How to fill out the form

The current form of income certificate - 2-NDFL - is approved by Appendix No. 1 to the order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/566. The same document approved:

- the procedure for filling out this certificate (Appendix No. 2, hereinafter referred to as the Procedure);

- electronic format 2-NDFL (Appendix No. 3).

The official name of the document in question is “Certificate of income and tax amounts of an individual” (form 2-NDFL).

Where to get it

If a citizen works, he should contact his boss directly for information. When there is no management at the enterprise, the chief accountant should be responsible for issuing certificates.

If a citizen does not officially work, he can apply for a document to the Employment Center, which is located at the place of registration. This institution will issue a certificate stating that the person has had no official income for the last 3 months .

Read What is a cassation appeal in a criminal case?

Individual entrepreneurs are not required to have income certificates. They must submit reports regularly. To do this, you can use any papers that confirm income for a certain period. The basis for a certificate to the social security authorities will be information from documents certified by the tax office.

Structure of the income certificate

2-NDFL consists of the following parts:

- general part (header);

- Section 1 “Data about the individual recipient of the income”;

- Section 2 “Total amounts of income and tax based on the results of the tax period”;

- Section 3 “Standard, social and property tax deductions”;

- Appendix “Information on income and corresponding deductions by month of the tax period.”

Please note that it is more convenient and correct to fill out the income certificate completely out of order. In what order to fill out the 2-NDFL certificate, find out from ConsultantPlus:

We recommend filling out the 2-NDFL certificate in the following order: ... (read more).

General rules for filling out income certificate 2-NDFL

The document is filled out for the tax period. This is a calendar year. Data is taken from tax registers.

Unacceptable:

- correcting errors by corrective or other similar means;

- double-sided printing and binding of sheets, leading to damage to the certificate;

- specifying negative numeric values.

Use black, purple or blue ink.

Each reference indicator corresponds to one field, consisting of a certain number of familiar places. Only one indicator is indicated in each field. The exception is the date (DD.MM.YYYY) or decimal fraction (two fields separated by a dot).

Fill out the help fields from left to right from the first (left) familiarity.

When filling out on a computer, the values of numerical indicators are aligned to the right (last) familiarity. It is acceptable to have no frames for familiar places and no dashes for empty familiar places.

Fill in CAPITAL PRINTED characters in Courier New font with a height of 16-18 points.

| SITUATION | SOLUTION |

| There is no indicator | In all familiar places in the corresponding field there is a dash. |

| To indicate any indicator, you do not need to fill out all the fields | In empty spaces there is a dash on the right side of the field. |

| No value for total indicators | Indicate zero (0) |

| Help cannot be completed on one page | Fill out the required number of pages located before the Application |

Continuous numbering. For example, for the first page - 001, for the twelfth - 012.

What happens if you don't submit reports?

The Federal Law “On the State Civil Service of the Russian Federation” regulates the timely completion of the declaration for civil servants 2021 and the provision by officials of incomplete information. In these cases, the civil servant faces disciplinary action or dismissal.

If, for compelling reasons, a certificate has not been submitted for one of the family members, it is imperative that an appropriate application be submitted instead. Otherwise, the official will be dismissed from service.

Legal documents

- by presidential decree No. 557 of May 18, 2009

- Federal Law of July 27, 2004 No. 79-FZ

- Decree dated June 23, 2014 No. 460

Filling out the general part of the income certificate 2-NDFL

| FIELD | HOW TO FILL OUT |

| INN checkpoint | Organizations indicate the tax agent identification number (TIN) and the reason for registration code (RPC) at the location of the organization according to a certificate from the tax office. Individuals - tax agents - only the TIN from the certificate of registration with the tax authority of the individual at the place of residence in the Russian Federation. If the certificate is submitted by an organization with separate divisions, after the TIN indicates the checkpoint at the location of the organization at the location of the separate division. In practice, a separate division may be closed. How to fill out 2-NDFL in this case, there is a separate explanation from the Federal Tax Service of Russia in ConsultantPlus: Federal Tax Service in connection with incoming requests from tax agent organizations regarding the submission of information on the income of individuals and the amounts of personal income tax in Form 2-NDFL (hereinafter referred to as certificates in Form 2-NDFL) and the calculation of amounts of personal income tax , calculated and withheld by the tax agent (form 6-NDFL) (hereinafter - calculation according to form 6-NDFL), in the event of liquidation (closing) of a separate division of the organization, reports the following. |

| Help number | A unique serial number in the reporting tax period assigned by the tax agent. When submitting a corrective or canceling certificate by a tax agent, in place of the previously submitted one, indicate the number of the primary one. When submitting a corrective or canceling certificate by the legal successor of the tax agent - the number of the previously submitted certificate by the tax agent. |

| Reporting year | Tax period for which the certificate was prepared |

| Sign | Indicate:

