Purpose of payment in tax payment

This detail is entered in field 107. 10 characters are allocated for it, 2 of which (3rd and 6th) are dividing dots (“.”). In general, it looks like this: XX.XX.XXXX.

The indicator reflects the frequency of payment of tax payments or the specific date for its payment established by law.

In the 4th and 5th digits for monthly payments the month number (from 01 to 12) is indicated, for quarterly payments - the quarter number (from 01 to 04), for semi-annual payments - the half-year number (01 or 02).

7–10 digits are the year for which the tax is paid.

When paying a tax payment once a year, a zero (0) is placed in place of the 4th and 5th digits of the tax period indicator. If the annual payment provides for more than 1 payment period and specific dates are established, then these dates are indicated.

MS.02.2020; KV.01.2020; PL.02.2020; GD.00.2020; 04.09.2020.

For more information about reflecting this detail, read the article “Indicate the tax period in the payment order – 2021 – 2020”.

The tax period is indicated for payments of the current year, as well as in the event of an independent discovery of an error in a previously submitted declaration and voluntary payment of additional tax (levy) for the expired tax period in the absence of a requirement from the tax authority to pay taxes (levies). The grounds for payment in field 106 are TP and ZD, respectively.

In case of early payment of tax, the 1st upcoming tax period for which payment must be made is given.

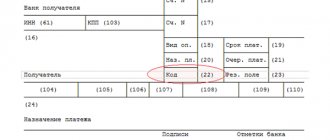

What is reflected in field 108

The payment order form is standard, its form is approved by Regulation No. 383-P of the Central Bank of the Russian Federation dated June 19, 2012. A standard payment order has many fields that are identified by numbers.

The fields reflect the details of the recipient and sender, the purpose of the payment and other important transfer parameters. One of the most important fields is field 108 in a payment order, filling out which often causes difficulties, primarily related to in what cases it is necessary to fill out this field and in what cases it is not. The content of field 108 is inextricably linked with the content of field 106. In field 108 it is necessary to reflect the document number indicated in column 106 “Base of payment”. That is, if you make a transfer in favor of paying, for example, transport tax, the basis (TR) must be indicated in field 106, and the number of the Federal Tax Service Inspectorate’s request to pay the tax must be indicated in field 108.

Both fields are not always filled in - you must enter the value in field 108 in the 2021 payment order when paying taxes, customs duties or making any other payments to the Russian budget. If the payment is not intended to replenish the budget fund, then the completed column 108 will become a reason for the bank to reject the payment order.

The document number in column 108 is written without the No. symbol, only the numbers themselves. In some cases, the value of field 108 in the 2019 payment order may be equal to “0”. It is very important to carefully fill out the payment order, using the table of abbreviations for different bases.

Field 108 in the payment order:

For detailed instructions on filling out each field in the payment order, see the recommendations of the State Finance System

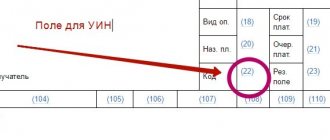

UIN and current payments

When paying current taxes, fees, and insurance premiums calculated by payers independently, the UIN is not established. Accordingly, there is no need to indicate it in field 22. Received current payments are identified by tax authorities or funds by TIN, KPP, KBK, OKTMO (OKATO) and other payment details. A UIN is not needed for this.

Also, the UIN does not need to be indicated on the payment slip when paying arrears (penalties, fines), which you calculated yourself and did not receive any requirements from the Federal Tax Service, Pension Fund or Social Insurance Fund.

If, when transferring current payments in field 22, you indicate “0”, then banks are obliged to execute such orders and do not have the right to require filling out the “Code” field if the payer’s TIN is indicated (letter of the Federal Tax Service of Russia dated 04/08/2016 No. ZN-4-1/6133 ). At the same time, do not leave field 22 completely empty. The bank will not accept such a payment.

When is it necessary to fill out a payment order?

A payment order is a document in a prescribed form that regulates the account holder’s instructions to make non-cash transfers in favor of the recipient of funds. The instruction has been sent to the bank that maintains the payer’s account. Funds are transferred from a deposit account. If for some reason the account does not have the required amount of money, but the agreement between the bank and the payer provides for an overdraft, the transfer will be carried out. This document must be drawn up and submitted to the bank for execution in electronic or paper form.

