Legal basis

There is no separate Federal Law on personal income tax benefits. A whole list of legislative acts regulates personal income tax benefits:

- NK (Article 217-222);

- Labor Code (Article 118);

- various letters from the Ministry of Finance, resolutions of the Government of the Russian Federation.

Russian legislation establishes two types of personal income tax benefits - tax deductions and exemptions from taxation of certain types of income. The Tax Code lists a closed list of such income:

- state benefits for unemployment, childbirth and pregnancy;

- old-age pensions (does not apply to insurance contributions of private pension funds);

- one-time and monthly payments for children;

- compensation for damage to health, dismissal, etc.;

- alimony;

- maternity capital;

- payment by the employer for the services of medical institutions to its employees.

The full list can be found in Art. 217 NK. Article 215 lists categories of foreign citizens who are also exempt from income tax.

There are several groups of tax deductions. The most common are:

- standard deductions (for yourself and for children);

- social (in a situation where a citizen incurs social costs - for study, treatment, charity);

- property (when selling, buying or constructing real estate, in other cases);

- professional (taxpayers are entrepreneurs with the status of individuals, notaries).

Regulates property tax deductions Art. 220 of the Tax Code, as well as various federal laws establishing changes in the tax code.

Article 56 of the Tax Code of the Russian Federation “Establishment and use of benefits for taxes and fees”

Article 215 of the Tax Code of the Russian Federation “Features of determining the income of certain categories of foreign citizens”

Article 217 of the Tax Code of the Russian Federation “Income not subject to taxation (exempt from taxation)”

Article 218 of the Tax Code of the Russian Federation “Standard tax deductions”

Article 219 of the Tax Code of the Russian Federation “Social tax deductions”

Article 220 of the Tax Code of the Russian Federation “Property tax deductions”

Article 221 of the Tax Code of the Russian Federation “Professional tax deductions”

Article 222 of the Tax Code of the Russian Federation “Powers of legislative (representative) bodies of the constituent entities of the Russian Federation to establish social and property deductions”

Article 118 of the Labor Code of the Russian Federation “Reimbursement of expenses when using the employee’s personal property”

What standard deductions are provided for this year?

The conditions and features of providing standard deductions in 2021 are regulated by the Tax Code. They are regulated at the federal level. This suggests that the norms and maximum amounts of payments are the same for all citizens of the country. Standard deductions apply to separately designated categories of citizens, the list of which is given in Art. 218 Tax Code of the Russian Federation. Only employed persons, from whose wages income tax is paid, will be able to count on their provision. A tax deduction allows you to reduce your taxable income. It is provided in a strictly fixed amount, prescribed in the Tax Code. Its excess or decrease is excluded. Citizens can apply for standard deductions for themselves and their children. The conditions for their provision, as well as the final salary amounts, are calculated according to generally accepted frameworks. Each of these types of benefits should be considered separately.

Limits by law

The amount of the personal income tax benefit has its own limit, which is established at the legislative level.

The limit on standard personal income tax benefits is fixed in Art. 218 NK. For social - Art. 219, property - Art. 220, professional - in Art. 221. There are two types of restrictions on the amount of tax deduction:

- fixed amount (standard);

- percentage of costs, but not more than a fixed amount (social, property, professional).

Important! All deductions are provided only to officially working citizens on income subject to 13% income tax.

In addition to the size limit, there are other restrictions - the number of payments (once a year, once in a lifetime), the object of receipt (parents, homeowner, etc.), types of expenses (medical services, purchase of housing, for children, etc.). ).

Read also: Unemployment benefits in 2021

New deduction codes

In the 2-NDFL certificates submitted in 2021, section 3 reflects the codes and amounts of income, as well as the following personal income tax deductions:

- payments that are not subject to personal income tax within the limit (daily allowance, financial benefits, etc.);

- professional deductions;

- amounts that reduce the tax base in accordance with Articles 213.1, 214, 214.1 of the Tax Code of the Russian Federation.

