Author of the article: Sudakov A.P.

Accountants and individual entrepreneurs who have to fill out Form 2-NDFL often have questions about how to correctly fill out this document. In this article we will look at what sign 1 means in certificate 2-NDFL, sign 2 and what information to enter in this line.

Who needs a 2nd personal income tax certificate?

The certificate is requested by different organizations, but the employer must provide it to some institutions, and the employee to others. As for the employer, according to the Tax Code of the Russian Federation, once a year all organizations and institutions must submit to the tax authority 2 personal income tax certificates for their employees to whom they made cash payments, from which, in turn, personal income tax was paid. These documents must be submitted by April 30 of the year following the reporting period.

Employees can provide their certificate where required, for example, when obtaining a loan or applying for a mortgage. In this case, the employee contacts the employer and receives a certificate. It is worth noting that the employer, regardless of whether he is a legal entity or an individual entrepreneur, cannot refuse his employee to receive an income certificate. The certificate is issued upon the employee’s application, which is written in any form, without indicating the reason for receiving the certificate.

What do the signs indicate?

When filing a declaration, an individual entrepreneur or LLC must include information on the following:

- A unit is entered if the document includes wages paid to employees and, accordingly, taxes withheld from them.

- A two is given if the document includes the amount of income received by an individual on which fees were not levied.

The “attribute” field is located immediately after the header “Certificate of income of an individual” and the dates. Only the number is entered into it; nothing more can be written in it.

Important:

If the declaration is filled out at the request of an employee, then there is no need to enter information in the field. This is done only when submitting to the tax authorities.

When it doesn’t make sense to fill out sheet D1

In some situations, even if the taxpayer's identification is entered correctly and the declaration is completed in accordance with all the requirements established by the current tax legislation, the income tax refund will still not be realized. This applies to the following cases:

- Receiving a property deduction. As a rule, a personal income tax refund for the purchase of any type of housing (or land), as well as for expenses associated with the repair work of these objects or their construction, is provided to individuals once.

- Buying a home from relatives. Those individuals who are relatives (namely spouses, parents of the owner of the property, children of the owner, as well as his brothers or sisters) and who carried out a transaction for the purchase and sale of property are not entitled by law to take advantage of an income tax refund. This restriction also applies to individuals connected by business relationships, for example, an employer-subordinate.

- Documents for deduction are not certified. As you know, a tax return is accompanied by a whole package of documentation confirming the accuracy of the information written in it. However, only some of them need to submit originals, and for most documents, copies must be made and submitted. However, if the copy is not certified, the document will not have legal force, so we strongly recommend that you do not forget about this.

Starting in 2021, a new order for filling out 3-NDFL dated October 3, 2018 No. MMV-7-11 came into effect. It is applied starting with reporting for 2018. The order approved a completely new declaration form. So even those citizens who have filled out 3-NDFL before may encounter some difficulties. In this article we will tell you how and on what sheet to correctly indicate the taxpayer’s attribute in 3-NDFL.

Features of issuing a 2-NDFL certificate with feature 2

Sign 2 in certificate 2-NDFL, what is it? Due to the non-standard situation and in order to avoid a lack of funds for transfer, as well as evasion of transfer by the tax agent, certificate 2-NDFL with feature 2 has the following criteria for its preparation.

- Any sum of money that, due to circumstances, could not be subject to taxation must be indicated strictly as belonging to the month in which this payment was made.

- If only part of the payment made to an employee is subject to tax collection, then when submitting a 2-NDFL certificate with attribute 2, it indicates only that part of the payment that was not subject to income tax.

- In a certificate with this particular feature, the tax authorities are not interested in providing information on other income from which the required withholding was made.

- If sign 2 in certificate 2-NDFL occurred, but during the past reporting period there were also periodic accruals with a withholding of 13%, then for this individual the tax agent is obliged to draw up and submit 2 certificates as reports. Thus, one 2-NDFL certificate will be standard, issued according to feature 1, and the second will be special, with feature 2. The tax office in this case will consider both certificates simultaneously.

Important! When submitting a certificate with characteristics 1 and 2 at the same time, in the first form it is necessary to indicate all income accrued to an individual, including those that were not subject to taxation, that is, a certificate with characteristic one indicates data on both characteristics, a certificate with characteristic two contains information only this sign. The last table in the document form must be completed in only four lines before sending it for verification.

