Sick leave to care for sick parents: registration

Sick leave is a standard form. You can’t do without it to:

- confirm the need to release the employee from work for the specified number of days;

- justify receiving benefits for the missed period of time.

To obtain a certificate of incapacity for work, which is issued to care for parents, you must go to the clinic to see a doctor who is treating them. The doctor will issue a document in the following situations:

- The patient definitely needs proper care. Otherwise, a significant deterioration in the condition may occur and the likelihood of death will increase;

- the patient cannot be admitted to hospital treatment because there are serious contraindications;

- There is no one to care for the patient except adult children. It is for one of them that the sick leave is issued.

Only a medical professional representing a licensed medical institution has the right to issue a document.

To receive it you must submit:

- passport of a citizen of the Russian Federation;

- documents confirming that the sick person is the parent of the person in whose name the certificate of incapacity for work will be issued;

- patient's medical card;

- conclusion of a medical commission on the need for constant care for the patient.

Deadline for issuing a strict reporting form

For the care and appropriate treatment of a sick relative, a strict reporting form is issued for seven days. The maximum period is 30 days , but after approval by the medical commission.

To care for a child under seven years old, 60 days are given; for diseases specified in the resolution of the Ministry of Health, the period will be 90 days. If the child’s age is more than 15 years, then parents are given a strict reporting form for only three days, but by decision of the commission the period can be 7 days.

If the child is disabled and under the age of 15, then the parents are exempt from work for 120 days. In case of HIV infection, sick leave is not limited when staying with a sick child. This also applies to relatives staying with children with post-vaccination consequences.

Also, the following restrictions are not imposed on adults with children under adulthood:

- Accommodation with the right of departure.

- whose parents received radiation exposure.

- The children got the disease as a result of radiation exposure from their parents.

If an employee stays with a child for more than the specified period, then he cannot be fired under any article. If the employer does not comply with this, then he may be held administratively liable for failure to comply with labor legislation. The employee will not be fired, but they will not be required to pay him for this period.

Sick leave certificates can be issued alternately to parents , and in the event of the second child falling ill during the illness of the first child, one strict reporting form is issued, in which all patients are included. It opens when the first case of the disease occurs, and closes only after the children have fully recovered.

If the person caring for the child becomes ill, then a strict reporting form on his illness is opened for him. And child care is either extended or opened to another relative.

In order to competently and correctly fill out a document of incapacity for work in cases of illness of the baby, we advise you to read the article “Rules for issuing sick leave for child care.” And if neither you nor your relatives are sick, but you still want to miss one or two working days, then read the article “How to take sick leave if you are not sick” and you will learn about all the legal and illegal ways to obtain a certificate of incapacity for work.

Reasons for refusal to issue a sick leave certificate

A medical institution will not issue sick leave to care for a parent:

- who has a chronic disease and has entered a period of remission - an improvement in health;

- undergoing treatment in a hospital;

- while the employee is on vacation with pay (regular, annual) or without it (at his own expense).

When the father or mother is still unwell and the employee's vacation has ended, he is granted sick leave for care from that day, which is a working day.

Pivot table

To understand how long it is allowed to care for a child and for how many days benefits will be paid, we have prepared a table that shows the maximum periods of sick leave depending on the age of the child and the features of payments. Please note: on April 10, a new version of Order of the Ministry of Health No. 624n came into force, and the corresponding amendments are already being taken into account.

| Patient's age | Duration of sick leave | Period of paid absence from work (during the year) |

| Up to 7 years | The entire treatment period | No more than 60 days For diseases from the Order of the Ministry of Health and Social Development dated February 20, 2008 No. 84n - no more than 90 days |

| From 7 to 15 years | 15 days, unless the period is changed by the medical commission | No more than 45 days |

| Over 15 years old | For outpatient treatment - up to 3 days By decision of the medical commission - up to 7 days | No more than 7 days per sheet No more than 30 days |

| Disabled person under 18 years old | The entire period of treatment, regardless of whether it is carried out at home or in a medical organization | No more than 120 days |

| HIV-infected person under 18 years of age | The entire period of joint stay in an inpatient treatment facility | No limits |

| Cancer patient under 18 years old | The entire treatment period | No limits |

Parents, grandparents and guardians should be aware that each of them may require a certificate of incapacity to help a sick child. And the above norms will apply to everyone separately.