In section 3 of the 2-NDFL certificate, tax deductions are shown opposite the corresponding income. If several deductions are allowed to be applied to one type of income, the first deduction is reflected opposite the income in the columns “Deduction Code” and “Deduction Amount”, the second – in the line below, etc. In this case, the fields “Month”, “Income Code” and “Amount” income" opposite the second and subsequent deductions are not filled in. Section 4 shows standard, social, investment and property deductions for the purchase (construction) of housing.

Which parent can receive

Article of the Tax Code clearly states who is entitled to personal income tax benefits for children under 18 years of age:

- both parents raising the child/children (including those who are not related by blood - stepfather, stepmother);

- guardians and trustees.

The main condition for obtaining income tax deductions is the presence of official work, from which taxes are received into the state treasury.

If the parents are divorced or living separately (which can be documented), one of the parents can refuse this benefit, and the other can issue a double deduction. Double deduction is available for single parents. It will be valid until marriage.

Who receives child benefits?

Employees who are residents of the Russian Federation and have supported children are entitled to children's personal income tax deductions. Deductions are provided to parents and their spouses, stepparents and their spouses, guardians or trustees of children. Deductions are provided for each child under the age of 18 and for each full-time student (graduate student, resident, student, intern, cadet) under the age of 24.

In the case of students, deductions are provided only during the period of study of children (academic leave issued in the prescribed manner is also included in the period of study). If the child completed his studies before reaching 24 years of age, then from the month following the month of graduation, the deduction is no longer provided (letter of the Ministry of Finance of Russia dated November 7, 2012 No. 03-04-05/8-1252, dated October 12, 2010 No. 03-04 -05/7-617).

Every parent (including adopted parents) has the right to a “children’s” deduction. By agreement of the parents, a double deduction may be provided to one of them. In such a situation, one of the parents must refuse the deduction (this fact must be confirmed by a statement).

Calculate personal income tax online in Kontur.Accounting in a few clicks Get free access for 14 days

Controversial situations arise during divorce:

- The parent with whom the child remains has an unconditional right to the deduction;

- the other parent has the right to a deduction only if he pays child support;

- if the parent with whom the child remains remarries, his new spouse also has the right to a deduction;

- children born into the families of new spouses are added to the children who were before the marriage. Those. if there are two children and another baby appears in the new family, a deduction for him will be provided as for the third child.

If the child is working or living separately, but is under 18 years of age or studying full-time, the parent is still entitled to the standard tax deduction.

Up to what amount of income is it allowed?

For individuals, there are restrictions on income deductions for personal income tax; they are related to the received annual income of citizens. Its size should not exceed 350 thousand rubles. On average 29-30 thousand per month.

In this case, the benefit is issued for a year. If the annual income is significantly higher, then it is valid for a month. That is, after receiving one personal income tax deduction, parents can only count on the next deduction next year. Important! Deductions are made only from the tax that is levied on the monthly salary.

Changing a job does not mean a loss of tax deduction, since it is paid by the state, not the employer. To do this, you need to take a certificate from your previous place of work.

Codes and required documentation

To fill out various documentation, all tax deductions are assigned digital codes. Examples of individual codes for personal income tax benefits are presented in the table below.

| Deduction | Recipient | Code |

| For a minor child (1,2 and 3), full-time student up to 24 years old | Any parent or adoptive parent | 126/127/128 |

| For a disabled child up to 18 years old (with groups 1 and 2 up to 24 years old) | 129 | |

| For a minor child (1,2 and 3), full-time student up to 24 years old | Guardian, foster parent or trustee | 130/131/132 |

| For a disabled child up to 18 years old (with groups 1 and 2 up to 24 years old) | 133 | |

| Double deduction for a minor child (1, 2 and 3), full-time student under 24 years of age | Single mothers, fathers, caregivers, guardians and foster parents | 134-139 |