The first is the total income received for the current reporting period, from which it was not possible to withhold, the calculation of the tax base for the accurate calculation of unpaid tax, the personal income tax itself, which was not collected from the taxpayer, and the amount of tax not withheld from an individual. All other columns of the specified table are filled with zeros

The last table in the document form must be completed in only four lines before sending it for verification. The first is the total income received for the current reporting period, from which it was not possible to withhold, the calculation of the tax base for the accurate calculation of unpaid tax, the personal income tax itself, which was not collected from the taxpayer, and the amount of tax not withheld from an individual. All other columns of the specified table are filled with zeros.

Federal Tax Service logo

A correctly drawn up certificate indicates that inspectors have no claims against the tax agent.

When personal income tax cannot be withheld

The Tax Code does not contain a list of specific circumstances under which it is impossible to withhold personal income tax. In practice, this situation arises when tax cannot be withheld directly when paying income, for example, because it is non-monetary income, and the tax agent no longer pays money to this individual until the end of the year.

Until 2021, personal income tax could still be withheld and transferred to the budget when any money is paid to an individual, even after the end of the year, but before the submission of the 2-NDFL certificate with sign 2 or the deadline for its submission. And show it in certificate 2-NDFL for the past year as withheld and paid (letter of the Ministry of Finance dated March 12, 2013 No. 03-04-06/7337). However, now the ability to withhold personal income tax is strictly limited to payments within the tax period (clause 5 of Article 226 of the Tax Code of the Russian Federation, clause 2 of Article 2 of Law No. 113-FZ dated May 2, 2015, Letter of the Ministry of Finance dated March 12, 2013 No. 03-04-06 /7337). And another approach is fraught with discrepancies between the calculation of 6-NDFL for the year and 2-NDFL certificates with sign 1 for this year.

In the calculation of 6-NDFL, only deductions made before the end of the reporting year are reflected. So the amount of personal income tax, even if it relates to that year, but withheld from payments after its end, will not be included in the calculation. But, as we have already said, 2-NDFL will appear on the certificate with attribute 1, and the data in these reporting forms will not match.

Moreover, personal income tax withheld from 2021 income in 2021 cannot be reflected in 6-personal income tax for 2021 (its reporting periods). It indicates only the tax amounts calculated for 2021 or its reporting periods (clause 2 of Article 230 of the Tax Code of the Russian Federation). And personal income tax is calculated on the date of actual receipt of income, which in our case falls on 2021 (clause 3 of article 226 of the Tax Code of the Russian Federation).

Read also “Filling out form 6-NDFL for 2021”

Tax return

Today, in order for an individual to reduce the size of the tax base or report on financial transactions related to his income, including the payment of taxes on them, there is a special document - a tax return. This document, as a rule, is submitted for verification to the tax service and must be filled out in accordance with the current form 3-NDFL.

Before you begin filling out the declaration, we advise you to pay attention to the following several aspects regarding the structure and rules for preparing this document:

Please note that the above rules and advice have a direct impact on the duration of the desk audit. If they are taken into account by the taxpayer and implemented in practice, the declaration will be checked within thirty days

Otherwise, the period for reviewing the document may take up to three months.

As noted earlier, a document drawn up according to the 3-NDFL model consists of mandatory pages for completion by all individuals and special sheets relating to the calculation of a specific type of tax discount.

The tax return includes sheet D1, which is intended for the procedure for calculating property-type deductions and requires indicating the taxpayer’s characteristics.

This indicator must be included in the first paragraph of the sheet, devoted to information about the property and expenses incurred by the taxpayer.

In paragraph one there is subparagraph 1.3, next to which the words “taxpayer characteristic” are written and next to it in brackets there is the designation 030. It is here that you need to enter a two-digit code that characterizes the very characteristic of the taxpayer discussed in this article.

What code to indicate

In the most common case, when real estate is registered as sole or common property (without children), 2 codes are used:

- the owner himself puts down taxpayer identification number 01;

- husband or wife of the owner - taxpayer sign 02.

The same codes mark the taxpayer’s attribute in 3-NDFL with common joint ownership.

