A taxpayer applying the simplified tax system, at his own request, from the beginning of the next tax period (calendar year) can change the object of taxation: “income” or “income reduced by the amount of expenses.” 1C experts talk about the procedure for changing the object of taxation under the simplified tax system, about the features of recognizing expenses in accordance with legislative norms, and about what accounting operations need to be reflected in the 1C: Accounting 8 program, edition 3.0, when switching to the simplified tax system with the object “income reduced by amount of expenses."

Changing the object of taxation under the simplified tax system

The objects of taxation under the simplified tax system are recognized (clause 1 of article 346.14 of the Tax Code of the Russian Federation):

- income;

- income reduced by expenses.

A taxpayer of the simplified tax system, at his own request, can change the object of taxation from the beginning of the next tax period (clause 2 of article 346.14 of the Tax Code of the Russian Federation). To do this, before December 31 of the current year, it is enough to send to the tax authority a notice of a change in the object of taxation in form No. 26.2-6 (approved by order of the Federal Tax Service of Russia dated November 2, 2012 No. MMV-7-3 / [email protected] ).

Confirmation from the Federal Tax Service is not required (letter of the Federal Tax Service of Russia dated April 15, 2013 No. ED-2-3/261). The object cannot be changed during the year.

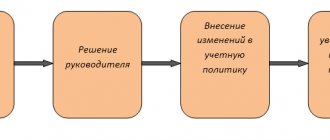

In “1C:Accounting 8” edition 3.0, a notification of changes in a taxable object can be prepared from the 1C-Reporting workplace. To do this, in the Notifications section, click the Create button from the simplified tax system group to select the Change simplified tax system parameters form (Fig. 1), fill it out, print it (if necessary), download it electronically and send it to the Federal Tax Service directly from the program.

Rice. 1. Notification of a change in the object of taxation under the simplified tax system

From the beginning of the new calendar year, it is necessary to reflect the change in the Taxation System register (section Main - Taxes and reports

— Taxation system).

Using the History of Changes hyperlink, you should go to the list form, create a new register entry (Create button), where you indicate the start date of the new tax period from which the simplified tax system object is changing, and change the position of the Tax System switch to Simplified (income) or Simplified (income minus expenses ).

When changing the object of taxation, one should take into account the features of tax accounting under a simplified taxation system and the associated transitional issues.

What happens if you miss the deadline for switching to the simplified tax system?

Newly registered individual entrepreneurs and LLCs that did not have time to submit a notification of work to the simplified tax system will be automatically transferred to the general taxation regime. It will be possible to switch to the simplified tax system only next year and only if you notify the Federal Tax Service before December 31 of the current year.

However, there is judicial practice on this issue, which confirms that not everything is so simple and additional tax assessments by the Federal Tax Service are not always legal. Examples are the resolution of the Arbitration Court of the Central District of the Russian Federation dated May 31, 2017 in case No. A36-2881/2016 and the resolution of the Arbitration Court of the Moscow District dated November 29, 2016 in case No. A41-92205/15.

The courts justify their position by the fact that the Federal Tax Service is obliged to independently monitor compliance with tax legislation. If the inspection accepted all the documentation related to the actual application of the simplified tax system, then they recognized the right of the individual entrepreneur or LLC to apply the chosen taxation system. Even despite the violation of notification deadlines, to which they themselves turned a blind eye.

The taxpayer is unlikely to be able to prove his case to the Federal Tax Service. To protect your rights, you will have to go to court, waste your nerves, money and time. It’s better not to let it come to this, but to follow the procedure for switching to the simplified tax system correctly and on time.

Tax accounting under the simplified tax system

For the purposes of calculating tax paid under the simplified tax system, in accordance with Article 346.24 of the Tax Code of the Russian Federation, taxpayers keep records of income and expenses in the book of income and expenses of organizations and individual entrepreneurs using the simplified tax system.

The KUDiR form was approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n. From 01/01/2018, the updated version of KUDiR should be applied, as amended by Order of the Ministry of Finance of Russia dated 12/07/2016 No. 227n. 1C:Enterprise solutions support the ability to maintain KUDiR in an updated form.

