How to register liquidation

A fixed asset is liquidated when it is no longer suitable for further use.

This usually occurs due to physical wear and tear of the object. Before liquidating a fixed asset, it is necessary to create a commission. It should include the chief accountant and persons who are responsible for the safety of fixed assets. Representatives of inspections, which, in accordance with the law, are entrusted with the functions of registration and supervision of certain types of property, may be invited to participate in the work of the commission. This is stated in paragraph 77 of the Guidelines for accounting of fixed assets (approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

The commission inspects the object, evaluates it in terms of suitability, possibility and efficiency of its use, and establishes the reasons for write-off. And in the case when we are talking about the unsuitability of an object due to damage caused to it, it identifies persons through whose fault the premature disposal of property occurs and makes proposals to bring these persons to responsibility established by law.

In addition, the commission must determine the possibility of using individual components, parts, and materials of the disposed facility and evaluate them based on the current market value. Subsequent control over the removal of non-ferrous and precious metals from the object written off, determination of weight and delivery to the appropriate warehouse is also within the competence of the commission.

The decision taken by the commission to write off a fixed asset item is documented in the Act on the write-off of a fixed asset item in form No. OS-4 (approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7). It contains data characterizing the object of fixed assets (date of acceptance of the object for accounting, year of manufacture or construction, time of commissioning, useful life, initial cost and amount of accrued depreciation, revaluations, repairs, reasons for disposal with their justification, condition of fixed assets). parts, details, assemblies, structural elements).

The act is drawn up in two copies. They are signed by members of the commission appointed by the head of the organization and approved by the head or his authorized person. The first copy is transferred to the accounting department, the second remains with the person responsible for the safety of fixed assets. The act is the basis for the delivery to the warehouse and sale of material assets and scrap metal remaining as a result of write-off.

Please note that the specified Act can be fully drawn up only after the completion of the liquidation of the fixed asset.

Documenting

Before liquidating property that is impossible or unprofitable to use, you will have to follow a number of procedures and fill out the necessary documents. Write off the fixed asset in the following sequence.

1. Create a liquidation commission and receive its conclusion.

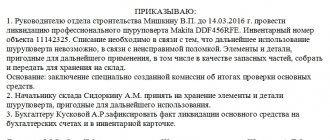

2. Based on the conclusion, the manager makes the final decision on liquidation, partial liquidation and write-off of property, formalizing it by order.

3. Draw up an act on write-off of the fixed asset.

4. Make the necessary entries in accounting documents about the write-off of the object.

This algorithm of actions follows from paragraphs 75–80 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

First, you need to decide on the composition of the liquidation commission. It must include the chief accountant, financially responsible persons and other employees appointed by order of the manager.

A decision to write off a fixed asset can be made after the liquidation commission has carried out a number of activities. Namely:

- will inspect the fixed asset, unless, of course, it has been stolen and is available;

- assess the possibilities and feasibility of restoring the property;

- establish the reasons for liquidation;

- will identify the perpetrators if the object is liquidated before the end of its standard service life due to someone else’s fault;

- will determine whether it is possible to use individual components, parts or materials of the liquidated fixed asset.

This is stated in paragraph 77 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

The commission formalizes the result with a conclusion. There is no standard form for it. Therefore, you can develop its shape yourself. The main thing is that it contains all the necessary details of the primary document. The form is approved by the manager with an order to the accounting policy. This procedure follows from parts 2 and 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ, paragraph 4 of PBU 1/2008.

Situation: is it possible to liquidate fixed assets if one or more members of the commission are absent?

No you can not.

Although formally there is no such restriction. Nevertheless, the commission’s conclusion must be signed by precisely those people who carried out the necessary activities. This requirement is established for all primary documents. You can verify this in paragraphs 6 and 7 of part 2 of article 9 of the Law of December 6, 2011 No. 402-FZ. Therefore, liquidation cannot be carried out in the absence of commission members and, as a result, an incorrectly drawn up conclusion cannot be used.

What then should you do if one of the members of the liquidation commission gets sick or goes on vacation? In this case, it is worth issuing an order signed by the head to change the composition of the commission or appoint an interim member of the commission.

Situation: can the chief accountant be the chairman of the commission when liquidating a fixed asset?

Yes maybe.

The chairman of the commission can be any employee, including the chief accountant. There are no restrictions in this regard in the Methodological Guidelines approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n. The chairman of the commission, as well as its members, is appointed by the head of the organization by order.

In any case, the commission must include: the chief accountant, financially responsible persons and other employees (clause 77 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

Situation: is it necessary to issue an order from the head of the organization to liquidate a fixed asset?

Yes need.

