Is VAT paid under a simplified taxation system?

The answer to this question is given by Art. 346.11 of the Tax Code of the Russian Federation, according to the norms of which firms operating on the simplified tax system are not recognized as VAT payers, except in cases relating to:

- import of goods into the Russian Federation;

- tax specified in Art. 174.1 of the Tax Code of the Russian Federation (operations under simple partnership and trust management agreements).

In addition, VAT under the simplified tax system must be paid to “simplified” tax agents. They will have to do the same when they issue invoices to their partners that include VAT. Situations in which “simplified people” are considered tax agents are given in Art. 161 of the Tax Code of the Russian Federation: transactions of sale, purchase and lease of state property, acquisition of goods, works, services on the territory of Russia from foreign counterparties not registered with the Russian tax authorities.

For more details, see the material “Who is recognized as a tax agent for VAT (responsibilities, nuances)” .

For information on how to take into account “input” and “import” VAT under the simplified tax system, see the Ready-made solution from ConsultantPlus. Get trial access to K+ for free.

How to take into account income and expenses when switching from OSNO to simplified tax system

When accounting for the income and expenses of legal entities during the transition period, one must proceed from the fact that the principle of their recognition is changing.

Almost all companies on OSNO use the accrual method to calculate income tax. This means that income and expenses are taken into account in the period when documents for shipment or write-off were issued.

Using the simplified tax system, income and expenses must be recognized “on payment”, i.e. on the dates when money was credited to or debited from the account. This leads to the accounting rules during the transition period (Clause 1, Article 346.25 of the Tax Code of the Russian Federation). The meaning of these rules is that each income or expense must be taken into account only once - either before the transition to the “simplified” system, or after.

- Advances received on OSNO and not “closed” by shipments must be included in the simplified tax system database on the date of transition.

- Payments received after the transition to the simplified tax system do not need to be included in the simplified tax base if shipments were previously used to calculate income tax.

- If expenses were paid using OSNO, but written off using simplified taxation, they must be taken into account when calculating the base according to the simplified tax system.

- If expenses were written off to OSNO, but paid under the simplified tax system, then they do not need to be taken into account to calculate the “simplified” tax.

Simplified Taxation System and VAT: purchase from a foreign person on the territory of the Russian Federation

entered into an agreement with a foreign manufacturer for the purchase of materials, while the sale of materials is carried out on the territory of the Russian Federation. What will happen to VAT in this case? It depends on whether the “foreigner” has a permanent establishment in the Russian Federation. A Russian company should pay VAT under the simplified tax system only if there is no such representative office. In this case, the Russian buyer is a tax agent who, in accordance with paragraphs. 1 and 2 tbsp. 161 of the Tax Code of the Russian Federation, is obliged to withhold VAT from the foreign counterparty and pay it to the budget.

Example

A Russian company, using the simplified tax system, entered into a contract with a foreign seller who does not have a permanent representative office in Russia for $12,000, including VAT. The contract is executed on the territory of the Russian Federation. In this case, the Russian company needs to withhold VAT from the “foreigner” under the simplified tax system in the amount of $2,000 and transfer it to the budget, and pay the remaining $10,000 for purchases.

To summarize: a “simplified” seller is required to pay VAT if the place of transaction is the Russian Federation and foreign sellers do not have the independent ability to pay VAT due to the fact that they do not have a permanent establishment in the Russian Federation.

For information on the procedure for deducting VAT withheld by a tax agent, read the article “How can a tax agent deduct VAT when purchasing goods (work, services) from a foreign seller.”

Accounting for income and expenses during the transition from OSNO to simplified tax system

| Revenue accrued / expenses written off | Money received/transferred | |

| Before the transition | After the transition | |

| Before the transition | BASIC | BASIC |

| After the transition | simplified tax system | simplified tax system |

If an organization created reserves in tax accounting, then their balances on the eve of the transition to the simplified tax system can be included in non-operating expenses for income tax ( clause 7 of article 250 of the Tax Code of the Russian Federation, subclause 5 of clause 4 of article 271 of the Tax Code of the Russian Federation ).

If an entrepreneur switches from OSNO to simplified tax system, then the “transitional” rules will be simpler. Individual entrepreneurs on OSNO consider personal income tax “on payment” similarly to the “simplified” ones. Therefore, the procedure for accounting for income and expenses will depend on the date of receipt or write-off of funds.

If the money came to the account or was spent before the change in the tax regime, then these incomes and expenses of the individual entrepreneur will be included in the calculation for OSNO. If the receipt or expense occurred after the transition, these transactions will be taken into account for the simplified tax system.