For the purpose of applying the simplified tax system, income and expenses are recognized on a cash basis. It means that:

- the date of receipt of income is the day of receipt of funds, as well as the day of payment to the taxpayer in another way (clause 1 of Article 346.17 of the Tax Code of the Russian Federation);

- Expenses are recognized as expenses after their actual payment, taking into account the features specified in paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation.

In the program, the report Book of Income and Expenses of the simplified tax system is filled out automatically based on tax accounting data for calculations under the simplified tax system. Tax accounting of settlements under the simplified tax system is organized in special registers of the simplified tax system subsystem. These are the accumulation registers:

- Book of accounting of income and expenses (section I);

- Book of accounting of income and expenses (section II);

- Registered payments of fixed assets (STS);

- Book of accounting of income and expenses (IMA);

- Registered payments for intangible assets (STS);

- Book of accounting of income and expenses (section IV);

- Book of accounting of income and expenses (section V);

- Expenses under the simplified tax system;

- Expenses that reduce tax under certain tax regimes;

- Other calculations.

And also information registers:

- Calculation of tax paid under the simplified tax system;

- Decoding KUDiR;

- Initial information of intangible assets (tax accounting of the simplified tax system);

- Initial information about OS (tax accounting of simplified tax system).

Entries in special registers of the simplified tax system are entered, as a rule, automatically when posting documents that record transactions.

Under the simplified tax system “income minus expenses,” the KUDiR takes into account income and expenses that reduce income (Article 346.16 of the Tax Code of the Russian Federation). For tax accounting purposes, most registers of the simplified tax system subsystem are used.

Under the simplified tax system, “income” in KUDiR takes into account income and expenses that reduce the amount of calculated tax (clause 3.1 of article 346.21 of the Tax Code of the Russian Federation). Tax accounting is carried out only using registers:

- Book of accounting of income and expenses (section I) (in terms of income);

- Book of accounting of income and expenses (section IV);

- Book of accounting of income and expenses (section V);

- Expenses that reduce tax under certain tax regimes;

- Calculation of tax paid under the simplified tax system.

| 1C:ITS For more information on how to organize tax accounting under the simplified tax system, see the reference book “Accounting when applying the simplified tax system” in the “Accounting and Tax Accounting” section. |

When switching from the simplified tax system “income minus expenses” to the simplified tax system “income”, some of the registers of the simplified tax system subsystem simply cease to be used.

The transition to the simplified tax system “income minus expenses” is more complicated: previously unused registers are connected, and in some cases it is necessary to enter initial balances for them for correct tax accounting.

What kind of cases could these be? Before answering this question, let’s consider the features of recognizing expenses when changing the object of the simplified tax system to “income minus expenses.”

How to choose: pros and cons of different taxation objects under the simplified tax system

So, ch. 26.2 of the Tax Code of the Russian Federation offers taxpayers a choice of two objects of taxation: “income” and “income minus expenses”. Before answering the question of which object of taxation is preferable, let us ask ourselves what goal we are pursuing in this case. The goal is obvious and clear: minimizing tax payments.

Thus, the existing results of financial and economic activities for the nine months of 2021 - income received, expenses, amounts of insurance premiums, trading fees - must be analyzed from the point of view of their impact on the final result - the amount of tax payable for the tax period. For newly registered organizations or individual entrepreneurs, the choice of taxation object will have to be made based not on actual data, but on the figures of the business plan.

To help the “simplified” people, we have compiled a comparative table of two objects of taxation. It highlights points that need to be paid special attention to.

