What should you consider when concluding a contract for the purchase of workwear?

- The employer is obliged to purchase and issue workwear that has passed certification or declaration of conformity.

- Until December 31, 2013, workwear was purchased and issued based on the results of certification of workplaces for working conditions. From January 1, 2014, instead of certifying workplaces based on working conditions, a special assessment of working conditions is carried out. Therefore, if the organization additionally creates new jobs, which, according to the results of the special safety assessment, contain harmful or dangerous factors, and the necessary protective clothing is not available, a contract for its supply should be concluded again.

- Working clothes are purchased at the expense of the employer. This means that purchasing such clothing at the expense of employees is unacceptable. In practice, similar situations often arise.

- The protective clothing issued to employees must correspond to their gender, height and size, the nature and conditions of the work performed. Thus, the law obliges the employer to provide workwear of the required size. Therefore, when concluding an agreement with a supplier, you should indicate the entire size range in the application. When delivering materials, monitor its implementation.

Reissue

It often happens that write-off of PPE upon dismissal of an employee is not required, because the former employee’s protective clothing is still suitable for further use: their wear rate is very small. In this case, it is handed over to a warehouse, and the commission, within the framework of the order to write off PPE, determines the possibility of further use.

In case of a successful outcome of the inspection, clean and repaired PPE is issued to the employee, with an entry in the personal PPE issuance card as used, indicating the percentage of wear.

Before re-issuance, safety shoes must undergo cleaning, disinfection and dust removal. If such a procedure has not been carried out, and you do not have supporting documents, then I do not advise you to take risks.

The point is also that in small settlements it is very difficult to find an organization that disinfects safety shoes: they are usually very far away, and given the transportation costs and the costs of the procedure itself, it is easier to buy a new pair of shoes.

The period for re-issuance should not exceed the percentage of wear. For example, upon dismissal, a mechanic handed over a suit to a warehouse and the percentage of wear and tear was determined by commission at 50%. Thus, the period for a future employee to wear a used suit should be no more than six months.

If a used suit has become unusable before the end of its wear period, then it must be written off prematurely, and the employee must be given a new set of workwear.

Refusal to receive used workwear

More than once I have encountered the fact that a recently hired employee completely refuses to receive used workwear. Which, strictly speaking, he has no right to.

Because the employer is obliged to provide workers with PPE, and workers, in turn, are not allowed to perform their job duties without using them (clause 26 of Order No. 290n).

He can refuse only if the overalls have not been washed and repaired (clause 22 of Order No. 290n) or are not suitable in height and size.

Here it is quite reasonable to take the employer’s side. A new employee came, worked for a month or two, quit, and the new set of workwear became used.

For reasons of saving the employer's budget, new recruits often first dressed in already used clothes (after washing, of course, and also if suitable sizes were available), and received a new one only when the suit expired or became unusable. This is a kind of probationary period.

But you should not abuse this opportunity, because if it turns out that the class of PPE is reduced, there will be many more problems: the reduced class is equivalent to the absence of PPE.

Loss or damage to PPE

There have also been situations where an employee reluctantly received used workwear, and then after a week or two it suddenly became unusable. He ruined it on purpose, which was quite obvious.

Workwear is the property of the employer, and the employee must carefully use the PPE issued for use.

If you can prove the employee’s guilt in causing damage, then on the basis of Art. 241 of the Labor Code of the Russian Federation, the residual cost of personal protective equipment is withheld within the limits of average monthly earnings, but not more than 20% of the payment.

If the employee is categorically against retention, the employer has no right to keep his personal documents.

In this case, it is necessary to obtain a written refusal of compensation at the expense of wages and, attaching a certificate of the cost of PPE, a personal issue card and a statement of receipt of protective clothing, send the documents to the court.

The issue is controversial, protracted and problematic, and often it is not worth the costs that the employer may incur, so management often decides to write off PPE that has not been returned.

When determining an employee’s guilt, it is worth remembering that intensive work, exposure to force majeure, force majeure, or the employer’s failure to provide conditions for storing PPE are not reasons for deducting the cost of protective clothing from the employee’s salary.