Mikhail bought an apartment in 2021 and registered it in his name. Together with my wife, I decided to receive the deduction. The law allows this. When filling out the declaration, Mikhail will put code 01 in Appendix 7.

And his wife is 02.

Clause 6 of Article 220 of the Tax Code provides for the opportunity for parents to claim a deduction for minor children. When a parent bought real estate and registered it in the name of a child, he puts 03 or 04 in the declaration. Separate codes are provided for the taxpayer’s attribute in 3-NDFL for common shared property, if a person declares a deduction for himself and the child at the same time (codes 13, 14, 23, 24).

In 2021, Maria purchased a two-room apartment with her own money. She registered it for herself and her 10-year-old son Alexei in equal shares. When filling out the deduction in Appendix 7, Maria enters taxpayer attribute 13. If Maria’s husband and Alexey’s father apply for the deduction, he will indicate taxpayer attribute 23 in 3-NDFL.

An innovation in the 2018 declaration is special taxpayer identification codes for those people who want to exercise the right to transfer deductions to previous periods. This opportunity is provided to pensioners in accordance with clause 10 of Article 220 of the Tax Code. These are codes 04, 11, 12, 14, 24. They seem to duplicate the meanings of the other codes described above.

Taxpayer characteristic codes

As is known, a property tax discount can be accrued not only to individuals who are owners of real estate, but also to individuals related to them by close forms of kinship - husband, wife, children, including those who have not reached the age of majority, and also to parents. In addition, a tax discount is provided even for those property assets that are owned in shared ownership.

In order to notify the tax inspector about to whom the property tax compensation is issued and what relation the individual has to the housing property, there is precisely such a cell as a taxpayer sign. The following codes are usually entered in this column:

- “01” - such figures are indicated if the taxpayer who is reducing his tax base is the owner of a housing property;

- “02” - this code is set in those situations in which a declaration for a property type of deduction is drawn up in the name of the wife or husband of an individual documented as the owner of the property;

- “03” – it often happens that parents, for some reason, decide to register an apartment, house or other property in the name of their son or daughter, who is currently under eighteen years of age. In order to return housing tax in such a situation, in the column that requires entering the taxpayer’s identification, you need to indicate the designation “03”;

- “13” – these numbers are written down if an individual claiming a tax discount for real estate has registered common ownership of the property for it, of which he himself, as well as his daughter/son who have not reached the age of majority, are participants;

- “23” - this combination of numbers should be written in cases where the taxpayer, who has expressed a desire to take advantage of the deduction for a property, has registered it as shared ownership between himself, his wife/husband, as well as their child who has not yet turned eighteen years old.

IMPORTANT! Only one of the above codes must be indicated on declaration sheet D1. If the taxpayer accidentally mixed up the code and then corrected it to the correct one, then the document containing the corrections will not be accepted by the tax inspector

Procedure for filling out 3-NDFL

- in sub. 2.8 Sheet D1 of the 3-NDFL Declaration - the total amount of expenses for new construction or the acquisition of a real estate object (objects), which is accepted for property tax deduction for the reporting tax period based on the Declaration. This amount cannot be greater than the size of the tax base calculated in subparagraph. 2.7;

- in sub. 2.9 Sheet D1 of Declaration 3-NDFL - the total amount of expenses for paying interest on targeted loans that were received from credit and other organizations of the Russian Federation, and on loans that were received to refinance loans for new construction or the acquisition of a real estate object (objects), accepted for the purposes of property tax deduction for the reporting tax period based on the Declaration. This amount cannot be greater than the difference between the values of subclauses 2.7 and 2.8;

- in sub. 2.10 Sheet D1 of Declaration 3-NDFL - the balance of the property tax deduction for expenses for new construction or acquisition of an object, which transfers to the next tax period.

- in sub. 1.11 Sheet D1 of Declaration 3-NDFL - indicates the year in which the use of the property tax deduction began, in which the tax base was reduced for the first time;

- in sub. 1.12 Sheet D1 of Declaration 3-NDFL - indicates the amount of expenses actually incurred by the taxpayer for new construction or acquisition of an object, but not more than the maximum permissible amount of property tax deduction to which the taxpayer is entitled (not taking into account the amounts that are used to repay interest on targeted loans, which were received from credit and other organizations of the Russian Federation, as well as for loans that were received to refinance loans for new construction or acquisition of an object).

