STS is an abbreviation for simplified taxation system. This is a preferential tax regime that allows organizations and individual entrepreneurs (abbreviated as individual entrepreneurs) to save on taxes. Being on a simplified taxation system, organizations and individual entrepreneurs pay one tax, which replaces VAT, income tax (paid in some cases, for example, as a tax on dividend income), property tax (in some cases, property tax will have to be paid). Tax on the simplified taxation system is of two types:

- income minus expenses. The tax in this case is equal to 15% of the taxable base;

- income. The tax in this case is equal to 6% of the tax base.

Tax rates can be found in Article 346.14 of the Tax Code of the Russian Federation.

If an organization or individual entrepreneur is just starting its activities and wants to immediately work on a simplified taxation system, then they must fill out an application in the established form and submit it to the tax office. To do this, individual entrepreneurs need:

- fill out an application in form P26001 (with simultaneous registration of individual entrepreneurs);

- fill out the “Notification of transition to a simplified taxation system (form 26.2-1).” This notice is Appendix No. 1 to the Order of the Federal Tax Service of Russia No. ММВ-7-3 / [email protected] dated November 2, 2012;

- make a copy of your passport;

- pay the state registration fee and attach the original receipt to the application. In 2021, the state duty is 800 rubles.

For organizations it is necessary:

- fill out the “Notification of transition to a simplified taxation system (form 26.2-1)”:

- attach all documents on the registration of the organization (if registration and transition to the simplified tax system occur simultaneously);

- pay the state fee for registration. In 2021 it was equal to 4,000 rubles.

If an organization or individual entrepreneur first registers and then submits a notification about the transition to the simplified tax system, then the organization or individual entrepreneur has another 30 calendar days to do this from the date of registration.

If an organization or individual entrepreneur first worked on the general tax system and then switched to the simplified taxation system, then in this case, it can submit a notification until December 31 of the current year. But you can switch to the simplified tax system only in the new year.

In order to switch to the simplified tax system, you need to meet certain requirements, which are prescribed in article 346.12 of the Tax Code of the Russian Federation.

What is a notice of application of the simplified tax system

Important! Notification of the application of the simplified taxation system, abbreviated as simplified tax system, is currently not issued by tax authorities by organizations or individual entrepreneurs . However, when taxpayers contact the tax authorities, they can receive confirmation that they are on a simplified taxation system. Currently, such a notification looks like an information letter. This letter will indicate the date of filing an application to begin applying the simplified taxation system by an organization or individual entrepreneur.

Why declare a transition to the simplified tax system?

The simplified tax system, as well as imputation and patent, are voluntary tax regimes and can be used by individual entrepreneurs and organizations at their own discretion, subject to the appropriate conditions.

OSNO is one of the most complex and economically unprofitable tax regimes for small businesses. In most cases, it is used when, due to the number of employees and cash turnover, a company or individual entrepreneur cannot apply the simplified tax system or UTII, or, in the case where the taxpayer cooperates mainly with counterparties interested in offsetting the “input” VAT.

https://www.youtube.com/watch{q}v=mT_DrHvNPEQ

If, when registering, an individual entrepreneur or organization forgot to submit a notification for the use of UTII or the simplified tax system, they will be able to switch to the special regime only next year.

The application of the simplified tax system is carried out only after notifying the tax authority about this and registering the specified person as a simplified tax payer. Without notification, you cannot switch to a simplified tax system, both during initial registration and when changing the taxation regime.

In what cases may confirmation of the application of the simplified tax system be necessary?

Information that an organization or individual entrepreneur is on a simplified taxation system may be needed in some cases . For example, for a bank, when an organization or individual entrepreneur applies for a loan. Buyers or sellers may need such a letter to confirm the absence of VAT. In general, different situations may arise in which such a letter will be useful. If this information letter is needed by counterparties, then perhaps a copy of the “Notification of the transition to a simplified taxation system (Form 26.2-1)” with a mark from the tax office will be enough for them.

Reasons for refusal to provide

Reasons for refusal may include:

Submitting a request to the tax authority, whose competence does not include providing this information.- Absence of all required details in the request.

- Submission of a petition by an authorized person of the taxpayer, without attaching a copy of the power of attorney confirming his authority in the prescribed manner.