Index

| Object of taxation “income” | Object of taxation “income minus expenses” | |

| Income | Income is taken into account, determined in the manner established by paragraphs 1 and 2 of Art. 248 Tax Code of the Russian Federation. Income referred to in Art. is not taken into account. 251 of the Tax Code of the Russian Federation, as well as subject to income tax and personal income tax (Article 346.15 of the Tax Code of the Russian Federation) | |

| Expenses | Not taken into account | The expenses indicated in the list and actually paid are taken into account (Articles 346.16, 346.17 of the Tax Code of the Russian Federation) |

| Insurance premiums | Reduce the amount of tax, but not more than 50%. Individual entrepreneurs who do not make payments to employees reduce tax on the entire amount of insurance premiums | Taken into account in expenses (clause 7, clause 1, article 346.16 of the Tax Code of the Russian Federation) |

| Trade fee | Reduces the amount of tax calculated for the object of taxation from the specified type of business activity | Taken into account in expenses (clause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation) |

| Losses | Not taken into account | Reduces the tax base based on the results of the tax period |

| The tax base | Monetary expression of income | Monetary value of income reduced by expenses |

| Tax rate | 6 %; laws of constituent entities of the Russian Federation can establish tax rates ranging from 1 to 6% depending on the categories of taxpayers; 0% – “tax holiday” for individual entrepreneurs | 15 %; The laws of the constituent entities of the Russian Federation may establish differentiated tax rates ranging from 5 to 15% depending on the categories of taxpayers. According to the laws of the Republic of Crimea and the city of Sevastopol in 2017 - 2021, the rate may be reduced to 3%; 0% – “tax holiday” for individual entrepreneurs |

| Minimum tax | Not paid | Paid at the end of the tax period if it exceeds the amount of tax calculated in accordance with the general procedure |

| Maintaining a book of income and expenses | Necessarily | Necessarily |

| Documentary evidence of income and expenses to determine the tax base under the simplified tax system | Mandatory, except for expenses | Necessarily |

The procedure for accounting for income under the simplified taxation system does not depend on the selected object of taxation. But under the simplified tax system there is a special procedure for accounting for expenses (only for the object “income minus expenses”):

- a “closed” list of expenses established by Art. 346.16 Tax Code of the Russian Federation;

- the expenses taken into account must meet the criteria specified in paragraph 1 of Art. 252 of the Tax Code of the Russian Federation (to be justified and documented);

- the features of accounting for certain types of expenses are indicated;

- Taxpayer expenses are recognized as expenses after they are actually paid.

Here you need to analyze the costs for inclusion in expenses under the simplified tax system: not all costs can be taken into account in expenses, and also, in order for them to become expenses, the costs must be paid. The availability and cost of fixed assets play an important role: in the case of the acquisition of expensive fixed assets, it may be advisable to use the object of taxation “income minus expenses”. Often these factors become decisive when choosing an object of taxation.

For the sake of fairness, let us recall that when the object of taxation is “income minus expenses,” the “simplifier” has the right to take into account in expenses the amount of the difference between the amount of the minimum tax paid and the amount of tax calculated in the general manner (clause 6 of Article 346.18 of the Tax Code of the Russian Federation), as well as reduce the tax base for the amount of loss received based on the results of previous tax periods with the same object of taxation (clause 7 of Article 346.18), which also allows minimizing the amount of tax payable at the end of the tax period.

An important advantage in favor of choosing the object of taxation “income” is the fact that the amount of tax can be reduced by half if the amount of paid insurance premiums and other payments is significant in accordance with clause 3.1 of Art. 346.21 of the Tax Code of the Russian Federation, as well as the amount of paid trade tax can be deducted from the tax amount.

As for supporting documents, there is an opinion that “simplified” people who apply the object of taxation “income” may not take into account “expenses” documents in any way and may not have them at all. But this is a misconception, since in addition to the tax paid under the simplified tax system, simplified tax agents perform the functions of tax agents for personal income tax, and are also payers of insurance premiums. In addition, documents confirming expenses are needed, for example, for settlements with counterparties.

From the above it follows that the determining factors when choosing an object of taxation under the simplified tax system are the type of activity being carried out and the specific types of expenses that occur.

Let us note another important point: today the subjects of the Russian Federation have been given broad rights to establish lower tax rates under the simplified tax system both for the object of taxation “income minus expenses” and for the object “income”, which they use. It is advisable to study regional legislation for adopted laws: perhaps the specific conditions for doing business in the region will allow the use of lower tax rates, thereby reducing tax payments.