Individuals can also process payment orders without opening a bank account. In this case, an order to the bank from an individual can be drawn up in the form of an application, in which the following information must be indicated:

- payer details;

- details of the recipient of funds;

- bank details of the payer and recipient;

- amount of money;

- purpose or purpose of payment;

- other information established by the bank.

When drawing up an order to the bank electronically, it is very important to correctly indicate the payer, recipient of the transfer, amount, purpose of payment

How to fill out a payment order correctly?

The completion and form of the payment order are regulated “On the rules for making funds transfers”.

Filling out a payment order is regulated by regulations, namely Regulation No. 383-P and Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107-N.

| Filling stage | Explanation |

| Payment order number, date | Indicate the serial number of the document, date in the format DD.MM.YYYY |

| Type of payment | “Urgent” – in this case, the transfer of funds will be carried out by means of urgent transfer. If the payment type remains blank, then such an order is classified as non-urgent using the appropriate means of transfer. |

| Status | It is necessary to indicate only when making a transfer in favor of the budget. Status codes are located in the previously mentioned Order No. 107-N (101) |

| Sum | Indicate the amount in words with a capital letter, while writing the words “rubles” and “kopecks” in full, but write the number of kopecks in numbers. Digital designation of the amount:

For example: seventeen thousand one hundred fifty rubles 17 kopecks (17150-17) |

| Payer |

|

| Recipient | See Payer, but the Recipient's details are entered |

| Type of operation | The payment is always coded 01 |

| Payment order | As a rule, stage 5 (tax deductions, insurance premiums, transfer of payments to counterparties) |

| Code | In the case of current payments, 0 is entered in the column. If the payment is made in accordance with the UIP, then its code is entered, specified in the document on the basis of which the payment order is generated (22) |

| Purpose of payment | The number of the contract, invoice, etc. is indicated. If the payment is tax, then the cells located above the “Purpose of payment” cell are filled in in the following order: KBK (104); OKTMO (105); two-digit payment basis code; tax period (quarter, half-year, year, or simply indicate the date of tax payment): MS.03.2017, KV.01.2017, GD.00.2017, 03.20.2017 (107); basis of payment (106); number of the document on the basis of which the payment is made (108); the date of drawing up the document on the basis of which the payment is made (in the case of a tax payment, the date of signing the declaration is indicated) (109); leave payment type blank. |

Example of filling out a payment order

ABC LLC received a writ of execution dated February 12, 2020. No. 147/2589 in relation to Petrov P.P. The subject of the writ of execution was the need to withhold land tax debt.

The payment order to the bailiffs will be filled out according to the following parameters:

| Payment order field | Filling |

| 60 (payer's tax identification number) | TIN Petrova P.P. |

| 102 (checkpoint) | |

| 8 (Name of payer) | ABV LLC |

| 101 (Payer status) | 19 |

| 22 (Code) | |

| 104 (KBK) | |

| OKTMO | 123456789 |

| 108 (Document number) | 01; 12 34 567890 |

| 106 (Document Base) | |

| 107 (Tax period) | |

| 109 (Document date) | |

| Recipient | Department of the Federal Bailiff Service for Alapaevsk |

| Payment order | 4 |

| Purpose of payment | Land tax according to the writ of execution dated February 12, 2020 No. 147/2589 |

The payment order looks like this:

| Admission to the bank of payments. | Debited from account plat. | ||

| 19 | |||

| PAYMENT ORDER No. 6 | 15.02.2020 | ||

| date | Payment type | ||

| Suma in cuirsive | One thousand one hundred forty rubles 10 kopecks | ||

| INN 123456789 | Checkpoint 0 | Sum | 2340-20 |

| ABV LLC | |||

| Account No. | 40702810094000009876 | ||

| Payer | |||

| PJSC "UBRD" | BIC | 044030002 | |

| Account No. | |||

| Payer's bank | |||

| North-Western State Administration of the Bank of Russia, St. Petersburg | BIC | 044030001 | |

| Account No. | |||

| payee's bank | |||

| INN 7820027250 | Gearbox 782001001 | Account No. | 40101810200000010001 |

| UFC in St. Petersburg | |||

| Type op. | 01 | Payment deadline. | |

| Name pl. | Outline of boards | 4 | |

| Recipient | Code | Res.field | |

| 40307000 | 01;123456789 | ||

| Land tax according to the writ of execution dated February 12, 2020 No. 147/2589 | |||

| Purpose of payment | |||

| Signatures | Bank marks | ||

| Ivanova | |||

| M.P. | |||

| Petrova |

Payment information

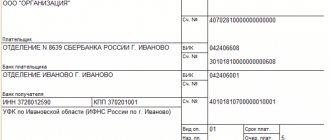

A payment order is the main document used by organizations for non-cash payments. Its form and composition of details are determined by the regulation of the Bank of Russia “On the rules for transferring funds” dated June 19, 2012 No. 383-P. It is acceptable to draw up instructions in electronic form and on paper.

