Project “Direct Social Insurance Payments” in 2021

The FSS pilot project has currently been introduced in 69 regions of the Russian Federation. The full list of participating entities can be found in this article. From January 2021, it is planned to extend the direct payments project to the entire territory of Russia.

The mechanism of the pilot project is as follows:

- The employee provides the employer with sick leave and all related documents confirming the insured event. The deadline for submitting a certificate of incapacity for work and other documents confirming the occurrence of an insured event is 6 months after the end of the sick leave.

- The employer submits a package of documents to the Social Insurance Fund within 5 days.

- Within 10 days, the Social Insurance Fund checks the papers provided by the employer and issues a decision on the appointment or refusal to pay benefits.

- The benefit is transferred to the employee’s current account or transferred by post. If any documents are missing or are drawn up incorrectly, the FSS will send a notice to the employer. Within 5 days, the policyholder is obliged to replace them or provide the missing documents.

This approach allows you to avoid errors in the assignment and payment of benefits, protect the policyholder from paying benefits on a fake sick leave, and guarantee the insured person timely payment of funds.

The following types of benefits are paid in the “direct payments” system:

- for pregnancy and childbirth (B&C);

- for child care;

- at the birth of a child;

- when registering in the early stages of pregnancy;

- in case of injury at work;

- due to illness.

The algorithm for calculating benefits has not changed: benefits for the first 3 days of an employee’s illness are also paid from the employer’s funds. In addition, the employer pays a funeral benefit and 4 additional days of caring for disabled children. The FSS reimburses the employer for the costs of the last two insured events.

Participation in the Direct Payments pilot project is mandatory for all policyholders registered in this region. The exception is separate divisions that do not have a current account and do not pay wages to employees. Provided that the parent organization is located in a region where the pilot project has not yet been introduced.

Possible questions and difficulties

- Can a company refuse to participate in a pilot project? No, if the company is located in a region that participates in the Direct Payments project.

- Is it possible to submit a single register to the Social Insurance Fund for several sick leaves at the same time? Yes, the employer has the right to submit one register for several certificates of incapacity for work. The form of the register and the rules for filling it out were approved by Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 579.

- If the package of documents to the FSS turns out to be incomplete or with shortcomings, does the FSS notify? What is the deadline for providing the missing documents? In this case, the Social Insurance Fund sends a notification to the organization. After receiving the notice, the employer must provide the fund with the missing documents. 6 days after sending the notice, it is considered received.

- What to do if all the documents were submitted to the Social Insurance Fund in a timely manner, but the employee does not receive payments? In this case, it is necessary to check whether the information in the documents submitted to the Fund is correct. Particular attention should be paid to the employee’s full name and bank details. If all data is entered correctly, the benefit status can be checked in your personal account on the Social Insurance Fund website or directly at the territorial office of the Social Insurance Fund.

In modern economic realities, the old “credit” system of social payments is catastrophically outdated. The Social Insurance Fund project is designed to simplify work with insurance payments and optimize document flow , as well as protect citizens from non-compliance with the law by the employer.

There are no obvious disadvantages to the project yet. Nothing will change for insured persons, but for organizations the procedure for calculating and paying out funds is greatly simplified.

What documents are needed for a pilot project?

In case of illness or leave due to employment and labor regulations, request the following package of documents from the employee:

- sick leave: paper or electronic bulletin number;

- certificates of the amount of earnings received from other policyholders for the 2 years preceding the year of the insured event;

- application for payment of benefits (according to the form from Appendix No. 1 of the Order of the Social Insurance Fund of November 24, 2017 No. 578).

The application is filled out by the employee in block letters and with a black pen. The document can be filled out on a computer and printed. An application from the employee is taken in any case.

