Deadline for 4-FSS

All organizations and individual entrepreneurs paying individuals remuneration subject to compulsory social insurance contributions (Clause 2, Part 9, Article 15 of Federal Law No. 212-FZ of July 24, 2009) must report in Form 4-FSS for the 4th quarter of 2021. . You must report on Form 4-FSS for the 4th quarter of 2021 within the following deadlines:

- no later than January 25, 2021 (this is Wednesday) - in electronic form;

- no later than January 20, 2021 (this is Friday) - “on paper”.

Please note that after the New Year holidays, as a general rule, people go to work on January 9, 2021 (this is Monday). See “New Year holidays 2021: how we relax.” Thus, the accountant has 10 working days in January to fill out and submit paper reports. There is more time to generate an electronic 4-FSS for the 4th quarter of 2016 - 13 working days.

Also see “Deadline for submitting 4-FSS calculations for 2021.”

Calculation submission deadline

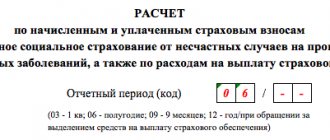

The deadline for submitting the calculation remains unchanged. It, as before, depends on the way it is presented. Thus, you must submit Form 4 - FSS for the first half of 2021 no later than the following dates (clause 2, part 9, article 15, part 7, article 4 of the Law of July 24, 2009 N 212-FZ, hereinafter referred to as the Law N 212-ФЗ):

- April 20, 2021 - in paper form;

- April 25, 2021 - electronically.

Please note that employers with an average number of employees of more than 25 people in 2015 must submit reports to the Social Insurance Fund for the first quarter of 2021 in electronic form. Newly created organizations whose number of employees exceeds the stated limit (Part 10, Article 15 of Law No. 212-FZ) must also report electronically. Other companies and individual entrepreneurs can submit calculations of their choice: either on paper or electronically.

Note! Separate divisions of organizations submit separate calculations in Form 4 - Social Insurance Fund for their employees only if they are allocated to a separate balance sheet, have a current account and make payments to employees (Part 11 of Article 15 of Law No. 212-FZ). In other cases, the parent organization reports (makes a single calculation) including for “separated” employees.

Form 4-FSS for the 4th quarter of 2021: new form?

You must report for the 4th quarter of 2021 using the form approved by Order No. 59 of the Federal Social Insurance Fund of Russia dated February 26, 2015. It was this form that was used when submitting the 4-FSS calculation for 9 months of 2016. Use it when submitting the annual 4-FSS calculation for 2016. Let us remind you that this form combines reporting:

- for contributions to compulsory social insurance in case of temporary disability and in connection with maternity;

- on contributions to compulsory social insurance against accidents at work and occupational diseases.

Please note that Order No. 381 of the Federal Social Insurance Fund of Russia dated September 26, 2016 approved a new form of calculation, 4-FSS. See “New calculation of 4-FSS from 2021: form approved.” However, you need to use the new form starting with reporting for the 1st quarter of 2021. For the first time, you must report using the new form no later than April 20 “on paper” and April 25, 2021 – in electronic form. Starting with reporting for the 1st quarter of 2021, 4-FSS will need to reflect only contributions “for injuries.” Download the new calculation form for free using the link “Form 4-FSS form from 2021”.

Deadlines and procedure for submitting form 4-FSS

Form 4-FSS must be submitted at the end of each reporting period: for the 1st quarter, half a year, 9 months and a year. The report on insurance premiums is sent to the territorial branch of social insurance. 4-FSS reports to the fund depends on how this is done. Details are in the article “Deadlines for submitting 4-FSS calculations from 2015.”

You can submit the report to your fund branch in several ways:

- In person or through a representative by proxy. Not the most convenient option, since you will have to visit a fund branch and spend time in line. In addition, this method is not suitable for companies with more than 25 employees.