What data is contained in the 2-NDFL certificate

The certificate is filled out in accordance with the requirements of the Tax Code of the Russian Federation in printed form indicating the following data on the form:

- The upper part of the form contains columns that indicate: the date of its preparation, the tax office code, as well as sign 1 or 2 regarding the nature of the tax withholding.

- Next, all the personal data of the tax agent is entered, most often the employer, who assumes full responsibility for the tax burden for his employee before the Federal Tax Service.

- Afterwards, the personal data of the taxpayer is entered - full name, date of birth, citizenship, passport data, and, most importantly, the identifier - TIN, which records all tax relations between the individual and the tax authority.

- After filling out all the data, the main part of the certificate should be presented in tabular form. The tax agent is obliged, in strict accordance with the income accrued to the employee and the taxes withheld, to write down all the lines of the table in order, indicating in them the income code, the payment amount, the tax rate and the amount of tax withheld.

On a note! If the certificate is submitted for the year, and payments were made once a month, 12 lines of the table are filled in, if twice a month - in the form of an advance and basic salary, which is more correct from the point of view of labor legislation, then 24 lines.

If the taxpayer was accrued any additional one-time bonuses or remuneration during the reporting period, they are also recorded in a new row of the table indicating the correct income code in accordance with the Tax Code of the Russian Federation.

- Having filled out the data on income and taxes on a monthly basis, at the end of the document it is necessary to draw up another table - the total amounts of accruals and deductions from them, where all the data from the top table is summed up and the resulting result fits into its own row of the table, making it possible to see the total amounts clearly.

- At the end, the 2-NDFL certificate is supported by the last name, first name and patronymic of the representative of the tax agent, as well as his signature and the seal of the organization.

Gifts from employer

A completed document, as a rule, can be issued both for the entire past reporting period, and for an incomplete current one, in which all data is limited to the last accrual and deduction.

Results

The taxpayer attribute field in the 2-NDFL certificate can take the value 1 if the tax was withheld from the employee’s income in full, 2 if the tax could not be withheld. Codes 3 and 4 are used by the legal successor submitting certificates for the reorganized company in similar situations. The deadline for submitting certificates with any indication is set at the same time: 03/02/2020.

Sources

- https://101biznesplan.ru/spravochnik-predprinimatelya/terminy-i-ponyatiya/chto-oznachaet-priznak-1-i-2-v-spravke-2-ndfl.html

- https://znatokdeneg.ru/terminologiya/chto-oznachaet-ndfl-s-priznakom-1-i-2.html

- https://zoloto-zlato.ru/terminy/ndfl-s-priznakom-1-i-2-chto-oznachaet.html

- https://nalog-nalog.ru/ndfl/spravka_2ndfl/zapolnyaem_priznak_nalogoplatelwika_v_spravke_2ndfl/

- https://www.klerk.ru/buh/articles/485174/

Sample of filling out a certificate in 2019

Before downloading the 2-NDFL certificate form to fill out in 2019, we recommend that you familiarize yourself with the rules in force in 2018 (until December 31):

- In section 1, you must indicate the name of the tax agent and his basic details: TIN, KPP, OKTMO code.

- Section 2 contains information about the individual: his full name, date of birth and passport details. As mentioned above, you do not need to indicate your residence address.

- Section 3 reflects the taxpayer’s income, graduated by month of payment, income code, and amount.

- Section 4 should provide information about tax deductions provided to individuals.

- The total amounts for the year: income and deductions of an individual, taxes calculated, withheld and transferred to the budget of the Russian Federation are reflected in section 5. The details of the person responsible for filling out are also indicated here.

- Section 3 is completed for each tax rate. For example, if an employee is a non-resident and receives dividends, then two sections 3 and two sections 5 of the certificate must be completed for him. Separately - for wages at a rate of 30% and separately - for dividends at a rate of 15%, indicating the income code.

When you can't withhold taxes

When conducting business, situations sometimes arise when an employer is physically unable to withhold tax from its employee. For example:

- The worker received income in kind (not intended for sale). This could be food, clothing, hygiene products, mining, etc. In this case, tax must be withheld from the worker when the money is first transferred, but if payments were constantly made in kind, then transfers to the budget are not made.

