Unified forms of primary accounting documents - what does this mean?

For many years, until 2013, only documents compiled according to specially approved forms could be used as primary documents for accounting and tax accounting purposes.

These forms are called unified. It was allowed to draw up in free form only those documents for which there was no unified form. With the entry into force of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, economic entities received the right to develop document forms independently, subject to compliance with certain requirements for them.

However, many companies continue to use unified forms, because... they comply with all legal requirements. ConsultantPlus experts have collected all the forms into a single material. Get trial access to the system and go to Help information for free.

After this, most of the unified forms of primary documents became recommended, but some remained mandatory. We will talk about them further.

Primary documentation for OSNO

The main taxation system is the most labor-intensive in accounting and requires the accountant to have knowledge of current legislation not only in the field of accounting. If there is an individual entrepreneur on OSNO, he may not keep accounting records in full, this is indicated by paragraph 2 of Article 6 of Federal Law No. 402-FZ of December 6, 2011. (as amended on May 23, 2021). But in this case, the entrepreneur must maintain detailed KUDiR in chronological order. The primary documents, the information of which is entered into the Book, are determined by the businessman’s field of activity:

- certificates of services rendered;

- invoices for products;

- expense cash orders;

- expense reports;

- money orders;

- statements, etc.

If the organization is located on OSNO, the accountant, when drawing up the Accounting Policy, selects the necessary primary accounting documents and uses this list in his daily work. All commercial companies, based on Law No. 402-FZ, are required to keep accounting records in full. The primary documentation in this case is all supporting documents confirming the completion of a particular business transaction.

What unified forms of primary accounting documentation are mandatory?

Forms of primary documentation established by authorized bodies in accordance with and on the basis of other federal laws continue to be mandatory (see letter of the Ministry of Finance of Russia dated March 6, 2013 No. 03-03-06/1/6700). For example this:

- Cash documents from the album of unified forms, approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88 (information of the Ministry of Finance of Russia No. PZ-10/2012, letter of the Ministry of Finance of Russia dated February 28, 2013 No. 03-03-06/1/5971).

- Consignment note in the form from Appendix 4 to the Rules for the transportation of goods by road, approved by Decree of the Government of the Russian Federation dated 04/15/2011 No. 272 (this follows from letters of the Ministry of Finance of Russia dated 09/06/2016 No. 03-03-06/1/52112, dated 07/20/2015 No. 03-03-06/1/41407, Federal Tax Service of the Russian Federation dated May 17, 2016 No. AS-4-15/ [email protected] )..

Thus, the mandatory use of unified forms applies not only to cash documents, but also to the waybill.

Find out how to properly prepare primary documents in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

You can find a transport bill of lading in the article “Confirmation of transport costs - with what documents?” or in the material “Transportation costs are confirmed by only one document.”

The forms established for state employees are also mandatory. They can be found in the Order of the Ministry of Finance dated March 30, 2015 No. 52n on the approval of forms of primary documents and accounting registers of government agencies and public sector employees and instructions for their use.

Avoid mistakes

Let us note what personnel officers need to pay attention to in order to avoid mistakes in connection with the development of their own unified forms.

1. In itself, the use of primary personnel records

necessarily, their composition remains the same, the relaxations apply only to the forms.

The lack of personnel documents may entail the risk of bringing the organization and its officials to liability under Art. 5.27 Code of Administrative Offenses of the Russian Federation. Please note that as of January 1, 2015, the fines under this article have been significantly increased.

In addition, the absence of primary accounting personnel documents may entail tax risks, in particular, non-recognition of labor costs as expenses when calculating income tax, and, as a result, additional tax assessment, penalty, as well as bringing to tax liability in the form of a fine according to the Tax Code of the Russian Federation .

2. When developing your own forms, you should take into account that the primary accounting document must contain Mandatory details

listed in Part 2 of Art. 9 of Law N 402-FZ:

1) name of the document;

2) date of preparation of the document;

3) the name of the economic entity that compiled the document;

4) the content of the fact of economic life;

5) the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

6) the name of the position of the person (persons) who performed the operation and is responsible for its registration, or the name of the position of the person responsible for the registration of the accomplished event;

7) signatures of the persons provided for in paragraph 6, indicating their surnames and initials or other details necessary to identify these persons.

Violation of the requirements for the form of personnel documents may also entail the risk of recognizing them as non-compliant with current legislation and being held accountable.

