Payout Basics

Objects covered:

- Residential buildings, apartments, shares in an apartment.

- Land plots, their shares on which the object is located.

- Land intended for construction.

In addition, the tax deduction can include costs incurred for the purchase of building materials and renovation of the apartment (provided that it was rented out unfinished or rough). It is also allowed to compensate funds paid for the development of the project for work on connecting communications.

Important! All these costs can be included in the deduction only if there is documentary evidence that they had to be carried out. That is, if the purchased apartment has a fine finish, but you simply don’t like it, you shouldn’t count on reimbursement of the funds spent on repairs.

Legislative regulation of the issue

In accordance with the Tax Code of the Russian Federation, the taxable base includes:

- worker's wages;

- profit, the reason for which was a piece of real estate or a car (if the person owned it for less than 3 years);

- copyright income;

- profit received by renting out land or residential space.

In 2014, several major amendments were made to the legislation regarding the return of personal income tax. It was these manipulations that significantly simplified the process of submitting documents and the procedure for receiving it.

The most significant changes:

- the right to receive unused tax deductions during the next reporting period;

- joint purchase of an object allows each of the shareholders to receive a return in accordance with the amount of money spent;

- Refunds include funds spent both on the purchase of housing and on construction and repair work.

In this case, we must not forget to comply with the following conditions:

- preservation of receipts, cash orders, payment guarantees and other documentary evidence of repairs;

- The purchase and sale agreement must include a clause stating that the property being purchased has not been subjected to finishing or renovation.

The property deduction is not limited in its application. That is, you can use the benefit at any time. There is only a limitation period for receiving personal income tax from the budget - 3 years. If housing was purchased in 2011, and a citizen applied for a refund in 2015, then the personal income tax paid can only be received for 2014, 2013 and 2012. You can return the purchase tax no earlier than such a right has appeared.

We must not forget about the statute of limitations if the subject of return is interest on the loan, which sometimes arises at a later time.

If a taxpayer sells property, he declares the benefit immediately - when he enters information about the income received in the declaration.

Who cannot count on a refund, regardless of the timing of the purchase of real estate

There are categories of persons who are not entitled to a deduction, among them:

- A child who is under 18 years of age.

- A student who does not have an official place of work.

- A pensioner who has no taxable income. But he can have any income, and this is not necessarily a salary. The key requirement is that income tax be paid from it.

- Individual entrepreneurs and legal entities.

- Any persons having income that is not subject to 13% tax.

- Those who bought property from a relative.

- A person who is not a resident of the Russian Federation, that is, stays in the country for less than 183 days a year.

- Those who do not have a certificate of title to housing.

- If the apartment was purchased with the assistance of a social service, with government funds or subsidies, including maternity capital. If assistance in the purchase was provided by the employer.

Deadline for filing a tax return

As a general rule, for all citizens who file a tax return for 2021, a general deadline is set - until 05/02/2017. The current legislation determines the official filing deadline - until April 30 of the year following the reporting year. But since this date fell on official holidays, the official filing deadline was also postponed.

Get 267 video lessons on 1C for free:

This rule applies to citizens who received income from the sale of property that was owned for at least 3 years. And for real estate - a minimum of 5 years, if the property was transferred into ownership after 01/01/2016. Also from business activities, from renting out real estate, as well as income received as a win or gift.

This is interesting: Forgery of a signature, the statute of limitations is 2021

Those individuals who file 3-NDFL tax returns solely for the purpose of obtaining a tax deduction are not included in the number of such persons. They are not subject to the above deadline and returns filed to obtain the deduction can be submitted at any time of the year, without any tax consequences.

At the same time, if an individual submits a declaration on income received in 2021 and also claims to receive a tax deduction, then the previous deadline is valid for him - until 05/02/2017.

About statute of limitations

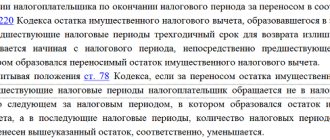

The laws of the Russian Federation do not establish a statute of limitations for obtaining a tax deduction. This means that no matter when the property was purchased, part of the money for it can be returned throughout your life.

- The period from which you can apply for a deduction begins from the moment you receive ownership.

- For the calculation, you can take the next 3 years; the period that preceded the acquisition cannot be included in the declaration.

- If housing was purchased under a sales contract, the right to a property deduction appears from the moment of registration of ownership rights.

