Taxpayers with the object “income minus expenses” at the end of the year calculate the minimum tax and compare it with the amount of tax in connection with the simplified tax system, calculated at the rate in force in the region. The larger of the two amounts received is paid to the budget.

An important change: from 2021, the minimum tax is paid not on a separate BCC, as before, but on the BCC for the simplified tax system “income minus expenses”.

If the simplified tax system is paid for 2021, the payment order may contain only two BCC values, depending on the selected taxation object.

Sample payment order for payment of the minimum tax in 2021 for individual entrepreneurs

Since the minimum tax is paid only at the end of the year, field 107 should always contain the value KV.04.2018; For advance payments, use the value of the quarter for which the payment is made.

The sample payment system for the simplified tax system “income” 2021 contains the same values of fields from 104 to 110 for both organizations and individual entrepreneurs.

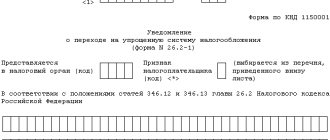

Tax details for payment of tax registration

Note that not all private owners employ an accountant. Consequently, filling out a payment order for a merchant can be problematic. Let us remind you that entrepreneurs have the right to pay tax using a receipt. You can fill out a receipt for payment of the simplified tax system on the official website of the Inspectorate. You can pay the Federal Tax Service at any bank, or use Internet services for online payment. Moreover, the procedure is the same for all intermediate billing periods. Follow the instructions: Calculate your total taxable income for the period January to June 2021.

The final payment to the budget is calculated at the end of the year. The amount of the simplified tax system payable is calculated minus the advances paid. Moreover, the procedure for calculating the advance and final payment depends on the selected object of taxation.

General procedure for processing tax payment orders

Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n determines the mandatory details for paying taxes and insurance premiums:

- 101 - status of the payer who issued the payment document;

- 104 - twenty-digit budget classification code, where the first three digits correspond to the tax administrator number;

- 105 - OKATO;

- 106 - basis of payment, consists of two letters (TP, ZD, AR);

- 107 - frequency of tax payment - month, quarter, half year, year;

- 108 — document date, filled in depending on the indicator of field 106;

- 109 - document number, if the debt is repaid on demand;

- 110 - payment type, currently not filled in.

This is important to know: Tax period code in the VAT return

Tax according to the simplified tax system: details for 2021

Advances for the simplified tax system must be transferred at the end of each reporting period (quarter, half-year, 9 months), 25 days are allotted for this after its end. That is, if there is a basis for calculating advances, money must be sent to the budget no later than April 25, July 25 and October 25 of the reporting year. Upon completion of the 3rd quarter of 2021, the advance payment must be transferred by October 25, 2019 (inclusive).

The amount of tax at the end of the year is transferred within the deadlines allotted for filing a declaration under the simplified tax system: no later than March 31 of the following year, legal entities pay tax, and no later than April 30 - individual entrepreneurs.

No fundamental differences were introduced into the details of the simplified tax system for 2021 for payment of annual tax and advance payments. In the payment slip or receipt for the transfer of tax for the year, the payment details for paying the simplified tax system will be the same as those for which quarterly advance payments are made. At the same time, you should regularly check the data of your tax office to which the funds are transferred - current account number, name and BIC of the bank. This can be done by accessing a special service on the Federal Tax Service website, where you just need to select your region and Federal Tax Service number.

The details for paying the simplified tax system are not affected by the category of taxpayer (individual entrepreneur or legal entity): entrepreneurs and organizations transfer payments using the same payment data.

At the same time, depending on the applied taxation object, different BCC (budget classification codes) are indicated in the simplified taxation system details.

Kbk according to the usn in 2021

Info

That is, the details for paying the simplified tax system for 2021 and 2021 are the same, but still differ depending on the object of taxation. Starting from 2021, a separate BCC for the minimum tax paid under income-expenditure simplification has been abolished. Now this BCC coincides with the one that must be indicated for the tax calculated in the usual manner under the simplified tax system “income minus expenses”.

But the KBK for paying the simplified tax system for 2017–2018 income has not undergone any changes. Regarding all other data, when issuing a payment order for payment of the simplified tax system for 2017–2018 (for non-cash transfers) or a receipt for payment of the simplified tax system (for individual entrepreneurs) for 2017–2018 (for payment of tax in cash through a bank), the taxpayer will indicate the same data that were given in these documents in the previous year. Let's look at how to fill out the fields of a payment order in 2021 for each of the simplified tax system objects.

Payment details for the simplified tax system for the 3rd quarter of 2021 (advance payment)

Let's take a closer look at what details of the simplified tax system for the 3rd quarter of 2021 need to be indicated in the payment slip for the transfer of an advance payment to those who use “income” as an object and to those whose tax object is “income minus expenses.”