3. According to the Information of the Ministry of Finance of Russia b/d N PZ-10/2012 “On the entry into force on January 1, 2013 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” The use of primary accounting forms remains mandatory documents established by authorized bodies in accordance with other federal laws

and on the basis of such laws.

Thus, considering the issue of preparing primary documents when sending an employee on a business trip, the Ministry of Labor of Russia in Letter dated February 14, 2013 N 14-2-291 noted that the relevant documents (in particular, a travel certificate) must be drawn up according to the forms approved by Resolution N 1.

Rostrud, in Letter dated 03/04/2013 N 164-6-1, also explained that when issuing a travel certificate, you should use the unified form N T-10 and be guided by the Instructions for filling it out, approved by Resolution No. 1.

When explaining the issue of recording working hours in the case of employees working on a shift schedule, the Ministry of Labor and Social Protection of the Russian Federation (clause 3 of Letter No. 14-1-1061 dated May 24, 2013) noted that Part 4 of Art. 91 of the Labor Code of the Russian Federation establishes the employer’s obligation to keep records of the time worked by employees. For this purpose, unified forms of working time sheets NN T-12 and T-13, approved by Resolution No. 1, are provided.

Thus, according to government agencies, when preparing some personnel documents, the employer needs to continue to use unified forms, in particular, with regard to travel certificates and time sheets.

4. When independently developing accounting forms, it is necessary to take into account other regulatory legal acts

, containing requirements for personnel registration forms. Let's consider what should be taken into account when developing the form of an employee's personal card.

Example 3. When an organization develops its own form of a personal card, it should be taken into account that the requirements for the application of Section. II unified form N T-2 for maintaining military registration is established by clause 27 of the Regulations on military registration, approved by Decree of the Government of the Russian Federation of November 27, 2006 N 719.

In addition, along with the mandatory details specified in Part 2 of Art. 9 of Law N 402-FZ, the personal card must contain columns in which it is necessary to enter information about the work performed, transfer to another permanent job and dismissal (clause 12 of the Rules for maintaining and storing work books, producing work book forms and providing them to employers <1 >, approved by Decree of the Government of the Russian Federation of April 16, 2003 N 225 “On work books”). Thus, when independently developing the form of a personal card, it is necessary to keep section. II in accordance with Resolution No. 1 and provide columns in accordance with the requirements of the Rules for maintaining and storing work books.

5. The possibility of independently developing personnel accounting documents applies only to unified forms

, approved by Resolution No. 1, and does not apply to personnel documents, the forms of which are determined by other regulatory legal acts.

Example 4. The form of the book for recording the movement of work books and inserts in them is not a unified form approved by Resolution No. 1. The form of the specified book was approved by Resolution of the Ministry of Labor of Russia of October 10, 2003 N 69 “On approval of the Instructions for filling out work books.” Thus, changes in the use of unified forms do not affect the form of the work book.

What does “album of unified forms of primary accounting documentation” mean (examples)

An album of unified forms is usually called the so-called thematic selection of document forms. So, there are accounting albums:

- personnel, working hours and settlements with personnel for wages;

- cash transactions;

- trading operations;

- fixed assets and intangible assets;

- materials;

- products, inventory items in storage areas;

- inventory results;

- works in capital construction and repair and construction work, etc.

Waybill (auto)

The conclusion of a contract for the carriage of goods is confirmed by the waybill.

The form and procedure for filling out the consignment note are established by the rules for the transportation of goods (clause 1.2 of Article 8 of the Charter of Road Transport, Appendix No. 4 to the Rules for the Transportation of Goods by Road, approved by Decree of the Government of the Russian Federation of April 15, 2011 N 272).

Peculiarities

The clarification of Rosalkogolregulirovanie dated 07/08/2011 stated that the waybill approved by this document is not an accompanying document certifying the legality of the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Unified forms of personnel documents (timesheets, statements, etc.)

Unified forms of personnel documents were approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. Conventionally, they can be divided into 2 groups:

- Documents directly related to personnel records - from hiring to dismissal:

- order (instruction) on hiring;

Cm. .

- employee personal card;

See “Unified form No. T-2 - form and sample filling” .

- staffing schedule;

See “Unified Form No. T-3 - Staffing (form)” .

- order (instruction) on granting leave to the employee;

Cm. .

- vacation schedule;

See "Unified Form No. T-7 - Vacation Schedule" .

- dismissal order, etc.

See “Unified form No. T-8 - form and sample filling” .

