What changed

From January 1, 2021, the list of non-taxable personal income tax includes:

| Type of income | Norm of the Tax Code of the Russian Federation | Explanation |

| Payment for travel to and from vacation destinations for employees living in the Far North and equivalent areas | New edition of clause 1 of Art. 217 (paragraph 10) | This also includes: • cost of transportation of luggage weighing up to 30 kg; • the cost of travel for non-working family members (husband, wife, minor children actually living with the employee); • the cost of carrying their luggage. Until 2021, there was also no need to pay personal income tax on such compensation, but according to the general norm of clause 3 of Art. 217 NK. That is, there was no special norm, so disputes arose. |

| Payment for additional days off to care for a disabled child | New clause 78 art. 217 | Applies to income received no earlier than 2021 These days are set in accordance with Art. 262 of the Labor Code of the Russian Federation for persons (parents, guardians, trustees) caring for disabled children. For a long time the issue was controversial. Recent court practice and departmental explanations tended to suggest that there is no tax. |

| Income in cash and in kind related to the birth of a child and paid in accordance with the law | New paragraph 77 of Art. 217 | Applies to income received no earlier than 2021 and paid according to:

|

| One-time compensation to medical workers not exceeding 1 million rubles, which are financially supported by a state program approved by the Government of the Russian Federation. | New edition of clause 37.2 of Art. 217 | Applies to payments, the right to receive which arose from 01/01/2018 to 12/31/2022 inclusive. Until 2021, only one-time compensations under Art. 51 of the Federal Law on Compulsory Medical Insurance dated November 29, 2010 No. 326-FZ. |

| One-time compensation for teachers up to 1 million rubles received under the state program. | New edition of clause 37.2 of Art. 217 | Introduced the Law of September 29, 2019 No. 325-FZ into the Tax Code of the Russian Federation. Applies to payments, the right to receive which appeared in 2020-2022. |

| Reimbursement of expenses for housing and communal services, incl. solid waste management services. | New edition of paragraph 3, clause 3, art. 217 Tax Code of the Russian Federation | Until 2021, only compensation related to the free provision of residential premises and utilities, fuel or corresponding monetary compensation was not taxed |

| Monetary compensation in exchange for a land plot due from state or municipal property, if it is established by the legislation of the Russian Federation or the region | New clause 41.2 of Art. 2017 | Applies to income received from the 2019 tax period |

| Income in cash and/or in kind received by certain categories of citizens as part of providing them with social support (assistance) in accordance with the law | New clause 79 of Art. 217 | Applies to income received from the 2019 tax period |

| Annual cash payment to honorary donors | new clause 80 art. 217 | Condition: have the appropriate badge. Regulated by Federal Law No. 125-FZ of July 20, 2012 “On the donation of blood and its components.” |

Financial assistance provided by educational organizations:

| New edition of clause 28 of Art. 217 | Applies to no more than 4,000 rubles per tax period |

Personal income tax on residents' income

Depending on their type, income received by residents may be subject to personal income tax at rates of 9, 35, 13 and 30 (15) percent.

Withhold personal income tax at a rate of 9 percent on payments paid to a resident:

- interest on mortgage-backed bonds issued before January 1, 2007;

- income of the founders of trust management of mortgage coverage, under mortgage participation certificates issued before January 1, 2007.

Income taxed at a rate of 9 percent is listed in paragraph 5 of Article 224 of the Tax Code of the Russian Federation.

The following income of residents is taxed at a rate of 35 percent:

1) the value of winnings and prizes received in games, competitions and other promotions conducted for the purpose of advertising goods (works, services). At the same time, only income over 4,000 rubles is subject to personal income tax. Income up to the specified amount is exempt from tax. If winnings (prizes) are received in lotteries not related to promotions, then income in the form of the value of these winnings (prizes) is taxed at a rate of 13 percent (letter of the Ministry of Finance of Russia dated September 19, 2011 No. 03-04-05/6-671 , letter of the Federal Tax Service of Russia dated May 30, 2012 No. ED-3-3/1898).

2) interest on bank deposits in excess of:

- refinancing rate increased by five percentage points, effective during the interest period, for ruble deposits;

- 9 percent for deposits in foreign currency.

This is stated in paragraph 3 of paragraph 2 of Article 224 of the Tax Code of the Russian Federation.

Attention: during the period from December 15, 2014 to December 31, 2015, an increased limit on interest on bank deposits not subject to personal income tax was in force.

Interest accrued on ruble bank deposits during this period is exempt from personal income tax if their amount does not exceed the refinancing rate increased by 10 percentage points. In relation to the current refinancing rate, the maximum interest rate was determined at a rate of 18.25 percent (8.25 + 10). For comparison: until December 15, 2014, the interest limit was determined at a rate of 13.25 percent (8.25 + 5). This procedure is provided for in paragraph 3 of Article 214.2 of the Tax Code of the Russian Federation.

