Value added tax is not an absolute charge. A number of business activities are subject to it, while others are exempt from VAT. An organization can do both at the same time. There are also frequent cases when a company has several tax regimes in effect simultaneously, for example, general and UTII, general and patent.

In such cases, accounting and financial records for such types of activities or tax systems must be maintained separately. The main thing is to choose the optimal method for this. Let's consider the principles of maintaining separate accounting for value added tax.

If you don't keep separate records

Separate accounting for VAT is mandatory for a company in the following cases:

- in the parallel conduct of taxable and non-taxable activities;

- when using two tax regimes at once;

- when providing services of both a commercial nature and those whose prices are regulated by the state;

- when working under government contracts;

- when combining commercial and non-commercial activities.

ATTENTION! The first case also includes accounting for “input” VAT for goods (works, services) purchased within the framework of different types of activities (taxable and non-taxable). This applies not only to objects, but also to intangible assets (paragraph 5, paragraph 4, article 170 of the Tax Code of the Russian Federation).

If an economic entity does not introduce separate accounting in these cases, it loses the rights to:

- VAT deductions;

- reduction of the income tax base by the amount of VAT (clause 4 of Article 170 of the Tax Code of the Russian Federation);

- tax benefits (clause 4 of article 149 of the Tax Code of the Russian Federation).

Exceptions: when there is no need to separate accounting

It is better for an entrepreneur to know when keeping separate records makes no practical sense, because without the need to increase the labor costs of the accounting department, it is unprofitable.

There are certain legally established situations in which separate accounting may not be maintained even if the above conditions are met. Among them is conducting trade outside the Russian Federation (a domestic organization operates territorially in another state). In this case, the services provided or goods sold are not the basis for calculating VAT.

IMPORTANT! In this case, reporting is carried out in accordance with the requirements of domestic legislation, however, it is recommended that the contract additionally indicate the place of sale of goods or provision of services (to reduce the likelihood of complications during inspections).

However, if an enterprise wants to keep separate records in cases where this is not provided for by law, no one will have anything against it. The purpose of such accounting can be not only purely commercial (providing VAT for deduction), but also informational, for example, detailing management data. Separate accounting in such situations is a voluntary right of any organization.

Features of separate accounting when leasing property

Let's consider the features of the RU if the OS:

- entered into the organization under a leasing agreement;

- used both in VAT-taxable and non-taxable activities;

- under the terms of the agreement: taken into account on the balance sheet of the lessee, becomes the property of the organization upon expiration of the agreement, the redemption price of the leased asset is not separated from the total amount of payments under the agreement.

In such a situation, it is necessary to take into account that the receipt by an organization of fixed assets under a leasing agreement is not a transfer of property, but a service, the payment for which is leasing payments.

It is possible to deduct VAT on the amount of such a service as soon as the lessee receives invoices after leasing payments are reflected in the accounting records - subclause. 1 item 2 art. 171, paragraph 1, art. 172 of the Tax Code of the Russian Federation.

Taking into account the above, when organizing RU it is necessary to take into account that:

- the entire amount of “input” VAT as part of the lease payment is distributed between taxable and non-taxable transactions;

- When determining in the accounting policy the duration of the tax period for calculating the VAT proportion, the taxpayer has no choice - it is set equal to a quarter, since leasing payments are a payment for services in the interpretation of clause 5 of Art. 38 of the Tax Code of the Russian Federation, and not by acquiring fixed assets;

- non-deductible VAT amounts are included in the cost of the purchased service, not the fixed asset, and are expensed when calculating income tax (will be an element of leasing payments that do not increase the cost of the leased asset).

For accounting features and other nuances of leasing operations, please read the materials posted on our website:

- “Operations under a leasing agreement in accounting”;

- “Transactions for leasing a car from the lessee”.

5% threshold

This is another rule that justifies the optional division of input VAT. It is justified in paragraph 9 of paragraph 4 of Art. 170 Tax Code of the Russian Federation. This rule can only be applied by those who have VAT benefits that are timely (quarterly) confirmed.

