unloading point and performs import customs clearance. The moment of risk transfer is loading on board the vessel.

- CFR - cost and freight. The supplier bears the costs of delivery to the agreed port, loading, freight and export payments. The point at which risk and expense pass is the movement of goods over the ship's rail. In fact, this is FOB, supplemented by the fact that the seller also pays for the delivery of cargo by sea to the buyer’s place. The risk passes when the consignment reaches the port of destination.

- CIF - Cost, Insurance and Freight. Similar to CFR, only the buyer pays for cargo insurance.

When receiving goods at customs, you will be faced with the need to determine the customs value. It will serve as the basis for determining duties, VAT and excise taxes. Customs value is the cost of the cargo under the contract plus all other costs (for loading, transportation, etc.).

Import VAT

Taxation also has its own subtleties when importing. Import transactions are generally subject to 20% VAT in 2021. If the sale of imported goods within the country is subject to a rate of 10%, then the corresponding VAT is charged when importing such goods. When implementing certain types of work (services) related to the import of goods, a 0% VAT rate is applied. It is important to pay VAT on time, since without this the goods will not be released from the temporary storage area. Penalties will begin to accrue for the delay.

Unlike domestic trade, the VAT tax base includes: the declared value of goods, customs duties and excise taxes. Don't forget to exercise your right and deduct VAT. To do this, observe the following points:

- the goods must be registered;

- imported products will be used to generate revenue, which is subject to VAT;

- expenses for the purchase of goods are confirmed by the primary source;

- VAT has been paid.

All of the above is appropriate for OSNO. When working on a simplified basis, VAT cannot be deducted. Depending on the type of simplified tax system, you have two options. The first is that in the simplified tax system “Income” the amount of VAT is included in the cost of purchased products. The second is that in the simplified tax system “Income - Expenses” the tax amount is included in expenses to reduce the simplified base.

Accounting for the export of goods outside the Customs Union

Below is a table with questions related to the export of goods, tax and accounting of export transactions, which most often arise in the practical activities of exporters. For each of them, the table provides links to the relevant legal acts in which answers to them can be found. We are talking about accounting for the shipment and sale of goods for export outside the Customs Union.

A detailed analysis of accounting for the export of goods requires a large amount of information about the market, which the enterprise often does not have. Therefore, it is worth turning to professionals. Our information and analytical department is one of those that stood at the origins of the business of processing and adapting market statistics collected by federal departments.

Find out more

Quality in our business is, first of all, the accuracy and completeness of information. When you make a decision based on data that is, to put it mildly, incorrect, how much will your loss be worth? When making important strategic decisions, it is necessary to rely only on reliable statistical information. But how can you be sure that this information is reliable? You can check this! And we will provide you with this opportunity.

You can find out all the details by calling: +7 (495) 565-35-51 and 8 .

Request a call back

Receipt of advance payment from a foreign buyer

Receipt of an advance payment from a foreign buyer is reflected in the document Receipt to the current account transaction type Payment from the buyer in the Bank and cash desk section - Bank - Bank statements - Receipt button.

Receipt to Current Account document using an example.

The Bank Accounts directory must first be filled out and information about the Organization's currency account to which payment is received from the buyer must be entered.

Prepayment in foreign currency is credited to a transit foreign currency account.

The agreement with the buyer in foreign currency must be completed as follows:

- Type of agreement – With the buyer ;

- Price in USD , i.e. the currency in which the contract was concluded;

- Payment in USD switch , i.e. payment currency.

As a result of selecting such an agreement in the Receipt to Current Account , accounts for settlements with the buyer are automatically set in the field:

- Settlement account - 62.21 “Settlements with buyers and customers (in foreign currency)”;

- Advances account - 62.22 “Calculations for advances received (in foreign currency).”

Since payment by the buyer is made in foreign currency, the document states:

- Bank account – a transit currency account in USD, into which funds are received from the buyer;

- Accounting account – “Currency accounts”, is installed automatically when selecting a foreign currency bank account;

- Amount – payment amount in currency according to the bank statement;

- VAT rate – 0%.

Postings according to the document

The document is filled out in foreign currency, because the contract is concluded in USD and payment is made in USD. In the postings, the amounts are reflected in both rubles and foreign currency.

This is due to the fact that accounting in the Russian Federation is carried out in rubles. The value of assets or liabilities in foreign currency is subject to conversion into rubles (clause 4 of PBU 3/2006).

The document generates the posting:

- Dt Kt 62.22 – receipt of prepayment from the buyer to the transit currency account.

The VAT tax base does not include advances received on transactions that are subject to VAT at a rate of 0% in accordance with clause 1 of Art. 164 of the Tax Code of the Russian Federation (clause 1 of Article 154 of the Tax Code of the Russian Federation).

Therefore, in our example:

- VAT is not charged on advances;

- an advance invoice is not issued (clause 17 of the Rules for maintaining a sales book, approved by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137, Letter of the Ministry of Finance of the Russian Federation dated 01.2018 N 03-07-08/142).

