How is the organization's property reflected in accounting?

To briefly answer the question of what accounting for an organization’s property consists of, we can name three main positions that fall into this category:

- funds (cash and non-cash, in accounts and at the cash desk);

- tangible assets (fixed assets and low-value assets);

- intangible assets.

Each property item has its location on a specific balance sheet account. This localization depends on many factors. In particular, on the cost. That property whose value is less than 40,000 rubles, but whose period of use exceeds a calendar year, is called low-value. It is taken into account on accounts 10, 11 and 15. Capitalization is expressed by standard accounting entries D10-K60.

Those same assets that cannot be classified as low-value and which the organization considers its fixed assets have a number of distinctive characteristics:

- this property is used to create goods that will be subsequently sold, as well as to provide services (perform work);

- operation of such property is possible for a long period (more than a year);

- the book value of the property is more than 40,000 rubles.

Fixed assets are capitalized by posting:

Debit 08 – Credit 60 (Purchase from supplier and classification as fixed assets).

Next, the cost of fixed assets is written off to the debit of account 01.

Both fixed assets and low-value assets are classified as tangible assets. That is, objects that have their own material expression and are localized in space. They can be touched, seen, used. But there are also those assets that also have value and are capable of generating income for their owner, and often considerable income, but they do not have a tangible physical form. These assets are considered to be intangible. And these include:

- intellectual rights;

- rights to use natural resources;

- business reputation of the organization;

- organizational expenses.

Intangible assets do not have physical form, but are capable of bringing economic benefits to an enterprise.

Find out the cost of writing such a paper!

Reply within 5 minutes!

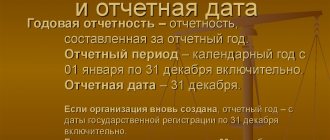

Without intermediaries! — reporting date as of which the balance sheet is presented

— full name of the organization in accordance with the constituent documents

— taxpayer identification number (TIN)

— the main activity of the enterprise with the OKVED code

— organizational and legal form/form of ownership (according to the OKOPF and OKFS classifiers)

— unit of measurement – thousand rubles. (OKEY code 384) or million rubles. (OKEY code 385)

- location (address)

— date of approval (the established date for the finished financial statements is indicated)

— date of sending/acceptance (the specific date of postal, electronic or other sending of accounting statements or the date of their actual transfer according to ownership is indicated).

1.1. Rules for filling out balance sheet asset items

Section I “Non-current assets”. It includes the following groups: intangible assets (results of research and development, intangible exploration assets, tangible exploration assets), fixed assets, profitable investments in tangible assets, financial investments, deferred tax assets and other non-current assets.

When filling out line 1110 “Intangible assets”, you should take into account the filling rules specified in PBU 14/2007 “Accounting for intangible assets”. The group of articles “Intangible assets” (IMA) shows the presence of intangible assets held by the organization under the right of ownership, economic management, and operational management.

The established procedure for the formation of balance sheet indicators according to the balance sheet principle - net provides for the reflection of intangible assets in the balance sheet at their residual value (minus accrued depreciation).

In general, the formula for providing the indicator for line 1110 is as follows:

“Balance at the beginning of the year debit on account 04” + “Turnover on the debit of account 04” - “Turnover on the credit of account 04 in terms of disposal” - “Accrued depreciation”, that is, the balance on the credit of account 05 “Amortization of intangible assets”.

When filling out line “Fixed assets” 1150, you should be guided by the main regulatory document regulating the procedure for reflecting fixed assets in accounting, PBU 6/01 “Accounting for fixed assets”.

The group of articles “Fixed assets” 1150 reflects material assets used as means of labor for a long time (more than a year). Data on fixed assets (fixed assets), both operating and those undergoing reconstruction, modernization, restoration, conservation or in reserve, are reflected in the balance sheet at their residual value (with the exception of fixed assets, for which, in accordance with the established procedure, depreciation is not charged) . This line also reflects capital investments in land improvements and rental buildings, structures, equipment and other objects related to fixed assets.

The article “Fixed assets” also shows land plots owned by the organization, environmental management facilities (water, subsoil and other natural resources), capital investments in perennial plantings, radical land improvement (drainage, irrigation and other reclamation works).

This group of articles reflects property provided under a lease (property lease) for a fee for temporary possession and use.

