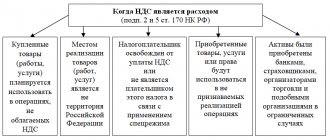

What is the difference between standardized and non-standardized advertising expenses?

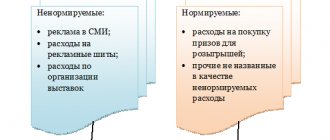

Advertising expenses, which are taken into account for tax purposes, are divided into two groups:

- non-standardized expenses, that is, those that can be taken into account completely;

- standardized expenses, that is, those for which there is a recognition procedure.

Tax Code of the Russian Federation in paragraph 4 of Art. 264 contains a more detailed classification.

Non-standard advertising expenses

It is allowed to include the following types of advertising expenses in the full amount of actual expenses:

- advertising that is placed through the media (television, radio, print, Internet);

- outdoor advertising (illuminated, billboards, stands, etc.);

Expenses on outdoor advertising are taken into account according to special rules. Which one? ConsultantPlus experts spoke about them:

Get free access to K+ and find out all the details on outdoor advertising.

- advertising carried out through participation in exhibitions, fairs, as well as through the design of shop windows, expositions, showrooms and sample rooms;

- production of advertising catalogs and brochures containing information about products, goods, services or work offered by the company, or about itself;

- deliberate reduction in price (markdown) of goods that have lost their quality during exhibition.

Is it possible for income tax purposes to include as advertising expenses for adhesive tape with the organization’s logo used to package goods? The answer to this question was given by 3rd Class Advisor to the State Civil Service of the Russian Federation Razgulin S.V. Get free trial access to the ConsultantPlus system and get acquainted with the official’s point of view.

There are some clarifications in the non-standardized part. The Ministry of Finance of Russia, using the provisions of paragraph. 4 p. 4 art. 264 of the Tax Code of the Russian Federation, included leaflets, booklets, leaflets and flyers among brochures and catalogues. The ministry’s specialists reflected their position in letters from the Ministry of Finance of Russia dated August 12, 2016 No. 03-03-06/1/42279, dated October 12, 2012 No. 03-03-06/1/544, dated November 2, 2011 No. 03-03-06/ 3/11 and dated 10.20.2011 No. 03-03-06/2/157. That is, the costs of producing such materials can be taken into account as part of non-standardized expenses.

Rationing of advertising expenses and tax accounting

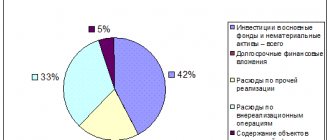

In NU, advertising expenses are recognized as other expenses related to the production and sale of goods (Tax Code of the Russian Federation, Article 264-1).

This article contains a closed list of expenses, the rationing of which is not necessary (clause 4 of the same article). The following will be taken into account in full:

- expenses for advertising in the media, including on the Internet: for the creation and promotion of an Internet page for a product, company, commercials, etc.;

- expenses for outdoor advertising: outdoor and indoor advertising structures, visual printed advertising (flyers, calendars, posters);

- expenses for participation in exhibitions and fairs (payment for participation, preparation of retail space, advertising paper products, markdown of product samples).

Other advertising expenses need to be rationed. The standard is set at 1% of sales revenue. They take into account not only the sale of their own products, but also goods for resale. The acquired property rights are also taken into account.

Question: How to record the costs of producing advertising printed materials? The contractual cost of producing advertising booklets and catalogs (printed products) amounted to 180,000 rubles. (including VAT 30,000 rubles), while the cost of producing a unit of these types of printed products exceeds 100 rubles. Advertising printed materials contain information about goods and services, the sale of which is subject to VAT, and are intended exclusively for distribution to visitors of a specialized exhibition in which the organization is participating. For the purposes of tax accounting of income and expenses, the accrual method is used. View answer

Expenses for mobile SMS mailings, product tastings, expenses for drawings, purchase of prizes, advertising in catalogues, etc. are regulated.