As a result of a technical error, the personal income tax for the resigned employee may not be fully withheld, but the 2-NDFL certificate for him has already been submitted to the tax office. After the tax period, do I need to submit two income certificates for it at once? See ConsultantPlus about this Fulfillment by the organization of the obligation to report the impossibility of withholding tax and the amount of tax in accordance with clause 5 of Art. |

| Correction number | Indicate:

A certificate of income of an individual whose personal income tax was recalculated for previous tax periods in connection with the clarification of his tax obligations is drawn up in the form of a corrective certificate. In the form of the revocation certificate, fill out the title, as well as the indicators of section 1 indicated in the previously submitted certificate. Sections 2 and 3, as well as the Appendix, are not completed. A sample of the correct completion of the cancellation certificate in form 2-NDFL is available in ConsultantPlus: Alpha LLC made a mistake when submitting certificates for 2021: the certificate in relation to I.I. |

| Submitted to the tax authority (code) | Four-digit code of the Federal Tax Service, to which the tax agent submits the income certificate. The first 2 digits are the region code, and the second two are the number of the Russian Federal Tax Service inspection in the region. |

| tax agent name | When submitting a certificate by a tax agent - a legal entity or a separate division, indicate the abbreviated name (in case of absence - the full name) of the organization in accordance with its constituent documents. If a legal successor, then the name of the reorganized organization or its separate division. When submitted by an individual recognized as a tax agent, indicate the full last name, first name, patronymic (if any) without abbreviations - in accordance with his identity document. In the case of a double surname, use a hyphen. |

| Form of reorganization (liquidation) (code) | Indicate the code in accordance with Appendix No. 2 to the Procedure:

Required when filling out the “Characteristic” field with a value of 3 or 4. |

| TIN/KPP of the reorganized organization | Accordingly, the TIN and KPP of the reorganized organization or its separate division. If you are not filing 2-NDFL for a reorganized organization, the fields “Form of reorganization (liquidation) (code)” and “TIN/KPP of the reorganized organization” are not filled in. Required to fill out when filling out:

|

| OKTMO code | Code of the municipality on whose territory the organization or separate subdivision is located. OKTMO codes are contained in the All-Russian Classifier of Municipal Territories OK 033-2013 (OKTMO). In free spaces to the right of the code value (if it has 8 rather than 11 characters) no symbols are placed. Individual entrepreneurs, private notaries, lawyers and other private practice specialists recognized as tax agents indicate the OKTMO code at their place of residence. Individual entrepreneurs recognized as tax agents who are registered at the place of activity in connection with the use of UTII or PSN, in relation to their employees, indicate the OKTMO code at the place of their such registration. The legal successor of the tax agent indicates the OKTMO code at the location of the reorganized organization or its separate division. |

| Telephone | City telephone code and contact telephone number of the tax agent, through which, if necessary, reference information regarding the taxation of personal income, as well as the credentials of this tax agent, can be obtained. |

As you can see, there are a number of features in filling out the 2-NDFL certificate during reorganization. All of them are listed in an accessible form in ConsultantPlus:

The legal successor submits certificates with the attribute “3” or “4” when it is necessary to report for the reorganized organization (clause 2.7 of the Procedure for filling out the 2-NDFL certificate).

Read completely.

Filling out section 1 of the income certificate

| FIELD | HOW TO FILL OUT |

| TIN in the Russian Federation | Identification number of an individual confirming his registration with the tax authority of the Russian Federation. If the tax agent does not have information about the TIN of the income recipient, they do not fill it out. |

| Surname Name Surname | Without abbreviations in accordance with the identity document. The middle name may be missing if it is not indicated in the identity document. For foreign citizens, it is permissible to indicate the last name, first name and patronymic in letters of the Latin alphabet. |

| Taxpayer status | Taxpayer status code:

As you can see, in relation to a non-resident foreigner, you also need to fill out certificates in form 2-NDFL. of how to do this in ConsultantPlus: In October 2021, the organization hired a citizen of Tajikistan, a non-resident of the Russian Federation, under an employment contract with a salary of 45,000 rubles. |

| Date of Birth | Date, serial number of month, year - by sequential writing in Arabic numerals. |

| Citizenship (country code) | Numerical code of the country of which the individual is a citizen. According to the All-Russian Classifier of Countries of the World (OKSM) (approved by Resolution of the State Standard of Russia dated December 14, 2001 No. 529-st). If you do not have citizenship, indicate the code of the country that issued the identity document. |

| Identity document code | Taken from Appendix No. 1 to the Procedure:

|

| Series and number | Details of the taxpayer’s identity document – series and number, respectively. The “No” sign is not placed. |

