What are cash and cash equivalents?

Cash and cash equivalents include all cash and highly liquid assets with short maturities (typically 90 days or 3 months). This item is always classified as current assets on line 1250 of the balance sheet.

Take our proprietary course on choosing stocks on the stock market → training course

Cash equivalents include bank accounts and marketable securities, which are debt securities with maturities of less than 90 days.

However, cash equivalents often do not include shares or shareholdings because they can fluctuate in value.

Examples of cash equivalents include commercial paper, Treasury bills, and short-term government bonds with maturities of three months or less. Marketable securities and money market assets are considered cash equivalents because they are liquid and not subject to significant fluctuations in value.

Cash equivalents on the balance sheet: distinctive features

In the accounting policy of each individual organization, it is necessary to determine the approaches that determine the separation of DE from other types of financial investments.

It should be based on the following signs:

- DE are included in financial investments (account 58), but are listed in a separate, specially opened second-order subaccount.

- Short-term investment. DEs are highly liquid assets, so you can get income from their sale in a short period of time. The repayment period is specified in the company's accounting policy as a separate clause. But, as a rule, it is three months or less.

- The purpose of cash equivalents is to pay short-term obligations. Therefore, they do not include those deposits that are designed for long-term investment.

- Income from sales is predictable, and it is not difficult to determine it in advance. The value of DE remains almost unchanged.

Important! In its accounting policy, an enterprise has the right to designate an additional list of characteristics that separate DE from other types of assets. You just need to take into account that these criteria should not leave the limits of the established accounting rules.

Long-term investments cannot be classified as cash equivalents. If necessary, it is impossible to obtain them immediately. Accounts receivable are also not DE, since it is too difficult to predict the specific amount of payments.

Concept and understanding of the category

Cash and cash equivalents are a group of assets owned by a company. For ease of understanding, this is the total value of cash on hand and cash-like assets. If a company has cash or cash equivalents, the totality of these assets is always shown on the top line of the balance sheet. This is because cash and cash equivalents are current assets, which means they are the most liquid of the short-term balance sheet items.

Important! Companies with significant amounts of cash and cash equivalents may have a positive view of their ability to meet short-term debt obligations.

Difference between cash and cash equivalents

The key differences are presented in the table below.

| View | Characteristics and distinctive features |

| Cash | Cash in the form of currency. They include all bills, coins and banknotes. |

| Cash equivalents | For an investment to qualify as equivalent, it must be readily convertible into cash and be subject to negligible value risk. Therefore, an investment usually qualifies as a cash equivalent only if it has a short maturity, say three months or less. |

The importance of using these categories

There are several main reasons why these categories are significant. They are reflected in the table below.

| No. | Cause | Characteristics and description | Clarification |

| Source of liquidity | Cash equivalents are held to satisfy short-term cash obligations and not for investment or other purposes and are an important source of liquidity. Thus, companies want to have a cash cushion to withstand unforeseen situations such as revenue shortfalls, equipment repairs or replacements, or other unforeseen circumstances not budgeted for. | Liquidity ratio calculations are important in determining the rate at which a company can pay off its short-term debt. Various options for liquidity ratios include: total liquidity ratio, current ratio, quick ratio. Total liquidity ratio: (cash and cash equivalents + marketable securities) ÷ current liabilities Current ratio: current assets ÷ current liabilities. Quick ratio: (Current asset - stock) ÷ Current liabilities. | |

| Speculative acquisition strategy | Another good reason for saving is an acquisition in the near future. | As an example, consider the cash balance on Apple Inc's balance sheet: · Cash = $13.844 billion · Total assets = $231.839 billion Cash as % of total assets = 13,844 / 231,839 ~ 6% · Total sales in 2014 = $182,795 Cash as % of Total Sales = 13,844 / 182,795 ~ 7.5% Investments of $13.844 billion (cash) + $11.233 billion (short-term investments) + $130.162 billion (long-term investments) amount to $155.2 billion. The combination of all this indicates that Apple may be looking for some kind of acquisition in the near future. |

Cash balance

It would seem that what could be simpler than calculating how much a particular company earned and how much it spent.

Like, all you need is to take into account all expenses and all income and, through simple arithmetic operations, identify the difference between them, positive or negative. However, the role of the budget balance is much more important for the normal operation of an enterprise than the elementary ratio of earnings and costs. Flow of funds

The fact is that the cash balance (that is, a table reflecting the correspondence of the income and expenses of an enterprise over a certain time period) plays a predictive rather than a statistical role. It is a clear reflection of the practical features of economic activity in a market economy.