On a note! When determining the volume of revenue, excise taxes and VAT are excluded from calculations (letter No. 03-03-01-04/1/310 of the Ministry of Finance dated 06/07/05).

Since the calculation of the volume of standardized expenses is associated with the calculation of revenue for the period and cumulative totals, the indicators will change throughout the year. The quarterly cumulative total of revenue allows expenses that were not included in the standard in the previous quarter to be classified as such in the next.

The final calculation of advertising costs of a regulated nature is made at the end of the year. The remainder of the amount of advertising costs that were not recognized as normalized at the end of the year is not carried over to the next year.

For example, the costs of creating your own website are taken into account for NU purposes entirely as advertising. However, the costs associated with organizing trade through the specified site are associated with the production and sale of goods for NU purposes. In this case, advertising as such may also take place.

The distribution of flyers at the fair (and the corresponding costs) is not regulated, but the distribution of branded prizes based on the results of a drawing arranged for visitors is included in the regulated advertising costs. The classification of the production and distribution of booklets and flyers into the category of non-standardized costs, along with brochures and catalogues, is confirmed by the Ministry of Finance (in letter No. 03-03-06/1/42279 dated 08/12/16 and a number of other earlier ones).

The list of regulated expenses is open by the legislator, therefore, a company can attribute to advertising any expenses with signs of advertising that comply with Federal Law No. 38, regardless of whether they are named in the Tax Code or not. Confirmation of this thesis can be found in the practice of the courts (for example, the post. FAS MO No. A40-54372/11-91-234 dated 21/03/12).

The general rule is that any expenses must have documentary evidence - this also applies to advertising expenses. Confirmation can be provided by estimate documentation, documentation confirming the acquisition of goods and materials, reference documentation when conducting advertising campaigns in the media.

Other advertising expenses can be included in the calculation for accounting purposes both in the period in which they were incurred and in the payment period, depending on the accounting method.

When using the accrual method, the moment of recognition may be the presentation of documents for the transaction: an act, an invoice, or the last day of the reporting (tax) period (Tax Code of the Russian Federation, Article 272).

On a note! Accounting for advertising expenses for OSNO and simplified tax system “income minus expenses” is carried out according to the same rules. Under the simplified tax system, the moment of actual payment of expenses is decisive (Tax Code of the Russian Federation, Article 346.17).

Commercial activities on an international scale obviously also include advertising costs, but there is one peculiarity here: international treaties and agreements may not fully comply with Russian analogous norms. In this case, the priority is the international treaty (Tax Code of the Russian Federation, Article 7, document of the Ministry of Finance No. 03-08-RZ/9491 05/03/14, a number of other similar ones) and its conditions. It follows from the above that in some cases, standardized advertising costs are fully included in tax calculations, without applying the standard.

Standardized advertising expenses

In an amount not exceeding 1% of the amount of sales proceeds (calculated in accordance with Article 249 of the Tax Code of the Russian Federation), the following types of expenses should be included in expenses:

- expenses for the production or purchase of prizes that are awarded during drawings during mass advertising campaigns;

- other advertising expenses.

The above list has one interesting feature. The fact is that the list of non-standardized expenses is closed and does not allow additions, while standard advertising expenses are not limited, and this list is always open.

For this reason, any expenses that bear signs of advertising expenses can be taken into account in expenses, even if they are not listed in the Tax Code. They will simply fall into the category of “standardized advertising costs.” Confirmation of this thesis can be found in the resolutions of the Federal Antimonopoly Service of the Moscow District dated March 21, 2012 No. A40-54372/11-91-234 and dated March 14, 2012 No. A40-63461/11-99-280.

An example is this type of advertising, such as promotional and informational materials delivered in the form of bulk and unaddressed mail. The costs of paying for courier or postal services can be attributed to advertising costs, and, in accordance with the provisions of paragraph. 5 paragraph 4 art. 264 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated January 12, 2007 No. 03-03-04/1/1, these will be standardized advertising expenses.

When is social advertising included in other expenses?