The order of the head of the organization to liquidate a fixed asset serves as the basis for drawing up an act in form No. OS-4 (OS-4a). In addition, most tax inspectors often require an order to liquidate fixed assets (see, for example, letters from the Federal Tax Service of Russia for Moscow dated May 23, 2006 No. 20-12/45320 and the Federal Tax Service of Russia for Moscow dated August 23 2004 No. 26-12/55121).

There is no standard sample order for the liquidation of a fixed asset, so it can be drawn up in any form.

After the commission’s conclusion on the need to liquidate the fixed asset has been received and the manager’s order has been issued, an act of write-off of the property is drawn up. To do this, you can use a standard or independently developed form. In the second case, it is necessary that the document contains all the necessary details. Like any other primary documents used in the organization, the selected form is approved by order of the manager.

This procedure is established by paragraph 78 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n and follows from the provisions of parts 2 and 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ, paragraph 4 of PBU 1/2008.

To draw up acts of write-off of fixed assets, you can use the following standard forms:

- Form No. OS-4 – for one fixed asset, with the exception of motor vehicles;

- Form No. OS-4a – for vehicles;

- Form No. OS-4b – for a group of fixed assets.

Standard forms of acts were approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

Situation: how to justify the write-off of fixed assets if they are physically worn out or obsolete?

You can justify the write-off of worn-out fixed assets by indicating in the act that further use of the property or its repair is impossible or impractical.

An entry about the reason for the write-off may look, for example, like this: “The server cannot cope with the increased load due to obsolescence. Cannot be modernized." Or: “The car is not subject to further use due to its physical wear and tear. Major repairs are not practical." This will avoid unnecessary questions during verification. If a dispute arises, a competent justification of the reason for the write-off will be a weighty argument for the judges (see, for example, the resolution of the Federal Antimonopoly Service of the North-Western District dated November 2, 2004 No. A05-3112/04-12).

Based on write-off acts, make notes on the disposal of fixed assets in inventory cards and books that you use to record the storage and movement of fixed assets. This is provided for in paragraph 80 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Typically these are standard documents of the following forms:

- inventory card in form No. OS-6, if you account for property separately;

- inventory card in form No. OS-6a, when fixed assets are taken into account as part of groups of objects;

- inventory book in form No. OS-6b, can be used by small enterprises.

Standard forms of acts were approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

When liquidating, dismantling and disassembling a fixed asset, you can obtain individual materials, components and assemblies suitable for use. Such property must be capitalized. This is established in paragraph 57 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

You can also register the receipt of objects received during dismantling of fixed assets using standard documents. For example:

- invoice in form No. M-11 - used when liquidating fixed assets, with the exception of buildings and structures;

- act in form No. M-35 - if the materials were received during the dismantling of buildings and structures.

The standard forms of these documents were approved by Decree of the State Statistics Committee of Russia dated October 30, 1997 No. 71a

Accounting

Liquidated property is subject to write-off from accounting accounts (clause 29 of PBU 6/01 “Accounting for fixed assets”). Income and expenses from write-offs are reflected in the accounting period to which they relate and are subject to credit to the profit and loss account as other income and expenses (clause 31 of PBU 6/01). This means that the residual value of the liquidated fixed asset and other expenses associated with its liquidation are reflected in the debit of account 91, subaccount “Other expenses”. The credit of account 91, subaccount “Other income” shows income from the receipt of materials received as a result of liquidation.

To account for the disposal of fixed assets, a subaccount “Retirement of fixed assets” can be opened to account 01 “Fixed Assets”. The cost of the liquidated object is transferred to the debit of this subaccount, and the amount of accumulated depreciation is transferred to the credit. In accounting entries it looks like this:

Debit 01 subaccount “Retirement of fixed assets” Credit 01 subaccount “Fixed assets in operation” – the initial cost of the object subject to liquidation is written off; Debit 02 Credit 01 subaccount “Disposal of fixed assets” - depreciation accumulated at the time of liquidation is written off; Debit 91 subaccount “Other expenses” Credit 01 subaccount “Disposal of fixed assets” – the residual value of the liquidated object is written off; Debit 10 Credit 91, subaccount “Other income” - materials received during the liquidation of the object were capitalized (at current market value).

Materials from the liquidation of fixed assets were capitalized: taxes

Income and expenses when dismantling the operating system will not only be in accounting. They will also have to be recognized for income tax purposes.

Thus, expenses for the liquidation of an operating system are included in non-operating expenses (subclause 8, clause 1, article 265 of the Tax Code of the Russian Federation). Note that on the same basis the residual value of the object being decommissioned is also written off.

The income will be the market value of the materials remaining after dismantling.