Details: payment of the simplified tax system “income”

When filling out the fields of the payment order, “simplified” workers who calculate tax from income indicate the following data and details:

Taxpayer status in field 101 – legal entity indicate “01”, individual entrepreneur – “09”.

“Type of operation” (field 18) is indicated by code “01”.

“Payment order” (field 21) – “5”.

The value in field 22 “Code” in the absence of a requirement from the Federal Tax Service is “0”. If the payment is made on demand, the UIN code given in it is indicated.

The OKTMO code is reflected in field 105.

When paying an advance for 9 months of 2021, in field 106 the type of payment is indicated - “TP” (current payment). If the debt is listed, the abbreviation “ZD” is indicated.

The period for which the advance is paid is indicated in field 107: “KV.03.2019”, which means payment for the reporting period of 9 months of 2021.

In fields 108 and 109, put “0” if there is no requirement of the Federal Tax Service. If it exists, indicate its number, and in field 109 its date.

The “Purpose of payment” (field 24) reflects what kind of payment is being made, for example: “Advance payment for 9 months of 2021 for a single tax under the simplified tax system, object “income”.”

This is important to know: Writing off tax debt: tax amnesty 2021

Details of the simplified tax system “income minus expenses”

For payers using the “income minus expenses” taxation object, filling out the fields of the advance payment form will be similar, with the exception of the following details:

In field 24 “Purpose of payment” it is indicated: “Advance payment for 9 months of 2021 for a single tax under the simplified tax system, object “income reduced by the amount of expenses”.”

Otherwise, filling out the payment form for both tax objects is the same.

Kbk usn income in 2021 for an individual entrepreneur

Attention

It is relevant for organizations and individual entrepreneurs: Purpose of payment Field 104 in the KBK payment order 2021 simplified tax system income: advance payment; single tax. 182 1 0500 110 KBK penalty under the simplified tax system with the object income in 2021 182 1 0500 110 Penalty code for simplification with the object income 182 1 0500 110 Here is an example of filling out a payment order for payment of the simplified tax system “income” (6 percent) in 2021: KBK according to the simplified tax system “income minus expenses” in 2021 (15%) For organizations and individual entrepreneurs on the simplified tax system “income minus expenses”, 19 KBK numbers out of 20 coincide. Make sure that in the KBK simplified tax system for 15 percent in 2021, in place of the 10th digit there is “2” and not “1”. This will be the main difference compared to the “income” object.

Details for paying the simplified tax system in 2021 will be needed for the error-free transfer of the single tax calculated under the simplified taxation system. The basic rules regarding its payment will be discussed below. To what budget is the simplified tax system paid and when do you need to give the payment to the bank? How to pay tax according to the simplified tax system: KBK for a payment order and other details? To what budget is the simplified tax system paid and when do you need to give the payment to the bank? Simplified taxation is a special tax regime (Art. 18

Tax Code of the Russian Federation). Taxes paid under special regimes are a type of federal taxes (clause 7 of Article 12 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated April 20, 2006 No. 03-02-07/2-30). However, the answer to the question: “To what budget is the simplified tax system paid?” - not so obvious. The fact is that the Tax Code of the Russian Federation does not connect the type of tax with the type of budget to which it goes.

In accordance with paragraph 2 of Art.

Payment to the budget

The simplified taxation system was introduced by Part 2 of the Tax Code of the Russian Federation and is a type of tax system in which the rate for small enterprises is reduced and simplifies the maintenance of accounting and tax reporting.

The simplified tax is paid at the place of residence for individual entrepreneurs and at the object of registration for institutions. It does not have a specific location; activities can be carried out throughout the Russian Federation, but payment must be made at a registered site.

The simplified tax system refers to federal types of duties , the funds paid are credited to the general state account, but the distribution itself takes place among budgets. That is, 100% is then credited to the regional budget. All transfers occur without the participation of the taxpayer .

According to the Tax Code of the Russian Federation, types of rates that are applicable to the simplified tax system:

- organizations pay 6%;

- 5-15% with income reduced by expenses.

Advance payments must be paid by the 25th of the previous period (quarter, six months, 9 months), i.e. in April, July and October. At the end of the calendar year, the total amount for payment is calculated, with the “income minus expenses” scheme, the single and minimum tax is calculated. If any of the dates falls on a weekend, its payment is postponed to the next business day.

There are special conditions for organizations and individual entrepreneurs on the simplified tax system when payment must be received:

- completion of the enterprise’s work - before the 25th, after the closure of the individual entrepreneur next month (notify the Federal Tax Service);

- loss of the simplified tax system – on the 25th day following the month in which the rights were lost.