- Send by Russian Post. This is also not a very successful method, since the letter may not arrive on time or may be completely lost. And if the inspector does receive it, he may make a mistake when transferring the data from your report to his computer. If your company has a small number of employees (less than 25), you have the right to use this method, but then 4-FSS should be sent by registered mail with a list of attachments and a return receipt - this way, if necessary, you will confirm that the report was submitted on time.

- According to TKS. The fastest and most timely way to submit reports to the Social Insurance Fund. Moreover, for companies with an average number of employees over 25 people, this is the only legal way to transfer 4-FSS . Read more about this in the article “In 2015, payers with fewer numbers will submit electronic reports to funds.”

To submit 4-FSS electronically, you must have an agreement with the operator for the transmission of electronic reporting or the social insurance itself.

What is convenient for reporting via TCS? Reporting programs, as a rule, include algorithms for checking declarations and reports, so you immediately see errors and inaccuracies and can quickly correct them without submitting an amendment. For example, the program provided by the FSS takes into account all the latest control ratios used by inspectors when checking reports. Read more about it in the article “The program for passing the 4-FSS has been updated.”

Note! At the beginning of autumn 2015, the 4-FSS . All the details of this innovation are in the article “New key for the FSS”.

In addition, when you submit the 4-FSS according to the TKS, the system will give you a receipt - confirmation of the submission of the report.

When using TCS, we still recommend submitting declarations and reports to government agencies in advance, without waiting until the last day, since sometimes failures occur in the reporting programs. If you sent 4-FSS on time, but due to problems the report was not received by the fund or arrived late, inspectors may issue a fine. What to do in such a situation, read the article “A technical failure exempts you from liability for violating the deadline for submitting reports to funds.”

At the same time, submitting reports to government agencies in advance will allow you to resend the report in case of problems with the TCS and avoid disputes with officials.

Where to submit: to the tax office or to the Social Insurance Fund?

Submit the calculation in form 4-FSS for the 4th quarter of 2021 to the FSS department. Tax inspectorates will not accept calculations for 2021. Moreover, the new 4-FSS calculation form, used for reporting for the 1st quarter of 2017, also needs to be submitted to the FSS, and not to the Federal Tax Service.

If the organization does not have separate divisions, then submit the 4-FSS calculation for the 4th quarter of 2021 to the territorial office of the FSS of Russia at its location. If separate divisions exist, then submit Form 4-FSS for the 4th quarter of 2021 to the territorial branch of the FSS of Russia at the location of the separate division. But only if such a division has its own balance sheet, current (personal) account and independently pays salaries to employees. Also see “How can separate divisions pay insurance premiums and submit reports to the Federal Tax Service from 2021.”

How to fill out a new FSS form - instructions

In order to correctly fill out the new FSS form, you must correctly fill out the data for the month. The main document is attached. What version of Social Security? In the upper right corner there must be a social registration number of the policyholder. The manager's seal is placed only on the title page. Under no circumstances will errors be corrected by any corrective means.

Having a problem? Call a lawyer: +7

— Moscow, Moscow region

+7

— St. Petersburg, Leningrad region

The call is free!

Changes to the new norm 4 FSS for 2021 - differences from the old one

In 2021, the version of submitting documentation to the Social Insurance Fund has changed. Moreover, it can be in electronic form with a full description of some of the features of the enterprise. There is an online service that calculates not only the payment of taxes, but also the salaries of subordinates. The number is uploaded automatically. The reporting program and declaration can be submitted in Excel. According to the new rules, if your company employs more than 25 people, it is recommended to submit it no later than the 10th of each month. For late submission, the fine is 5-10 percent of the contributions.

Zero 4-FSS: is it necessary to take it?

Moreover, if an organization did not make any payments to individuals during the period from January to December 2021, then it still needs to submit the annual 4-FSS calculation for 2021. This is explained by the fact that organizations are always policyholders. The status of “insurer” is assigned to legal entities almost immediately after state registration. Organizations always remain in this status, regardless of the nature and existence of contracts with employees. Accordingly, even if there were no payments to individuals in 2016, you must submit at least a zero calculation of 4-FSS for the 4th quarter of 2016. Only individual entrepreneurs without employees can not submit 4-FSS for 2021. They are not recognized as insurers. Therefore, they do not submit the 4-FSS zero calculation.