The 5% rule states : you can ignore input VAT separately if the costs of operations supported by benefits do not exceed 5% of general production costs. In this case, it is allowed to deduct the entire input VAT without including it in the cost of goods, works, and services.

ATTENTION! The 5% rule does not apply to separate accounting of income - it is mandatory to maintain it under appropriate conditions.

If an enterprise conducts only non-taxable transactions and purchases goods (work or services) from another party, the 5% rule is not applicable for this situation: VAT cannot be deducted on these acquisitions (Decision of the Supreme Court of the Russian Federation dated October 12, 2016 No. 305-KG16- 9537 in case No. A40-65178/2015).

For a long time, the application of the 5% rule for UTII payers was controversial - the Ministry of Finance of the Russian Federation in a letter dated 07/08/2005 No. 03-04-11/143 and the Federal Tax Service in a letter dated May 31, 2005 No. 03-1-03/897/ [email protected ] argued that the 5% threshold does not apply to this tax regime. But judicial precedent put an end to this issue, and the Federal Tax Service changed its position, reflecting this in letter dated February 17, 2010 No. 3-1-11 / [email protected] ).

5% threshold in trading activities

The above rule speaks primarily about production costs. But a considerable proportion of organizations and entrepreneurs are not manufacturers, but taxpayers-merchants conducting trading activities. Will this rule be valid for trade?

The Ministry of Finance of the Russian Federation, in a letter dated January 29, 2008 No. 03-07-11/37, allowed the 5% threshold to be extended to trade operations, but did not definitely establish this, but only indicated this possibility.

Meanwhile, there are arbitration precedents establishing the refusal of separate accounting due to the “5% rule” for trading activities. The reason is simple: trade, be it wholesale or retail, is not production; “production” accounts are not used to reflect its operations in accounting.

Separate VAT accounting using the simplest examples

Separate accounting is carried out by companies that combine transactions subject to VAT with preferential ones. And this situation occurs more often than it seems at first glance. For example, when a company issues loans to a partner. And of course, organizations that combine a common system with UTII are forced to distribute “input” VAT between types of activities. We will tell you in this article how to keep separate records, guided by the latest explanations from officials.

Our recommendations may also be useful to “simplified” people who pay tax on income minus expenses and apply UTII. After all, in order to determine the amount of VAT that can be attributed to expenses, separate accounting is also needed.

If your

The recommendations given in this article are relevant for companies that combine income and expense “simplified taxation” with UTII.

Specify the separate accounting method in the accounting policy

When checking, controllers will, of course, demand to show them the accounting policies. And it should contain the rules for separate accounting. This follows from paragraph 4 of Article 170 of the Tax Code of the Russian Federation. Tax authorities adhere to the same position (see, for example, letter of the Federal Tax Service of Russia for Moscow dated March 11, 2010 No. 16 - 15/25433). And if your accounting methodology is not described, inspectors may deduct VAT. Even if in fact you keep separate records. In such a situation, you can try to defend your position in arbitration. After all, sometimes judges express the opinion that a company is not obliged to establish separate accounting rules in its accounting policies (resolution of the FAS East Siberian District dated January 20, 2011 in case No. A58 - 2951/10). But it is possible that the tax authorities will win the case. After all, their position was supported by the judges of the Supreme Arbitration Court in the ruling of July 21, 2008 No. 7105/08.

Carefully!

The judges of the Supreme Arbitration Court of the Russian Federation agreed with the officials: the rules for separate accounting need to be spelled out in the accounting policy.

Distinguish between taxable and preferential (imputed) transactions in accounting as much as possible.

So, the main task of separate accounting is to isolate from the “input” value added tax the part that relates to taxable transactions. You can put this amount as a deduction. You will have to include the rest of the tax in the cost of purchased goods (works, services) or charge them to expenses. To do this, you need to distribute not only VAT amounts in accounting between taxable and preferential transactions, but also goods, revenue, and expenses. Usually, for this purpose, different sub-accounts are opened for accounts 19, 41, 90, 91, etc.