The fields of the payment order are presented in the figure below.

Let's look at the detailed procedure for filling out the payment fields.

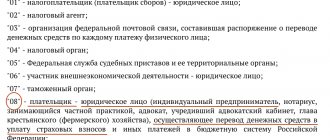

This is field 101. It is filled in on tax bills. The list of status codes is given in Appendix 5 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. Basic codes:

- 01 - taxpayer (payer of fees) - legal entity;

- 02 - tax agent;

- 08 - payer-legal entity (IP) paying insurance premiums and other payments to the budget system of the Russian Federation;

- 09 - taxpayer (payer of fees) - individual entrepreneur;

- 14 - taxpayer making payments to individuals;

- 24 - an individual payer who pays insurance premiums and other payments to the budget system of the Russian Federation.

The following fields are provided for it:

- 8 - it provides the full or abbreviated name of the legal entity, full name of the entrepreneur and his legal status, or full name and indication of the type of activity of private practitioners;

- 60 - TIN;

- 102 - checkpoint.

After indicating the payer, his bank details are given:

- account number - field 9;

- bank name - field 10 (filled out only in a paper order);

- BIC - field 11;

- bank correspondent account - field 12.

For the payee, you must provide the same information as for the payer, only in a slightly different order. First, his bank details are indicated: bank name (in a paper payment), account number, BIC and corr. score (fields 13, 14, 15 and 17).

IMPORTANT! Be careful when specifying your bank! If you make a mistake, the tax (contribution) may be declared unpaid (clause 4 of Art.

45 of the Tax Code of the Russian Federation). This means that penalties will be charged.

After the bank details, information about the recipient is provided: his name, TIN and KPP (fields 16, 61 and 103).

The TIN and checkpoint can be found on the websites of the Federal Tax Service of Russia and the Social Insurance Fund.

Read about where to find out the details for tax payments here.

In orders to transfer money to counterparties, only the purpose of the payment is indicated: the account or agreement number, for which VAT is paid (this is field 24).

In payments for taxes and contributions, fields 104–110 are also required to be filled in. In this case, you need to be guided by the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. Let's look at these fields further.

Regulation No. 383-P of the Central Bank of the Russian Federation dated June 19, 2012 approves the form and appearance of the payment order. Therefore, in all financial organizations of the Russian Federation the document form looks the same. The regulatory act also establishes the rules and procedure for filling out the fields of payment slips. The tax document number in the payment order is no exception. It is indicated in field 108, which is located in the very bottom line on the right.

The document number in the payment order is transferred from the document officially received from the tax office. The column must be filled out if payment is made to the state budget. If the payment card has a different purpose and the bank specialist sees field 108 filled in, the money transfer will not be made due to an error, and the client will receive a refusal.

Filling out field 108 based on data about an individual

According to Appendix 4 to Order of the Ministry of Finance dated November 12, 2013 No. 107n by an individual (status 24), when paying insurance fees to the social insurance fund, in field 108 the digital 2-digit designation of the document - the individual’s identifier is indicated, and then its number is entered if the payment is transferred to an individual :

- by the post office (status 03 in field 101) when drawing up an order to pay insurance premiums or other payments on behalf of an individual;

- by the employer (status 19 in field 101) when drawing up an order to pay the employee’s debt to the budget, withheld from his salary on the basis of an executive document;

- credit institutions (status 20) when transferring funds to pay insurance premiums or other payments accepted from individuals.

The following citizen identification cards are used:

- passport of a citizen of the Russian Federation (01);

- birth certificate issued by the registry office or other municipal authorities (02);

- seaman's passport (03);

- document confirming the identity of the military personnel (04);

- military service ticket (05);

- temporary certificate of citizenship of the Russian Federation (06);

- certificate of release (07);

- identity document of a foreign national (08);

- issued residence permit (09);

- document for temporary residence of stateless persons (10);

- refugee certificate (11);

- issued migration card (12);

- passport confirming USSR citizenship (13);

- SNILS card (14);

- driver's license (22);

- document confirming vehicle registration (24).

