Inventory of goods in a warehouse is a check to clarify data about the inventory and material assets stored in it. The research results are compared with the information specified in accounting and financial documents. Such an audit allows you to timely identify surpluses and theft in production.

When is it necessary to conduct a warehouse inventory?

There are scheduled and unscheduled inspections. The first type of procedure is carried out once a year according to the approved schedule. The second type of audit is appointed by the company's management or regulatory authorities in the presence of special circumstances.

The list of special cases is prescribed in Federal Law No. 402 of 2011. Such situations include:

- change of management or transfer of ownership and management of the company;

- reduction of more than 50% of the workforce;

- transfer of the organization to another form of ownership;

- fact of theft, illegal use of property, damage;

- complete or partial destruction of stocks as a result of an emergency.

Emergency situations mean events related to force majeure. These include floods, fires, hurricanes and other disasters not related to human factors. Below we will look at how inventory is carried out correctly in a warehouse and what documents are drawn up at the end of the event.

Business Solutions

- shops clothing, shoes, groceries, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

Documents for download.

- – a decision by the manager about all the steps that need to be taken regarding the event. At large enterprises, several copies of the form are allowed for different types of warehouse inventory. Most often, a large number of orders are created when it is necessary to conduct an audit of several premises within one company.

- – required in 2 copies to record the total upon counting of products. The documents are kept by the employee being inspected and in the accounting department.

- previously issued (INV-4 form) - filled out for items received for which there is no payment. For such positions there are special conditions for the transfer of ownership rights. The form classifies them into two categories: revenue not received due to delays and due to non-arrival of the payment date.

- , which is kept by the employee responsible for savings (INV-5 form) - all inventories are taken into account. The receipt for the form indicates which items need to be capitalized or written off. Facts of disagreement with accounting data in the accounting department are recorded in the statement (form INV-19).

- not arrived at the warehouse (INV-6) - appropriate for accounting for products that were not delivered due to long-term transportation, are delivered, they are declared with the appropriate notes during the inventory of goods in the warehouse; we will consider in more detail below how to correctly carry out such a check.

Who conducts the warehouse inventory?

Control of balances is carried out at the initiative of the head of the company to compare the actual amount of inventory with the total data specified in the documents. The event makes it possible to establish natural loss that occurs in the process of spoilage and other reasons not related to the human factor, arithmetic and technical errors in primary documentation, misgrading, deficiencies and excesses.

The procedure for conducting inventory in a warehouse is regulated by the provisions of the Methodological Instructions approved by Order No. 49 of the Ministry of Finance of June 13, 1995; if a theft or suspicion of theft is detected, third-party services are involved. These include independent expert commissions, auditors, representatives of law enforcement agencies and the tax service. Representatives of each type of inspection are included in the firm’s commission and approved by issuing a special order.

Composition of the commission

The recount is carried out in the presence of the employee responsible for storage, but he is not included in the commission. This is approved by an order issued by the manager. In a small company, at least three people are appointed, in a large enterprise - from 6 people. It is recommended to appoint the following specialists:

- chief accountant or his deputy;

- director or deputy of the company;

- head of the department;

- representative of the logistics department;

- security or security officer of the company;

- employee responsible for compliance with labor rights.

The composition of the commission when conducting inventory in a warehouse is selected at the discretion of the manager. The goal is to ensure an efficient recount. The inspection must include the equipment necessary for weighing and counting, as well as the appropriate equipment for counting and transportation. If the number of employees in the commission is approved less than the minimum allowable number, the results of the event will be considered invalid.

Product inventory

The inventory list of goods subject to safe storage is carried out according to a special form. Entries in the inventory are made by responsible persons based on inspection of the goods. An inventory of goods subject to safekeeping is drawn up in two copies. An inventory is prepared indicating the name, quantity, types (grades), price of goods deposited for safekeeping of goods, as well as the date, place, number and date of creation of documents on acceptance of goods for safekeeping. When conducting an inventory of cargo accepted for safekeeping, not only the requirements of general regulatory documents in this area are taken into account, but also special regulatory documents relating to specific areas and industries.

Inventory of goods accepted for safekeeping is carried out sequentially in the order of their placement in the warehouse. For this purpose, a plan map is used, which indicates the location of goods accepted for safekeeping at the time the inventory begins.