Please note that costs associated with the gratuitous provision of services for the production or distribution of social advertising can be included by taxpayers in other expenses on the basis of subclause. 48.4 clause 1 art. 264 Tax Code of the Russian Federation. In this case, one of the conditions specified in subsection must be met. 32 clause 3 art. 149 of the Tax Code of the Russian Federation, namely:

- in radio programs, the duration of mentions of sponsors should be no more than 3 seconds;

- in television programs and in film and video services, mention of sponsors should be allocated no more than 3 seconds and no more than 7% of the frame area;

- When distributing information about sponsors by other means, no more than 5% of the advertising area (space) may be allocated.

When to apply the provisions of international agreements

In business practice, there are circumstances in which an international agreement on the avoidance of double taxation determines the accounting of advertising expenses on other principles that differ from those provided for by the Tax Code of the Russian Federation. In such cases, according to Art. 7 of the Tax Code of the Russian Federation, contractual provisions should be adhered to.

In particular, the agreement between the Russian Federation and Germany provides that advertising expenses incurred by a Russian organization with the participation of a company from Germany are allowed to be taken into account when calculating income tax in full. There is only one condition: the amount of such a deduction cannot exceed the amount of expenses of independent companies under similar operating conditions.

Confirmation of this statement can be found in letters from the Ministry of Finance of Russia dated 03/05/2014 No. 03-08-RZ/9491, dated 03/01/2013 No. 03-08-05/6124 and dated 01/11/2013 No. 03-08-05. The authors of the letters explain that if the above conditions are met, even normalized advertising costs can be taken into account in full. This principle must be observed regardless of the size of the German company’s share.

Accounting for entertainment expenses: opinions of regulatory authorities

In Letters dated 07/05/2019 No. 03-03-06/1/49848, dated 05/27/2009 No. 03-03-06/1/351 and dated 03/27/2009 No. 03-03-06/2/64, the Ministry of Finance of Russia concluded , that representation expenses include the costs of negotiations with individuals who are both actual and potential clients of the organization. These documents are not accidental, since from the literal wording of sub. 22 clause 1 art. 264 of the Tax Code of the Russian Federation it follows that entertainment expenses include expenses associated with the official reception and service of representatives of other organizations participating in negotiations in order to establish and maintain cooperation.

Previously, specialists from the Ministry of Finance argued that the Tax Code of the Russian Federation does not provide for the inclusion of costs for receiving and servicing individual clients as expenses (Letter of the Ministry of Finance of Russia dated November 24, 2005 No. 03-03-04/2/119).

Alcoholic drinks, among other food products, are taken into account as part of the costs of organizing an official meeting during a representative event (Letters of the Ministry of Finance of Russia dated January 22, 2019 No. 03-03-06/1/3120, dated March 25, 2010 No. 03-03-06/1 /176, dated August 16, 2006 No. 03-03-04/4/136).

It must be remembered that everything is good in moderation. In practice, some organizations try to “cover up” with entertainment expenses the costs of holding corporate events for various holidays. Of course, if such a fact is discovered during a tax audit, these expenses are excluded from the costs that reduce the tax base when calculating income tax.

The Letter of the Ministry of Finance of Russia dated May 12, 2010 No. 03-03-06/1/327 concluded that the cost of purchasing tea, coffee, sweets, cookies, which are laid out on the table for counterparties (forwarders) awaiting documents, does not comply with the provisions of p. .2 tbsp. 264 of the Tax Code of the Russian Federation and cannot be included in entertainment expenses for profit tax purposes.

Advertising costs are included in other expenses

In accordance with sub. 28 clause 1 art. 264 of the Tax Code of the Russian Federation, advertising expenses should be included in other expenses that are associated with production and sales. Moreover, according to paragraph 1 of Art. 318 of the Tax Code of the Russian Federation are indirect. Depending on the accrual method, the moment at which such expenses are recognized will differ:

- If a legal entity uses the accrual method of accounting, then advertising expenses should be classified as other expenses in the reporting or tax period in which they were incurred. The moment of actual payment (in any form) does not matter here (clause 1 of Article 272 of the Tax Code of the Russian Federation).