| Double deduction for a disabled child under 18 years old (with groups 1 and 2 up to 24 years old) | Single mothers, fathers, caregivers, guardians and foster parents | 140/141 |

| Double deduction for a minor child (1, 2 and 3), full-time student under 24 years of age | For one of the parents (guardians, adoptive parents) in case of refusal to deduct the second | 142-147 |

| Double deduction for a disabled child under 18 years old (with groups 1 and 2 up to 24 years old) | For one of the parents (guardians, adoptive parents) in case of refusal of a tax deduction for the second | 148/149 |

Distribution details

Tax benefits are available not only to parents of minor children, but also to other categories of citizens (veterans, disabled people, families with disabled children, etc.).

Let's look at them briefly.

To a combat veteran

This category includes not only participants of the Second World War, but also other military operations:

- Afghans;

- members of the Chechen company;

- military personnel taking part in the Syrian operation;

- other armed conflicts.

This category of Russians is not subject to tax in accordance with the changes to the Tax Code that entered into force in 2021. This happened on the basis of a decision of the Constitutional Court of the Russian Federation. Until 2021, personal income tax was withheld by employers.

Selling an apartment or land

The most famous tax preference is when an individual receives a deduction from the sale of an apartment, house or land. This benefit is called a property tax deduction. It is important for him to meet one of the conditions:

- the citizen has been the owner of the property for more than 3 years;

- the income received does not exceed 1 million rubles.

Residential premises include real estate:

- purchased before 2021;

- gifted/inherited;

- privatized;

- received from a life annuity agreement.

From 2021, the ownership period has been increased to 5 years. That is, a citizen who purchased an apartment or house after 02/01/2019, worth more than 1 million rubles, will be able to receive a tax deduction only after 5 years.

There are many nuances if the owner of the apartment is not the only one. For example, with common shared property, spouses distribute the property tax deduction independently. If the shares are defined in the agreement, then divide according to the specified parts.

Read also: Benefits for low-income families in 2021

Help for a single mother

Single mother is the official status given to a woman who has given birth to a child/children out of wedlock.

In this case, the child has a dash in the “father” column on the birth certificate. Or information that is recorded from the words of the mother. A single father is very rare in Russia. A single parent (mother or father) has the right to receive a remote deduction for the child/children. To receive it, you will need to write a separate application attaching the child’s birth certificate, where there is a dash in the “father” column.

If the document contains information from the words of the mother, then she needs to obtain from the registry office a certificate of the birth of the child in Form 25, which is proof of the status of a single mother.

If the child

The most common tax deduction is the presence of a child/children in the family (based on birth). In addition, there are other conditions:

- official employment of at least one of the parents;

- taxable income tax at a rate of 13%;

- staying within Russia for more than 181 days a year.

The deduction is provided to parents (one of them) a month after birth. You can receive it every month or once a year.

All adults who provide for the life of a child have the right to deduction. For example, a divorced woman who remarried receives alimony from her ex-husband. All three (mother, stepfather, father paying child support) are entitled to an income tax deduction.

A man who has not entered into a legal relationship with the mother of his child will be able to obtain benefits only by documenting paternity. You will also need a confirmation statement from the mother that the man lives with them or provides for the baby.

Children are also entitled to deductions if they study in paid institutions:

- educational and sports schools;

- kindergartens;

- all kinds of mugs.

The organization can be both Russian and foreign. The main condition is appropriate accreditation. The benefit limit is 50 thousand rubles.

Tax deductions also apply to payments for medical services provided to a minor child. These are the services:

- medicines approved by the Government of the Russian Federation;

- treatment in a sanatorium/resort;

- expensive prosthetics;

- therapy insurance;

- surgical measures.

The medical institution must have a license to provide services. The benefit limit is 120 thousand rubles.