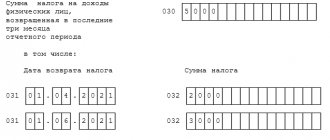

Filling out section 2 of the income certificate

The totals are shown here:

- accrued and actually received income;

- calculated, withheld and transferred personal income tax at the appropriate rate specified in the “Tax rate” field of section 2 of the certificate.

| FIELD | HOW TO FILL OUT |

| Total income | The total amount of accrued and actually received income, excluding deductions from Section 3 and Appendix to the certificate |

| The tax base | On which the tax is calculated. The indicator corresponds to the amount of income from the “Total Amount of Income” field, reduced by the amount of deductions from Section 3 and the Appendix. If the amount of deductions in Section 3 and the Appendix exceeds the total amount of income, indicate 0.00. |

| Tax amount calculated | Total tax amount calculated |

| Amount of tax withheld | Total amount of tax withheld |

| Amount of fixed advance payments | The amount of fixed advance payments accepted to reduce the amount of calculated tax |

| Tax amount transferred | Total amount of tax transferred |

| Amount of tax over-withheld by the tax agent | Indicate:

|

| Amount of tax not withheld by the tax agent | The calculated amount of tax that the tax agent did not withhold in the tax period |

In case of payment of income during the tax period to an individual recipient, taxed at different rates, fill out the required number of pages of the certificate. Then, on the second and subsequent pages of the certificate, fill out “TIN”, “KPP”, “Certificate Number”, “Reporting Year”, “Characteristic”, “Adjustment Number”, “Submitted to the tax authority (code)”, section 2 and, if necessary section 3. The remaining fields of the certificate are filled in with dashes.

When filling out a certificate with sign 2 or 4 :

| FIELD | HOW TO FILL OUT |

| Total income | The amount of accrued and actually received income from which personal income tax is not withheld by the tax agent, reflected in the Appendix |

| Tax amount calculated | Tax amount calculated but not withheld |

| Amount of tax withheld Tax amount transferred Amount of tax over-withheld by the tax agent | Zero (0) |

| Amount of tax not withheld by the tax agent | The calculated amount of personal income tax that the tax agent did not withhold in the tax period |

If you paid income to an individual, but were unable to withhold tax from it, you must report this to the Federal Tax Service (clause 5 of Article 226 of the Tax Code of the Russian Federation). To do this, you need to fill out a 2-NDFL certificate with sign 2. A sample of correct completion if it is impossible to withhold personal income tax is available in ConsultantPlus:

In December 2021, at the request of an employee who is a tax resident of the Russian Federation, the organization paid for his treatment, the cost of which was 45,000 rubles.

The specified amount is not returned by the employee. The employee was not paid any other income in cash in December 2021. See sample filling.

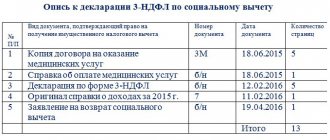

Completing Section 3

The information is shown here:

- about standard, social and property tax deductions provided by the tax agent;

- relevant notifications issued by the tax authority.

| FIELD | HOW TO FILL OUT |

| Deduction code | Selected from Appendix No. 2 to the order of the Federal Tax Service dated September 10, 2015 No. MMV-7-11/387. For a complete list of deduction codes for 2-personal income tax, see a separate file here. Accountants are usually confused about the last 620 code on this list. It is open in nature, because it reflects “other amounts that reduce the tax base...”. Which deductions are reflected by code 620 in 2-NDFL, see ConsultantPlus: Each deduction has its own code. At the same time, deduction code 620 reflects other amounts that reduce the tax base for personal income tax, for which... (read more). |

| The amount of the deduction | Amounts of deductions corresponding to the specified code |

| Notification type code | Indicate:

|

| Notification number Date of issue of notice Code of the tax authority that issued the notification | If notifications are received more than once, the tax agent fills out the required number of pages of the income certificate. |