Types of inventory

Full inventory control involves recalculation and comparison of all property in the enterprise. Objects that the company rents are also subject to inspection.

Partial audit is a study of only some goods and values. If a shortage is identified during the event, the scope of inspection expands.

Selective - implies the recalculation of only certain types of stocks or values.

Scheduled – assigned according to the approved schedule. The list of objects to be studied is determined by the director.

Preparatory work

The warehouse is being put in order. Many people have a question: where to start, how to carry out inventory in a warehouse effectively. Initially, documents are prepared for the commission related to receipts, write-offs, movements and other operations (damage, loss, expenses) for the period under review.

In papers relating to the previous reporting period, o. Preparing them allows you to speed up the audit process and promptly detect discrepancies between facts and the source document.

The financially responsible person gives the sorted package of papers to the commission for signature. Documents on inventories written off as expenses are attached to all inventories. The write-off is certified by a signature.

We also have:

Warehouse information services

Renting a warehouse for storing personal belongings: how to choose to suit your needs?

Basic concepts and terms in logistics

| Tell your friends about us! |

Warehouse inventory procedure

According to the rules for conducting inventory, matching statements are prepared at the warehouse. During the recalculation process, they will be updated with current information related to the discrepancy in fact with the information in the documents. The data is entered into a single register in which all statements and inventories are recorded. At the end of the procedure, a conclusion is drawn up according to the information in the register.

Goods that are temporarily in the warehouse are recorded in a separate statement. All facts of discrepancy, including absence, must be recorded. The financially responsible person must be at the workplace during the registration of such a disagreement. If ambiguous situations are detected, the copies are re-compared with the information from the generated report.

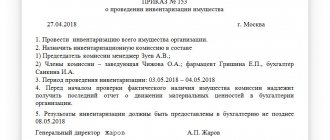

Step 1. Issue an order to conduct an inventory

The issuance of an order is the beginning of the inventory process. The order is drawn up in any form or on a form (INV-22). It states the reason for the inspection, the composition of the commission, the list of stocks or objects being inspected, the date and deadline for completion.

Sample document

The order is drawn up in accordance with the norms of office work in a printed version according to the sample. This order is given for familiarization to all members of the inventory commission against signature on the document.

Step 2. Property audit

A warehouse audit is the identification of the actual availability of stocks and balances. The information is recorded in the inventory in sections: type of product, grade, article and other important identification data in accordance with paragraph 3.15 of the Methodological Instructions. Comparison is carried out through reweighing and re-measuring. information is entered into the statement only upon the fact of recount; recording from the words of, including the interested person, is not allowed. The following are subject to mandatory audit:

- names on the way;

- goods issued for which payment has not been received;

- company assets stored on the premises of other companies;

- materials transferred for processing to other organizations.

The container is examined by the commission according to its type, condition and purpose of use in accordance with paragraph 3.26 of the Guidelines. If during the procedure it is necessary to receive new goods, they are accepted in the presence of the commission and placed in the receipt at the end of the inventory check. The fact of receipt is recorded in a separate statement.

If the inventory regulations in the warehouse are violated, the inspection period is delayed, the release of products is allowed after written permission from management. The released goods are recorded in a separate statement, and the issue is carried out in the presence of the commission. If the financially responsible person has several storage facilities at his disposal, the inspection is carried out gradually. After completing the inspection of the premises, they seal it with a sealer and proceed to inspect the next one.

Rules for conducting an inventory of warehouse balances

The number of inventories in the reporting year and the dates of their conduct are determined by the head of the organization. However, regardless of the adopted accounting policy, according to paragraph 2 of Article 12 of the Law “On Accounting”, an inventory is mandatory (see box “Regulatory Documents”).

In accordance with paragraph 1.6 of the Guidelines for taking an inventory of property and financial obligations in the event of collective (team) financial liability, inventories are carried out when there is a change in the team leader (foreman) or dismissal of more than 50% of the team’s employees, as well as at the request of one or more members of the team (team).