Basic details

In 2021, taxpayers are required to make a final payment for 2018, taking into account advances already made, as well as 3 quarterly payments using the advance method. have remained virtually unchanged this year . The main fields for filling out a payment form that need to be studied.

| Field number | Name | Specifying details for paying tax |

| 101 | taxpayer | 09 – individual entrepreneur, 01 – institutions |

| 18 | type of operation | 01 |

| 21 | payment queue | 5 |

| 22 | code | 0 – advance payment or tax specified by the Federal Tax Service |

| 24 | payment object and purpose | simplified tax system for income or advance |

| 104 | KBK | 182 105 01011 011000 110 |

| 105 | OKTMO | location of individual entrepreneur or company |

| 106 | basis of payment | current payment, debt, Federal Tax Service requirement |

| 107 | date of payment | for the quarter (Q.01.2019), for the year (Y.00.2018) |

| 108 | payment number | 0 – advance payment or tax, collection number provided by the tax office |

| 109 | documentation date | 0 – advance payment, declaration number when paying tax, if its serial number is required |

Payment of fees is possible only in Russian currency . The execution will not be considered valid if the executor’s bank and the treasury account number for the territory of Russia where the taxpayer is registered are incorrectly indicated.

Same for all taxpayers

The general information that taxpayers provide is passport data, which must be entered. The KBK code differs for categories of payments and directions to the budget. Therefore, the code for profit and income minus expenses will be different. Details for paying the simplified tax system, purpose of payment and everything else are filled out according to the same principle.

They can only change if the payer himself has changed any data, for example, last name, name of the organization. All data on details are updated in accordance with legislative acts, which will be reported to the Federal Tax Service.

KBK for payment of a single tax with a simplification of the difference between income and expenses

For example, the rate of the simplified tax system “Income minus expenses” St. Petersburg 2021 is 7%. This percentage is set from 01/01/2021 to the present. Before this period, in St. Petersburg, a rate of 10% was applied on the amount of the resulting difference between income and costs. But in the Moscow region, a reduced rate is established for certain types of activities. For example, 10% - for manufacturing enterprises in Moscow.

Please note that legislators have set restrictions here too. The rate under the simplified tax system “Income minus expenses” cannot be less than 5%, and cannot exceed 15%. The benefit is approved by the power of the subject. If such a privilege is not provided, taxpayers calculate tax at the maximum rate of 15%.

We recommend reading: Employment Contract for 2021 Sample

Regulation of the use of budget classification codes

KBK is used to record expenses, income and is used in tax and accounting, with the help of which payment documents are drawn up.

This is important to know: What taxes does an individual entrepreneur pay on a patent in 2021 without employees?

The KBK has greatly facilitated the work of distributing the budget among the regions of the Russian Federation at the federal level for the next year. When making a payment, it is possible to fully determine its category, purpose, who sent it and when . A set of 20 digits, each of which relates to payment categories.

KBC classifies different categories of payments :

- fines for damage caused;

- payment of insurance;

- taxes of any categories;

- state fees, etc.

Filling out a payment form

It is necessary to draw up a payment order under the simplified tax system in 2021 in a form approved by the legislation of the Russian Federation. Each field is assigned its own identification number .

The following information must be indicated on the income statement :

- Status of the person (101) paying the tax - individual entrepreneur - 09 or organization - 01.

- Order of payment (21) – advance or tax – 5, if the Federal Tax Service has made a demand for payment – 3.

- KBK (104).

- OKTMO (105) – code of 8 or 11 digits location.

- Reasons why tax is paid (106) – constant payment, debt, advance payment.

- Payment term (107) – year, quarter to which the payment relates.

- Payment number (108) – set to 0 if the individual entrepreneur pays an advance or a single tax.

- Document date (109).

- Payment category (110) – not filled in.

Codes may occasionally change, latest amendments for 2021 according to the BCC.

The table below shows payment invoice numbers that must be filled out correctly to avoid sending the payment incorrectly.

Kbk usn in 2021 for LLC and individual entrepreneur

The BC RF simplified tax in full (including its minimum part) is subject to credit to the regional budget. Current simplified tax payments are made quarterly in advance until the 25th day of the month following the reporting quarter. To determine the final annual amount, you need to perform the following actions according to the deadlines indicated below: Subscribe to our channel in Yandex.Zen! Subscribe to the channel Tax payment is carried out by submitting a receipt to the bank (this is only possible for individual entrepreneurs) or a payment slip according to the simplified tax system - in 2021 you need to pay for 2021.

The moment of payment (clause 3 of Article 45 of the Tax Code of the Russian Federation) is considered the moment of submission of the payment to the bank, provided that the required amount of funds is available in the payer’s account. The last days for the formation and transfer of payment slips to the bank - taking into account postponements due to weekends - will be April 2 (for legal entities) and April 30 (for individual entrepreneurs) 2018.