At the same time, it is advisable to separate accounting between types of activities to the maximum. After all, the fewer calculation methods there are, the less likely it is to find fault with inspectors. Let's explain with an example. The company sells goods wholesale and retail. For wholesale trade, it pays taxes according to the regular system, and for retail it applies UTII. The ideal option is when it is immediately clear for what activity the products were purchased. Then VAT on goods intended for wholesale sale can be immediately deducted. And for retail goods, take them into account in their cost.

Unfortunately, even in this case there will be VAT amounts that cannot be distributed in this way. This usually applies to general business and general production expenses, which are taken into account in accounts 26, 25, 44. And it is not always possible to distribute the goods themselves. For example, at the time of purchase, the accountant may not know whether they will be sold wholesale or retail. Therefore, on account 19 (as well as 41, 90, etc.) you can open the following subaccounts:

- 1 “VAT on goods (work, services) purchased for wholesale trade”;

- 2 “VAT on goods (work, services) purchased for retail trade”;

- 3 “VAT on goods (works, services) purchased for wholesale and retail trade.”

In the last subaccount, you will take into account VAT on general business expenses and fixed assets used simultaneously in taxable and preferential transactions. This sub-account is also useful when the purpose of goods (works, services) is still unknown.

Invoices - invoices for goods, works or services that are accounted for in subaccount 1, are immediately registered in the purchase book (if, of course, all standard conditions for deduction are met). Invoices - invoices related to subaccount 2 do not need to be registered. And then we’ll see what to do with subaccount 3.

Determine the amount of VAT by calculation if goods, works, services are used simultaneously in ordinary and preferential (imputed) activities

Let's start with general business expenses. So, when you cannot accurately classify them as taxable or preferential transactions, do it by calculation. During the quarter, accumulate the “input” tax on these expenses in subaccount 3 to account 19. On the last day of the quarter, first determine the share of proceeds from the sale of taxable goods (works, services):

Please note: revenue from taxable transactions must be taken without VAT so that it is comparable to the same indicator for preferential transactions (letter of the Ministry of Finance of Russia dated August 18, 2009 No. 03 - 07 - 11/208).

How to determine revenue if goods are given free of charge, for example the same advertising catalogues? You need to take the VAT tax base, which is equal to the market value of the goods. Questions often arise about what amount to take into account if a company has issued a loan. Tax officials believe that interest on the loan (letter of the Federal Tax Service of Russia dated November 6, 2009 No. 3 - 1-11/886 @).

We also note that the calculation does not need to take into account income that is not revenue. For example, interest on bank deposits and accounts, dividends on shares (letters of the Ministry of Finance of Russia dated August 3, 2010 No. 03 - 07 - 11/339, dated March 17, 2010 No. 03 - 07 - 11/64).

Now you can distribute the “input” tax. First, calculate the amount you can deduct:

Moreover, this indicator will have to be calculated separately for all invoices that relate to general business expenses. After which you can register these accounts in the purchase book, each for the amount calculated for it (clause 8 of the Rules, approved by Decree of the Government of the Russian Federation of December 2, 2000 No. 914).

Let's calculate the tax that must be attributed to expenses:

The calculation of all these indicators should be reflected in the accounting statement.

Example 1:

How to determine the amount of VAT to be deducted on general business expenses.

Trader LLC is engaged in retail trade. In addition, the company sometimes sells products to wholesalers. For retail trade, the LLC pays UTII, but for wholesale it applies the general taxation regime.

At the end of the second quarter of 2011, revenue from the sale of goods at retail amounted to 12,000,000 rubles, and from wholesale – 3,540,000 rubles. (including VAT - 540,000 rubles).

The company pays monthly rent and utilities 177,000 rubles, including VAT - 27,000 rubles.

On June 30, the accountant calculated the share of revenue from the sale of goods subject to VAT:

3,000,000 rub. : (RUB 12,000,000 + RUB 3,000,000) 100% = 20%.

The amount of VAT on rent and utility bills that can be deducted monthly is equal to:

27,000 rub. 20% = 5400 rub.