We indicate the base for calculating contributions in Table 1 of Form 4-FSS (required)

At this stage, payments in favor of employees (including disabled people) are calculated, subject to and not subject to insurance premiums for injuries:

- from the beginning of the billing period - calendar year;

- for each of the last three months of the reporting period.

The base for calculating contributions is indicated as the difference between the total amount of employee income and non-taxable payments (Articles 20.1, 20.2 of the Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents...”).

The premium rate is given according to the policyholder's professional risk class and established discounts and allowances.

Why the code of the main activity is confirmed annually, we described here.

Procedure for filling out 4-FSS for the 4th quarter 4-FSS: examples

All policyholders in the 4-FSS for the 4th quarter of 2021 must fill out and submit to the FSS:

- title page;

- tables 1 and 3 of section I;

- tables 6, 7, 10 of section II.

All other tables of sections 1 and 2 of the 4-FSS calculation for the 4th quarter of 2016 must be filled out only if there are indicators that need to be reflected in these tables. If there is no data, then the tables are not filled out and are not submitted (clause 2 of the Procedure, approved by Order of the FSS of Russia dated February 26, 2015 No. 59, hereinafter referred to as the Procedure).

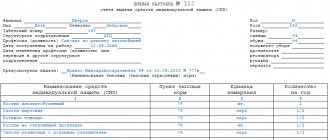

At the top of Form 4-FSS for the 4th quarter, on each page, indicate the registration number of the policyholder, subordination code and page number.

New form 4-FSS

The form of the 4-FSS form was approved by Order of the Federal Social Insurance Fund of the Russian Federation dated February 26, 2015 No. 59. It is this that must be used when filling out the 4-FSS for 9 months of 2016. However, by Order of the FSS of the Russian Federation dated July 4, 2016 No. 260, changes were made to the specified form 4-FSS.

In the updated form 4-FSS, a new table 6.1 has appeared “Information necessary for calculating insurance premiums by policyholders specified in paragraph 2.1 of Article 22 of the Federal Law of July 24, 1998 No. 125-FZ.” This table must be filled out by insurers who rent out their employees. See “New Form 4-FSS for reporting 9 months of 2021: what has changed.”

You can use the new 4-FSS form in Excel format. See “Form 4-SS reporting form for 9 months of 2021.”

Filling out the title page

If an organization or individual entrepreneur submits 4-FSS for the 4th quarter for the first time, then in the “Adjustment number” field, show “000”. If in 2021 the previously submitted 4-FSS calculation for the previous period (for example, for six months or 9 months) is being clarified, then enter the serial number of the adjustment (“001” – being clarified for the first time, “002” – for the second time, etc.). d.).

In the “Reporting period” field, fill out the first two cells - indicate 12 in them. Thus, you will make it clear that you are submitting the annual calculation of 4-FSS for 2021. Place dashes in the next two cells. In the Calendar Year field, enter 2016. Also include the company name. The individual entrepreneur must indicate his last name, first name and patronymic.

Also, on the title page, indicate the TIN, KPP, OGRN and registration address. There are usually no problems filling out these details. But there are difficulties with the “Average number of employees” field. In this indicator, do not take into account women on maternity leave, as well as workers on parental leave for up to 1.5 years.

In the “of which women” field, show how many insured women the policyholder has in total. But do not include women on maternity leave in this indicator (clause 5.14 of the Procedure). Also see “Who to include in the average number of employees for 2021.” Here is a sample filling:

Changes to the title page

Let us remind you that all policyholders must submit the cover page of Form 4-FSS. This is stated in paragraph 2 of the Procedure for filling out 4-FSS (approved by FSS order No. 59 dated February 26, 2015). In the title page of the updated calculation, the fields that are intended to indicate the registration address of the policyholder and the number of its employees have been adjusted.