Application form to the Social Insurance Fund from an employee (pilot project)

Sample application to the Social Insurance Fund from an employee (pilot project)

In certain insurance cases, the following additional documents may be required:

| Benefit, payment | Documentation |

| One-time benefit when registering in the early stages of pregnancy | Certificate from the medical institution that registered the employee |

| One-time benefit for the birth of a child |

If the parents are divorced, a certificate of divorce and a certificate of cohabitation with the child must be submitted |

| Monthly allowance for child care up to 1.5 years |

|

| Accident or injury at work |

|

| To reimburse benefits | |

| Payment for additional days to care for a disabled child | A copy of the order granting additional days off |

| Funeral benefit | Death certificate |

When filling out a sick leave form, do not fill in the following cells:

- “at the expense of the Social Insurance Fund”;

- “Total accrued.”

Sample of filling out a sick leave certificate by an employer (pilot project)

Rules for filling out reports on insurance premiums and Form 4-FSS from 2021

In addition to the fact that from 2021, accountants will stop calculating benefits for temporary disability and child care, the rules for filling out reports on insurance premiums will also partially change

.

Since the employer will no longer accrue and pay benefits (almost all) to its employees, in reporting on insurance premiums from 2021 it will not be necessary to fill out Appendices 3 and 4 to Section 1. Since they are filled out only in the case of accrual and payment of benefits. An exception can only be if the region joins direct payments not from the beginning of the year, but for example, from the middle, provided that amendments to Russian Government Decree No. 249 are adopted (the pilot project will be extended until the end of 2021).

For a similar reason, accountants will fill out Form 4-FSS differently.

. Since the employer does not pay benefits, the following are not filled out in Form 4-FSS:

- line 15 of table No. 2 (dash);

- table No. 3.

Exception

– if the region joins direct benefit payments not from the beginning of 2021 (provided that the pilot project itself will be extended until the end of 2021).

How to submit documents on direct payments to the Social Insurance Fund

The method of transmitting data to the Social Insurance Fund depends on the average number of employees of the employer:

- 25 people or more - documents, including the register of information, are sent to the FSS in electronic form;

- 24 people or less - documents, including an inventory, can be sent to the FSS both electronically and on paper.

Let's consider each of the methods.

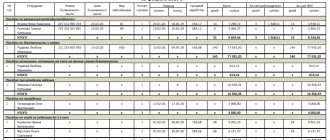

Direct payments: electronic register

The register can be filled out in relation to one or more employees who applied for various types of social benefits during the last 5 calendar days. Data for each employee must be indicated in a separate line of the register. If there is no data to fill out any columns, dashes are placed in them.

Fill out the register taking into account the following features:

- If the employee will receive benefits on the Mir card, the address of residence in column 7 does not need to be filled in.

A number of benefits from the Social Insurance Fund are paid only to the Mir card. You can find out more about this here.

- In column 19 “Cause of disability”, transfer the code from the sick leave certificate.

- When replacing years in the billing period, in column 37 “Calculation period”, indicate the date of the employee’s application on the basis of which the replacement is made.

- In columns 39 and 40 “Amount of average earnings for the billing period,” indicate the larger of the values: the base for calculating benefits or 24 times the minimum wage.

- In column 42 “Other information affecting the right to receive benefits or the calculation of its amount,” indicate the details of certificates in Form 182n from previous employers or the size of the coefficient if the employee works in an area where the regional coefficient is applied.

Within 5 calendar days, submit the originals of the above documents to Social Security. The FSS will return them after checking and assigning benefits (refusal to pay).

Registry form in the Social Insurance Fund (pilot project)

Sample of filling out the register in the Social Insurance Fund (pilot project)

Procedure for filling out the register

Inventory of documents in the Social Insurance Fund: pilot project

If the average number of employees is 24 or less, fill out a list of applications and documents instead of a register. The inventory form is given in Appendix No. 2 to Order No. 578 of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017.