Numerical values in field 108 are entered using the separator character “;”. For example, RF passport 5800 No. 111222 in field 108 will be designated as follows: 01;5800111222.

How to fill out field 107 for customs

The payer must ask at the customs post at which customs office the payment will be made at this location. That is, what code does the higher customs office have for accepting transferred funds?

EXAMPLE

Bryansk customs has 10 posts for customs inspection. And each of them has its own individual code. But when a company fills out the customs authority code, in field 107 of the payment they indicate the numbers of the central office of the customs office of the Bryansk region. This code looks like this - 10102000.

This information is also provided on the website of the Customs Service of the Russian Federation https://ved.customs.ru/ in the “Databases” section. Everything that needs to be entered in field 107 is given at this link.

Examples of filling out field 109

Let's look at several examples of filling out field 109 “Document date”.

Example 1

The organization pays the current income tax payment. The date for signing the declaration submitted to the tax authority is 03/27/2020. Then field 106 “Basis of payment” has the value TP, therefore, field 109 will indicate: 03/27/2020.

See a sample income tax payment form.

Example 2

The organization independently identified the underpayment of property taxes for 2021 and is transferring it. In this case, field 106 should have the value ZD, and field 109 should have the value 0.

Look for the BCC for property tax.

Example 3

The organization pays tax at the request of the tax authority dated February 22, 2020. Field 106 indicates the TR value, and field 109 indicates the date of the request: 02/22/2020.

You can learn about the procedure for tax authorities to issue demands from the selection of materials in this section.

Example 4

The organization pays an advance payment for land tax. There are no values in field 106 “Basis of payment”; field 109 will contain 0.

For information on how to correctly fill out a payment order for the payment of land tax, see the article “Payment order for the payment of land tax (sample)”.

Payment order – field 108: filling in for customs payments

When making customs payments, numerical values are indicated in field 108, while in field 106 the grounds that led to the payment are indicated:

| Field code 106 | The value specified in field 108 |

| DE, CT | Last 7 digits of the customs declaration |

| BY | No. of customs receipt order |

| ID | No. of the executive document on the basis of which payment is made |

| THAT | Requirement on the basis of which customs duties are paid |

| IN | Collection document no. |

| DB | No. of the accounting document of the customs authorities |

| KP | No. of the agreement between large taxpayers when making centralized payments |

Field 107 “Tax period” in the payment order for 2019–2020

Let us consider in detail the rules for filling out the tax period in a payment order (field 107 “Tax period”) in 2019–2020. This field is filled in when generating payment orders for the payment of taxes and contributions:

- To indicate the period for which the tax (contribution) is paid.

- To indicate a specific payment date - in exceptional cases established by law.

Field 107 has 10 characters, 8 of them are indicated in a specific order, and the remaining 2 are used for separation and are filled with periods. Signs 1 and 2 indicate the frequency of tax (contribution) payment, which can take the following values:

- menstruation (MS);

- quarterly (QW);

- semi-annual (PL);

- annual (AH).

The 4th and 5th digits of the indicator correspond to the number of the selected period:

- for monthly payments, the number of the month of the reporting period is indicated - such a number can take a value from 01 to 12 according to the number of months in the year;

- for quarterly payments, the quarter number is given - the number takes a value from 01 to 04 according to the number of quarters;

- for a half-year, the half-year number is indicated, it has 2 values: 01 and 02;

- for payments made once a year, zeros are entered.

The 3rd and 6th characters correspond to the “dot” symbol and are separating characters.

The “Tax period” field can be filled in for payments not only of the current year, but also of past periods, if the taxpayer himself has discovered errors in the reports already submitted and independently pays additional tax (contribution). In this case, field 107 should reflect the tax period in which the changes were made.

There are a number of situations in which a specific date is indicated in the “Tax period” field. This occurs when the associated Payment Basis field 106 has a specific encoding. A specific date in such situations means for the basis of payment:

- TP - payment deadline established by the tax authority;

- RS - date of payment of part of the installment tax amount, based on the existing installment schedule;

- FROM - the date when the deferred payment ends;

- RT - date of payment of part of the restructured debt based on the existing restructuring schedule;

- PB - the end date of the procedure that is applied in a bankruptcy case;

- PR—end date of suspension of collection;

- IN - date of payment of part of the investment tax credit.