Recognition of expenses when changing the object of the simplified tax system

According to the general rule, when a taxpayer switches from the simplified tax system “income” to the simplified tax system “income minus expenses”, expenses related to tax periods in which the object of taxation in the form of income was applied are not taken into account when calculating the tax base (clause 4 of article 346.17 of the Tax Code of the Russian Federation) .

It is on the basis of paragraph 4 of Article 346.17 of the Tax Code of the Russian Federation that the Ministry of Finance of Russia concludes: wages accrued during the period of application of the taxable object in the form of income, but paid after changing the taxable object, are not included in expenses (see, for example, letter dated May 26, 2014 No. 03-11-06/2/24949).

This conclusion can be extended to other expenses directly related to the period of the simplified tax system “income”, but paid in the next year, after changing the object of taxation. These could be, for example, expenses:

- for communication services;

- in the form of interest under a loan agreement;

- for auditing, accounting and legal services;

- for business trips, etc.

The Russian Ministry of Finance makes a similar conclusion regarding the agency fee paid by the principal to the agent for goods sold by him. If goods are sold during the period of application of the simplified tax system “income”, and remuneration is paid during the period of application of “income minus expenses”, then expenses in the form of agency fees are not taken into account when calculating the tax base (letter of the Ministry of Finance of Russia dated March 29, 2018 No. 03-11-11/ 20015).

At the same time, regarding the costs of acquiring non-exclusive rights to use software, the Russian Ministry of Finance expresses a different opinion. When acquiring these rights during the period of application of the simplified tax system, “income” with payment of their cost in installments, the amounts of payments paid in accordance with the license agreement after the transition to the simplified tax system “income minus expenses” can be taken into account as expenses in the amount of amounts actually paid (letter from the Ministry of Finance of Russia dated May 24, 2013 No. 03-11-06/2/18966). Based on the terms of the license agreement, the costs of acquiring non-exclusive rights relate to several tax periods, therefore the rule of paragraph 4 of Article 346.17 of the Tax Code of the Russian Federation does not apply in this situation.

This rule does not apply to expenses pre-paid under the simplified tax system “income”, but relating to the period of the simplified tax system “income minus expenses” (provided that this type of expense is provided for in Article 346.16 of the Tax Code of the Russian Federation). This could be expenses for rent, internet services, etc., paid last year in advance or through a security deposit. The period to which the expenses incurred are determined by contracts, primary accounting documents, transcripts and other supporting documents.

Certain types of costs are recognized as expenses of the simplified tax system, taking into account the features specified in paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation. Such expenses with recognition features include the following expenses:

- for the purchase of raw materials and materials;

- purchasing goods for further sale;

- acquisition (construction, production) of fixed assets.

Material expenses are recognized under the simplified tax system at the time of repayment of the debt, that is, on the date of debiting funds from the taxpayer’s current account or payment from the cash register (clause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation). Consequently, if raw materials and supplies were purchased during a period when the object of taxation is income, but in fact the funds in payment were transferred to the counterparty after the object of taxation was changed, such expenses can be taken into account after the transition to the simplified tax system “income minus expenses” (letter of the Ministry of Finance of Russia dated May 26, 2014 No. 03-11-06/2/24949).

In accounting, inventories are written off as expenses at the time of release into production or upon other disposal. Write-off is carried out in the assessment established by the accounting policy of the organization (at the cost of each unit, at the average cost or using the FIFO method) (clause 16 of PBU 5/01 “On approval of the Accounting Regulations “Accounting for Inventories””, approved by order of the Ministry of Finance Russia dated 06/09/2001 No. 44n).

Expenses for payment for goods purchased for the purpose of resale are taken into account as expenses as they are sold (clause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation), as well as in accounting. Therefore, if goods were paid for during the period of application of the simplified tax system “income”, and were sold after the transition to the simplified tax system “income minus expenses”, the cost of such goods can be taken into account in expenses (letter of the Ministry of Finance of Russia dated December 31, 2013 No. 03-11-06/2/ 58778).