- Payments under the agreement were made at the end of the tax period, so the agent simply did not have time to transfer the funds before the end of the reporting year. A fairly common practice associated with delaying payments.

- The employee receives a financial benefit.

There are other options when an employer cannot withhold tax from an employee. In these cases, sign 2 is indicated in the 2-NDFL certificate. What is it and how is it classified by the tax authority? This code confirms that income tax was not physically paid on the income.

Data transfer

Let’s say you previously worked on another program and when switching to the Taxpayer Legal Entity software, you want to transfer lists of employees/contractors without entering them again. No problem: the program ensures that both the certificate and the individual, taking into account personal information within the data of the 2-NDFL certificate, are accepted into the list of employees or contractors.

For this:

1. Specify the path to the folder where the uploaded file is located (in 2-NDFL format).

2. Place the cursor on the desired file.

3. Press the button.

4. Then click the Run> button.

KEEP IN MIND

Certificates and information on employees can be accepted only if the tax agent is on the list of taxpayers and his list of employees is not completed/this individual is not in the list of employees.

You can check the presence of a tax agent in the list of taxpayers using the INN and KPP.

Checking the presence of an individual in the list of employees is possible using the Taxpayer Identification Number (TIN), and in case of its absence, using additional mandatory details (date of birth, details of an identity document, etc.).

It is also possible to load data from DBF files. So, to download income certificates from a DBF file, you need to create files doc1.dbf, doc2.dbf, doc3.dbf, doc4.dbf with the appropriate structure. Next, you need to select the menu item Documents - Income Certificates 2-NDFL - Upload button. Then select the file.

Also see “What documents and reporting can you work with in the Federal Tax Service program “Legal Taxpayer”.

What do the signs mean in the certificate in form 2NDFL

The attribute code is entered by the tax agent, that is, the employer, depending on the timing of payment of taxes on the income of his employee. Let's look at the meaning of each code.

Important! Data is as of the beginning of 2021!

1 sign

Item 1 in certificate 2-NDFL is indicated if during the reporting year the employer paid the employee the required salary in the standard manner. At the same time, tax on this earnings can be withheld by the employer either in full or in part. Such a certificate must contain the calculation of personal income tax based on the citizen’s income, as well as notes on its deduction to the budget.

2 sign

This sign is indicated if the employer for some reason did not withhold personal income tax from the citizen’s income in the reporting year. Typically, this happens for the following reasons:

- the income was received at the end of the billing period, and the accountant did not have time to process the tax deduction;

- the salary was paid in kind;

- the employee received material benefits from the enterprise.

What does the taxpayer sign mean in 3 personal income tax?

Filling out the tax return form in question is offered as a service by many organizations specializing in legal issues. Citizens who are faced with the need to provide this document for the first time quite often turn to such organizations, since, at first glance, independently filling out all the required information requires deep knowledge in tax matters. This opinion is based on several factors:

- due to the need to carry out certain calculations and reflect their results in the submitted reports;

- due to the representation of much information in the form of code.

In particular, the taxpayer’s attribute in 3 personal income tax must also be displayed in the form of one or another figure.

However, upon closer examination and familiarization with the instructions for filling out, it becomes clear that you can cope with filling out the 3rd personal income tax declaration on your own, especially if we are talking about any standard situation.

If we are talking about how to fill out the taxpayer’s sign in 3 personal income tax, then here it is enough to refer to the background information. The taxpayer attribute (which is listed in line 030) in this declaration is intended to reflect information about who acts as the applicant. To correctly determine the code, you should carefully read the corresponding table.

Please note that legal regulations are subject to change. Last year there were only two signs of a taxpayer, while now there are more

In this regard, to obtain reliable information, you should refer to the primary source: the appendix to the relevant order of the Ministry of Finance of the Russian Federation.

Features of providing 2-NDFL

Certificate 2-NDFL can be submitted:

- in paper;

- in electronic format.

If the number of employees is up to 25 people, the first option is allowed, and above - the second.

A tax agent can be declared by an authorized representative with documentary evidence of this. The filing deadline is counted:

- upon personal delivery by an authorized representative;

- by date of mailing;

- by recording in electronic format.

The taxpayer has the right to obtain such a certificate from a tax agent for presentation to a bank, tax service, or court. The “Sign” field is not filled in for such cases.