3) Interest on the use of funds of members (shareholders) of consumer credit cooperatives, as well as interest on loans issued to agricultural credit consumer cooperatives by their members (associate members). The portion of interest exceeding the refinancing rate increased by 5 percentage points is subject to taxation at a rate of 35 percent (for the period from December 15, 2014 to December 31, 2015 - in the part exceeding the refinancing rate increased by 10 percentage points).

This is provided for in paragraph 5 of paragraph 2 of Article 224, Article 214.2.1 of the Tax Code of the Russian Federation.

4) material benefit from the borrowed (credit) funds received.

Income taxed at a rate of 35 percent is listed in paragraph 2 of Article 224 of the Tax Code of the Russian Federation.

A personal income tax rate of 30 percent is applied when paying income on securities of Russian organizations (except for income in the form of dividends), the rights for which are recorded in the securities accounts of foreign holders (depository programs). But only if such income is paid to persons whose information has not been provided to the tax agent in accordance with Article 214.6 of the Tax Code of the Russian Federation. This is stated in paragraph 6 of Article 224 of the Tax Code of the Russian Federation.

All other income of residents is subject to personal income tax at a rate of 13 percent (clause 1 of article 224 of the Tax Code of the Russian Federation).

What else you need to know about income without personal income tax

Basically, the corresponding changes to the Tax Code of the Russian Federation were made by Federal Law No. 147-FZ of June 17, 2019 (hereinafter referred to as Law No. 147-FZ).

In general, payments related to state benefits and compensation and listed until 2021 in paragraphs 1 and 3 of Art. 217 of the Tax Code of the Russian Federation, are now combined into one paragraph - the first. Accordingly, the third paragraph will no longer apply.

Also, starting from 2021, the norm (clause 69 of Article 217 of the Tax Code of the Russian Federation) on the composition of non-taxable income of veteran soldiers has been expanded. In essence, the new edition consolidated the rules established for 2021.

In addition, from 2021, the new paragraph 76 of Art. 217 of the Tax Code of the Russian Federation exempts from tax payments to citizens exposed to radiation (Chernobyl, Semipalatinsk, Mayak).

Also see: What's Income Tax Changes in 2021: Full Review.

Read also

28.11.2019

Tax agents

In accordance with Russian legislation, organizations and individual entrepreneurs must perform the duties of tax agents for personal income tax. What are they? When paying income in cash and in kind, it is necessary to calculate, withhold and transfer the corresponding tax to the budget.

In this regard, the accountant needs to know the non-taxable income for personal income tax in 2021. After all, tax must be withheld only from those payments that are subject to personal income tax.

Income in kind is goods, work, services, intangible assets transferred to the employee. The fact that the payment to an individual is not made in money is not a reason not to pay tax. Personal income tax can be withheld from any other payment to this individual in cash. If this is not possible, then the fact of non-withholding of tax should be reported to the Federal Tax Service.

An accountant needs to be careful when withholding tax on payments to individuals. The fact is that levying income tax on non-taxable income under the Personal Income Tax 2021 will result in the taxpayer receiving less money than he is owed. This may serve as a basis for claims against the company.

List of income not subject to personal income tax

The income on which an individual pays tax is indicated in Article 208. Tax Code of the Russian Federation. Their list consists of amounts received from sources in the Russian Federation and abroad. In particular, personal income tax is paid on wages, royalties, income from the sale or rental of real estate, a number of benefits (including temporary disability), dividends, etc.

The list of non-taxable personal income tax income is much larger - now it includes more than 75 items, and from January 2021 there will be even more of them. It applies to both tax residents and non-residents. This feature of Article 217 of the Tax Code of the Russian Federation is reported in Letter of the Ministry of Finance of the Russian Federation No. 03-04-06/6-125 dated June 18, 2010, which states that the types of income contained in it are excluded from taxation regardless of the status of the taxpayer.

So, in 2021 and 2021 The following income of individuals is exempt from personal income tax:

- pensions – insurance, funded, state, as well as social supplements to these pensions;

- maternity capital, “Putin” payments for the 1st and 2nd child, provided for by Law No. 418-FZ of December 28, 2017 for low-income families;

- various types of compensation established by law - compensation for harm to health, payment of the cost of meals or sports equipment for athletes, free housing, etc.;

- daily allowance (within 700 rubles/day – for domestic business trips, 2500 rubles/day – for foreign business trips);

- cash rewards for “self-employed” caregivers, tutors, and au pairs received in 2017-2019. (if they notified the tax authorities about their activities and did not involve hired workers in them);

- unemployment benefits, maternity benefits;

- alimony received;

- financial assistance paid to employees, the cost of gifts given to them (in total, no more than 4,000 rubles per year are not taxed), etc.

In addition to the above-mentioned Article 217 of the Tax Code of the Russian Federation, the code contains a rule establishing the conditions under which personal income tax is not paid on income received from the sale of real estate (Article 217.1 of the Tax Code of the Russian Federation). From January 2020, some of its provisions will be supplemented.