Expenses for the acquisition (manufacturing) of fixed assets are taken into account from the moment they are put into operation. During the year, expenses are accepted for reporting periods in equal shares (clause 3 of Article 346.16 of the Tax Code of the Russian Federation).

If fixed assets were acquired, paid for and put into operation during the application of the simplified tax system “income”, the taxpayer will not be able to recognize the costs of their acquisition.

It is lawful to reduce the tax base for such objects only in the case when the fixed asset was paid for and acquired during the period of application of the taxable object “income”, and commissioning was carried out after a change in the taxable object (see letters of the Ministry of Finance of Russia dated October 18, 2017 No. 03-11- 11/68187, dated July 24, 2013 No. 03-11-11/29209).

The opposite situation may also occur, when the fixed asset was purchased during the period of application of the simplified tax system “income” with installment payment. In this case, the organization, after switching to the simplified tax system “income minus expenses,” has the right to take into account as expenses the cost of the specified fixed asset in the part paid after changing the object of taxation (letter of the Ministry of Finance dated December 9, 2013 No. 03-11-06/2/53560).

Let's look at how these situations are reflected in 1C: Accounting 8 (rev. 3.0).

Transition to the simplified tax system “income minus expenses” in “1C: Accounting 8”

To change the object of taxation from “income” to “income minus expenses”, it is not enough in the Taxation System register to set the switch to the Simplified position (income minus expenses). For different types of expenses in the program, you will need to enter initial balances in tax accounting registers at the end of the year, that is, before switching to the simplified tax system “income minus expenses.” Before entering balances, all routine month-closing operations for December must be completed, including Balance Sheet Reformation.

BALANCE ENTRY ASSISTANT

To enter initial balances in “1C: Accounting 8” edition 3.0, there is a special processing Assistant for entering initial balances (section Main - Assistant for entering balances).

Pay attention to the hyperlink Balance entry date

. If balances have already been entered for the organization, then the date for entering balances is filled in and cannot be changed. After changing the date for entering balances, old documents for entering balances will be transferred to the new date, and routine operations included in the Month Closing processing for the period preceding the date for entering balances will no longer be performed.

If the balance date has not been established, then it must be set to the end of the year preceding the start of accounting in the program. Then, in the assistant form, you should select the accounting account for which balances are entered, enter the appropriate accounting section and click on the Create button. In the form of the document Entering balances, click on the button Entering balances, you must go to the form of entering balances mode and set the flag to the Entering balances for tax accounting position. The Input of accounting balances and Input of balances in special registers flags must be disabled (Fig. 2).

Rice. 2. Balance entry mode

After setting the mode for entering balances for each new document, you can change the date for entering balances: it should be set to the end of the year, before changing the simplified tax system object. For which accounting accounts and for which sections of accounting should balances be entered? Let's look at specific situations.

LABOR COSTS

In order for expenses to be taken into account correctly in tax accounting, you will need to enter initial balances for accrued and unpaid wages, as well as for insurance premiums.

Example 1

| In 2021, Berezka LLC applies the simplified tax system with the object of taxation “income”. Starting from 2021, Berezka LLC will switch to the “income reduced by the amount of expenses” object. Berezka LLC pays accrued wages and insurance premiums for December 2021 in January 2021. |

In the form of the assistant for entering initial balances, select account 70 “Settlements with personnel for wages”, enter the accounting section of the same name and click on the Create button. In the document form Entering balances, account 70 balances at the end of the year preceding the transition are entered for all employees. In order for the December salary not to be taken into account in expenses when paying (according to the letter of the Ministry of Finance of Russia dated May 26, 2014 No. 03-11-06/2/24949), in the Reflection in the simplified tax system field, select the value Not accepted (Fig. 3).

Rice. 3. Entering salary balances

When posted, the document will generate movements in the registers Other calculations and Expenses under the simplified tax system.

Similarly, it is necessary to enter the initial balances for account 68.01 “Personal income tax when performing the duties of a tax agent,” as well as for all involved subaccounts of account 69 “Calculations for social insurance and security.”