But keep in mind that sick leave is not always issued. For example, if a mother is on leave to care for another child or on maternity leave, then she will not be given a certificate of incapacity for work to treat a sick baby. But the attending physician can issue such a document for the father or grandmother.

Duration of sick leave to care for parents

A company employee can legally claim sick leave to care for his father or mother. But the number of days is limited. First, the health worker issues a document for at least three days, and then, if the situation has not improved, for a few more days, but in general, no more than seven. This applies to outpatient treatment.

When one of the parents needs surgical intervention and subsequent inpatient therapy, the maximum period for which paid sick leave is issued is 30 calendar days:

| Who is sick | Number of payment days (maximum) | Clarification |

| Parents | 30 7 | Overall for the year Ambulatory treatment |

Sick leave is not issued for more than thirty days in one calendar year.

To care for your parents for a longer period of time, you will need to take time off. It can be annual or at your own expense. When the employer does not agree to this option, you will have to quit your job completely.

When parents turn 80, they can apply for social benefits. But the prerequisites for this are: the person must not work and be of working age. The monthly payment is 1200 rubles.

How many days do they give?

A certificate of temporary incapacity for caregiving can be issued for a limited number of days. After the first doctor's appointment, sick leave is issued for 3 days, then it can be extended to 7 days. A patient may have several cases of sick leave for up to 7 days. However, the total duration of sick leave should not exceed 30 days per year.

If this time is not enough to care for a parent, then the employee can take leave at his own expense at the discretion of the director.

Does the number change if mom or dad is considered elderly?

The number of days remains unchanged in accordance with clause 35 and clause 36 of the Procedure established by Order of the Ministry of Social Development No. 624n dated June 29, 2011. The exception is caring for bedridden patients, children under 15 years of age and patients with diseases requiring surgical intervention.

Funds to pay for sick leave

An employee who cares for sick parents receives money calculated according to the certificate of incapacity for work at the cash desk of his enterprise. Sick leave is paid from the Social Insurance Fund. The FSS reimburses the money given to the employee as payment for a certificate of temporary incapacity for work in full. Fund:

- sends them to the company’s account;

or:

- the company transfers contributions to the Social Insurance Fund, the amount of which is reduced by the amount of funds issued for sick leave.

The assignment of benefits and calculation occurs no later than ten days after the employee submits the document. The money is paid on the next payday of the company.

Who can be issued a sick leave certificate?

The recipient of the leaflet can be either a citizen of the Russian Federation or a person temporarily residing or temporarily staying in the country. The main condition is that a person applying for sick leave must be insured in the compulsory social insurance system of the Russian Federation and insurance premiums must be paid for him.

Insured persons include those who:

- works under a concluded employment contract;

- is a state or municipal employee;

- fills a state or municipal position;

- is a member of a production cooperative and participates in its activities through his labor;

- refers to clergy;

- has the status of: lawyer, individual entrepreneur, member of the peasant association, notary, member of the family community of indigenous peoples of the north. At the same time, he participates in the insurance system and pays contributions;

- was injured or fell ill within a month after termination of work under a previously concluded contract.

The following may also receive a BL in accordance with the procedure established by law:

- a woman dismissed due to the liquidation of the employing organization, or a woman who ceased working within the framework of a previously carried out private practice, if her pregnancy occurred no earlier than a year before she was declared unemployed;

- a citizen who has a temporary disability, is officially recognized as unemployed, and is registered at the labor exchange;

- citizens of other states and stateless persons temporarily staying in Russia if they have lost the ability to work in production or due to an occupational disease.

How is the amount of sick leave payments calculated?

The company's accountant calculates the amount due to the employee based on two indicators:

- Duration of insurance period.

- Average salary per month. The employee’s earnings for the last two years are taken into account.

The first indicator determines whether the entire accrued amount is paid, or only part of it. The benefit percentage is determined by the insurance period:

| Insurance experience, years | % of sick leave payments |

| 0,5-5 | 60,0 |

| Up to 8 | 80,0 |

| 8 and more | 100,0 |

Important! When an employee has up to six months of experience, payments are also made, but the minimum wage is taken into account.