Thus, at least one inventory must be carried out at the warehouse during the year - before drawing up annual reports. Naturally, the more often inventories are carried out, the more accurate the accounting data and the clearer the “photograph” of the property status of the enterprise. However, it is worth keeping in mind that this process is expensive, associated with the intense and monotonous work of a large number of employees (and not only warehouse workers). Moreover, often carrying out an inventory makes it very difficult, or even completely paralyzes, the work of the warehouse. Therefore, although no one questions the effectiveness of inventory as a commodity accounting tool, it should still be used with caution.

Regulations

ARTICLE 12 of the Law “On Accounting”. Carrying out an inventory is mandatory in the following cases:

when transferring property for rent, redemption, sale, as well as during the transformation of a state or municipal unitary enterprise;

before preparing annual financial statements;

when changing materially responsible persons;

after revealing facts of theft, abuse or damage to goods;

in the event of a natural disaster, fire or other emergency situations caused by extreme conditions;

during the reorganization of the enterprise.

In addition to the inventory itself, control checks of its results are also carried out. The need for this no less complex procedure arises when one of the interested parties does not agree with the results of the inventory or when the initiative for verification comes from the outside (for example, at the request of the parent organization of the holding).

Very often, inventory means a prompt, random check of goods, for example, when analyzing a customer’s complaint about a shortage during delivery. This kind of inventory is an equally interesting topic that requires special attention. However, in our article we will be interested only in product inventories, which are carried out by order of the manager, and checks based on the results of such inventories.

PREPARATION FOR INVENTORY

When organizing inventory and control checks of stocks, it is necessary to take into account the structure of the warehouse, since warehouses of enterprise divisions can be independent accounting units or be part of other accounting units. The classification of warehouses as independent accounting units is determined by the head of the organization on the recommendation of the chief accountant (or accountant - in the absence of a chief accountant position on staff). In departments whose warehouses are not independent accounting units, inventory in warehouses is carried out simultaneously with inventory of work in progress.

for reference:

Inventory is a method of checking the compliance of the actual availability of assets listed on the organization’s balance sheet, their safety and correct storage, obligations and rights to receive funds with accounting data. The purpose of the inventory is to ensure the reliability of accounting and reporting data. In addition, this is one of the most effective mechanisms of internal control over the safety of the property of organizations, the completeness and timeliness of settlements under business contracts and obligations to pay taxes and fees, compliance with legal requirements in the implementation and accounting of financial and economic activities, timely identification of errors in accounting and making corrections to accounting and reporting data.

The procedure for conducting inventories in an organization involves the creation of an inventory commission consisting of the head of the enterprise or his deputy (chairman of the commission), the chief accountant, heads of structural divisions (services), and representatives of the public. The commission also includes representatives of the security service, technologists (logistics) and other specialists. Alternatively, employees of the enterprise’s internal audit service or independent audit organizations can be invited to conduct the inventory. The absence of at least one member of the inventory commission during the inventory serves as grounds for declaring the inventory results invalid.

Such a commission works constantly, including during the inter-inventory period, ensuring the completeness and accuracy of the reflection of data on the actual balances of fixed assets, inventories, goods, cash, other property and financial obligations included in the inventories and acts. The tasks of the commissions also include determining specific names, types, groups of stocks of goods subject to inspection, as well as the timing of the inspection.

The personnel of the permanent inventory and working (counting) commissions is approved by the head of the enterprise, about which an administrative document is issued in the form INV-22 - Order (resolution, instruction) on conducting an inventory. The document on the composition of the commission (order, resolution, instruction) is registered in the Logbook for monitoring the implementation of orders (decrees, instructions) to conduct an inventory in the INV-23 form.

The head of the organization also has the responsibility to create conditions for an accurate and complete calculation of the actual availability of goods within the established time frame, to provide the commission with employees and equipment for rehanging, counting and moving goods. The results of the inventory must be reflected in the accounting and reporting of the month in which it was completed, and the results of the annual inventory - in the annual financial statements.

CONDUCTING INVENTORY

Before checking the actual availability of property, the commission must receive the latest incoming and outgoing documents or reports on the movement of goods and funds at the time of inventory. The chairman of the inventory commission endorses all incoming and outgoing documents attached to the registers (reports), indicating “before inventory on (date),” which should serve as the accounting department’s basis for determining the balance of goods by the beginning of the inventory according to accounting data.

on a note

We prepare matching statements. Matching statements are compiled for goods, during the inventory of which deviations from the accounting data were identified (INV-19 “Comparison sheet of inventory inventory results”). Such statements reflect the results of the inventory, that is, the discrepancies between the indicators according to accounting data and according to inventory records. The amounts of surplus and shortage of inventory items are indicated in accordance with their assessment in accounting. To document inventory results, unified registers can be used, which combine the indicators of inventory lists and reconciliation sheets.