Policyholder's registration address

According to clause 5.12 of the Procedure for filling out 4-FSS, legal entity insurers indicate their legal address on the title page of the form, and individual entrepreneurs indicate their registered address at the place of residence. Several fields are used for this.

The commented order stipulates that after the “subject” field, policyholders will have to additionally fill in the “district” field (that is, indicate the district to which the registration address belongs). For example, if the policyholder is registered in the Odintsovo district of the Moscow region, then this area should be noted on the title page of form 4-FSS:

Average headcount

In the previously valid Form 4-FSS, on the title page in the “number of employees” field, the average number of employees should have been indicated, taking into account women on maternity leave and employees on maternity leave for up to 1.5 years. Also see “Reporting to the Social Insurance Fund for 9 months of 2015: how the procedure for filling it out has changed.”

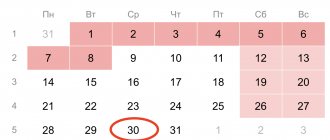

In the updated form 4-FSS, the “number of employees” field is called “average number of employees.” At the same time, the order in which this field is filled in has changed. According to the new edition of clause 5.14 of the Procedure for filling out 4-FSS, the average number of employees as of the reporting date should be determined according to the rules approved by Rosstat. Please note that in the Procedure for filling out 4-FSS, the concept of “reporting date” is not disclosed. In our opinion, the reporting date can be considered the last date of the reporting period. So, if the reporting period is the first quarter, then the average number of employees must be indicated as of March 31 (for the period from January to March).

Let us remind you that the average number of employees is calculated in accordance with paragraphs 78–83 of the Instructions for filling out statistical observation forms (approved by Rosstat order No. 428 dated October 28, 2013; hereinafter referred to as the Instructions). Some employees are not taken into account when calculating this indicator. These include (clause 81.1 of the Guidelines):

- persons who were on maternity leave, as well as child care leave;

- employees who studied in educational institutions and were on additional unpaid leave;

- employees who entered educational institutions and were on leave without pay to take entrance exams.

To determine the average number of employees for a quarter, you need to add up the average number of employees for all months of the quarter and divide the resulting amount by three (clause 81.5 of the Instructions).

As for the field “of which women,” the updated 4-FSS form should also reflect the average number of women in this field. Let us assume that the average number of employees of the policyholder as of March 31, 2021 is 39 people. Of these, 10 are women (those employees who were, for example, on maternity leave or parental leave during the reporting period, are not taken into account). In this case, the average headcount indicators on the title page will look like this:

We also note that previously, on the title page of Form 4-FSS, it was necessary to separately highlight how many disabled people and employees the insurer has who are engaged in work with harmful and (or) hazardous production factors. In the new form 4-FSS, these fields are excluded from the title page. They are now in front of Table 6 of Section II (see below for more details).

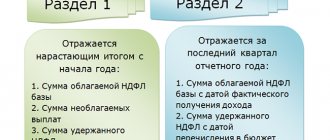

Completing section 1

In Section I of 4-FSS for the 4th quarter of 2021, you need to show the data necessary to calculate insurance premiums in case of temporary disability and in connection with maternity, as well as the amounts of sick leave, “children’s” benefits and other payments themselves. Let us explain some of the features of filling out the tables in this section as part of the annual calculation of 4-FSS for 2021.

OKVED code

At the beginning of Section I you need to reflect the OKVED code. In this case, the “OKVED Code” field is filled in only by insurers who in 2021 applied reduced premium rates in accordance with paragraphs 8 and 11 of part 1 of Article 58 of Federal Law No. 212-FZ of July 24, 2009. If contributions were paid at regular rates, then leave the OKVED field empty.