Example 1.

Accountant Smirnova E.R. cared for her seriously ill father from March 20 to 31. He was undergoing outpatient treatment. Smirnova received sick leave for seven calendar days: from March 20 to 26. For the remaining days, vacation is at your own expense.

Data for calculating benefits:

| Indicators | Values |

| Insurance experience, years | 7,5 |

| % benefit | 60,0 |

| Annual salary, rub.: 2015 2016 | 305 000 312 000 |

- Let's calculate the average earnings per day:

- Benefit amount (80%, since the length of service is up to 8 years):

854,79·7·0,8 = 4 786,82

Smirnova will receive an allowance of 4,786.82 rubles (minus personal income tax) in her next salary.

How benefits are calculated

The following factors influence the amount of payment:

- the total insurance length of the employee in whose name sick leave was issued to care for parents;

- the amount of his earnings for the previous 2 years, which is taken into account for the average;

- number of days on sick leave.

The benefit amount is calculated using an algorithm;

- The total income for 2 years is determined:

- number of calendar days during this time;

- by dividing the amount of income by the number of days, the average daily earnings are obtained;

- the resulting amount is multiplied by the number of working days on the certificate of incapacity for work.

The calculated amount is adjusted in accordance with the employee’s length of service. It will be paid:

- completely, if the service has not been interrupted for more than 8 years;

- in the amount of 80% with work experience from 5 to 8 years;

- 60% of the calculated amount is paid to employees whose work experience does not exceed 5 years;

- based on the amount of the minimum wage on the day the sick leave was submitted, if the employee worked for no more than 6 months. Today the minimum wage is 9,489 rubles.

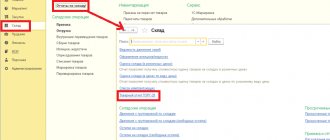

Registration in the sick leave report for caring for parents

An employee of an enterprise is obliged to warn his management that he has been issued sick leave to care for his parents. The official whose responsibilities include maintaining a time sheet records the code “B” or “19” in the document next to his last name. This means that the employee is absent from the enterprise due to his sick leave, for which payment will be made.

When the period of temporary incapacity for work has ended, and the parents continue to need care, the employee, in agreement with the employer, has the right to take leave. Then, on the timesheet, the employee’s absence days can be marked as follows:

- OT (or 09) – paid annual leave.

- DO (16) – leave without pay, granted with the permission of the employer.

If an employee does not notify the manager on time about the reason for his absence from work, the following entry will appear on the timesheet:

NN (30) – absences for unknown reasons.

Registration procedure

Applying for sick leave for parents or adult relatives is not difficult. First, you need to contact any medical institution for help.

A public or private clinic must have a license to provide services and issue certificates of incapacity for work.

If a person needs outpatient treatment and care during an illness, the doctor must ask who will be with the sick person. A sick leave will be issued for this person.

The latter may need documents confirming the relationship, because when registering a sick leave, a relationship code is entered in a special column.

The document must be not only a passport, but, for example, a birth or marriage certificate.

In practice, verbal assurance is usually sufficient, so the doctor agrees to issue a sick leave even to a close person of the sick person who is not related to him by blood.

A sample sick leave form can be used when filling out the document. What does a maternity leave sheet look like? Find out here.

Accounting for payments of sick leave benefits for parental care: postings

In accounting, to reflect transactions containing the accrual of hospital benefits, account 70 is used. The entries in the accountant’s documents are as follows (numerical data of example 1):

| Explanation | Debit | Credit | Amount, rub. |

| Calculation of benefits using Social Insurance Fund funds | 69 | 70 | 4 786,82 |

| Withholding personal income tax (personal income tax) | 70 | 68 | 622,29 (4 786,82·0,13) |

| Benefit paid to employee | 70 | 51 or 50 | 4 164,53 (4 786,82-622,29) |

Missing entry:

| Dt 20 (or 23, 25, 26, 44 - depending on which part of the production the employee works in) | Kt 70 |

This entry is not used, since the entire amount of the benefit is issued from the Social Insurance Fund. The company does not pay for the first days of illness of an employee - this is precisely the operation described by the missing posting.

