Home / Labor Law / Responsibility / Material

Back

Published: 04/29/2016

Reading time: 8 min

0

6793

At every enterprise, regardless of the type of its financial and economic activities, there is an acute issue of compliance with the amount of material assets in its warehouses and the available documentation.

Ideally, these indicators should coincide, but in practice this happens extremely rarely.

- How is product shortage determined during inventory?

- How to register a shortage? Within the normal rate of natural loss

- As a result of uncontrollable circumstances

- As a result of theft

On what basis is inventory carried out?

Let's start with the fact that for many people, the concepts of shortages and inventory are inextricably associated with trade. This is a fundamentally incorrect judgment. Inventory is necessary at any enterprise, regardless of the area of activity, including budgetary organizations .

In essence, an inventory is carried out to identify excesses or shortages of inventory items listed on the organization’s balance sheet. This may include goods, cash, furniture and even accounting documentation. According to the method of conducting, inventory can be planned or unscheduled. In the first case, this procedure is regulated by the regulatory documents of the enterprise. The frequency of inspection is set by the manager, depending on the turnover and specifics of the activity.

Emergency incidents may serve as grounds for an unscheduled inventory. For example:

- Suspicion of theft of goods;

- Fire in the warehouse;

- Sale of the enterprise.

In addition, the availability of inventory items can be checked when the person responsible for storage changes.

Reasons for conducting an inventory

Carrying out an inventory of goods and materials is an integral part of the work of any organization. There is a mistaken opinion that this is only necessary in those companies that are involved in trade. This is absolutely false. In fact, even in government agencies, the inventory procedure should be carried out in exactly the same way. Furniture, equipment, even documentation (work books) are material assets that are subject to evaluation and recalculation.

Inventory checks can be scheduled or unscheduled. In this case, it is necessary to follow the procedure and deadlines. All surpluses and shortages during the inventory must be clearly displayed in the documentation and properly executed.

The planned inventory must be carried out in accordance with the plans approved previously. They will be different for each organization. The frequency depends on the size of the organization and types of activities.

You can conduct an unscheduled inspection. The following events may be the reason:

- fire, natural disaster;

- change of financially responsible person;

- resale of the enterprise;

- industrial theft (or suspicion thereof).

To do this, it is necessary to issue an order within the enterprise indicating the date of inventory, responsible persons, as well as the basis for this inspection.

What is called a shortage?

24114899

This definition hides the shortage of something previously put on the balance sheet of the enterprise and taken into account in the accounting documentation. This applies to funds, goods and materials in safekeeping. The amount of the shortfall is usually deducted from the salary of the person responsible or the culprit.

Here it is necessary to clarify that the shortfall also includes the profit lost by the enterprise. For example, if a product cannot be sold due to its breakdown. This may include the expiration of the shelf life, when products have to be sold at reduced prices. In this case, the shortage will be considered the difference between the actual and estimated cost.

Step-by-step instruction

It is not always possible to write off shortages that are discovered after recounting products. Then the collection procedure must be carried out according to the following algorithm:

- First, you will need to draw up and sign an official act, in which you need to clarify the results of the re-accounting of goods or money.

- Next, you should issue an official notice to the employee about the withholding of a certain amount.

- Finally, you need to deduct from his salary. The employer must take into account that more than 20% of the funds cannot be withdrawn from the employee’s funds.

The deficiency can be recovered from the guilty person even if the employment relationship with him was terminated for some reason. If, based on the results of the repeated accounting of valuables, violations were discovered, then a report on the theft of products should be drawn up as quickly as possible and the employee should be fired.

What could cause the shortage?

Here are the following factors:

- Re-grading. For example, the store sells Krasnodar and Dutch apples. They are similar in appearance, but differ in cost. If Krasnodar products are mistakenly sold instead of Dutch fruits, there will be a shortage.

- Production costs. This may include the fact that some goods may fall apart during the sales process, which will also lead to shortages.

- Insurmountable circumstances. For example, as a result of a flood, warehouses were flooded and some of the products became unusable.

- Theft. This is the fault of employees who, using their official position, appropriate funds or goods from the company.

Read also: Corporate property tax in 2021

How is a shortage investigated?

The inventory assets of an enterprise are never ownerless, and a specific person from among the employees is responsible for them.

If a shortage is identified, an explanatory note is taken from such an employee, which sets out in detail the reasons for what happened. Such a note is drawn up in free form, but is always certified by the signature of the person guilty or suspected of the shortage. The employee is obliged to explain the reasons for the shortage within 2 days from the moment such a demand is presented to him. The degree of guilt of the employee is determined by the head of the enterprise. He also has the right to apply legal sanctions to those responsible. For example, to recover the amount of damages or to fire an unscrupulous employee. If we are talking about dismissal, the culprit must be familiarized with the relevant order within three days.

