What to consider when numbering invoices

The list of mandatory details of shipping, advance and adjustment invoices is contained in paragraphs.

5, 5.1 and 5.2 art. 169 of the Tax Code of the Russian Federation, respectively. One of these details is the serial number. At the same time, the Tax Code itself does not establish the order of numbering of invoices and refers us to the by-law - the resolution of the Government of the Russian Federation (clause 8 of Article 169 of the Tax Code of the Russian Federation). For 2021, a similar document is the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. However, regarding the issues of numbering invoices, nothing has changed. Thus, since the entry into force of Resolution No. 1137, there have been no fundamental innovations in numbering in its text. Some clarifications took place in the summer of 2014 (Resolution of the Government of the Russian Federation dated July 30, 2014 No. 735), when the type of dividing mark used in invoices of separate divisions, participants in partnerships and trustees was determined. This sign became the slash (fraction, slash) - “/” (previously it was simply a dividing line, but it was not specified whether a slash was meant or a dash).

The main points about the numbering of invoices were given by ConsultantPlus experts. Get trial access to the system and move on to the Ready-made solution.

Read about the latest changes that significantly changed the form and rules for filling out an invoice here .

General rules for numbering documents in 1C

Before correcting automatically generated invoice numbers, you should remember the general principles of document numbering in 1C.

Firstly, numbers in 1C are assigned only to object data: for directories this attribute is called Code, and for documents - Number. In both cases, the meaning is absolutely the same, as well as the principles for changing the numbering. In addition, the discussed principles for correcting the numbering of 1C invoices are also applicable to documents of other types, for example, cash receipts and debit orders, as well as to elements of any directories.

When a new invoice is recorded in the database, it is assigned the next serial number. If the invoice already has a number, this means that it has already been recorded. The numbering of invoices is sequential, continuous (for example, 1,2,3,...10 and so on).

Another important point. Any object in 1C has a certain unique identifier that allows you to clearly distinguish it from other objects. And this is NOT a number at all, as many people think! The document number is just one of the details and can be easily changed.

What are the rules for numbering invoices?

The main (and only) rule is that numbers are assigned in chronological order as invoices are compiled/issued (subparagraph “a” of paragraph 1 of the rules for filling out an invoice, subparagraph “a” of paragraph 1 of the rules for filling out an adjustment invoice) .

An organization can set the numbering renewal period independently in its accounting policies, depending on the number of documents it prepares. For example, you can resume numbering from the beginning of the next year, quarter, month. The only thing that officials spoke out against was the daily numbering of invoices from the first number (letter of the Ministry of Finance of Russia dated October 11, 2013 No. 03-07-09/42466).

Invoice numbers may not only consist of numbers: the use of letter prefixes and digital indices is allowed. The latter must be included in invoices:

- separate divisions (the document number separated by a slash is supplemented by the digital index of the OP, fixed in the accounting policy);

- participants of partnerships or trustees (the company’s transaction index for a specific agreement is also indicated through a slash).

Read more about invoice details and their significance for this document in this article .

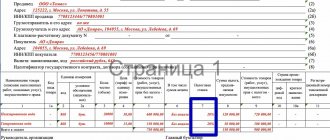

Invoice issued

To create an invoice issued in the document “Sales (acts, invoices)”, click the “Write an invoice” button:

There are two numbers here:

- The document number for the program - in the example it is KPPB-0000003. KPPB is the prefix of the organization and the prefix of the information base. The organization's prefix is indicated in its card:

The prefix is not required; it is used if there are several organizations in the database. The database prefix is specified in the menu “Administration - Program Settings - Data Synchronization”:

This prefix is used if exchange with other programs is configured. To distinguish in which database documents were created.

- The number for printing the invoice is displayed at the top of the document, in the example it is 3 dated 02/20/2020. It is this number that is displayed when printed and in the Sales Book:

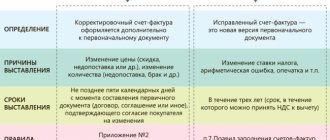

Can advance or adjustment invoices be numbered separately?