Now you know what personal income tax means with signs “1” and “2” and you can correctly issue a certificate. It is also easy to submit a report based on this information.

Prepare for expenses if the certificate with symptom 2 is late

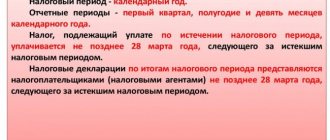

2-NDFL certificates with signs 1 or 2 must be submitted to the controllers:

- once a year;

- on different reporting dates: with sign 1 - no later than April 1, and with sign 2 - before March 1.

Failure to meet deadlines means additional material costs.

Example

At the end of the year, the accountant of PJSC TechnoStroyKom submitted to the Federal Tax Service a complete set of 2-NDFL certificates on March 27. A total of 1,360 certificates were issued and handed over to controllers. Of these, 347 are 2-NDFL certificates with sign 2.

PJSC TechnoStroyKom was assessed a fine of 69,400 rubles. (347 × 200 rubles) - this is the amount that tax legislation estimates the fact of being late with 347 documents that have the status of mandatory tax reporting. The remaining certificates (with sign 1) were received by the inspectorate on time, therefore they are not involved in determining the fine amount.

200 rub. - the amount of financial punishment for each late certificate (clause 1 of Article 126 of the Tax Code of the Russian Federation). From 300 to 500 rub. management will have to pay to the treasury (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

Application

Fill out the fields in the help application as follows:

| Field | What to indicate |

| "Month" | Serial number of the month |

| "Revenue code" | Income code in accordance with Appendix 1 to the order of the Federal Tax Service dated September 10, 2015 No. ММВ-7-11/387. If there is no separate code for income, enter code 4800 (letter of the Federal Tax Service dated September 19, 2016 No. BS-4-11/17537) |

| "Amount of income" | The amount of accrued and actually received income by an individual this month |

| "Deduction code" | Code according to Appendix 2 to the order of the Federal Tax Service dated September 10, 2015 No. ММВ-7-11/387 |

| "The amount of the deduction" | The amount of the deduction provided. It cannot exceed the amount of the relevant income |

Note: For a list of deductions that reduce the tax base for personal income tax, see the table (.pdf 220Kb).

In the appendix, show professional tax deductions (Article 221 of the Tax Code). Deductions in the amounts provided for in Article 217 of the Tax Code. As well as amounts that reduce the tax base in accordance with Articles 213.1, 214, 214.1 of the Tax Code.

If several deductions can be applied to one type of income, then indicate the first deduction after the income in the fields “Deduction Code” and “Deduction Amount”, the second - in a line below, etc. In this case, the fields “Month”, “Income Code” and “ Amount of income” do not fill in before the second and subsequent deductions.

What changed

Since the beginning of 2021, it has become known that employers and companies paying income (for example, dividends) to individuals based on the results of the current year will continue to have to report according to new rules, for which they will need a sample 2-NDFL for 2021. The new registration procedure is significantly different from the previous one. Let's look at how to fill out, where to find and download the current Form 2-NDFL 2021.

Since the purpose of the certificates is different, they have a different structure and procedure for filling out. And the Order of the Federal Tax Service directly states this. Minimal changes have been made to the form that employers must issue to employees (Appendix No. 5 of the Order of the Federal Tax Service). In particular, the line about the attribute, the adjustment number and the Federal Tax Service code and the details of the notification of the provision of a deduction were excluded from it. Since the new year, the document looks like this:

As for the report, which is submitted to the Federal Tax Service from 2021, there are slightly more changes in it. The help consists of an introductory part, two sections and one appendix. The previous form 2-NDFL had 5 sections. In addition, tax authorities removed fields for indicating the TIN of individuals and left only one field to clarify the type of notification confirming the right to one of the tax deductions.

Please note that if you fill out reports for tax authorities electronically and transfer them to the Federal Tax Service through operators, you will not notice any special changes. Intermediaries promise that they will promptly update the formats that tax agents use when transmitting data on income and personal income tax amounts. As for certificates for employees, and such requests are not uncommon, it is necessary to use new forms so as not to violate the requirements of the Tax Code of the Russian Federation.

