Who can give money for business needs?

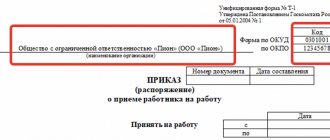

Employers are obliged to organize and maintain internal control of the facts of economic life. You can find such a requirement in Part 1 of Article 19 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”. The procedure for control over the issuance of money to accountable persons must be determined by the general director of the company. He may issue an order with a list of persons who are entitled to receive funds. Here is a sample of such an order, according to which funds can be issued on account:

In order to comply with cash discipline, an employee is considered to be a person with whom an employment or civil law contract has been concluded (clauses 5 and 6.3 of Bank of Russia Directive No. 3210-U dated March 11, 2014). Consequently, money can be issued, including to the contractor, on account. He may need them, for example, to purchase materials to perform work under a civil contract. This amount can be given to him for the report, for example, from the cash register.

Accountable amounts can be transferred to the bank card of the accountable person, incl. for salary (Letter of the Ministry of Finance dated August 25, 2014 No. 03-11-11/42288).

Deadlines for submitting an advance report by the accountable person

Contents » Business organization » Accounting » Payments » Cash » Accounting » Deadline for submitting an advance report to the accounting department Do you know how many deadlines are provided for reporting to the enterprise on accountable funds received?

There are actually several of them. And each is set for its own reporting stage. The only regulatory document that establishes deadlines for reporting on money issued for reporting is Directive of the Bank of Russia No. 3210-U dated March 11, 2014 “On the procedure for conducting cash transactions.”

In clause 6.3 (paragraph 2) of this Directive it is established that the deadline for submitting an advance report is three working (!) days.

And many novice accountants mistakenly start counting this three-day period from the moment the funds are issued for reporting.

In fact, the three-day reporting period begins:

- from the day following the end of the period for which funds were issued for the report. This period in each specific case is established in the application of the person who asks to give him money on account. Moreover, the head of the organization (or entrepreneur) can either confirm the period for which the employee is asking for funds or change it by extending or shortening it. And it is precisely this period, which the manager approved in the application, that will be considered official. And it is upon its completion that within 3 working days the employee will be obliged to report on the expenditure of the funds issued to him;

- from the date the employee returns to work.

As a rule, this period is “used” when the employee returns from a business trip.But it would not be a mistake to apply the specified period to an employee’s return from sick leave or vacation, for example. Also, very often this formulation is used in the case when the three-day period for the report falls on weekends and (or) non-working holidays. After all, the employee must report within 3 working days, not calendar days.

It is worth noting that Bank of Russia Directive No. 3210-U contains an indication in paragraph 2, clause 6.3 for 3 days

Application for the issuance of money: is it necessary?

Until recently, in order to receive cash on account, an employee had to submit an application for the issuance of funds to the accounting department or human resources department. A sample of such an application shows that it was necessary to indicate the required amount, as well as explain for what purposes it will be spent. Here is a sample of such an application for the issuance of funds:

However, as of August 19, 2021, the situation has changed. The amendments are provided for by Directive of the Central Bank of Russia dated June 19, 2017 No. 4416-U. From the specified date, you can give the employee money on account without his application. To issue money, an order for the issuance of funds from a report or other administrative document of the company is sufficient. The same rules for issuing money on account continue to apply in 2021.

Deadlines for reporting imprest amounts

After the period for which the funds were received, the employee must:

- or within three days submit an advance report to the accounting department of the enterprise;

- or return unspent amounts.

If an employee is absent from the workplace on the day when the return of accountable amounts is due, he must report after returning to work, also within three days.

Documents confirming expenses must be attached to the advance report (its form can be developed and approved independently or using the unified No. AO-1 approved by the State Statistics Committee). The statute of limitations for checks for advance reports is not established by law.

Before the amendment to Directive 3210-U in August 2021, the issuance of a new report was allowed only upon full repayment of the debt for previously received amounts. This led to the fact that if it was impossible to submit a report (for example, the person was on a business trip), the employee had to spend personal funds, with subsequent compensation. On August 19, 2021, by Directive 4416-U, this requirement was canceled.