Above we talked about accounting for both income and expenses during the transition period. But if a businessman switches to the simplified tax system with the “Income” object, then after the start of applying the “simplified system” he will not be able to take into account any expenses for calculating tax.

In this case, you need to try to write off all expenses paid for OSNO before switching to the simplified tax system. In particular, to sell stocks of goods before the transition, since the costs of their purchase can be written off only after the sale.

VAT when working on the simplified tax system: is there a tax when renting state property?

In the case of leasing state property, in accordance with clause 3 of Art. 161 of the Tax Code of the Russian Federation, the tenant will have to pay VAT under the simplified tax system. In this case, the tax base will correspond to the amount of rent including VAT. Moreover, the need to pay tax does not depend on whether the payment in the agreement with the lessor is indicated with VAT or without it: if the price is indicated without VAT, the “simplified” will need to charge a tax on top of it and pay it to the budget.

See also the material “The Federal Tax Service reminded when the duties of an agent do not arise when renting government property .

Dating of received non-operating income in tax legislation

In accordance with the previously presented Art. 271, the following procedure for dating non-operating profits is legalized:

- For punitive and other measures, as well as in the form of compensation for damage - the date of recognition by the principal or the entry into force of a court decision.

- In relation to profits of previous years - the day of its identification (arrival), documentary evidence.

- For profit in monetary units of foreign countries - conversion of money into rubles at the rate of the Central Bank of the Russian Federation on the date of their determination.

- Regarding the amounts of refund of previously paid contributions included in expenses, the date of arrival of money to the account of the obligated person.

- For profit from misuse of property - the day of its actual use or the failure of agreements on its use.

- When leasing property, the day of payment on the basis of the contract, other documents, as well as the last date of the reporting period.

- For profit from equity participation in the activities of other structures - the date of arrival of the monetary component to the account of the obligated person.

- For profit in the form of a positive exchange rate difference on property and liabilities (price in foreign currency), as well as revaluation of the price of precious metals and requirements in their expression in accordance with the legal regulation of the Central Bank of the Russian Federation - the last day of this month.

- For a loan for the reporting period - at the end of each month of the tax period.

Clause 4 art. 271 of the Tax Code of the Russian Federation also regulates a specific dating procedure when non-operating profits arise in the format of license payments for the use of intellectual property and in other cases.

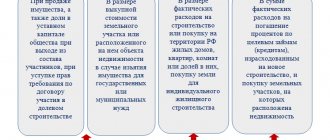

Simplified VAT when purchasing state property

When selling state property, the tax base, according to clause 3 of Art. 161 of the Tax Code of the Russian Federation, corresponds to the amount of income from the sale including VAT. In this case, it is not the seller of state property who must pay the tax, but its buyer, who is recognized as a tax agent. It is he (in this case, the “simplified” buyer) who is obliged to calculate VAT under the simplified tax system, withhold it from income payable, and transfer it to the budget.

However, sub. 12 paragraph 2 art. 146 of the Tax Code provides the opportunity for a “simplified” buyer not to withhold VAT on the income of the seller of state property if the conditions for the purchase of state and municipal property established by Art. 3 of the Law of the Russian Federation “On the peculiarities of the alienation of real estate in state ownership...” dated July 22, 2008 No. 159-FZ:

- As of July 1, 2015, the property rented by the simplifier had already been leased to him for at least 2 years.

- He has no arrears of rent or other related payments (fines, penalties).

- The property is not included in the approved list of property intended for rental and free from the rights of third parties.

- On the day of concluding the repurchase agreement, the simplifier is listed in the register of small and medium-sized businesses.

When and how can you switch to the simplified tax system?

If you are just planning to open your own business, notification of the transition to the simplified tax system can be submitted immediately upon registration or within 30 days after.

To do this, you need to fill out form No. 26.2-1. Existing individual entrepreneurs and LLCs under other taxation regimes can switch to the simplified tax system starting next year, and they must submit an application to the Federal Tax Service before December 31 of the current year. You can change the tax regime (switch from simplified tax system to another and vice versa) once a year. The income of the LLC for 9 months of the current year should not exceed 112.5 million rubles (clause 2 of Article 346.12 of the Tax Code of the Russian Federation).

Issuing an invoice with VAT instead of a document without VAT

There are cases when a “simplifier”, at the request of the buyer, issues an invoice in which he indicates VAT, although he is exempt from it. By doing this, he does himself a disservice: as a result, he will have to not only pay the VAT allocated in the invoice, but also submit a VAT return to the simplified tax system.

We recommend that you read the following materials:

- “A simplifier should not pay VAT if the buyer mistakenly indicated the tax on the payment slip”;

- “How to take into account input VAT under the simplified tax system?”