The amount of tax that can be attributed to expenses was:

27,000 rub. – 5400 rub. = 21,600 rub.

Particular attention should be paid to separate VAT accounting for fixed assets. The amount of depreciation and the amount of property tax depend on this. In general, you can do the same here as with general business expenses. Then the initial cost will be equal to the purchase price without VAT. Based on the results of the quarter, you will determine by calculation for a specific fixed asset the amount of tax that can be deducted. You will then adjust the original cost by increasing it by the remaining VAT. Formally, this will look like correcting an accounting error.

Moreover, if the company purchased a fixed asset in the first month of the quarter, then the depreciation amount in the second month will be underestimated. This means that the amount of income tax will be overestimated. This gives the right to companies that transfer advance payments monthly not to submit updated declarations, but to take into account the error in the current period.

As for property tax, you will calculate its amount correctly. Because at the end of the quarter, you will already know the “correct” initial cost of the fixed asset. Let us remind you that it is important to spell out this entire procedure in the company’s accounting policy.

A special procedure is provided for real estate. In this case, the company can immediately deduct the “input” VAT, despite the fact that the property will be used in tax-free activities. True, then the tax will have to be gradually restored.

You can read more about how to restore VAT on real estate in the article “In what cases do you need to restore VAT and what will change in the very near future” (published in the magazine “Glavbukh” No. 5, 2011).

You can read a detailed commentary on this issue below. The procedure described therein must be applied when real estate is simultaneously (during the first year) used for taxable and non-taxable transactions. If the company will use the building in non-taxable operations only after a long time (for example, 16 years), then this rule applies. There is no need to restore “input” VAT when the object is completely depreciated or at least 15 years have passed since its commissioning for this organization.

Example 2:

How to take into account “input” VAT on a fixed asset that is used in taxable and preferential activities.

Concern LLC is engaged in activities subject to VAT, as well as preferential operations. In April 2011, the company bought a computer for accounting needs worth RUB 47,554, including VAT - RUB 7,254. The computer has a useful life of three years (36 months).

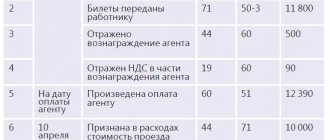

In April, the accountant made the following entries:

DEBIT 08 CREDIT 60

—40,300 rub. — the computer has been capitalized;

DEBIT 19 subaccount “VAT on goods (work, services) purchased for taxable and non-taxable transactions” CREDIT 60

—7254 rub. — VAT on the purchased computer has been taken into account;

DEBIT 01 CREDIT 08

—40,300 rub. — the computer is included in fixed assets.

In May, the accountant made the following entry:

DEBIT 26 CREDIT 02

—1119 rub. — depreciation has been calculated (RUB 40,300: 36 months).

On June 30, the accountant calculated the share of revenue from VAT-taxable transactions. It was 70 percent. The following entries were made in accounting:

DEBIT 19 subaccount “VAT on goods (work, services) purchased for taxable transactions” CREDIT 19 subaccount “VAT on goods (work, services) purchased for taxable and non-taxable transactions”

—5078 rub. (RUB 7,254 70%) — the amount of VAT on the computer to be deducted has been determined;

DEBIT 19 subaccount “VAT on goods (work, services) purchased for non-taxable transactions” CREDIT 19 subaccount “VAT on goods (work, services) purchased for taxable and non-taxable transactions”

—2176 rub. (7254 – 5078) — the amount of VAT on the computer has been calculated, which must be included in its cost;

DEBIT 68 subaccount “Calculations for VAT” CREDIT 19 subaccount “VAT on goods (work, services) purchased for taxable transactions”

—5078 rub. — part of the VAT on the computer has been accepted for deduction;

DEBIT 01 CREDIT 19 subaccount “VAT on goods (work, services) purchased for non-taxable transactions”

—2176 rub. — part of the VAT is included in the initial cost;

DEBIT 26 CREDIT 02

—60 rub. (RUB 2,176: 36 months) - additional depreciation accrued for May;

DEBIT 26 CREDIT 02

—1180 rub. ((40,300 rub. + 2,176 rub.) : 36 months) - depreciation for June.