- The presence of offensive expressions or obscene phrases in the request.

How to receive a letter about the application of the simplified tax system

In order to receive an information letter on the application of the simplified taxation system, you must write an application to the tax authority at the place of registration of the organization or individual entrepreneur. The application is written in free form. The letter must be addressed to the head of the tax authority to which you are submitting this application. His position, last name, first name, patronymic will need to be clarified with the tax office itself or on its official website. Next, you need to indicate who this letter is from; the name of the organization, its INN, OGRN, address, telephone number are indicated here. If there is a number for the outgoing letter, then it must be indicated, as well as the date of the letter. If the application is submitted by an individual entrepreneur, then he indicates his last name, first name, patronymic in full, his INN and OGRN. Next, write the word “Application” and below the text of the letter. The text of the letter may be as follows: “Please provide an information letter about our organization’s current application of a simplified taxation system for provision to interested parties.” Next, indicate the position of the employee, his last name, initials, signature and seal of the organization. For an individual entrepreneur, the text may be as follows: “Please provide an information letter stating that I, as an individual entrepreneur, currently apply a simplified taxation system. The letter must be submitted to the bank (or at the place of request).” Next, indicate his last name, initials, signature and, if there is a seal.

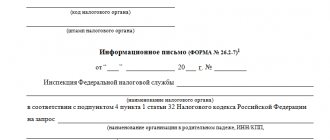

After this, the application must be taken to the tax authority and registered. Within 30 days after registration of this letter, the tax authority is obliged to respond. The response will be issued in form 26.2-7 (Order of the Federal Tax Service No. MMV-7-3 / [email protected] dated November 2, 2012).

Submission deadlines

The deadline for submitting a notification directly depends on the reasons for which an organization or individual entrepreneur is switching to the simplified tax system:

- When registering an LLC or individual entrepreneur for the first time, the notification must be submitted either simultaneously with the general package of documents for registration, or within 30 days after it.

As mentioned above, if a businessman forgets to submit an application to switch to a simplified tax regime within thirty days, he will automatically be transferred to the general taxation regime, which he will be able to change only next year.

- An existing organization or individual entrepreneur, when switching from another taxation system or when opening a new type of activity for which it is planned to apply the simplified tax system, must submit an application no later than December 31 of the year preceding the one from which the simplified tax system will be applied.

Organizations that decide to switch to the simplified tax system must submit an application no earlier than October 1, since the specified document must reflect the amount of income for the past 9 months (as of October 1). For individual entrepreneurs, this restriction does not apply.

- When transferring from UTII, if the activity at the imputation is terminated, the application is submitted within a period of no later than a month from the date of termination of work at the imputation.

In this case, the individual entrepreneur or organization begins to apply the simplified tax system not from the beginning of the year, but from the month in which the activity on UTII was terminated

- When switching from the simplified tax system to another taxation regime, it is necessary to submit a notification in form 2-3 before January 15 of the year from which the individual entrepreneur or organization plans to switch to another taxation system.

Please note that an individual entrepreneur or organization can change the taxation system from the simplified tax system to another, or change the object of taxation (“income” or “income minus expenses”) only from the next year, except in the case of loss of the right to use the simplified tax system due to exceeding the limit of employees or income received since the beginning of the tax period.

A request to the tax service can be submitted in person or by an authorized person directly at the taxpayer’s place of registration, by mail or electronically.

If you submit the application in person, it is advisable to have two copies - one for the Federal Tax Service, the second - with the registration date, for the taxpayer.

When filing an application electronically (via telecommunication channels), the taxpayer is sent two electronic documents:

- Confirmation by the tax authority of the date of receipt of the request.

- Receipt of acceptance of the application for consideration.

The certificate is provided within five working days from the date of registration of the request with the Federal Tax Service.

The completed document can be obtained:

- Personally.

Upon issuance, the inspector will check the availability of identification documents of the taxpayer or authorized person. One copy of the certificate is issued to the recipient, the second remains with the tax authorities. It bears a mark of issue, date, surname, first name, patronymic and signature of the recipient. If the taxpayer has not received the certificate in person within five working days, the Federal Tax Service sends the document by mail to the address specified in the request. - By mail. In the case where the applicant in the request indicated the method of receipt “by mail”.