In no case should you “go too far”; in the event of a violation of his rights, an employee can file a complaint with the State Tax Inspectorate.

What sources of financing can be used to purchase workwear?

This question most often interests accountants of budgetary institutions.

This type of expenditure can be financed both from budget subsidies allocated for the implementation of state (municipal) tasks, and from funds received from the provision of paid services. In addition, a budgetary institution has the right to purchase special clothing using insurance contributions for compulsory social insurance against industrial accidents and occupational diseases. The basis for the acquisition is the results of the SOUT.

The amount of funds allocated by the policyholder to finance preventive measures cannot exceed 20% of the amount of insurance premiums accrued for the previous calendar year, minus the costs of paying security for the specified type of insurance, made by the policyholder in the previous calendar year.

Let us note that in order to make expenses from insurance premiums for injuries, a budgetary organization must submit an application to the executive body of the Social Insurance Fund at the place of its registration before August 1 of the current calendar year.

Arrival of workwear

Workwear is registered with the institution at its actual cost. What does this cost consist of? The basis, of course, is the cost of the clothing itself. To this are added additional costs for delivery, payment for intermediaries, duties, and other possible expenses that arose during the purchase and preparation for use. The accountant first collects all these amounts in account 0 10600 000 “Investments in non-financial assets”. Only after this can the workwear be accepted for registration.

Please note: you cannot change the actual cost of workwear after it has been registered (clause 107 of Instruction No. 157n).

If there were no additional costs, then the workwear is credited directly to the account 0 105X5 000. Let's look at this option using an example.

Example 1.

State Budgetary Educational Institution “Technical School of Mechanical Engineering”, using subsidies for the implementation of state assignments, purchased 10 sets of workwear for teachers of technical disciplines from LLC “Sila”. Total cost - 59,000 rubles, including VAT - 9,000 rubles. The institution also transferred 2,360 rubles (excluding VAT) to the transport company as payment for delivery. Let's assume that the purchased workwear is not particularly valuable property.

The GBOU accountant must generate the following entries:

| Contents of operation | Debit | Credit | Amount, rub. |

| The purchase price of the kits and the debt to Sila LLC are reflected | 4 10634 340 | 4 30234 730 | 59 000 |

| Money was transferred to Sila LLC | 4 30234 830 | 4 20111 610 | 59 000 |

| Transport costs and debt to Mig LLC are reflected | 4 10634 340 | 4 30222 730 | 2 360 |

| The debt to Mig LLC was repaid | 4 30222 830 | 4 20111 610 | 2 360 |

| The actual cost of workwear has been generated | 4 10535 340 | 4 10634 340 | 61 360 |

Let us note that different types of institutions have their own nuances of accounting for workwear. For example, government institutions receive it as part of centralized supply. The transfer is documented by means of a notice (f. 0504805).

Postings depend on the budget level and status of the institution:

| Contents of operation | Debit | Credit |

| The overalls came from other subordinate institutions within the department | 0 10535 340 | 0 30404 340 |

| The overalls were received from institutions that are under the control of different managers of the same budget level, or subordinate to the same GRBS as part of income-generating activities (similar postings will be made when receiving clothing from individuals). | 0 10535 340 | 0 40110 180 |

| The overalls were received from a budgetary institution of a different budget level | 0 10535 340 | 0 40110 151 |

Having received the protective clothing, the institution is obliged to mark it. The procedure is controlled by managers and accountants. The procedure for marking soft equipment is described in detail in paragraph 118 of Instruction No. 157n.

How to account for workwear costs

Workwear owned by the organization is accounted for in the accounts/sub-accounts for materials accounting before being put into operation. Like other materials, it is taken into account at the cost of actual acquisition costs. The procedure for accounting for workwear is fixed as an element of the company’s accounting policy. The purchased workwear arrives at the warehouse on the basis of a receipt order.