Separate accounting for goods whose purpose when purchased is unknown can be maintained based on planned indicators

Comments, Elena Vikhlyaeva, Ministry of Finance of Russia

- Often a company purchases goods that can be used both in VAT-taxable and in “imputed” (or preferential) activities. In such cases, we recommend keeping separate records based on the intended purpose of the goods. For example, a company applies a general taxation system for wholesale trade and UTII for retail. She purchased a batch of goods, of which 70 percent is planned to be sold wholesale, and 30 percent at retail. Then the company will deduct 70 percent of the “input” tax amount, and include 30 percent in the cost of goods. If the results of the actual sale of goods do not coincide with the planned proportion, adjustments will have to be made to the accounting. Suppose that not 30, as planned, but 50 percent of the goods were sold at retail. Then part of the VAT, which falls on 20 percent of goods, will need to be restored.

VAT on real estate can be immediately deducted

Comments, Ruslan Khusnetdinov, Ministry of Finance of Russia

- Let's say your company bought a building that will be used in both taxable and preferential transactions (or activities that are transferred to the “imputed” tax). You can immediately deduct the “input” VAT. After this, at the end of each calendar year for 10 years, the part of the tax that relates to non-taxable transactions will need to be restored (clause 6 of Article 171 of the Tax Code of the Russian Federation). This was confirmed in the letter of the Federal Tax Service of Russia dated November 28, 2008 No. ShS - 6-3/862 @.

Thus, it is necessary to begin to restore VAT from the year in which the building began to be used, including for non-taxable operations. For 10 years, you will write off the recovered VAT amount annually against other costs associated with production and sales for tax accounting purposes. To calculate it, you need to take 1/10 of the amount of “input” VAT, which is accepted for deduction, and multiply by the share of revenue from non-taxable transactions in the organization’s total revenue for the year.

Let's move on to goods purchased simultaneously for taxable and preferential (imputed) transactions. Let’s say that at the time of purchase their purpose is not known exactly. Officials recommend basing the products on their intended use.

Use the five percent rule

If a company’s expenses for operations not subject to VAT fall within 5 percent, it can deduct the entire “input” tax. Moreover, the amount of non-taxable income no longer matters here. This was confirmed by officials of the Ministry of Finance in a letter dated November 1, 2010 No. 03 - 07 - 07/70.

This rule can be used by companies that carry out single preferential transactions. After all, the costs for them will probably fall within 5 percent. So, calculate the share of expenses for non-taxable transactions:

Important detail

When calculating the share of expenses for preferential transactions, take into account not only direct, but also indirect costs.

Please pay attention to this important point. The calculation includes not only direct, but also indirect costs. The tax authorities insist on this (letter of the Federal Tax Service of Russia dated November 13, 2008 No. ShS - 6-3/827 @). Therefore, you need to distribute general business expenses between taxable and preferential transactions. It’s easier to do it the way we said above - in proportion to revenue. But you can use another indicator. For example, direct costs, number of employees, wage fund. Or, say, the cost of fixed assets (letter of the Federal Tax Service of Russia dated March 22, 2011 No. KE - 4-3/4475). In any case, be sure to establish the procedure for distributing indirect costs in the accounting policy.

But even if a company falls under the five percent rule, it is still necessary to maintain separate accounting for costs and revenue. Otherwise, you will not be able to calculate the share of expenses and thereby confirm the right to deduct VAT in the full amount. So there is only one way to completely get away from separate accounting - to refuse the benefit. But this can only be done in relation to transactions that are provided for in paragraph 3 of Article 149 of the Tax Code of the Russian Federation.

The main thing to remember

1. The rules for separate accounting must be recorded in the accounting policy.

2. “Input” VAT can be distributed among general business expenses based on the results of the current quarter.

3. If the share of expenses for the production of preferential goods does not exceed 5 percent, the entire “input” tax can be deducted.

Accuracy of accounting policies for VAT accounting

The organization is authorized to choose the system for introducing separate accounting. Naturally, the adopted standards should be recorded in the accounting policy (clause 2 of article 11 of the Tax Code of the Russian Federation).