- Documents reflecting data for settlements with personnel:

- time sheets according to forms No. T-12 and T-13;

See “Unified Form No. T-12 - Form and Sample” and “Unified Form No. T-13 - Form and Sample” .

- salary slips: payroll, settlement and payroll;

See “Unified Form No. T-49 - Form and Sample” , “Unified Form No. T-51 - Calculation Sheet” and .

- personal account, etc.

See “Unified Form No. T-54 - Personal Account” .

What primary documentation does an individual entrepreneur prepare for UTII?

An individual entrepreneur who is a taxpayer of the single tax on imputed income must keep records of those physical indicators that determine the size of the tax base. These could be hired workers, square meters of area, etc. (depending on the chosen type of activity). Moreover, it is necessary to keep records of these physical indicators throughout the entire period of time, so that if they are adjusted, you can prove to the tax authorities the correctness of your calculations.

If an individual entrepreneur reduces the tax base by the amount of insurance contributions from the wage fund of hired personnel, it is necessary to keep primary records of the accrual and payment of wages to these employees. The primary forms in this case will be as follows:

- time sheet;

- work orders for piecework wages;

- payrolls;

- certificates of incapacity for work, etc.

Many individual entrepreneurs on UTII retain agreements with counterparties in case of a counter tax audit, but these documents do not belong to the category of primary documentation and are more of a reference nature.

Unified documentation for recording cash transactions

Again, these forms are required. This means that you are required to draw up cash documents strictly according to the forms that are present in the album approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88. These are well-known to everyone:

- cash receipt order;

See “Unified form No. KO-1 - cash receipt order” .

- account cash warrant;

See "Unified Form No. KO-2 - Cash Order" .

- cash book, etc.

See “Unified Form No. KO-4 - Cash Book”

Look for other documents on the cash register on our website in the section “Online cash registers KKT KKM”.

And you will find the main forms of primary accounting documentation for other areas and objects in the section “Accounting > Accounting Documents”.

NOTE! On our website there are completed samples for all documents, which can not only be viewed on the website, but also downloaded in Word or Excel formats.

...with changes and/or additions

Amendments and/or additions to the unified forms are made according to the rules established by Resolution of the State Statistics Committee of Russia dated March 24, 1999 N 20 “On approval of the Procedure for using unified forms of primary accounting documentation” (hereinafter referred to as Resolution N 20). According to the document, if an organization decides to continue using the unified forms, making some changes to them, these changes must be formalized by order.

The deadlines for making changes and/or additions are not established by Resolution No. 20, therefore we believe that the date of this order can be any, and does not have to fall at the end of the year (see also paragraph 10 of PBU 1/2008, which indicates cases when it may accounting policies are changed).

Results

The organization has a choice: to independently develop primary documents or use their unified forms. But there is an exception: when carrying out operations involving the transportation of goods by road or the acceptance/issuance of funds, it is still necessary to use the form of the bill of lading approved in the regulatory documents and documents for processing cash transactions (receipt/expenditure cash orders, cash book).

Sources: Law “On Accounting” dated December 6, 2011 No. 402-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What kind of primary documentation is there?

The purpose of primary documentation determines its classification into the following types:

- administrative (payment orders, powers of attorney);

- executive or exculpatory (acts, salary payment statements).

According to the type of design, the primary document can be:

- accounting (calculations, certificates) – prepared by an accountant;

- combined (advance reports, cash receipts) – more than one employee is involved in the preparation and execution of documents.

A separate group among all primary documentation are strict reporting forms: receipts, tickets, subscriptions, etc. The production, accounting and storage of these papers is carried out in strict accordance with the requirements of the legislation on SSR.

Primary documents can contain varying amounts of information, be one-time or cumulative registers (an example of the latter is fuel limit statements). Regarding the performer, the primary is divided into 2 categories:

- internal, drawn up within the organization (acts, invoices, cash orders, etc.);

- external (invoices from the supplier, bank statements, invoices, etc.).

Primary accounting registers can be drawn up on unified or specialized forms; this issue must be specified in the Accounting Policy of a business entity. Specialized forms are documents, the form of which was developed by the organization itself to record highly specialized operations.

The preparation of primary documents occurs upon completion of a business transaction. All information presented in these registers is processed and serves as input data for the preparation of consolidated reporting.