- If the cash method is used, then advertising expenses should be recognized after the actual payment is made (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Separately, it is worth pointing out that if advertising costs are due to payment for the services of third-party companies, then they can be taken into account in 2 different ways:

- at the time of presentation of documents on the basis of which calculations should be made (invoice and certificate of completion of work);

- on the last day of the reporting or tax period.

Both options are legal in accordance with clause 7.3 of Art. 272 of the Tax Code of the Russian Federation, which is confirmed in the letter of the Ministry of Finance of Russia dated March 29, 2010 No. 03-03-06/1/201.

The concept of "advertising"

First, let's define the terms and concepts.

Advertising means information disseminated in any way, in any form and using any means, addressed to an indefinite number of persons and aimed at attracting attention to the object of advertising, creating or maintaining interest in it and promoting it on the market (Clause 1 Article 3 of Law No. 38‑FZ).

| note As noted in the Resolution of the Supreme Court of Ukraine dated March 18, 2020 No. F09-1053/20 in case No. A47-14439/2018, the concept of “an indefinite circle of persons” implies a circle of persons who cannot be individualized (determined) in advance. Therefore, based on the concept of “advertising” for tax purposes, the costs of distributing advertising materials can be included in advertising costs only if these materials are intended for an indefinite number of people. |

Standardized advertising expenses: calculation of the maximum amount

As already noted, recognition of standardized advertising expenses in the reporting period is possible only in an amount that does not exceed 1% of sales revenue, determined, in turn, in accordance with Art. 249 of the Tax Code of the Russian Federation.

In paragraph 1 of this article there is a rule that requires the inclusion of proceeds from sales as income. However, in accordance with paragraph. 2 clause 1.2 art. 248 of the Tax Code of the Russian Federation, when determining the final amount of income, it is necessary to subtract from the received proceeds all amounts of taxes that are presented to the buyer. This refers to VAT and excise taxes.

That is, the maximum amount of standardized advertising expenses is calculated from the amount of sales revenue minus the amount of VAT and excise taxes. Confirmation of this thesis can be found in the letter of the Ministry of Finance of Russia dated 06/07/2005 No. 03-03-01-04/1/310.

Example

The organization received revenue from the sale of services in the amount of 530,000 rubles in the reporting period. (including VAT). First, let's determine the amount of VAT that is included in the revenue:

530,000 rub. × 20/120 = 88,333 rub.

Then let's find the difference:

530,000 rub. – 88,333 rub. = 441,667 rub.

Now, finally, let’s determine the amount of the maximum amount of advertising expenses:

RUB 441,667 × 1% = 4417 rub.

Within the limits of this amount, it is permissible to include advertising costs in expenses.

If you have access to K+, check whether you have determined the standard correctly. If you don’t have access, get free trial access to the system and go to the Ready Solution.

To learn how this limit is calculated under the simplified tax system, read the material “How to take into account advertising costs under the simplified tax system.”

When to consider consumption

The general rule for writing off expenses on the simplified tax system is this: you can take into account the expense only when you have received and fully paid for the product or service.

On June 10, you paid 20 thousand rubles for website promotion services. A month later, on July 10, the company completed the task and you signed the act. Take into account 20 thousand rubles in expenses on July 10.

This rule applies to both regulated and non-standardized expenses. But remember that you can write off normal expenses throughout the year as your revenue grows. So that expenses do not exceed 1% of revenue for the same period. For convenience, the normalized expense can be written off at the end of each quarter - until you fully take into account the costs or the year ends.

How to confirm consumption

Be sure to save documents that confirm advertising costs. If the tax office asks you to confirm the expense, but you cannot, they will charge additional taxes and fine you. The more money you spend on advertising, the more seriously you will take the paperwork.