How to issue an order to issue money: example

So, the issuance of funds for reporting in 2021 is possible on the basis of an order or other administrative document (clause 6.3 of the Bank of Russia instructions dated March 11, 2014 No. 3210-U). At the same time, there are no restrictions on the amount of accountable amounts and the period for issuing money. Here is an order for the issuance of funds on account (sample):

Moreover, there are no special requirements for how to draw up an order for the issuance of accountable amounts. In our opinion, it makes sense to record in the order: the employee’s full name, amount, goals and terms of issue.

We also note that it is possible to issue a general order for several amounts. So, for example, if the issuance of cash for reporting is necessary for several employees, then the order may look like this:

From August 19, 2021, the basis for issuing funds is an order or other administrative document. At the same time, no one prohibits employers from continuing to accept applications from employees for the necessary amounts of money. However, keep in mind that the procedure for issuing appropriations should be fixed in the regulations on the issuance of funds in the report. You can provide an example of a provision on the issuance of accountable funds.

How to draw up an order for the appointment of accountable persons for 2020-2021

Order on the appointment of accountable persons - a sample of such a document is developed at each enterprise.

This order is a local regulatory document that approves the list of employees who have the right to receive funds in advance to make targeted payments for the needs of the company. This document must be approved by the head of the company. ConsultantPlus experts explained in detail in what order an accountant should accept an advance report from an employee. Get trial access to the system for free and go to the Ready-made solution.

In addition to the list of persons to whom money is issued on account, the order on accountable persons - a sample of its execution will be presented below - contains information on the maximum amounts of funds issued in advance to meet the needs of the enterprise, as well as the maximum periods for which funds are issued. At the same time, the specified deadlines for submitting advance reports should not exceed the normative ones.

Read more about reports in our article “Features of advance reports in accounting” .

Accountable persons may include any employees of the company who, for official purposes, are given funds for the organizational, representative or economic needs of the enterprise. Among the responsibilities of accountable persons are not only spending for the intended purpose, but also timely submission to the accounting department of a written report with supporting documents attached, as well as the return of unused funds to the cash desk.

A local act - an order on accountable persons - must contain the following details:

- in the header - the name of the company;

- date(s) of document preparation/approval;

- a list of individuals indicating their full name and position held, who may be entrusted with funds for reporting purposes;

- information about the maximum amounts and purpose of funds issued against the report, as well as the deadlines for submitting the report (return of unused funds);

- Full name and signature of the manager;

- Full name and signature of the official responsible for issuing accountable funds.

The location of the details should be as follows:

Deadlines for issuing funds

What are the deadlines for issuing funds? When do employees need to submit a report on money spent to their employer? The answer to this question must be sought in the order of the general director. After all, it is in it that such a period is indicated.

As a general rule, an employee must report on the amounts received for reporting no later than three working days after the expiration of the period for which these amounts were issued (clause 6.3 of the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U). But what to do if the return period has not been set? According to tax authorities, in such a situation the employee must submit the report on the same day on which they received them (letter of the Federal Tax Service of Russia dated January 24, 2005 No. 04-1-02/704).

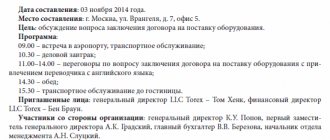

Travel allowance report

Special conditions are defined for travel expenses. The employee must report on them within three working days from the date of return from a business trip (clause 26 of the Regulations, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

Rules for receiving money on account

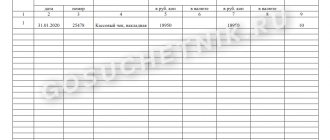

In accordance with clause 6.3 of the instructions of the Bank of the Russian Federation dated March 11, 2014 No. 3210-U, the issuance of funds to accountable persons is formalized by issuing an expenditure cash order (hereinafter referred to as RKO).

The basis for issuing a cash settlement is the statement of the accountable person himself, drawn up in writing, or an administrative document of the economic entity. ATTENTION! From November 30, 2020, an administrative document can be drawn up for several cash payments to one or more employees. In this case, you need to indicate the name, amount and period for which the money is issued for each employee.

ConsultantPlus experts told us what other innovations in the procedure for recording cash transactions came into effect on November 30, 2020. Get trial access to the K+ system and go to the review material for free.

