Expert of the magazine “Regulatory Acts for Accountants” A.F. Klyuev provides a commentary on the letter of the Ministry of Finance of the Russian Federation dated October 14, 2013 No. 03-04-06/42790.

A branch of a Russian organization pays taxes in the foreign country in which it is registered. For personal income tax purposes, are the payments he makes to employees income received from sources outside the Russian Federation:

- wage;

- compensation for travel expenses to your place of work and residence;

- payment of the cost of visas and health insurance;

- average earnings while on vacation and on a business trip;

- material aid;

- payment of travel expenses?

Income from sources outside the Russian Federation

In a published letter, the Russian Ministry of Finance noted that the branch of the organization, which is the source of payment to its employees of all of the above income, conducts commercial activities in a foreign country. Therefore, the above payments to employees relate to income from sources outside the Russian Federation.

In letter dated June 11, 2010 No. 03-04-06/6-118, the Russian Ministry of Finance considered a similar situation when a branch of a Russian organization located outside of Russia and registered as a legal entity of a foreign state pays its employees for accommodation, food and medical care. According to the Finance Ministry, such payments also apply to income received from sources outside the Russian Federation.

Persons attributing the taxpayer's income to those received from sources in the Russian Federation or abroad

There may be situations where it is difficult to unambiguously attribute income received to one type or another. Part 2 art. 42 of the Tax Code provides for a method for resolving such conflicts. According to the current rules, the assignment occurs on the basis of acts of the federal government body that has supervisory and control functions in the tax field.

These include the following structures:

1. Ministry of Finance of Russia. Since this body is responsible for forming the foundations of tax policy, it can issue acts clarifying certain provisions of the current law;

2. Federal Tax Service. It has this right due to the fact that this structure controls the payments received by the budget;

3. Courts. Since clarifications and individual acts adopted by the above bodies can be appealed, the Constitutional Court or arbitration courts can make decisions affecting the status of certain incomes.

Taxation of personal income tax

In addition, the Ministry of Finance of Russia in a published letter recalled that personal income tax payers are individuals who (clause 1 of Article 207 of the Tax Code of the Russian Federation):

- are tax residents of the Russian Federation;

- are not tax residents of the Russian Federation, but receive income from sources in Russia.

Reference

Tax residents are individuals who are actually in the Russian Federation for more than 183 calendar days over the next 12 consecutive months (clause 2 of Article 207 of the Tax Code of the Russian Federation).

This means that branch employees who are not tax residents of the Russian Federation are not recognized as personal income tax payers in relation to income received from sources outside the Russian Federation.

It turns out that those employees of the branch who are tax residents of the Russian Federation are recognized as payers of personal income tax in relation to income received from sources outside the Russian Federation.

Thus, income paid to employees of a branch of a Russian organization in a foreign country relates to income from sources outside the Russian Federation and:

- are not subject to personal income tax if employees are not tax residents of the Russian Federation;

- are subject to personal income tax if employees are tax residents of the Russian Federation.

As a rule, personal income tax is withheld from the income of tax residents of the Russian Federation at a rate of 13 percent.

Clause 2 of Article 208 of the Tax Code of the Russian Federation

For the purposes of this chapter, the income of an individual received as a result of foreign trade operations (including commodity exchange) carried out exclusively on behalf and in the interests of this individual and related exclusively to the purchase (acquisition) does not apply to income received from sources in the Russian Federation. goods (performance of work, provision of services) in the Russian Federation, as well as with the import of goods into the territory of the Russian Federation.

This provision applies to operations related to the importation of goods into the territory of the Russian Federation in the customs procedure of release for domestic consumption only if the following conditions are met: (As amended by Federal Law No. 306-FZ dated November 27, 2010)

clause 1, delivery of goods is carried out by an individual not from storage places (including customs warehouses) located on the territory of the Russian Federation; (As amended by Federal Law No. 166-FZ dated December 29, 2000)

clause 2 (Subclause has lost force - Federal Law dated July 18, 2011 No. 227-FZ)

Clause 3 , the goods are not sold through a separate division of a foreign organization in the Russian Federation. (As amended by Federal Law No. 216-FZ dated July 24, 2007)

If at least one of the specified conditions is not met, income received from sources in the Russian Federation in connection with the sale of goods is recognized as the part of the income received relating to the activities of an individual in the Russian Federation.