How is the calculation done?

They can only officially apply for payment of a certificate of incapacity for work.

those who have formalized their employment relationship with the employer, socially insured persons or those who are independently insured with the Social Insurance Fund.

The amount to be paid is affected by length of service and salary level.

The main value required for calculation is the average daily income of the employee for the two years preceding the occurrence of the insured event. Further calculations are made as a percentage of this value (60, 80 or 100% depending on length of service).

The exception is cases of child care on an outpatient basis. In this case, the first ten days are paid on a general basis, and then in the amount of half the daily wage.

If the employee’s length of service is less than 6 months, then he will be paid in accordance with the minimum wage.

The responsibility for providing information about wages at previous places of work, when the period of service with the last employer is less than 2 years, lies with the employee. He must request the appropriate certificate from the old employer and provide it to the personnel department of the new one. Otherwise, the payment amount may be less than possible. If providing a certificate is difficult (the employer has ceased to exist, is located in another city, does not respond to requests), then this is not the end. At the request of the employee, the employer can request this data from the Pension Fund.

If the onset of the need to care for a loved one was preceded by parental leave, then it is possible that during this period the average earnings will be less than what they were during working hours. This is due to the fact that there is a maximum limit on maternity benefits, and after the child turns 1.5 years old, in many regions it stops being paid altogether.

In this case, it is necessary to submit an application with a request to replace this period with a worker prior to going on vacation. This should only be done when the period change will increase the total amount payable to the employee.

Is the bonus included in the calculation of holiday pay? You can find out by reading our article. Find out how to properly fire a pensioner by reading our article.

A sample voluntary resignation letter can be found here.

Is it possible to have two sick days at the same time?

An employee may well submit two sick leave certificates to the company’s accounting department at the same time. It is possible that they refer to the same period of time. A similar situation arises, for example, when an employee, while on sick leave to care for his parents, falls ill himself or goes on leave under the B&R. He receives two certificates of incapacity for work, which were issued due to various insurance events. The periods of release from work partially overlap.

The HR department employee who receives such documents checks their accuracy and transfers them to the accounting department for calculating benefits. It is logical that double payment is not charged for the same period of time. Therefore, if there are two sick leaves, benefits are paid only for one of them.

There are exceptions to the rules. For example, at the time of receiving the second sick leave, the employee’s insurance period increased and the percentage of payment increased. Then the first sheet is paid before the day the second is issued. Payment for the latter is made taking into account the increasing length of insurance coverage.

Who is eligible?

First of all, their adult able-bodied children who temporarily leave production have the right to receive sick leave to care for sick parents.

But other family members also have the right to care for them and receive benefits. According to family law, spouses, their children, and parents of spouses are considered members of one family. But brothers and sisters of older people, uncles and aunts are also considered close relatives.

Sometimes a distant relative may agree to provide care, which is also permitted by law for the payment of sick leave benefits.

Family law emphasizes that people who are not related by blood to the sick person, for example, guardians, educators or pupils, are also considered family members.

Persons who have the right to sick leave to care for an elderly person do not necessarily have to live with him in the same apartment or house.

Conditions

In order for an employee to be able to issue sick leave with subsequent payment, certain conditions must be met:

- An important condition for one of the relatives to receive sick leave benefits is the actual care of the person. If falsification is discovered, the court will subsequently recover the amount paid, despite the fact that the medical institution issued a certificate of temporary incapacity for work.

- The second important condition is treatment at home. When a doctor has diagnosed a disease, it is important that he prescribe outpatient treatment; if a sick parent should be sent to an inpatient department, it is assumed that medical staff will take care of him there, so the relative is not entitled to sick leave. If in the future he needs care at home, one of his relatives or loved ones can take out sick leave for his care.

- Another condition is the employment of the caring person. He must be an adult and officially employed; a certificate of incapacity for work is not issued to caring pensioners.

Legislation

Legislative acts of the Russian Federation consider and establish various aspects of the legal relationship between the employee and the state that arise in the situation of temporary disability.

Federal Law No. 255 on social insurance describes cases when a person is entitled to sick leave and how long it can be taken, as well as who can be cared for in order to be guaranteed benefits.