For more information about filling out cash registers, read our article “How is an expense cash order (RKO) filled out?” .

The application, which is drawn up in any form, must contain:

- information about the amount of money to be reported;

- information about the period of use of funds issued on account for targeted expenses;

- date and signature of the company director.

Until August 19, 2017, money was issued on account only if the accountable person had no debt on funds issued on account the previous time. From the above date, accountable amounts are allowed to be issued, even if the accountant has not repaid past debts.

An organization can establish general rules for the issuance and expenditure of accountable amounts (such as document flow, deadlines for issuance and return, etc.) in special instructions. To compose it correctly, use the recommendations and sample from ConsultantPlus experts. Trial access to the legal system is free.

Process of issuing money

To issue money, the employer needs to do the following:

- issue a cash expense order (RKO). It must be signed by the chief accountant or other authorized person (clauses 4.2, 4.3, clause 4 of Directive No. 3210-U).

- after the accountant puts his signature on the cash register, the cashier gives him money from the cash register and signs the cash register (clause 6.2, clause 6 of Directive No. 3210-U).

- register the issuance of money under the reporting posting (cash flow item):

| Wiring | Operation |

| D 71 - K 50 | The employee was given money on account |

Here is a sample cash settlement report for the issuance of funds:

Money issued on account is not subject to personal income tax and insurance premiums.

You can issue cash on account if the employee has not repaid the debt on previously issued funds. This can be done from August 19, 2021. However, this does not mean that employees no longer need to prepare advance reports on the amount spent. Even after August 19, 2021 (for example, in 2020), the employee must submit reporting documents to the accounting department about the money spent.

It is worth noting that the issuance of funds to the founder or director is not prohibited. However, it is worth understanding that no “indulgences” are provided for managers in this part. For example, the founder, like any other employee, is obliged to return the accountable funds received.

Read also

11.07.2016

Order to issue accountable amounts to the director

The issuance of funds from the cash register to the account applies not only to the employees of the organization, but also to its manager. In this case, it is also necessary to issue an order to issue money. It should indicate the purpose of the issue, the size and period during which the manager must purchase the goods necessary for the organization. Even if the organization has left the writing of applications from employees for the issuance of accountable funds, the director does not need to write it. It is enough to issue an order in which the manager will also be an accountable person.

Order on accountable persons

Who are the accountable persons?

As mentioned above, the order determines the list of employees who will be given the right to receive funds from the organization’s cash desk on account (for entertainment and operating expenses of the organization, to solve various business problems).

It also installs:

- the time period for which funds are issued;

- purpose of funds.

In addition, such an order is used to generate accounting and tax reporting; its presence and content are checked during desk audits.

It is enough to issue this document once, if there are no changes in the composition of accountable persons. If their list changes, a sample of a new reporting order is drawn up.

The concept of accountable money

This is the common name for funds given in advance to an employee from the organization’s cash desk to pay for the needs of the enterprise.

The amount of amounts that can be issued for reporting is indicated in the order. The settlement limit (no more than 100,000 rubles per agreement) must be taken into account only when making payments between organizations.

At the same time, all expenses incurred by employees at the expense of money issued in this way must be economically justified and caused by real need.

The procedure for issuing funds for reporting

- We determine a list of employees who, due to their official needs, have the right to receive money from the company’s cash register or to a bank card.

- We issue an order in which, in addition to the list of employees, the purposes for using the money issued on account are prescribed.

- One-time reports can be issued in separate administrative documents indicating the required details (see below).

The amount of amounts issued cannot exceed the limit specified in the order. Also, the employee must report his expenses.

Is it possible to do without an order?

It is necessary if the company uses the practice of transferring funds to employees on account.

There are no statutory penalties for incorrect execution of the issuance of money on account. But in practice, in the absence of an order, the inspection authorities (tax service or labor inspectorate) may impose penalties for violation of cash rules (see Part 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation):

- for officials in the amount of 4,000 to 5,000 rubles;

- for legal entities - from 40,000 to 50,000 rubles.

Sample order for the appointment of accountable persons 2019

A sample order for accountable amounts is drawn up in any form. Most often in a single copy. It must indicate:

- registration number and date of compilation;

- Company name;

- a complete list of accountable persons indicating their positions, full names;

- the maximum amounts allowed to be issued for reporting purposes;

- goals and deadlines for which money can be issued.