Here are a few features of filling out section 3 of the income certificate:

| SITUATION | HOW TO FILL OUT |

| Providing deductions corresponding to different codes during the tax period | Fill in the required number of fields “Deduction Code” and “Deduction Amount” |

| The number of deductions provided during the tax period exceeds the number of fields allocated for filling them out | Fill out the required number of help pages. On subsequent sheets of the certificate, fill in the fields “TIN”, “KPP”, “Page”, “Certificate number”, “Reporting year”, “Characteristic”, “Adjustment number”, “Submitted to the tax authority (code)”, “name tax agent", "Deduction code", "Deduction amount". The remaining fields are filled in with dashes. |

| Failure to provide deductions during the tax period on income taxed at the appropriate rate | The fields “Deduction Code” and “Deduction Amount” are not filled in |

| When there are no notifications | The fields “Notification type code”, “Notification number”, “Date of issue of notification” and “Code of the tax authority that issued the notification” are not filled in |

Filling out the Income Certificate Appendix

Here is information about income accrued and actually received by an individual:

- in cash and in kind;

- in the form of material benefit.

Fill out by month of the tax period and corresponding deductions, for each personal income tax rate.

| SITUATION | HOW TO FILL OUT THE APPENDIX TO 2-NDFL |

| Filling out a certificate form with sign 1 or 3 | Indicate in the appropriate fields:

|

| Filling out a certificate form with sign 2 or 4 | Indicate the amount of income actually received, from which personal income tax is not withheld by the tax agent |

Standard, social and property tax deductions are not reflected in the Appendix to the income certificate.

By the way, the Appendix to the 2-NDFL certificate reflects vacation pay. How to do this correctly, see ConsultantPlus here.

| FIELD | HOW TO FILL OUT |

| Help number Reporting year Tax rate | The corresponding certificate number, reporting year and tax rate at which personal income tax is calculated, reflected on the corresponding sheet 2-NDFL |

| Month | In chronological order - the serial number of the month of the tax period for which income was accrued and actually received |

| Revenue code | Selected from Appendix No. 1 to the order of the Federal Tax Service dated September 10, 2015 No. MMV-7-11/387. For a complete list of income codes for 2-NDFL, see a separate file here. An individual can receive paid goods/work/services as income. Usually here the accountant has difficulty deciding which income code to indicate in the certificate - 2510 or 2520. This situation is discussed in detail in ConsultantPlus: Let us note that the Order does not establish new types of income, but only codes those defined by the Tax Code of the Russian Federation. |

| Amount of income | The entire amount of accrued and actually received income according to the specified income code |

| Deduction code | Selected from Appendix No. 2 to the order of the Federal Tax Service dated September 10, 2015 No. MMV-7-11/387. For a complete list of deduction codes for 2-personal income tax, see a separate file here. Indicate if the amount of the corresponding deduction is available. For the relevant types of income for which appropriate deductions are provided or which are not subject to personal income tax in full, indicate the deduction code selected from the specified document. |

| The amount of the deduction | Should not exceed the amount of income indicated in the corresponding column “Amount of Income” |

For income from transactions with securities and derivative financial instruments (Article 214.1 of the Tax Code of the Russian Federation), from repos with securities (Article 214.3 of the Tax Code of the Russian Federation) and from loans with securities (Article 214.4 of the Tax Code of the Russian Federation) in relation to one income code may be Several are indicated . In this case:

- the first deduction code and its amount are indicated below the corresponding income code;

- other codes and amounts of deductions are indicated in the corresponding columns in the lines below;

- the fields “Month”, “Income Code” and “Income Amount” opposite such codes and deduction amounts are filled in with dashes.

If the tax agent accrued to an individual during the tax period income taxed at different rates, sections 1, 2 and 3 (if necessary), as well as the Appendix, are filled out for each of the rates.

As for lawyers, they can receive different types of income - remuneration for providing legal assistance to the client, for performing work duties, as well as other types of remuneration. Which income code to indicate for each situation, see ConsultantPlus:

A lawyer has the right to enter into labor relations as an employee in the event of carrying out scientific, teaching and other creative activities. Income from the work of a lawyer as an employee is indicated in the 2-NDFL certificate with code... (read more).

Instructions for filling out certificate No. 460

Let's look at how to fill out the certificate under discussion. In the form in which we know it now, it was approved in 2014 through the issuance of a presidential decree.

If a citizen fills out the form independently, he has the right to enter the following data:

- using a computer;

- on other printing devices.

In this case, each completed sheet must be signed by the employee or citizen filling out the paper.

Step No. 1 – fill out the title page

The title page is completed first.

Help title page

- At the beginning, indicate the full name of the employee who provides information to the organization. Abbreviations are not allowed. Filling out is done exactly as this data is indicated in the citizen’s main document.