In January 2021, after the salary payment for December of last year is reflected in the program, along with the accounting register, movements are formed in the accumulation registers of the simplified tax system subsystem:

- Book of accounting of income and expenses (section I);

- Other calculations;

- Expenses under the simplified tax system.

At the same time, in the register Book of Income and Expenses (Section I), expenses for the purposes of the simplified tax system are not reflected.

If salary transactions are uploaded from an external program in a consolidated manner, then account 70 balances do not need to be entered.

In this mode of operation, salary expenses are not taken into account in the simplified tax system registers and are not automatically recognized. In this case, balances for taxes and contributions must be entered in any case.

Labor costs will be automatically reflected in KUDiR, starting with payments for January 2021.

COSTS FOR PURCHASE OF FIXED ASSETS

First, let’s look at an example where a fixed asset was purchased during the period of application of the simplified tax system “income” with installment payment.

Example 2

| Berezka LLC in December 2021, during the period of application of the simplified tax system “income”, acquires and puts into operation a machine worth 800,000 rubles. In December 2021, Berezka LLC pays only half the cost of the machine. The remaining amount is transferred to the supplier in January 2021 after the transition to the simplified tax system “income minus expenses”. |

Payment for the machine in December 2021 and January 2021 can be reflected in the accounting system documents Write-off from the current account, and the purchase can be reflected in the document Receipt (act, invoice) with the type of operation Fixed assets. At the same time, the company will be able to take into account only 400,000 rubles in expenses, that is, the amount paid in 2021 (letter of the Ministry of Finance of Russia dated December 9, 2013 No. 03-11-06/2/53560).

In relation to this object, accepted for accounting during the period of application of the simplified tax system “income”, it is necessary to enter tax accounting balances and register payment for 2021.

In the form of the assistant for entering initial balances, select account 01.01 “Fixed assets in the organization”, enter the accounting section Fixed assets and click on the Create button. For a new document, you must set the Enter tax accounting balances mode and specify the date for entering balances as the end of the year. By clicking the Add button in the Fixed Assets form that opens, you must select a fixed asset from the directory of the same name. Despite the fact that only information for tax accounting purposes of the simplified tax system will be used, the document requires filling out data on all tabs of the form.

On the Initial balances tab according to accounting data, the initial cost of the object, the cost at the time of entering balances, accumulated depreciation and the method of reflecting depreciation expenses are indicated.

On the Accounting tab, general information and parameters of fixed asset depreciation are indicated, which correspond to the information specified during commissioning in the document Acceptance for accounting of fixed assets.

On the Tax Accounting tab, fill in the fields (Fig. 4):

- Initial cost (USN) - indicates the cost of the machine (800,000 rubles);

- The amount of accrued depreciation (for the transition to the simplified tax system) - a zero amount is indicated;

- Date of acquisition - indicates the date of receipt of the OS in accordance with the supplier’s primary documents;

- Useful life in months (corresponds to the period specified upon acceptance for accounting);

- The procedure for including cost in expenses is the value Include in depreciable property (Clause 4, Article 346.16 of the Tax Code of the Russian Federation).

Rice. 4. Entering fixed asset balances for tax accounting purposes under the simplified tax system

On the Events tab, the date of acceptance of the OS for accounting and details of the document with the help of which the OS was put into operation are indicated.

When posted, the document will generate movements in the OS Initial Information register (tax accounting of the simplified tax system).

To register payment for fixed assets and intangible assets, the program uses the document Registration of payment for fixed assets and intangible assets for the simplified tax system (section of fixed assets and intangible assets) (Fig. 5).

Rice. 5. Registration of OS payment

When posted, the document will generate a register entry for Registered payments of fixed assets (STS).

Under the terms of Example 2, the costs of purchasing a machine are taken into account for the purpose of determining the tax base in the 1st, 2nd, 3rd and 4th quarters of 2019 in equal parts of 100,000 rubles. (RUB 400,000 / 4).