Build this package:

- Agreement or invoice agreement. It should say what kind of advertising you are buying. The more details, the better. The agreement is optional, but with it the tax authorities will understand what kind of advertising you paid for, and it will be easier for you to explain its benefits for business.

- An act or other document that confirms the provision of services. List in detail the services that were provided to you. If the company that provides advertising services does not issue receipts, then to confirm the expense, use an email confirming that the services were provided. Print it out and have it certified with your signature and seal, or better yet, with a notary.

- Payment document. This could be a bank account statement or a cash receipt.

For example, you place contextual advertising through Yandex.Direct. You are given an invoice which you pay. Based on the results of your work, you receive an act and a report with visit statistics. These documents are sufficient to confirm the expense: invoice, payment and report. Here you can add an offer agreement from the Yandex website.

Submit reports in three clicks

Elba will prepare a tax return according to the simplified tax system and calculate taxes. The service is used by 100,000 individual entrepreneurs and LLCs. Try it too!

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

How are advertising expenses reflected in accounting and reporting?

In accounting, advertising expenses are expenses for ordinary activities that are reflected as part of business expenses. Sub-paragraph is aimed at such reflection. 5 and 7 of the accounting regulations “Expenses of the organization” PBU 10/99 (approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n).

As for the chart of accounts, it is recommended to reflect such expenses in the debit of account 44 “Sale expenses” (instructions for using the Chart of Accounts for accounting financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n). For accounting purposes they do not have a standardized nature.

The amount of advertising expenses in the income tax return is always reflected in one place, regardless of the method used to determine income and expenses. This amount forms the data indicated in line 040 of Appendix 2 to sheet 02 of the declaration (approved by order of the Federal Tax Service of Russia on October 19, 2016 No. ММВ-7-3 / [email protected] ).

Advertising expenses in tax accounting under the simplified tax system

In this case, of course, we mean the object “Income minus expenses”, because When using the “Revenue” object, tax accounting of costs does not make sense.

Article 346.16 of the Tax Code of the Russian Federation determines that “simplified” advertising expenses are recognized in a manner similar to income tax. Those. they are also divided into two categories: recognized in full and at the rate of 1% of revenue.

Here you should also take into account one of the features of the simplified tax system - the recognition of income and expenses “on payment”, i.e. cash method. Therefore, in order to account for advertising expenses (like any other), the “simplified” company must not only draw up primary documents, but also fully pay the supplier.

When calculating the 1% standard for standardized expenses, revenue is also taken into account “on payment”, including advances received.

How to correctly take into account advertising expenses when increasing profits in the tax period

The tax base for profit during the tax period is determined on an accrual basis (clause 7 of Article 274 of the Tax Code of the Russian Federation). Naturally, due to the gradual increase in the amount of revenue, the maximum amount of standardized advertising expenses will also increase, which can be taken into account when calculating the tax.

The letter of the Ministry of Finance of Russia dated November 6, 2009 No. 03-07-11/285 states that excess advertising expenses that could not be taken into account in the past reporting period can be taken into account during the calendar year in subsequent reporting periods (clause 44 of Art. 270 of the Tax Code of the Russian Federation).

In accounting, in such circumstances, a deductible temporary difference is formed, which is a deferred tax asset equal to the amount of excess advertising expenses (clauses 8–11, 14, 17 of the accounting regulations “Accounting for income tax calculations” PBU 18/02, approved. by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n).

Example

Circumstances:

, engaged in trade, spent 21,000 rubles on the production of prizes, which were then raffled off during the advertising campaign. (including VAT 3,500 rubles) The company is exempt from having to pay VAT in accordance with Art. 145 Tax Code of the Russian Federation.

Sigma's revenue by quarter was:

- for the 1st quarter - RUB 1,590,000;

- for half a year - 2,380,000 rubles.

Reflection in accounting:

According to paragraph 2 of Art. 285 of the Tax Code of the Russian Federation for income tax, reporting periods are considered to be 1 quarter, 6 months and 9 months.

If there were no other advertising expenses in the specified periods, the calculation of the maximum amount of normalized advertising expenses will look as follows.