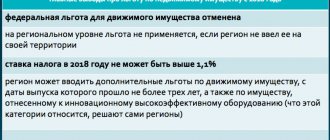

There is another way. As can be seen from paragraph 9 of the Guidelines, an organization can keep records of special tools, fixtures, and equipment in the manner prescribed for accounting for fixed assets. This method has a number of disadvantages. Firstly, the cost of workwear will have to be subject to property tax. Secondly, it is necessary to monitor the condition of the workwear so that it can be written off on time.

Accounting for workwear in an organization: accounting and tax

If you believe that workwear is issued only to construction workers and factory workers, then take a look at the Standard Standards approved by Order of the Russian Ministry of Labor dated December 09, 2014 No. 997n. Among others, you will see in the list of positions: driver, archivist, computer operator, loader, technician, supply manager, seller of non-food products, which can be in almost any company.

Since the employer is responsible for organizing safe conditions and labor protection, employees must be provided with personal protective equipment. This article will help you organize accounting of workwear in your organization.

The content of the article:

1. Standards for providing workers with special clothing

2. Card for free issue of workwear

3. Postings for accounting of workwear

4. Write-off of workwear in accounting

5. Example

6. Write-off of workwear in tax accounting

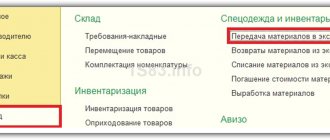

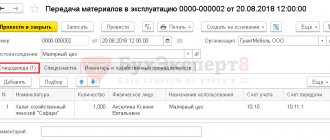

7. Accounting for workwear in 1s 8.3

8. Accounting for workwear in an organization using the simplified tax system

9. How to write off workwear that has become unusable

10. Overalls when dismissing an employee

So, let's go in order. If you don't have time to read a long article, watch the short video below, from which you will learn all the most important things about the topic of the article.

(if the video is not clear, there is a gear at the bottom of the video, click it and select 720p Quality)

We will discuss the topic further in the article in more detail than in the video.

Standards for providing workers with special clothing

To whom the employer is obliged to issue special clothing is specified in Articles 212, 221 of the Labor Code of the Russian Federation:

- workers engaged in work with harmful or dangerous working conditions;

- workers engaged in work performed in special temperature conditions or associated with pollution .

The document that regulates the provision of workers with special clothing is the Intersectoral Rules for Providing Workers with Special Clothing, Special Footwear and Other Personal Protective Equipment, approved by Order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n . It establishes requirements for the issuance of personal protective equipment (PPE):

- PPE must undergo certification and declaration of conformity;

- PPE is purchased at the expense of the organization or under a lease agreement for temporary use;

- PPE is issued free of charge according to standard standards and based on the results of a special assessment of working conditions

- An organization, in a local act, can establish its own standards for providing workers with protective clothing that exceed the standard ones, and also replace one type of protective clothing with a similar level of protection.

You can check the standards for providing workers with special clothing for positions available in the staffing table in the following documents :

- Standard standards approved by Order of the Ministry of Labor of Russia dated December 9, 2014 No. 997n - for workers in cross-cutting professions and positions of all types of economic activity;

- Standards for issuing warm work clothes and footwear to employees, approved by Resolution of the Ministry of Labor dated December 31, 1997 No. 70 - according to climatic zones, the same for all sectors of the economy;

- Standard issuance standards approved by Order of the Ministry of Health and Social Development dated April 20, 2006 No. 297 - for certified special high-visibility signal clothing to workers in all sectors of the economy;

- Industry standard standards (for example, in construction, medical, manufacturing activities, banks, housing and communal services, etc.).

- in Section IV of the Report on the special assessment of working conditions (Appendix No. 3 to Order of the Ministry of Labor of Russia dated January 24, 2014 N 33n).

In these documents, for each position and profession, you can find a list of special clothing by type and quantity that should be issued to employees for a year.

The enterprise must approve the list of positions to which special clothing is issued and the issuance standards. This may be an order from the manager or an annex to an employment or collective agreement.