A direct indication of a unified chronology of all invoices drawn up by the taxpayer appeared in 2012 with the release of Resolution No. 1137. In the previous Decree of the Government of the Russian Federation of December 2, 2000 No. 914, there were no such norms, therefore accountants often numbered invoices for shipment and prepayment separately - it was so convenient. Now you shouldn’t do this so as not to cause criticism from the inspectors.

The Ministry of Finance of Russia is clearly against separate numbering of advance invoices (letters dated October 16, 2012 No. 03-07-11/427 and August 10, 2012 No. 03-07-11/284). If there is a desire or need to somehow distinguish invoices for an advance payment, it is permissible to use a letter prefix (for example, A or AB) to a number that fits into a single chronology.

Read more about issuing invoices for advance payments in the article “Rules for issuing invoices for advance payments in 2021 - 2021” .

As for adjustment invoices, the filling rules clearly state that serial numbers are assigned to them in general chronological order. This order must be followed.

Should invoices be in order? Violation of invoice numbering

All individual entrepreneurs, as well as organizations (regardless of their form of ownership) must compulsorily generate special reporting documents - invoices.

What you need to know

You need to know that the rules for numbering invoices in 2021 have not undergone major changes. But, despite this, it is necessary to monitor all changes in legislation regarding the formation of documents of the type in question.

Since various kinds of bills are approved annually, related both to transaction codes and other aspects of filling out.

It is important for all accountants, as well as other officials who fill out documents of this type, to become familiar with the following issues:

- basic information about invoices;

- in what cases is it necessary to generate a document;

- normative base.

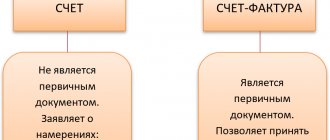

Basic information

An invoice is a special document that must be issued by the seller of any product or service to the buyer.

Those carrying out construction or other work (or an intermediary) can also act as a seller. The main purpose of an invoice is accounting.

Moreover, all concepts regarding the document of the type in question are enshrined in the articles of the Tax Code of the Russian Federation, as well as various letters of the Federal Tax Service and other legislative bodies.

The invoice contains all the details of both the seller and the buyer. The remaining data (values, operations) are displayed using special codes:

- appendices to - it indicates all digital encodings;

Do not forget that every year changes are made directly to the Tax Code of the Russian Federation.

In what cases should I generate a document?

In 2021, a law was adopted on the basis of which individual entrepreneurs and organizations that are not payers of value added tax are not required to generate invoices.

All other legal entities engaged in any commercial activity must draw up this document accordingly.

A document of the type in question must be generated in the following cases:

- when selling goods;

- when transferring rights to any property (cars, real estate, etc.);

- when providing any .

All requirements imposed at the legislative level for filling out an invoice are indicated in.

In this case, this document is subsequently used to generate the corresponding deduction for value added tax.

That is why you need to be as careful as possible when filling out the invoice form. The presence of errors may be perceived by the Federal Tax Service as an attempt to evade paying taxes.

In addition to those indicated above, there are also other cases when an invoice is generated:

- making advance payments;

- it is necessary to correct the data in the document.

It is mandatory to prepare these documents for advances. Moreover, the numbering of advance invoices from 2021 is carried out in the same way as before.

Sometimes it happens that for some reason the invoice was filled out incorrectly. In such a situation, you should definitely draw up another, corrected document.

Normative base

All persons preparing an invoice must carefully study the regulatory framework.

This will allow you to avoid various kinds of errors and omissions. It is also best to familiarize yourself with samples of correctly compiled documents of the type in question in advance.

The fundamental document in this matter is the Tax Code of the Russian Federation, or rather its following articles:

It is also necessary to pay close attention to Federal legislation. The issue of such a document as an invoice is addressed in the following documents:

When drawing up an invoice, it is necessary to take into account a fairly large number of different nuances. You need to know them all. This also applies to the numbering order of the sheets - if there are several of them.

Numbering order of invoices in 2021

The tax office, where all documents must be submitted to receive deductions, pay attention to the smallest details. This applies not only to the information directly on invoices, but also to the numbering order of individual pages.