The further fate of the inventories obtained in this way will also affect the profit tax. So, when the materials obtained as a result of the liquidation of the operating system are released into production or sold, their cost will go to material costs or sales costs, respectively.

Learn about tax accounting of fixed assets in 2021 from the material “Procedure for tax accounting of fixed assets.”

Is it necessary to restore VAT if the fixed asset on which VAT was claimed for refund is dismantled? The issue of tax restoration is considered in detail by ConsultantPlus experts. Get trial access to the system and find out the answer for free.

Tax accounting

Tax legislation allows the residual value of the liquidated object to be attributed to non-operating expenses (subclause 8, clause 1, article 265 of the Tax Code of the Russian Federation). The basis and documentary evidence of expenses in the form of the residual value of a liquidated fixed asset, the useful life of which has not expired, will be the above-mentioned Act on the write-off of a fixed asset item (Form No. OS-4). After all, it is this document that testifies to the liquidation of the object. This position is confirmed by the Ministry of Finance (letter dated November 16, 2010 No. 03-03-06/1/726).

But this applies only to those assets for which depreciation is calculated using the straight-line method. In relation to objects depreciated in a non-linear way, decommissioning is carried out according to the rules prescribed in paragraph 13 of Article 259.2 of the Tax Code of the Russian Federation. According to the rules, the residual value of the fixed asset will not reduce the total balance of the depreciation group, that is, the object is liquidated, removed from the depreciable property, and depreciation continues to accrue. The Ministry of Finance in letter dated December 20, 2010 No. 03-03-06/2/217 also explains that the amount of underaccrued depreciation will continue to be written off as part of the total balance of the corresponding depreciation group (subgroup).

A situation is possible when liquidation is started (and the fixed asset is taken out of service) in one tax period and completed in another. The under-depreciated cost in this case is taken into account as part of non-operating expenses on the date of completion of liquidation (letter of the Ministry of Finance dated October 21, 2008 No. 03-03-06/1/592).

Despite the fact that the Tax Code of the Russian Federation contains a rule on the possibility of attributing to expenses the residual value of liquidated property, tax authorities may doubt the need for liquidation. Thus, according to the Ministry of Finance (letter dated 04/08/05 No. 03-03-01-04/2/61), expenses for the liquidation of fixed assets, including in the form of amounts of underaccrued depreciation, are justified if these fixed assets are unsuitable for further use. use, and their restoration is impossible or ineffective. Of course, if we are talking about physical wear and tear, breakdown as a result of an accident, excessive use, etc., then problems should not arise, because the property has been damaged and is therefore unsuitable for further use.

If the reason for the liquidation of a fixed asset was, say, obsolescence of the fixed asset, then there may be problems. It is possible that, during an audit, tax authorities will require evidence that further use of the property was ineffective and inappropriate, and selling it externally is impossible.

For our part, we note that the provisions of the Tax Code of the Russian Federation do not contain such conditions, and other legislative acts mention the possibility of writing off an object due to obsolescence, however, for accounting purposes (clause 29 of PBU 6/01). In addition, the Ministry of Finance in letter dated 07/09/09 No. 03-03-06/1/454 notes that obsolescence may be the reason for the liquidation of a fixed asset.

Postings to fixed assets

The certificate can be obtained from an expert organization or it can be drawn up by a company’s specialized specialist who will monitor the cost of similar materials and make an informed conclusion. Capitalized materials remaining from a liquidated facility can be used in production activities or sold. The receipt of materials from dismantling is reflected by the entry: Dt 10 Kt 91-1. Further use in production will be reflected by posting: Dt 20, 25, 26, etc. Kt 10. Upon sale, other income will arise in the amount of revenue and other expenses in the amount at which the materials were taken to the warehouse:

- Dt 62 Kt 91-1;

- Dt 91-2 Kt 10.

Find all the nuances of writing off materials in our article “The procedure for writing off materials in accounting (nuances).”

Is it necessary to restore VAT?

The next question that arises during the liquidation of a fixed asset is related to VAT. As is known, when accepting an object for accounting, organizations deduct the “input” VAT included in the cost of the object. If at the time of liquidation the useful life of the property has not expired, that is, the original cost has not been completely transferred to expenses, then the tax authorities require the restoration of VAT from the residual value of the property. They refer to the fact that the liquidated entity ceases to participate in transactions recognized as subject to VAT taxation (and one of the conditions for the deduction is the entity’s participation in transactions subject to VAT). Similar conclusions were made by the Ministry of Finance (letters dated 07/08/09 No. 03-03-06/1/447, dated 01/29/09 No. 03-07-11/22).