Appendix to the order:

When hiring an employee, the employer must inform the employee about the personal protective equipment they are required to wear. The employee signs that he has read the Rules for Providing Workers with Work Clothing, and the standard standards for issuing PPE corresponding to his profession and position.

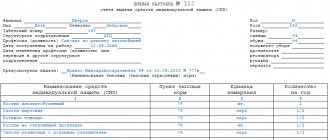

Card for free issue of workwear

When issuing workwear to employees, one should take into account the gender, height and size of the employee, and the nature of his work. To control the standards for the issuance of protective clothing and their service life, a personal record card for the issuance of personal protective equipment for each employee. The form of the card for the free issuance of workwear is approved by the Intersectoral Rules (Order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n).

Intersectoral rules allow maintaining personal cards in paper or electronic form. When filling out a personal registration card for the issuance of PPE in the program, instead of the employee’s signature on receipt, a reference is made to the details of the primary document, which contains the employee’s signature on receipt of PPE (for example, claim invoice M-11).

If PPE is not used by employees all the time, but is required for the duration of certain work, a card for the free issuance of special clothing is issued for them from the island.

documents are usually transferred to the accounting department using standardized forms (approved by Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a):

- No. MB-2 “Registration card for low-value and wear-and-tear items”;

- No. MB-4 “Act of disposal of low-value and wear-and-tear items” to account for the write-off of workwear that has become unusable;

- No. MB-7 “Registration sheet for the issuance of work clothes, safety shoes and safety devices” - to record the issuance of personal protective equipment to employees for use;

- No. MB-8 “Act for the write-off of low-value and wearable items” - to account for the write-off of worn-out and unsuitable for further use of personal protective equipment.

Organizations themselves can develop similar forms of primary documents for accounting for workwear, taking into account the specifics of the company’s activities and the personal protective equipment issued. For example, an act for writing off workwear may look like this.

Postings for accounting of workwear

Organizations maintain records of protective clothing and other protective equipment in accordance with the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated December 26, 2002 N 135n.

Accounting for workwear in an organization and the accounting account depend on which assets will include PPE. Methodological guidelines propose to take into account special clothing as part of inventories , regardless of the period of use and cost. But the accounting policy can provide for the accounting of work clothes in the organization as part of fixed assets .

Features of accounting and posting for accounting of workwear in the organization in each option are shown in the table.

| Overalls as part of the MPZ | Overalls included in OS | Working clothes for temporary use | |

| Attribution criteria | Regardless of their cost and period of use | The period of use is more than a year and the cost is over 40,000 rubles. (or other established value for recognizing assets as fixed assets) | Receipt of workwear under a rental agreement |

| Workwear accounting account in the organization | 10 “Special equipment and special clothing” | 01 "Fixed assets" | On off-balance sheet account 002 “Inventory assets accepted for safekeeping” |

| Basis (primary documents) | Receipt order f. M-4, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a | Act of acceptance and transfer of OS object f. OS-1, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 N 7 | Transfer and Acceptance Certificate |

| Cost of registration | at actual cost, in the amount of actual costs of acquisition or production | in the assessment provided for in the contract, or in the assessment agreed with their owner | |

| Postings for accounting for the purchase of workwear | Debit 10-10 “Special equipment and special clothing in the warehouse” Credit 60,71,76 – special clothing was capitalized | Debit 08 “Investment in non-current assets” Credit 60,71,76 – personal protective equipment was capitalized Debit 01 “Fixed assets” Credit 08 – personal protective equipment included in fixed assets | Debit 002 “Inventory assets accepted for safekeeping” |

| Normative act | clause 11 of the Methodological guidelines approved by Order of the Ministry of Finance of the Russian Federation dated December 26, 2002 N 135n, Guidelines for the accounting of industrial goods approved by Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n | clause 9 of the Methodological guidelines approved by Order of the Ministry of Finance of Russia dated December 26, 2002 N 135n, PBU 6/01 “Accounting for fixed assets”, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n Letter of the Ministry of Finance of the Russian Federation dated May 12, 2003 No. 16-00 -14/159 | clause 12 of the Guidelines approved by Order of the Ministry of Finance of Russia dated December 26, 2002 N 135n |

Write-off of workwear in accounting

Postings for writing off workwear in accounting will depend on the account in which they were recorded upon receipt.