For commodity assets that do not belong to the enterprise, but are listed in the accounting records (those in safekeeping, rented, received for processing), separate matching statements are compiled. Matching statements can be compiled using computer and other organizational technology, or manually.

According to the same Methodological Instructions for the inventory of property and financial obligations, financially responsible persons give receipts stating that by the beginning of the inventory, all expenditure and receipt documents for the goods have been submitted to the accounting department or transferred to the commission and all goods received under their responsibility have been capitalized, and the disposed assets are written off as expenses. The receipt form must be attached to the inventory forms. Checking the actual availability of goods is carried out only with the direct participation of materially responsible persons.

When inventorying a large number of weighted goods, the sheets of plumb lines are kept separately by one of the members of the working (counting) commission and the materially responsible person (forms INV-3 “Inventory list of inventory items” or INV-5 “Inventory inventory of inventory items accepted at responsible storage"). Inventory must be filled out in ink or ballpoint pen clearly and clearly, without blots or erasures. The names of the goods being inventoried, their quantity and expiration date are indicated in the inventory according to the nomenclature, and in the units of measurement used in accounting.

Errors are corrected in all copies of the inventory by crossing out incorrect entries and placing the correct ones above them. All corrections made must be agreed upon and signed by all members of the counting commission and financially responsible persons. Please note that in no case should you leave blank lines in the inventory (such lines are crossed out on the last pages).

Regulations:

When preparing and conducting an inventory, be guided by the following documents:

1. Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n “On approval of Guidelines for accounting of inventories.”

2. Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49 “On approval of the Methodological Guidelines for the Inventory of Property and Financial Liabilities.”

3. Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

4. Resolution of the State Statistics Committee of Russia dated March 27, 2000 No. 26.

The inventories are signed by all members of the counting commission and financially responsible persons. At the end of the inventory, financially responsible persons give a receipt that they confirm:

inspection of property by the commission;

absence of any claims against members of the commission;

acceptance of the property listed in the inventory for safekeeping.

The receipt form must be attached to the inventory forms.

If the inventory of goods is carried out over several days, then the premises where the goods are stored must be sealed when the inventory or working (counting) commission leaves. During breaks in the work of the inventory or counting commissions, the inventory must be left in a box (cabinet, safe) in a closed room where the inventory is carried out. If materially responsible persons discover errors in the inventories after the inventory, they must immediately (before the warehouse opens) report this to the chairman of the inventory commission. Based on these statements, the specified facts will be verified and, if confirmed, the identified errors will be corrected in the prescribed manner.

On a note:

We carry out control checks. Upon completion of the inventory, control checks of the correctness of the inventory can be carried out. They should be carried out with the participation of members of inventory commissions and materially responsible persons before the opening of the warehouse where the inventory was carried out.

The results of control checks of the correctness of the inventory are documented in act INV-24 “Act on the control check of the correctness of the inventory of valuables.” They are registered in the book INV-25 “Register of control checks of the correctness of inventories.”

MOVEMENT OF GOODS DURING INVENTORY

During inventory, it is prohibited to move goods between warehouses and rearrange them to other storage cells. Inventory assets received during the work of the commission are accepted by financially responsible persons in the presence of members of this commission and are accounted for according to the register or commodity report after inventory.

Such inventory items are entered into a separate inventory under the name “Inventory items received during inventory” (form INV-3 “Inventory inventory of inventory items”). This description indicates:

- receipt date;

- Supplier name;

- date and number of the receipt document;

name of the product, its quantity, price and total amount.

At the same time, on the receipt document signed by the chairman of the inventory commission (or on behalf of the chairman or member of the commission), an o is made with reference to the date of the inventory in which these values are recorded.

