What is the accounting policy of the organization

There are business transactions that can be reflected in different ways. The rules of tax accounting (TA) and accounting (BU) imply several methods, and the company has the right to choose one of them. Here are some examples:

- In NU, organizations have the right to reflect the depreciation premium, that is, to write off 10% (in some cases - 30%) of the original cost of a fixed asset (clause 9 of Article 258 of the Tax Code of the Russian Federation) as current expenses. But it is permissible to refuse the bonus;

- in tax accounting, for most fixed assets it is allowed to choose the depreciation method: linear or non-linear (clause 1 of article 259 of the Tax Code of the Russian Federation). The choice of depreciation method is also fixed in accounting (clause 18 PBU 6/01 “Accounting for fixed assets”, clause 35 FSBU 6/2020 “Fixed assets”; see “What will change in the accounting of fixed assets: read the new FSBU 6/2020 ").

Maintain tax and accounting records of fixed assets according to the new rules

- In accounting, companies (except small enterprises) are required to create reserves for upcoming vacations. To do this, it is necessary, among other things, to calculate the starting amount of the reserve. The calculation method is not established by the standards. An organization can determine the starting value for each employee, or for the division as a whole (see “How “former” small businesses can create a reserve for upcoming vacations in accounting”).

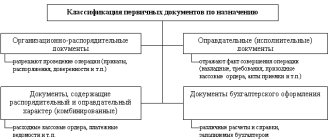

In addition, organizations have the right to choose: use unified forms of primary documents, or develop their own. This applies to the invoice in form No. TORG-12, vacation schedule, time sheet, staffing table, etc.

Create a staffing table using a ready-made template Try for free

ATTENTION

An accounting policy (AP) is an internal document of a company, which records all the ways it has chosen to reflect operations and the forms of primary documents. For example, the CP may stipulate that depreciation of fixed assets is calculated using the straight-line method. Bonus depreciation does not apply. The starting amount of the expense reserve for upcoming vacations is calculated for each employee. When shipping goods, a unified form of invoice TORG-12, etc. is used.

Accounting policies for accounting purposes

All legal entities must form a management system for accounting purposes. This follows from paragraph 3 of PBU 1/2008 “Accounting policies of the organization.” Both the head office and each branch, division and representative office of the organization are required to adhere to the UP (clause 9 of PBU 1/2008).

Accounting policies should, in particular, ensure:

- Completeness of reflection in accounting of all facts of economic activity.

- Timely reflection of each transaction in accounting and financial statements.

- Equality of analytical accounting data with turnover and account balances on the last day of each month.

REFERENCE

A working chart of accounts is one of the elements of the management program for accounting purposes. From all the accounts (approved by order of the Ministry of Finance dated October 31, 2000 No. 94n), the organization selects those that it will use in its work. As a last resort, with the permission of the Ministry of Finance, it is permissible to introduce a new account. To do this, you can use “free” numbers from the approved plan (see “Chart of Accounts in 2020”).

Get a sample accounting policy for a small LLC Get it for free

Accounting policy for tax accounting purposes

If the Tax Code allows for different accounting methods, the company must choose one of them and consolidate it in its UP.

IMPORTANT

You cannot deviate from the approved accounting policies. This was indicated by the Constitutional Court in its ruling dated May 12, 2005 No. 167-O. It says, we quote: “However, by choosing a specific option for such a policy, each taxpayer is included in the corresponding taxation mechanism and, as a result, is deprived of the opportunity to use another.”

Cooperation with: your advantages and bonuses

If you want to create an effective accounting policy for an organization, please contact. With us you can collaborate with specialists who:

- They have extensive work experience. Work experience is a serious bonus. Our company was founded in 2000. We have been working in the accounting and legal fields for 21 years. In order to develop effective accounting policies for an organization, it is important that the accountant has the opportunity to gain practical experience in different firms. The “professional outlook” of a specialist depends on this. Only an accountant who has advised employees of different companies will be able to clearly and accurately find an option for forming an organization’s accounting policy for you. An individual approach is a precise choice from a large number of existing options.

- Competent in their work. Knowledge is the basis of competent consultation. Experience is the basis of effective assistance. Specialists have both knowledge and experience. An organization's accounting policy is a system that will make your company successful. Our specialists will pass on their experience to your full-time employees. Or they will perform the actions necessary for optimization on their own.

- Versatile. We have extensive experience in forming and developing accounting policies for various organizations. It is this experience that helps us choose the best option that suits your company. We analyze its structure, features, specifics of work, number of jobs and overall size of the company. Development of an organization's accounting policy is a service that we provide based on extensive experience.

Requirements for registration of an enterprise's accounting policy

Neither laws nor other regulations establish strict requirements for the design of accounting policies. Paragraph 8 of PBU 1/2008 only says that it is necessary to draw up an organizational and administrative document: order, regulation, standard, etc.

In practice, the vast majority of legal entities do the following: they issue an order approving the accounting policies signed by the director. During tax audits, inspectors usually request this document. If it is missing, some business transactions may be considered incorrectly executed, which will entail additional taxes, as well as, possibly, penalties and fines.