In general, the formula for providing indicators on line 1150 is as follows:

“Balance at the beginning of the year debit account 01” + “Turnover on debit account 01” - “Turnover on credit account 01” - “Balance on credit account 02”.

The balance at the beginning of the year for account 01 and account 02 may not correspond to the values of the final balance of these accounts at the end of the previous year if a revaluation of fixed assets was carried out, the results of which are reflected in the reporting period.

The group of articles “Profitable investments in tangible assets” 1160 shows the residual value of property (buildings, equipment and other tangible assets) acquired for rent (under a leasing agreement, under a rental agreement, etc.) for temporary use in order to receive additional income.

The above property is accounted for in account 03 “Profitable investments in material assets” with appropriate analytics. Property located in the organization and property transferred for temporary use are accounted for separately. Since the property is owned by the organization, depreciation is charged by the owner on account 02 “Depreciation of fixed assets.” The initial cost of property is formed through account 08 “Investments in non-current assets”.

To form the indicator “Financial investments” 1170, one should take into account the requirements of the Balance Sheet Regulation 19/02 “Accounting for Financial Investments” and clause 19 of the Accounting Regulation 4/99 “Accounting Statements of an Organization”, in accordance with which assets and liabilities must be presented in the balance sheet with a division into long-term.

The article “Financial investments” shows the organization’s investments in authorized (share) capitals, bonds and other securities of other organizations, in government securities, loans provided to other organizations, acquisition of receivables under assignment agreements, contributions to simple partnerships, deposits in banks .

Financial investments in accounting are on account 58, and on account 59 reserves are taken into account to secure investments in securities. Thus, line 1170 reflects the difference between the balance on account 58 and the credit balance on account 59.

In order to link the income tax, determined according to accounting rules, with this indicator, calculated in accordance with the Tax Code of the Russian Federation and PBU 18/02 “Accounting for income tax”. In this regard, indicator 1180 “Deferred tax liabilities” was introduced into section I of the balance sheet.

The item “Deferred tax assets” 1180 shows the part of the deferred income tax, which leads to a decrease in income tax and is subject to payment to the budget in the next reporting or subsequent reporting period.

The concept of a deferred tax asset arises when there is a difference in accounting and tax accounting regarding the recognition of income (expenses).

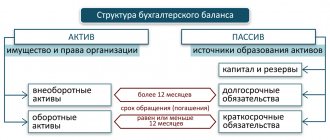

How to keep records of the sources of an organization's property

Accounting for an organization's property implies identifying the sources of formation of such property. All sources can be divided into two main groups - own funds and attracted resources. Often, an enterprise acquires property through the use of its own capital. The organization creates equipment and, using funds from its sale, updates the machine park: it expands the list of fixed assets with the help of which it makes a profit in the future. But equity capital is not always enough for large-scale activities. It is especially difficult to implement a developed business plan at the initial stage, when there are very few such funds. Often, a company attracts resources by concluding loan agreements with credit institutions, as well as with business partners. From an accounting point of view, property formed from borrowed funds is also considered to be property acquired by an enterprise on the terms of deferred or installment payment. In other words, the counterparty credited the organization for the amount of the cost of material assets supplied and services provided.

It is extremely difficult to carry out business activities without using attracted financing. In truth, there are no organizations that operate without borrowed funds.

Read material on the topic: Accounting services for companies

Next, we will consider what equity and borrowed capital are and what they consist of.

Each enterprise has certain assets on its balance sheet. But it is not always fully paid for by the company. That is, part of the property, as we have already said, can be formed through borrowed funds. Therefore, the value of its liabilities should be subtracted from the value of the organization’s property, and then you will receive the net value of the property - that is, the enterprise’s equity capital. It consists of several parts:

- The authorized capital is formed at the stage of formation of the enterprise from the contributions of the founders. The percentage of these contributions and their amount are not specified by law; there is only a minimum limit for the authorized capital - 10,000 rubles. If the owners of the company do not raise this amount initially, then they will not be able to register the organization.