Theoretically, entrepreneurship is about achieving a positive ratio of income and expenses in the process of receiving one-time payments from customers for goods and services and making one-time payments to suppliers, credit organizations, tax services, and so on. That is, ideally, a company should immediately receive money for what it sells and immediately give money for what it acquires. But practice differs from theory in that in the vast majority of cases, the company does not have the ability to immediately make all payments: not all goods produced immediately find a buyer, not all purchased goods are immediately paid for in cash, not all events provide an immediate economic effect, being designed for development of the enterprise's activities and greater profits in the future. But payments usually tend to be immediate and urgent. And if in settlements with suppliers of raw materials deferment and non-cash schemes can still be used, then with payments of bank loans or tax payments, payments usually have to be made immediately. When this is not possible, bankruptcy proceedings are usually launched, and no one cares that fabulous profits are expected after six months or a year.

The cash balance is precisely intended to give an objective assessment and forecast of what income as a result of certain operations can be counted on at a certain stage, what payments need to be made and what, positive or negative, this balance will be at a certain point in time. Correct calculation of cash flow (that is, receipts and payments to the company’s accounts) allows you to correctly plan the company’s activities and avoid problems. After all, if it follows from the balance sheet that, for example, significant loan payments or tax deductions are coming in the next quarter, and less cash will be received from clients, then, accordingly, in no case should large-scale long-term investments be made. The objectivity of such data depends primarily on the adequacy of the compiled cash balance.

Drawing up a balance is the most important task

In the normal, planned mode of operation of an enterprise, the cash balance is compiled for fairly long periods of time - for the financial year and quarterly. If the situation is unfavorable, the threat of bankruptcy is real, then more careful monitoring is necessary to find possible solutions, so the balance is drawn up monthly and even weekly. The main tactical goal of drawing up a cash balance is to create an objective picture of income (how much the company earns on certain types of goods, which customers are most reliable in terms of payments, which season accounts for the bulk of sales, etc.) and expenses (which payments are regular, for example , utility costs for maintaining production activities, and which are one-time expenses - the purchase of one or another raw material, tax payments based on the results of the quarter or financial year). The main strategic task is to create conditions under which cash receipts exceed expenses, and the balance would always be positive. This is exactly what actions such as increasing sales of goods, reducing costs, and optimizing credit and tax payments serve.

The fundamental principle of drawing up a cash balance is the most complete accounting of all receipts and payments. In this case, of course, the balance sheet of each individual enterprise will have its own specifics, determined by the specifics of its activities. However, in most cases the main balance sheet items are uniform.

It is curious that there are almost always not too many income points and they include:

- cash at the beginning of the period,

- receipts from sales on credit and in fact, including VAT,

- bank loans,

- increase in sustainable liabilities

- total amount of receipts.

In turn, the list of payments is invariably more substantial:

- actual costs of purchasing raw materials and goods;

- purchase of raw materials and goods on credit;

- fare;

- utility costs;

- payment of wages;

- payment of interest on loans and other bank payments;

- acquisition of additional fixed assets;

- tax payments;

- insurance payments;

- additional expenses.

As a result, payments must be reflected in the cash balance at the beginning of the period, in the balance sheet at the time of drawing up the document and in the balance sheet at the end of the period.

Alexander Babitsky

|

|

Pros and cons of availability

Positive aspects of having:

- maturity and ease of conversion. They are beneficial from a business perspective because a company can use them to meet any short-term needs;

- financial repository. Retained equity is a way of storing money until a business decides what to do with it.

Negative aspects of having:

- loss of income: sometimes companies set aside an amount in equivalents that exceeds the amount needed to cover immediate obligations, depending on market conditions. When this happens, the company loses potential income because money that could have generated higher profits elsewhere has been transferred to a cash account;

- low yield: many equivalents have yield. However, the interest rate is usually low. A low interest rate makes sense given that equivalents are low risk.

The most common options and types

Cash and cash equivalents help companies in meeting their working capital needs as these liquid assets are used to pay off current liabilities, which are short-term debts and bills.

Cash is money in the form of currency and includes all bills, coins and notes.

A demand deposit is a type of account from which funds can be withdrawn at any time without notifying the institution. Examples of demand deposit accounts include checking and savings accounts. All demand account balances at the date of the financial statements are included in total cash.