Upon the subsequent sale of goods acquired by an individual through foreign trade transactions provided for by this paragraph, the income of such an individual received from sources in the Russian Federation includes income from any sale of this product, including its resale or pledge, from those located on the territory of the Russian Federation, warehouses belonging to this individual, rented or used by him or other places of location and storage of such goods, with the exception of their sale outside the Russian Federation from customs warehouses. (As amended by Federal Law No. 166-FZ dated December 29, 2000)

Responsibilities of tax residents of the Russian Federation

It should be borne in mind that those tax residents of the Russian Federation who receive income from sources outside of Russia calculate, declare and pay personal income tax independently at the end of the tax period (that is, the calendar year). The basis is subparagraph 3 of paragraph 1 and paragraph 2 of Article 228 of the Tax Code of the Russian Federation.

Moreover, with regard to employee income received from sources outside the Russian Federation, the employing company is not recognized as a tax agent. That is, in relation to the indicated income, she does not need to fulfill the duties of calculating, withholding and transferring personal income tax to the budget of the Russian Federation.

EXAMPLE: Let’s say that during a calendar year, an employee’s status changes to non-resident and remains so until the end of the tax period. In this case, such an individual, in accordance with paragraph 1 of Article 207 of the Code, is not recognized as a personal income tax payer on income received from sources outside the Russian Federation. Accordingly, such an employee does not have any taxpayer obligations to declare income from sources outside the Russian Federation, including those received before acquiring non-resident status, and to pay personal income tax. Similar explanations are given in letters of the Ministry of Finance of Russia dated June 28, 2012 No. 03-04-06/6-183, dated June 11, 2010 No. 03-04-06/6-120.

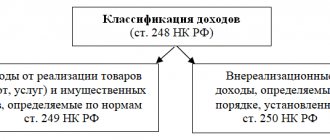

Types of taxpayers for income tax purposes

Unlike personal income tax, tax rules establishing territorial principles when taxing profits do not provide for the separation of sources, but a differentiated approach to taxpayers.

1. Payers are Russian organizations.

These are companies created and registered in accordance with the norms of federal legislation in the civil sphere. Their distinctive feature is state registration certificates obtained in Russia. These documents are issued by authorized tax inspectorates.

Consolidated groups of taxpayers are also distinguished, among which a responsible person stands out.

2. Payers are foreign companies.

As a general rule, non-Russian companies that have the obligation to calculate and make income tax payments to the state budget include organizations with permanent representative offices in the Russian Federation. Another reason is their receipt of income from property located on Russian territory.

A special rule applies to FIFA. According to it, this organization is not recognized as a taxpayer. This norm is due to the holding of the World Cup.

3. Foreign companies that are equal to Russian ones.

Such companies are equated with Russian ones on the basis of Art. 246.2 NK. We are talking about tax residents. These include cases where this is provided for by a bilateral state agreement on double taxation. In addition, we are talking about organizations that are managed from Russia.

Working abroad is not a business trip

For the purposes of calculating personal income tax, income received from sources outside the Russian Federation includes, in particular, remuneration for the performance of labor or other duties, work performed, service provided, action performed in a foreign state (subclause 6, clause 3, article 208 of the Tax Code RF).

If employees of an organization perform all their labor duties stipulated by employment contracts outside the Russian Federation, then the actual place of work of the employees will be in a foreign country. And they cannot be considered to be on a business trip. Indeed, in accordance with Article 166 of the Labor Code of the Russian Federation, a business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work.

When employees are sent to work abroad, when they perform all their labor duties stipulated by the employment contract at their place of work in a foreign state, the salary they receive is remuneration for work in the territory of a foreign state. It does not apply to income from sources in the Russian Federation. This is reported in letters of the Ministry of Finance of Russia dated September 25, 2012 No. 03-04-06/6-289, dated June 11, 2010 No. 03-04-06/6-120.

Taxation of income received from abroad

A situation is possible when an individual who is not registered as an individual entrepreneur enters into an agreement with a foreign organization that does not have a representative office in Russia to provide services on the territory of the Russian Federation. For the provision of services, a foreign organization will monthly transfer remuneration in foreign currency to an individual’s account in a Russian bank. Let's consider the procedure for taxation of received income.

Lebedeva M.A. The main regulatory legal act of currency legislation regulating currency legal relations, the rights and obligations of Russian and foreign individuals and legal entities, the powers of currency regulation authorities, is the Federal Law of December 10, 2003 N 173-FZ “On Currency Regulation and Currency Control” (hereinafter - Law N 173-FZ).