The order must be signed by the director of the company. Without his signature it is considered invalid.

The following must be signed:

- persons specified in the document and entitled to receive money on account;

- workers responsible for carrying out the order.

By this they indicate that they have read and agree with the document.

It is not necessary to certify it with a seal.

Since such an order relates to documents related to the main activity, it must be stored permanently.

Sample order for issuance of accountable amounts 2019

If a certain amount of money needs to be given to one of the employees of the enterprise, an order is drawn up for the issuance of accountable amounts.

The following data must be entered in the order on the timing of reporting on imputed amounts:

- name of company;

- name of the order;

- its number, date, place of compilation;

- justification and basis for creating the order;

- who is responsible for issuing accountable amounts;

- maximum amount of amounts;

- the period for which they can be issued;

- an employee who has the right to receive the necessary funds from the cash register;

- the official responsible for the execution of this order.

The document must be signed by the head of the enterprise, the employee who has the right to receive money on account, and the person responsible for executing the order. Also, the details of the decree should be recorded in a special accounting journal.

Additional Information

Change is ok

List of changes made in 2021 to the procedure for issuing accountable amounts:

- Money can be issued to personnel who work not only under an employment agreement, but also under a civil law one.

- The employee’s application is the only basis for issuing funds. Previously, the head of the organization had to write the amount of funds and the deadline for issuing them in his own hand, but now there is no such need, and the application can be drawn up electronically.

- The issuance of funds is possible only if there is no debt on previous amounts.

- It is now possible to transfer accountable funds from an organization’s account to an employee’s card.

- All transactions with accountable funds must be recorded in tax and accounting records.

- The advance report must be submitted within the established time frame. Failure to meet deadlines may result in additional personal income tax assessment.

- When preparing an advance report, form AO-1 is used.

Form AO-1 in word format

An application for the issuance of cash on account is submitted by those persons who were previously approved by the director as accountable. 2021 income tax returns can be found here.

How to avoid fines and liability

There is no fine for violation of cash discipline, but during tax audits the organization may be arrested for the following reasons:

- violation of the procedure in accordance with which available cash should be stored;

- violation of the order in accordance with which cash transactions should be conducted.

The collection of a fine for such reasons and due to the lack of an application can be challenged in court.

During a tax audit, one day is given to provide all necessary documents. During this day, all missing applications for funds can be processed. They will need to be attached to the RKO.

There is a statute of limitations for imposing administrative liability for violation of cash discipline. In paragraph 1 of Art. 4.5 of the Code of Administrative Offenses states that it is equal to two months, so applications need to be drawn up only for the last two months before the tax audit.

Sample of filling out an order for the issuance of money for reporting to the manager

Rules and features

There are fixed rules in accordance with which the procedure for issuing accountable funds should be carried out:

- The issuance of funds can only be carried out in cases where the funds are spent on purposes that relate to the activities of the organization.

- Either a labor or civil law agreement must be concluded between the employee and the organization. Only upon conclusion of an agreement can an employee receive accountable money.

- A prerequisite is confirmation of the application for the issuance of funds from the head of the enterprise. If the funds were transferred to the employee’s card, then the relevant documents must also be submitted.

- The transfer of funds to both the manager and other employees must occur when registering cash settlements.

- Funds will be issued only if the employee has no debt. After receiving the funds, you will need to submit an expense report and all necessary documents.

- Submitted documents are subject to careful verification. After verification, the head of the company must set the period during which the issued amount must be repaid.

These rules apply to absolutely every employee of the organization, including the director.

Many specialists involved in this issue have problems in processing the issuance of funds to the head of the enterprise.

In such situations, the following features need to be taken into account:

- As stated in the Labor Code of the Russian Federation, the director of an organization has the same labor relations with it as other employees, therefore the process of issuing accountable funds to the director should not differ in any way from the standard process.

- The second feature is that the director of the enterprise must certify his application himself. In cases where an organization has several directors, the process of signing an application is much simpler: if funds need to be issued to one director, then another director has the right to certify his application.