Accounting registers for primary

Each primary document received by the accounting department must be registered. Therefore, there are special accounting registers. These are special counting tables made in a specific form. They are necessary to collect information about business transactions on accounts and not get confused in a bunch of certificates, invoices, and so on.

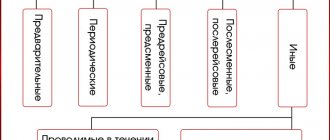

Accounting registers are different. As a rule, they are divided into the following categories:

- By appointment. This includes chronological (documents are recorded as they appear), systematic (the primary document is recorded taking into account its grouping characteristics). The combination of these two types is called synchronistic registers - ideally this is what accounting should do.

- By summarizing the data. Integrated (from particular to general) and differentiated (from general to particular) registers fall into this category.

- By appearance. Everything is very simple - they are divided according to the physical form of the register. It can be in the form of a card, book, electronic media, and so on.

Proper maintenance of accounting registers will significantly simplify the task and protect against many problems.

Required details

When answering the question of what primary documentation is in accounting, you need to take into account that this is not only a document used to enter information into accounting registers. This is, first of all, confirmation of the operation. And it must be designed in such a way as not to cause claims from regulatory authorities.

Each primary document must contain seven mandatory details (clause 2 of Article 9 402-FZ):

- Title of the document.

- Date of preparation.

- Name of the entity (organization or individual entrepreneur) that compiled the document.

- Description of the fact of economic life.

- Natural and (or) monetary measure of a fact of economic life, its unit of measurement.

- The position of the person who made the transaction and is responsible for its execution.

- Signatures of responsible persons indicating full name.

Mandatory primary documents

Despite the variability of transactions, there is a list of mandatory documents that are drawn up for any type of transaction:

- Agreement;

- Check;

- Strict reporting forms, cash register, sales receipt;

- Invoice;

- Certificate of completed work (services rendered);

When carrying out a transaction, an agreement is concluded with the client, which specifies all the details of the upcoming business transactions: payment procedures, shipment of goods, deadlines for completing work or conditions for the provision of services.

The contract regulates the rights and obligations of the parties. Ideally, each transaction should be accompanied by a separate agreement for the supply of goods or services. However, with long-term cooperation and the implementation of similar operations, it is possible to conclude one general agreement.

Some transactions do not require a written contract. Thus, a sales contract is concluded from the moment the buyer receives a cash or sales receipt.

The agreement is drawn up in two copies with stamps and signatures of each party.

An invoice for payment

An invoice is an agreement whereby a supplier fixes the price for its goods or services.

The buyer accepts the terms of the agreement by making the appropriate payment. The form of the invoice for payment is not strictly regulated, therefore each company has the right to develop its own form of this document.

The invoice may specify the terms of the transaction, such as terms, notification of advance payment, payment and delivery procedures, etc.

In accordance with Article 9-FZ “On Accounting”, the signature of the director or chief accountant and the seal are not mandatory for this document. We recommend, however, to ignore them in order to avoid questions from counterparties and the state. An invoice is not a document that allows you to present any demands to the supplier - it only fixes the price of a product or service. At the same time, the buyer retains the right to demand a refund in the event of unjust enrichment of the supplier.

Payment documents: cash receipts, strict reporting forms (SSR)

This group of primary documents allows you to confirm the fact of payment for the purchased goods or services.

Payment documents include sales and cash receipts, financial statements, payment requests and orders. The buyer can receive the latter from the bank by paying by bank transfer. The buyer receives a cash or goods receipt from the supplier when paying in cash.

Bill of lading or sales receipt

Sales receipts, as we said above, are issued when selling goods to individuals or by the individuals themselves.

Invoices are used primarily by legal entities to register the release/sale of goods or inventory items and their further receipt by the client.

The invoice must be prepared in two copies. The first remains with the supplier and is a document confirming the fact of transfer of goods, and the second copy is transferred to the buyer.

Please note that the data reflected in the invoice must match the numbers indicated in the invoice.

The authorized person responsible for the release of goods must put his signature and the organization’s seal on the invoice. The party receiving the goods is also obliged to sign and certify it with a seal on the delivery note. The use of a facsimile signature is permitted, but this must be recorded in the contract.

Certificate of services rendered (work performed)

The act is a two-sided primary document that confirms the fact of the transaction, the cost and timing of services or work.

The act is issued by the contractor to his client based on the results of the provision of services or work performed. This primary document is also a fact of confirmation of compliance of the services provided (work performed) with the terms of the concluded contract.