Foreign currency. Companies holding more than one currency conduct transactions such as currency exchange. Currency for foreign countries must be converted into reporting currency for financial purposes. The conversion must provide results comparable to those that would have occurred if the business had completed operations using only one currency. Foreign currency revaluation losses are not reflected in cash and cash equivalents. These losses are reflected in a separate document.

Cash equivalents are investments that can be easily converted into cash. Investments must be short-term, usually with a maximum duration of three months or less. If the investment period exceeds 3 months, it should be classified in an account called “other investments”. Cash equivalents must be highly liquid and easily traded in the market. Buyers of these investments must be easily accessible.

All cash equivalents must have a known market price and should not be subject to fluctuations in value. The value of cash equivalents cannot be expected to change significantly prior to maturity.

Certificates of deposit may be considered cash equivalents depending on their maturity date.

Preferred shares may be considered cash equivalent if they are purchased close to the maturity date and are not expected to fluctuate significantly in value.

What cash and equivalents do not include

There are some exceptions for current assets and current assets classified as cash and cash equivalents.

Credit collateral. Exceptions may exist for short-term debt instruments such as Treasury bills if they are used as collateral for an outstanding loan or line of credit. Prohibited T-bills must be identified separately. In other words, there may be no restrictions on the conversion of any of the securities listed as cash and cash equivalents.

Inventories. The inventory that a company has in stock is not considered cash equivalent because it cannot be easily converted into cash. In addition, the value of inventory is not guaranteed, meaning there is no certainty as to the amount that will be received for the liquidation of these assets.

Calculation example

Example No. 1. For example, suppose that the opening balance of the cash account was 10,000 rubles, the total amount of debits for the year was 15,000 rubles, and the total amount of credits for the year was 8,000 rubles.

Let's add each account's total debit to its opening balance. For example, let's add 15,000 tr. to the total amount of debits to the initial balance on the cash account of 10,000 tr., which is equal to 25,000 tr.

We subtract the total number of credits of each account from each result to calculate the year-end balance for each account.

For example, we subtract 8,000 rubles. in the total amount of loans on the cash account from the result of 25,000 tr. This equals a final cash balance of 17,000 rubles.

We will calculate the ending balance of each account to determine the balance at the end of the year in cash and cash equivalents.

For example, if the year-end balances for cash, wages, petty cash investments and money market investments are respectively 17,000, 5,000, 1,000 and 4,000 TR, then their amount should be calculated. It is equal to 27,000 tr. as the balance of cash and cash equivalents at the end of the year.

Indicate the balance of cash and cash equivalents at the end of the year in line 1250 of the balance sheet in the current assets section.

Details

According to the rules for filling out the company’s reports, at the end of the year, generalized information about all the company’s existing financial flows, both for transactions with cash, foreign currency, and non-cash transfers, and actions with cash equivalents, is entered in line 1250 of the balance sheet.

The company's funds can be presented in both cash and non-cash form. The balance sheet displays the following basic information:

- cash balance in the cash register on a given date, including in foreign currency;

- balances on the company's current accounts;

- money denominated in foreign currency and stored in various foreign currency accounts;

- other funds (for example, transfers in transit or funds in special accounts).

Note from the author! If there is a currency for inclusion in the balance sheet, it is recalculated at the current exchange rate of the Central Bank of the Russian Federation established as of the reporting date.

When making cash payments, according to the law, it is necessary to set a limit on the cash balance. Amounts in excess of the limit are credited to the organization's current account.

What can increase cash on the balance sheet?

Companies can increase cash through increased sales, collection of overdue accounts, control of expenses, and financing and investment. These options are reflected in the table below.

| Growth option | Characteristic |

| Sales growth | Increased sales usually mean higher levels of cash on the balance sheet. When a company makes a cash sale, the accounts must increase the sales account on the income statement and the cash account on the balance sheet. When it receives cash payments on credit accounts, the company converts the amounts from accounts receivable to cash. Innovative and quality products, targeted marketing and superior customer service are some of the ways to consistently achieve higher sales and gain a competitive advantage in the market. |

| Accounts receivable management | Some sales are cash and others are on credit. The accounts receivable balance in the current assets section of the balance sheet contains outstanding credit accounts. Although a business may receive most payments during the billing period, some bills are past due while others are not due for collection. More stringent credit control procedures, such as reducing credit limits for customers who have fallen behind in the past or waiving loans to customers experiencing financial difficulties, can reduce the number of overdue accounts and increase cash flow. Sending automatic email reminders, following up with overdue customers, and offering discounts for early payment of invoices are some of the other ways to manage accounts receivable and increase cash on your balance sheet. |