For disabled children

According to the letter of the Ministry of Finance dated March 20, 2021 No. 03-04-06/15803, parents of a child/children with disabilities are entitled to two types of deductions:

- by birth;

- according to the status of “disabled person”.

Birth order also plays a role. The more children, the higher the income tax deductions for the subsequent offspring.

Important! These personal income tax benefits are summed up.

Parents raising children in this category are provided with double deductions.

Benefit type: standard

Standard tax deductions have one big difference from the other three types - they are not associated with the taxpayer incurring certain expenses. To receive this tax benefit, you only need to belong to those categories of citizens to whom it is provided by law. Deductions are provided by one of the employer agents paying income to the citizen. Each taxpayer is free to choose where to get their tax refunds from. Let us note that both the direct employer and another tax agent are capable of providing standard benefits to citizens. Thus, a person can rent out a car (money received by him is subject to a 13% rate) and has the right to demand a deduction from the renting company.

So, let's look at what categories of citizens can count on a standard tax benefit. First of all, the tax amount will be reduced by five hundred rubles monthly for the following payers:

- Awarded the Order of Glory of three degrees.

- Residents of besieged Leningrad.

- Prisoners of concentration camps.

- Persons suffering from radiation sickness (and other ailments due to radiation exposure).

- Bone marrow donors, thanks to whom people survived.

- Disabled people since childhood, as well as disabled people of the second and third groups.

- Heroes of the USSR and Russia.

- Spouses and parents of military personnel who died defending the Motherland.

- Evacuees from the Chernobyl exclusion zone.

A reduction in the tax amount by three thousand rubles applies to:

- Disabled people of the Great Patriotic War.

- Disabled people of the first, second and third groups who received serious harm to their health while defending (military service) the Motherland.

- Those who received injuries or radiation sickness at the Mayak production association and during the discharge of radiation waste into Techa.

- Persons who took part in exercises, assembly and testing of nuclear weapons.

- “Chernobyl survivors” who suffered during the liquidation of the tragedy.

- Persons liable for military service - participants (including those already discharged from service) of work at the Shelter facility.

Taxpayers with custodial children and biological spouses may also be able to take the standard child deduction. This benefit will be provided “automatically”, no matter whether the citizen receives other tax deductions. Such a deduction will be made either until adulthood, or up to twenty-four years of age, if this is a full-time student or full-time cadet, studying in graduate school or residency. The employer usually automatically issues such a tax benefit, but it is better to clarify information about this when hiring. Also, if a newborn or adopted child appears in the family, you need to immediately tell about it at work.

Parents are entitled to automatic tax deductions

Table 1. Standard Child Tax Credits

| Amount of children | Sum |

| One child | 1,400 rubles |

| Two children | 1,400 rubles |

| Three or more | 3,000 rubles |

| Disabled child | 12,000 rubles for parents and adoptive parents, half of this amount - 6,000 rubles for trustees, foster families and in case of registration of guardianship |

The number of children is taken into account, regardless of their age. If the payer has a 30-year-old daughter and two sons aged 10 and 16, then the monthly deduction will be 3,400 rubles (1,400+3,000 rubles).

Important point! One of the parents has the right to write a refusal to receive such a benefit, then the second parent can count on a double deduction.

In 2021, it was established by law that “children’s” standard benefits can be received every month, the income in which since the beginning of the year, on an accrual basis, has not exceeded 350 thousand rubles. This means that you need to add up the income for this month and all previous ones since January.

Child tax deduction: how to prepare documents

In the material presented, we discuss how to go through this bureaucratic procedure and use the right to receive a cash deduction for children.

Let's look at an example. The salary of a citizen with two minor sons is one hundred thousand rubles before deduction of personal income tax. When calculating income using the accrual method, it turns out that in January a person received one hundred thousand, in February - two hundred thousand, in March - three hundred thousand. In April, this amount already reaches four hundred thousand rubles. Thus, for three months a year a citizen can receive this benefit (2,800 rubles); for a year, the deduction amount will be 8,400 rubles. To receive this money, you need to provide the employer with a copy of the children’s birth certificate or their passports, if the children are over 14 years old, as well as an application requesting a deduction. After these procedures, wages for January, February and March will be subject to less tax.