Please note that as of 01/01/2019 the following are no longer valid:

- Order of the Federal Tax Service of the Russian Federation dated October 30, 2015 No. MMV-7-11/485 and Order of the Federal Tax Service dated January 17, 2018 No. MMV-7-11/, which now approved the working version of the document and the procedure for filling it out;

- Order of the Federal Tax Service of the Russian Federation dated September 16, 2011 No. ММВ-7-3/576 and Order of the Federal Tax Service dated December 8, 2014 No. ММВ-7-11/, which describe the rules on how to submit information on electronic and paper media and through telecommunication channel operators communications.

To submit information to the Tax Inspectorate of Moscow, St. Petersburg or another region, use our forms. To access them, registration or other additional steps are not required: all information is free for readers. It's up to you to fill out documents in word, excel or some other format.

What is it for?

This section helps employees of the Federal Tax Service collect the necessary data on taxpayers. If the number “1” is entered in the section, the tax office simply enters into the database information about persons who receive salary and corresponding payments. When the number “2” is entered into it, the tax authorities collect a database of persons who are debtors (since payments from the remuneration have not been made). Let us remind you that information about any rewards received is entered into the form. These include:

- Payment of salary according to the agreement.

- Payment for sick leave and vacation pay. In this case, payments for maternity disability relate to the insured event and are not included in the declaration).

- Financial assistance received by the employee.

- Dividends and bonuses paid to employees.

- All kinds of deductions made under a civil contract, as well as other payments.

Rules for filling out personal income tax

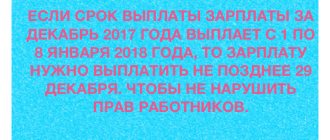

According to current regulations, a unique code is associated with each type of remuneration, and the person filling it out must indicate it so that tax authorities understand exactly what payments are being made. A tax of 13% is paid on the total amount; it is withheld on the same day when the payment itself is made . Personal income tax is transferred according to the following rules:

- Sick leave and vacation pay are paid on the last working day of the month. For example, if payments were made on October 15, then personal income tax must be paid by October 31.

- For other types of payments, transfers are made on the next business day after the actual payment to employees.

If payments to the budget have been made, the employer issues a certificate and enters item 1 in the required paragraph.

Comments and clarifications

| Taxpayer status | Code | Tax rate, % | |

| by labor income | for other income (dividends, financial benefits, etc.) | ||

| Tax resident * | 1 | 13 | 9; 35 |

| Non-resident | 2 | 30 | 15; 30 |

| Non-resident – highly qualified specialist | 3 | 13 | 15; 30 |

| A non-resident is a participant in the state program for the voluntary resettlement of compatriots in the Russian Federation | 4 | 13 | 15; 30 |

| Refugees | 5 | 13 | 15; 30 |

| Foreigners working under a patent | 6 | 13 | 15; 30 |

* - an individual who, on the date of receipt of income, is in the Russian Federation for at least 183 calendar days within 12 consecutive months

Taxpayer status is determined as of the end of the year for which certificate 2-NDFL is submitted (letter of the Ministry of Finance dated November 15, 2012 No. 03-04-05/6-1305). If an employee is dismissed before the end of the year, his status is determined as of the date of dismissal.

The certificate does not need to reflect income that is completely exempt from taxation in accordance with Art. 217 of the Tax Code of the Russian Federation (letter of the Ministry of Finance dated April 18, 2012 No. 03-04-06/8-118). These, for example, include: maternity benefits, monthly child care benefits, compensation payments, alimony, etc.

Attention! The tax agent must reflect in the 2-NDFL certificate those non-taxable incomes that are partially exempt from taxation. In particular, they are indicated in paragraph

28 Art. 217 of the Tax Code of the Russian Federation (material assistance, prizes, gifts).

Codes of income and deductions indicated in 2-NDFL certificates are filled out on the basis of Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ (as amended by Order of the Federal Tax Service dated November 22, 2016 No. ММВ-7-11/).