It follows from this that the heads of organizations do not have any benefits when receiving funds on account: before receiving funds, they must go through all verification procedures, like other employees, and an order must also be drawn up for them to issue money on account to the manager.

Order on accountable persons

Drawing up an order on accountable persons is mandatory if the enterprise has employees who are entitled to use cash issued from the cash register to achieve any official goals.

Who are called accountable persons?

The category of accountable persons may include any employees of the enterprise:

- secretaries who receive money from the cash register to purchase stationery, materials for office equipment and other office equipment,

- caretakers, to whom money is given to purchase household or household supplies. Accountable persons also include specialists who often go on business trips; they are given funds in advance against the report to pay for tickets, hotels, entertainment expenses, etc.,

- drivers who receive “cash” to pay for gasoline and other fuel liquids and spare parts also have accountable status,

- accountants and cashiers of enterprises.

Separately, we can single out employees of branches and structural divisions who do not have an independent balance sheet and receive money for business and other expenses from the main cash register of the enterprise.

The concept of accountable money

Any funds issued by an accountant or cashier of a company to any of the employees in advance (i.e. in advance) to pay for any needs related to the activities of the enterprise are called accountable .

The law does not establish limits for the amounts issued for reporting, so they are determined at each enterprise individually, depending on existing capabilities and needs.

At the same time, all expenses incurred in the form of subaccounting must be economically justified and caused by real need.

The procedure for issuing funds for reporting

- The first step at the enterprise is to determine a list of employees who, due to their official needs, can take cash from the cash register on a regular basis.

- Next, a corresponding order is issued, which, in addition to the list of employees, prescribes the conditions for the use of accountable funds.

- After this, on the basis of this document, the employees mentioned in the order can receive the necessary amounts without additional orders from management.

However, the amount of finance issued in this way cannot exceed the limits specified in the order. In addition, the employee must report on his expenses during the period also specified in the document.

If, after spending the amount allocated for the report, some balance is left, it must be returned to the cashier, but if, on the contrary, the employee had to pay extra for the needs of the enterprise from his own, the accountant is obliged to reimburse these expenses. In this case, all expenses must be documented.

It should be noted that employees who are not mentioned in the order as accountable persons can also receive cash from the cash register to complete tasks set by the employer, but only on condition that a separate order from the director of the company is first drawn up for this.

Who should draw up an order on accountable persons

Any employee who has the necessary knowledge and skills can directly draw up the order: a legal adviser, a personnel officer, a secretary. In this case, the document must be submitted to the director of the company for signature, since without his autograph it will not be considered valid.

Is it possible to do without an order?

The presence of an order on accountable persons is not strictly mandatory ; however, if the enterprise uses the practice of transferring funds to employees on account (and without this, the activities of any organization are practically impossible), it is better to stock up on this document. Otherwise, as a result of a sudden inspection by the tax service or labor inspectorate, sanctions from regulatory structures in the form of a fine, which can be imposed both on the legal entity itself and on its director, cannot be ruled out.

Sample order on accountable persons

Today, the order on accountable persons does not have a single standard template that is mandatory for use, so organizations and enterprises have every right to write it in any form or according to a template developed within the company and approved in its accounting policies. Moreover, like any other administrative document, it must include a number of certain data, in particular:

- number and date of compilation;

- Company name;

- a complete list of accountable persons indicating their positions, full names;

- the maximum amounts allowed to be issued for reporting purposes;

- goals and deadlines for which money can be issued.

How to place an order

In terms of design, the order is also quite variable: it can be created in handwritten format or printed on a computer using a standard A4 (or even A5) sheet or company letterhead. In this case, the order must be certified by the autograph of the head of the company or another person authorized to endorse such documents.

In addition, everyone who is mentioned in it must leave their signatures under the order: the reporting employees themselves, as well as the employees responsible for implementing the order - by this they indicate that they have read and agree with the document.

It is not necessary to certify the order with a seal, because from 2021, the norm for the use of seals and stamps by legal entities has ceased to be a legal requirement.

The order is usually written in a single copy and, during the period of validity, is contained together with other regulatory and administrative papers of the enterprise. After the relevance of the order is lost, it is transferred for storage to the archive, where it lies until the expiration of the legally established period, then it, along with other outdated documents, can be sent for disposal.