Invoice

An invoice is a document that is needed solely to control the movement of VAT. Invoices are usually issued in conjunction with delivery notes or acts. It is not uncommon to receive invoices for advance payments.

This primary document is strictly regulated. He contains:

- Information about the amounts of funds;

- The invoice part.

An invoice is the basis for accepting the presented VAT amounts for deduction. All enterprises that pay VAT are required to write it out.

Recently, UPD - a universal transfer document - has been gaining momentum. This document replaces the pair invoice - invoice or act-invoice.

Conduct business in Kontur.Accounting - a convenient online service for calculating salaries and sending reports to the Federal Tax Service, Pension Fund and Social Insurance Fund. The service is suitable for comfortable collaboration between an accountant and a director.

Concept and purpose of unified documents

Until January 1, 2013, exclusively unified forms of primary documentation were used to process accounting transactions.

Definition 1

A unified document is a specially developed standard form of a primary document used for registration of homogeneous transactions by any organizations, regardless of the field of activity or legal form.

The use of unified documents contributed to: firstly, the standardization of primary accounting; secondly, the development of optimal forms of primary documentation; thirdly, reducing the time for processing documents by various organizations.

In fact, the rejection of unified primary documentation represents a step back in improving the accounting process, since such documentation established and consolidated uniform requirements for documenting the financial and economic activities of organizations, systematized accounting processes, and also contributed to the regular updating of documentation.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

During the period of mandatory use of unified primary documentation, free forms of primary documents could be used only if unified forms were not provided for processing certain operations.

Currently, the use of unified forms is not mandatory, so organizations can, based on their own needs, organize document flow as follows:

- firstly, continue to use unified documents, which significantly saves time and money compared to abandoning them. In this case, the corresponding entry must be made in the organization’s accounting policies or in a separate administrative document;

- secondly, modify the unified documents taking into account the needs of the organization and approve them as an annex to the accounting policies;

- thirdly, develop your own forms of primary documents and approve them as an annex to the accounting policies.

Note 1

When developing your own or modifying unified forms of documents, it is necessary to preserve the contents of the document, as well as all mandatory details established by law.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

Primary accounting documents: list

As a rule, a complete list of certificates that perform fundamental functions remains unchanged and is approved at the highest level. Currently this category includes:

- Agreement. They stipulate the specific terms of the transaction, the responsibilities of the parties and financial issues. In general, all the conditions that are in one way or another related to the transaction are indicated here. Please note that for some transactions a written contract is not required. Thus, from the moment the buyer receives the sales receipt, the transaction is considered concluded.

- Accounts. With the help of documents of this type, the buyer confirms his willingness to pay for the goods (services) of the seller. In addition, invoices may contain additional terms of the transaction and record specific prices that the seller sets for its products and services. If for some reason the buyer is not satisfied with the product (service) presented to him, he has the right to demand a refund of his funds based on the invoice.

- Packing list. It displays a complete list of all goods or materials that are transferred. The invoice must be drawn up in several versions depending on the number of participants in the transaction.

- The act of acceptance and transfer. It is compiled based on the results of the provision of the service as confirmation that the result of the work meets the previously stated criteria and is fully approved by the receiving party.

- Payslips. They display all issues related to payroll settlements with hired personnel. Moreover, all information regarding bonuses, additional payments and other mechanisms for financial incentives for employees should be displayed here.

- Acceptance and transfer certificates No. OS-1. This type of documentation is used to record any activities related to the input or output of fixed assets.

- Cash documents, which include incoming and outgoing cash orders, and in addition, a cash book. They contain information regarding financial transactions carried out as part of the sale.

Documents on accounting of fixed assets and inventory items

Inventory accounting

Bill of lading (CH) is a document recording the sale or issue of goods and materials. The seller draws up two TN forms, keeps one for himself as a basis for write-off, and transfers the other to the buyer, to whom this form gives the right to accept inventory items for accounting.

The unified form of TN is TORG-12. The upper right corner contains statistics codes. If the shipment occurs from a branch, its address must be indicated in the “actual address” column. The TN also contains all information about the product - name, articles, product code, packaging form, number of places in the batch, unit of measurement and its code, weight in one place and total, net and gross weight, price and total cost. If goods and materials are subject to VAT, it must also be reflected in the tax bill. TN has columns with column totals where necessary. The number of TN sheets is fixed if there are several of them. At the bottom you must enter the details of the responsible persons.