Note that the new OKVED codes were approved by Rosstandart by Order No. 14-st dated January 31, 2014. They apply from 2021. In this regard, in the calculation of 4-FSS for the 1st quarter of 2021, you need to indicate a new OKVED code according to the OK 029-2014 Classifier. How the OKVED code of your company has changed, see on the website of the Ministry of Economic Development of Russia https://economy.gov.ru/ in the section “Activities - Directions - All-Russian classifiers assigned to the Ministry of Economic Development of Russia” https://economy.gov.ru/

However, when calculating 4-FSS for the 4th quarter of 2021, indicate the old codes in accordance with Classifier OK 029-2001.

Keep in mind that in Form 4-FSS for 2021, the accountant will encounter the “OKVED Code” field three times. However, not all code fields need to be filled out. To avoid errors in OKVED codes when filling out the report, pay attention to the table below. She will tell you which code to indicate in 4-FSS for 2021.

| Field in 4-FSS | Who fills out the “OKVED Code” | Which OKVED to apply |

| Section 1 before table 1 | Organizations on the simplified tax system applying reduced tariffs | Code according to OK 029-2001 for preferential type of activity |

| Section 2 before table 6 | All organizations | Code according to OK 029-2001 for the main type of activity based on revenue data for 2015 |

| Section 2 in column 4 of table 6.1 | Organizations that sent their employees to other companies under a personnel supply agreement | Code according to OK 029-2001 of the receiving party |

Who should apply the new OKVED

Provide the new OKVED codes according to the OK 029-2014 classifier in the 4-FSS calculation for 2021, if the organization was registered after July 11, 2021. All other companies put down the old codes according to the OK 029-2001 classifier.

Table 1

Table 1 is a mandatory component of the 4-FSS for the 4th quarter of 2016. It must reflect information on accrued and paid insurance premiums and on settlements with the Social Insurance Fund of Russia as of January 1 and December 31, 2021.

For example, in line 1 of Table I, show the debt on insurance premiums that existed as of January 1, 2021. This indicator should be equal to the indicator in line 19 of Table 1 of the 4-FSS calculation for 2015. That is, just take this value from the 2015 annual calculation and transfer it to the current calculation.

In line 2 of Table 1 4-FSS for the 4th quarter of 2021, show the amounts of insurance premiums accrued for payment. Using the line “At the beginning of the reporting period” of 4-FSS for 2021, highlight the amount of accrued contributions for the quarters preceding the reporting period. That is, the amount of contributions accrued for 9 months (from January to September inclusive).

In column 3 of line 2, indicate the total amount of insurance premiums accrued for the entire year 2021 (from January to December). This indicator will be equal to the sum of the indicators indicated in the lines “At the beginning of the reporting period” + “For the last three months of the reporting period.” That is, in the example below RUB 39,092. = (RUB 26,042 + RUB 13,050)

On line 15 of Table 1, indicate expenses for the purposes of compulsory social insurance from the beginning of 2021 until December 31 and separately highlight expenses for October, November and December. This indicator must correspond to the indicator in line 15 of Table 2 of Form 4-FSS (clause 7.13 of the Procedure). Let’s say that from January to December 2021 inclusive, the organization paid the employee sickness benefits once in December 2021 in the amount of 4,670 rubles. The accountant must fill out this amount in the annual calculation as follows:

On line 16 of Table 1, include contributions paid for the period from January to December 2021 inclusive. In this case, you must indicate the details of payment orders that were sent for payment in October, November and December 2021.

How to reflect December contributions

Show the accrued contributions for December 2021 in 4-FSS for the 4th quarter of 2021 in lines 2 of tables 1 and 7. And there is a special feature for the listed December contributions. If the organization paid contributions in December 2021, then fill out lines 16 of tables 1 and 7. And if in January 2021, then do not reflect them at all in 4-FSS for 2021. See “Insurance premium payment deadlines for December 2021“.

table 2

In Table 2 of Section I, fill in the benefits and payments accrued to employees from the Social Insurance Fund budget (in particular, sickness and maternity benefits). Reflect the benefit amounts together with personal income tax. Please keep in mind that sick leave benefits accrued by the employer at its own expense for the first three days of illness should not be included in Table 2. If, for example, one employee received sickness benefits from the Social Insurance Fund in the amount of 2,800 rubles, then this amount should be transferred to Table 2.