But there may be some incidents that should be taken into account related to VAT benefits and the 5% rule. It is not known exactly how costs will be distributed across activities. This will only be clear based on the results of the quarter. What if the 5% threshold is exceeded and separate accounting was not maintained? You will have to restore it, and in some cases also adjust tax returns, which is expensive and inconvenient. Therefore, you need to make a decision whether to stipulate this norm in the accounting policy or not, and if not, then not to use it, even if such a threshold does arise.

Accounting policies are established for a one-year period. But what if an organization has VAT-free activities after it has been submitted to the tax authorities? Give up the opportunity to save money by avoiding separate accounting? No, you can formulate and provide an addition to the accounting policy : this will not be considered a change in it, because such operations arose for the first time, and at the beginning of the reporting period they were not provided for (clause 16 of PBU 1/98 “Accounting policy of the organization”, approved by order of the Ministry of Finance Russia dated December 9, 1998 No. 60n).

FOR YOUR INFORMATION! The accounting policy should list the types of activities that the organization is engaged in: separately - taxable and non-taxable VAT.

VAT distribution - who needs to do it

When carrying out their activities, legal entities and individuals can carry out transactions subject to and not subject to VAT, and simultaneously apply different tax regimes.

For example, combine conventional taxation with a single tax on imputed income or conventional taxation with the patent system. Also, taxpayers can conduct transactions at different tax rates - 10, 20 or 0%, and carry out activities in Russia and abroad. When combining, it is necessary to organize separate VAT accounting, i.e., separately generate income and expenses for taxable revenue and activities without VAT. The requirement to carry out such accounting is expressly stated in paragraph 4 of Art. 149 of the Tax Code of the Russian Federation.

Amendments made to paragraph 4 of Art. 170 of the Tax Code of the Russian Federation by law dated November 27, 2017 No. 335-FZ, obligated, starting from 2021, to keep separate records of all taxpayers carrying out VAT-taxable and non-VAT-taxable transactions. Previously, separate VAT accounting was optional for organizations that did not cross the 5% barrier for all expenses when using transactions not subject to VAT.

Distribution of VAT under separate accounting is the division of the so-called input tax on the acquisition of goods (work, services), fixed assets, intangible assets, property rights used in taxable and non-taxable transactions.

About in what cases it is necessary to keep separate records, and when it is not needed, is described in great detail in the ConsultantPlus ready-made solution. Get a free trial access to the system to find answers to your questions.

Calculation of proportions when maintaining separate accounting

By proportion here we mean determining the share of input VAT that falls on taxable and non-taxable transactions. It must be calculated to determine what share of VAT (as a percentage) can be deducted. Expenses need to be grouped:

- expenses for activities subject to VAT;

- expenses for non-VAT-taxable transactions;

- other costs that are difficult to unambiguously attribute to the first or second group.

Formula for calculating the proportion of VAT on taxable transactions:

DVObl. = (VOBL.VAT + DPrObl.VAT / V_VAT + DPr_VAT) x 100% , where:

- DVObl. – share of revenue from taxable transactions for the accounting period;

- VOBL._VAT – revenue from taxable sales excluding VAT;

- DPRobl_VAT – other income from taxable transactions excluding VAT;

- V_VAT – total sales revenue excluding VAT;

- DPR_VAT – other income excluding VAT for all transactions.

All indicators are taken into account without VAT so that the cost of non-taxable transactions is comparable to preferential ones.

NOTE! The accounting period for VAT is a quarter, which means that the proportion must be calculated quarterly.

To calculate the share of non-VAT-taxable transactions, the same principle of proportion is applied, only the ratio of revenue from non-VAT-taxable transactions to the total amount for the accounting period is sought.

The third group, mixed, is not required to be distributed for separate accounting purposes. It’s easier to attribute it all to either the first or second operations.

Example of VAT calculation for general business expenses

IP Bakunin F.G. owns a network of retail stores, but part of its products is sold to wholesale customers. For retail trade, individual entrepreneurs report on UTII; for wholesale sales, the general tax regime is used.