- In the 1st quarter, since the amount of revenue is RUB 1,590,000:

- maximum amount of advertising expenses: RUB 1,590,000. × 1% = 15,900 rub.;

- the amount of advertising expenses that can be recognized in this reporting period is also equal to 15,900 (since it is less than the entire amount of expenses of RUB 21,000).

- maximum amount of advertising expenses: RUB 2,380,000. × 1% = 23,800 rub.;

- It will still be possible to admit: 21,000 rubles. – 15,900 rub. = 5,100 rub.

But it would be possible to write off a larger amount of advertising costs as expenses if their cost were higher. For the half year, this value was: 23,800 – 21,000 = 2,800 rubles.

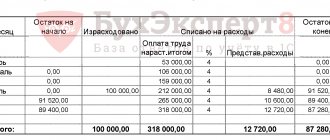

In accounting, the above transactions will be reflected as follows:

Dt 10/6 Kt 60 – prizes in the amount of 21,000 rubles were capitalized. (VAT is included in their price, since the company operates without VAT);

Dt 44 Kt 10/6 – the cost of prizes (21,000 rubles) was written off as expenses.

In addition, at the end of the first quarter on March 31, you need to make the following posting:

Dt 09 Kt 68 - a recognized and deferred tax asset of 1020 rubles is reflected. ([21,000 – 15,900] × 20%).

And based on the results of the six months of June 30 of the current year, the following entries are drawn up:

Dt 68 Kt 09 - the deferred tax asset is written off in the amount of 1020 rubles.

How to take into account the costs of a representative event in another city?

If you are organizing a representative event, for example, in another city or another country, then you should pay attention to the Letter of the Federal Tax Service of the Russian Federation for Moscow dated July 14, 2006 No. 28-11/62271. It states that the cost of air and railway tickets, payment for travel by any other transport of representatives (except for transport support for the delivery of these persons to the venue of the representative event), as well as visa support for employees of foreign companies are not considered entertainment expenses.

However, one may not agree with this approach. According to paragraph 2 of Art. 264 of the Tax Code of the Russian Federation, costs of transportation to the venue of the entertainment event and back are included in entertainment expenses. At the same time, transport support can also be understood as the costs of air or rail delivery of participants in a representative event. The most important thing is to justify the need to hold a representative event in another region.

If the entertainment event is held at the place of the employee’s business trip, then the costs of holding business dinners as part of negotiations with clients can be taken into account, provided they comply with the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation. This conclusion was made in the Letter of the Ministry of Finance of Russia dated November 1, 2010 No. 03-03-06/1/675.

Let us note that previously the Ministry of Finance took a different position: expenses for holding an informal meeting in a restaurant with potential partners, organized by an employee of the organization who is on a business trip in the city of residence of these partners, are not recognized as entertainment expenses and are not taken into account for profit tax purposes (Letter of the Ministry of Finance of Russia dated November 16 .2009 No. 03-03-06/1/759).

Please note that expenses for the purchase of prizes, the production of diplomas, and decoration of the hall cannot be taken into account as part of entertainment expenses for profit tax purposes, since clause 2 of Art. 264 of the Tax Code of the Russian Federation are not provided for. This conclusion was made in the Letter of the Ministry of Finance of Russia dated March 25, 2010 No. 03-03-06/1/176.

In conclusion, I note that accurate qualification of expenses incurred will help the accountant to correctly take them into account during taxation, and, accordingly, avoid penalties and fines during a tax audit.

| Egorova Olga Viktorovna Tax expert, tax service advisor, III rank (Moscow). |

Back

Forward

Results

Advertising expenses can be taken into account in full when calculating profits if they are included in the list from clause 4 of Art. 264 Tax Code of the Russian Federation. If there are no advertising costs incurred, they are taken into account in an amount equal to 1% of revenue.

In accounting, advertising costs are written off in full. If the amount of standardized costs is more than 1% of revenue, temporary differences arise between tax and accounting accounting.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.