- If purchased under a contract, the DU is the date of signing the transfer and acceptance certificate, that is, the period from which the house was put into operation.

There is one exception - it concerns the transfer of the right to deduction for pensioners. If a non-working pensioner bought real estate, then he has the right to use the income tax that he paid in the period 3 years before the date of purchase.

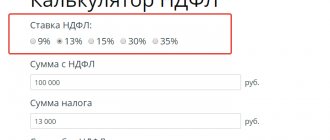

Maximum amounts that can be returned:

- When using your own funds - 260 thousand rubles.

- If you take out a loan - 390 thousand rubles, but only in payment of interest.

Examples

Citizen A purchased an apartment under a sales contract in August 2021, and a month later he issued a certificate of ownership for it. He wants to immediately receive the maximum possible deduction for the purchase. Therefore, he will have to wait until 2021, since it is at the beginning of it that he can receive a return for 2021, 2021, 2021. Citizen A could do differently and submit documents for a tax refund every year, in 2017, 2021 and 2021. Naturally, payments will be extended over such a period if the taxes he paid to the budget are not enough to pay the entire amount at once.

Citizen B registered a temporary residence permit in 2021, the facility will be commissioned at the beginning of 2021. As soon as he receives the acceptance certificate, he acquires the right to a tax deduction, but the first payment can only be received in 2021, since he will submit the declaration and the entire package of documents in 2021. A citizen can act differently, and in this same year, arrange personal income tax payment through the employer. In this case, after 1.5-2 months he can count on an increase in the form of 13% personal income tax, which will not be deducted from his salary.

This is important to know: Support for a young family when buying an apartment in 2021: subsidy

For both examples there are important points:

- Both citizens must officially work for the entire period and pay 13% personal income tax.

- Both cannot get a refund using the previous year as the reporting period. For the first example, these are 2012, 2013, 2014. For the second, 2014, 2021, 2021, and it does not matter in what year the DDU was issued, because only the date of transfer of ownership of the object is taken into account.

Deadlines for submitting 3 personal income taxes in 2021

The deadline for filing the declaration is strictly defined until April 30. It is important to know that if this date falls on a non-working day, it will be transferred to the next working day. For 2021, taxpayers have until April 30, 2021 to file.

In general, a taxpayer needs to remember two main dates in 2021 so that there are no delays in filing returns and paying taxes:

- April 30 is the final deadline for filing the 3rd personal income tax return;

- July 15 is the final deadline for individuals to pay taxes for 2021.

Regarding the latter situation, it is worth noting that before the end of the year you can submit a declaration for a property tax deduction not only for 2018, but also for 2021, 2021. The statute of limitations in this situation is three years. However, if such a resident in 2018 had income that was subject to taxation, and the tax agent did not withhold tax from him and transfer it to the budget, then this is a different situation.

The third case cannot be applied to a taxpayer who simultaneously applies for taxes and property deductions. In this situation, the deadline for filing the 3rd personal income tax return for deduction will coincide with the main deadline for filing the return (no later than April 30, 2021).

There is no statute of limitations

Indeed, there is no statute of limitations for property tax deductions. You can claim the right to it any time after purchase, even after 20 years. Regardless of the year in which the refund application was submitted, only the previous 3 years can be taken into account. That is, if the apartment was purchased in 2000, and the application for refund followed only in 2021, then the years 2013, 2014, 2016 are taken into account.

It is also worth knowing these points:

- Real estate purchased before January 1, 2014 has a deduction base of 1 million, and not 2 as it is now. This means that you can return no more than 130 thousand rubles.

- As for apartments and other housing purchased after this date, the deduction amounts are 260 thousand for own funds and 390 thousand for credit.

Examples

Citizen B bought an apartment in 2002, but for 5 years, that is, from 2002 to 2007, she worked unofficially, that is, she did not make income tax deductions, then she was on maternity leave for 6 years. In 2021, she officially found a job, which means she began to transfer funds to the state budget. From 2021, she has the right to claim tax deductions. But she didn’t know about this right when she found out in 2021 and filed a declaration and the entire package of documents. As a result, she may receive a deduction for 2021, 2021, and next year 2021 she may claim the underutilized amount. Naturally, she can count on no more than 130 thousand rubles.