For reference:

- Citizens who fit into several categories at once are not entitled to all deductions at once. They are entitled to only one - the maximum. At the same time, “children’s” benefits are provided additionally.

- If, due to the fault of the tax agent, benefits were provided incompletely or not on time, the citizen must submit a corresponding application, after which the tax (financial) base will be recalculated at the end of the tax period.

Receiving mechanism

There are two ways to apply for an income tax deduction: through the tax office or the employer.

Receiving a tax deduction through the Federal Tax Service is a one-time process, so it is better to submit the application at the end of the calendar year. You can contact the tax service in several ways:

- come in person;

- through the website;

- send a registered letter with documents by mail;

- using the State Services portal.

If the benefit is calculated by the employer’s accounting department, the citizen may not see this. Since the accrual occurs automatically. As a rule, this happens monthly. However, an application for deduction must be written. It is better to do this at the beginning of the year, or as soon as the right to the benefit arises.

Read also: Compensation for deposits

Required documents

In addition to the application, you will need to confirm your right to a tax deduction. The list of securities may vary significantly depending on the type of payment.

Documents for personal income tax benefits:

- passport of a citizen of the Russian Federation;

- a document confirming the right to the benefit (certificate of a combat participant, Chernobyl survivor, etc.);

- certificate of disability (if necessary);

- other.

For standard deductions for children, additional paperwork will be required:

- birth certificates;

This is what a baby's birth certificate looks like - certificate from an educational institution (for persons over 18 years of age);

- certificate of disability;

- parents' marriage certificate;

Sample marriage certificate - refusal of the second parent (for double payment);

- other documents confirming the single parenting of the child.

For adoptive parents/guardians/trustees, evidence of their status will be required.

A common document for everyone is confirmation of taxpayer status.

Drawing up an application

The application is drawn up in free form, printed or handwritten. Mandatory information:

- name of the institution where the document is submitted;

- Full name and position of the head or official of the Federal Tax Service;

- date of assignment of the benefit;

- a link to an article of law that gives the right to deduct from income tax;

- list of attached certificates;

- date, signature.

An example of an application for personal income tax benefits is presented below.

Sample application

Types of tax deductions for personal income tax

Let's figure out what exactly is a tax deduction.

The employee does not receive the full amount of wages accrued in the accounting department, but minus 13% of the total amount.

Example

Salary is 20,000 rubles. 13% of this amount - 2,600 rubles. The employee is due: 20,000 – 2,600 = 17,400 rubles.

The base for calculating personal income tax includes all types of income, including accruals for sick leave (Article 217 of the Tax Code of the Russian Federation), as well as vacation pay, bonuses, incentives, bonuses, thirteenth salary, etc. Income tax is not withheld only from social payments, such, for example, as maternity benefits or child care benefits up to 1.5 years. But there are ways to legally reduce the amount of tax withheld from a particular employee's paycheck through so-called deductions.

Note! From 2021, the employer pays for the first 3 days of illness. The remaining benefits are paid by the Social Insurance Fund within the framework of the “Direct Payments” project (Article 4, Part 4, Article 8 of the Law “On the Peculiarities of Calculating Benefits...” dated 04/01/2020 No. 104-FZ). The employer withholds personal income tax from his part; from other days the tax is withheld by the FSS of the Russian Federation.

Deductions are always strictly individual and do not apply to anyone and everyone. To receive a deduction, the employee must have grounds. And all deductions, even those that are indisputably due to the employee, are of a declarative nature. That is, they are not provided automatically, because the accountant is not obliged and cannot know about all the details of the life of each employee that give him the right to benefits. To receive some of them, it is enough to submit an application for deductions to the organization’s accounting department, supported by relevant documents. A number of deductions are given only after contacting the Federal Tax Service.