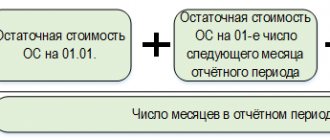

Option 1. Write-off of workwear recorded as part of the inventory with a period of use of more than 12 months

- the cost of personal protective equipment is written off as expenses linearly over the entire period of use in accordance with clause 26 of the Guidelines

- Debit 10-11 “Special equipment and special clothing in operation” Credit 10-10 “Special equipment and special clothing in warehouse” - special clothing transferred to the employee for temporary use

- Debit 20, 26, 44 Credit 10-11 “Special equipment and special clothing in use” - partial write-off of special clothing in accounting as expenses (monthly during the period of use of PPE)

Option 2. Disposal of workwear as part of industrial equipment with a service life of less than 12 months

- the cost of workwear is expensed at the time of issue to the employee in accordance with clause 21 of the Methodological Instructions. This rule must be enshrined in the organization’s accounting policies for accounting purposes.

- Debit 20, 26, 44 Credit 10-10 “Special equipment and special clothing in warehouse” - write-off of special clothing in accounting as expenses when transferred to an employee

- Accounting for workwear in an organization that is used by employees and written off as expenses can be carried out on the off-balance sheet account “Workwear in use” (clause 23 of the Guidelines).

Option 3. Write-off of the cost of workwear included in fixed assets

- the cost of workwear is expensed through depreciation

- Debit 20,26,44 Credit 02 “Depreciation of fixed assets” - depreciation is calculated on the cost of workwear on a monthly basis during the period of use

Example

On 12/05/2016, at the service station for car repair mechanic Kozlov, we purchased protective clothing: a protective suit made of mixed fabrics, 1 pc. at a price of RUB 4,500.00, gloves 1 pair for RUB 420.00, safety glasses 1 pc. RUR 6,500.00 each, insulated jacket 1 pc. RUR 5,600 each, insulated trousers 1 pc. for 3800.00 rubles, felt boots for 4800.00 rubles.

The overalls were issued to the employee on December 11, 2016. According to approved standards, the period of use of a suit, gloves, glasses is less than 12 months, an insulated jacket, trousers - 30 months, felt boots - 36 months.

05.12.2016

Debit 10-10 “Special equipment and special clothing in warehouse” Credit 60 – 25,620.00 rub. (4500+420+6500+5600+3800+4800) — Workwear posted to the warehouse

11.12.2016

Debit 26 Credit 10-10 – 11420.00 rub. (4500+420+6500) The cost of the suit, gloves, glasses issued to the mechanic was written off as expenses.

Debit 10-11 “Special equipment and special clothing in use” Credit 10-10 – RUB 14,200.00. (5600+3800+4800) — The employee was given an insulated jacket, insulated trousers, felt boots

31.12.2016

Debit 26 Credit 10-11 “Special equipment and special clothing in use” 446.67 rubles. (5600/30+3800/30+4800/36) - Partial write-off of the cost of workwear, the use of which is more than 12 months.

Write-off of workwear in tax accounting

The cost of personal protective equipment can be written off as expenses that reduce the income tax base. But the write-off of workwear in tax accounting is limited by the standards for the free issuance of PPE: standard or approved by the company based on the results of a special assessment of working conditions. This position was expressed by the Ministry of Finance in Letter No. 03-03-06/1/59763 dated November 25, 2014, and No. 03-03-06/4/8 dated February 16, 2012.

For tax purposes, the reflection of workwear depends on its cost and service life:

- As depreciable property:

- Subject to the following conditions: cost more than 100 thousand rubles, period of use more than 12 months;

- Write-off is carried out by calculating depreciation monthly over the useful life

- Included material costs:

- If the period of use is less than 12 months, the cost of the workwear can be any;

- It is expensed at the time of issue to the employee or evenly over the period of operation if this period extends beyond one reporting period for income tax. This procedure is provided for in paragraphs. 3 p. 1 art. 254 Tax Code of the Russian Federation. The option that the organization uses is fixed in the accounting policy for tax purposes.