- If the certificate is filled out for a family member, his full name is also indicated, and one of the options in the column where the family ties between the employee and the specified person is indicated is mandatory.

- Next, the real date of birth of the person is indicated, the day, month, year is completely written down, similar to the information indicated in the citizen’s passport.

- From the order in hand on the appointment of this employee to a specific position, the organization - place of work, as well as the position into which the employee entered, is rewritten in the full name.

- Next, enter the place of residence of the person, according to his registration, current on the day on which the certificate is provided. It is necessary to rewrite the data from the passport without making mistakes. Enter: region;

- city or other populated area;

- Street;

- house;

- apartment;

- zip code of the post office corresponding to your place of residence.

If a citizen’s registration is temporary, it must be indicated in brackets after the main one. If there is no main one, a temporary one is entered instead.

If the person filling out the form or his relatives do not live at the place of registration, then after the official address the actual address is indicated in brackets.

Step No. 2 – fill out the first section with information about income received

The income of an employee or members of his family means cash receipts in any form that occurred during the period for which reporting is provided.

First Help Section

Clause 1. Funds received as wages at the place of employment.

This column includes the income that the employee received in the government organization where he occupies any of the above positions for the temporary period of providing up-to-date information. The vessels enter the full amount of funds received. You can find it in the 2-NDFL form issued by the accounting department.

Help 2-NDFL: sample filling

Don’t know how to fill out the 2-NDFL form? You can familiarize yourself with this topic on our portal. Step-by-step instructions, a sample form, and how to avoid basic mistakes when filling out the declaration.

If the transition to a position occurred during the period for which reporting is provided, it is necessary to enter the funds received in the previous position or place of work in the column for income of a different nature.

Clause 2. Funds received in the form of income from activities of the following nature:

- pedagogical;

- and/or scientific.

In this period, enter the amount of income received if the employee carried out activities of a pedagogical nature, as well as scientific ones. A 2-NDFL certificate with its value can be obtained at the place where an agreement on teaching and conducting scientific work on a reimbursable basis was concluded. This column also includes the writing of teaching aids and other works that are the intellectual property of the person submitting form No. 460.

If this activity was carried out at the main place of employment, then this column is not filled in, and the income is entered into the first paragraph of the section in question.

Clause 3. Income received from activities of a creative nature.

Inside this column is entered the amount of funds received that were paid to the citizen for conducting creative activities, for example:

- writing literary works;

- painting;

- creation of sculptures;

- production of photographs for further implementation in print;

- writing music;

- filming videos, etc.

Clause 4. In lines number two and three, enter amounts received in the form of grants from the state or organizations of an international or other nature, which will be used as support for culture, art, scientific and educational activities.

Clause 5. Money received for deposits made in credit institutions is entered in the column with the appropriate name. It will contain data on interest received for the temporary reporting period from bank deposits or deposits from other types of credit organizations. It does not matter in what currency the deposit is made.

Note! Funds received from a deposit that was closed during the reporting period must also be indicated.

If funds were received not in rubles, but in the form of foreign currency, then they must also be recorded in translation into Russian rubles, according to the current exchange rate indicated by the Central Bank of the Russian Federation

Clause 6. Funds received from securities and for equity participation in organizations of a commercial nature. In this column, enter the amount of funds received, which can be:

- money issued as a result of dividing the profit received by the organization, minus tax fees, according to the size of the shares of each shareholder, in other words - dividends;

- interest on deposits or debt obligations from domestic individual entrepreneurs or Russian representative offices of foreign companies;

- money received from transactions carried out with securities of value, while the securities themselves are entered in section of the form under discussion under number 5.

Clause 7. Other income is indicated in the appropriate line. These include:

- pension accruals;

- sums of money due to pensions, which play the role of an additional payment assigned by the state to certain categories of citizens;

- various benefits issued on a permanent or temporary basis, for example, benefits for pregnant women or those who gave birth, social benefits, etc.;

- funds for maternity capital, if they were used in full or in part during the reporting period;

- alimony received for a child or yourself;

- scholarship accruals;

- any subsidies related to solving housing problems that were received during the reporting period;

- rent for renting the property of the employee filling out the form;

- funds received as a result of the sale of real estate and other types of property, for example, a car;

- money resulting from the sale of valuable securities or parts of commercial companies;

- money earned as a result of work carried out in conjunction with the main place of work;

- remuneration paid to an employee as a result of concluding civil contracts;

- income from the operation of engineering networks and communications of various types;

- donated money;

- compensation for harm caused to the employee’s health;

- payments that reimburse the costs of obtaining additional qualifications;

- inheritance;

- payments of an insurance nature;

- funds due to the employee upon dismissal from the 2-NDFL form from the previous place of employment;

- financial rewards for people who donate blood, plasma and other components;

- financial assistance of a charitable nature provided to the employee or his relatives;

- all payments to disabled people or pensioners, as well as minor children, that are compensatory in nature, for example, reimbursement of funds spent on vouchers to sanatoriums, etc.

