Hello, Vasily Zhdanov is here, in this article we will look at the long-term liabilities of an enterprise. The concept of passive (from the Latin passivus “passive, inactive”) implies part of the book. balance sheet opposite to assets. This part includes all financial sources from which the enterprise’s funds are generated. These, as is customary, are its liabilities and its own (borrowed) capital.

It follows that the liabilities of an enterprise are the sources of its funds, as well as its obligations. Schematically, the composition of the liability can be displayed as follows.

Take our proprietary course on choosing stocks on the stock market → training course

Important! It is generally accepted that the terms “liabilities” and “obligations” are identified in the “borrowed capital” part.

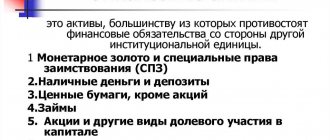

Thus, if assets show the property that an enterprise has, then liabilities reflect the sources of its formation. Liabilities are subject to classification. The following types are distinguished:

- current liabilities, the repayment period of which falls on the next year;

- long-term or long-term debt (eng. long-term debt) – long-term loans and bonds available on the financial market;

- long-term or long-term liabilities (eng. long-term liabilities) – other obligations (for example, to employees, lessors, etc.)

Obligations, in turn, can be systematized according to various criteria. The most common and well-known classification of them is based on urgency. The following obligations are distinguished: short-term (with a period of up to a year) and long-term (with a period of more than a year).

In addition to systematization on this basis, the liabilities of an enterprise are divided into groups depending on who owns them (own capital or borrowed capital). In practice, systematization is also used on a subjective basis, that is, depending on who the company owes something to. Such debts include, for example, salary debt to employees or debt to government agencies and contractors. As for equity capital, it is usually divided into authorized and share capital.

Long-term liabilities in accounting. balance sheet: concept, composition, lines

So, the liability is book. The balance sheet consists of capital, reserves, as well as long-term and short-term liabilities. Long-term (or long-term) liabilities are those obligations that an enterprise must pay off over a period of more than a year. They are reflected in the corresponding lines of the account. balance sheet, which is a key document reflecting the financial condition of the enterprise at the end of a specific period. These include: loans, bank loans, unpaid lease amounts, deferred tax amounts, i.e. different types of debts. On balance sheet lines, long-term liabilities are displayed along with the amount required to repay them. That is, interest, discount, etc. are taken into account and recorded.

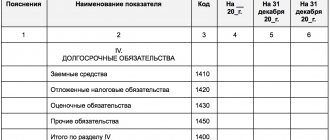

Today, enterprises and other organizations (with the exception of credit institutions) use the new accounting system. balance, approved The Ministry of Finance of the Russian Federation, in particular, by Order No. 66n dated July 2, 2010. It is called form No. 1, and according to OKUD 0710001. The composition of long-term liabilities can be fairly accurately traced along the balance sheet lines. Section No. IV is intended for them, which is called “Long-term obligations”. It consists of 5 lines.

| Section IV book. balance sheet “Long-term liabilities” (line by line) | ||||

| Borrowed funds | Deferred tax. obligated | Estimated liabilities | Other obligations | Total according to sec. IV |

| Page 1410 | Page 1420 | Page 1430 | Page 1450 | Page 1400 |

Each of the named lines is supplemented with the following columns: “Explanations” (column No. 1), the indicator “For __ 20_g.” (gr. No. 4), as well as “As of December 31, 20_.” (gr. No. 4 and 5).

When analyzing the financial condition of an enterprise, long-term accounts payable are divided into 2 parts. One of them should be extinguished before the end of the next 12 months. after the reporting date. The second - after a year following the reporting date.

Passive in book. The balance sheet, in addition to Section IV, includes another Section V. It contains information about the obligations that need to be repaid throughout the year, i.e., in a shorter period. It’s called: “Short-term liabilities”.

Total liabilities on balance sheet

Attention

What are current liabilities? Any commercial or government organization raises borrowed funds to carry out its activities. Obligations that fall due within a calendar year are called current.

They are reflected in the liabilities side of the balance sheet, in the “Current liabilities” section.

As a rule, they are fully secured by the availability of liquid assets on a specific date. Current liabilities include: debts to employees for wages, obligations to the budget, short-term loans, loans and borrowings, debts to suppliers of raw materials, supplies and equipment (within the limits provided for by the contract).