For the first quarter, revenue from retail sales is equal to 14,000,000 rubles, from wholesale sales - 5,340,000 rubles. (including VAT – 630,000 rubles).

Every month, the individual entrepreneur pays the cost of renting stores and utility bills in the amount of 167,000 rubles, including VAT - 24,000 rubles.

On March 31, the accounting department calculated the share of revenue from the sale of products subject to VAT: RUB 3,000,000. : (RUB 12,500,000 + RUB 2,500,000) 100% = 20%.

The amount of VAT on rental payments and utility costs, which we accept for deduction every month, is: 24,000 rubles. 20% = 4800 rub.

The amount of tax that we attribute to expenses is calculated: 24,000 rubles. – 4800 rub. = 19,200 rub.

What if there is temporarily no income?

In practice, sometimes there are certain periods when the company does not conduct business operations that generate income, while expenses are still incurred. This is often observed, for example, among newly registered organizations. It happens that among expenses transactions there are both VAT taxable and preferential ones. Is it necessary to divide such expenses in accounting? After all, there was no actual sale of goods and services.

Until 2015, the Ministry of Finance of the Russian Federation allowed in such cases to neglect separate accounting due to the lack of transactions with VAT benefits. However, in 2015, he voiced a different position regulating separate VAT accounting in such “non-shipment” periods.

Borrowing operations and separate accounting

Providing loans, selling securities and other similar transactions are subject to VAT. A significant nuance in calculating the proportion for such operations is the indicator of income amounts, which is key in the formula. For operations of one type or another, it will have a different composition, which is influenced by the current provisions of federal legislation. Federal Law No. 420 of December 28, 2013 proposes that for transactions with securities not subject to VAT, the following amount should be considered income:

D = Tsr – Rpr , where:

- D – tax-free income;

- CR – selling price of securities (according to the provisions of Article 280 of the Tax Code of the Russian Federation);

- Ррр – expenses for the acquisition of these securities (and/or sale).

If the difference is less than 0 (that is, there will be a loss), then the income is not taken into account.

The proportional calculation method for separating taxable and non-taxable transactions in this situation involves calculating the ratio between the cost of all goods sold (both in Russia and abroad) and the item of interest. The amount of income will also include:

- the entity's revenue;

- the cost of its fixed assets;

- his non-operating income.

Currently, there is no consensus on the need to maintain separate accounting for borrowing transactions. However, the Ministry of Finance of the Russian Federation is increasingly inclined to this position due to the introduction of significant changes to the Tax Code of the Russian Federation.

Separate accounting for personal income tax and simplified tax system

The Tax Code does not provide for preferential rates for personal income tax. But an entrepreneur working for OSNO can simultaneously apply the “imputation” or patent system. In this case, he will also need to keep separate records. When distributing “mixed” expenses, you can use the general rule (clause 1 of Article 272 of the Tax Code of the Russian Federation) and divide them in proportion to revenue from the corresponding tax regimes.

UTII or PSN can be used not only by companies or individual entrepreneurs on OSNO, but also by those who use the simplified code. In this case, it is also necessary to maintain separate tax records.

In this case, the distribution of expenses that relate to both types of activities should be carried out in proportion to income. This is indicated in paragraph 8 of Art. 346.18 Tax Code of the Russian Federation.

Thus, separate accounting when combining “imputation” or a patent with the simplified tax system is carried out similarly to the situation when these regimes are used simultaneously with the main tax system.

Posting input VAT on preferential activities

In accounting, input VAT will be reflected in account 19 (different subaccounts are used for different transactions). This is what the wiring will look like:

- debit 41 “Goods”, credit 60 “Settlements with suppliers and contractors” - reflection of the receipt of goods from the supplier excluding VAT;

- debit 19 “VAT on acquired values”, credit 60 - allocation of VAT, which can subsequently be deducted;

- debit 68 “Calculations for taxes and fees”, credit 19 - acceptance of input VAT for deduction;

- debit 41, credit 19 - reflection of VAT for non-taxable transactions and included in the cost of the purchased product (service, work).