During a long-term inventory, in exceptional cases and only with the written permission of the head and chief accountant of the company during the inspection process, goods can be released to customers in the presence of members of the commission. For this product, form INV-2 “Inventory Label” must be filled out, which indicates the quantity of goods before and after release. Moreover, after shipment, the INV-4 form “Inventory report of goods shipped” is drawn up for the released goods. A note is made in the expenditure documents signed by the chairman of the commission or, on his instructions, a member of the commission.

How to take inventory?

Step 1. The head of the enterprise issues an order to create an inventory commission.

Step 2. The commission prepares an inventory plan, which indicates:

- inventory zones;

- employees who will conduct recounts in the specified zones;

- time frame for conducting recalculations in each specified zone.

Step 3. The head of the enterprise approves the inventory plan.

Step 4. The head of the enterprise issues an order to stop for the duration of the inventory:

- movement of goods within warehouse units;

- movement of goods to other enterprises;

- shipment of goods to customers.

Step 5. The head of the enterprise issues an order on the composition of the working (counting) commissions, according to the inventory plan.

Step 6. The inventory commission prepares inventories of inventory items.

Step 7. The chairman of the inventory commission receives receipts from financially responsible persons that by the beginning of the inventory, all expenditure and receipt documents for goods have been submitted to the accounting department or transferred to the commission and all goods and materials received under their responsibility have been capitalized, and those disposed of are written off as expenses. .

Step 8. The inventory commission instructs employees appointed by order to the working (counting) commissions on conducting recalculations and filling out inventories of inventory items.

Step 9. After the recount, the inventory commission checks the correctness of filling out the inventory lists of inventory items. If there are no comments, the data is entered into the inventory processing program. If any shortcomings are found, members of the counting commission, together with members of the inventory commission, re-count the goods.

Step 10. If discrepancies are detected between the recalculation data and the accounting data of certain items of goods, the inventory commission prepares inventories of inventory items for re-counting.

Step 11. According to the inventory lists of inventory items, the working (counting) commission recounts the goods.

Step 12. The inventory commission checks the correctness of filling out inventory lists of inventory items. If there are no comments regarding completion, the data is entered into the inventory processing program. Otherwise, the goods will be re-counted.

Step 13. Based on the results of the second recount, the inventory commission prepares comparison statements of the results of the inventory of inventory items.

Step 14. All inventory documents are transferred by the inventory commission to the enterprise accounting department for further processing.

Step 15. If discrepancies are detected between the inventory results and accounting data, accounting staff may take the initiative to conduct a control check of the inventory results.

Step 16. The head of the enterprise issues an order to create a commission to conduct a control check of the inventory results.

Step 17. The commission draws up an act of control verification of the correctness of the inventory of valuables and conducts control recalculations of goods. The results are agreed upon with all members of the inventory commission and entered into the accounting journal.

Separate inventories are compiled for goods shipped, not paid on time, stored in warehouses of other companies, or goods in transit. The inventories of each individual shipment of still “travelling” goods indicate the name, quantity and value, date of shipment, as well as the list and numbers of documents on the basis of which these values are recorded in the accounting accounts (form INV-6 “Act of Inventory of Materials and Goods, on the way").

In the inventory of goods shipped and not paid for on time for each individual shipment, the name of the buyer, a list of inventory items, amount, date of shipment, date of issue and number of the settlement document are given (form INV-4 “Inventory report of goods shipped”). Goods stored in warehouses of other organizations are entered into the inventory on the basis of documents confirming their delivery for safekeeping. The inventories for such goods and materials indicate the names of goods, quantity, grades, cost (according to accounting data), date of acceptance of the cargo for storage, storage location, numbers and dates of documents (INV-5 “Inventory list of inventory items deposited for safekeeping” ).

Business Solutions

- the shops

clothes, shoes, products, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

Step 3. Registration of warehouse inventory results

The results of the inventory audit are documented in a package of documents:

- inventory (INV-3);

- document on verification of shipped goods (INV-4);

- act of settlement for positions en route (INV-6);

- matching statement (INV-19).

Papers are generated confirming the facts of the shortage. If the culprit is not identified, such a discrepancy is recorded by postings:

- DT2 CT1;

- DT94 KT1;

- DT91/2 KT64.

There are limits to shortages that can be attributed to production costs. If the quantity of missing goods exceeds acceptable standards, additional investigations are ordered to identify the culprits and the reasons for the discrepancy. If the commission has identified the culprit of the shortage, the information is marked with the following entries:

- DT73 KT94;

- DT50 KT73.