Expenses for the acquisition of fixed assets for the purposes of the simplified tax system in the program are recognized at the end of each quarter when performing a regulatory operation Recognition of expenses for the acquisition of fixed assets for the simplified tax system, included in the month-end closing processing. When carrying out this regulatory operation, entries on expenses for the acquisition of fixed assets are made in the tax accounting registers, the Book of Income and Expenses (Section I) (Fig. 6) and the Book of Income and Expenses (Section II)

.

Rice. 6. Recognition of expenses for the acquisition of fixed assets

Now let’s look at an example where a fixed asset was purchased and paid for during the period of application of the simplified tax system “income”, and was put into operation after a change of object.

Example 3

| The organization Berezka LLC in December 2021, during the period of application of the simplified tax system “income”, purchased and paid for a machine worth 485,000 rubles. Starting from 2021, Berezka LLC switched to the simplified tax system “income minus expenses”. In January 2021, the machine was put into operation. |

Payment for the machine in December 2021 can be reflected in the document Write-off from the current account.

Since the OS was received in one period and put into operation in another, you should use two different program documents from the OS and intangible assets section:

- in December 2021 - Receipt (act, invoice) with the type of operation Equipment;

- in January 2021 – Acceptance of fixed assets for accounting. On the Tax Accounting (USN) tab, you can immediately register payment for 2021.

When posting the document Acceptance for accounting of fixed assets, movements are generated in the registers of the simplified tax system subsystem, therefore, unlike Example 2, entering balances is not required.

Since the fixed asset was put into operation during the simplified taxation system “income minus expenses”, then, in accordance with the letter of the Ministry of Finance of Russia dated October 18, 2017 No. 03-11-11/68187, the costs of purchasing this fixed asset can be taken into account when calculating tax in 2021. Under the terms of Example 3, expenses for the purchase of a machine are automatically recognized in the 1st, 2nd, 3rd and 4th quarters of 2021 in equal parts of 121,250 rubles. (RUB 485,000 / 4).

MATERIAL COSTS

Let's consider an example of accounting for material costs when changing a simplified tax system object.

Example 4

| The organization Berezka LLC in December 2021, during the period of application of the simplified tax system “income”, purchased materials for a total amount of 20,000 rubles. In the same month, the materials were written off as general business expenses. Payment for materials was transferred to the supplier in 2019 after the transition to the simplified tax system “income minus expenses”. |

The receipt of materials is reflected in the document Receipt (act, invoice) with the transaction type Goods (Purchases section), and the write-off of materials as expenses is reflected in the document Requirement-invoice (Warehouse section). During the period of application of the simplified tax system “income”, neither one nor the other document makes movements into the registers of the simplified tax system subsystem. In order for the cost of materials to be taken into account at the time of payment in 2021 (according to the letter of the Ministry of Finance of Russia dated May 26, 2014 No. 03-11-06/2/24949), for tax accounting purposes it is necessary to enter initial balances.

In the form of the assistant for entering initial balances, select the corresponding account 10 “Materials”, enter the accounting section of the same name and click on the Create button. For a new document, you must set the Enter tax accounting balances mode and specify the date for entering balances as the end of the year. By clicking the Add button in the form that opens, you need to fill out the tabular part (Fig. 7):

- select a materials account;

- indicate the name from the Nomenclature directory;

- indicate the batch document and the settlement document;

- in the Expense Status field, select the value Not written off, not paid;

- in the field Reflection in the simplified tax system – Accepted;

- indicate the quantity and amount of remaining materials, including the cost in the currency of settlement, which will be accepted for expenses after the change of object.

Rice. 7. Entering balances for materials

When posted, the document will generate movements in the Expenses register under the simplified tax system.

In 2021, when posting the document Write-off from a current account registering payment for materials to the supplier, movements are generated in the registers of the simplified tax system subsystem, including in the register Book of Income and Expenses (Section I), where expenses are reflected for the purposes of the simplified tax system.

COSTS OF PURCHASING GOODS FOR RESALE

Let's consider how the balances of unsold goods are taken into account when changing the object of the simplified tax system.