Types of deductions:

- Standard.

- Social.

- Property.

- Professional.

Standard tax deductions are provided to citizens in accordance with paragraph 1 of Art. 218 Tax Code of the Russian Federation. We only note that the benefits or deductions for personal income tax provided for in subsection. 1 and 2 paragraphs 1 art. 218 of the Tax Code of the Russian Federation, have no restrictions on the tax base. That is, they are provided in any case, regardless of the amount of income from the beginning of the year. If a taxpayer, by virtue of his status, is entitled to several standard deductions, then he is provided with the maximum possible.

ConsultantPlus experts told how to get deductions from your employer. Explore the Ready Solution with a free trial of the legal system.

Read more about the types of standard deductions and the features of their application here .

The amount of personal income tax benefits in 2021

According to Art. 218 of the Tax Code, citizens are entitled to the following standard deductions:

- 3000 rubles monthly - for disabled Chernobyl victims; persons whose professional activities were related to radiation and nuclear weapons; disabled people of the Second World War;

- 500 rubles monthly - to the heroes of the USSR and the Russian Federation; blockade survivors; disabled people since childhood (including groups 1 and 2); parents and spouses of fallen military personnel.

According to Art. 220 of the Tax Code, Russians are entitled to property deductions in the amount of:

- when purchasing or constructing a one-time fee - 13% of the cost of real estate (but not more than 2 million rubles);

- one-time mortgage interest - 13% of the loan amount (but not more than 3 million rubles).

According to Art. 219 of the Tax Code, individuals are entitled to social benefits that are equal to the costs of treatment, training, therapy, insurance, and additional pension contributions. But no more than 120 thousand rubles per year.

On 1, 2, 3 and subsequent

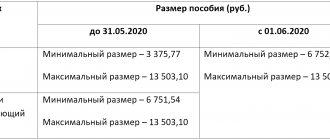

Income tax deductions for children and their amount are regulated by Art. 218 NK. Paragraph 4 states that the deduction is provided to both parents and adoptive parents in the amount of:

- for 1 and 2 children - 1400 rubles;

- for the 3rd and subsequent children - 3000 rubles;

- for each disabled child under 18 years of age (up to 24 years of age if the child is both a full-time student and a disabled person of group 1.2) - 12 thousand rubles.

The double deduction is respectively 2800, 6000 and 24,000 rubles.

For adoptive parents and guardians, the deduction amount is the same as listed above, except for the last point. For each disabled child, 6 thousand rubles are allocated.

What to pay attention to

In accordance with the current legislation of Russia, citizens are required to pay taxes on certain financial actions, if this is expressly provided for by law. The tax burden was introduced to form the state budget.

In fact, any profit received by an individual is subject to taxation (there are exceptions expressly specified in the law).

But it is also possible to reduce the tax burden, for which you need to use one of the methods.

The most common option is to use the right to a tax deduction, which is considered an amount that can reduce the amount of tax.

A deduction is not just a social measure, not a payment from the state, but a way to somewhat reduce the burden that has already been incurred.

First of all, it is necessary to find out which categories of citizens have the corresponding right in accordance with the legislation of the Russian Federation.

Thus, only a resident of the Russian Federation who is also a recipient of income can count on this benefit.

The deduction can be obtained after purchasing real estate, paying for education, including parents who paid for the education of children, participants in military operations, and so on.

It is worth paying attention to the fact that the deduction is provided only within the limits of previously paid taxes.

If a citizen does not work or has not paid personal income tax, then he will not be able to use this right, as this will contradict the very concept of a deduction.

There are several types of tax deductions for individuals, each of which will differ depending on the area of application.

So, in one case we are talking about social expenses, for example, treatment costs, which can be partially reimbursed, in another - property issues, and so on.