If benefits were not accrued from the Social Insurance Fund budget in the period from January to December, then do not fill out Table 2 as part of 4-FSS for the 4th quarter and do not submit it.

Table 3

Table 3 is a mandatory table as part of the calculation for the 4th quarter. Show in it the calculation of the base for calculating insurance premiums. In particular, reflect the total income of employees on an accrual basis from January to December 2021 inclusive, and also separately highlight the amount of payments that are not subject to contributions. For example, if non-taxable payments for the period from January to December 2021 amounted to 2000 rubles, then fill in this amount in the table as follows:

Compare the total amount of payments for 2021 for each employee with the maximum base for insurance contributions to the Social Insurance Fund - 718,000 rubles. If there were more payments, then indicate the excess in line 3 of Table 3 of the annual 4-FSS.

Table 3.1

This table is intended for information about foreigners (except for the EAEU) temporarily staying in the Russian Federation (you need to provide personal information for each person, indicate his TIN, SNILS and citizenship). In the 4-FSS calculation table for the 4th quarter, you need to cumulatively summarize all foreigners whose payments from January to December 2016 were subject to insurance premiums (clause 11 of the Procedure).

Table 4

Table 4 is filled out only by companies operating in the field of IT technologies. The table provides data confirming the right to apply a reduced rate of insurance premiums (Part 3 of Article 58 of the Federal Law of July 24, 2009 No. 212-FZ).

Table 4.1

Table 4.1 is filled out by organizations or individual entrepreneurs on the simplified tax system, carrying out “preferential” types of activities in 2021, named in paragraph 8 of part 1 of article 58 of the Federal Law of July 24, 2009 No. 212-FZ. Fill out this table with a cumulative total. That is, show the amounts accumulated from January to December 2021 inclusive. This is stated in the table itself. As for filling, then:

- line 1 – show the total amount of income according to the simplified tax system;

- on line 2 - reflect income from the main activity according to the simplified tax system;

- on line 3 - highlight the share of income from the main activity according to the simplified tax system.

Table 4.2

Table 4.2 is filled out by non-profit organizations on the simplified tax system engaged in social services for the population, scientific research and development, education, healthcare, culture, art and mass sports.

Filling out table 1

In the “OKVED Code” field, it is necessary to indicate the policyholder’s code in accordance with the All-Russian Classifier of Economic Activities only if the organization submitting the calculation applies a reduced tariff in accordance with Article 58 of the Federal Law of July 24, 2009 No. 212-FZ insurance premiums.

In this table of the new Form 4 FSS from 2021, all mutual settlements with the FSS of Russia should be indicated. Including the amount of debt the organization has for insurance premiums as of January 1, 2016. To check this indicator, it must be compared with the data from line 19 of section 1 of the calculation for 2015. It does not change throughout the calendar year.

It is imperative to indicate the amount of insurance premiums that were accrued in the reporting period and are subject to payment to the Fund. It is necessary to detail this amount by month - in the 1st quarter it will be January, February and March. As shown in the sample form 4 fss for the 1st quarter of 2021.

The amount of contributions additionally accrued to the organization by specialists of the Federal Social Insurance Fund of the Russian Federation based on the results of desk and on-site inspections should also be indicated in the column of the policyholder’s obligations. Provided that it was in the reporting period. Otherwise, you need to put a dash. In addition, the amount of additional accrued contributions for previous reporting periods and the amount of the organization’s expenses for social insurance, which was not accepted by social insurance for offset, are reflected.