| Cost control | Controlling expenses increases cash levels. Sales growth is an important but not sufficient condition for increasing cash flow. For example, if a five percent increase in sales requires a seven percent increase in marketing spending, cash levels may actually decrease rather than increase. Companies incur variable costs such as direct labor and raw materials. The companies also recorded overhead costs such as administrative staff salaries and advertising. Negotiating better terms with suppliers and adjusting production shifts to accommodate rising or falling demand are ways to manage variable costs. Streamlining business processes, reducing travel, and using contractors instead of in-house employees are some ways to reduce overhead costs. |

| Financing and investment activities | Companies can increase cash levels through financing and investing. Financing activities include proceeds from bank loans and from issuing shares or bonds to investors. For small businesses that may not have easy access to financial markets, an infusion of cash from founding partners, venture capitalists and angel investors will increase cash on the balance sheet. Paying dividends and interest from investments in stocks and bonds also increases cash levels. Selling excess capital investments, such as regional offices, distribution centers, excess equipment or unused vehicles, increases cash on the balance sheet. |

| Other | Other ways to increase cash include selling investments in subsidiaries or spinning off business units. |

Cash reporting

In addition to the balance sheet, the organization must draw up other forms of documents in which it reports on incoming and outgoing funds. Among such documents: an appendix to the balance sheet, a profit and loss statement, a cash book, a cash flow statement, a book of purchases and sales. All these documents are prepared by the accountant at the end of the reporting period. In some cases there is a need for reporting in interim periods. If the end of the period is December 31 of the current year, reports must be submitted no later than January 15. Intermediate periods are the end of the quarters of the year, that is, March 31, June 30, September 30. Quarterly reporting is submitted no later than half the month following the end of the period.

The set of reporting forms gives an idea of the company’s activities, its financial situation, and its ability to meet its obligations. If an organization does not submit reports, submits them on time or with erroneous data, it may be subject to penalties, unscheduled tax audits, blocking of accounts, prohibition of activities, and forced bankruptcy proceedings. In some situations, punishment is provided for the management of the organization - criminal and administrative.

FAQ

Question No. 1. What is included in cash?

Answer. These include such means as:

- money;

- currency;

- cash in current accounts;

- cash in savings accounts;

- bank amounts;

- Money transfers.

Question No. 2. What is considered cash equivalents?

Answer:

Answer. These include such means as:

- short-term government bonds;

- bills;

- securities;

- money market funds;

- treasury bonds.

Question No. 3. What are the main criteria for classifying cash and cash equivalents?

Answer. The two main criteria for classification as a cash equivalent are that:

- the asset can be easily converted into a known amount of cash;

- it must be so close to the maturity date that there is little risk of changes in value due to changes in interest rates at the time of maturity.

Question No. 4. In what situations is cash and cash equivalents analysis used?

Answer. Information about cash and cash equivalents is sometimes used by analysts in comparison to a firm's current liabilities to assess its ability to pay its bills in the short term. However, this analysis may be flawed if there are accounts receivable that can be easily converted into cash within a few days.

Question No. 5. What is included in cash?

Answer. In economic terms, cash is the form of exchange for all business transactions and activities of a company. In other words, it is a standard payment method for businesses. This is a banknote that is legal tender for all public and private debts.

Question #6 : Are certificates of deposit included in this category?

Answer. Yes, certificates of deposit are short-term securities that are easily converted into a known amount of money in a short period of time. Certificates of deposit are always included in cash equivalents.

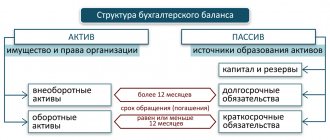

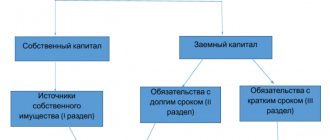

A few words about the balance sheet

The balance sheet is the most important reporting document of an organization. It reflects summary information about all the company’s assets, sources of their formation, obligations to other companies and government agencies. It is also called Form No. 1 of financial statements. Presented in the form of a table, it is divided into two columns - assets and liabilities. The first part contains all the property and investments of the company, expressed in monetary terms, that is, the assets of the organization. The second part contains information about where the funds for this property came from - equity capital, reserves, long-term and short-term obligations to other participants in the economic process. This article will focus on cash on the balance sheet. This line refers to the balance sheet asset, namely to its second section - current assets. In the same area there are several other types of property.