All the details of reflecting “input” VAT in the book of accounting for income and expenses under the simplified tax system are set out in the Ready-made solution from ConsultantPlus. Trial access to K+ is free.

Reporting on the simplified tax system “Income” in 2021

Tax on the simplified tax system is paid quarterly, and the declaration is submitted once at the end of the year - this is the most important thing that entrepreneurs on the simplified tax system need to remember. Quarterly payments are called advance payments because you pay them in advance for the whole year.

Every quarter you need to pay tax:

- until March 31, 2021 for LLCs, until April 30, 2021 for individual entrepreneurs - final calculation of the simplified tax system for 2021.

- until April 26 - for the 1st quarter of 2021,

- until July 26 - for the first half of 2021,

- until October 25 - for 9 months of 2021.

Submit your simplified taxation tax return once a year. For 2021, LLCs report until March 31, 2021, and individual entrepreneurs - until April 30, 2021.

In addition, keep a book of income accounting. Record all business income and insurance premiums paid there. This book does not need to be handed over to the tax office until it asks.

Article “How to keep a book of income and expenses.”

VAT under the simplified tax system in 2020-2021

In 2020-2021, there are no innovations in terms of VAT when applying the simplified tax system. In this case, you need to remember the following.

1. “Simplified” companies can enter into a written agreement with their counterparties not to issue invoices to them.

See also the material “Consent to not prepare invoices can be electronic .

2. “Simplers” are required to reflect in the VAT return the information contained in the issued invoices.

3. Intermediaries who are not tax agents working for the simplified tax system, when receiving or issuing invoices, are required to send a journal of invoices to the Federal Tax Service by the 20th day of the month following the reporting month.

For more information about the accounting journal, see our material “ Invoice journal: who will need it . ”

How to take into account the cost of fixed assets and intangible assets when switching from OSNO to the simplified tax system “Income minus expenses”

If at the date of transition the company or individual entrepreneur had fixed assets (FPE) or intangible assets (ITA) purchased or built under OSNO, then the residual value of these objects must be determined.

The residual value will be equal to the difference between the purchase (construction) cost and the amount of depreciation that was accrued in tax accounting for the entire period of application of OSNO.

Further write-off of the residual value of the object on the simplified tax system “Income minus expenses” depends on its useful life (clause 3 of article 346.16 of the Tax Code of the Russian Federation):

- Up to 3 years inclusive - write-off during the first year using the simplified tax system.

- From 3 to 15 years inclusive - write-off within 3 years:

— 1 year – 50% of the cost;

— 2nd year – 30% of the cost;

— 3rd year – 20% of the cost.

- Over 15 years – write-off over 10 years in equal installments.

If the fixed asset was purchased on deferred payment terms and was not paid at the time of transfer, then its cost can be written off for the simplified tax system only after payment (clause 4, clause 2, article 346.17 of the Tax Code of the Russian Federation).

When paying in installments, expenses after switching to the simplified tax system can be written off only within the limits of the amounts actually paid to the seller or contractor (letter of the Ministry of Finance of the Russian Federation dated September 25, 2019 No. 03-11-11/73807).

Results

An organization or individual entrepreneur using the simplified tax system is not a VAT payer, with the exception of operations for the import of goods and trust management. However, simplifiers can act as tax agents, performing duties to withhold VAT from taxpayers when carrying out transactions specified in Art. 161 of the Tax Code of the Russian Federation, its payment to the budget. Also, the obligation to pay VAT arises for “simplified” companies when issuing invoices with an allocated tax amount.

Sources:

- Tax Code of the Russian Federation

- Federal Law of July 22, 2008 N 159-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is it possible to work with VAT using simplified language?

As a general rule, companies and individual entrepreneurs using a simplified taxation system are exempt from paying VAT.

But sometimes, in the interests of business, it is necessary to pay a tax to attract customers. The law does not prohibit doing this - every “simplified” person has the right to issue an invoice and transfer VAT to the budget. In addition, there are operations in which working with VAT is the responsibility of an organization or entrepreneur using the simplified tax system. When performing such transactions, “simplified” not only can, but must issue invoices and pay value added tax.

Fill out, check and submit your VAT return online for free

Simplified tax system in 2021: tax calculation and benefits

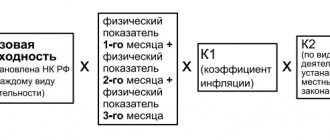

The amount of tax under the simplified tax system is calculated on an accrual basis from the beginning of the tax period as the product of the tax base and the tax rate (see table) (Article 329 of the Tax Code of the Republic of Belarus; hereinafter referred to as the Tax Code).