But we consider this position to be incorrect. Article 170 of the Tax Code of the Russian Federation contains an exhaustive list of cases in which the corresponding tax amounts are subject to restoration. The liquidation of under-depreciated fixed assets is not indicated there. Therefore, there is no need to restore VAT. It is this argumentation that allows taxpayers to win disputes in the courts (resolutions of the FAS Volga District dated January 27, 2011 in case No. A55-7952/2010, FAS North Caucasus District dated November 3, 2010 in case No. A22-60/10/9-5, FAS Moscow District dated May 14, 2009 No. KA-A40/3703-09-2).

1C:Accounting 8 edition 3.0 - Partial liquidation of a fixed asset item

265 of the Tax Code of the Russian Federation). Consequently, if the dismantling of a fixed asset is carried out by a contractor, then the costs can be unconditionally attributed to non-operating expenses.

Attention

But determining when to write off these expenses causes some difficulties, because often the process of liquidating a fixed asset can begin in one tax period and end in another. On the one hand, the date of incurring expenses for payment for work performed by a third-party organization is the date of settlements in accordance with concluded agreements or the date of presentation to the taxpayer of documents serving as the basis for the settlements, as well as the last date of the reporting (tax) period (clauses

3 paragraph 7 art.

Rules for preparing the act

In the process of liquidation of fixed assets, it is imperative to document this process and draw up an act on the liquidation of fixed assets. The act of liquidation of fixed assets is prepared based on the results of the inventory.

Currently, unified accounting forms are no longer mandatory for use. Therefore, when preparing an act, accountants can develop the form of the act independently. Information from the Ministry of Finance No. PZ-10/2012 also indicates this. If the company develops the form independently, then it must be fixed in the accounting policy for accounting.

But quite often accountants use the unified form of the act on write-off of fixed assets No. OS-4. It was approved by the State Statistics Committee in Resolution No. 7 of 2003. A unified form allows you to avoid mistakes and take into account all the mandatory information that must be contained in this document.

In the column “Original cost as of the date of acceptance for accounting or replacement cost” for fixed assets that have undergone revaluation, the replacement value at the last revaluation is indicated. If the objects have not been revalued, then the initial valuation is recorded at the time the asset was accepted for accounting.

The column with the amount of depreciation indicates the amount of depreciation since the initial operation.

The costs of writing off fixed assets and the cost of material assets that were received as a result of disassembly are indicated in section 3 “Information on the costs associated with writing off fixed assets from accounting and on the receipt of material assets from their write-off.” This section indicates the cost of spare parts and materials that remain after disassembly and can be useful in production.

The act in form No. OS-4 is prepared in 2 copies. It must be signed by the commission members and the head of the organization. The first copy of the act is subject to transfer to the accounting department and will serve as the documentary basis for writing off the object from the register, and the second copy remains with the responsible person. Such a person, who is responsible for ensuring the safety of fixed assets, is appointed by order of the head of the enterprise.

A second copy may also be needed in case materials remaining from liquidation are transferred to the warehouse. Information about the costs incurred for liquidation and the cost of materials is written down in section 3 of the act in form No. OS-4.

It is worth considering that the form of the act used may vary depending on the type of fixed asset or the specifics of the situation:

- To write off vehicles, you can use the act of writing off vehicles in form No. OS-4a.

- When writing off a group of fixed assets - an act in form No. OS-4b “Act on writing off groups of fixed assets”.

A sample act of liquidation of fixed assets can be downloaded here.

What is the liquidation of fixed assets and what are its goals?

The liquidation of fixed assets (fixed assets) means the process of writing them off from the balance sheet of an enterprise with the process of dismantling them due to physical or moral obsolescence.

Damage to a fixed asset (regardless of the possibility of its further use) entails mandatory inventory at the enterprise. This is indicated in paragraph 27 of the Regulations according to Order of the Ministry of Finance No. 34n of 1998.

The procedure for liquidating fixed assets from the balance sheet is prescribed in paragraphs. 94-97 Methodological guidelines for accounting, approved in Order of the Ministry of Finance of 1998 No. 33n. These standards today are advisory in nature for accountants and other responsible persons.

Liquidation of a fixed asset is necessary in the following cases:

- for its write-off in the event of an accident, natural disaster or other emergency and the impossibility of further use for its intended purpose or restoration;

- to write off an object due to its physical and moral wear and tear;

- in case of long-term non-use of the facility for the production of products , performance of work and provision of services or for management purposes;

- in other cases established by law.

Liquidation of a fixed asset can be complete or partial. In the latter case, we are talking about this type of write-off when a certain part of the object can be used in the future (for example, as raw materials in production or for the repair of fixed assets).