Example 5

| The organization Berezka LLC in December 2021, during the period of application of the simplified tax system “income”, purchased and paid for goods for further resale for a total amount of 15,000 rubles. The goods were sold in 2021 after the transition to the simplified tax system “income minus expenses”. |

In order for the cost of goods to be taken into account at the time of their sale in 2019 (in accordance with the letter of the Ministry of Finance of Russia dated December 31, 2013 No. 03-11-06/2/58778), for tax accounting purposes it is necessary to enter initial balances.

In the form of the assistant for entering initial balances, select account 41.01 “Goods in warehouses”, enter the accounting section Goods and click on the Create button. For a new document, you must set the Enter tax accounting balances mode and specify the date for entering balances as the end of the year. By clicking the Add button in the form that opens, you need to fill out the tabular part (Fig. 8):

- select a goods account;

- indicate the name from the Nomenclature directory;

- indicate the batch document and the settlement document;

- in the Consumption Status field, select the value Not written off;

- in the field Reflection in the simplified tax system – Accepted;

- indicate the quantity and amount of remaining goods, including the cost in the currency of settlement, which will be accepted for expenses after the change of object.

Rice. 8. Entering balances for goods

When posted, the document will generate movements in the Expenses register under the simplified tax system.

In 2021, when posting the Sales document (act, invoice), reflecting the sale of goods to the buyer, movements are generated in the registers of the simplified tax system subsystem, including in the register Book of Income and Expenses (Section I), where expenses are recognized for the purposes of the simplified tax system.

COSTS OF ACQUISITION OF NON-EXCLUSIVE RIGHTS

Let's consider how the costs of acquiring non-exclusive rights to the results of intellectual activity are taken into account when changing the object of the simplified tax system.

Example 6

| The organization Berezka LLC in December 2021, during the period of application of the simplified tax system “income”, acquired non-exclusive rights to use software under a license agreement for a total amount of 12,000 rubles. The payment under the license agreement was paid in January 2021 after the transition to the simplified tax system “income minus expenses”. In accordance with the accounting policy, expenses for the acquisition of non-exclusive rights are taken into account over two years in equal shares. |

An organization can accept the amount of a fixed payment as expenses after its actual payment in January 2021 (letter of the Ministry of Finance of Russia dated May 24, 2013 No. 03-11-06/2/18966). Moreover, the costs of purchasing, adapting and installing licensed software are taken into account as expenses at a time (clause 19, clause 1, article 346.16 of the Tax Code of the Russian Federation).

In accounting, the costs of purchasing software, paid in the form of a fixed payment, can be classified as deferred expenses (paragraph 2 of clause 39 of PBU 14/2007 “Accounting for intangible assets”, approved by order of the Ministry of Finance of Russia dated December 27, 2007 No. 153n) . The period of use of the program is established in the license agreement. If the deadline is not established in the agreement, then the taxpayer can set the deadline independently, enshrining this rule in its accounting policy (letter of the Ministry of Finance of Russia dated March 18, 2013 No. 03-03-06/1/8161). When writing off expenses, you can be guided by an assessment of the expected receipt of future economic benefits from the use of this program (clause 3 of PBU 21/2008 “Changes in estimated values, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n).

In “1C: Accounting 8” edition 3.0, the receipt of a non-exclusive right to use a software product can be reflected in the document Receipt (act, invoice) with the transaction type Services. When filling out the tabular part of the document, you must indicate the name of the licensed software received, its cost, cost account (97.21 “Other deferred expenses”) and the corresponding analytics. At the end of the month, after completing the regulatory operation Write-off of deferred expenses, the cost of the software will be uniformly included in expenses for accounting purposes over 24 months, based on the specified start and end dates of write-off.

In order to take into account the costs of acquiring non-exclusive rights at a time in tax accounting, you must manually make an entry in the accumulation register of the Book of Income and Expenses (Section I). The document Record of the book of income and expenses of the simplified tax system from the Operations section is intended for this purpose. Initial balances are not entered in Example 6.