Tax rates under the simplified tax system

| Application of the simplified tax system | Tax rate under simplified tax system, % |

| Including VAT | 3 |

| Without paying VAT | 5 |

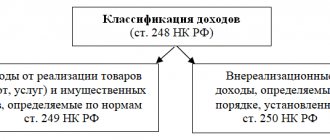

In relation to non-operating income, defined as:

| 16 |

The tax base for the tax under the simplified tax system is the monetary expression of gross revenue. It is defined as the amount consisting of:

- from proceeds from the sale of goods (works, services), property rights;

- non-operating income (clause 1 of Article 328 of the Tax Code).

Example . Calculation of tax under the simplified tax system with payment of VAT

The organization applies the simplified tax system with payment of VAT (reporting period – month). For January – February 2021, revenue from the sale of goods amounted to 660,000 rubles. VAT rate is 20%. The tax amount under the simplified tax system according to the previous declaration is 9,900 rubles.

- The amount of VAT calculated on the proceeds from the sale of goods will be 110,000 rubles. (660,000 × 20 / 120).

- The tax base under the simplified tax system is 550,000 rubles. (660,000 – 110,000).

- The tax amount under the simplified tax system for 3 months of the current year will be equal to 16,500 rubles. (550,000 × 3/100).

- The amount of tax under the simplified tax system payable for February 2021 will be 6,600 rubles. (16,500 – 9,900).

The calculation of the tax amount under the simplified tax system is made in the tax declaration (calculation) under the simplified tax system, the form of which is established in Appendix 16 to the resolution of the Ministry of Taxes of the Republic of Belarus dated January 3, 2019 No. 2 “On the calculation and payment of taxes, fees (duties), and other payments.”

For reference: the declaration must be submitted to the tax authority no later than the 20th day of the month following the expired reporting period. Pay tax under the simplified tax system no later than the 22nd day of the month following the expired reporting period.

Business entities using the simplified tax system will be provided with tax benefits in 2021

For reference: tax benefits are advantages granted to certain categories of payers in accordance with legislative acts over other payers, including the opportunity not to pay taxes and fees or to pay them in a smaller amount.

1. For the period from January 1, 2019 to December 31, 2023, tax benefits are provided for subjects of the Orsha region that apply the simplified tax system, in the form of the application of reduced tax rates under the simplified tax system (part one, subclause 4.1, clause 4 of the Decree of the President of the Republic of Belarus dated December 31. 2018 No. 506 “On the development of the Orsha district of the Vitebsk region”; hereinafter referred to as Decree No. 506):

- 1% – in relation to revenue from the sale of goods of own production;

- 2% – in relation to revenue from the sale of works (services) of own production.

For reference: subjects of the Orsha district for the purposes of Decree No. 506 are legal entities and individual entrepreneurs registered in the Republic of Belarus with a location (residence) in the Orsha district and carrying out activities on its territory for the production of goods (works, services) of their own production, in respect of which During the calendar year (part of it), a certificate of products (works and services) of own production was valid.

Important! Reduced tax rates under the simplified tax system apply when applying the simplified tax system both with and without payment of VAT.

In addition, the subjects of the Orsha region are given the right to apply the simplified tax system in the manner and under the conditions established by Chapter. 32 of the Tax Code, regardless of the restrictions provided for by the Tax Code in connection with:

- with the sale of jewelry and other household products;

- implementation of property rights to means of individualization of participants in civil transactions, goods (works, services);

- transfer of lease or other use of real estate;

- recognition of the subjects of the Orsha district as residents of parks and free (special) economic zones operating in the republic, participants in a simple partnership agreement (note 1 to clause 4 of Decree No. 506).

2. Science and technology parks and their residents who pay contributions to innovative development funds are exempt from paying tax under the simplified tax system in the amount of no more than 50% of the amount of tax calculated for the reporting (tax) period. The benefit can be applied provided that contributions to the innovation development fund are actually transferred in the same reporting (tax) period (part 11 sub-clause 2.1 clause 2 of the Decree of the President of the Republic of Belarus dated 01/03/2007 No. 1 “On approval of the Regulations on the procedure for creating innovation entities infrastructure", as amended on March 12, 2018; hereinafter referred to as Decree No. 1).

For reference: if a payment order is sent to the bank, but there is no money in the current account, then the payer cannot apply the tax benefit. He will be able to exercise his right to the benefit only after transferring funds.

Summary

Business entities using the simplified tax system can take advantage of the benefits provided by Decree No. 506 and Decree No. 1.

Elena Goroshko, tax consultant, auditor