Depending on the type of activity of the company, you need to use along with account 41 “Goods” and other accounts - 10 “Materials”, 23 “Auxiliary production”, 25 “General production expenses”, 26 “General expenses”, 29 “Service production and facilities” and other.

Cost comparison example

The company produces children's shoes, including medical orthopedic boots, the sale of which is exempt from taxation. The accounting records reflect direct costs for the production of autumn boots on account 20 “Direct expenses” - on the sub-account “Boots” and “Orthopedists”. During the reporting quarter, direct production expenses of the enterprise amounted to RUB 9,000,000. (of which 600,000 for boots and 200,000 for orthopedic shoes), general business expenses were also incurred - 4,000,000 rubles, and general production expenses - 3,000,000 rubles.

Let's calculate the cost ratio to determine whether this case falls under the 5% rule. 600,000 / (9,000,000 + 4,000,000 + 3,000,000) x 100% = 3.7%. Since the threshold turned out to be less than the coveted 5%, the accounting department may not keep separate records for input VAT, presenting for deduction the entire amount of value added tax billed by suppliers.

But in the tax return you will need to reflect the direct cost of production with tax benefits - 200,000 rubles.

Example

The organization’s total revenue for the quarter is 20 million rubles. excluding VAT, including on taxable transactions – 18 million rubles. excluding VAT, for non-taxable transactions – 2 million rubles. Input VAT on general business expenses (office rent, heating, communications, etc.) for the same period amounted to 500 thousand rubles. An organization can deduct the following amount:

VAT = 500 x (18 / 20) = 500 x 90% = 450 thousand rubles.

The remaining 50 thousand rubles. VAT should be included in the cost of purchased services to calculate income tax.

Until 2021, the so-called “5% rule” was in effect. If the share of non-taxable transactions in the total amount of expenses did not exceed 5%, then the taxpayer could deduct the entire input VAT and not keep separate records.

Now, according to the new edition of paragraph 4 of Art. 170 of the Tax Code of the Russian Federation, the effect of this rule is significantly limited:

- Separate accounting must be maintained in any case, regardless of the share of non-taxable transactions in expenses.

- Only input VAT on “mixed” transactions can be deducted. If a product (service) is purchased exclusively for non-taxable transactions, then the amount of VAT must be included in the purchase price.

When using the “5% rule”, it is important not to confuse the methodology with the distribution of input VAT discussed above. In this case, the share of non-taxable transactions is calculated not from revenue, but from total costs.

Checking the correct distribution of expenses

In modern practice, accounting calculations are carried out using special software. The calculation of the proportion for separate accounting is also automated. To check the final data, it is convenient to create special tables from which the entire calculation will be visible: separately for transactions subject to VAT and for non-taxable ones. The table will summarize the main indicators used to calculate the proportion:

- acquisition/sale expenses – transactions not subject to taxation (it is better to list all their types);

- qualifying expenses for taxable transactions;

- total line of direct expenses;

- mixed group of expenses (also list);

- summation.

In order to maintain separate VAT accounting correctly and when it is really necessary, you need to constantly monitor the updating of current information. The rules for maintaining separate accounting for VAT are directly related to updates in the Tax Code of the Russian Federation, which happens constantly, and recently - especially intensively.

Separation of transactions when accounting for VAT

The main purpose of separate accounting for this tax is to separate transactions subject to VAT from the bulk of the “input” tax. This amount will be deducted. The remaining block must be added to the cost of purchased goods and services or added to the expense group. It is effective to divide in accounting between taxable and “zero” transactions, in addition to the amount of VAT and goods, also expenses with revenue. A common practice in this case is to open sub-accounts for the nineteenth, forty-first, ninetieth and other accounts.

Separate accounting of VAT is required if a company wants to use the right to deduct amounts of “input” VAT and/or increase the cost of goods or services sold by the amount of VAT.

It is optimal to achieve a clear separation of accounting for various options for the organization’s activities in order to minimize the number of calculation methods.