- prizes for participation in events such as lotteries and other types;

- business trips;

- reimbursement of travel expenses to a vacation spot during vacation.

Step No. 3 – fill out the second section

This section must be completed only if the time period covered by the report contained cash receipts from purchase transactions:

- cars;

- cottage and other residential real estate;

- shares;

- securities of value.

Second part of the form

As a result of completed transactions, expenses incurred must exceed the total receipt of funds over the past 36 months.

Let's give an example. You present certificate No. 460 at your place of work, and in 2021 you bought a country house. By summing up the income received from 2014 to 2021, you get an amount less than the cost of the purchased property, therefore, indicate the transaction in the second section of the form.

If funds provided by government agencies were used during the purchase of property, you are in any case required to provide this information.

In the corresponding column for real estate owned by the employee’s family, indicate:

- location in the form of a full address;

- the amount of its footage.

For a motor vehicle enter:

- model;

- variety;

- belonging to a particular brand;

- when the car was released.

For securities of value:

- variety;

- issued by the legal entity.

Since the property was worth more than the income received over the past 36 months, a column must be filled in, inside which the source of incoming funds is shown. Its role may be:

- funds obtained through the labor of the wife/husband;

- other legal income of the employee;

- interest received on deposits made by the family;

- funds accumulated over the past year;

- money received by the heirs of a deceased relative;

- donated money;

- a loan taken for a targeted or non-targeted nature;

- funds received as a result of the sale of other property;

- rent;

- subsidy from the state;

- maternal capital.

The form for entering this source and indicating the circumstances in which the funds were acquired is free.

Step No. 4 – fill out section three

Paragraph 1. This part of the form contains information about real estate property that is in the possession of an employee or one of his family representatives. This includes:

- plots of land;

- subsoil;

- houses and other buildings that cannot be separated from the land without irreparable damage.

In addition, the following vessels are considered real estate:

- marine;

- space;

- air;

- inland navigation.

Clause 2. According to the list, the third section includes all real estate that belongs to an employee of the organization or his spouse and children, and the date of its acquisition does not matter.

In the type and name of property objects, you can specify land plots of the following type:

- garden - for growing berries, fruits, vegetables and other crops and recreation;

- garden - for growing vegetables, fruits, berries, and other crops on which various buildings can be erected;

- garden land - for growing any crops and farming, as well as erecting buildings;

- dacha land is for recreation, you can build the necessary buildings on them, in which you cannot register, but you can live, and the plot is also provided for growing crops.

Clause 3. By personal farming, which has the nature of subsidiary farming, the law means the cultivation and process of processing products represented by agricultural names. Land is suitable for its implementation, both within the city and beyond.

Clause 4. For the production of agricultural products, so-called personal plots are used, in addition, residential buildings and outbuildings are erected on them, complying with the regulations established by the state in the field of urban planning concerning aspects of:

- sanitary and hygienic;

- construction;

- environmental;

- preventing fires, etc.

If an employee owns a plot of land in a field, then a house cannot be built on it; it can only be used for production

As for the land for the construction of an individual building, it should be noted that the role of such a building is assigned to a residential house, standing separately from the rest, and the maximum number of floors for it is three units. One family should live inside such a house.

If an employee enters property for himself or his spouse or children into the third section in the form of a house suitable for habitation, a country house or a garden, he must also provide information on the plot of land on which the building is located.

Clause 5. When it is intended to include a dwelling in the form of an apartment, the following information about it is indicated:

- square;

- number of rooms;

- type, etc.

For a garage or place of storage of a vehicle, data is provided in the form of paper indicating its ownership.

Point 6. The line in which you need to enter the type of property implies one of the following answer options:

- share;

- joint;

- individual.

According to the Civil Code of the Russian Federation, property is in joint ownership if it belongs to several persons without determining the size of each person’s shares. In shared ownership, if the size of the shares is known. And individual, if there is only one owner.

For general property, all owners are indicated, regardless of whether their ownership shares are determined.

Clause 7. For real estate in Russia, enter:

- postcode;

- region;

- area;

- populated area;

- street;

- building number;

- apartment number.