Line by line filling out Section IV of the book. balance: main nuances

This section should contain information about all obligations the company has that need to be paid off for a period of more than a year. Data from Section IV, together with other economic indicators from other sections, are used in financial analysis. According to the structure of the section, you will need to fill out 5 lines. It should be taken into account that:

- Page 1410: indicate all credits, borrowings (in cash or in kind) of the enterprise, the term of which exceeds a year. When filling out, use data on the account. 67 (calculation of long-term loans, loans).

- Page 1420 is filled out by those organizations that work using PBU 18/02, approved. by order of the Ministry of Finance of the Russian Federation No. 114n dated November 19, 2002 (as amended in 2015). This Regulation defines the general rules for the formation and disclosure of information on profit calculations for payers of this tax. When filling out this line, you should take account data into account. 77 (regarding deferred tax liabilities) and account. 09 (regarding deferred tax assets). It is necessary to have a loan. account balance 77 was more than the flow rate. account balance 09. Only then the line must be filled out.

- Page 1430: indicate reserves formed according to PBU 8/10, approved. By Order of the Ministry of Finance of the Russian Federation No. 167n dated December 13, 2010 (as amended on April 4, 2015). This Regulation regulates the procedure for displaying estimated and contingent liabilities, including contingent assets, in the accounting of legal entities. Account is used. 96 (about reserves for future expenses regarding obligations with a maturity of more than a year). The credit is written down on the line. balance remaining at 31 Dec.

- Page 1450: other long-term liabilities that are not reflected in the previous lines are indicated here. Data you will need: account. 60, 62, 68, 69, 76 (settlements with suppliers, buyers, taxes, social insurance, debtors, creditors), as well as accounts. 86 (targeted financing).

- Page 1400 is the total amount of the enterprise’s long-term borrowed capital (i.e., the total sum of all previous lines of the section: 1410, 1420, 1430, 1450).

Make a book. The balance sheet is best done using specialized software designed specifically for accounting. If it is compiled independently, then based on the results you should compare the balance sheet of assets and liabilities. If the values are the same, then boo. the balance is correct.

It should be noted that no general standard has been established for long-term liabilities. They can be compared with short-term ones in terms of rational use and volumes. It is quite obvious that a positive motivator is an increase in the share of long-term obligations and a decrease in short-term ones. Accordingly, if there is a choice for an enterprise, the best solution will be one that involves an increase in long-term liabilities.

Total liabilities on the balance sheet are

Important

People who have already had to draw up a balance sheet, as well as understand its values, have probably seen the column “code” . Through its application, statistical authorities gain the opportunity to systematize the information contained in the balance sheet of companies. Therefore, when submitting reports and other papers to the relevant government agencies, they must contain the appropriate code value, as stated in Art.

18 of the Accounting Law.

According to legal norms, within the framework of the balance sheet, the code indicators of the lines from 2014 must be in accordance with the values specified in Appendix 4 of Order No. 66 of the Ministry of Finance of Russia. Outdated indicators and values are no longer used.

It is not so difficult to distinguish modern parameters from old ones; the easiest way to do this is by the number of digits .

And finally, the final line, represented by the sum of all filled columns (1460).

Section 5 – Short-term liabilities

The assignment of code values and numbering in section 5 follows the same principle. There are 5 main directions and one final direction .

In line 1510, borrowed funds are reflected; in 1520, you can obtain information about data on accounts payable. Within the framework of page 1530, it is possible to obtain data on income receipts of future periods.

Reserves for upcoming expenditure areas appear in column 1540, and other liabilities are indicated in 1550.

But if the paper is compiled for a quarter or another, shorter reporting period, filling out the lines is not necessary , because

Ranking and use of liabilities to determine the liquidity of an enterprise

When separating liabilities for the purpose of determining liquidity, they rely on financial sources. As you know, on this basis, liabilities are divided into 4 groups, one of which is long-term liabilities (or P3). A visual systematization of liabilities by maturity is as follows:

- P1 (most urgent obligations).

- P2 (short-term liabilities).

- P3 (long-term liabilities).

- P4 (permanent liabilities).

These groups of liabilities are compared with assets, thus determining whether a particular enterprise is liquid. For your information, assets are also ranked into 4 groups: A1 (the most liquid), A2 (quickly liquid), A3 (slowly liquid), A4 (difficult to liquid). In relation to bu. In the balance sheet, this ranking of assets and liabilities will be as follows.

| Index | Row distribution | Ownership of indicators |

| A1 | Page 1250 + 1240 | |

| A2 | Page 1230 | |

| A3 | Page 1210 + 1220 + 1260 + 12605 | Assets |

| A4 | Page 1100 | |

| P1 | Page 1520 | |

| P2 | Page 1510 + 1540 + 1550 | |

| P3 | Page 1400 | Liabilities |

| P4 | Page 1300 + 1530 + 12605 |

Long-term liabilities (P3) are compared with slowly liquid assets (A3). If as a result it turns out that A3>=P3, then the enterprise is considered liquid and is able to pay long-term obligations. This means that the value of slowly liquid assets must be greater than or equal to the value of long-term liabilities.