In the event that payment is made for a debt identified during a tax audit or according to a writ of execution, a zero value is indicated in the “Tax period” field.

In case of advance payment of tax, field 107 indicates the tax period for which payment is made.

NOTE! When making payments to customs, field 107 is filled in completely differently

Payment order – field 108: filling in when paying taxes

According to Appendix 2 of Bank of Russia Regulation No. 383-P dated June 19, 2012, in field 108 of the payment order for the transfer of funds, the document number is indicated, which is the basis for the payment and can take the following form:

| Code | A comment |

| TR | Number of the tax authority's request for payment of tax (fees, insurance contributions). Typically, the Federal Tax Service informs taxpayers about arrears in paying taxes and fees. The request indicates the amount of arrears and the period intended for payment of the debt. |

| RS | Installment decision number. According to Article 61 of the Tax Code of the Russian Federation, a taxpayer has the right to write an application to the Federal Tax Service for the provision of an installment plan for paying taxes and insurance contributions. The tax authorities, having assessed the taxpayer’s inability to make timely payments, make a decision allowing or not allowing the debt to be repaid in equal payments throughout the year. |

| FROM | Deferment decision number. The decision to defer is made by the tax authorities. The taxpayer has the right to write an application to the Federal Tax Service for a deferral of payment of taxes and insurance contributions, about which the tax authorities will make an appropriate decision. |

| RT | Restructuring decision number. The taxpayer has the right to request the drawing up of an individual repayment schedule for debts on taxes, insurance premiums, fines and penalties. |

| PB | Number of the case or material considered by the arbitration court. Indicated if the arbitration court makes a decision aimed at the need to make a payment in favor of the budget of the Russian Federation, i.e. The court sided with the Federal Tax Service. |

| ETC | Number of the decision to suspend collection. |

| AP | The number of the decision to prosecute for committing a tax offense or to refuse to prosecute for committing a tax offense. |

| AR | Number of the enforcement document and the enforcement proceedings initiated on the basis of it. |

| IN | Number of the decision to provide an investment tax credit. An investment tax credit can be provided to a taxpayer for a period of up to 10 years, but in this case interest will inevitably accrue. |

| TL | Number of the arbitration court ruling on the satisfaction of the statement of intention to pay off the claims against the debtor |

When indicating the number of the corresponding document, the number sign (“No”) is not inserted.

When paying current payments, including on the basis of a tax return (calculation), or voluntary repayment of debt in the absence of a requirement from the tax authority to pay taxes (fees, insurance contributions) (the payment basis indicator has the value “TP” or “ZD”) in the indicator The document number is indicated as zero (“0”).

When drawing up an order to transfer funds to pay tax payments, insurance premiums of a payer - an individual - a bank client (account holder) on the basis of a tax return (calculation), zero ("0") is indicated in detail "108".

Here is OKTMO

The OKTMO code is given in field 105 in accordance with the All-Russian Classifier of Municipal Territories (approved by Order of Rosstandart dated June 14, 2013 No. 159-ST). It replaced the OKATO code.

This code can consist of 8 or 11 characters:

- 8-digit is indicated when taxes either go entirely to the regional budget, or partially or completely to the budgets of municipalities (urban or rural settlements);

- 11-digit is given if taxes are distributed between settlements included in municipalities.

The OKTMO in the payment order must correspond to the OKTMO specified in the tax return.

We talked about the nuances of indicating OKTMO in payments here.

What is the document index in the Federal Tax Service?

The document index for paying tax through Sberbank consists of 20 digits. It is unique and never repeated. When transferring taxes that go to the state budget, and when making payments from state, regional or municipal structures.

This number is created by the organization that receives the transfer to its account. How to find out the document index for paying taxes online? It is indicated on the receipt or other form of payment document; it is used to pay both taxes and administrative penalties.

The index acts as a mandatory document identifier; before making a payment, you must make sure that it exists. It is easier for payers if they make payments after receiving a message from the tax office. It often contains the required data.

If such a message does not exist, you can create it yourself. This is not difficult to do; to do this, you need to visit the Federal Tax Service website, the server will automatically assign an index to the place of registration of the individual entrepreneur.

When paying taxes through the Sberbank Online service, you should indicate the index in the field provided for it. It will be processed automatically, and the display will show tax obligations that must be paid within the specified time frame.