Dismissal due to shortage

Dismissal is a rather unpleasant moment, especially if it is accompanied by a conflict between the parties to the contract. And if a person is financially responsible and quits when there is a shortage, then the problem worsens even more.

It is important to know that a shortage is not a basis for refusing to terminate the contract. Failure to comply with the dismissal deadlines entails adverse consequences for the employer.

If a person decides to resign of his own free will, he must notify the director 14 days in advance. Upon receipt of the application, the employer is obliged to conduct an inventory of the property. Moreover, this must be done before the employee quits.

Having identified damage, management can recover an amount by issuing an order within the limits of average monthly earnings. If the amount is larger and there is no admission of guilt, or if the employee has already resigned, the employer will go to court to recover the shortfall.

The employee is obliged to attend the inventory, as well as transfer the material assets entrusted to him to the new responsible person. Refusal to participate in the inventory and write an explanatory note in the future may adversely affect the position of the specialist.

Termination of labor relations in the event of a shortage does not exempt the perpetrator from compensation for damage to the enterprise. If the shortage is proven in court due to the fault of the dismissed employee, the judge will oblige him to compensate for the damage caused.

Registration of identified shortages

When registering a shortage, its reasons are always taken into account. In particular, losses may be caused as a result of the fault of third parties or unforeseen circumstances. The fact of production costs is also taken into account. Separate types of accounting entries apply to each situation.

Natural loss

Let's say that a store sells flour. During packaging, some of the goods fall apart, which is written off as production costs. Let’s assume that during the reporting period, the shortage amounted to 2,000 rubles, excluding the trade margin of 500 rubles.

The accounting entry will be as follows:

- Debit 94/Credit 41 - 1,500 amount of deficiency;

- Debit 94/Credit 42 - 5 00 the size of the trade margin for unavailable products;

- Debit 44/Credit 94 - 1,500 cost of shortage within production costs.

Unseen circumstances

Let’s assume that a concrete mixer worth 15,000 rubles burned down at a construction company. Accrued depreciation amounted to 2,500 rubles, the culprits of the fire have not been identified.

This is shown in the reporting documentation as follows:

- Debit 94/Credit 01 - 15,000 initial cost of equipment;

- Debit 02/Credit 01 - 2,500 accrued depreciation;

- Debit 91-2/Credit 94 - 15,000 amount of deficiency.

Theft has been committed

For example, taking advantage of her official position, a store cashier embezzled 12,500 rubles. The fault has been established, the shortage will be deducted from the cashier’s salary in equal installments of 1,250 rubles per month.

It will appear in the accounting entry as follows:

- Debit 70/Credit 73 - 1,250 deduction from salary.

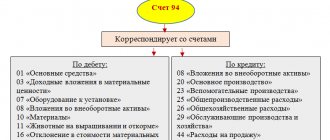

Registration and accounting of shortages

Production and economic costs must be confirmed by primary documents, and reports of damage and shortages are drawn up. You can develop document forms yourself or use existing ones. For example, TORG - 6, 15, 16, 20 and others, depending on the detected problem. The book value of the missing property is written off to account 94 “shortages and damage from loss of valuables.” The posting is based on the matching sheet and the inventory accounting sheet.

Shortage within the limits of natural loss

If a shortage is found that does not exceed the limits of natural loss, it is written off as production costs or selling expenses. The norms for natural loss are determined by law. They differ for all types of goods. If the norms of natural loss are not provided for this property, then the shortage is considered as excess.

DT - 20 (44, etc.), CT - 94

Shortage attributed to the financially responsible person

In other cases, check the documentation and reconcile account balances. After all, a shortage may be the result of errors in calculations, incorrect execution of reports, or lack of control on the part of the financially responsible person. If editing the documents did not help eliminate the deficiency, then responsibility for it falls on the MOL. The person responsible must draw up an explanatory note, which is attached to the results of the inspection. It will not be difficult to collect the amount of the deficiency from the financially responsible person. Damage from shortages is calculated at the purchase price, while lost profits in the form of trade margins are not taken into account. Formalize the decision to recover from the MOL by order. Withhold the amount of the shortfall from your salary partially or completely, but not more than 50%. The employer may also refuse to recover damages from the employee.