Inventory form in the Social Insurance Fund (pilot project)

Sample of filling out the inventory (pilot project)

How direct payment of benefits from the Social Insurance Fund is made for Moscow

The algorithm for working with the FSS pilot project for direct payments for Moscow, as well as for policyholders from other regions, is not complicated. How is payment made (Resolution of the Government of the Russian Federation dated April 21, 2011 No. 294):

- First, the employee provides the employer with documents that are the basis for granting benefits (sick leave, certificates, copies of children’s birth certificates, etc.).

- Then the employee writes an application indicating his bank details where the assigned benefit must be transferred (application form approved by order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578); if the employee does not have an account, the funds will be sent to him by postal order (in 2021, the procedure may change - the bill, which is currently being registered, provides for the registration of applications immediately upon hiring).

- The employer is given 5 calendar days to create and submit the register and documents to the Social Insurance Fund.

- The FSS checks the information received and, if the decision is positive, transfers the benefit amount to the recipient within 10 days.

- If the documents are completed incorrectly, the Social Insurance Fund will notify the employer. He has 5 working days to correct the registry. The funds will be paid to the recipient within 3 days from the date of receipt of the corrected information.

The employer must notify the Social Insurance Fund of the termination of the right to receive benefits for a child under 1.5 years of age within 3 days.

Part of the sick leave benefit for the first 3 days of illness, assigned from the employer’s own funds, is paid to the employee receiving the benefit as before - on the day of the next salary payment.

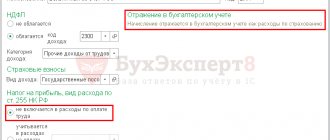

How to reflect benefits in the calculation of insurance premiums

The calculation of insurance premiums was approved by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] Fill it out as usual. Prepare Appendix No. 2 to Section 1 taking into account the following features:

- in field 001 “Payer tariff code”, enter code “1”;

- enter zeros on pages 070 and 080.

Do not include Schedules 3 and 4 to Section 1 unless the policyholder paid the benefit before participating in the pilot project. For example, if the region in which the employer is registered joins the project in the middle of the year or the company registered in the region participating in the project after moving. In this case, complete Appendices 3 and 4 only for the benefit costs incurred prior to participating in the pilot project.

Useful information from Consultant+

Question: The organization participating in the pilot project of the Federal Social Insurance Fund of the Russian Federation is in the process of liquidation. One of the employees is disabled and will continue to be sick after dismissal and liquidation of the organization. How can such an employee receive temporary disability benefits? How much is this benefit paid? See the answer here.

Benefit payments in 2021

Since, in accordance with Decree of the Government of the Russian Federation No. 294, the pilot project ends on the last day of 2020, from January 1, 2021, all regions will switch to direct payments of temporary disability and child care benefits from the Social Insurance Fund. That is, the employer will only need to send a package of documents to the Social Insurance Fund and pay for the first 3 days of sick leave at his own expense.

Currently, amendments to the Government of the Russian Federation No. 294 are under consideration, which involve extending the pilot project for another 1 year

. In accordance with the amendments, starting next year, all regions will switch to direct payments of benefits at the expense of the Social Insurance Fund. But next year will be considered a “trial” year, and the obligation to switch to direct payments will come into force in 2022. The amendments have not yet been approved at the legislative level; they are being discussed in the Russian Government.

Despite possible amendments to the Resolution, all employers will be transferred to the new payment regime from 2021

. That is, next year the work of accountants in relation to the calculation and payment of benefits will change greatly.

Let's sum it up

- In regions that have joined the Direct Payments project, benefits are transferred to the employee directly from the Social Insurance Fund.

- The list of documents submitted by the employer participating in the pilot project to the Social Insurance Fund depends on the insured event.

- If the number of employees is 25 people or more, documents and the register are transferred to the Social Insurance Fund only in electronic form.

- If the average number of employees is 24 people or less, documents and inventory can be submitted to the Social Insurance Fund both on paper and electronically.

If you find an error, please select a piece of text and press Ctrl+Enter.