It is necessary to familiarize yourself in detail with the following points in the legislative framework:

- end-to-end ordering;

- numbering is not in order;

- adjustment invoices.

Usually numbering is done in simple numbers. But in some cases it is necessary to put a letter through a hyphen - if the invoice is generated in any department of the organization. In some cases, numbering is performed with letters.

End-to-end ordering

According to clause 13 of the Accounting Guidelines, which was approved, all accounting documents (including invoices) must be numbered accordingly.

The number itself can be placed directly when registering a document of the type in question. Repeating the same invoice numbers within the same organization is not permitted.

The basis for this is But at the same time, this document does not fully disclose the concept of numbering (end-to-end or otherwise).

It is necessary to refer to clause 8 of Article No. 169 of the Tax Code of the Russian Federation, which was established

According to this document, line No. 1 of the document of the type in question must necessarily indicate the serial number, as well as the date of preparation of the document of the type in question.

This numbering must be used when making calculations regarding value added tax. All numbering must be done in strict chronological order.

Numbering is out of order

The Ministry of Finance of the Russian Federation explains that the numbering of all invoice sheets must be carried out in strictly chronological order.

At the same time, employees of this financial department made it clear that the numbering of documents of the type in question for advances is not provided for by Resolution No. 1137.

This is confirmed by the following Letters from the Ministry of Finance:

However, there are no other requirements regarding the numbering of invoices in the current legislation. Thus, numbering out of order is recognized by the Federal Tax Service as an error in any case.

But at the same time, it is necessary to remember that clause 1, clause 5, Article No. 169 of the Tax Code of the Russian Federation imposes requirements directly on the very presence of the number. But in no case to its chronological order.

Therefore, if errors of this type do not in any way interfere with the audit by the tax authorities, their presence is not a basis for refusing to accept value added tax amounts for deduction.

Source: https://bankfs.ru/money—news/dolzhny-li-schet-faktury-idti-po-poryadku-narushenie-numeracii-schetov-faktur.html

The numbers are out of order: will the seller be punished?

Mistakes happen to everyone, and violation of invoice numbering, alas, is not uncommon. The most common occurrences are missing numbers or non-compliance with chronology (an invoice that is later in date has a lower number than the previous ones, or vice versa). Duplication is a rarer case, because basically everyone works with accounting programs and the software simply does not allow you to assign the same number to different documents.

It is extremely difficult to bring the broken numbering into chronological order, since as a result of shuffling invoices, the numbers of later documents that have already been transferred to buyers will “creep”. Therefore, the question arises: is it necessary to do this?

We answer: not necessarily, since tax legislation does not provide for liability for violation of the rules for numbering invoices for the seller. In Art. 120 of the Tax Code of the Russian Federation talks about a fine for the lack of invoices, but it cannot be applied to the situation with “dropped out” numbers. We can talk about the absence of invoices only when there is an obligation to issue them, but it has not been fulfilled - missing a number does not apply here. However, all this does not mean that the rule of a single chronology can be ignored.

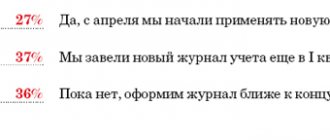

Numbering invoices out of order: what to do in 2021 – Accounting

This order must be followed. The numbers are not in order: will the seller be punished? Mistakes happen to everyone, and violation of invoice numbering, alas, is not uncommon. The most common occurrences are missing numbers or non-compliance with chronology (an invoice that is later in date has a lower number than the previous ones, or vice versa).

Duplication is a rarer case, because basically everyone works with accounting programs and the software simply does not allow you to assign the same number to different documents.

Invoice numbers are out of order, what should I do in 2021?

Important Numbering rules The main rule of numbering is assigning numbers in chronological order: numbers are indicated as they are assigned. Renewal of numbering is permitted. This is inevitable if a company has been in business for a long time.

However, a government decree limits the resumption of numbering: it cannot be started from the beginning every day.

This will be considered a violation. The frequency of updates depends on the document flow of a particular enterprise. The more papers are filled out, the more often the numbers are renewed.

Types of invoice numbers Numbers can consist of both numbers and letters. Letter designations must be present when document flow is in the following structures:

- Separate units.