Personal income tax: main correspondence accounts

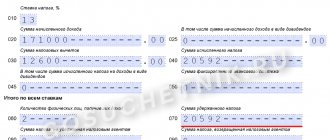

Depending on the type of remuneration received by the employee, the entries for calculating personal income tax have the following correspondence:

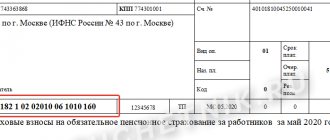

- Dt 70 Kt 68.01 - personal income tax withheld:

- from salary;

- from sick leave;

- from vacation pay;

- from bonuses;

- from business trips in excess of the norm;

- with material benefits from savings on interest.

- Dt 73 Kt 68.01 - income tax accrued:

- with financial assistance over 4000 rubles,

- from gifts over 4000 rubles.

- Dt 75 Kt 68.01 - personal income tax is charged on dividends to the founders.

- Dt 76 Kt 68.01 - income tax on payments under a GPC agreement to persons who are not members of the state.

When personal income tax is withheld, no additional posting occurs, because income tax is withheld at the time of payment of income to an individual. Since income is paid minus accrued tax, this is an operation to withhold income tax by the tax agent. Until income minus income tax is paid, personal income tax is not considered withheld.

Income not subject to personal income tax in 2021: expanding the list

In 2021, on the basis of Article 1 of Law No. 147-FZ of June 17, 2019, the list of non-taxable personal income tax income will be supplemented with new items. No tax will be charged:

- from cash payments to Chernobyl victims, as well as citizens exposed to radiation as a result of other man-made disasters and nuclear tests (received in accordance with laws No. 1244-1 of May 15, 1991, No. 2-FZ of January 10, 2002, No. 175-FZ of November 26, 1998 );

- from amounts paid in connection with the birth of a child, if they are established by federal laws, acts of the President of the Russian Federation or the Cabinet of Ministers, regional regulations (laws, regulations, etc.);

- from payment of an additional day off provided to one of the parents or guardians of a disabled child (Article 262 of the Labor Code of the Russian Federation);

- from the income of disabled people and disabled children (received under Law No. 181-FZ of November 24, 1995 on their social protection);

- from payments that are measures of social support for certain categories of citizens;

- from cash payments to Honorary donors, Heroes of Labor, full holders of the Order of Labor Glory, Heroes of the Russian Federation and the Soviet Union (received in accordance with the relevant laws).

What income is not subject to personal income tax from 2021 is also established by other laws that amend Article 217 of the Tax Code:

- No. 210-FZ dated July 26, 2019;

- No. 323-FZ dated September 29, 2019;

- No. 325-FZ dated September 29, 2019;

- No. 327-FZ dated September 29, 2019.

According to these acts, from 2021 personal income tax will not be paid:

- from income in the form of a bad debt to a creditor (under certain conditions, in particular, if the debtor and creditor do not have an employment relationship with each other);

- from one-time compensation payments to teachers paid under the state program - up to 1 million rubles. (currently this rule applies only to medical workers);

- with financial assistance up to 4,000 rubles provided by an educational organization to students, graduate students, cadets and other students.

Also, the tax will not be imposed on natural and monetary income (including forgiven debt) of persons affected by a natural disaster, terrorist attack and other emergency situations on the territory of the Russian Federation, received in connection with such events.

What to pay attention to when making calculations?

If there are minor children (students under 24 years old), this must be highlighted when performing online personal income tax calculations using a calculator. Try to find a program that calculates tax taking into account the benefit. According to paragraph 4 of Article 218 of the Tax Code of the Russian Federation, each of the parents (guardians) has the right to claim a deduction in the amount of:

- up to 2 children – 1400 rubles;

- for 3 or more children – 3000 rubles;

- If a parent raises children alone, the deduction amount increases by 2 times.

Pay special attention to the last point, even if the program is able to calculate the NDFL for the parent, the calculated result may turn out to be erroneous, since a double deduction was not made. You will have to calculate the tax amount yourself. To do this, subtract 1400 or 3000 from the result obtained, depending on the number of dependent minors.

Another important point: the deduction for children will be calculated until the taxpayer’s annual income in total reaches three hundred and fifty thousand rubles. For example, if a person’s salary is 50 thousand per month, then in September personal income tax will be calculated without taking into account children.

The calculator will help you calculate your property deduction. The grounds for its provision arise after the acquisition or sale of housing and in a number of other cases (clause 1 of Article 220 of the Tax Code of the Russian Federation). So, if a person bought real estate, he has the opportunity to return part of the previously taken tax. And after selling the home, he can receive a property deduction by reducing the tax paid to the budget on the profit received.

Basic formulas

To calculate the tax base from the beginning of the year, the amount of property, social or other deduction should be subtracted from total income.

Knowing the base and rate, you can easily separate out the amount of personal income tax from the profit received.

To do this, use the following calculation formulas:

- Personal income tax = NB * 13% (for residents);

- Personal income tax = NB * 30% (for non-residents).

Formulas for separating personal income tax from wages:

- initially accrued earnings = cash in hand / (100% - 13%);

- Personal income tax = take-home salary * 13% / (100% - 13%).