DT - 73, CT - 94

The perpetrators were not found or the court refused to recover damages

If there is no financially responsible person and the guilty person has not been identified or his guilt has not been proven, you will not be able to compensate for the loss from the loss of property. It will have to be written off as other expenses. In this case, it is necessary to confirm the validity of such a write-off:

- a court decision confirming the absence of the guilty person;

- a court decision refusing to recover damages from the perpetrator;

- conclusion about the fact of damage to valuables.

DT - 91.2, CT - 94

In addition to the organization’s employees themselves, your counterparty may also be responsible for the shortage. In this case, the amount of compensation is determined based on the terms of the contract and the norms of the Civil Code.

Registration and accounting of surplus

The surpluses identified during the inventory do not pose any problems for the accountant, but they must be taken into account. The basis for accepting the surplus for accounting will be a matching sheet or a sheet of accounting for inventory results. But there is no need to rush into accepting the surplus for accounting, because it may turn out to be the result of an error by an accountant or inventory commission. Then the error needs to be corrected.

Assets are taken into account at their current market value and in the same amount, the accountant recognizes other income. You can determine the market value of an asset yourself or invite an appraiser. Based on the assessment results, a certificate or appraiser's report is issued.

DT - 01, 08,10,41, etc., CT - 91.1

The inventory commission must determine the reasons for the surplus and obtain an explanation from the financially responsible person. In this case, no penalties are applied to the responsible person. However, management may reprimand him or deprive him of his bonus for disorder in the warehouse.

It is worth paying attention to the tax accounting procedure for surpluses. They are included in non-operating income and taken into account when calculating income tax. VAT-related consequences do not arise when surpluses are identified. When transferring them to production, VAT is also not required. However, in the event of further sale of discovered surpluses, VAT is charged in accordance with the general procedure.

Everything is at your fingertips in the program

Everything in Accounting is clear even to a beginner. Payments to employees, receipt and write-off of goods, reporting - an accessible interface, everything is at your fingertips. Previously, I worked in a popular accounting program: it was cumbersome, the database hung all the time, additional materials on legislation had to be searched on the Internet, and submission of reports took much more time.

Oksana Evteeva, accountant at IP Evteev (Bratsk)

Is it possible to write off the shortage?

The law provides for this possibility.

For example, a customer in a store accidentally dropped two bottles of expensive alcohol from the display case. This entails a shortage, but it will not be possible to recover losses from the buyer. Here, the store employee who was engaged in displaying the goods may be considered guilty. However, for each type of product there are certain standards, which are called distribution costs. If the amount of the shortfall does not exceed the established norms, it can be written off without any legal consequences. If, in the case of broken alcohol, distribution costs include the loss of 3 bottles, the shortage can be written off. However, this fact remains at the discretion of the manager.

General procedure for the employer

If a shortage is identified during the inventory, then the manager’s main task is to process and document everything correctly. If assistance from law enforcement agencies is required, then it is necessary to contact them as quickly as possible. Most often this happens if the shortage is a consequence of illegal actions of employees.

Next, depending on the situation, a decision is made on further actions: whether the shortage will be written off or whether it will need to be withheld from the guilty person, having previously identified him.

If the manager initiates the dismissal of an employee, then there is no need to wait the required 2 weeks (they only apply to leaving the company at will). You can fire someone even by issuing an order on the day of reviewing the results of the inventory. By the way, there are no restrictions here - the manager can fire any employee for such a gross violation.

Withholding the shortfall from the perpetrators

Typically, financial responsibility is negotiated during employment.

For example, a storekeeper will be fully responsible for the products in his warehouse. Department seller - for goods under his control. If a shortage is identified, losses are recovered from the salary of the responsible person. Here it is necessary to clarify that for shortages on particularly large scales, criminal prosecution is possible. However, this punishment does not exempt the culprit from compensation for losses caused. Read also: Depreciation bonus in 2021

Please note that financial liability can be personal or collective. The second option is often used in stores and supermarkets. For example, if a shortage is identified in the sausage department, the amount of the shortage will be covered by all employees who work here.

The amount is usually distributed in equal shares, regardless of whose shift the shortage occurred.

What to do if you don’t agree with the shortage?

Shortage in an enterprise is a difficult situation that leads to conflict between an employee and his superiors. If, after an inventory, a lack of property is revealed, management holds accountable the persons responsible for it. If you do not agree with the shortage or the calculated amount of compensation, the first step is to request from the employer all the documents on the inventory and investigation of the incident. The employee has the right to file a claim in court to appeal the employer’s actions.

Labor legislation provides for cases in which personnel liability for shortages is excluded. For example, the director’s failure to comply with the proper rules for storing property, force majeure, normal risks of the company, a consequence of extreme necessity or necessary defense. If such circumstances exist, the employee must indicate them in the claim.