For real estate located in another country they write:

- country of location;

- populated area;

- address.

The area of the name is entered in accordance with the documents confirming the ownership of the employee or his relatives. In addition, for each object in possession, it is indicated on what basis it was acquired, and from what source the funds for the acquisition came.

Clause 8. The subsection on vehicles contains data on those cars, motorcycles and other vehicles that are in the possession of the employee, no matter how long ago they were purchased and where the registration procedure was carried out.

The following must also be indicated within the certificate:

- stolen;

- used by third parties on the basis of a power of attorney;

- which are secured by a credit institution;

- not on the move;

- accounting for which has been discontinued.

If the car was sold before the reporting date, then it may not be indicated in the certificate.

Step No. 5 – fill out the fourth section

This section involves entering information on bank accounts. These include accounts not only of the employee himself, but also of representatives of his family, even if the reporting employee himself is not a client of this credit institution.

The fourth part of the form

Paragraph 1. It also contains information on metal accounts of an impersonal nature, that is, accounts actually in precious metals. In the corresponding columns you need to reflect the number of grams of precious metals available to the reporting person, as well as what their conversion into rubles will be.

In addition, they indicate accounts for salary bank cards issued at the place of work, while entering:

- Bank's name;

- in what form does the account exist?

- in what currency it is conducted;

- when it was opened;

- how much money is left on the plastic card during the reporting period.

Clause 2. The presence of credit or overdraft bank cards is also included in this part of the form. If there is a debt of more than half a million rubles, it must be written down in a specially designated section section.

Clause 3. In addition, existing accounts are reflected:

- settlement nature - for carrying out financial transactions represented in the conduct of business activities, and in addition for achieving the goals of non-profit companies;

- current nature - to perform actions that are in no way related to the conduct of business;

- trust management – for the purpose of conducting activities in the relevant area;

- by deposits – cash deposits made;

- specialized - for payment agents, subagents, clearing, nominee, escrow, etc.;

- deposit - for courts and other legal facilities.

The information indicated in the certificate form must be 100% consistent with the data entered in bank statements.

Filling out a line containing information about money accrued to the required account is done only in a situation where the total amount of financial injections for it is greater than the income of the employee and his spouse for the established reporting period plus the 24 months that have passed before it. For foreign currency accounts, values are indicated in rubles.

Clause 4. If a person’s account was closed before the reporting date or the banking organization through whose work it was created was liquidated before the specified deadline, it is not necessary to indicate it inside the form in question.

Step No. 6 – fill out section number five

This section of the form receives information regarding valuable securities held by the employee. The cash income coming from them also fits in, but its size is included in the first section.

Fifth part

Clause 1. In the appropriate columns, enter information about the valuable securities held by a citizen, an employee of the desired structure, and indicate:

- the organization that provides these papers;

- format of the organizational and legal structure of a given society.

Clause 2. Then they contribute the amount of capital in accordance with the charter of the organization, recorded through the presented indicators of the constituent documentation, corresponding to the date of reporting. If the capital is presented in foreign currency, then the entry is still made in rubles, according to the rate presented by the Central Bank of the Russian Federation.

Clause 3. In addition to information on shares, it is necessary to enter information about other securities, which may include:

- mortgages;

- bills of lading;

- checks;

- investment shares;

- certificates

- bills;

- bonds, etc.

Point 4. Having calculated the total cost of all securities in your hands that are valuable, you must indicate its value in the advising column.

Step No. 7 - fill out the sixth section

This part of the certificate contains information about the obligations of the employee and his family members that are of a property nature.

Clause 1. It contains information on the property represented by immovable objects that are in use by the employee providing the certificate or his relatives only temporarily, in addition, for this use it is necessary to have a basis in the form of an agreement.

We are talking about the following that are not owned by the employee:

- residential premises within which an employee of a government agency or members of his family live, without concluding a rental agreement or drawing up other documents of this kind;

- apartments or other objects rented in accordance with a signed lease agreement, use free of charge or rental of a social nature.

In this case, it is necessary to enter data on the total area of the item under discussion.

This part of the section is completed by those citizens who do not live in the locality where they work or serve, but are there temporarily, on a registration basis, which is also temporary in nature.

Clause 2. The following must be entered:

- type of object;

- is it rented or used free of charge;

- for how long the dwelling is occupied;

- on what basis did the employee and his family receive the right to live there (contract, etc.).

Clause 3. In terms of monetary obligations of an urgent nature, the family’s debts amount to more than half a million rubles. It is described in the corresponding line what it is:

- credit;

- loan, etc.