The surplus is registered with the wiring DT1 KT91/1. Many people have difficulties with preparing the final documents for the audit in the warehouse; we will consider how the final stage is carried out below.

The concept of inventory and the need for it

Inventories are assets of an enterprise used as raw materials in the manufacture of goods, works or services produced for further sale to consumers. In other words, inventory items are everything that relates to the direct control of the organization.

In accordance with No. 120-FZ, inventory assets of each enterprise are subject to inventory. Moreover, the company and its structural divisions are required to regularly undergo this procedure.

Inventory – monitoring the availability of actual inventory items at an operating enterprise. Its main purpose is to verify the property owned by the company, the organization’s financial resources, and structural divisions recorded on the balance sheet.

End of the event

After drawing up the final documentation based on the results of the inspection, a protocol on the work of the commission is formed and discrepancies are calculated in monetary terms. This indicator can confirm losses or savings in production. The cause of the shortage is improper storage, theft, or negligence of the person responsible for the valuables. Excesses (savings) on a large scale appear as a result of dishonest work by employees or fraudulent actions with primary documents or accounting programs.

Persons found guilty of discrepancies between facts and accounting data are subject to financial liability. They compensate for losses by reimbursing the required amounts from earnings in the amount in accordance with the provisions of the liability agreement and the contract. The manager has the right to demote the guilty party in position, and in case of theft on a large scale, dismiss from the enterprise under the relevant article of the Labor Code or transfer the case to law enforcement agencies.

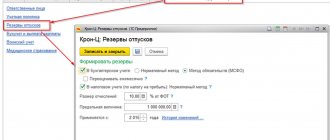

Inventory automation

Used to replace manual comparison with information collection using equipment. Such an audit helps reduce the likelihood of inaccuracies associated with the human factor. The labeling process is labor intensive. offers updated programs, for example, Warehouse 15 - for working under new reporting conditions, as well as projects for labeling different product groups.

Special mobile readers are used to read stickers and barcodes. Balances are recalculated through the database terminal. Information is entered into the database automatically for each item of goods. The advantages of the Cleverens automated check include:

- reducing the time for collecting and processing information by 2 times;

- there is no requirement to close the warehouse during the audit period;

- there are no errors due to human factors;

- the costs of introducing automation will pay off within 2 years;

- the risk of information distortion is minimized.

The implementation of automation is carried out in stages. Initially, a database is formed, in the appropriate sections of which information on property, goods, inventories and other material assets in the enterprise is entered. Each reporting unit is marked with a sticker or barcode, allowing you to find the position in the database. A scanner is used to read data from such stickers. The information is processed and stored in the database.

Matches are recorded immediately, and information about missing copies or missing items becomes available after the verification is completed. The terminal automatically notifies you of a shortage. The obtained data is recorded in electronic format and used for calculations and analysis. The Cleverence company offers software for automating business processes that allows you to label products and track statistics on which brands for a given item are delivered to the warehouse complex.

What not to do when taking inventory of inventories

During the audit, it is not allowed to mix items or transfer them for storage to other sections or premises. During the inspection period, the release of inventories and consumables to production is prohibited, except in situations where the need for release is confirmed by written permission from the manager.

If the inventory is being carried out over a long period of time, employees, including the head of the department, are not allowed to enter the territory without the presence of a commission. At the end of the working day, the object is sealed with the exact time indicated on the seal.

The inventory commission is carried out before drawing up the annual final documentation.

The results of the event are subject to mandatory documentation. At the end of the inspection, a protocol is drawn up, which is endorsed by the signature of the manager and the company’s seal. Inventory of goods in a warehouse is the only way to confirm the integrity of the storage of material assets in the company’s warehouse. Number of impressions: 18444

Factors for effective automated inventory of warehouse products

Automated inventory of warehouse products requires financial and personnel investments; to recoup the costs, it is necessary to provide for some nuances:

- Select which method to mark the product (barcode, RFID tag).

- Select a data collection terminal (DCT).

- Organize a rational system of addresses for storing goods in a warehouse (dynamic, static).

- Monitor the workload of warehouse personnel and maintain resource billing.

Online TSD in ABM WMS. Moving.