It is important to know that if the employer does not agree to pay the damage, the employer will only be able to recover it in court. He will have to prove to the judge that you are guilty of the shortage.

At the meeting, you must petition to request the necessary documents that were not given to you. To prove your innocence, all available evidence is provided to the court, even witness testimony will do.

Art. 250 of the Labor Code of the Russian Federation provides that the court, at the request of the employee, may reduce the amount of compensation. This depends on the employee’s income, marital status, the degree and form of his guilt and other circumstances. The employee himself will have to prove their presence. However, they will not be completely exempt from paying damages.

A reduction in the amount of recovery is possible both with partial and full financial liability. As judicial practice shows, if an application to reduce the amount is not received, the judge himself must bring the issue up for discussion.

To protect your rights, it is better to contact our labor dispute lawyer. He will not only advise you on your situation, but will also prepare a statement of claim or objection to the enterprise’s statement in accordance with the law. Also, the lawyer will prove that the employee is not at fault, and if it is, he will challenge the amount of recovery and prove the need to reduce the amount of compensation.

How to properly contain shortages

If the loss does not fit into the distribution cost norms, it cannot be written off. In this case, deduction from the salary of the guilty or responsible person is applied. To ensure that everything happens within the framework of the law, the following rules are observed:

- A matching statement is prepared and a report on the fact of shortage is drawn up;

- The employee is given a written notice indicating for what and in what amount the deduction will be made from him;

- The form of compensation for losses is established: a one-time deduction or equal amounts, but not more than 20% of the total amount that the employee receives in hand.

Here it is necessary to clarify that recovery of damages is possible after the dismissal of the employee responsible for the shortage. However, such a procedure is performed only in court, and the employer will have to prove the employee’s guilt.

Recovery of damages

The employer must prove:

- absence of circumstances excluding the employee’s financial liability;

- illegality of the behavior of the harm-doer;

- the employee’s guilt in causing the damage;

- the causal relationship between the employee’s behavior and the damage that occurred;

- the presence of direct actual damage;

- the amount of damage caused;

- compliance with the rules for concluding an agreement on full financial liability (clause 4 of the resolution of the Plenum of the Armed Forces of the Russian Federation dated November 16, 2006 No. 52).

Failure to prove one of these circumstances excludes the employee’s financial liability. If the employer proves the above circumstances, the employee can prove the absence of his guilt in causing the damage.

The procedure for collecting damages is established by Article 248 of the Labor Code of the Russian Federation.

Collection of the amount of damage caused, not exceeding the average monthly earnings of the employee, does not require the consent of the employee and is carried out by order of the employer. However, such an order must be made no later than one month from the date of final determination by the employer of the amount of damage caused by the employee. If the month period is missed, then collection can only be carried out by the court. With such an amount of damage, it does not matter what kind of financial liability the employee bears - limited or full.

If the employee does not agree with this penalty, he has the right to appeal the employer’s actions in court.

If the amount of damage exceeds the employee’s average monthly earnings and he does not agree to voluntarily compensate for the damage caused to the employer, then recovery can only be carried out by the court. This procedure applies in a situation of full financial responsibility.

In any case, remember: based on Article 138 of the Labor Code of the Russian Federation, the total amount of all deductions for each payment of wages cannot exceed 20%.

EXAMPLE 2. REFLECTING THE SHORTAGE

The amount of the shortage that arose through the fault of the seller is 5,000 rubles, which does not exceed his average monthly earnings.

The seller’s salary is 20,000 rubles, minus personal income tax – 17,400 rubles. (RUB 20,000 × (100 – 13)%). A one-time deduction from the seller’s salary is possible in the amount of 3,480 rubles. (RUB 17,400 × 20%). Under such circumstances, the accountant of a trade organization will make the following entries: DEBIT 94 CREDIT 41

- 5000 rubles.

– a shortage of goods was identified based on the results of the inventory; DEBIT 73 CREDIT 94

- 5000 rub.

– an order was issued from the head of the company to collect the shortfall from the seller; DEBIT 70 CREDIT 73

- 3480 rub.

– withheld from the seller’s salary to compensate for damage in the first month; DEBIT 70 CREDIT 73

- 1520 rub. (5000 – 3480) – withheld from the seller’s salary for final compensation for damage in the second month.

An employee who is guilty of causing damage to the employer may voluntarily compensate for it in whole or in part. It is necessary to distinguish compensation from collection: the restriction on deductions from wages does not apply to compensation. By agreement of the parties to the employment contract, compensation for damage by installments is allowed. In this case, the employee submits to the employer a written obligation to compensate for damages, indicating specific payment terms.