Note! An employee can be either a debtor or a party providing funds, so the correct person must be indicated in the line containing information about the creditor or debtor.

Clause 4. Based on the basis for the occurrence of financial obligations, an agreement or other regulatory act is prescribed that confirms the existence of the debt.

Clause 5. The amount of the obligation is entered in the column with the same name, the amount of the obligation, that is, the unpaid balance, is indicated next. It does not matter whether the money is taken in foreign currency, the description in any case is made in rubles, according to the Central Bank of the Russian Federation exchange rate.

The terms of the existing obligation contain information on:

- interest rate;

- whether any property is pledged against it;

- what guarantees were provided;

- whether there was a guarantee.

In addition, all documents accompanying the loan are included. This also includes official agreements regarding participation in construction of a shared nature; at the same time, they must enter data on the state registration procedure that the object under construction has undergone.

BC help for civil servants: how to fill out the form correctly

SPO "BK Help" is aimed at automating document flow and significantly simplifies the work process for both taxpayers and inspection authorities. A more detailed description and step-by-step instructions for filling out can be found in our special article.

Video – Educational film “Filling out income certificates”

Certification of income certificate pages

| FIELD | HOW TO FILL OUT |

| I confirm the accuracy and completeness of the information specified in this Certificate | Indicate:

|

| surname, name, patronymic signature | Last name, first name, patronymic (if any) of the authorized person who submitted the certificate, and his signature |

| Name and details of the document confirming the authority of the representative of the tax agent (successor of the tax agent) | Filled out in case of submission of a certificate by a representative of the tax agent (his legal successor). |

Do I need a stamp on the 2-NDFL certificate? There is a separate explanation about this in ConsultantPlus: read here.

Why does the employment center need a certificate of average earnings?

The amount of unemployment benefits assigned depends on the income the citizen received at his last place of work. Therefore, in accordance with paragraph 2 of Art. 3 of Law No. 1032-1, when registering, the employment service requires you to provide a certificate of average earnings for the last three months.

The amount of average earnings indicated in the certificate will be paid to the unemployed citizen during a certain period of searching for work. If the certificate is not submitted, the benefit will be calculated based on the minimum wage established by law on the date of registration.

Example of filling out an income certificate

Let’s assume that Alexander Alexandrovich Sergeev worked at Alpha LLC in 2021 and received the following income:

- January – 22,000 rubles: salary;

- February – 22,000 rubles: salary (17,000 rubles) + sick leave (5,000 rubles);

- March – 22,000 rubles: salary;

- April – 22,000 rubles: salary;

- May – 22,000 rubles: salary;

- June – 52,000 rubles: salary (22,000 rubles) + bonus (10,000 rubles) + vacation pay (20,000 rubles);

- July – 2,000 rubles: salary;

- August – 22,000 rubles: salary;

- September – 22,000 rubles: salary;

- October – 22,000 rubles: salary;

- November – 22,000 rubles: salary;

- December – 22,000 rubles: salary.

Total: 274,000 rub.

For each month of 2021, Alpha LLC provided A.A. Sergeev receives a standard deduction for the first child.

Next, a sample income certificate in form 2-NDFL for A.A., fully correctly filled out by the accounting department of Alpha LLC. Sergeev , see ConsultantPlus HERE .

The employer is obliged to issue a 2-NDFL certificate to a resigned employee if during the calendar year he was unable to withhold personal income tax from his income. In this case, it must be filled out taking into account a number of features that are disclosed in ConsultantPlus:

Read the complete solution.

Read also

01.09.2020

Special requirements

As for the informational part, that is, directly the amount of the employee’s income, some social security authorities require this information to be presented in the form of a table. It looks something like this:

| Month | Total amount of payments (RUB) | Withheld (RUB) | Issued by hand (RUB) |

| October | 10 000 | 1 300 | 8 700 |

| november | 10 000 | 1 300 | 8 700 |

| December | 10 000 | 1 300 | 8 700 |

| Total | 30 000 | 3 900 | 2 6100 |

So that the employee does not waste time, and the accountant does not redo the certificate again, it is better to find out in advance in what form the data should be presented.

Attention! One of the purposes of a salary certificate is to receive a subsidy for housing costs. In this case, it should contain data not for 3, but for 6 months . This is the requirement of paragraph 32 of the Rules for the Provision of Subsidies, approved by Decree of the Government of the Russian Federation of December 14, 2005 No. 761.

This is important to know: Inventory act of goods and materials: sample 2021