- Electronic. When sending a request via telecommunication channels.

A certificate on the status of settlements with the budget for taxes, penalties and fines was developed in order to improve the quality of performance of government functions, create comfortable conditions for tax payers, determine the timing and sequence of actions of the Federal Tax Service, its territorial bodies and officials.

Article 346.13 of the Tax Code of the Russian Federation allows a newly created organization and a registered individual entrepreneur to switch to a simplified system within 30 days after tax registration. In this case, the applicant is recognized as using the simplified form from the date of registration of the individual entrepreneur or LLC.

The clause was made specifically so as not to force taxpayers to report under the general taxation system several days before the transition to the simplified tax system. For example, an entrepreneur registered on April 25, 2021, but reported his choice only on May 10. He met the 30-day deadline, therefore he is considered to be applying the simplified taxation system from 04/25/19. He is not required to report for the third quarter under OSNO.

To calculate advance payments for the quarter, use our free simplified taxation system calculator.

Simplified tax system calculator

You can submit an application to switch to the simplified tax system immediately along with other documents for state registration, however, if the tax inspectorates (registering and the one where the taxpayer will be registered) are different, then acceptance may be refused.

Just be prepared for such a situation; refusal to accept is not the arbitrariness of the tax authorities, but an unclear requirement of the Tax Code. In this case, you simply must submit Form 26.2-1 to the inspectorate where you were registered: at the registration of the individual entrepreneur or the legal address of the organization. The main thing is to do this within 30 days after registering the business.

If you do not immediately notify the Federal Tax Service about the transition, then the opportunity will appear only next year. So, if the individual entrepreneur from our example, registered on April 25, 2019, does not report this, he will work on the common system until the end of 2021. And from 2021, he will again receive the right to switch to a preferential regime, but this must be reported no later than December 31, 2021.

We invite you to familiarize yourself with: Application for suspension of work in case of delay in salary. Sample

How to switch to the simplified tax system in 2021

Thus, you can notify the tax authorities of your choice either within 30 days from the date of registration of an individual entrepreneur/LLC or before December 31 in order to switch to the simplified tax system from the new year. An exception is made only for those working on UTII; they have the right to switch to simplified taxation during the middle of the year, but if they are deregistered as payers of the imputed tax.

For ease of doing business, paying taxes and insurance premiums, we recommend opening a bank account. Moreover, now many banks offer favorable conditions for opening and maintaining a current account.

Common mistakes when writing an application to the tax authority

Error. When writing an application to the tax authority, the organization did not indicate its INN and OGRN.

How right. When writing any free-form applications to the tax authority, it is recommended to indicate the following information. (click to expand)

| Necessary information | Notes |

| Name of the organization | An abbreviated name is enough |

| TIN, KPP, OGRN | It is enough to indicate the TIN and OGRN of the organization. They are needed so that the tax authority can identify the taxpayer, since there may be several organizations with the same name |

| Full name of the tax authority | You can find out the full name from the tax office itself or on its official website |

| FULL NAME. head of the tax authority | The application is addressed to the manager, so this information must be indicated |

| Information about the employee who signed the application - his position, full name, contact telephone number | This information is needed to understand whether this person has the right to sign this application or not. The telephone is needed for prompt communication with the taxpayer |

| Signature, seal of the organization | Essential elements for any application. Without them, the application will not be considered an official document |

| Date of the letter | It is necessary to indicate, because the deadline for the tax office to respond to the application will be based on this date |

| Address at the location of the organization, or postal address | It is necessary to indicate so that the tax office knows to which address the response can be sent. |

| Outgoing letter number | It is not necessary to indicate, but some tax authorities require it, so it is better to indicate it. |

Content of the letter

There is a list of certain details:

Full name of the organization (full name of the individual).- TIN (for organizations).

- Signature of the head of the organization (individual).

- Seal of the organization.

In your request you can specify:

- Method of receiving the statement (in person/by mail). If the method of receipt is not specified, the completed document is sent by registered mail.

- The date on which the certificate must be issued. If there is no date, then the document is drawn up at the time of registration of the petition.

Read about how to make a request to the tax office for the provision of information here, and from this article you will learn about the specifics of filing a request to the Federal Tax Service about the absence of debt.