The rights of citizens of the Russian Federation regarding temporary disability are also protected:

- Labor (Articles 124, 183) and Tax (Articles 217, 255) codes;

- Law No. 323 (2011) on the fundamentals of health protection;

- Resolution No. 375 (2007) approving the Regulations on the procedure for calculating benefits in case of temporary disability;

- Order No. 624 (2011) on the procedure for issuing sick leave.

Features of obtaining sick leave for individual entrepreneurs

An entrepreneur who is officially engaged in individual business transfers funds to the Pension Fund and the Social Insurance Fund. Therefore, as a participant in the insurance system, he has the right to sick pay. To receive benefits, an individual entrepreneur must:

- Contact a doctor at the clinic and apply for a sick leave certificate.

- Submit an application to the local branch of the Social Insurance Fund, which contains a request to pay for the period of incapacity for work and transfer the funds to the specified account.

- Prepare copies of receipts confirming the availability of contributions to the Social Insurance Fund.

- Submit documents to the local FSS office.

Sick leave payment amount:

- depends on the individual entrepreneur’s work experience;

- determined by the minimum wage.

The benefit amount is calculated as follows:

Example 2. Individual entrepreneur G. Yu. Belova received an exemption from work to care for her sick mother from April 3 to April 7 of this year. She regularly paid funds to the Social Insurance Fund. Belova has three years of insurance experience.

Payment is made in the amount of 60%, since Belova has less than five years of experience. In the part of the sick leave form that is filled out by the employer, the following is written in the line for the place of work: Individual Entrepreneur and Last Name. Below: registration number, TIN, SNILS.

Important! Individual entrepreneurs should conclude an agreement with the Social Insurance Fund in advance and make regular payments. Then getting sick leave to care for your father or mother will not be difficult.

Calculation of the number of paid days

Sick leave for caring for a sick relative is subject to payment for different periods, depending on the category of the sick family member.

When caring for a child aged 7-15 years, the maximum paid period does not exceed 45 days during the calendar year. For parents whose children are over 15 years old, such sick leave does not exceed 7 days.

Family members can apply for sick leave for up to 60 days when caring for a child under 7 years of age. The limit on the paid period increases to 90 days if a child is diagnosed with a pathology included in the register of the Ministry of Health and Social Development of the Russian Federation. Details of the extension are specified in Order of the Ministry of Health and Social Development of Russia No. 84n.

120 calendar days is the paid limit when caring for a child under 18 years of age with a disability.

The law provides for the removal of limits on the number of paid days for family members caring for an HIV-infected child under 18 years of age. The same is true for children under 18 years of age who have complications after vaccination. Sick leave is paid for the entire period of stay of a relative with a patient undergoing inpatient treatment in a medical institution.

For reference. Exceeding the established limits does not entail dismissal. Since absenteeism is due to a valid reason, the employee retains the job. However, these days are not paid.

Sick leave to care for a sick adult relative undergoing outpatient treatment is issued for a period not exceeding 7 days. The benefit is paid regardless of the pathology.

In accordance with Article 6 “Conditions and duration of payment of benefits for temporary disability” of Federal Law No. 255-FZ, the total period of the paid period for all cases of illness can be up to 30 days within one year.

For how long is sick leave issued?

At its core, sick leave serves as a valid reason for absence from work and for receiving monetary compensation for missed workdays. The state has established maximum periods of sick leave for various categories of citizens.

It is especially difficult for those families in which there is a relative whose health condition requires the constant presence of an assistant. Caring, especially for elderly patients, is an open-ended mission that rarely fits into 7 days of sick leave.

Questions are often asked: Is sick leave required to care for a bedridden relative who has been paralyzed after a stroke? Is sick leave issued to care for an elderly mother? Can I get sick leave to care for my spouse after brain surgery? In all these and many other cases, the answer will be the same: it is possible, but no more than 7 calendar days per individual case.

Family members have to make difficult choices between work and proper care for a loved one. After all, often the time frame when a patient needs outside help is much longer than the required 7 days of sick leave. And for the care of chronic patients in remission, sick leave is not issued in principle. The solution to a difficult situation may be to contact a nursing service, which will provide a qualified nurse.