- Additional capital is the amount formed as a result of the additional valuation of non-current assets, which is periodically carried out as part of accounting for the organization’s property. In general, ways to generate additional capital can be: revaluation of fixed assets as a result of inflationary processes, which led to an increase in their value;

- the result of conversions into domestic currency of contributions from foreign owners to the company’s authorized capital, the result of the impact of exchange rate differences on the assessment of the value of the company’s property. The day of registration of the enterprise and the day of actual payment of the authorized capital do not always coincide. That is why, on the day of registration, the founder’s contribution was valued at one amount, and at the time of payment this amount could increase significantly due to changes in the exchange rate;

- the appearance of share premium of a joint-stock company in cases where the real value of the shares sold exceeds their nominal value. The opposite situation during the initial issue of shares is simply unacceptable. And selling at a price higher than the nominal price is a common thing.

- Credit debt is the organization's obligations to counterparties. This may be arrears for settlements with partners, or perhaps the obligation to distribute GDP.

Preparation for the formation of balance sheet indicators

The construction of an enterprise's balance sheet is carried out on the basis of accounting data, namely account balances. At the end of the reporting period (quarter or year), turnover for such a period is formed on certain accounting accounts and final balances are formed on the debit and credit of such accounts.

Note 1

The debit balances in the total amount completely coincide with the credit balances of the accounting accounts. This is the main rule, and if the balances do not match, it means an error was made in the accounting that needs to be detected and corrected. Also, the accountant must check that the balances of active accounts are formed as a debit account, and passive accounts - as a credit account.

Finished works on a similar topic

- Coursework Formation of a balance sheet 430 rub.

- Abstract Formation of a balance sheet 240 rub.

- Test work Formation of a balance sheet 210 rub.

Receive completed work or specialist advice on your educational project Find out the cost

How is an organization's property inventory recorded?

Accounting for an organization’s property is impossible without carrying out inventory measures, during which the property on the enterprise’s balance sheet is checked.

Tangible assets are subject to inventory, whether low-value or fixed assets. For this purpose, a commission must be created, which includes financially responsible persons. Before starting the preparation of annual reports, an inventory must be carried out every three years. Of course, it is advisable to do this only if the enterprise has any fixed assets on its balance sheet.

The Law “On Accounting” dated December 6, 2011 N 402-FZ declares the obligation of each organization to ensure the reliability of accounting information regarding the accounting of the company’s property and its reporting. This must be done by reconciling the existing accounting data in the enterprise with the data obtained as a result of the inventory.

Based on the results of the inventory, in order to most effectively account for property, an inventory sheet is compiled, which contains all the results of checking fixed assets. Accounting data is verified with the actual condition and location of these resources. The results of the reconciliation are recorded in the statement.

Inventory is of great importance for monitoring the current economic activities of an enterprise. With its help, you can check reporting and contributions to the tax authorities. Based on the results of the inventory procedure, it is possible to identify some surpluses that should be used rationally until the end of the current quarter, optimizing settlements with budget funds.

Read the material on the topic: What tax reporting do individual entrepreneurs submit?

Inventory is necessary to account for the organization’s property, which includes not only fixed assets accepted on the balance sheet, but also inventories, intangible assets, financial investments, finished goods, and raw materials.

The inventory commission identifies surpluses or deficiencies, identifies those responsible, and signs a reconciliation plan. Those responsible will subsequently face administrative punishment.

The entire reconciliation can be divided into three main stages. The first of them, preparatory, consists of the following actions:

- The head of the organization issues an order for the upcoming inspection in the INV-22 form. It is advisable to indicate in this document the timing of this event, as well as the composition of the commission created to organize it.

- The list of commission members is also approved by the head.

- It is necessary to determine the scope of this procedure: what exactly is being checked and within what time frame.

- Financially responsible officials must be familiarized with the issued preparatory orders against signature.

At the second stage, the actual inventory begins, which is an accounting of the enterprise’s property (all values, assets, liabilities are calculated and entered into reconciliation inventories, for which unified forms have been developed):

- fixed assets accounting (INV-1);

- inventory of intangible assets (INV-1a);

- inventory of inventory items (INV-3);

- inventory report of shipped goods and materials (INV-4);

- inventory of property accepted for safekeeping (INV-5);

- inventory of goods in transit: sent but not yet received by the addressee (INV-6).