The nuances of numbering invoices out of order in 2021-2021

Attention: The display of other data (values, transactions) is carried out using special codes: Do not forget that annually changes are made directly to the Tax Code of the Russian Federation.

In what cases should a document be generated? In 2014, a law was passed on the basis of which individual entrepreneurs and organizations that are not payers of value added tax are not required to generate invoices.

All other legal entities engaged in any commercial activity must draw up this document accordingly. This can be done both in 1C and in manual mode.

How to correctly number invoices

They must be listed in chronological order. Penalty for incorrect numbering When assigning numbers to invoices, errors quite often occur.

The most common ones are:

- Skipping numbers.

- Ignoring the need for chronology.

- Assigning the same number to the same document.

The last mistake is quite rare, since most accountants use special programs. The software prevents bifurcation. Violation of the numbering order is the most difficult case.

To correct the violation you will have to spend a lot of time and effort. An error in the chronology of one number leads to the fact that other numbers “creep”.

It turns out that the invoices already sent to the buyer contain incorrect numbers.

Numbering in invoices 2021

Return back to Invoice 2021 The list of mandatory details for shipping, advance and adjustment invoices is contained in paragraphs. 5, 5.1 and 5.2 art. 169 of the Tax Code of the Russian Federation, respectively. One of these details is the serial number.

Source:

BP 3 0 in invoices not in order of invoice numbers

Home / Copyright / Bp 3 0 in invoices not in order of invoice numbers

This sign became the slash (fraction, slash) - “/” (previously it was simply a dividing line, but it was not specified whether a slash was meant or a dash).

For changes made to the form and rules for filling out an invoice in 2021, read the material “How to fill out a new invoice form from October 2021?”

What are the rules for numbering invoices? The main (and only) rule is that numbers are assigned in chronological order as invoices are drawn up/issued (subsection “a” of clause 1 of the rules for filling out invoices, subsection “a” of clause

1 rules for filling out an adjustment invoice). An organization can set the numbering renewal period independently in its accounting policies, depending on the number of documents it prepares. For example, you can resume numbering from the beginning of the next year, quarter, month.

Numbering rules The main rule of numbering is assigning numbers in chronological order: numbers are indicated as they are assigned. Renewal of numbering is permitted. This is inevitable if a company has been in business for a long time.

Attention

It is imperative to reflect renewal periods in the company's accounting policies. The period may be as follows:

However, a government decree limits the resumption of numbering: it cannot be started from the beginning every day.

Types of invoice numbers Numbers can consist of both numbers and letters. Letter designations must be present when document flow is in the following structures:

- Separate units.

BP 3.0 numbering of invoices without prefixes in the sales book

There is a risk that the buyer, upon discovering the letter designation, will require correction of the papers. A person’s motivation is to prevent problems from arising during a tax audit.

Important

ATTENTION! There is a compromise method. You can assign both an official and an auxiliary number to an invoice. This measure will not be considered a violation. You can indicate the auxiliary number not only in the accounting program, but also in the document itself.

Permission to use additional numbers is given in letters from the Ministry of Finance.

Numbering of invoices out of order in 2021

Do the numbering need to be corrected? This measure makes sense if an error was made in the last number of the document, which has not yet been transferred to the buyer. If the error concerns a late number, it is not necessary to correct it.

The seller does not bear any penalties for this violation. ATTENTION! Article 120 of the Tax Code of the Russian Federation states that the absence of invoices for completed transactions entails a fine.

These penalties do not apply to incorrect numbers. However, correct numbering is important in any case. This is taken into account during inspections. How does incorrect numbering affect the buyer? In most cases, incorrect numbering does not have any impact on the buyer.

Errors don't bother you:

- identification of the parties to the contract;

- name of GWS, their cost;

- rate and total VAT.

Source: https://buchgalterman.ru/blanki/numeratsiya-schetov-faktur-ne-po-poryadku-chto-delat-v-2021-godu.html

Will jumping numbering affect the buyer?