All indicators necessary for comparisons are taken from the accounting records. balance. The actual value of P3 is the total of Section IV (p. 1400). A comparison of two values (P3 and A3) is used mostly in accounting analysis. balance sheet to determine its liquidity.

Property of the organization - assets and liabilities

The breakdown of sections into articles is due to the need to highlight the main types of property and liabilities that form the corresponding sections of the balance sheet. The accounting balance is filled out, as a rule, in thousands of rubles without decimal places. Organizations with large turnover can amount to millions of rubles.

Data for the article “Profitable investments in assets” is taken as the difference between the balances of accounts 03 and 02 in relation to the same objects.

Trade organizations and public catering organizations indicate in this line the purchase price of goods (excluding trade margins taken into account on account 42 “Trade margins”). When an organization engaged in retail trade accounts for goods at sales prices, the difference between the acquisition cost and the sales value is reflected in the financial statements separately in.

An organization can create a reserve:

- for upcoming payment of vacations (including payments for social insurance and security) to employees of the organization;

- for the payment of annual remuneration for long service;

- for production costs for preparatory work due to the seasonal nature of production;

- for repair of fixed assets;

- for the upcoming costs of land reclamation and other environmental measures;

- for warranty repairs and warranty service.

Thus, liability lines provide information about where the funds came from and to whom the company must return them.

This line reflects the credit balance of account 69 “Calculations for social insurance and security”.

View full version: financial condition for the tender. Equity Equity Equity is the value of all of a business's assets after all debts have been paid. Retained earnings are the remaining earnings after taxes, interest, and dividends. As a rule, it constitutes a significant part of the financing of new capital investments.

Total liabilities in the balance sheet The balance sheet liability line characterizes the sources of those funds from which the balance sheet asset was formed.

This is any property of the institution. For example, cash on hand, inventories, fixed assets, buildings, machines and other material and financial assets that directly belong to the company.

Answers to frequently asked questions

Question No. 1. What does “total capital” mean? What does it include?

The total capital of an enterprise is its own capital + borrowed capital (i.e., the total amount of all capital that exists and is used in the enterprise). This is the name for the entire liability (balance sheet currency).

Question No. 2: Is the presence of long-term liabilities of an enterprise a positive or negative factor? What should you use to correctly characterize this situation?

They are definitely not a negative factor. Quite the contrary, their presence is actually beneficial for the enterprise, especially in light of inflationary processes. Naturally, provided that they are attracted and used rationally, in moderation and competently.

Passive balance: decoding lines

Bivalent to current liabilities and early repayable long-term debt. They are not at risk if the current asset position is so strong that the loans can be treated as current liabilities, or if the ability to earn a profit is so strong and reliable that refinancing is not a problem.

This equality is based on the reflection of property and liabilities using a double entry method in accounting accounts. For internal purposes, the organization itself has the right to choose the frequency, methods and methods of preparing the balance sheet.

The lines of the passive part of the balance sheet reflect the sources of funds that the company manages, in other words, the sources of its financing. The information contained in the liability lines helps to understand how the structure of equity and debt capital has changed, how much the company has attracted borrowed funds, how many of them are short-term and how many are long-term, etc.

Balance sheet liabilities include all the obligations of the organization that were accepted by it in the reporting period, as well as the sources of the formation of material assets and resources of the institution. In other words, the liability side of the balance sheet is a grouping of assets according to the sources of their formation, that is, liabilities are the sources of formation of material assets, cash, and intangible assets.

In a situation where the balance sheet is prepared for a quarter or other reporting period, in order for it to be considered at internal meetings for the purpose of introducing the state of affairs or analyzing the company’s activities, it is not necessary to fill in the code lines, since they do not carry any responsibility in this case no functions.

Businesses have various obligations. Depending on the urgency of repayment, there are 3 types of obligations:

- Short term;

- Long-term;

- Urgent.

Thanks to these indicators, it is possible to assess the state of the enterprise.

Accounts payable are built from several points:

- Funds received from clients and customers;

- Debts to suppliers;

- Taxes and fees;

- Insurance premiums;

- Wage;

- Other obligations.