In the sixth line of Table 1 of Form 4 of the Social Insurance Fund for the 1st quarter of 2016, we indicate the amount of money that the company received from the Social Insurance Fund of the Russian Federation and was used to pay social benefits to employees. The amount of funds returned to the organization from the Fund as overpaid is reflected separately. Line 8 shows the sum of lines 1-7, it is the control. The organization must reflect in the report the amount of all insurance premiums transferred to it. They must be detailed, indicating all the numbers and dates of the payments with which they were listed for three months of the quarter.

The Fund's debt to the policyholder at the end of the reporting period is reflected below. This means that in the calculation of Form 4FSS for the 1st quarter of 2021, the amount of debt as of March 31, 2021 should be indicated. The amount of social insurance debt must also be reflected as of January 1, 2021. In this case, the verification lines will be lines 9-11 from Form 4 FSS 2015, the form of which can be downloaded for free on the official website of the FSS of the Russian Federation. The amount of arrears that social insurance wrote off from the organization is separately highlighted. Line 18 reflects the sum of indicators of lines 12, 15-17, for control. Below you should indicate the amount of the organization's debt to the fund at the end of the reporting period, that is, as of March 31, 2021.

Table 4.3

Table 4.3 is filled out, in general, by individual entrepreneurs on a patent. In the table, list information about issued patents, as well as provide data on payments to employees from the beginning of 2021 and separately show payments for October, November and December 2021. However, some individual entrepreneurs do not need to fill out this table. This applies to those businessmen who:

- provide catering services;

- engage in retail trade through trading floors or retail locations;

- rent out real estate owned by them.

Table 5

Table 5 as part of the 4-FSS calculation for the 4th quarter of 2021 is intended for payments made from the federal budget. Please note: not at the expense of the Social Insurance Fund, but at the expense of the federal budget. Such payments include, for example, payments in excess of the established amounts of benefits to citizens affected by radiation (in case of accidents at the Chernobyl nuclear power plant, Mayak PA, Semipalatinsk test site, etc.).

Completing Section II

In Section II of Form 4-FSS, indicators are entered on the basis of which insurance premiums for “injuries” are calculated and the costs of paying insurance coverage are reflected. At the beginning of Section II, indicate the number of employed disabled people, as well as workers engaged in work with harmful and (or) hazardous production factors. Also indicate the OKVED code according to Classifier OK 029-2001 for the main type of activity based on revenue data for 2015.

Table 6

This table is called “Calculation of the base for calculating insurance premiums.” On line 1 of Table 6, indicate the total amount of payments subject to insurance premiums from the beginning of 2021, as well as separately for October, November and December 2021. Line 2 – payments that are not subject to insurance premiums. On line 3 – reflect the tax base. It is equal to the difference between the indicators of line 1 and line 2.

In column 3, provide the indicators calculated on an accrual basis from the beginning of the year (from January to December inclusive). And in columns 4–6 - indicators for the last three months of the reporting period (for October, November and December).

Table 6.1

This table as part of 4-FSS for 2021 needs to be filled out only by those who temporarily rent out their employees. Insurance premiums from payments to these employees are charged by the employer, and not by the one who hires the employees. If you don’t “rent” anyone, then don’t fill out the table.

Table 7

Next, we will explain how to fill out some of the rows of Table 7 for 2016:

- line 1 – show the debt to the Federal Social Insurance Fund of Russia at the beginning of 2016 (if any). Even if it has already been repaid, it still needs to be reflected;

- line 2 – highlight the amount of accrued insurance premiums at the beginning of 2021 and separately for October, November and December 2016;

- line 8 – indicate the total amount. It is obtained by adding lines 1 to 7;

- line 16 – fill out the insurance premiums paid to the Social Insurance Fund, broken down for October, November and December 2021.

- line 18 indicate the total amount (lines 12 to 17, except 13 and 14).

- line 19 – debt as of December 31, 2021.

Table 9

Fill out Table 9 of Section II of Form 4-FSS if in 2021 the policyholder had industrial accidents or occupational diseases.