Accounting for workwear in 1s 8.3

In the 1C program: Accounting 8th edition. 3.0, you can also organize accounting for the receipt, issue and write-off of workwear and other personal protective equipment. For instructions on how to use the program, watch the video.

Accounting for workwear in an organization using the simplified tax system

Accounting for protective clothing on the simplified tax system, as well as on the general system, depends on how protective equipment is taken into account. Since the simplification uses the cash method of recognizing income and expenses, the workwear must be paid for.

If workwear is accounted for as materials, then their cost is included in expenses under the simplified tax system after payment and acceptance for accounting at a time.

When PPE is accepted as the main means, then the accounting of workwear in the organization on the simplified tax system is carried out in accordance with paragraph 3 of Art. 346.16, sec. 4 paragraphs 2 art. 346.17 Tax Code of the Russian Federation. The cost of workwear is included in expenses on the last day of the reporting period in the payment amount.

How to write off workwear that has become unusable

In the event that protective clothing has become unusable and its useful life has not expired, the Guidelines allow for the possibility of writing off such PPE. The decision on the unsuitability of special clothing falls within the competence of the permanent inventory commission (clause 34 of the Guidelines). A commission appointed by order of the head examines the personal protective equipment, determines the reasons for failure, identifies those responsible for damage to the protective clothing, and draws up a write-off report.

that is completely unusable and cannot be restored is subject to write- . The write-off act is transferred to the accounting department. How to write off workwear that has become unusable? The accountant will have to make the following entries:

Debit 94 Credit 10-11 – write-off of workwear that has become unusable at residual value;

According to clause 11 of PBU 10/99, expenses for writing off personal protective equipment that is not suitable for use are included in accounting as part of other expenses in the reporting period to which they relate.

Debit 91-2 Credit 94 - the cost of workwear that has become unusable is reflected in other expenses.

If the commission determines the culprit , then the cost of the protective clothing is attributed to the guilty person (subparagraph “b”, paragraph 28 of the Accounting and Reporting Regulations):

Debit 73 Credit 94 – the cost of workwear is attributed to the guilty person.

Debit 50,51,70 Credit 73 – compensation for damage (deduction from salary) by the culprit.

Debit 91-2 Credit 73 – writing off damage to other expenses if the guilty person is found not guilty by the court.

Overalls when dismissing an employee

The ownership of workwear remains with the organization for the entire period of use. Therefore, when an employee is dismissed or transferred to another position, workwear must be returned to the warehouse. This obligation is provided for in clause 64 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 26, 2002 No. 135n.

The return of workwear in accounting is reflected by the following entries:

- Debit 01 “Fixed assets in warehouse” Credit 01 “Fixed assets in operation” - when accounting for workwear as fixed assets;

- Debit 10-10 Credit 10-11 – at residual value, if workwear included in the inventory is written off evenly over the period of use;

- Accounting entries are not made if the cost of the workwear was written off at a time when issued to the employee. In this case, only quantitative accounting is carried out.

The organization has the right to deduct from the employee’s salary the cost of protective clothing that was not returned upon dismissal or that was lost by the employee. Accounting for the deduction of the cost of workwear upon dismissal of an employee is similar to the procedure discussed in the previous section.

The issuance of workwear to employees does not entail a transfer of ownership, so the employer does not have an object of VAT taxation. Also, the cost of workwear is not recognized by the legislator as employee income, and the cost of the workwear provided is not subject to personal income tax and insurance contributions.

In conclusion, a few words about responsibility. Failure to provide employees with protective equipment may result in a fine of 20 to 30 thousand rubles for officials, and from 130 to 150 thousand rubles for a company (Clause 4 of Article 5.27.1 of the Code of Administrative Offenses of the Russian Federation). Therefore, I ask you not to neglect your responsibility to provide workers with special clothing. And if you have any unanswered questions about accounting for workwear, write in the comments, let's try to find the answer together!