- act of accounting for precious metals and products made from them (INV-8);

- inventory of precious metals available in semi-finished products, finished equipment, individual parts, instruments and products (INV-8a);

- act of inventory of precious stone products and precious stones themselves (INV-9);

- inventory of unfinished repair activities (INV-10);

- act on future expenses (INV-11);

- inventory of cash (INV-15);

- inventory of securities and strict reporting forms (INV-16);

- act of reconciliation of settlements with debtors and creditors (INV-17).

The third final stage is intended to draw up the organization's balance sheet. When all the property is described in fact, you can reconcile with the nominal positions in the accounting documents and make adjustments. You can check fixed assets using the INV-18 form, and record the difference in inventory accounting in a statement using the INV-19 form.

Specific individuals are not always to blame for shortages and surpluses. Often, differences between the theoretical amount of property and the actual amount are attributed to company expenses.

If, as a result of the inventory, it is possible to find unaccounted for fixed assets, they are recorded using the following entries:

Debit account 01 – Credit account 91/1 (at original cost).

Debit 91/2 – Credit 02 account (for the amount of depreciation).

If the inspection reveals a shortage, which also happens quite often, it is reflected in the following entries:

Debit 01/2 account – credit 01 (at original cost).

Debit 02 account – Credit 01/2 account (for the amount of depreciation).

Debit 94 accounts – credit 01/2 (at residual value).

In order to assign the deficiency to a specific guilty person, a basis in the form of a court decision is required. This is formalized by posting D 73/2-K 94.

If you simply write off the deficiency as losses of the enterprise, posting D 91/2-K 94 is used

How does registration of real estate of an organization take place?

People in the Russian Federation do not become taxpayers of their own free will. If a company owns any real estate, and also has separate divisions on the territory of the state, it is automatically obliged to register for taxation not only at its location, but also at the location of each existing separate division, as well as real estate and transport. The tax authority assigns the organization an individual taxpayer number.

The obligation to be registered with the tax authority at the location of the real estate forces the business company to write a corresponding application to the tax office at the location of such property within a specific period - 30 days from the date of registration of the property.

However, tax authorities themselves must also take measures to register taxpayers. Thus, after registering ownership of real estate, authorized services provide information to the tax inspectorate at the place of registration, and that, in turn, registers the organization within five days from the date of receipt of the relevant information. The inspection certificate is issued in person or sent by registered mail.

Tax registration at the location of the property subsequently entails the obligation to pay property tax and forces you to provide a calculation using the unified form KND 1152026 (submitted for each separate division and property).

How to keep records of corporate property taxes

The regional tax on property of enterprises is provided for by Chapter 30 of the Tax Code of the Russian Federation. The amount of tax paid depends entirely on the tax rate, which is established by law in the regions of the Russian Federation. The maximum amounts are indicated by the Tax Code of the Russian Federation. The tax payment deadline and procedure are also set out in this basic set of laws.

Bodies of constituent entities of the Russian Federation have the right to establish their own tax benefits for certain categories of taxpayers. But in addition to benefits and privileges, there is also such a thing as the complete exemption of individual objects from the need to pay taxes.

Objects not subject to property tax:

- natural resources, environmental management facilities;

- objects used for the needs of state defense, security and law enforcement that are under the operational management of federal executive authorities (that is, objects of military service and other equivalent service);

- objects of cultural heritage of the peoples of the Russian Federation;

- especially dangerous facilities that serve to store nuclear materials, radioactive waste, as well as nuclear installations themselves;

- shipping transport for nuclear technology services and ships containing nuclear installations;

- space objects;

- ships registered in international registries;

- fixed assets classified as the first and second depreciation groups according to the Classification of fixed assets approved by the Government of the Russian Federation.

Read the material on the topic: Optimization of company taxes

Enterprise property: concept, varieties

First of all, let’s define the concept of “property”. Property refers to tangible and intangible assets, and in the context of commercial activity we mean all those objects that are used in the process of production and sale of goods, works and services. There are:

Take our proprietary course on choosing stocks on the stock market → training course

- depreciable property (its cost is constantly included in the cost of goods ready for sale);

- non-depreciable property (the cost of which is included only once in the price of products sold).

In addition, property refers to the rights and obligations of an enterprise, recorded in the balance sheet as Assets and Liabilities - together they characterize the property position of the company. If a company transfers its rights to another organization, we are talking about succession. Termination of duties is possible upon liquidation of a legal entity.