Table 10

Table 10 is mandatory in Form 4-FSS. All policyholders must fill it out. It is filled out on the basis (clauses 29.1, 29.2 of the Procedure):

- a report on a special assessment (certification) of working conditions carried out in the organization;

- medical records, reports and other documents issued based on the results of mandatory preliminary and periodic medical examinations of employees.

All data in Table 10 is as of January 1, 2021. Therefore, table 10 of the 4-FSS calculation for the 4th quarter of 2021 will be exactly the same as in the 4-FSS for the 9 months of 2021. But if the organization was registered in 2021, then put dashes in Table 10 (clause 2 of the Procedure).

Changes to Section II

In Section II of Form 4-FSS, indicators are entered on the basis of which insurance premiums for “injuries” are calculated and the costs of paying insurance coverage are reflected. In this section, two new fields have appeared and Table 6 has been adjusted.

New fields

At the beginning of section II of the new form 4-FSS, as in the previous form, you need to indicate the OKVED code according to the All-Russian Classifier of Economic Activities OK-029-2001 (NACE Rev. 1) (see “Classifiers OKVED, OKDP, OKUN, OKP and OKOF will operate until 2017").

But after this detail, two new fields should be filled in: “the number of working disabled people” and “the number of workers engaged in work with harmful and (or) hazardous production factors.” As mentioned above, these fields were excluded from the title page of form 4-FSS and moved to section II:

These fields reflect the number of disabled workers on the payroll, as well as employees engaged in work with harmful and (or) hazardous production factors. It is calculated as of the reporting date according to the rules approved by Rosstat (new edition of clause 23 of the Procedure for filling out 4-FSS).

Let us remind you that when determining the payroll number, not all employees are taken into account. For example, the payroll does not include persons who perform work or provide services under civil contracts, as well as external part-time workers. At the same time, the payroll should take into account persons who are on maternity leave, as well as child care leave (clauses 80, 81.1 of the Instructions, approved by Rosstat order dated October 28, 2013 No. 428).

Table 6

Table 6 of Section II of the updated Form 4-FSS is presented in a new edition and is called “Calculation of the base for calculating insurance premiums.” However, in terms of the set of indicators, there are no fundamental differences from the previous version of this table. As before, it must indicate payments transferred to employees in the reporting period, the size of the insurance tariff and discounts to the tariff, as well as other information necessary for calculating contributions for “injuries”. But in its structure, table 6 of section II has become similar to table 3 of section I (remember that the latter reflects the calculation of the base for calculating contributions in case of temporary disability and in connection with maternity). The rules for filling out the adjusted table 6 are set out in paragraphs 24.1 - 24.9 of the new edition of the Procedure for filling out 4-FSS. Now table 6 looks like this:

4-FSS FOR Q4 in pilot regions

A FSS pilot project is being implemented in many regions (See “Participants in the FSS pilot project”).

A pilot project is an experiment involving the payment of social benefits without the participation of employers. During the pilot project, there is direct financing of expenses for the prevention of injuries and occupational diseases from the budget of the Social Insurance Fund of Russia.

So, in general, fill out the 4-FSS calculation for the 4th quarter of 2021 in the regions participating in the pilot project according to the general rules. However, you need to take into account some subtleties. They are due to the fact that participants in the pilot project do not pay social benefits on their own and, accordingly, do not claim to have payments offset against contributions.

In Section I of Table 1, participants in the pilot project do not need to fill out line 15 (usually it shows information about expenses for compulsory social insurance). There is also no need to reflect any data in Tables 2 and 5 of Section I and Table 8 of Section II of Form 4-FSS for the 4th quarter of 2021.

Also, some insurers do not know how to show in 4-FSS payment for additional days off when the employee was caring for a disabled child? In the “pilot” 4-FSS for the 4th quarter, do not show such amounts at all. In such a situation, the policyholder simply needs to pay for additional days off and submit an application for reimbursement of expenses to the FSS of Russia.

Read also

31.08.2018