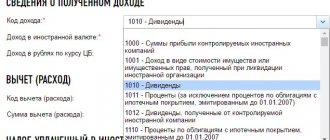

For each income code, you can specify a specific list of deductions. The correspondence between the most commonly used income codes and deduction codes for 2-NDFL certificates is given in the following table:

| Revenue code | Deduction code reflected: | |

| in section 3 | in section 4 | |

| 1010 | 601 | |

| 1211 | 510 | |

| 1530 | 201, 208, 216, 218, 222 | |

| 1531 | 202, 217, 219, 223 | |

| 1532 | 205, 206, 208 | |

| 1533 | 220 | |

| 1535 | 207, 209, 210 | |

| 1536 | 203, 224 | |

| 1537 | 211 | |

| 1538 | 215 | |

| 1539 | 213 | |

| 1541 | 620 | |

| 2000 | 104, 105, 126-149, 311, 312, 320, 321, 324-328 | |

| 2001 | ||

| 2002 | ||

| 2010 | 403 | |

| 2012 | 104, 105, 126-149, 311, 312, 320, 321, 324-328 | |

| 2201-2209 | 404, 405 | |

| 2300 | ||

| 2530 | ||

| 2710 | ||

| 2720 | 501 | |

| 2730 | 502 | |

| 2740 | 505 | |

| 2760 | 503 | 104, 105, 126-149, 311, 312, 320, 321, 324-328 |

| 2761 | 506 | |

| 2762 | 508 | |

| 2790 | 507 |

In this case, the organization (separate division) must submit to the tax authority at its new location:

- 2-NDFL certificates filled out for the period of registration at the old address indicating OKTMO at the previous location;

- 2-NDFL certificates filled out for the period after registration at the new address indicating OKTMO at the new location.

Attention! All certificates indicate the checkpoint of the organization (separate division) assigned to the new address (letter of the Federal Tax Service of Russia dated December 29, 2016 No. BS-4-11/)

If an employee quits within one calendar year and is then rehired, then one 2-NDFL certificate is issued for him for all income received from this employer both before dismissal and after rehiring.

Tax agents who paid any income to individuals in 2021 must report to the Federal Tax Service using Form 2-NDFL. Recipients of income can be both employees of the reporting company and persons who are not in an employment relationship with it. The deadline for submitting the certificate is 04/02/2018.

In addition, by March 1, 2018, all enterprises and individual entrepreneurs that have not withheld personal income tax are required to submit this type of reporting.

Certificate form 2-NDFL approved by order of the Federal Tax Service of the Russian Federation dated October 30, 2015 No. ММВ-7-11/

Organizations and individual entrepreneurs that have paid money to more than 25 individuals must submit 2-NDFL in electronic format.

A necessary addition to form 2-NDFL is the register of information on income, which contains information about the prepared certificates.

Form and format for submitting 2-NDFL

Certificate 2-NDFL reflects information about the source of income of an individual, wages, other income and withheld tax. The main document regulating the submission of reports in form 2-NDFL, order of the Federal Tax Service of the Russian Federation dated October 2, 2018 N ММВ-7-11/ [email protected]

Also important are the Appendices of the order of the Federal Tax Service of the Russian Federation dated October 2, 2018 N ММВ-7-11/ [email protected] , which regulate the rules and procedure for submitting information. In particular, they describe the procedure for submitting information about the impossibility of withholding tax with sign 2. This order also contains a new modified form of the register and protocol for receiving information.

And, of course, an important document is the Tax Code, which also regulates the submission of 2-NDFL reports.

Certificate 2-NDFL is submitted to the Federal Tax Service once a year. The deadline for submission depends on the characteristics of the document. If tax is withheld from payments to an employee, put the number “1” in the “Sign” column and submit the report to the tax office by April 1 of the next year. If the tax was not withheld, check the box “2” and submit the certificate before March 1 of the next year.

Certificate 2-NDFL from 2021: sample filling

What does the modified form 2-NDFL look like from 2021

Tags: job description of the general director, loan, tax, personal income tax, order, expense

Introduction

According to the laws of the Russian Federation, every citizen is required to pay tax on income received. This is done in different ways: for individual entrepreneurs he pays himself, for the employee: the employer, for public sector employees: the state. This tax must be paid by both individual entrepreneurs and legal entities, no matter what form of ownership they have. Both the former and the latter are required to submit reports to the Federal Tax Service in form 2-NDFL, indicating the amount of taxes and various remunerations paid. In this form there is a “Sign” item, in which you need to put the number “one” or “two”. Let's consider what exactly needs to be added and what exactly are the differences between these features.