Advances received and issued in foreign currency are not subsequently revalued in accounting records and in NU. The ruble valuation of the advance is fixed at the rate of the Central Bank of the Russian Federation on the date of the advance (clause 7, clause 10 of PBU 3/2006, clause 11 of Article 250 of the Tax Code of the Russian Federation, clause 5 of clause 1 of Article 265 of the Tax Code of the Russian Federation).

See also Selling currency

Accounting for customs payments

Reflection of customs duties as part of costs is documented in the document Transaction entered manually, type of transaction Transaction in the section Operations – Accounting – Transactions entered manually – Create button.

Let's look at the features of filling out the Operation using an example.

The tabular part of the document is filled in with the following entries:

- Debit – account 44.01 “Costs of distribution in organizations engaged in trading activities”; Subconto 1 – cost item Taxes and fees . Type of expense - Taxes and fees ;

Export customs duties are taken into account as part of distribution costs and are reflected in Dt account 44.01.

Since 2011, account 90.05 “Export duties” has not been used in transactions (Letter of the Ministry of Finance of the Russian Federation dated 01/09/2013 N 07-02-18/01).

- Credit - account 76.09 “Other settlements with various debtors and creditors”; Subconto 1 – customs, selected from the Contractors directory;

- Subconto 2 – agreement on the basis of settlements with customs, Type of agreement Other ;

- Subconto 3 – document of transfer of advance payment to customs;

Example of export accounting transactions

The Morina enterprise entered into a contract for the export shipment of goods. The customs value was 20,000 euros. The fee was 0.1%. The cost of the purchase was 840,000 (including VAT in the amount of 128,135.59) rubles. Delivery costs amounted to 52,000 rubles. The euro exchange rate was 70 rubles throughout the entire period of operations. The following operations are carried out in the accounting of the Morina enterprise:

- The supply of goods from the Russian company is reflected: Dt 41 Kt 60 in the amount of 711,864.41 rubles;

- VAT charged by the supplier is taken into account: Dt 19 Kt 60 in the amount of 128,135.59 rubles;

- Payment to the supplier is reflected: Dt 60 Kt 51 in the amount of 840,000 rubles;

- The following duty was charged: Dt 44 Kt 76 in the amount of 1,400 rubles (20,000 x 70 x 0.1%);

- The payment of customs duties is taken into account: Dt 76 Kt 51 in the amount of 1,400 rubles;

- Carrier services reflected: Dt 44 Kt 60 in the amount of 52,000 rubles;

- Payment for services was made: Dt 60 Kt 51 in the amount of 52,000 rubles;

- Revenue was reflected on the date of transfer of ownership: Dt 62 Kt 90/1 in the amount of 1,400,000 rubles (20,000 x 70);

- The cost of sales is reflected: Dt 90/2 Kt 41 (44) in the amount of 763,864.41 rubles;

- The revenue received from the buyer is taken into account: Dt 52 Kt 62 in the amount of 1,400,000 rubles.

- After preparing a package of documents for export shipment, the amount of VAT in the amount of 128,135.59 rubles presented by the supplier of the goods can be claimed for deduction.

Conditions for applying the zero VAT rate

The use of a zero VAT tax rate must be justified. To do this, the exporting organization must:

- confirm the fact of export of goods (the fact of performance of work (provision of services) related to the export of goods for export) with documents, the list of which is given in Article 165 of the Tax Code of the Russian Federation (clause 9 of Article 165 of the Tax Code of the Russian Federation);

- fill out the relevant sections of the VAT return and submit it to the tax office along with the collected package of documents (clause 10 of article 165 of the Tax Code of the Russian Federation).

To collect documents confirming the right to apply a 0 percent VAT rate, the organization is given 180 calendar days.

For goods, the 180-day period is counted starting from the day the goods are placed under the customs export procedure (paragraph 1, clause 9, article 165 of the Tax Code of the Russian Federation). Features of the preparation of documents confirming the right to apply a 0 percent VAT rate when exporting goods are presented in the table.

In relation to work (services) related to the export of goods (including for export), the 180-day period is determined depending on the type of work performed (services provided).

Features of documentary accounting of foreign trade activities

A standard chart of accounts is used to record transaction data. To obtain reliable information, separate sub-accounts are used to separate data on ordinary and foreign economic activities.

Features of conducting business include: (click to expand)

- Availability of payments made in foreign currency. The need to keep records in Russian rubles obliges enterprises to convert currencies, taking into account emerging exchange rate differences.

- The emergence of additional supporting documents.

- Application of a special procedure for VAT taxation.

The main document on which accounting is based is the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control.” Conducting foreign economic activity obliges enterprises to use additional forms of primary accounting that are not used to reflect domestic transactions. Forms completed in a foreign language must be translated.

Documents often used in accounting:

| Document | Description |

| Transaction passport | Confirms the legality of the transaction and has the information necessary to carry out control |

| Contract | Concluded with foreign partners |

| gas turbine engine | Filled out for each batch when moving goods or placing them under customs control |

| Invoice | Issued by the seller for the buyer and contains data about the product |

| Licenses, certificates, insurance policy | A complete list of required documents is provided by the body exercising control |