Citizen G bought an apartment in February 2014, but then quit his job. He did not know about the right to deduction. I only found out in 2016, but at that time I was not working officially. Starting in 2021, I got an official job. He will claim the deduction only in 2021, but he will be able to include 2021 in the calculation. The amount he expects is a maximum of 260 thousand.

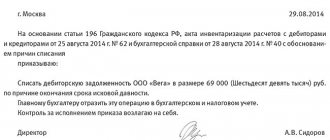

Property deduction: statute of limitations for erroneously returned taxes

Sometimes tax authorities grant the right to a deduction and return previously paid tax by mistake. Such situations may arise, for example, in the case when the Federal Tax Service did not take into account that the deduction by an individual had already been exhausted earlier, and approved the return of personal income tax to him.

In the future, such amount of refunded tax can be disputed and collected from the citizen by tax authorities through the court as unjust enrichment. But at the same time, certain limitation periods apply, after which it is impossible to claim money from an individual (Resolution of the Constitutional Court of the Russian Federation dated March 24, 2017 No. 9-P):

3 years from the date the tax authority makes a decision to provide a deduction to a citizen, if the error was made by the tax authorities themselves;

3 years from the moment the Federal Tax Service found out or should have found out that there are no grounds for providing a deduction if the error was caused by illegal actions of the taxpayer himself (for example, he provided false documents to support his expenses).

Restriction on submission of documents

A tax deduction is an amount that reduces the income received (tax base). That is, you need to pay tax only on the difference between the amount of income received and the amount of the tax deduction.

The same concept applies to the refund of previously paid tax. The reasons are as follows: purchasing a residential property, paying for expensive treatment or studying at a university.

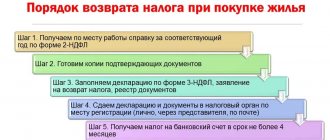

To receive a deduction, you must submit certain documents to the tax office after the end of the calendar year. Within 3 months, appropriate checks are carried out, and then (if there is a positive result), the required amount is transferred.

Various reasons for tax refund

Certain categories of citizens who are tax residents can take advantage of the standard tax deduction.

Implementation is not possible unless the following steps are completed:

- the employer has not received an application with a request for provision and the corresponding package of documents confirming the right to receive it;

- the income received within 1 year exceeded the maximum amount - 350 thousand rubles. – in case of applying for a standard child tax deduction.

Every citizen has the right to a refund of overpaid tax, but only if the period does not exceed 3 years.

You can submit documents for a refund of social deductions within 3 years from the time the expenses occurred.

The value can partly be called fixed, since the costs of medical services, medications and expensive types of medical care are determined by law.

The deduction is based on actual expenses incurred, but cannot be greater than the total amount established for a particular financial year.

The statute of limitations for receiving social deductions for treatment is 3 years. That is, income tax on the amount spent on medical care for yourself or your children in 2021 can be returned in 2017-2019.

The provision of social deductions, whether for treatment or training, is carried out annually.

The limitation applies to the total amount of social deductions. Currently it is 120 thousand rubles.

A professional tax deduction is a procedure for reducing the taxable income received from any income-generating activity by the amount of expenses necessary to make a profit.

You can apply for such a privilege:

- entrepreneur;

- a citizen performing work or providing a service in accordance with the contract;

- author, inventor, designer, etc.

To receive a deduction, you must contact the tax office before April 30 and provide a completed declaration of income received during the past calendar year.

A citizen can apply for a professional deduction only if he acted in accordance with a contract or provided services.

An individual who has become the owner of royalties also has the right to a refund of previously paid tax. The reason for the reward may be a scientific discovery, a literary work, an object of art, an invention, etc.

Lawyer Anisimov Representation and defense in court

If there are insufficient or absent funds in the taxpayer’s accounts, in the absence of information about the taxpayer’s accounts, as well as in other cases provided for in paragraph 7 of Article 46 of the Tax Code of the Russian Federation, the tax authority has the right to make a recovery at the expense of the taxpayer’s property. The decision on collection in this case must be made by the tax authority within 1 year after the expiration of the deadline for fulfilling the requirement to pay the tax.

The periods listed above, during which the tax authority can apply to the court for collection, are established for organizations and individual entrepreneurs. An application for recovery against an individual who is not an individual entrepreneur may be filed within the time limits established by Article 48 of the Tax Code of the Russian Federation.