REFERENCE

The order is allowed to be drawn up in free form. The main thing is to put the number, date and signature. And also list the persons who are responsible for compliance with the UP.

As for the policy itself, it can be stated in the text of the order, or issued in the form of an appendix. Most often, two policies are drawn up: a separate tax policy and a separate accounting policy. In each of them, several sections are drawn up: “fixed assets”, “allocation to direct and indirect expenses”, “creation of reserves”, etc. Any other options are acceptable if they meet the needs of the company.

Methodological section for tax purposes

In this section of the accounting policy, the enterprise indicates the main accounting elements that affect the tax base. In particular these are:

- the method of depreciation of fixed assets chosen by the organization;

- the method of inventory valuation chosen by the organization;

- the method chosen by the organization for recognizing income and expenses;

- procedure and deadlines for submitting a tax return;

- a list of direct and indirect costs selected by the organization.

Note 2

It is important that all sections of accounting policies comply with current regulations and do not contradict each other.

Need advice on your academic work? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Approval of accounting policies

As a general rule, newly created companies develop a management program and apply it from the beginning of their activities until the end of the period (reporting or tax). Then the policy is adjusted or the old one remains. In the first case, a new order is issued, in the second case, by default the previous document continues to be in effect.

The deadlines for approving accounting policies for accounting and for tax accounting purposes are different:

- The accounting policy for accounting purposes is approved no later than 90 days from the date of state registration of the legal entity (newly created or reorganized). But it applies from the moment the entry is made in the Unified State Register of Legal Entities. If the UP changes from next year, the corresponding order must be approved before January 1 of this year (clause 9 of PBU 1/2008).

- Newly created organizations approve their VAT accounting policies no later than the end of the first tax period (quarter). And they apply - from the date of creation (clause 12 of article 167 of the Tax Code of the Russian Federation).

- There are no deadlines for approval of the UE for income tax. But it is indicated that in the general case it must be applied until the end of the current tax period (Article 313 of the Tax Code of the Russian Federation).

IMPORTANT

It is not forbidden to change accounting policies in the middle of a reporting or tax period. But this requires substantial reasons. There are two of them. The first is the emergence of new operations or a new type of activity. The second is amendments to tax legislation, or to federal or industry standards. For accounting purposes, there is an additional basis - the development or selection of a more effective method of accounting.

Get a free sample accounting policy and do accounting in a web service for small LLCs and individual entrepreneurs

How to draw up an organization's accounting policy for 2021

It is necessary to reflect the changes that will come into force. Here are the main innovations:

- from 2021, the tax regime in the form of UTII ceases to exist. “Imposumers” should decide which taxation system they will apply and record this in the CP. If the choice fell on the simplified tax system, then no later than December 31, 2021, you need to submit an application to switch to the “simplified tax” (see “Cancellation of UTII: tax officials told how to switch from “imputed” to “simplified” and “Abolition of UTII from 2021: how to switch to the simplified tax system, OSNO, patent or unified agricultural tax and continue to work”);

Fill out and submit a notice of transition to the simplified tax system via the Internet Submit for free

- in 2021, the limits allowing the use of the “simplified tax” will increase. In terms of the number of employees - from 100 to 130 people, in terms of income - from 150 million to 200 million rubles. (see “How the simplified tax system will change in 2021: read the latest amendments to the Tax Code”). If these indicators are not met, a different tax system should be chosen in advance;

- in 2021, reduced insurance premium rates will continue to apply to small and medium-sized businesses. They apply to the part of the salary exceeding the minimum wage (see “Insurance contribution rates have been reduced for small and medium-sized businesses”). Tariffs affect the size of the vacation reserve;

Calculate insurance premiums at a new, reduced rate Try for free

- If desired, from January 2021 it is allowed to apply the federal standard “Fixed Assets” instead of PBU 6/01. The accounting policy can provide, for example, that fixed assets - just like in tax accounting - include objects worth more than 100,000 rubles. (see “What will change in the accounting of fixed assets: read the new FAS 6/2020”);

- for IT companies, starting from 2021, the income tax rate is reduced (from 20% to 3%) and insurance premiums (from 14% to 7.6%; see “For IT organizations, income tax and insurance rates have been reduced.” insurance premiums"). This will also be reflected in the management program, for example, when compiling a vacation reserve;

- Mandatory details have been added to the waybill form, so a new version of this document should be developed. And decide in what form to fill it out - electronically or on paper (see “The rules for filling out travel forms will change from January 1”).

Fill out and print the waybill with all the necessary details

Methodological section for accounting purposes

This section, first of all, indicates the forms of financial statements compiled by the organization and separately regulates the preparation of interim statements.

For accounting purposes the following are also approved:

- units of accounting for goods, finished products, inventories:

- method for assessing the receipt of goods, finished products, inventories;

- determination of types of income and expenses by type of activity;

- the allocation of commercial and administrative expenses is indicated (if any);

- the procedure for creating various reserves is indicated;

- the method for assessing work in progress is indicated;

- to account for income tax calculations, the application or non-application of PBU 18/02 is indicated;

- the procedure for accounting for fixed assets in an organization.