What if the damage was caused by the fault of the manager?

Let us turn to the clarifications of the resolution of the Plenum of the Supreme Court of the Russian Federation dated 06/02/2015 No. 21 “On some issues that arose with the courts when applying the legislation regulating the work of the head of the organization and members of the collegial executive body of the organization” (paragraphs 5, 6).

In accordance with part one of Article 277 of the Labor Code of the Russian Federation, the head of the organization (including the former) bears full financial responsibility for direct actual damage caused to the organization. Bringing the manager to financial liability in the amount of direct actual damage is carried out in accordance with the provisions of Chapters 37 “General Provisions” and 39 “Financial Liability of the Employee” of the Labor Code of the Russian Federation.

In cases provided for by federal laws (for example, Article 53.1 of the Civil Code of the Russian Federation, Article 25 of the Federal Law of November 14, 2002 No. 161-FZ “On State and Municipal Unitary Enterprises”, Article 71 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies”, Article 44 of the Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies”, etc.) the head of the organization (including the former) compensates the organization and lost income (lost profits), caused by his guilty actions.

Sample documents

Inventory order

Inventory order

Inventory report

Inventory report sample

Report of shortage of goods

Report of shortage of goods

Features of shortages during inventory

Let us consider the features of the various circumstances that caused the shortage.

Production costs

The following factors are taken into account:

- Methods of transportation and storage;

- Production technology;

- Climatic and seasonal conditions.

For example, if a company is engaged in the production of concrete, then natural losses of bulk materials are explainable and secured by local regulations. Such standards are reviewed every 5 years.

Re-grading

Offsetting can be used here, and the shortage is written off as natural loss, but only for certain types of products. At the same time, the concept of regrading is not always applied. To do this, it is necessary that the products have similar characteristics, quantity and name, and one person must bear financial responsibility for both types of goods.

Technical losses

This aspect is inextricably linked with production technology and is not regulated at the legislative level. Therefore, acceptable standards are determined by each enterprise individually. It should be clarified that the approved limits should be based on calculations that reflect the characteristics of the transportation of raw materials and production cycles.

Theft

Based on Article 22 of the Labor Code, heads of organizations have the right to hold their employees financially liable. Here, the fact of a shortage is revealed by an inventory, the reasons and culprits are established. All these nuances are documented, and deductions are made from the salaries of those responsible.

If there are no culprits

In such cases, the shortage is associated with the financial result and is reflected in the reporting documentation.

How is product shortage determined during inventory?

The main difficulty in monitoring the state of material assets listed on the organization’s balance sheet is the so-called natural loss or normalized losses (spoilage, shrinkage, etc.) .

In addition, cases of theft often occur at enterprises, which remain undisclosed and, naturally, are not reflected in any way in the financial statements.

The human factor is another reason for the occurrence of shortages, surpluses, mismatches, etc.

In order to avoid financial liability of employees in the event of a shortage of property, organizations conduct inventories.

- The beginning of this procedure is preceded by a preparatory stage - the preparation of reporting documentation. At this stage, the accounting department carries out calculations of all property on the balance sheet, and if inconsistencies are detected, the responsible persons document these facts.

- Then employees proceed directly to inventory, i.e. counting. It can be done either manually or using a variety of technical means. The results of the calculations are also recorded signed by members of the inventory commission.

- The final stage is the process of identifying product shortages: comparing data from accounting calculations and the actual quantity of products in the organization’s warehouses. If the differences between the accounting and actual quantities for some items are too large, a repeat inventory is assigned with a new commission.

After carrying out (if necessary) a repeated inventory procedure, the identified discrepancies are recalculated into a monetary equivalent. It can be either positive (savings) or negative (shortage).

Regardless of this, a significant discrepancy is a reason for an internal investigation by the security service, since the cause of the shortage may be theft, and the excess may be due to customer deception or fraud with documents.

Features of tax accounting

Let's look at the identified shortage through the prism of the Tax Code.

Income tax

Based on Article 265 of the Tax Code, the identified shortage is equated to non-operating expenses. If it is necessary to replenish inventories, this is taken into account as expenses in the period when the shortage was identified.

Read also: Is it possible to close an individual entrepreneur with debts?

Arbitrage practice

This example demonstrates that the manager may not deduct the shortfall from wages on his own.

In this case, the employee was simply issued an official demand for repayment of the debt. The employee agreed with the management's decision, but did not contribute any amount. Then the manager went to court to demand not only the amount of debt, but also interest for the entire period of non-repayment. The decision was satisfied in full. Based on the resolution, the collection will be carried out by state bodies. Decision of October 3, 2021 in case No. 2-1549/2017