Accounting for workwear in an organization: accounting and tax

Issuance of protective clothing to employees

When transferring workwear from a warehouse to other divisions of the company, it is necessary to draw up a primary document on the basis of which the workwear is kept accountable. Such paper will be enough to write off the cost of workwear as an expense both in accounting and tax accounting.

If you choose a unified primary, you can use one of these forms:

- demand-invoice;

- invoice for materials release.

If you decide to develop your own form, then you can take the invoice for the release of materials as a basis, removing unnecessary things from it.

The employee responsible for receiving workwear issues it to employees. His actions also need to be recorded somewhere. It is advisable to create a special statement for each person in all departments for a year or month, so as not to fill it out every time you issue special clothing.

Records can also be kept on a special card, which is filled out for each employee of the organization who has received special clothing.

Issuance and accounting of personal protective equipment

PPE: the procedure for issuing and accounting is regulated by Order of the Ministry of Health and Social Development of Russia N 290n “On approval of Intersectoral Rules for Providing Workers with Special Clothing, Special Footwear and Other Personal Protective Equipment.”

The main document confirming the issue is a personal card for recording the issuance of PPE. It can be filled out both in paper and electronic form.

A journal is also maintained for the issuance of personal protective equipment, which contains lists of workers who have received personal protective equipment.

How to retain the cost of workwear from a resigning employee?

When you issue workwear to an employee, you must conclude an agreement with him on the transfer of soft equipment for use or a one-time document on acceptance and transfer.

The employee’s obligation to compensate for direct actual damage caused to the employer is provided for in Article 238 of the Labor Code of the Russian Federation, therefore termination of the employment contract does not entail the release of the employee from financial liability for non-return of workwear.

Thus, in the case of correct registration of the issue of special clothing if it is not returned by an employee leaving the organization, the employer has the right to demand reimbursement of the cost of the special clothing (the useful life of which has not expired) taking into account the degree of wear and tear (Article 246 of the Labor Code of the Russian Federation).

The programs “Kontur-Accounting Asset” and “Kontur-Accounting Budget” allow you to avoid errors when keeping records of workwear or uniforms.

Yulia Volkhina , project manager

Disposal of workwear

The reason for writing off workwear may be:

- dismissal of the employee who used it;

- expiration of useful life;

- complete wear and tear of workwear.

In the first two cases, the employee must hand over the workwear to the warehouse.

For write-off, use accounts 0 10900 000 “Costs for the manufacture of finished products, performance of work, services” or 0 40120 000 “Expenses of the current financial year”.

There are two ways to write off workwear:

- at the actual cost of each unit;

- at the average actual cost.

In practice, institutions prefer to write off workwear at the actual cost of each unit. If you choose the second option, do so by inventory group separately. The total actual cost of the group takes into account the average actual cost and balance at the beginning of the month, as well as items received during the current month. This amount is divided by the number of objects on the write-off date.

After a decision has been made to deregister several objects, the commission for the receipt and disposal of assets draws up an Act on the write-off of soft and household equipment (f. 0504143). The act must indicate the reason for the write-off, for example, physical wear and tear, etc. The document is drawn up in two copies and signed by all members of the commission. One copy is submitted to the accounting department, and the second remains with the financially responsible employee.

Sometimes clothes wear out prematurely through no fault of the employee. The reason may be the nature of the institution's activities. In this case, use the wiring shown in example 2.

Example 2.

During the production process, the work suit of the foreman of the training workshop at the State Autonomous Institution "Technical Lyceum" was damaged. The initial cost of the suit is 7,000 rubles. After completing the relevant documents, the following entries will be made in accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| The cost of a suit that has become unusable has been written off. | 0 40120 272 | 0 10535 440 | 7 000 |

Disposal of special clothing due to emergency circumstances is reflected in the debit of account 0 40120 273 “Extraordinary expenses from operations with assets.” Discarded clothing can be used as rags.