Most likely it will not be affected. An error in the invoice number does not prevent the identification of the seller, the buyer, the name of the goods (work, services) and their cost, the rate and amount of VAT, and therefore does not provide grounds for refusing the buyer a deduction (clause 2 of clause 169 of the Tax Code of the Russian Federation) . In any case, such claims by controllers have long been easily disputed. According to some courts, even the absence of a number in the invoice should not deprive the VAT deduction (resolutions of the Federal Antimonopoly Service of the Central District dated 04/08/2013 in case No. A14-7612/2011, FAS Moscow District dated 08/10/2011 in case No. A41-41420/ 09).

For other non-fatal errors in the invoice, read the material “What errors in filling out the invoice are not critical for VAT deduction?” .

Invoice received

When receiving an invoice from a supplier, they are entered into 1C with the details that the supplier indicated in the primary documents. Due to this, invoices are reflected equally for the supplier and the buyer.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

For example, we created a document, indicated the number and date:

Let’s print the invoice using the “Print” button:

Results

One of the required details for each type of invoice is its serial number. The word “ordinal” implies numbering in order as documents are drawn up. However, it is not always possible to comply with it, and the attempt at ordering is reflected in the numbering of documents issued later than those whose numbers failed. There is no liability for jumping or missing numbers. The deduction of errors in the number is not prevented.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Error in invoice number in 1C 8.3

Good afternoon Taisiya. Yes, you need to submit an updated return for the 3rd quarter. If you do not submit an updated declaration, then your invoice will not find a “pair” during verification and the tax office will receive requests for clarification of information to you and your counterparty.

Despite the fact that, according to paragraph 1 of Art. 81 of the Tax Code of the Russian Federation, the obligation to submit an updated declaration arises only if mistakes made led to an understatement of the amount of tax payable to the budget; correction of information, a previously incorrectly specified invoice number and date, is possible only by submitting an updated tax return. Unfortunately, you did not indicate in which invoice the error was made. Therefore, let’s look at how to correct it in 1C Accounting using the example of a received invoice and correcting an error in the purchase book:

We perform the following actions: 1. To correct the invoice details, we draw up the document “Receipt Adjustment” based on the receipt document. 2. In “Adjustment of receipts” on the “Main” tab, in the “Type of operation” field, select the value “Correction of own error”. Fields: “Base”; "Organization"; “Counterparty”; “Agreement”, are filled in automatically based on the document “Receipt (act, invoice)” In the “Reflect adjustment” field we set the value “Only for VAT accounting”, since correcting technical errors in entering invoice details does not affect the reflection of transactions in the accounting accounts accounting and does not require making entries in the accounting register. 3. In the “Correcting errors in invoice details” block: • in the “What we are correcting” line, a hyperlink to the corrected document “Invoice received” is automatically inserted; • for indicators: “Incoming number”; "Date of"; “TIN of the counterparty”; “Counterparty checkpoint”; “Operation type code”, two columns are formed with the indicators “Old value” and “New value”, into which the corresponding information from the “Invoice received” document is initially automatically transferred. • In the “New value” column, enter the correct data. 4. Generate an updated VAT return for the 3rd quarter. When generating an updated VAT return for the 3rd quarter, the same sections will be included as in the primary declaration (clause 2 of the Procedure for filling out a VAT tax return, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [ email protected] ). The date of signature of the declaration must be indicated no earlier than the date of the “Receipt Adjustment” document. You can find out more about how to correct errors in the invoice number on the ITS disk in the article Correcting errors in entering details of a received invoice in the purchase book https://its.1c.ru/db/accnds#content:1543:1cbuh8-3:op2 .3:%D1%83%D1%82%D0%BE%D1%87%D0%BD%D0%B5%D0%BD%D0%BD%D0%B0%D1%8F%20%D0%B4% D0%B5%D0%BA%D0%BB%D0%B0%D1%80%D0%B0%D1%86%D0%B8%D0%B8%20%D0%BF%D0%BE%20%D0% BD%D0%B4%D1%81

We have a series of seminars dedicated to reporting, one of the seminars is “VAT return for the 2nd quarter of 2021.” in 1C:8" https://www.profbuh8.ru/product/otchet-oct2016/